Global Boiler Market Size, Share, Trends, & Growth Forecast Report Segmented By Fuel (Natural Gas, Oil, Coal, Electric, and Others), Capacity, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Boiler Market Size

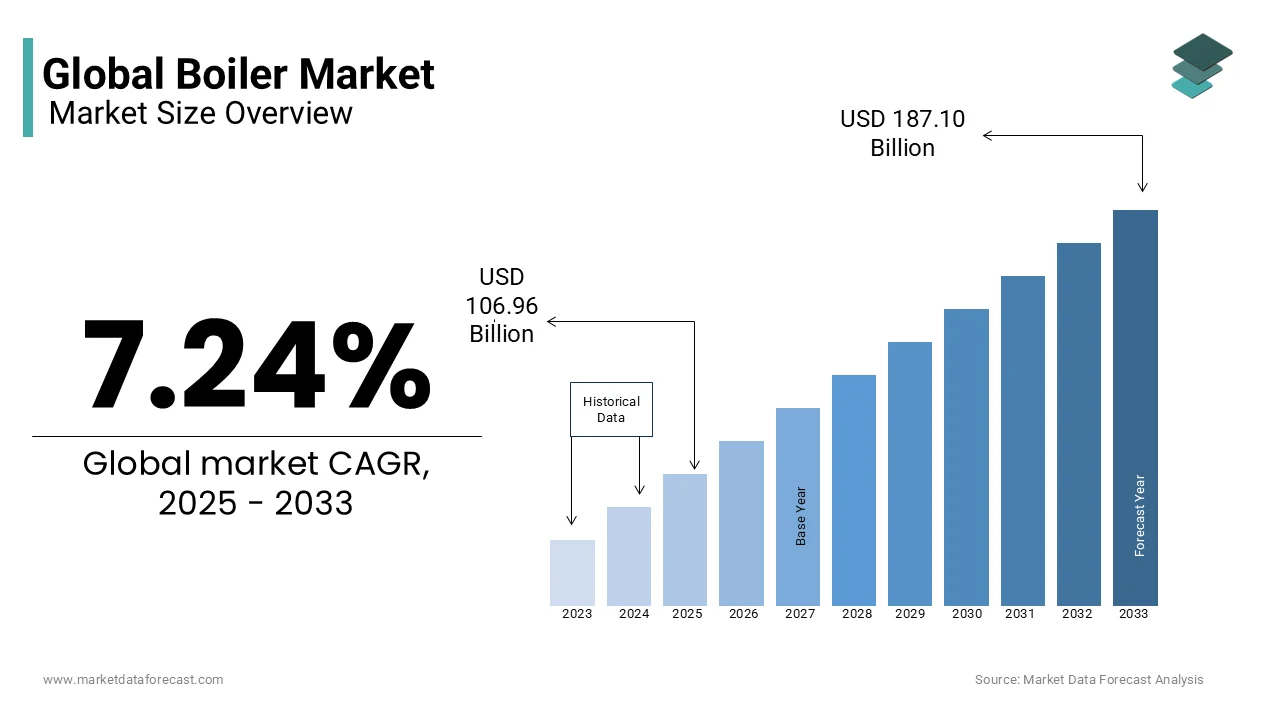

The global boiler market was worth USD 99.74 billion in 2024. The global market is estimated to reach USD 187.10 billion by 2033 from USD 106.96 billion in 2025, rising at a CAGR of 7.24% from 2025 to 2033.

Boilers are used in homes, businesses and industries to heat liquids, mostly water, to create steam or hot water. Industries such as power plants, food factories, and chemical companies use them for their operations. Boilers can run on different types of fuel, including natural gas, oil, coal, biomass, and electricity, depending on the needs of each sector. In factories and industrial sites, boilers play a major role in energy use. The International Energy Agency (IEA) states that, in 2019, industries used about 37% of the world’s total energy, with a big part of it going to heating and steam production. In the U.S., research by Global Efficiency Intelligence in 2018 found that 75% of energy used in manufacturing came from heating processes, and around 17% of this was from traditional industrial boilers.

Industries also have a big impact on the environment. The Intergovernmental Panel on Climate Change (IPCC) reported that in 2019, industries were responsible for about 34% of global carbon dioxide (CO₂) emissions, including emissions from power and heat production. This highlights the need for more energy-efficient boilers and a shift toward cleaner technologies to reduce pollution. To address these environmental concerns, there is a rising focus on using electricity and renewable energy in boilers. According to the IEA, the amount of electricity used in industries grew from 19% in 2010 to 23% in 2022, mainly due to more activity in light industries. This change shows a move toward greener energy solutions in the boiler industry, reducing the need for fossil fuels and cutting greenhouse gas emissions.

MARKET DRIVERS

Industrial Energy Consumption

Industries require a large amount of energy, making them a major factor in the boiler market. The International Energy Agency (IEA) states that in 2022, industries used 37% of global final energy, totaling 166 exajoules. This demand is driven by sectors such as manufacturing, mining, and construction, where boilers are essential for heating and steam production. The IEA reports that industrial energy consumption has steadily increased over the past decade due to rising production in energy-intensive industries. Since industries continue to rely on boilers for key operations, the demand for boilers will remain high, making them a crucial component of industrial energy use worldwide.

Environmental Regulations and Emission Reduction Initiatives

Strict environmental laws are significantly influencing the boiler market by pushing industries to cut emissions. The Intergovernmental Panel on Climate Change (IPCC) reported that in 2019, human activities released 59 gigatonnes of CO₂-equivalent emissions, and a large share came from industries. The European Union’s Ecodesign Directive enforces rules on efficiency and emissions for heating equipment, including boilers. These regulations encourage industries to adopt cleaner and more efficient boiler systems that lower pollution and save energy. As companies work to meet environmental standards, they are driving innovation and investment in advanced, sustainable boiler technologies that benefit both industries and the planet.

MARKET RESTRAINTS

High Initial Costs and Installation Complexity

New boiler technologies, such as condensing and biomass boilers, have high upfront costs and require complex installations, which limits their adoption. The European Commission’s Joint Research Centre states that low-carbon energy systems, including advanced boilers, require significant initial investments. While these modern boilers help save money over time, their high starting costs discourage many businesses and homeowners from making the switch. Additionally, installing these advanced boilers requires skilled technicians, making it harder for consumers to adopt them. To encourage wider use, governments and organizations need to provide financial support and training programs that make energy-efficient heating solutions more accessible to the market.

Dependence on Fossil Fuels and Regulatory Pressures

Many boilers still rely on fossil fuels like natural gas and oil, which contribute to pollution and climate change. According to Eurostat, in 2022, natural gas made up 30.9% of household energy use in the European Union. However, governments are enforcing strict rules to cut emissions. The EU’s "Fit for 55" plan aims to reduce emissions by 55% by 2030, forcing industries to adopt cleaner energy sources. The switch to renewable systems requires large investments in infrastructure, making it difficult for industries to adapt quickly. Without sufficient government funding and support, the transition to cleaner boiler technologies will remain slow, affecting the market’s long-term growth potential.

MARKET OPPORTUNITIES

Integration of Renewable Energy Sources

The push for renewable energy is creating new opportunities in the boiler market. The International Energy Agency (IEA) states that by 2030, the world will add over 5,500 gigawatts (GW) of renewable energy, nearly tripling the pace of expansion seen in previous years. China alone is expected to account for 60% of this growth. This trend increases the need for boilers that can use cleaner fuels like biomass and solar thermal energy instead of fossil fuels. Manufacturers that develop boilers compatible with renewable energy can help industries meet environmental goals while reducing dependence on traditional fuel sources, making sustainability a key driver of future growth in the market.

Advancements in Energy Efficiency Technologies

Improving energy efficiency is a global priority to cut energy use and emissions. The IEA states that doubling the global energy efficiency improvement rate from 2% to over 4% annually by 2030 would significantly lower emissions. This trend is increasing demand for high-efficiency boilers that reduce energy waste. Innovations like condensing boilers can achieve much higher efficiency than older models. As governments enforce stricter energy standards and customers look for ways to lower energy bills, boiler manufacturers can benefit by investing in better technologies that offer cost savings and environmental advantages, ensuring their continued relevance in a changing market.

MARKET CHALLENGES

Regulatory Uncertainty and Policy Changes

Changing government policies create uncertainty in the boiler market, making long-term investment decisions difficult. In the United Kingdom, for example, the government originally planned to ban gas boilers in new homes by 2025 to reduce emissions. Later, they proposed banning all new gas boiler sales by 2035, but this plan was eventually scrapped. These inconsistent policies confuse manufacturers and consumers, delaying investments in new heating solutions. Frequent changes in regulations make industries hesitant to commit to alternative technologies, slowing the transition to greener heating options and creating obstacles for companies aiming to develop long-term energy strategies.

Competition from Alternative Heating Technologies

The rise of alternative heating technologies, especially heat pumps, poses a challenge to traditional boilers. To promote heat pump use, the UK government raised financial incentives from £5,000 to £7,500 to make them more affordable for homeowners. However, high installation costs and property limitations have prevented widespread adoption. Even though heat pump adoption remains low compared to gas boilers, improvements in cost and efficiency may make them a strong competitor in the future. To stay competitive, boiler manufacturers must develop more energy-efficient models and improve their products’ environmental impact to remain relevant in an increasingly eco-conscious heating market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.24% |

|

Segments Covered |

By Fuel, Capacity, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens AG, Mitsubishi Heavy Industries Ltd, Bosch Industriekessel GmbH, Babcock & Wilcox (B&W), Thermax, Babcock Wanson, IHI Corporation, Cleaver-Brooks, Viessmann, and Fulton. |

SEGMENTAL ANALYSIS

By Fuel Insights

The natural gas-fired boilers held the most significant share of the global boiler market in 2024. The domination of the segment in the global market is primarily attributed to natural gas being a cleaner and more efficient fuel source compared to oil or coal, resulting in lower carbon emissions and operational costs. The U.S. Energy Information Administration (EIA) reports that in 2022, natural gas constituted about 38% of electricity generation in the United States, underscoring its widespread availability and infrastructure support. Additionally, natural gas boilers offer high efficiency and reliability, making them a preferred choice for both residential and commercial heating applications.

The electric boilers segment is on the rise and is predicted to register the fastest CAGR of 10.2% from 2025 to 2033 owing to the increasing environmental concerns and stringent emission regulations prompting a shift towards cleaner energy solutions. Electric boilers produce zero on-site emissions, aligning with global decarbonization goals. The International Energy Agency (IEA) notes that electricity's share in final energy consumption is rising, reflecting a broader trend towards electrification. Moreover, advancements in renewable energy integration enhance the sustainability of electric boilers, making them an attractive option for eco-conscious consumers and industries aiming to reduce their carbon footprint.

By Capacity Insights

The 50 to 100 MMBtu/hr segment accounted for 53.1% global boiler market share in 2024. The prominence of the segment is largely due to their extensive application in medium to large-scale industrial operations, where substantial steam and heat outputs are essential. Industries such as chemical manufacturing, food processing, and pulp and paper production rely heavily on these boilers to meet their energy demands efficiently. The versatility and capability of >50–100 MMBtu/hr boilers to handle diverse fuel types and their adaptability to various industrial processes make them indispensable in sectors requiring consistent and robust thermal energy solutions.

The 10 MMBtu/hr segment is projected to witness a promising CAGR of 5.74% during the forecast period due to their suitability for small to medium-sized enterprises and commercial establishments. The increasing emphasis on energy efficiency and the need for cost-effective heating solutions have propelled the adoption of these compact boilers. Their relatively lower installation and operational costs, combined with advancements in technology enhancing their efficiency, make them an attractive option for businesses aiming to reduce energy expenditures. As urbanization continues and small businesses expand, the demand for ≤10 MMBtu/hr boilers is expected to rise, reflecting a shift towards more sustainable and economical heating solutions in the commercial sector.

By Application Insights

The industrial segment dominated the market by holding 45.7% of worldwide market share in 2024. The extensive use of boilers in industries such as chemicals, food and beverages, and metals and mining are propelling the growth of the industrial segment in the global market. For instance, the food and beverage industry alone accounts for about 35% of the total demand for boiler systems, as continuous heating and steam are essential in food processing and packaging. Similarly, the chemical industry contributes approximately 25% to the market share, utilizing boilers for various chemical production processes requiring precise temperature control. The metals and mining sector also significantly relies on boilers, contributing around 20% to the market, using boiler systems for heating, drying, and energy generation. These figures underscore the critical role of boilers in maintaining operational efficiency across various industrial applications.

The residential boiler segment is anticipated to witness the highest CAGR of 5.5% over the forecast period. Factors such as the increasing urbanization and a rapidly growing population, particularly in emerging nations like India, China, and Brazil are driving the growth of the residential segment in the global market. For example, the number of housing units in the United States increased from 136.57 million in 2017 to 141.95 million in 2021, as reported by the U.S. Census Bureau. This expansion in the housing sector elevates the demand for efficient heating solutions, prompting homeowners to invest in modern boilers that offer enhanced energy efficiency and reduced environmental impact. Additionally, government initiatives promoting energy-efficient appliances further bolster this growth, as consumers seek to reduce energy consumption and utility costs.

REGIONAL ANALYSIS

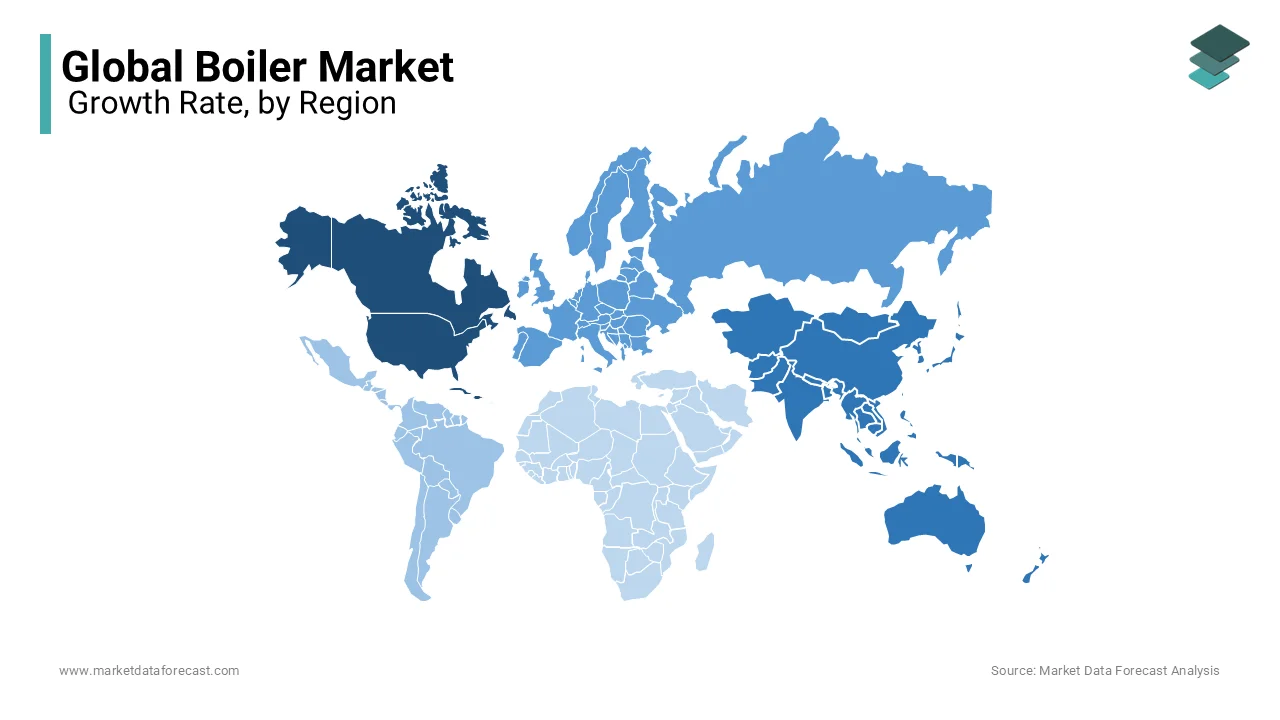

North America is one of the most leading regions in the global boiler market. In the United States alone, the residential boiler market is worth over USD 2.2 billion. The reason for this large market is the strict environmental rules and the growing need for energy-saving heating systems. Many homes and industries in North America use boilers to heat spaces and provide hot water. According to the U.S. Energy Information Administration (EIA), about 38% of the electricity in the United States came from natural gas in 2022. This shows that gas-fired boilers are very common. Also, the government is pushing for lower carbon emissions, leading to new, more efficient boiler technologies that help reduce pollution and increase energy savings.

The Asia-Pacific region is anticipated to experience the fastest growth in the global boiler market and is projected to showcase a CAGR of 5.6% over the forecast period. China and India are industrializing quickly and cities are expanding. The International Energy Agency (IEA) reports that China plans to start 44 new oil refinery projects between 2022 and 2026. These projects will make up 24% of all refinery projects in Asia, which will increase the demand for industrial boilers. Additionally, governments are encouraging industries to switch to cleaner energy and follow strict environmental laws. Because of this, many businesses are investing in energy-efficient boilers, helping to create a more sustainable and greener future.

Europe is a notable region in the boiler market, with a strong focus on energy efficiency and reducing pollution. Many industries in Europe, such as chemicals, food and beverage, and paper and pulp, rely heavily on boilers for their operations. The European Union has put in place strict environmental policies to cut greenhouse gas emissions. This has led to a big push for the use of modern and advanced boiler technologies that save energy and reduce pollution. Countries like Germany, France, and the United Kingdom are leading in this transition. These nations have introduced regulations that support the use of high-efficiency boilers while also working to phase out older, less efficient models.

The boiler market in Latin America is growing at a steady pace, especially in countries such as Brazil and Argentina. This is mainly because industries in the region, like food and beverage processing and petrochemicals, are expanding. As more people move to cities and the region’s economy develops, the need for efficient heating systems is increasing. However, there are challenges to market growth. The region experiences economic ups and downs, and not all businesses have enough money to invest in better infrastructure. Despite this, the overall demand for heating solutions continues to grow, and as the economy stabilizes, more industries will adopt modern and efficient boiler technologies.

The Middle East and Africa region is an emerging market for boilers, meaning it is developing new opportunities in the industry. This growth is mainly because of investments in oil and gas projects and improvements in infrastructure. In the next few years, the industrial boiler sector in this region is expected to expand as industrialization increases. Countries like Saudi Arabia and the United Arab Emirates are investing in manufacturing and industrial development. These industries need advanced boilers to help with heating and steam production. However, some problems could slow down this growth. Political issues and economic differences between countries can make it harder for industries to expand quickly. Even with these challenges, the region has a lot of potential for boiler market growth.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global boiler market include Siemens AG, Mitsubishi Heavy Industries Ltd, Bosch Industriekessel GmbH, Babcock & Wilcox (B&W), Thermax, Babcock Wanson, IHI Corporation, Cleaver-Brooks, Viessmann, and Fulton.

The global boiler market is highly competitive, driven by technological advancements, regulatory changes, and increasing demand for energy-efficient solutions. Leading manufacturers such as Mitsubishi Heavy Industries, Siemens AG, and BDR Thermea Group compete by leveraging innovation, strategic acquisitions, and sustainability initiatives to maintain their market positions.

Technological advancements play a critical role in competition, with companies investing in smart boiler systems, hydrogen-powered boilers, and low-emission technologies to comply with strict environmental regulations. Companies that can develop high-efficiency, cost-effective, and eco-friendly boilers gain a competitive edge, especially in markets with strong sustainability policies like Europe and North America.

Another key factor is geographical market expansion. Players aim to strengthen their foothold in emerging markets like India, China, and Southeast Asia, where industrialization and urbanization are driving demand for high-capacity boilers. Mergers, acquisitions, and partnerships help companies expand their product portfolios and enter new regions.

The rise of renewable energy solutions also impacts competition, as companies shift toward hybrid heating systems, biomass boilers, and heat pumps. Firms that quickly adapt to these trends can outpace competitors and capture a larger market share. Ultimately, innovation, sustainability, and market expansion define the competitive landscape in the boiler industry.

Top 3 Players in the Market

Mitsui & Co., Ltd.

Mitsui & Co., Ltd. is a major company from Japan with a strong presence in the boiler manufacturing industry. The company operates in many sectors, including machinery and energy-related products. In the fiscal year ending March 2021, Mitsui & Co. reported revenues of approximately $75.56 billion, making it a leading player in the global boiler market. The company has built a large network across different industries, helping meet the growing demand for reliable and energy-efficient boiler systems. Mitsui & Co. continues to expand its reach by supplying advanced boiler technologies to different industries, ensuring that they meet the modern needs of power generation and manufacturing.

Siemens AG

Siemens AG, based in Germany, is one of the largest global technology companies, focusing on electrification, automation, and digitalization. In 2021, Siemens reported revenues of approximately $62.99 billion, making it a powerful force in the boiler industry. The company has been at the forefront of innovation, constantly developing new and improved boiler systems that focus on energy efficiency and environmental sustainability. One of Siemens’ key contributions to the industry is the integration of automation and smart digital control systems into boilers. These advanced features help improve operational efficiency while reducing emissions, making Siemens a key player in the transition toward eco-friendly boiler solutions.

Mitsubishi Heavy Industries, Ltd.

Mitsubishi Heavy Industries (MHI) is another leading Japanese company with a strong presence in the boiler market. The company reported revenues of approximately $34.90 billion in 2021 and is known for manufacturing high-quality boilers for power generation and industrial applications. MHI has invested heavily in research and development, focusing on creating boilers that are both highly efficient and environmentally friendly. The company’s advanced technology supports global efforts to reduce carbon emissions while ensuring that industries continue to get the reliable heating and steam solutions they need. With its technological expertise, MHI has been able to serve multiple industries, helping them meet their evolving energy needs.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Strategic Partnerships and Acquisitions

Many leading companies in the boiler market strengthen their position by forming partnerships and acquiring other businesses. This strategy helps them expand into new regions and gain access to better technology. For example, BDR Thermea Group has grown significantly by acquiring Baymak in Turkey and Hitecsa in Spain. These acquisitions have helped BDR Thermea diversify its product range and enter new emerging markets. Similarly, ISGEC Heavy Engineering Ltd. has formed key partnerships with Amec Foster Wheeler and Siemens Heat Transfer Technology, gaining access to cutting-edge boiler innovations. These strategic moves allow companies to integrate advanced technology, grow their customer base, and increase their global influence.

Innovation and Development of Sustainable Technologies

As governments enforce strict environmental regulations, boiler manufacturers are focusing on creating sustainable and energy-efficient products. Many companies are investing heavily in research and development to design low-emission and high-efficiency boilers. For example, Vaillant Group has developed green heating solutions such as heat pumps and solar thermal systems, contributing to a cleaner environment. BDR Thermea Group is also leading the way in developing hydrogen-powered boilers through its participation in the Hy4Heat project in the UK. By focusing on cleaner energy solutions, companies can meet government regulations, reduce environmental impact, and gain a competitive edge in the market.

Diversification of Product Portfolio

To stay relevant in a rapidly changing market, boiler manufacturers are expanding their product portfolios beyond traditional boilers. Instead of just focusing on gas and oil-fired boilers, many companies are offering solar thermal systems, biomass boilers, hybrid heating systems, and combined heat and power (CHP) technologies. For example, Baxi, a subsidiary of BDR Thermea, has introduced micro-CHP technology, allowing homeowners to generate electricity while heating their homes. Likewise, Mitsubishi Heavy Industries has integrated smart automation into its boiler systems to improve efficiency and performance. This diversification strategy ensures that manufacturers meet changing customer demands while adapting to new industry trends.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, the Government of Tripura announced the "Tripura Boilers (Third Amendment) Rules, 2024," which introduced significant changes to the state's boiler regulations. This amendment aims to modernize boiler safety and compliance standards in the region.

- In November 2024, the UK government announced reforms to the Clean Heat Market Mechanism (CHMM), reducing fines for boiler manufacturers who fail to meet heat pump sales targets from £3,000 to £500 per missed sale. This adjustment aims to balance the promotion of heat pump adoption with cost-of-living considerations.

- In October 2024, Hepworth Brewery in West Sussex became the first UK brewery to utilize an ultra-high-temperature heat pump instead of a traditional oil boiler for beer production. This innovation is expected to significantly reduce the brewery's emissions and fuel costs.

- In October 2024, OneFortyOne, a forestry industry leader, announced a $30 million investment in renewable power generation at their Jubilee Sawmill in Mount Gambier. The project includes installing a new boiler and steam turbine to produce electricity from biomass, aiming to power the entire site with renewable energy by 2026.

MARKET SEGMENTATION

This research report on the global boiler market is segmented and sub-segmented into the following categories.

By Fuel

- Natural Gas

- Oil

- Coal

- Electric

- Others

By Capacity

- ≤ 10 MMBTU/hr

- > 10 - 50 MMBTU/hr

- > 50 - 100 MMBTU/hr

- > 100 - 250 MMBTU/hr

- > 250 MMBTU/hr

By Application

- Residential

- Commercial

- Offices

- Healthcare Facilities

- Educational Institutions

- Lodgings

- Retail Stores

- Others

- Industrial

- Food Processing

- Pulp & Paper

- Chemical

- Refinery

- Primary Metal

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which industries are the biggest consumers of boilers worldwide?

Key industries include power generation, oil & gas, food & beverage, and chemical processing. The textile, paper, and pharmaceutical sectors also rely on boilers for steam and heat applications. Demand varies by region based on industrialization levels. Heavy industries generally require high-capacity boilers.

What are the key factors driving global boiler market growth?

Increasing energy demand, industrialization, and stricter environmental regulations drive growth. The shift toward energy-efficient and eco-friendly boilers is also a major factor. Government incentives for cleaner energy solutions boost market expansion. Technological advancements further enhance efficiency and performance.

What role does government policy play in the boiler market?

Governments regulate emissions, efficiency standards, and safety requirements for boilers. Incentives and subsidies encourage the adoption of cleaner and more efficient technologies. Stringent policies in developed nations drive innovation in energy-efficient boilers. In emerging markets, policy support helps expand industrial infrastructure.

What is the future outlook for the global boiler market?

The market is expected to grow with rising industrialization and energy demand. Innovation in hydrogen, electric, and biomass boilers will drive sustainability trends. Stringent emission norms will push industries to upgrade to greener solutions. Emerging economies will see increased adoption due to expanding infrastructure projects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]