Global Boat Market Size, Share, Trends & Growth Forecast Report – Segmented By Type, Size, End-User, Propulsion, Hull, Application and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) - Industry Analysis Forecast (2025 to 2033)

Global Boat Market Size

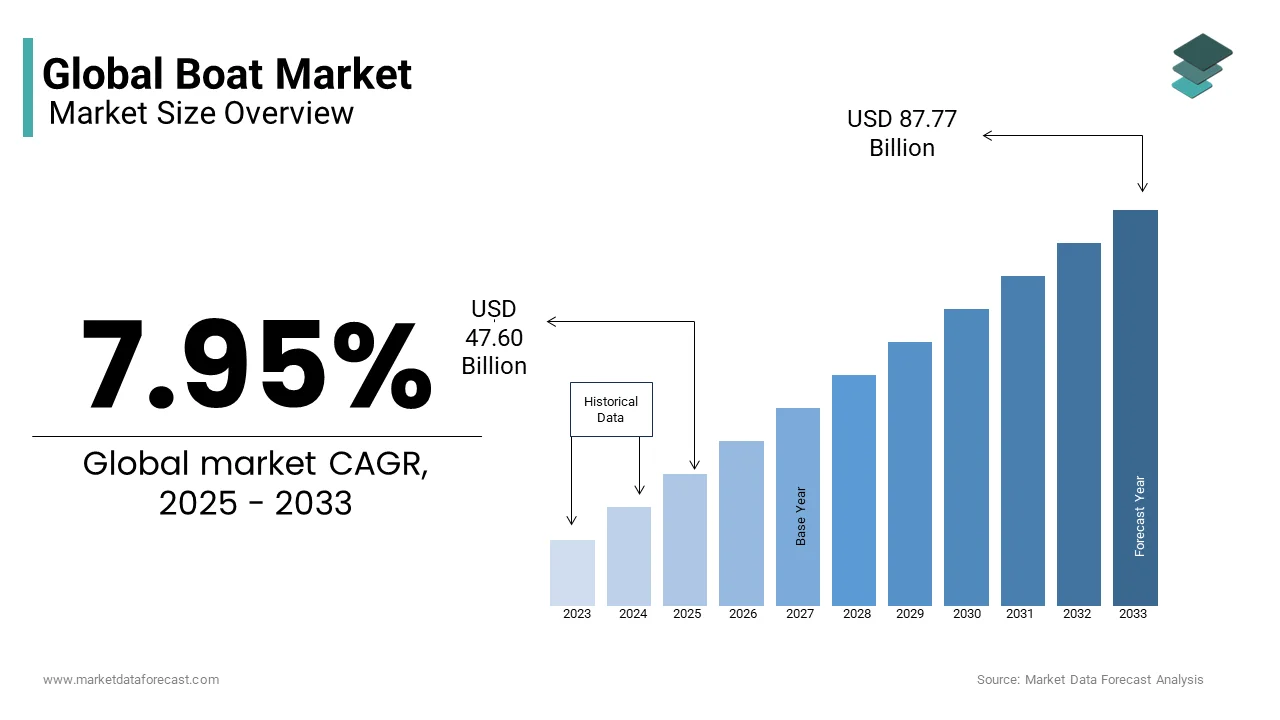

The global boat market size was valued at USD 44.09 billion in 2024 and is anticipated to reach USD 47.60 billion in 2025 from USD 87.77 billion by 2033, growing at a CAGR of 7.95% during the forecast period from 2025 to 2033.

Current Scenario Of The Global Boat Market

Boats include a wide range of boats, such as small motorboats, sailboats, luxury yachts, and fishing boats, along with boats used for tourism and transport. Boats are used both for personal enjoyment and commercial purposes, ranging from affordable boats to high-end yachts. In recent years, recreational boating has become more popular as people spend more time outdoors. In the United States, more than 87 million people participated in recreational boating in 2021, according to the National Marine Manufacturers Association (NMMA). The boat market is strong in countries like the United States, Italy, and the United Kingdom, where boating is a major leisure activity.

Sustainability is playing a bigger role in the boat market as people look for more eco-friendly options. Boat manufacturers are now developing electric and hybrid-powered boats to reduce fuel consumption and pollution. The International Council of Marine Industry Associations (ICOMIA) predicts that electric boats will become more common by 2030. This shift towards greener solutions is changing the way boats are designed, manufactured, and regulated, making sustainability a priority for both companies and consumers.

Market Drivers

More People Taking Up Recreational Boating

Recreational boating is growing fast as more people are interested in water activities. In 2022, 100 million Americans took part in boating, showing a steady increase in boat ownership and usage, according to the National Marine Manufacturers Association (NMMA). In Europe, countries like France, Spain, and Italy have strong boating cultures, where owning and renting boats is common. Younger generations are also driving growth by choosing outdoor adventures and shared boating services. Boat rentals have become more popular, making it easier for people to enjoy boating without buying a boat, which is increasing the overall demand for watercraft.

Advancements in Boat Technology and Propulsion

New technologies are shaping the boat market, especially in propulsion systems. More people are choosing electric and hybrid boats as awareness of environmental issues grows. The International Maritime Organization (IMO) aims to cut greenhouse gas emissions from the marine industry by 50% by 2050, which is pushing manufacturers to develop cleaner propulsion systems. Many leading boat companies have launched electric models, and ICOMIA predicts that electric and hybrid boats will have a larger share of the market by 2030. Governments in the U.S. and Europe are also offering incentives to encourage people to buy eco-friendly boats, which is further driving growth in this segment.

Market Restraints

High Costs of Buying and Maintaining Boats

The high cost of purchasing and maintaining boats is a major challenge. According to the National Marine Manufacturers Association (NMMA), the average price of a new recreational boat in the U.S. was $40,000 in 2021, while luxury yachts and bigger vessels can cost millions. Maintenance costs are also significant, with boat owners spending about 10-15% of their boat's purchase price annually on upkeep, according to the American Boat and Yacht Council (ABYC). Additional costs such as storage, fuel, and insurance make boat ownership expensive, which prevents many potential buyers from entering the market, especially when the economy is uncertain.

Strict Environmental Regulations

Tough environmental regulations are another challenge for the boat market. In the U.S., the Environmental Protection Agency (EPA) has introduced Tier 3 emission standards, which require marine engines to release fewer pollutants. These regulations help reduce nitrogen oxides and other harmful emissions but also increase production costs for boat manufacturers. Additionally, the United Nations Environment Programme (UNEP) estimates that 8 million tons of plastic enter the oceans each year, which has led to growing concerns about marine pollution. This has forced boat manufacturers to adopt sustainable practices and cleaner technologies, adding complexity and higher costs to boat production.

Market Opportunities

Rising Demand for Eco-Friendly Boats

More consumers are looking for eco-friendly boats to reduce environmental harm. The International Council of Marine Industry Associations (ICOMIA) predicts that by 2030, electric and hybrid boats could make up 10% of the global boating market. Governments worldwide are also encouraging the use of greener boats by offering incentives for eco-friendly marine technologies. The U.S. Environmental Protection Agency (EPA) is supporting cleaner propulsion systems through grants and initiatives. As more people become conscious of sustainability, boat manufacturers that invest in electric and energy-efficient designs will have new growth opportunities.

Growth in Boating Tourism

Boating tourism is expanding fast and creating more demand for boats. The United Nations World Tourism Organization (UNWTO) states that maritime tourism, including boat and yacht rentals, is a key part of the global travel industry. In popular travel regions like the Mediterranean, the Caribbean, and Southeast Asia, demand for yacht charters and luxury boat vacations is increasing. Eco-tourism is also on the rise, with more tourists choosing sustainable boating experiences. The growth of boating tourism is benefiting both recreational boat makers and high-end yacht manufacturers, providing significant opportunities for expansion in the market.

Market Challenges

Impact of Climate Change on Boating Facilities

Climate change is affecting boating infrastructure like marinas, docks, and harbors. Rising sea levels and extreme weather events are damaging coastal areas. The National Oceanic and Atmospheric Administration (NOAA) reports that global sea levels have risen by 3.3 millimeters per year since 1993, and the rate is increasing. The Federal Emergency Management Agency (FEMA) also notes that hurricanes and storms have caused billions of dollars in damage to coastal infrastructure. Repairing and maintaining these facilities is costly, and rising insurance costs make it harder for marinas and boat operators to sustain operations.

Rising Fuel Prices and Supply Chain Problems

High fuel prices and supply chain disruptions are creating difficulties for the boat market. According to the U.S. Energy Information Administration (EIA), diesel fuel prices reached record highs in May and June 2022, making it more expensive to run fuel-powered boats. These high costs affect both recreational and commercial boat owners. Additionally, the U.S. Department of Transportation reports that global supply chain issues have led to material shortages, such as fiberglass and engine parts, causing delays in boat production. These disruptions increase manufacturing costs and make it harder for boat companies to meet customer demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.95% |

|

Segments Covered |

By Type, Size, End-user, Propulsion, Hull, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Malibu Inc. (U.S.), Brunswick Corporation (U.S.), Polaris Inc. (U.S.), Groupe Beneteau (France), Yamaha Motor Corporation (Japan), Marine Product Corporation (U.S.), Sun Tracker Boats (U.S.), Carolina Skiff, LLC (U.S.), Berkshire Pontoons (U.S.), Premier Marine Inc. (U.S.). |

SEGMENT ANALYSIS

Boat Market Analysis By Type

The inboard boats segment led the market by holding 54.5% of the global market share in 2024. The performance of boats, particularly in the luxury and commercial segments is majorly contributing to the domination of the inboard segment in the global boats market. Inboard engines offer superior fuel efficiency and provide better stability, which is crucial for larger vessels like yachts and sport fishing boats. The National Marine Manufacturers Association (NMMA) reports that inboard boats are preferred for long-distance cruising, water sports, and recreational boating, especially in high-end markets. These boats are especially popular in markets such as North America and Europe, where luxury yacht ownership and long-distance marine tourism continue to thrive.

The outboard segment is projected to register the highest CAGR of 7.1% over the forecast period due to the increasing demand for affordable, easy-to-maintain, and versatile boating options. The International Council of Marine Industry Associations (ICOMIA) reports that outboard-powered boats are gaining popularity in emerging markets due to their lower purchase price and simplicity compared to inboard models. Additionally, advancements in electric outboard technology have spurred growth, with the U.S. Department of Energy noting that electric outboards contribute to reducing emissions and lowering long-term operating costs. As interest in fishing and recreational boating rises, especially in coastal and lake regions, outboard boats continue to capture a significant market share.

Boat Market Analysis By Size

The 20-50 ft size range segment commanded the global boat market by accounting for 37.4% of the global market share in 2024. The domination of 20-50 ft segment is majorly driven by its balance between size, functionality, and affordability, making it ideal for recreational activities such as cruising, fishing, and water sports. According to the National Marine Manufacturers Association (NMMA), boats in this range are especially popular in North America and Europe, where they offer adequate space for comfort and performance while maintaining ease of handling and lower maintenance costs. The segment’s popularity is driven by increasing consumer preference for versatile, multi-use boats that cater to various recreational needs.

The below 20 ft segment is estimated to grow at the highest CAGR of 6.3% during the forecast period owing to the increasing interest in affordable and easy-to-operate recreational boats. The International Council of Marine Industry Associations (ICOMIA) reports that smaller boats are gaining traction in emerging markets and among younger consumers due to their accessibility and lower operational costs. Moreover, smaller boats are favored for inland activities like fishing and watersports, which are growing in popularity. The trend toward boat rentals and shared boating services is also contributing to the segment's rapid expansion, as consumers seek low-cost options for occasional use.

Boat Market Analysis By End-user

The recreational segment held the leading share of 56.6% of the global market share in 2024. The growing popularity of water-based leisure activities, such as boating, fishing, and watersports is driving the growth of the recreational segment in the global market. According to the National Marine Manufacturers Association (NMMA), approximately 87 million Americans engage in recreational boating, which continues to drive market growth. These boats are favored for their versatility, offering options for family outings, adventure, and relaxation. The increasing interest in outdoor and wellness activities further fuels the demand for recreational boats, making this segment the largest and most established in the market.

The commercial boat segment is expected to progress at a CAGR of 5.9% over the forecast period owing to the increasing demand for boats used in commercial fishing, transportation, and offshore operations. The International Maritime Organization (IMO) reports that maritime transport accounts for over 80% of global trade by volume, highlighting the importance of commercial vessels. Additionally, sectors like tourism and energy are contributing to growth, with rising demand for boats designed for specific commercial needs. Environmental regulations and advances in fuel efficiency are also driving innovations in commercial boats, further accelerating market expansion.

Boat Market Analysis By Propulsion

The conventional propulsion segment held the largest share of 64.6% of the global market in 2024. This segment includes boats powered by traditional internal combustion engines (ICE), which remain the most prevalent due to their power, reliability, and cost-effectiveness. The National Marine Manufacturers Association (NMMA) reports that conventional engines are still preferred for recreational boating, especially for larger vessels like yachts and sport fishing boats. These systems are capable of handling longer distances and higher power demands, which is essential for activities like offshore cruising and commercial applications. The segment remains crucial due to its affordability and wide availability, making it indispensable for both recreational and commercial users.

The electric propulsion segment is projected to showcase the fastest CAGR of 13.4% over the forecast period owing to the rise in electric-powered boats is driven by consumer demand for environmentally friendly alternatives and stricter regulatory policies. According to the International Council of Marine Industry Associations (ICOMIA), electric boats have seen growing popularity, especially in Europe, where governments are offering subsidies and incentives for eco-friendly marine products. Additionally, advancements in battery technology, improving energy density and reducing costs, are making electric propulsion more viable. The U.S. Department of Energy reports that electric boat technology is advancing rapidly, and increasing environmental awareness continues to push the growth of this segment.

Boat Market Analysis By Hull

The GRP (Glass Reinforced Plastic) hull segment captured 41.4% of the global market share in 2024. GRP's popularity is driven by its exceptional durability, corrosion resistance, and lightweight properties, making it ideal for a variety of boating applications, including recreational and commercial vessels. According to the National Marine Manufacturers Association (NMMA), GRP boats are commonly used in the production of both small boats and large yachts, with the material offering a perfect balance between performance and maintenance. Its relatively low manufacturing cost compared to other materials, alongside its long lifespan, solidifies its position as the dominant material choice for boat hulls.

The aluminum hull segment is predicted to grow at the fastest CAGR of 6.5% over the forecast period owing to factors such as the increasing demand for aluminum boats is due to their light weight, strength, and resistance to corrosion, especially in freshwater environments. According to the International Council of Marine Industry Associations (ICOMIA), aluminum is particularly preferred for boats in the fishing and recreational segments, where fuel efficiency and durability are essential. Aluminum's recyclability and environmental benefits further support its growing demand, as consumers shift toward more sustainable boating solutions. The segment's rapid growth is also fueled by advances in production technologies that lower costs and enhance aluminum's performance.

Boat Market Analysis By Application

The fishing segment remained as the largest segment in the global boats market by accounting for 39.4% of the global market share in 2024. Fishing boats are essential for both recreational and commercial fishing activities. Over 50 million recreational anglers in the U.S. use fishing boats, contributing significantly to the segment's size. Commercial fishing vessels are vital for the global seafood industry, which generates more than $250 billion annually. The versatility of fishing boats, their adaptation to various water bodies and their importance to the economy ensure that this segment remains dominant in the market.

The water sports segment is estimated to showcase the fastest CAGR of 8.2% from 2025 to 2033. The lead of the water sports segment is majorly driven by the increasing popularity of activities like wakeboarding, waterskiing, and jet skiing. According to the International Council of Marine Industry Associations (ICOMIA), water sports participation has surged globally, with significant growth in markets like North America and Europe. The National Marine Manufacturers Association (NMMA) reports that sport-specific boats for water activities are becoming more popular due to technological advancements in design and performance. As more consumers seek active, outdoor water experiences, the demand for water sports boats is expected to continue rising rapidly.

REGIONAL ANALYSIS

North America played the most dominating role in the global boat market by commanding 45.2% of the global market share in 2024. The dominance of North America in the global market is largely driven by the U.S., where boating is a significant recreational activity. According to the National Marine Manufacturers Association (NMMA), more than 87 million Americans participate in recreational boating. The region benefits from vast coastlines, lakes, and rivers that promote boating activities, further solidifying its position as the largest market. Additionally, North America has a well-established manufacturing industry for both recreational and commercial vessels, contributing to the region’s leading market share.

The Asia-Pacific region is the rapidly growing regional market with a projected CAGR of 9.5% over the forecast period. The growth of the Asia-Pacific market is driven by an expanding middle class, rising disposable incomes, and increasing interest in water sports and tourism. ICOMIA reports that countries like China and India are investing in recreational boating, with coastal tourism increasing significantly. The China National Tourism Administration also notes rising demand for leisure boating, as infrastructure improvements and a growing affluent population support higher boat ownership. Asia-Pacific's burgeoning boat market is becoming a crucial player in the global landscape.

Europe remains a stable and significant market, with strong demand for both luxury yachts and recreational boats. According to the European Boating Industry (EBI), boating is an important part of the European lifestyle, particularly in countries like France, Italy, and Spain. With a growing emphasis on sustainable boating solutions, including electric boats, Europe is expected to continue its gradual market expansion. The region's long history of maritime activity and established manufacturing capabilities ensure its continuing dominance in the luxury boat market.

The Latin American market is growing steadily and particularly in Brazil and Mexico, due to increasing tourism and interest in recreational boating. The Latin American Association of Boat Manufacturers (ALAMAR) reports that Brazil’s coastal tourism is experiencing an uptick, driving demand for boats, especially among the rising middle class. Improvements in marine infrastructure and government support for tourism are expected to fuel further growth in the boating market. However, growth may vary by country, with Brazil leading the charge.

The Middle East and Africa region is showing promising growth, particularly in the luxury boating sector. According to Frost & Sullivan, countries like the UAE and Saudi Arabia are seeing increased demand for luxury yachts and recreational vessels. Rising wealth and maritime tourism are key factors driving this demand, with the UAE positioning itself as a global hub for boating and maritime activities. However, in some parts of Africa, growth may be slower due to economic challenges and less developed infrastructure.

Top 3 Players in the market

Brunswick Corporation

Brunswick Corporation is the largest player in the global recreational boating market, commanding a significant portion of the market with its diverse range of brands. The company’s portfolio includes well-known names like Mercury Marine, Sea Ray, Bayliner, Lund, and Boston Whaler. Brunswick has established itself as a leader in innovation, particularly through Mercury Marine, which is at the forefront of marine propulsion systems. Brunswick has made considerable strides in sustainable boating, most notably with its electric propulsion systems and smart boating technologies like Siren Marine, which offers IoT-based boat monitoring solutions. Brunswick's commitment to sustainability is also reflected in its ongoing efforts to reduce emissions and develop more energy-efficient products. With a broad manufacturing base and a global network, Brunswick serves markets across North America, Europe, and Asia, influencing boat design, technology, and sustainability trends worldwide.

Groupe Beneteau

Groupe Beneteau, headquartered in France, stands as one of the dominant forces in the global boating market, particularly within the luxury yacht and sailing segments. Known for its prestigious brands, including Beneteau, Jeanneau, Lagoon, and Prestige, the company offers a wide range of vessels, from affordable cruisers to ultra-luxury yachts. Groupe Beneteau has earned recognition for its commitment to sustainability, pioneering hybrid and electric-powered yachts, and adopting greener manufacturing practices. The company is also a leader in marine innovation, providing smart boating systems that enhance user experience. Through strategic acquisitions, Beneteau has significantly broadened its reach, providing products for a variety of market segments while focusing on eco-friendly designs to meet the growing demand for sustainable boating options. Groupe Beneteau’s expansive reach in Europe, North America, and Asia cements its position as a global leader in boating innovation and luxury.

Ferretti Group

Ferretti Group is synonymous with luxury, innovation, and craftsmanship in the global yacht industry. Renowned for its iconic brands such as Ferretti Yachts, Riva, Pershing, and Mochi Craft, Ferretti has carved a niche in the luxury superyacht market, where it continues to set the benchmark for design and performance. The company is committed to pushing the boundaries of yacht innovation, with a focus on cutting-edge technology, energy-efficient systems, and sustainable practices. Ferretti has invested in hybrid and electric propulsion systems, aligning itself with the market’s movement toward greener technologies. Known for producing highly customized yachts, Ferretti caters to the ultra-wealthy, offering bespoke vessels that reflect the client’s personal style and preferences. With a strong presence in key luxury markets across Europe, the U.S., and Asia, Ferretti remains one of the foremost players in the global high-performance and luxury boating sector, continually driving trends in both design and technology.

Top strategies used by the key market participants

Brunswick Corporation – Innovation and Sustainability Integration

One of Brunswick Corporation’s major strategies to strengthen its position in the global boat market is its relentless focus on innovation and sustainability. Brunswick has heavily invested in advancing marine propulsion systems, particularly through its subsidiary Mercury Marine. Mercury’s development of electric outboard motors, like the Avator series, demonstrates the company's commitment to reducing the environmental impact of recreational boating. This aligns with Brunswick's broader sustainability goals, which include reducing carbon emissions, enhancing fuel efficiency, and developing eco-friendly technologies. Additionally, the company has capitalized on the growing trend of connected boating by acquiring companies like Siren Marine, which provides IoT-based solutions for monitoring boats. By blending cutting-edge technology with sustainability, Brunswick has positioned itself as a forward-thinking leader in the boating sector, appealing to environmentally-conscious consumers and tech-savvy boaters.

Groupe Beneteau – Strategic Acquisitions and Brand Diversification

Groupe Beneteau employs a strategy of strategic acquisitions and brand diversification to strengthen its position in the boat market. Over the years, Beneteau has expanded its portfolio by acquiring several well-established brands like Prestige Yachts and Lagoon Catamarans, allowing it to capture a broader market, from affordable leisure boats to luxury yachts. This approach not only enhances Beneteau's reach across various market segments but also provides access to new design philosophies and innovation. In addition to its luxury focus, Beneteau is actively pursuing eco-friendly solutions by developing hybrid and electric-powered vessels under its core brands. The company’s acquisition strategy is complemented by a strong focus on sustainable boating, ensuring that it remains competitive as consumer preferences shift toward greener, more energy-efficient options. By diversifying its offerings and focusing on sustainability, Groupe Beneteau strengthens its market leadership while catering to a wider range of boating enthusiasts.

Ferretti Group – Luxury Customization and Technological Excellence

Ferretti Group has built its strategy around luxury customization and technological excellence, making it a dominant force in the high-end yacht market. By focusing on offering bespoke yachts that cater to the unique tastes and preferences of ultra-wealthy clients, Ferretti ensures that it remains a leader in the luxury segment. This approach allows the company to offer highly personalized experiences and stand out in a market where exclusivity and craftsmanship are paramount. Ferretti also invests heavily in research and development to stay ahead of the curve in terms of technological innovation. The company incorporates cutting-edge systems for navigation, security, and comfort, while also focusing on sustainability with hybrid and electric propulsion options. By combining luxury customization with advanced technology and sustainability, Ferretti maintains its status as a prestigious brand while attracting discerning clients seeking both performance and exclusivity.

KEY MARKET PLAYERS

Malibu Inc. (U.S.), Brunswick Corporation (U.S.), Polaris Inc. (U.S.), Groupe Beneteau (France), Yamaha Motor Corporation (Japan), Marine Product Corporation (U.S.), Sun Tracker Boats (U.S.), Carolina Skiff, LLC (U.S.), Berkshire Pontoons (U.S.), Premier Marine Inc. (U.S.). these are the market drivers that are driving the global boat market.

Competitive Landscape

The competition in the global boat market is intense, driven by several key players across different segments, from recreational boats to luxury yachts. Major companies like Brunswick Corporation, Groupe Beneteau, and Ferretti Group lead the market, each dominating in specific areas—recreational boats, luxury yachts, and high-performance vessels, respectively. These companies compete not only in terms of product offerings but also through technological innovations, sustainability efforts, and brand prestige.

In recent years, sustainability has become a critical factor, with companies increasingly investing in eco-friendly solutions like electric and hybrid propulsion systems. This trend has heightened competition, particularly as consumers demand greener options. Furthermore, technological innovation is playing a significant role, with brands focusing on smart boating features, connected vessels, and improved onboard experiences to meet the expectations of the tech-savvy consumer.

Smaller, niche players are also vying for market share by offering specialized boats or custom solutions, further intensifying competition. At the same time, companies are leveraging strategic partnerships and acquisitions to expand their portfolios and reach new markets, both regionally and globally.

As the boating market continues to evolve, competition will remain fierce, with companies striving to outpace each other in terms of technology, sustainability, design, and customer experience.

RECENT HAPPENINGS IN THIS MARKET

- In January 2025, Brunswick Corporation, a global leader in marine technology, will showcase its extensive, industry-leading technology portfolio and introduce its 'Boating Intelligence' initiative at the 2025 Consumer Electronics Show (CES) in Las Vegas. The Boating Intelligence initiative aims to enhance Brunswick's ACES (Autonomous, Connected, Electrified, and Shared) strategy by integrating AI capabilities into its products, resulting in a boating experience that is simpler, safer, smarter, and more sustainable.

- In February 2025, Vision Marine Technologies has broadened its collaboration with Aileron Residences, a high-end waterfront community located in Dania Beach, Florida. This expanded partnership allows Vision Marine Electric Boat Rental to provide rental services and set up a new retail location. Soon, Aileron residents will automatically gain membership to Vision Marine's exclusive electric boat club, granting them access to a fleet of top-tier electric boats.

MARKET SEGMENTATION

This research report on the global boat market is segmented and sub-segmented into the following categories.

By Type

- Inboard

- Outboard

By Size

- Below 20 ft

- 20 – 50 ft

- More than 50 ft

By End-user

- Commercial

- Recreational

By Propulsion

- Electric

- Conventional

- Others (Sailboat, Solar, and Others)

By Hull

- Wood

- GRP

- Aluminum

- Steel

- Others (ABS, PE, and Others)

By Application

- Fishing

- Water Sports

- Sailing

- Tourism

- Surveys

- Others (Rescue, Patrol Boats, and Others)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]