Global Blood Group Typing Market Size, Share, Trends & Growth Forecast Report By Product Test Type, Technique, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Blood Group Typing Market Size

The global blood group typing market was worth US$ 3.46 billion in 2024 and is anticipated to reach a valuation of US$ 8.09 billion by 2033 from US$ 3.8 billion in 2025, and it is predicted to register a CAGR of 9.9% during the forecast period 2025-2033.

The global blood group typing market has experienced notable growth in the recent past due to the growing awareness among healthcare professionals and the public of the importance of blood group compatibility in various medical procedures that range from transfusions and organ transplants to prenatal care. The blood group typing market is expected to continue the momentum during the forecast period owing to the continuing impact of these factors. The demand for blood group typing services is particularly high in countries such as the United States, Canada, European nations, Japan, and Australia, as these countries have access to robust healthcare systems, and medical procedures keep happening at a high volume on a regular basis. On the other hand, highly populated countries such as India, China, and Brazil have been experiencing increasing demand for blood group typing services over the last few years, and these countries are predicted to be lucrative markets for blood group typing services during the forecast period.

In the recent past, the global pandemic has presented unprecedented challenges to the blood group typing market. When it comes to receiving a blood transfusion, accurate blood grouping is essential. The nature and presence of antigens in red blood cells play a role in blood group identification. During a blood transfusion or organ transplant treatment, blood group typing is a critical examination that helps determine the donor's similarity to the recipient. Improvements aided the market's development in the blood detection technique. According to the American National Red Cross, almost 21 million blood products are transfused annually in the United States. According to the same article, nearly 6.8 million individuals in the United States donate blood each year.

MARKET DRIVERS

Y-O-Y growth in the number of blood banks worldwide, increased blood donors, blood donation campaigns, and blood transfusions across the globe are expected to boost the global blood group typing market.

Increasing prevalence to identify an individual's blood group in the medical sector is a key driving factor for the blood group typing market to grow. The growing number of blood banks across the world is accelerating the demand of the market. Besides, increasing accidental cases and blood in emergency cases propel the need for the blood group typing market. Rising incidences of chronic diseases and the growing number of surgical treatment procedures greatly influence the growth of the global blood group typing market. Even in rural areas, increasing blood donation campaigns is gearing up the demand of this market. The emergence of the latest technologies in the medical sector is to set up growth opportunities for the market.

Furthermore, the market benefits from an increase in the number of traffic crashes and injuries, and an increase in the number of blood checks for blood transfusion improves the market growth. Blood transfusions and organ replacement have risen as the number of blood tumors such as lymphoma, leukemia, and myeloma, and blood-related diseases have increased. However, improving healthcare infrastructure in developing markets such as China and India are expected to propel the market growth. The market is expected to expand further as more of these tests diagnose Hemolytic Disease of the Newborn (HDN).

Also, a rising number of healthcare facilities and the advances in blood group typing systems, on the other hand, create promising growth opportunities for market participants, which is likely to augment market growth. Another important factor driving the market growth is the growing relevance of blood group typing during pregnancy. The rising prevalence of chronic diseases, as well as increased R&D initiatives aimed at understanding the molecular basis of blood and antibody-antigen interactions, can be credited for this segment's large share and rapid development.

MARKET RESTRAINTS

The negligence of the staff members in maintaining correct formats and high cost associated with blood group testing services are primarily hindering the growth of the global market. Limited awareness among people about the importance of blood group typing, lack of skilled healthcare professionals for blood typing and regulatory hurdles for blood typing kits and technologies are impeding the growth of the global market. Limited reimbursement options for blood typing tests, concerns about patient privacy and data security and the competition from alternative blood typing methods or technologies are hampering the growth of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.9% |

|

Segments Covered |

By Product, Technique, Test Type, End User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bio-Rad Laboratories, Inc., Grifols, S.A., Immucor Inc., Ortho Clinical Diagnostics, Inc., Quotient, Ltd., Novacyt Group, BAG Healthcare GmbH, Rapid Labs, Day medical SA, DIAGAST, and AXO Science., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

The consumables segment accounted for 57.4% of the global market share in 2023 and the domination of the segment is anticipated to continue throughout the forecast period. The lead of the consumables segment is primarily attributed to the growing surgical processes and usage of laboratories worldwide. Factors such as Y-o-Y growth in the demand for blood transfusions, advancements in testing technologies, the expansion of healthcare infrastructure, rising prevalence of chronic diseases and the increasing number of surgical procedures that necessitate accurate blood typing are further contributing to the expansion of the consumables segment in the worldwide market. For instance, an estimated 120 million blood typing tests were conducted globally in 2023 and this number is expected to grow further during the forecast period and result in the increasing demand for consumables.

The services segment is predicted to witness a prominent CAGR during the forecast period in the global market. Factors such as the growing volume of blood donations and transfusions, rising need for pre-transfusion testing and the outsourcing of blood typing services by smaller hospitals to specialized labs are primarily boosting the growth of the services segment in the worldwide market.

By Technique Insights

The PCR-based and Microarray techniques segment led the market with 56.88% of the global market share in 2023 and is likely to hold the largest share of global market throughout the forecast period owing to the growing aged people population and the number of people increasing with different kinds of health issues. The advancements in genetic analysis technologies, Y-o-Y growth in the need for precise blood typing in transfusion medicine, the increasing adoption of personalized medicine and the rise in genetic disorders that require detailed blood group typing are propelling the growth of the PCR-based and Microarray techniques segment in the global market. The launch of new PCR-based kits that offer quicker turnaround times is further contributing to the expansion of the segment.

By Test Type Insights

The antibody screening segment occupied 30.84% of the global market share in 2023 and is expected to grow at a healthy CAGR during the forecast period. The growth of the segment is primarily driven by the Y-o-Y growth in the need for safe blood transfusions and the rising prevalence of chronic diseases that require regular transfusions. Collaborations between diagnostic companies and healthcare providers are also promoting the widespread adoption of advanced antibody screening methods, which is further fuelling the growth of the antibody screening segment in the global market.

The ABO testing segment is another major segment and held for a substantial share of the worldwide market in 2023 and the segmental domination is likely to continue throughout the forecast period.

By End-User Insights

The hospital segment dominated the market in 2023, accounting for 46.8% of the global market share and is likely to have an intense growth during the forecast period. The growth of the hospital segment is majorly credited to the increasing number of complex surgical procedures, rising incidence of trauma cases and the growing prevalence of chronic diseases that necessitate frequent transfusions. The rapid adoption of automated blood typing systems in hospitals to improve efficiency and accuracy in patient care is further boosting the growth rate of the hospital segment in the global market.

REGIONAL ANALYSIS

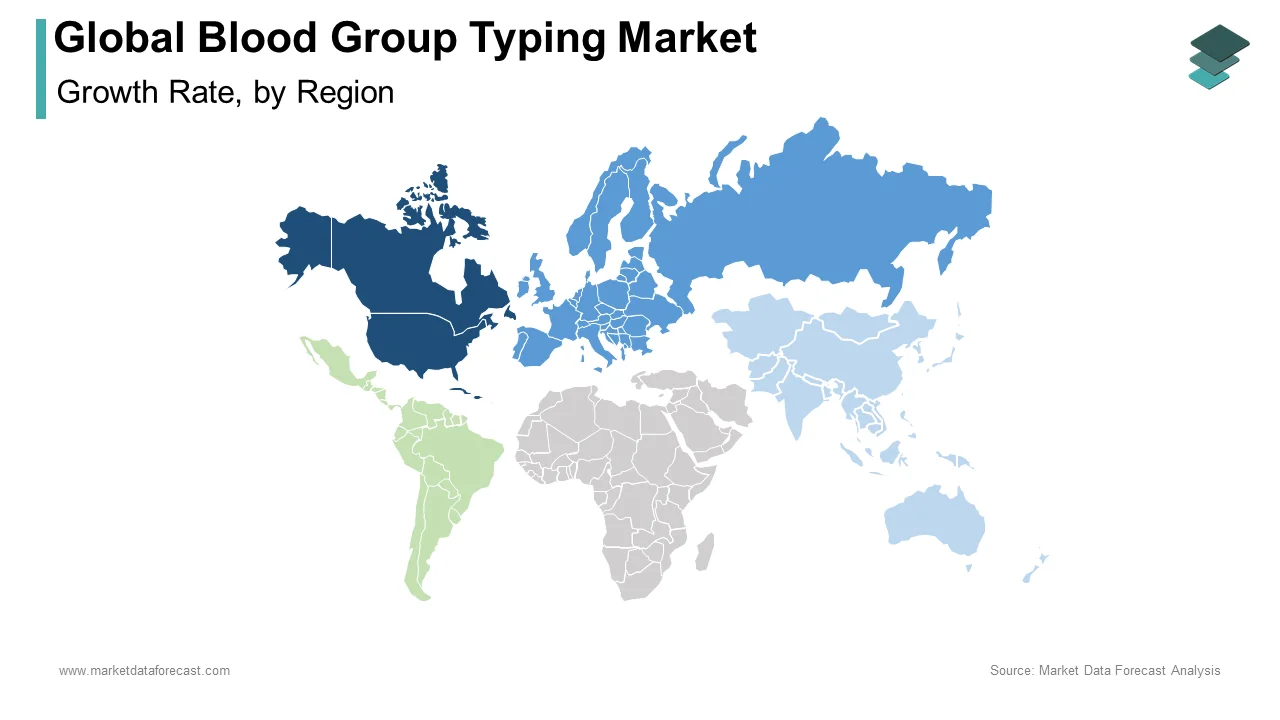

North America was the largest regional segment and accounted for 36.1% of the global blood group typing market in 2023. The North American region is also projected to grow at a healthy CAGR during the forecast period due to the presence of several key market participants such as Ortho Clinical Diagnostics, Immucor and Grifols and the launch of various new techniques in the medical sector to enable easy identification of blood groups. The presence of advanced healthcare infrastructure, high volume of blood donations and a strong focus on patient safety and precision medicine are further supporting the growth of the North American market. For instance, an estimated 60 million blood typing tests were conducted in North America in 2023. The U.S. and Canada are promising nations in the North American market and account for the most of the North American market share.

Europe is a notable region for blood group typing market and occupied a substantial share of the global market in 2023. During the forecast period, Europe is predicted to register a healthy CAGR owing to the strong regulatory framework of Europe, increasing number of R&D activities and the rising prevalence of chronic diseases. Companies such as Bio-Rad Laboratories, DIAGAST, and BAG Health Care are currently playing a leading role in the European market. Germany, the United Kingdom and France are major countries in the European market.

KEY MARKET PARTICIPANTS

Some of the promising leading the global blood group typing market profiled in the report are Bio-Rad Laboratories, Inc., Grifols, S.A., Immucor Inc., Ortho Clinical Diagnostics, Inc., Quotient, Ltd., Novacyt Group, BAG Healthcare GmbH, Rapid Labs, Day medical SA, DIAGAST, and AXO Science.

RECENT MARKET HAPPENINGS

- Product Initiative - In 2017: The Philippines launched a free blood group typing scheme. In this initiative, it is easy to identify possible blood donors through times of disease outbreak, and the title of this campaign was "Type ng Bayan" sponsored by health government departments along with the collaboration of DU30 cabinet spouses.

- Product Approval - In late 2016: The U.S. Food and Drug Administration (FDA) approved Immucor's Precise Type HEA test and its use to identify sickle cell characteristics in blood donors. Many regulatory agencies, such as the FDA, are involved in developing and applying uniform access to reliable blood policies at the country level.

- Acquisition - In Jan 2017: Grifols has completed the acquisition of Hologic 2017. This acquisition company mainly focussed on research, production, assay manufacturing, NAT (Nucleic Acid Testing) technology-based instruments for transfusion and transplantation screening.

- In June 2014, Carlyle Group bought Ortho-Clinical Diagnostics, Inc. for about USD 4 billion in late 2014. Through this purchase, the business has invested in Research and Development throughout the world for medical diagnostic products and services.

- Acquisition - In 2014: Immucor, Inc., a world leader in diagnostics for transfusion and transplantation, confirmed its acquisition of Mountain View, Sirona Genomics (Sirona), headquartered in CA, at the end of 2014. Under this, Immucor aimed to provide research funding to support the promotion of Sirona's HLA model sample preparation and bioinformatics service using leading NGS methods.

MARKET SEGMENTATION

This report on the global blood group typing market has been segmented and sub-segmented based on product, technique, test type, end-user, and region.

By Product

- Consumables

- Instruments

- Services

By Technique

- PCR-based and Microarray Techniques

- Assay-based Techniques

- Massively Parallel Sequencing Techniques

- Other Techniques

By Test Type

- Antibody Screening

- HLA Typing

- Cross-Matching Tests

- ABO Blood Tests

- Antigen Typing

By End-User

- Hospitals

- Blood Banks

- Clinical Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]