Global Blepharoplasty Market Size, Share, Trends & Growth Forecast Report By Product Type (Laser Shields, Laser Instruments and Other Surgical Instruments), Procedure Type (Upper Eyelid Blepharoplasty and Lower Eyelid Blepharoplasty), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa) – Industry Analysis (2025 to 2033)

Global Blepharoplasty Market Size

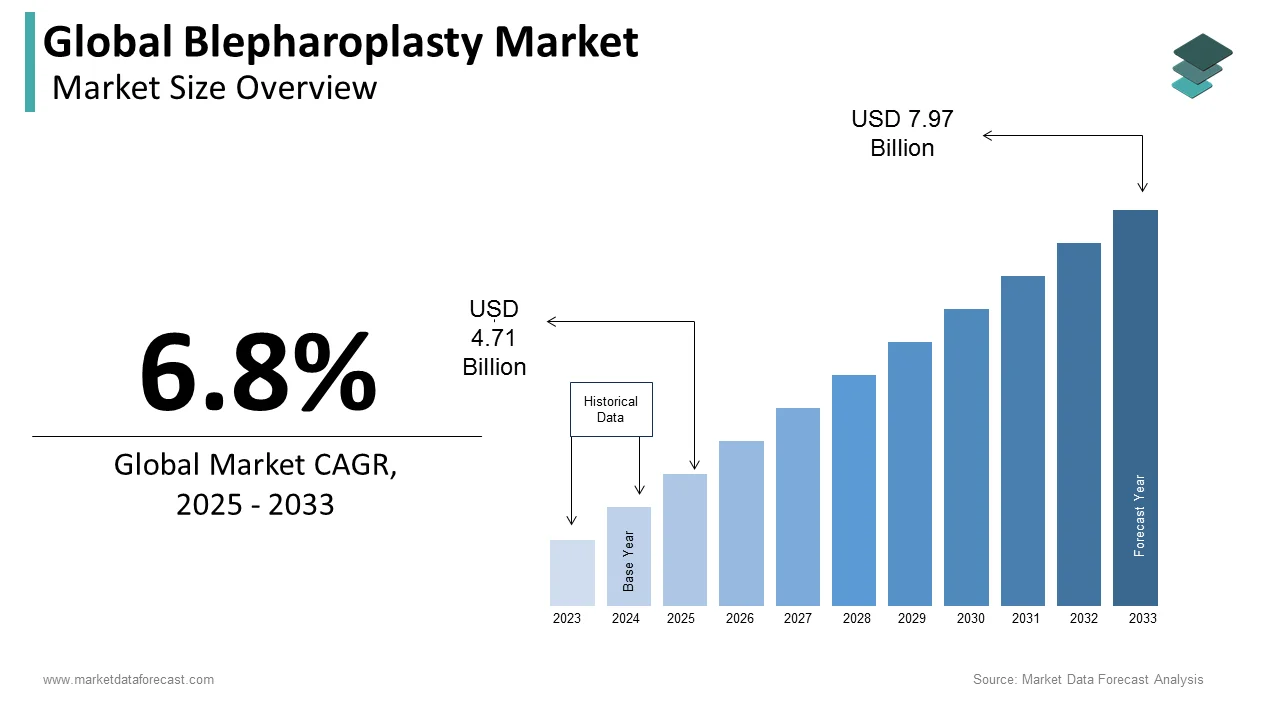

The size of the global blepharoplasty market was worth USD 4.41 billion in 2024. The global market is anticipated to grow at a CAGR of 6.8% from 2025 to 2033 and be worth USD 7.97 billion by 2033 from USD 4.71 billion in 2025.

The blepharoplasty market is growing steadily owing to the rising demand for aesthetic procedures and the increasing aging population worldwide. Blepharoplasty is a surgical procedure to improve the appearance or functionality of the eyelids, which has gained popularity for its ability to rejuvenate facial appearance by removing excess skin, fat, or muscle around the eyes. This procedure appeals to individuals seeking cosmetic enhancement as well as those needing functional improvements due to vision obstruction.

Advancements in minimally invasive surgical techniques, along with the adoption of laser-assisted and non-surgical alternatives, have contributed to the appeal of the procedure. Patients increasingly prefer shorter recovery times and less invasive options, prompting innovation in the types of treatments available. Additionally, the influence of social media and growing awareness about cosmetic procedures have significantly improved the awareness of this surgical procedure, especially among younger consumers. Geographically, the Asia-Pacific region is a major contributor to market growth, largely due to the popularity of cosmetic surgery in countries like South Korea and Japan, where beauty standards emphasize youthful and symmetrical facial features.

MARKET DRIVERS

Growth in Aging Population and Demand for Anti-Aging Solutions

With a growing global aging population, demand for anti-aging cosmetic procedures, including blepharoplasty, is rising. As skin elasticity declines with age, eyelid drooping becomes common, making blepharoplasty an appealing option for older adults seeking a youthful appearance. The World Health Organization projects that the global population aged 60 and above will reach 2.1 billion by 2050, expanding the target demographic for this procedure. This trend is especially prevalent in developed countries where disposable income allows for elective surgeries aimed at rejuvenation.

Technological Advancements in Surgical Techniques

Advances in surgical technology, such as laser-assisted blepharoplasty and the use of radiofrequency devices, have made eyelid surgery safer, less invasive, and more appealing. These techniques minimize scarring, reduce recovery time, and lower risk, making the procedure accessible to a broader audience. According to a report by the American Academy of Cosmetic Surgery, 70% of surgeons report increased patient interest in laser blepharoplasty. These innovations not only enhance patient outcomes but also boost market growth by broadening the options available to those interested in eyelid surgery.

Growing Popularity of Aesthetic Procedures Among Younger Demographics

Cosmetic procedures are increasingly popular among younger demographics, driven by social media influence and a growing emphasis on aesthetic enhancement. In regions like Asia-Pacific, where blepharoplasty is common, younger individuals view it as a standard beauty enhancement. A 2022 survey by the International Society of Aesthetic Plastic Surgery (ISAPS) found that blepharoplasty is among the top five procedures globally, with younger patients (20s-30s) contributing notably to this demand. This shift is reshaping the market, with providers offering both surgical and non-surgical options that cater to aesthetic-conscious younger consumers.

MARKET RESTRAINTS

High Procedure Costs

Blepharoplasty can be expensive, with costs ranging from $3,000 to $6,000 per procedure in countries like the United States, depending on the complexity and specific requirements. This expense is often out-of-pocket, as blepharoplasty is generally categorized as a cosmetic procedure and not covered by insurance. In countries with limited access to affordable cosmetic surgery, high costs significantly limit demand. This price sensitivity can push potential clients toward less invasive, lower-cost alternatives, restraining market growth, especially in regions where discretionary spending on aesthetic procedures is limited.

Potential Health Risks and Complications

Although blepharoplasty is generally safe, risks such as infection, scarring, and vision problems deter some potential patients. Complications, although rare, can include dry eye, bleeding, or adverse reactions to anesthesia. The American Society of Plastic Surgeons has emphasized the need for qualified professionals due to these risks, and prospective patients may be hesitant due to the fear of unfavorable outcomes. These health-related concerns may drive some patients toward non-surgical alternatives or discourage them from undergoing the procedure entirely, impacting overall market demand.

Cultural and Social Stigmas Around Cosmetic Surgery

In some cultures and social circles, there remains a stigma associated with elective cosmetic surgery, particularly when it’s seen as vanity-driven. For example, while Asia-Pacific markets have a high acceptance of cosmetic procedures, Western countries often see mixed reactions. A report by the International Society of Aesthetic Plastic Surgery (ISAPS) notes that cosmetic surgery acceptance varies significantly worldwide. Social pressure and cultural perceptions can deter individuals from seeking eyelid surgery, reducing market potential, particularly in markets where aesthetic surgeries are still controversial or socially discouraged.

MARKET OPPORTUNITIES

Expansion of Non-Surgical Alternatives

The demand for non-surgical eyelid treatments, like laser therapy, radiofrequency, and plasma-based techniques, is rising, presenting an opportunity for market growth. These alternatives offer quicker recovery times, reduced costs, and lower risk, appealing to a broader range of patients, particularly younger individuals. According to the American Academy of Facial Plastic and Reconstructive Surgery, over 70% of surgeons report increased demand for minimally invasive treatments. As innovations continue, non-surgical blepharoplasty could capture a sizable market share, meeting demand from patients interested in aesthetic improvement without the commitment of surgery.

Growing Interest in Medical Tourism

Medical tourism for cosmetic procedures is on the rise, particularly for blepharoplasty in destinations like South Korea, Thailand, and Turkey, where costs are lower and quality is high. These destinations offer up to 50% savings compared to North America or Europe, making them attractive to international patients. According to the Medical Tourism Association, the industry sees annual growth of 15-25%, and blepharoplasty is one of the most sought-after procedures. This trend presents a significant opportunity for providers to tap into international demand and offer attractive packages to patients seeking cost-effective surgery abroad.

Increased Adoption Among Men

Although cosmetic surgery is traditionally associated with women, male patients are increasingly seeking procedures like blepharoplasty to maintain a youthful appearance and boost confidence. According to the American Society of Plastic Surgeons, male cosmetic surgeries have risen by over 20% in the last decade, with eyelid surgery among the top choices. This growing acceptance among men represents a new demographic for providers, allowing them to expand their client base. Marketing strategies targeting men, coupled with tailored, subtle results, can capitalize on this trend and significantly boost market potential.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Issues

The blepharoplasty market is subject to strict regulatory standards, varying significantly across countries, which can delay product approvals, limit market entry, and increase costs for providers. In the U.S., the FDA imposes stringent safety and efficacy standards for devices and procedures, slowing the adoption of new technologies. Regulatory requirements in Europe, under the Medical Device Regulation (MDR), have also become more rigorous, further complicating market expansion. These compliance issues present a challenge for manufacturers and providers aiming to innovate or expand into new regions, limiting market growth potential.

Shortage of Skilled Surgeons and Specialists

Blepharoplasty requires precision and expertise to achieve desirable, safe outcomes, and there is a shortage of highly skilled oculoplastic and cosmetic surgeons in many regions. According to the American Society of Plastic Surgeons, specialized training is crucial for minimizing risks, yet not all regions have sufficient experts. The shortage affects service quality and accessibility, particularly in emerging markets where demand is growing. This gap in skilled practitioners can result in longer patient wait times, inconsistent outcomes, and limited availability, all of which pose challenges to the market's ability to meet rising consumer interest.

Economic Uncertainty and Consumer Spending Trends

Economic downturns and inflationary pressures can deter discretionary spending on cosmetic procedures like blepharoplasty as consumers prioritize essential expenses. For instance, in times of economic uncertainty, elective procedures often see reduced demand; according to a survey by the American Society of Plastic Surgeons, elective cosmetic procedures dipped by 14% during the 2008 financial crisis. With the global economy facing recent volatility, such challenges may resurface, impacting patient willingness to invest in blepharoplasty and potentially slowing market growth as consumers delay or forego aesthetic procedures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product Type, Procedure Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bomtech Electronics Co. Ltd., Cynosure LLC, Grand Aespio Inc., GTG Wellness, Loptima, Lightscalpel, London Bridge Plastic Surgery, Lumenis BE Ltd., New-Med Instruments, Osheru LLC, Sciton, Sisram Medical Ltd., Solta Medical, Surgical Holdings, Thermigen LLC and USA Plastic Surgery |

SEGMENTAL ANALYSIS

By Product Type Insights

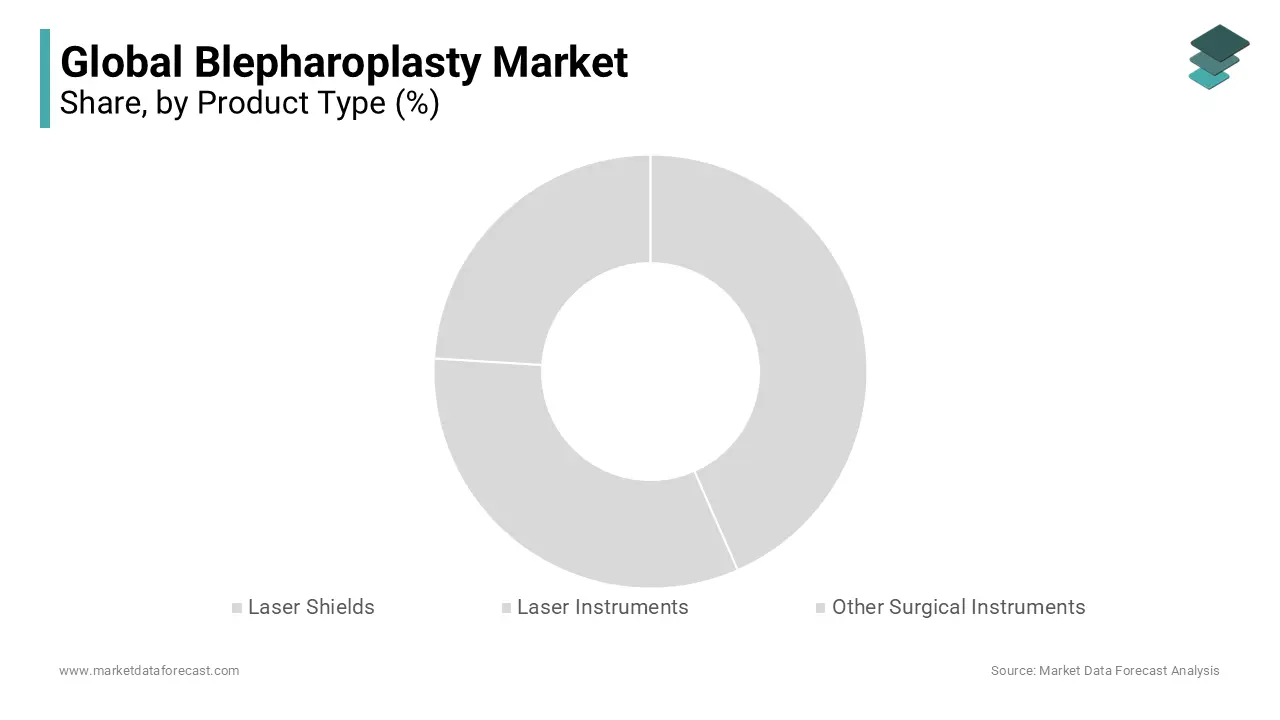

The laser shields segment dominated the market and captured 44.6% of the global market share in 2022. The dominance of the segment is attributed to their critical role in protecting both patients and medical personnel from laser exposure during eyelid surgeries, ensuring safety and compliance with health regulations.

On the other hand, the laser instruments segment is the fastest-growing segment and is estimated to register a CAGR of 7.72% over the forecast period. This rapid expansion is driven by technological advancements that enhance precision and efficiency in blepharoplasty procedures, leading to improved patient outcomes and reduced recovery times. The increasing adoption of minimally invasive techniques further propels the demand for advanced laser instruments in the market.

By Procedure Type Insights

The upper eyelid blepharoplasty segment had 66.3% of the global market share in 2023. The growth of the segment is driven majorly by the effectiveness of the procedure in addressing common concerns such as drooping eyelids and vision obstruction caused by excess skin. The increasing aging population and rising awareness of cosmetic enhancements contribute to the sustained demand for upper eyelid surgeries.

The lower eyelid blepharoplasty segment is predicted to witness the fastest CAGR of 7.88% over the forecast period. This growth is driven by the procedure's ability to effectively reduce under-eye bags, wrinkles, and dark circles, leading to a more youthful appearance. Advancements in surgical techniques and a growing emphasis on aesthetic appeal are further propelling the demand for lower eyelid surgeries.

By End-User Insights

The hospitals segment constitutes the largest segment among end-users and occupied 40.9% of the global market share in 2023 owing to the comprehensive medical facilities of hospitals, availability of advanced surgical equipment, and the presence of specialized healthcare professionals. Patients often prefer hospitals for blepharoplasty procedures due to the assurance of safety, access to emergency care, and the ability to handle complex cases.

The ambulatory surgical centers (ASCs) segment is growing rapidly and is expected to register a CAGR of 8.08% over the forecast period. The rapid growth of ASCs is driven by the cost-effectiveness, convenience and specialization of ASCs. The increasing preference for minimally invasive procedures and the emphasis on outpatient care further contribute to the growth of the ASCs segment in the blepharoplasty market.

REGIONAL ANALYSIS

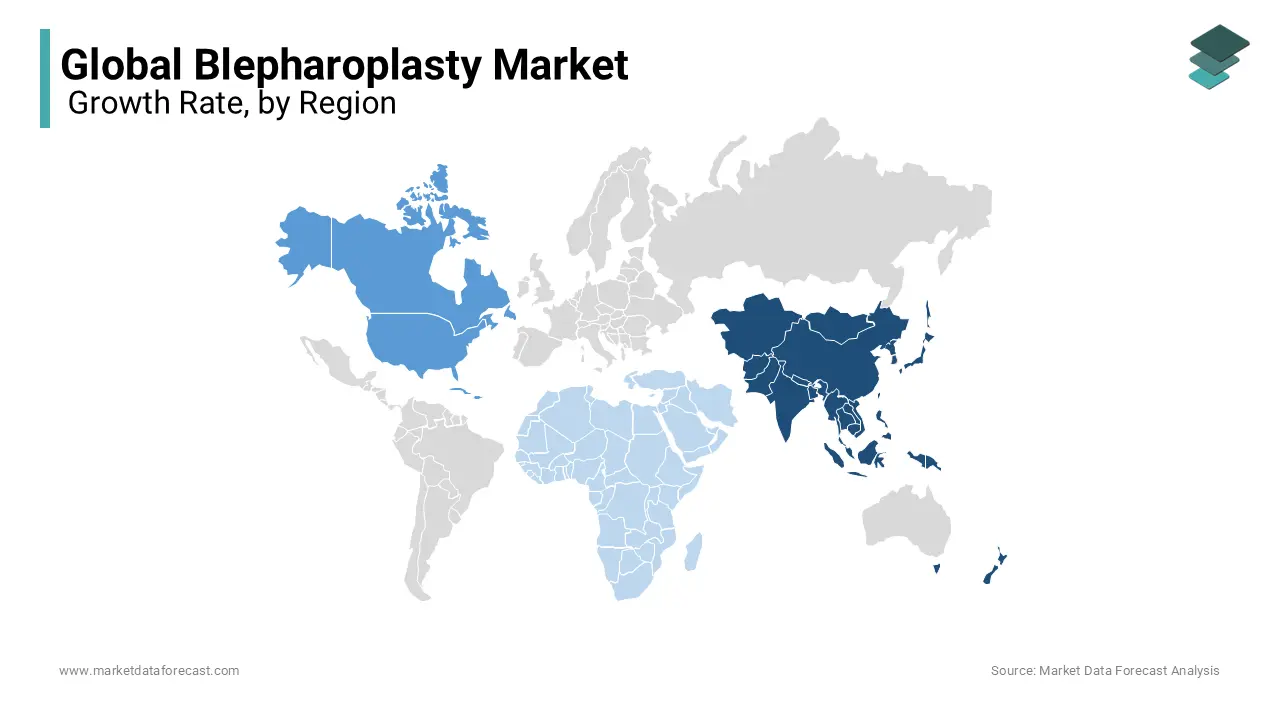

Asia-Pacific dominated the market and accounted for 34.7% of the global market share in 2023, with a significant contribution from countries like South Korea, Japan, and China. Blepharoplasty is one of the most popular cosmetic procedures in this region, often seen as a cultural beauty standard. Asia-Pacific is expected to exhibit the highest CAGR over the forecast period due to cultural demand, rising disposable income, and increased access to advanced surgical options. The market growth in the Asia-Pacific is anticipated to expand substantially as cosmetic surgery becomes increasingly normalized across age groups. South Korea leads the region with high procedural volumes due to the popularity of cosmetic surgery. Japan and China follow closely, with rising demand fueled by aesthetic trends and increasing access to high-quality medical facilities.

North America held a substantial share of the worldwide market in 2024. The growth of the North American market is majorly credited to the presence of people with high disposable income and high awareness among consumers of blepharoplasty in this region. The U.S. is a key contributor, with a strong demand for cosmetic procedures and a well-established market. The growth of the North American market is further driven by the rising demand for minimally invasive options and an aging population seeking anti-aging solutions. The U.S. dominates the North American market, accounting for over 80% of the regional demand for blepharoplasty procedures, followed by Canada, where demand is growing due to increased consumer acceptance of cosmetic procedures.

Europe is another prominent market, with countries like Germany, the U.K., and France leading in procedural demand. The region has a well-established healthcare infrastructure and high adoption of advanced cosmetic techniques. The market in Europe is expected to grow at a notable CAGR due to the increasing acceptance of cosmetic procedures and technological advancements. However, regulatory standards under the European Medical Device Regulation (MDR) can slow new product entry, affecting growth. Germany and the U.K. are key players, together representing about 60% of Europe’s market share in blepharoplasty. France is also a growing market due to high consumer interest in anti-aging treatments.

Latin America is an emerging market for blepharoplasty, with growing acceptance of cosmetic procedures, especially in Brazil and Mexico. Economic disparities, however, affect market expansion. The growth of the Latin American market is driven by increasing medical tourism and a growing middle class. However, growth is tempered by economic variability and access limitations. Brazil is the region’s leader, recognized for its high rate of cosmetic surgeries, followed by Mexico, which benefits from its proximity to North America and a growing number of accredited medical centers for cosmetic treatments.

The market in the Middle East and Africa had a smaller share of the global blepharoplasty market in 2024, though there is rising demand in Gulf countries, where beauty procedures are increasingly popular. The growth of the MEA market is driven by increased consumer spending in wealthier Gulf countries and improved healthcare facilities. However, growth is limited in certain areas due to economic disparities and cultural resistance in some countries. The United Arab Emirates and Saudi Arabia lead in blepharoplasty demand, driven by high disposable incomes and a growing trend toward aesthetic enhancement among affluent residents. South Africa also shows promise, though demand remains comparatively limited.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the global blepharoplasty market include Bomtech Electronics Co. Ltd., Cynosure LLC, Grand Aespio Inc., GTG Wellness, Loptima, Lightscalpel, London Bridge Plastic Surgery, Lumenis BE Ltd., New-Med Instruments, Osheru LLC, Sciton, Sisram Medical Ltd., Solta Medical, Surgical Holdings, Thermigen LLC and USA Plastic Surgery.

RECENT MARKET DEVELOPMENTS

- In April 2024, Cynosure LLC, a leading medical aesthetics company, merged with Lutronic, a prominent developer of laser-based devices. This strategic merger aimed to create a comprehensive portfolio of aesthetic solutions, enhancing their global market presence and offering advanced technologies to healthcare providers.

- In January 2024, Bomtech Electronics Co. Ltd., a manufacturer of medical devices, launched an advanced laser shield technology designed to improve safety and precision in blepharoplasty procedures. This innovation was introduced to strengthen their position in the global eyelid surgery market.

- In March 2024, LightScalpel, a developer of surgical CO₂ lasers, released a new laser system specifically tailored for delicate eyelid procedures. This development aimed to enhance precision and patient comfort during blepharoplasty surgeries.

- In February 2024, Lumenis Be Ltd., a leader in energy-based medical solutions, introduced a next-generation laser platform integrating multiple functionalities to streamline blepharoplasty procedures. This launch was part of their strategy to offer comprehensive solutions in the aesthetic surgery market.

- In May 2024, Sciton, a manufacturer of high-quality laser and light systems, unveiled a new laser module addressing both aesthetic and functional aspects of eyelid surgery. This innovation aimed to broaden treatment options and improve patient outcomes in blepharoplasty.

- In June 2024, Sisram Medical Ltd., a global provider of energy-based medical aesthetic solutions, expanded its global footprint by establishing new distribution channels in emerging markets. This expansion was intended to increase accessibility to their blepharoplasty solutions worldwide.

- In July 2024, GTG Wellness, a company specializing in aesthetic medical devices, launched a comprehensive training program for surgeons, focusing on the latest techniques and technologies in eyelid surgery. This initiative aimed to enhance surgical outcomes and promote the adoption of advanced blepharoplasty procedures.

- In August 2024, Ioptima, a developer of minimally invasive ophthalmic devices, introduced a new device aimed at reducing recovery time and improving results for blepharoplasty patients. This innovation was developed to meet the growing demand for less invasive surgical options.

- In September 2024, Grand Aespio Inc., a provider of aesthetic medical devices, entered into a strategic partnership with a leading cosmetic surgery clinic to supply state-of-the-art surgical instruments for blepharoplasty. This collaboration aimed to enhance the quality of surgical tools available in the market.

- In October 2024, London Bridge Plastic Surgery, a renowned cosmetic surgery clinic, opened a state-of-the-art facility equipped with cutting-edge technology to perform advanced blepharoplasty surgeries. This development was part of their strategy to offer superior surgical services and attract a global clientele.

MARKET SEGMENTATION

This research report on the global blepharoplasty market is segmented and sub-segmented into product type, procedure type, end-user and region.

By Product Type

- Laser Shields

- Laser Instruments

- Other Surgical Instruments

By Procedure Type

- Upper Eyelid Blepharoplasty

- Lower Eyelid Blepharoplasty

By End-user

- Hospitals

- Clinics

- Ambulatory Surgical Centres

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which segment by procedure type is dominating the blepharoplasty market?

The upper eyelid blepharoplasty segment is currently dominating the blepharoplasty market currently.

How big is the blepharoplasty market?

The global blepharoplasty market was valued at USD 4.41 billion in 2024 and is expected to be valued at USD 4.71 billion in 2025.

What is the segmentation involved in this blepharoplasty market report?

This research report on the global blepharoplasty market is segmented and sub-segmented into product type, procedure type, end-user and region.

Who are the key players in the global blepharoplasty market?

Bomtech Electronics Co. Ltd., Cynosure LLC, Grand Aespio Inc., GTG Wellness, Loptima, Lightscalpel, London Bridge Plastic Surgery, Lumenis BE Ltd., New-Med Instruments, Osheru LLC, Sciton, Sisram Medical Ltd., Solta Medical, Surgical Holdings, Thermigen LLC and USA Plastic Surgery are some of the key players in the global blepharoplasty market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]