Global Biosimilars Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type (Protein, Insulin, Human Growth Hormones, Granulocyte Colony-stimulating Factor (G-CSF), Interferons, Recombinant Glycosylated Proteins, Erythropoietin, Monoclonal Antibodies, Follitropin, Recombinant Peptides and Glucagon), Technology, Diseases and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Biosimilars Market Size

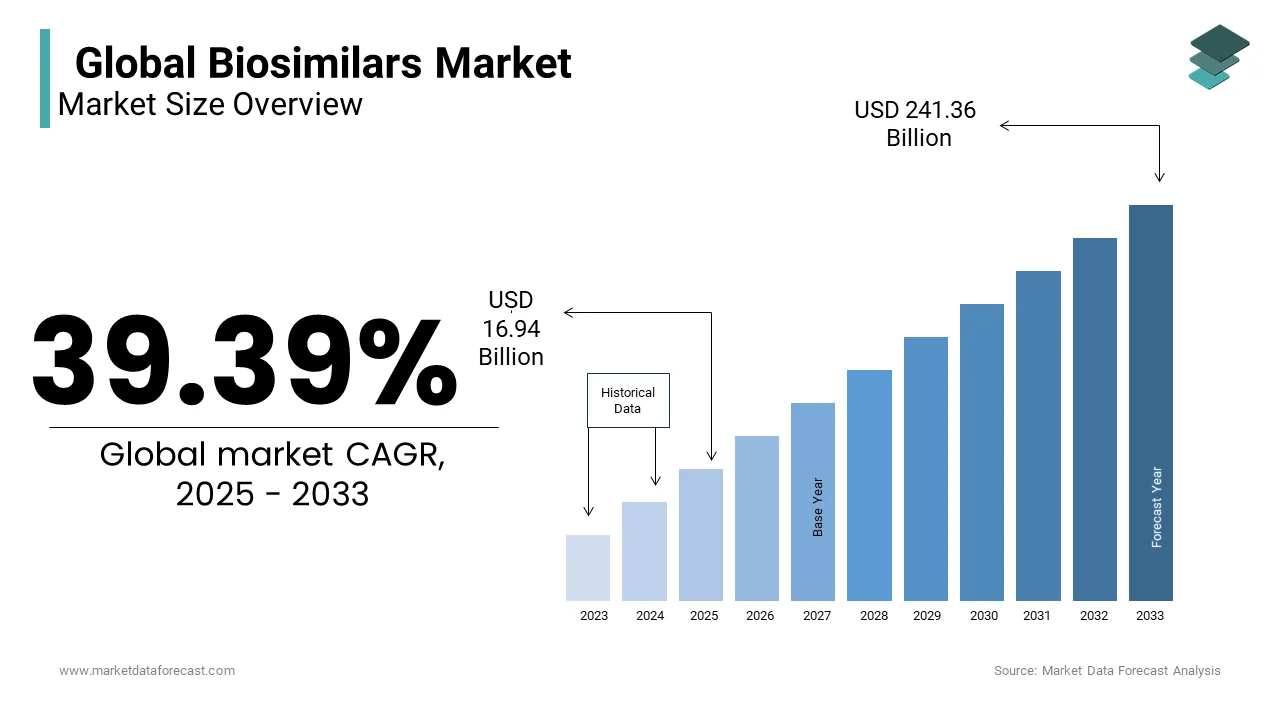

The global biosimilars market size was valued at USD 12.15 billion in 2024. The biosimilars market size is expected to have 39.39% CAGR from 2025 to 2033 and be worth USD 241.36 billion by 2033 from USD 16.94 billion in 2025.

Biosimilars are biological medical products identical to the original products manufactured by different companies. These were introduced in the early 1990s and are unlike generic drugs. Around 59 biosimilars in the United Kingdom and 19 biosimilar products in the United States have received approval from the FDA by April 2019. Currently, over 1040 biosimilars are operating in the biopharma R&D pipeline. Drug-related authorities such as the European Medicines Agency (EMA), the U.S. Food and Drug Administration (FDA), and the Health Products and Food Branch of Health Canada monitor biosimilar products' quality and safety. In addition, they have their guidance on the requirements for demonstration. According to the Biologics Price Competition and Innovation (BPCI) Act - FDA 351(k) is the pathway for the approval of biosimilars. In Jan 2018, the Food and Drug Administration in the United States introduced a Biosimilar Action Plan (BAP), which promotes and protects public health services.

MARKET DRIVERS

The cost-effective nature of biosimilars majorly drives global biosimilars market growth.

Various government cost-saving initiatives and the low cost of biosimilars are significant factors fuelling the biosimilars market growth. The primary factors, such as patent expiration of biological drugs and increasing research and development activities by the market players in developing safe, cost-effective biosimilars with high efficacy, are augmenting the growth of the biosimilars market size. The rise in the scale of pharmaceutical companies and the growing prevalence of improving the quality of drugs are promoting the market's growth rate. In addition, increasing focus on introducing innovative and novel medications by implementing the latest technology and the growing number of startup-level biosimilar manufacturers are all accelerating the expansion of the global biosimilar market value.

The rise in awareness over the availability of various products and the government's increasing initiatives through campaigns in undeveloped countries are significantly helping the market achieve new heights in biosimilar market growth. The increasing prevalence of cancer worldwide contributes prominently to the adoption of biosimilars in the regions. According to GLOBOCAN 2020, in the United States, 2,281,658 cases are estimated to be newly diagnosed, and nearly 612,390 deaths in 2020. The increasing prevalence of chronic diseases prevalence of is driving the healthcare industry to pursue new and innovative forms of drug development with limited resources, escalating the biosimilar market growth in the coming years.

MARKET RESTRAINTS

The stringent regulatory environment for biosimilars is majorly hampering the market growth.

Limited therapeutic areas of biosimilars act as an impediment to the growth of the biosimilars market. Biosimilars are only available for specific diseases such as cancer, autoimmune diseases, and diabetes. Compared to generic drugs, biosimilars have complex and lengthy regulatory processes for approvals due to the complexity involved in the manufacturing of the biosimilars, and this can result in growing costs and delays that can discourage the market participants from investing significant amounts in the innovation of biosimilars. Unfavorable reimbursement policies for biosimilars are further hindering market growth. There needs to be more acceptance from physicians and patients for biosimilars due to concerns about the safety and efficacy of biosimilars, limiting the adoption of biosimilars and inhibiting the market's growth rate. Lack of awareness among healthcare providers, patients, and payers regarding the benefits and safety of biosimilars and intellectual property issues are further notable obstacles to the growth of the global biosimilars market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Technology, Disease & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Sandoz International GmbH, Wockhardt Ltd, Hospira, Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Biocon Limited, Mylan, Inc., Zydus Cadila, Celltrion Inc., Roche Diagnostics and Cipla Ltd. |

SEGMENTAL ANALYSIS

Global Biosimilars Market Analysis By Product Type

The recombinant glycosylated protein segment accounted for a significant share of the global biosimilar market in 2024 and is expected to register a healthy CAGR in the coming years. The segment's growth can be attributed to the growing production rate of insulin and growth hormone drugs globally. In addition, the growing prevalence of cancer is favoring segmental growth. Furthermore, the patent expiration of biological drugs such as erythropoietin and monoclonal antibodies is expected to grow in this segment during the forecast period.

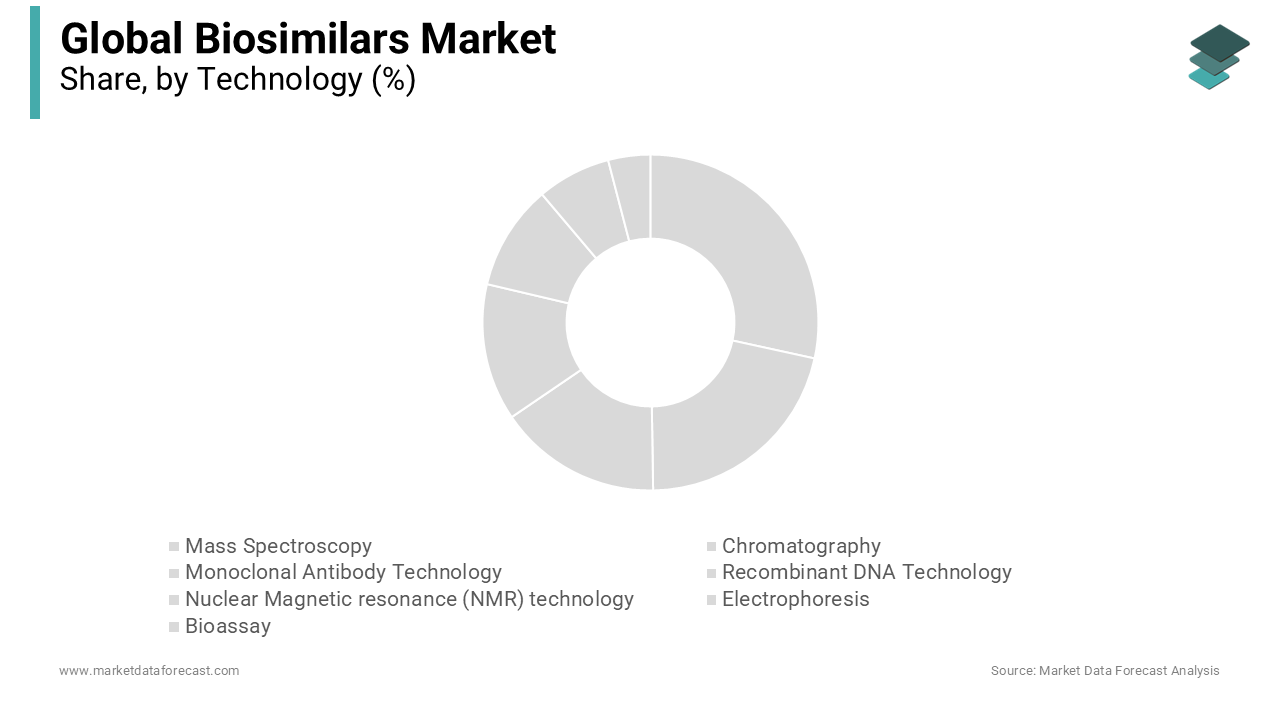

Global Biosimilars Market Analysis By Technology

The recombinant DNA technology segment is estimated to lead the biosimilar market during the forecast period. This segment manufactures biosimilar products such as human growth hormones, insulin, and erythropoietin. The advanced technologies help intensify the biosimilar's ability to treat diseases instantly and efficiently.

Global Biosimilars Market Analysis By Disease

The oncology segment led the market based on disease. It held a significant share of the global biosimilars market in 2024 and is anticipated to continue dominating the market during the forecast period owing to the increase in obtaining less-cost biosimilar drugs for the treatment of cancer. Furthermore, this segment is leading due to factors like the approval for different types of drugs, and the massive number of oncology products in the stream of cancer treatment is one of the significant factors that make this oncology disease segment proliferate.

On the other hand, the blood disorders segment is likely to grow at a healthy CAGR during the forecast period. Diseases such as anemia and hemophilia and the positive results of ongoing clinical trials contribute to segmental growth.

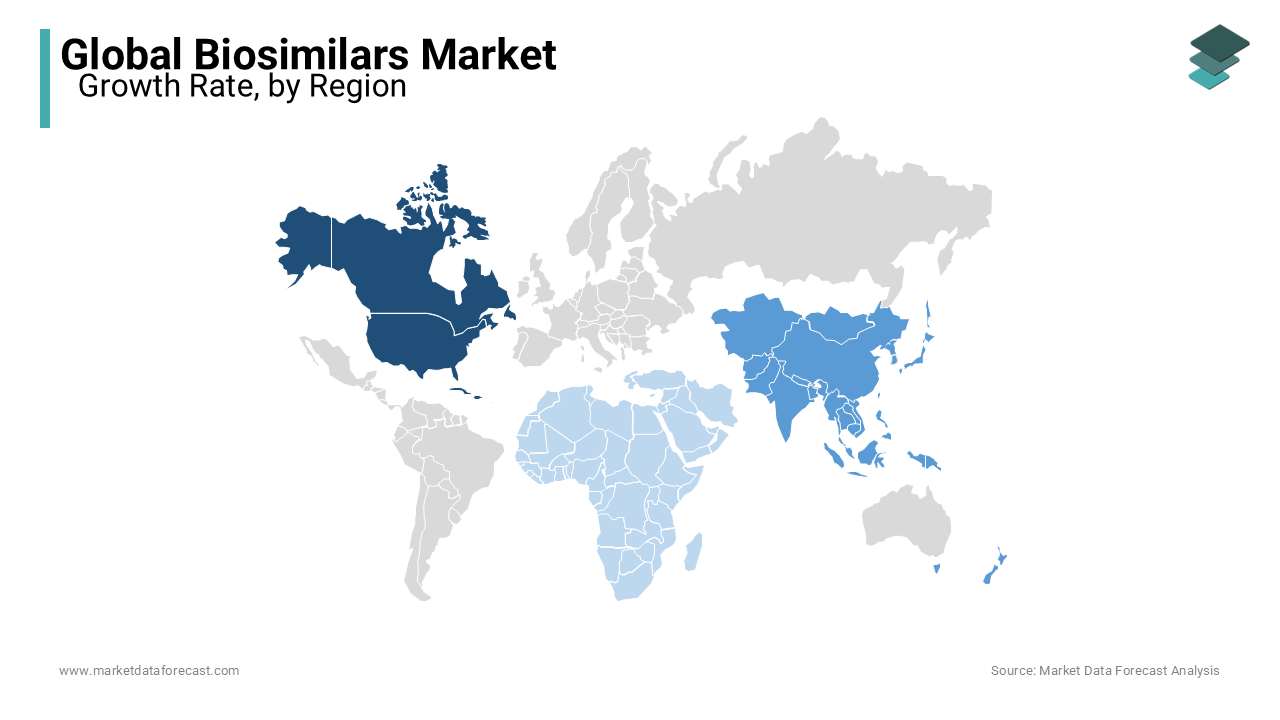

REGIONAL ANALYSIS

In 2024, the North American market held the largest share of the worldwide market, and the region's domination is likely to continue during the forecast period. The growing acceptance of advanced technologies primarily drives regional market growth. The U.S. occupied a significant share of the North American market in 2024, followed by Canada. The U.S. biosimilar market growth is primarily driven by the growing patient population, increasing healthcare expenditure, and a well-established regulatory environment that drives the regional market. The Canadian market is predicted to witness a notable CAGR during the forecast period due to the increasing patient population suffering from chronic diseases and rising demand for cost-effective treatment options.

The Asia-Pacific region is one of the potential regions worldwide and is estimated to grow at the fastest CAGR during the forecast period. The growing disposable incomes in developing countries are accelerating the biosimilar market growth in the region. The rising aging population and the increasing population suffering from cancer, diabetes, and autoimmune diseases, increasing demand for cost-effective treatment options in developing countries such as India, China, and Japan is fuelling the growth rate of the biosimilars market in the region. Countries such as South Korea and Japan are expected to showcase a notable CAGR during the forecast period due to the favorable regulatory environment for biosimilars and an increasing number of biosimilar product launches in these countries.

The European market is predicted to showcase a promising CAGR during the forecast period due to increased construction activities in healthcare centers to provide proper patient care. The UK, Germany, and France held a significant share of the European market in 2021, and the trend is expected to continue throughout the forecast period. The expiration of patents for several biologic drugs and the support of regulatory authorities for developing and approving biosimilars are primarily boosting the growth of the European market. The rising adoption of biosimilars by healthcare providers and patients owing to their cost-effectiveness and efficacy biosimilars is further promoting the growth of the European market.

The Latin American market is projected to hold a considerable share of the worldwide market in the coming years. Factors such as increasing healthcare spending and a growing number of initiatives by Latin American countries are favoring the biosimilar market growth in the region. Countries such as Brazil and Mexico captured a significant share of the Latin American market in 2024.

The MEA region is anticipated to grow at a moderate CAGR during the forecast period.

KEY PLAYERS IN THE GLOBAL BIOSIMILAR MARKET

Sandoz International GmbH, Wockhardt Ltd, Hospira, Inc., Teva Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories, Biocon Limited, Mylan, Inc., Zydus Cadila, Celltrion Inc., Roche Diagnostics and Cipla Ltd are some of the notable players in the Latin American biosimilars market.

RECENT HAPPENINGS IN THIS MARKET

- In May 2024, Boehringer Ingelheim received U.S. FDA clearance for Cyltezo Pen, a novel autoinjector choice for Cyltezo, an interchangeable biosimilar to Humira.

- In May 2024, Amneal Pharmaceuticals, Inc. received U.S. FDA approval for a Biologics License Application (BLA) for pegfilgrastim-pbbk, a biosimilar referencing Neulasta.

- In September 2021, Samsung Bioepis and Biogen announced the U.S. FDA's approval of BYOOVIZ, a biosimilar to Lucentis, for the treatment of neovascular age-related macular degeneration, macular edema, and myopic choroidal neovascularization. Byooviz is the first ophthalmic biosimilar product approved in the United States.

- In May 2020, Dr. Reddy Laboratories received approval for ELYXYB by the FDA, which is for migraine in adults with or without aura and is considered the most successful migraine treatment.

- In March 2020, Teva Pharmaceuticals and Celltrion collaborated and launched Herzuma's fourth biosimilar, trastuzumab. This biosimilar is available as an injection commonly used for patients with breast cancer.

DETAILED SEGMENTATION OF THE GLOBAL BIOSIMILARS MARKET INCLUDED IN THIS REPORT

This market research report on the global diagnostic imaging market has been segmented and sub-segmented based on the type, application, and region.

By Product Type

- Protein

- Insulin

- Human Growth Hormones

- Granulocyte Colony-stimulating Factor (G-CSF)

- Interferons

- Recombinant Glycosylated Proteins

- Erythropoietin

- Monoclonal Antibodies

- Follitropin

- Recombinant Peptides

- Glucagon

By Technology

- Mass Spectroscopy

- Chromatography

- Monoclonal Antibody Technology

- Recombinant DNA Technology

- Nuclear Magnetic resonance (NMR) technology

- Electrophoresis

- Bioassay

By Disease

- Oncology Diseases

- Blood Disorders

- Growth hormone deficiencies

- Chronic and autoimmune diseases

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global biosimilars market?

The global biosimilars market size is predicted to be worth USD 241.36 billion by 2033.

Which segment by product type is predicted to lead the global biosimilars market?

Based on the product type, the recombinant non-glycosylated protein segment dominated the biosimilars market in 2024 and the domination is expected to be continuing throughout the forecast period.

Which segment by disease is expected to dominate in the biosimilars market in the coming years?

Based on the disease, the oncology segment is predicted to rise at a healthy CAGR from 2024 to 2033.

Which region led the biosimilars market in 2024?

Geographically, the North American regional market dominated the biosimilars market in 2024.

Which are the key market participants in the global biosimilars market?

Sandoz International GmbH, Wockhardt Ltd, Hospira, Inc., Teva Pharmaceutical Industries Reddy’s Laboratories, Biocon Limited, Mylan, Inc., Zydus Cadila, Celltrion Inc., Roche Diagnostics, and Cipla Ltd are some of the promising companies in the global biosimilars market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]