Global Biologics Market Size, Share, Trends and Growth Forecast Report By Source (Microbial, Mammalian and Others), Product (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi, & Molecular Therapy and Others), Biologics Manufacturing Type, Disease Category & Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Biologics Market Size

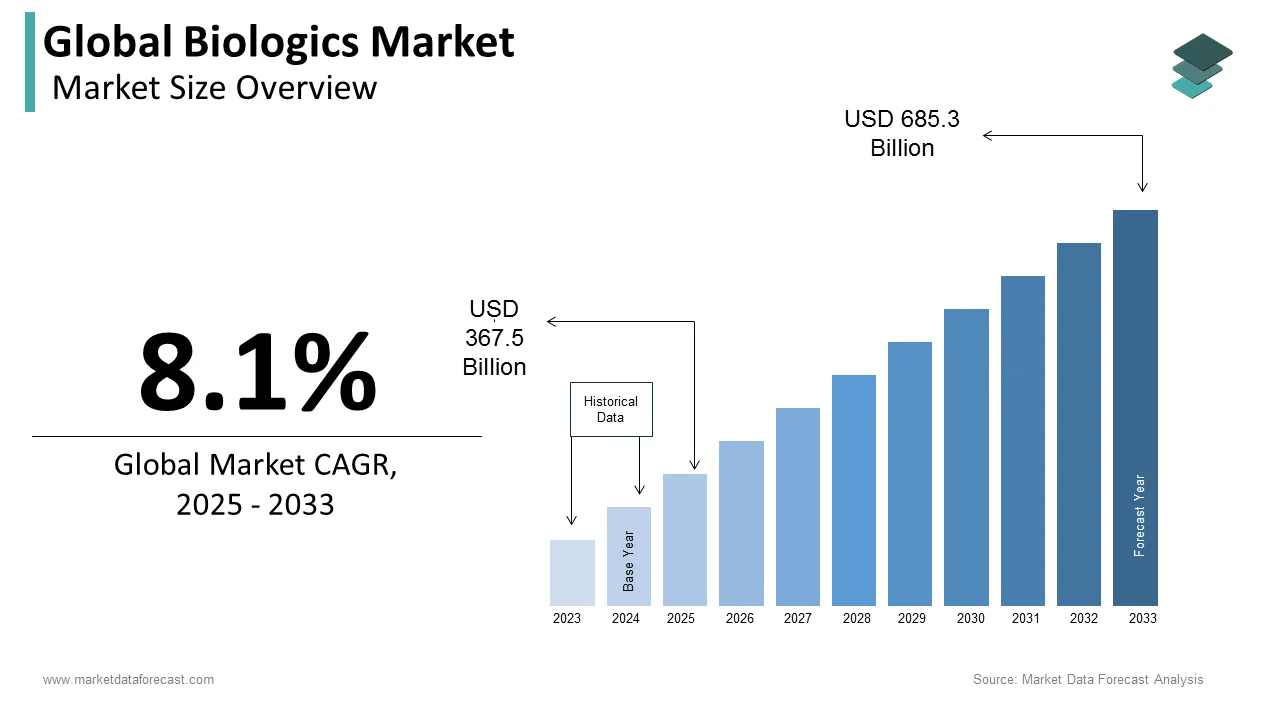

The size of the global biologics market was estimated at USD 340 billion in 2024. The global market is anticipated to grow at a CAGR of 8.1% from 2025 to 2033 and be worth USD 685.3 billion by 2033 from USD 367.5 billion in 2025.

MARKET DRIVERS

Y-O-Y growth in the incidence of chronic diseases and an increasing number of initiatives from the governments of several countries to develop innovative techniques are driving the growth of the global biologics market. iologics have broad applications in targeted therapies and help treat various medical conditions when treatments are unavailable. The increasing acceptability of innovative therapies and rising demand for biological drugs with an increasing number of patent expiries are promoting the demand for biologics worldwide. In addition, gene-based and cellular biologics are major elements in biomedical research. In addition, growing healthcare expenditure and the rising prevalence of promoting promising treatment procedures are contributing to the biologics market expansion.

The rising scale of pharmaceutical companies worldwide is a plus to the growth rate of the biologics market. Oral products have increased efficacy for various diseases such as Crohn's and rheumatoid arthritis, pulling patients to adopt novel treatment procedures. This is enhancing the growth rate of the biologics market eventually. Furthermore, the rising geriatric population and increasing prominence to lower the cost of treatment procedures are also urging the biologics market growth. Also, people's preference for pills rather than injections is increasing the market's growth rate. Technological advancements are also expanding the growth rate of the market. For instance, Eli Lilly and Pfizer adopted Amazon's Elastic Compute Cloud (EC2) platform to conduct simulation models more effectively in early drug discovery.

Furthermore, launching innovative therapies with the latest technologies is anticipated to set growth opportunities for the market. Reduction in the demand for small molecule drug R&D activities is expected to promote the biologics market growth shortly.

MARKET RESTRAINTS

Lack of awareness regarding the utilization of biologics in the research centers and the complex regulatory structure by the government in approving new products are some of the major factors hindering the market's growth rate. In addition, long-term use of biologics leads to specific problems such as changes in blood pressure, gastrointestinal complications, and breathing problems, slowly hampering the market's demand. Furthermore, supervising treatment procedures with biologics requires advanced technologies. This is quietly to restrain the biologics market growth during the forecast period. Furthermore, the absence of skilled people in laboratories to analyze the outcome limits the biologics market's growth rate. The high cost of installing and maintaining laboratory devices impedes market growth. Furthermore, the manufacturing process of biologics drugs is a little complex and remains a significant challenge for the market to grow. Less turnover for clinical trials is declining the growth rate of the biologics market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Source, Product, Biologics Manufacturing Type, Disease Category and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Johnson & Johnson (J&J), F Hoffmann-La Roche, Bristol-Myers Squibb, GlaxoSmithKline, AbbVie, Amgen, Sanofi, Eli Lilly and Company, Merck & Co., and Pfizer Inc. |

SEGMENTAL ANALYSIS

By Source Insights

The microbial segment accounted for the largest share of the worldwide biologics market in 2024 and is expected to grow at the highest CAGR during the forecast period. This is because scientists have found various beneficial applications that can be derived from microbial source biologics.

On the other hand, the mammalian segment had a considerable share of the worldwide market in 2024 and is expected to grow at a reasonable CAGR during the forecast period. This is because scientists are doing more research in this field, and soon this source will have the same market share as microbial.

By Product Insights

The monoclonal antibodies segment dominated the biologics market in terms of share in 2024 and is expected to grow at a healthy CAGR during the forecast period owing to their higher usage in different therapeutic areas. Monoclonal antibodies allow the targeting of unhealthy cells without harming healthy cells. These drugs benefit cancer management and treat autoimmune diseases, including rheumatoid arthritis.

The vaccines segment is anticipated to witness the fastest CAGR in the coming years owing to its usage as a preventative tool in infectious diseases. Currently, when the world is suffering from a deadly virus, there is an immediate need for an effective virus, and biologics will be a key to the development of vaccines.

By Biologics Manufacturing Insights

The in-house segment had a significant global market share in 2024. Manufacturing is a part of the significant steps of biologics production and comprises a substantial share of the biologics market. It has two segments, 'Outsourced' and 'In-house' Companies, that are opting to manufacture biologics in their plants; thus, in-house dominates the market. Companies are engaged in investing in their bioprocessing capabilities. The companies are investing more in their plants to increase their commercial manufacturing capacity. The rising population has forced the countries to be self-sustained, as in the case of the world pandemic, and there might be problems in supply dependent on others.

By Disease Category Insights

The oncology segment accounted for the largest share of the worldwide market in 2024 and is estimated to grow at a healthy CAGR in the coming years owing to the rising incidence of cancer coupled with the cure it. In addition, different R&D projects are present. These projects include gene therapies and antisense therapies for cancer eradication. Oncology also had the second-highest growth rate among all other sub-segments. The advantages of cancer therapy are significant.

The infectious disease segment held a substantial share of the global market in 2024. The increase in the negative impact of viral diseases has led to more investments in treating infectious diseases. As a result, it will soon take over the oncology sub-segment.

Immunological, cardiovascular, and hematological disorders have third, fourth and fifth places, respectively.

REGIONAL ANALYSIS

North America accounted for the largest share of the worldwide market in 2024. The region's domination is anticipated to continue during the forecast period owing to significant established participants in this region. In addition, the North American region has the world's 80% research in healthcare biotechnology. As a result, higher demand for products for treating diseases has increased this region's revenue share.

Europe held the second-largest share worldwide in 2024 and is expected to grow reasonably. The improvement in healthcare quality and the rise in disease cases have fuelled the growth in this region.

Asia Pacific captured the third-largest share of the worldwide market in 2024 and is expected to have the highest growth CAGR in the global market owing to the growing population and high expected population growth have led to more investments.

During the forecast period, Latin America is anticipated to grow steadily.

The MEA market is estimated to hold a moderate global market share in the coming years.

KEY MARKET PLAYERS

Johnson & Johnson (J&J), F Hoffmann-La Roche, Bristol-Myers Squibb, GlaxoSmithKline, AbbVie, Amgen, Sanofi, Eli Lilly and Company, Merck & Co., and Pfizer Inc. are some of the dominating companies in the global biologics market.

RECENT HAPPENINGS IN THIS MARKET

- In August 2019, the National Centre for Research and Development funded Euro 6.7 billion to Wroclaw-based Pure Biologics, a biotech startup, for its PureBike project. The project focussed on developing an immuno-oncological drug that is useful to treat triple-negative breast cancer (TNBC).

- In September 2019, BioCare Medical LLC, a leading provider of immunohistochemistry (IHC) instrumentation and reagents, announced the launch of p16INK4a, a new mouse monoclonal antibody. It is cost-effective and shows accurate results in the evaluation of cervical biopsies.

MARKET SEGMENTATION

This research report on the global biologics market has been segmented and sub-segmented based on source, product, biologics manufacturing type, disease category, and region.

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense, RNAi, & Molecular Therapy

- Others

By Biologics Manufacturing

- Outsourced

- In-house

By Disease Category

- Oncology

- Infectious Diseases

- Immunological Disorders

- Cardiovascular Disorders

- Hematological Disorders

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the future of biologics market?

The global biologics market size is estimated to be growing 8.1% from 2025 to 2033.

What are the factors driving the biologics market?

Favorable initiatives from multiple governments and the growing incidence of chronic diseases are propelling the growth rate of the global biologics market.

Which segment by source is expected to do well in the biologics market in the coming future?

The microbial source segment by source is expected to be the fastest-growing segment in the global biologics market and led the market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]