Global Biological Safety Cabinets Market Size, Share, Trends, COVID-19 Impact & Growth Analysis Report – Segmented By Product Type (Class I, Class II, Class III ), End User & Region (North America, Europe, APAC, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Biological Safety Cabinets Market Size

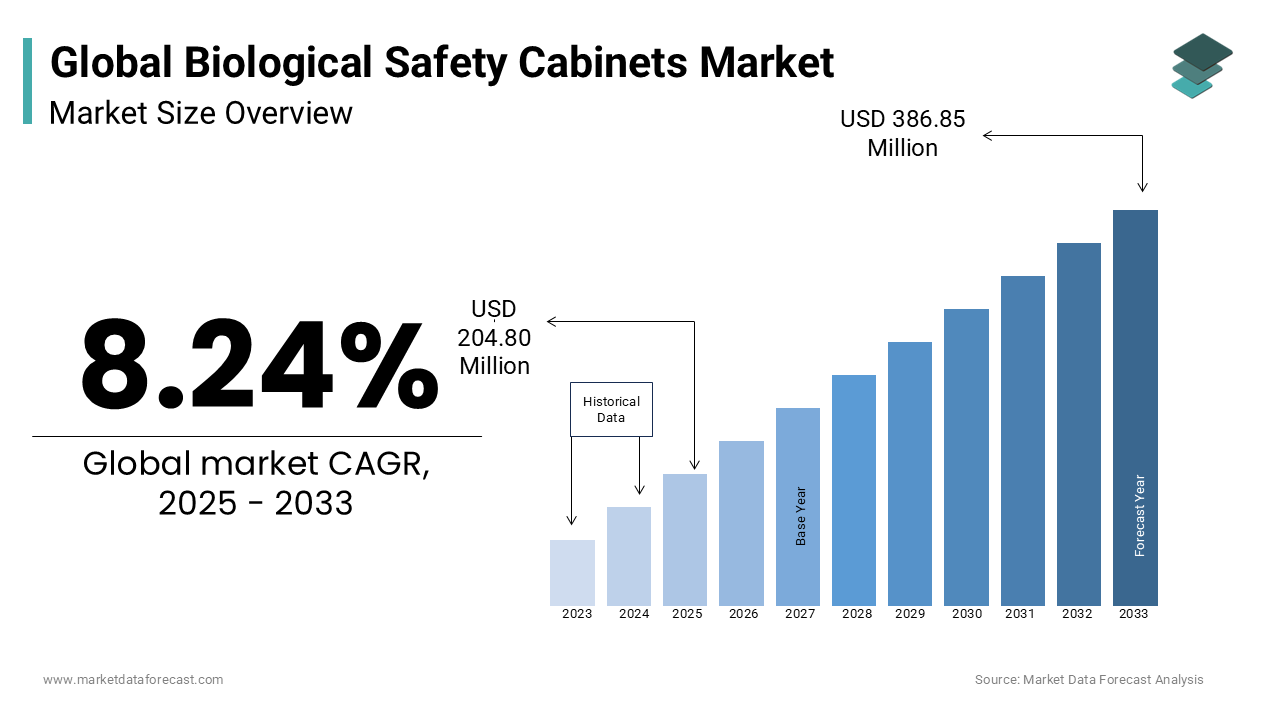

The size of the global biological safety cabinets market was worth USD 189.21 million in 2024. This value is predicted to grow at a CAGR of 8.24% from 2025 to 2033 and is worth USD 204.80 million in 2025 and USD 386.85 million by 2033.

A biological safety cabinet (BSC) is a specialized enclosed workspace designed to protect users, samples, and the environment from exposure to hazardous biological materials. These cabinets use HEPA filters to remove harmful particles from the air ensuring safe handling of infectious agents, toxins, and other dangerous substances. BSCs are essential in laboratories for applications like drug development, disease research, and diagnostic testing. According to the World Health Organization, over 70% of labs globally rely on BSCs to maintain biosafety standards during experiments.

The global biological safety cabinet market has seen steady growth due to increasing demand for advanced lab equipment. The Centers for Disease Control and Prevention states that there are over 10,000 high-containment labs worldwide requiring such safety measures. Additionally, the rise in biopharmaceutical research and growing concerns about pandemics like COVID-19 have boosted demand. The National Institutes of Health reports that global spending on biotech R&D reached $250 billion in 2022 showcasing the need for safe lab environments.

Governments and health organizations are also emphasizing stricter biosafety regulations which drive adoption. For instance, the Food and Drug Administration mandates the use of BSCs in pharmaceutical manufacturing to prevent contamination. With advancements in technology, modern BSCs now offer energy efficiency and improved airflow systems making them more appealing. Experts predict that innovations in design and rising investments in healthcare infrastructure will further propel the market forward. This makes BSCs not just a tool for safety but a cornerstone of modern scientific research and public health preparedness.

MARKET DRIVERS

Rising Demand for Biosafety in Laboratories

The need for biosafety is growing due to increasing research on infectious diseases. The World Health Organization states that over 1,500 new pathogens have been discovered since 1980 requiring safe handling. Labs use biological safety cabinets to protect workers and samples during experiments. For example, the Centers for Disease Control and Prevention states that 70% of emerging diseases are zoonotic which increases lab activities. Governments are also investing in high-containment labs with WHO reporting a 25% rise globally from 2015 to 2022. These facilities require advanced safety equipment like BSCs to meet international standards ensuring their adoption rises steadily worldwide.

Stringent Government Regulations

Governments enforce strict regulations to ensure lab safety driving demand for biological safety cabinets. The Food and Drug Administration mandates HEPA-filtered systems for handling hazardous materials in pharmaceutical production. The Occupational Safety and Health Administration reports that non-compliance with safety standards caused over 50,000 lab accidents annually in the U.S. alone. Additionally, the European Medicines Agency emphasizes that 80% of clinical trials must follow biosafety protocols. With rising awareness about contamination risks, institutions adopt these regulations widely. This creates a strong push for BSCs as essential tools to meet legal requirements and safeguard public health effectively.

MARKET RESTRAINTS

High Initial Costs of Biological Safety Cabinets

The cost of purchasing and installing biological safety cabinets is a major barrier for many labs. The National Institutes of Health states that advanced BSC models can cost up to $20,000 per unit making them unaffordable for small-scale labs. Maintenance costs add further burden with annual expenses reaching $2,000 per cabinet according to the Occupational Safety and Health Administration. In low-income countries, limited funding restricts access to such equipment. According to the World Health Organization, only 30% of African labs have adequate safety infrastructure due to budget constraints. These financial challenges slow down adoption rates especially in resource-limited settings hindering market growth significantly.

Lack of Skilled Personnel for Operation

Operating biological safety cabinets requires trained personnel which is a challenge in many regions. The Pan American Health Organization reports that over 60% of labs in Latin America lack certified staff to handle advanced equipment. Training programs are often expensive and time-consuming limiting availability. As per the Centers for Disease Control and Prevention, improper use of BSCs causes 40% of lab contamination incidents globally. Without skilled operators, the full benefits of these cabinets cannot be realized. This shortage of expertise delays widespread adoption particularly in developing nations where education systems struggle to keep pace with technological advancements.

MARKET OPPORTUNITIES

Expansion of Biopharmaceutical Research

Biopharmaceutical research is expanding rapidly creating opportunities for biological safety cabinets. The National Institutes of Health reports that global spending on biotech R&D reached $250 billion in 2022. Over 50% of this research involves handling sensitive biological materials requiring BSCs. The Food and Drug Administration states that 70% of new drugs involve biologics which need contamination-free environments. With governments investing heavily in life sciences, the demand for advanced lab equipment rises. For instance, the European Union allocated €12 billion for biotech innovation in 2023. This trend opens doors for manufacturers to supply innovative and efficient safety solutions meeting growing market needs.

Growing Focus on Pandemic Preparedness

Pandemic preparedness efforts are driving demand for biological safety cabinets worldwide. The World Health Organization notes that over 100 countries upgraded their lab infrastructure after the COVID-19 pandemic. High-containment labs increased by 30% globally from 2020 to 2023 according to the Global Health Security Index. These facilities rely on BSCs to safely process infectious samples. Governments are prioritizing investments in public health with the U.S. allocating $10 billion for pandemic readiness in 2023. As outbreaks become more frequent, the need for reliable safety equipment grows making BSCs vital for disease control and prevention strategies globally.

MARKET CHALLENGES

Complex Installation and Maintenance Requirements

Installing and maintaining biological safety cabinets is complex posing a significant challenge. The Occupational Safety and Health Administration states that improper installation causes 30% of equipment failures in labs. Regular maintenance is critical yet costly with annual servicing fees reaching $2,000 per unit. The World Health Organization stresses that 40% of labs in low-income countries face disruptions due to inadequate technical support. Complex airflow systems require specialized expertise which is scarce in remote areas. These challenges hinder smooth operations and reduce the effectiveness of BSCs impacting overall lab productivity and safety compliance significantly.

Limited Awareness in Developing Regions

Awareness about biological safety cabinets remains low in many developing regions limiting their adoption. The African Union reports that only 20% of labs in Sub-Saharan Africa use advanced safety equipment due to lack of knowledge. The Pan American Health Organization emphasizes that 50% of healthcare workers in rural areas are unaware of proper biosafety practices. Educational campaigns are rare and underfunded restricting information flow. Without awareness, labs fail to prioritize safety investments. This gap slows progress in improving lab standards especially in regions already struggling with weak healthcare systems and limited resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Thermo Fisher Scientific (US), Esco Micro (Singapore), Labconco (US), The Baker Company (US), Kewaunee Scientific (US), NuAire (US), Germfree Laboratories (US), EUROCLONE (Italy), Cruma (Spain), Air Science (US), Berner International (Germany) and BIOBASE (China). |

SEGMENTAL ANALYSIS

By Product Type Insights

The Class II cabinets segment held a substantial market share to become the largest category in 2024. These cabinets are widely used due to their ability to protect both the user and samples with HEPA-filtered air. The CDC states that over 90% of labs use Class II cabinets for handling infectious agents safely. Their importance lies in preventing contamination which is critical for research and diagnostics. For example, the NIH reports that labs conducting COVID-19 testing rely heavily on these units ensuring safety during sample processing.

The Class III cabinets segment show a fastest CAGR of 8.5% during the forecast period. This growth is driven by rising demand for maximum protection in high-risk environments like BSL-4 labs. The National Institute for Occupational Safety and Health notes that such labs increased by 20% globally from 2015 to 2022. Additionally, the World Health Organization emphasizes stricter biosafety regulations which boost adoption. With increasing bioterrorism concerns, governments are investing more in advanced containment systems making this segment vital for future preparedness.

By End-User Insights

The Pharmaceutical companies segment accounted for 50.2% of the market share in 2024. These firms require biological safety cabinets for drug development and quality control processes. According to the European Medicines Agency, pharmaceutical R&D spending reached $200 billion in 2022 drawing attention to the need for safe lab equipment. Furthermore, WHO states that 70% of new drugs involve biologics requiring stringent contamination control measures. This makes these cabinets indispensable for maintaining product integrity and regulatory compliance.

The Diagnostics labs segment exhibit a CAGR of 9.2% over the forecast period. Rapid expansion in diagnostic services fueled by pandemics like COVID-19 drives this growth. The Global Health Security Index reports a 30% rise in testing facilities worldwide since 2020. Moreover, the American Society for Microbiology states that point-of-care testing has surged by 40% annually. Increased focus on early disease detection and government funding for public health infrastructure further accelerates demand making this segment crucial for addressing global health challenges effectively.

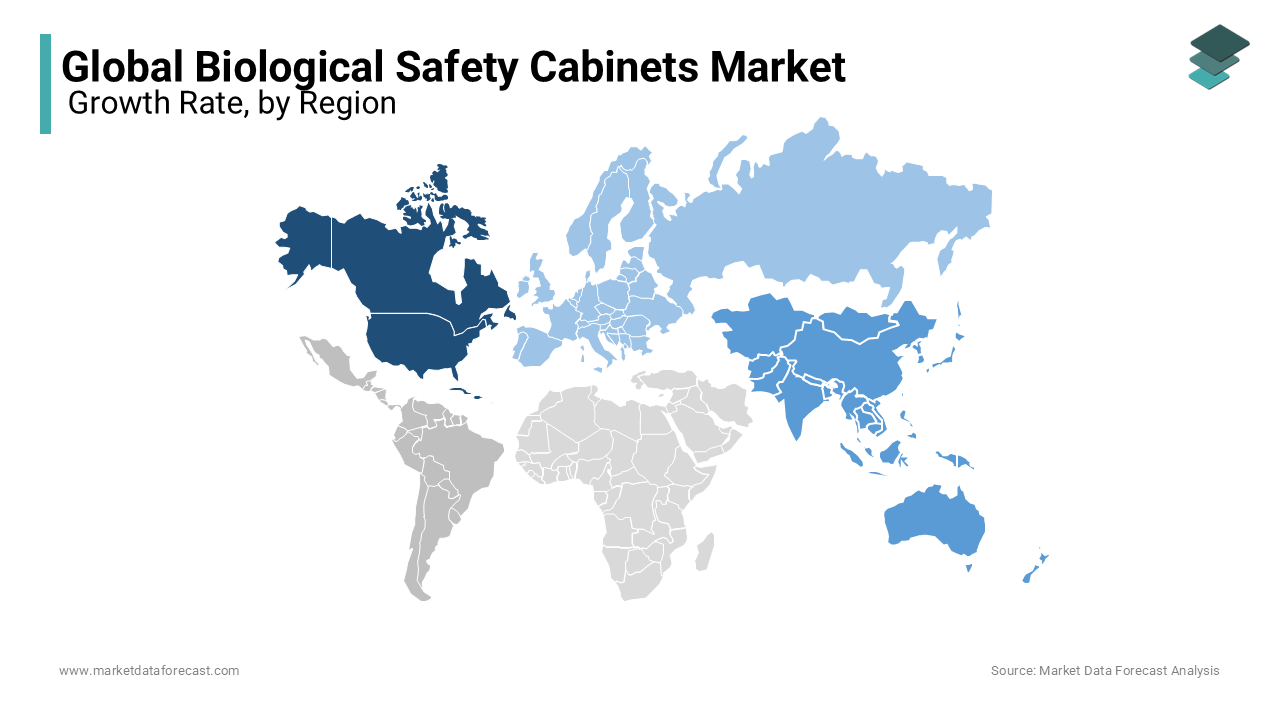

REGIONAL ANALYSIS

North America captured the dominant market share of 40.8% in 2024. The region moves ahead due to advanced healthcare infrastructure and high R&D spending. The NIH reports that U.S. labs conduct over 50% of global biotech research requiring safety cabinets. Additionally, WHO states that North America accounts for 35% of global pharmaceutical production driving demand. Strict biosafety regulations also ensure widespread adoption making this region crucial for innovation and compliance in biological safety practices.

Asia-Pacific sees a CAGR of 10.2% in the future. The development is influenced by rising healthcare investments and expanding biopharma industries. The Asian Development Bank notes that medical R&D funding grew by 15% annually from 2018 to 2022. Furthermore, the CDC exhibits a 25% increase in diagnostic labs in India and China. Governments are prioritizing public health preparedness boosting demand for safety equipment. This rapid expansion underscores the region’s role in addressing emerging health challenges through advanced lab technologies.

Europe is expected to maintain steady growth in the biological safety cabinet market. The European Medicines Agency states that 30% of global clinical trials occur here requiring robust lab setups. WHO emphasizes strict EU regulations on lab safety driving adoption. With increasing focus on green technologies Europe invests in energy-efficient models. The CDC predicts a 5% annual rise in biotech startups further boosting demand ensuring Europe remains a key player in promoting safe laboratory environments globally.

Latin America is poised for gradual growth in the biological safety cabinet market. The Pan American Health Organization reports a 20% rise in infectious disease research labs since 2020. Governments are upgrading healthcare systems with WHO support enhancing lab safety standards. Increased awareness about biosafety drives adoption especially in Brazil and Mexico. The World Bank forecasts healthcare spending growth at 6% annually improving infrastructure. These trends indicate Latin America’s growing importance in regional disease control and prevention efforts.

The Middle East and Africa show potential for significant market expansion. The African Union states a 30% increase in public health labs since 2019 supported by WHO initiatives. Rising awareness about pandemic preparedness boosts demand for safety equipment. Gulf nations like Saudi Arabia invest heavily in healthcare modernization projects. UNICEF states that lab capacity doubled in some African countries aiding diagnostics. These developments underscore the region’s critical role in strengthening healthcare resilience and addressing endemic diseases effectively.

Top 3 Players in the market

Thermo Fisher Scientific

Thermo Fisher Scientific is a prominent leader in the BSC market, offering a comprehensive range of products designed to meet diverse laboratory needs. Their commitment to innovation is evident in the development of advanced BSCs that prioritize user safety and sample protection. The company's global presence and extensive distribution network have enabled it to cater to a wide array of clients, from academic research institutions to pharmaceutical companies. Thermo Fisher's continuous investment in research and development ensures that their BSCs incorporate the latest technologies, maintaining their competitive edge in the market.

Esco Micro

Esco Micro is another key player in the BSC market, renowned for its high-quality biosafety cabinets that comply with international standards. The company's focus on energy efficiency and ergonomic design has made its products popular among laboratories worldwide. Esco's dedication to sustainability is reflected in their eco-friendly BSC models, which reduce energy consumption without compromising safety or performance. Their strong emphasis on customer support and training further enhances their reputation, contributing significantly to their growth and market share.

Labconco

Labconco has established itself as a significant contributor to the global BSC market through its innovative and reliable products. The company's biosafety cabinets are designed to provide maximum protection for both personnel and samples, adhering to rigorous safety standards. Labconco's commitment to quality and durability has earned them a loyal customer base across various sectors, including healthcare, research, and industrial laboratories. Their continuous efforts to integrate cutting-edge technology into their products have positioned them well in the competitive BSC landscape.

Top strategies used by the key market participants

Product Innovation and Development

Leading companies such as Thermo Fisher Scientific, Labconco Corporation, and Esco Micro prioritize continuous product innovation to maintain a competitive edge in the Biological Safety Cabinet (BSC) market. These companies address evolving laboratory needs by incorporating advanced filtration systems, energy-efficient designs, and enhanced safety features. Innovations like low-noise operation, ergonomic workspaces, and touchscreen control panels improve user experience and efficiency. Additionally, adherence to stringent safety certifications such as NSF/ANSI 49 and EN 12469 enhances credibility. Continuous research and development investments allow these firms to introduce next-generation BSCs with automation and IoT-enabled monitoring, further solidifying their market leadership. This strategic focus on technological advancement ensures that their products remain in high demand across pharmaceutical, biotechnology, and research industries.

Strategic Partnerships and Collaborations

Key players in the BSC market actively pursue strategic partnerships and collaborations to expand their technological capabilities and market reach. By working with research institutions, healthcare organizations, and biotech firms, companies like Thermo Fisher Scientific and Esco Micro leverage shared expertise to accelerate product innovation. Collaborations with regulatory agencies help ensure compliance with safety and quality standards, boosting consumer confidence. Joint ventures with distributors and service providers enhance product accessibility, ensuring a broader customer base. Some firms also engage in mergers and acquisitions to strengthen their portfolio, integrating complementary technologies. These strategic alliances provide competitive advantages, enabling companies to stay ahead of market trends while fostering innovation, improving supply chains, and enhancing overall brand presence in the global biosafety cabinet sector.

Geographical Expansion

To strengthen their position, leading BSC manufacturers focus on geographical expansion, targeting emerging markets with increasing demand for laboratory safety equipment. Companies like Labconco, Thermo Fisher Scientific, and Esco Micro establish regional manufacturing units, reducing costs and improving supply chain efficiency. Expanding distribution networks in Asia-Pacific, Latin America, and the Middle East allows companies to cater to diverse customer needs while navigating local regulatory requirements. By setting up regional service centers, firms ensure timely maintenance and technical support, increasing customer satisfaction. Additionally, they adapt product designs to regional preferences, such as energy-efficient models for areas with unstable power supply. This strategic global expansion not only drives revenue growth but also positions companies as dominant players in the international BSC market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Thermo Fisher Scientific (US), Esco Micro (Singapore), Labconco (US), The Baker Company (US), Kewaunee Scientific (US), NuAire (US), Germfree Laboratories (US), EUROCLONE (Italy), Cruma (Spain), Air Science (US), Berner International (Germany) and BIOBASE (China) are a few of the prominent companies operating in the global biological safety cabinets market profiled in this report.

The Biological Safety Cabinet (BSC) market is very competitive. Many companies make and sell these cabinets to hospitals research labs and pharmaceutical companies. The market is growing because more people need safe spaces to work with dangerous biological materials.

Big companies like Thermo Fisher Scientific Esco Micro and Labconco lead the market. They compete by making high-quality products with new technology. These companies focus on safety energy efficiency and user-friendly designs. They also invest in research to improve their cabinets and follow strict safety rules.

Smaller companies also compete by offering lower prices or unique features. Some focus on special markets like small labs or developing countries. Others provide strong customer service and fast delivery to attract buyers.Companies try to grow by working with partners or expanding to new countries. They open factories in different places to make products faster and cheaper. Some also buy smaller companies to increase their market share.

Since more labs hospitals and research centers need safety cabinets the demand is rising. This strong demand makes the market very competitive. Companies must keep improving their products and services to stay ahead. Those who offer the best mix of quality price and service will succeed.

RECENT MARKET DEVELOPMENTS

- In August 2024, Thermo Fisher Scientific launched the Herasafe 2025 Biological Safety Cabinet. This new BSC is designed to enhance sample protection and user safety, focusing on containment, comfort, and convenience.

- In November 2024, the U.S. Food and Drug Administration (FDA) issued a safety communication highlighting serious risks associated with certain biological products. While not specific to BSCs, this underscores the importance of biosafety in laboratory environments.

- In June 2024, the University of Washington updated its Biological Safety Cabinet guidelines. The revised guidelines emphasize annual certification and proper maintenance to ensure optimal performance and safety.

- In September 2023, Esco Lifesciences introduced the Streamline G4 Class II Biosafety Cabinet. Featuring the Centurion Touchscreen controller, this EN12469-certified cabinet provides an ergonomic work zone with advanced safety features.

MARKET SEGMENTATION

This research report on the global biological safety cabinets market has been segmented and sub-segmented based on product type, end-user, and region.

By Product Type

-

Class I

-

Class II

-

Class II Type A

-

Class II Type B

-

-

Class III

By End-User

-

Pharmaceutical and Biopharmaceutical Companies

-

Diagnostics & Testing Laboratories

-

Academic & Research Organizations

By Region

-

North America

-

Asia Pacific

-

Europe

-

Latin America

-

The Middle East and Africa

Frequently Asked Questions

What is the CAGR of the biological safety testing market?

The global biological safety testing market is estimated to grow at a CAGR of 8.24% from 2025 to 2033.

Which region is anticipated to witness fastest growth in the global biological safety testing market?

The Asia-pacific region is forecasted to showcase fastest CAGR in the global biological safety testing market during the forecast period.

Who are the major players in the biological safety cabinets market?

Companies playing a key role in the biological safety testing market are Thermo Fisher Scientific (US), Esco Micro (Singapore), Labconco (US), The Baker Company (US), Kewaunee Scientific (US), NuAire (US), Germfree Laboratories (US), EUROCLONE (Italy), Cruma (Spain), Air Science (US), Berner International (Germany) and BIOBASE (China).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]