Global Biologic Therapeutic Drugs Market Size, Share, Trends & Growth Forecast Report By Source (Microbial, Mammalian and Others), Product (Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense & RNAi Therapeutics and Others), Manufacturing (In-House and Outsourced), Disease Category (Oncology, Infectious Diseases, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders and Others), End-Users (Hospitals, Speciality Clinics, Homecare and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Biologic Therapeutic Drugs Market Size

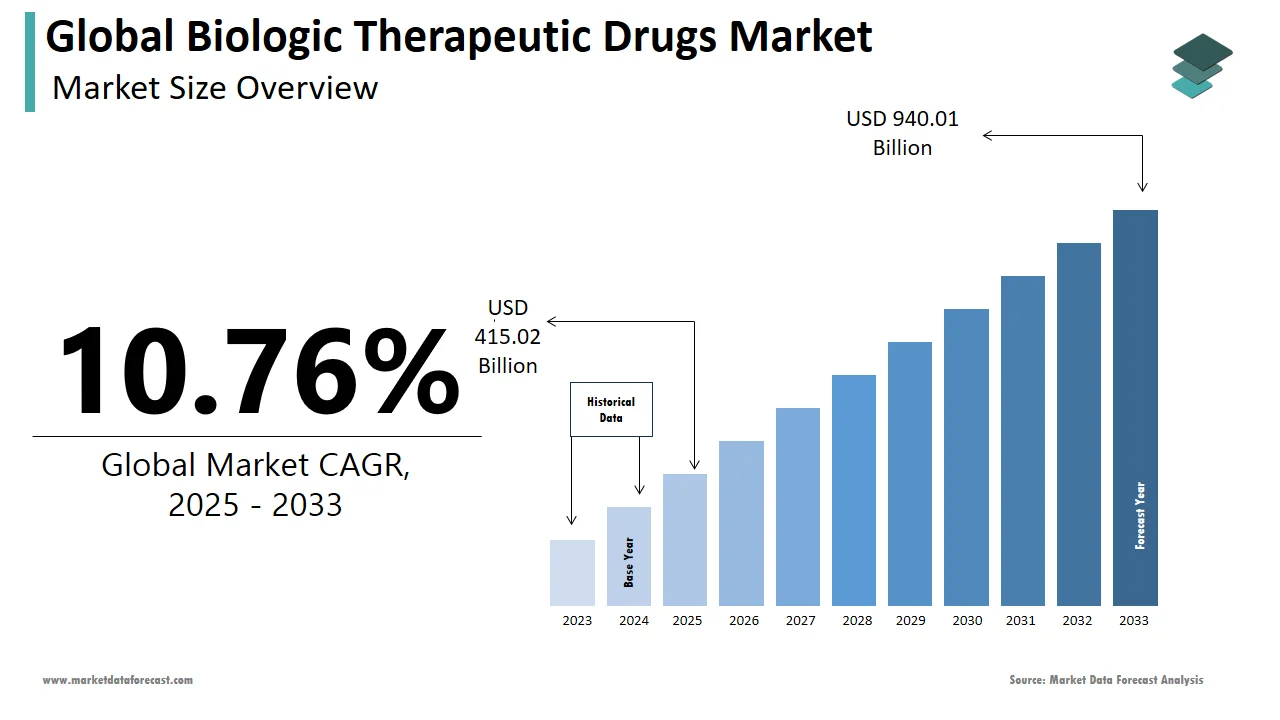

The size of the global biologic therapeutic drugs market was worth USD 374.7 billion in 2024. The global market is anticipated to grow at a CAGR of 10.76% from 2025 to 2033 and be worth USD 940.01 billion by 2033 from USD 415.02 billion in 2025.

Biologics are medicines that include growth factors, immune modulators, monoclonal antibodies, and others derived from the live or living organism components such as microorganisms, human blood, and plasma. The biological products have complex mixtures that cannot be quickly identified or characterized and tend to be heat-sensitive to microbial contamination. The global biological therapeutic drugs market has grown significantly in recent years. It is projected to have notable growth with a prominent growth rate during the forecast period. The growing incidence of various disease conditions is enhancing the adoption of new and innovative therapeutic therapies, contributing to market growth.

MARKET DRIVERS

The growing patient population suffering from various diseases is fueling the growth of the biologic therapeutic drugs market.

The rising prevalence of cancer, genetic disorders, and other new disease conditions worldwide is enhancing the approval of several disease-modifying therapies for the treatment of these conditions. The increasing need for effective and more targeted treatments in the healthcare industry and the development of personalized medicines propel the growth rate of the biologic therapeutic drugs market. The autoimmune disease cases are experiencing rapid growth of 3% to 9% each year, escalating the demand for effective biologics and leading to market revenue growth. The healthcare industry is experiencing notable technological advancements, including introducing novel products such as gene therapy, RNAi therapies, and mRNA-based vaccines, which have gained colossal commercialization. Introducing these successful biologics is expected to accelerate the market growth opportunities during the forecast period. Various biologics such as antibodies, enzymes, interferons, hormones, liposomes, vaccines, and interleukins are gaining traction in reaching the therapeutic regions treatment, augmenting the market growth rate. The increasing investments by the market players in developing and manufacturing effective biologics for various targeted diseases will provide market growth opportunities.

MARKET RESTRAINTS

High costs associated with biologic therapeutic drugs are a significant concern for global market growth.

The high costs associated with biologics development and manufacturing will enhance the final product's overall costs, hampering the adoption of biologics among people with restricted budgets. The expensive biologics will increase the costs of distribution owing to the complex manufacturing process, which limits affordability and accessibility, leading to restricted market growth. The presence of stringent regulatory challenges for market players in expanding the market revenue growth limits the approvals and product launches due to complexity. Certain regulatory authorities, such as the FDA and the European Medicines Agency, demand the results and proper clinical trial documentation to ensure the biological drugs' safety and efficacy. Meeting these requirements will take time and involve expenditure, which is expected to slow down the approval process, hindering market growth. The availability of other treatment procedures, the development of biosimilars, and the specific side effects produced by biologics impede the market growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Source, Product, Manufacturing, End-Users, & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bristol-Myers Squibb Company, Merck & Co., Novartis, Pfizer Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd, AbbVie Inc., Eli Lilly and Company, AstraZeneca PLC and GlaxoSmithKline PLC |

SEGMENTAL ANALYSIS

By Source Insights

The microbial segment dominated the biological therapeutics market with a prominent share of 59.4% in 2024. Most approved biologics from the past years and the therapeutic drugs in the pipeline are developed and manufactured in microbial expression systems, boosting the segment's revenue growth. Effective therapeutic products such as recombinant insulin, platelet-derived growth factor, and recombinant interferons are developed using microbial expression systems. The mammalian segment is expected to grow significantly during the forecast period, with a notable CAGR. Mammalian expression systems are mostly used in the development of recombinant proteins and viral-vector-based vaccines, which propels the market growth opportunities.

By Product Insights

The monoclonal antibodies segment held the most significant growth rate, leading to a prominent share of 68% in the global market in 2024. Increasing monoclonal antibody usage in various therapeutic areas contributes to the market growth. The monoclonal antibodies work by targeting the unhealthy cells without affecting the healthy cells, primarily the adoption in the therapeutics leading to segment growth. The Monoclonal antibodies have been determined to be the predominant category for approved biological drugs for the past few years, escalating the segment revenue growth. The antisense and RNAi therapeutics segment is expected to expand significantly in the coming years. The growing incidence of genetic diseases is enhancing the demand for gene-silencing drugs, augmenting the segment's growth rate.

By Manufacturing Insights

The in-house segment dominates the global biologic therapeutic drugs market, with an 85.3% share in 2024. Biologics manufacturing is more complex than small molecules, and the use of live microorganism cultures accelerates the adoption of in-house manufacturing, which drives the segment growth. Various benefits of in-house manufacturing, such as direct control and better monitoring of the drugs, are escalating the segment growth rate. The outsourced segment is projected to expand prominently at a CAGR during the forecast period. Most companies collaborate with CDMOs, which have advanced biologic manufacturing facilities for the production of efficient and safe drugs, which is creating market growth opportunities through this segment.

By End-Users Insights

The hospital's segment experienced notable growth in the global biologic therapeutic drugs market and is expected to dominate during the forecast period. The primary factor contributing to the segment's growth is the increased collaborations and partnerships between hospitals and various pharmaceutical companies. The specialty clinics and homecare segments are estimated to grow considerably in the coming years. The growing number of biologics producers and the rising prevalence of various diseases worldwide are propelling the market's growth opportunities.

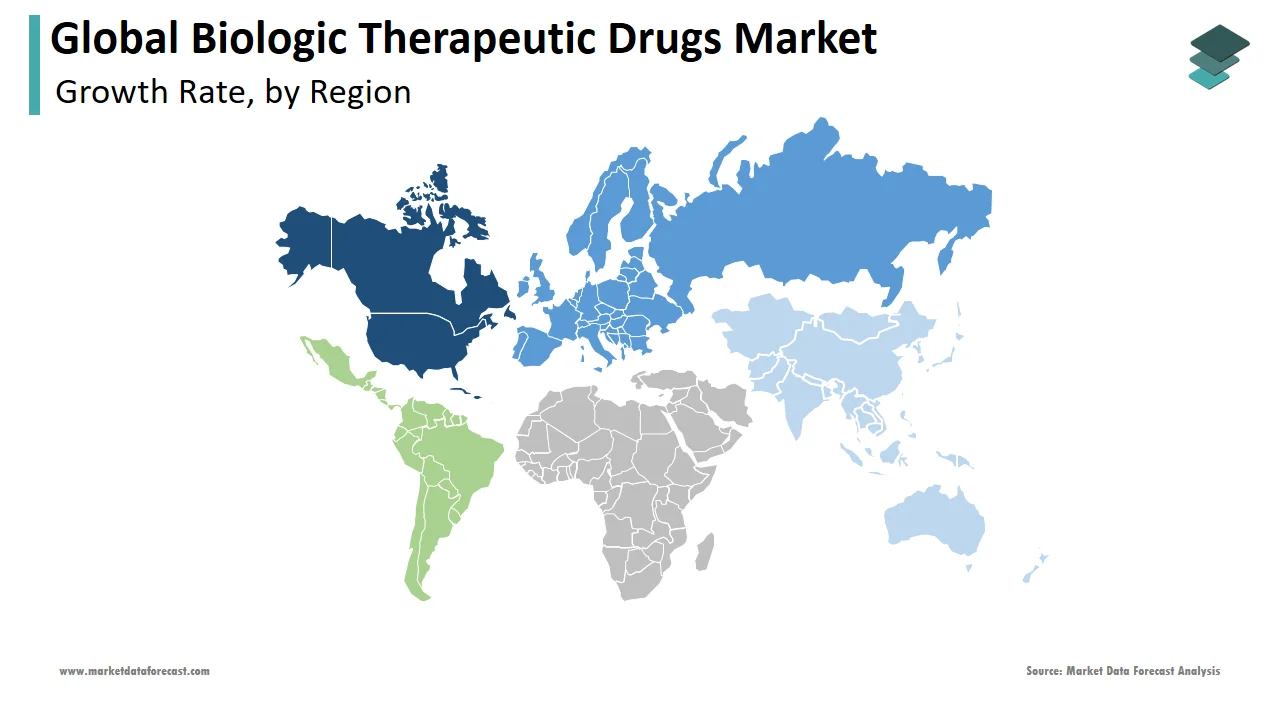

REGIONAL ANALYSIS

North America captured the largest share of the global market in 2024.

The domination of the North American region is expected to continue throughout the forecast period. Factors such as well-established healthcare infrastructure, numerous leading biopharmaceuticals, and favorable regulatory frameworks are primary factors contributing to the growth of regional market share. The growing investments in the R&D activities for developing the targeted drugs from the public and private organizations are fueling the market growth in the region. According to the data provided by the JAMA Network, biologics accounted for around 37% of the total drug spending in the United States.

The Asia Pacific region is projected to have the fastest growth during the forecast period.

The rising prevalence of chronic diseases such as diabetes, hypertension, cardiovascular diseases, and genetic disorders are primarily contributing to the expansion of the biologic therapeutic drugs market in the Asia-Pacific region. The escalating number of geriatric patients and the growing incidence of diseases propel the demand for biologics, leading to regional market growth. The growing investments by the market players in research activities to introduce innovative and novel therapeutics provide market growth opportunities in the region.

KEY MARKET PLAYERS

Companies playing a prominent role in the global biologic therapeutic drugs market profiled in this report are Bristol-Myers Squibb Company, Merck & Co., Novartis, Pfizer Inc., Johnson & Johnson Services Inc., F. Hoffmann-La Roche Ltd, AbbVie Inc.,Eli Lilly and Company, AstraZeneca PLC and GlaxoSmithKline PLC

RECENT MARKET HAPPENINGS

- In February 2025, AbbVie Inc. and Tentarix Biotherapeutics announced their partnership to identify and advance conditionally active, multi-specific biologic candidates in immunology and oncology.

- In September 2023, Novartis announced its establishment of a fully integrated, around USD 300 million scientific environment for next-generation biotherapeutics in the existing Novartis locations.

- In September 2023, Biogen, Inc. announced the approval received from the U.S. Food and Drug Administration for Tofidence (tocilizumab-bavi) intravenous formulation. This biosimilar was introduced in the United States to make significant advancements in the treatment of certain medical conditions.

- In March 2023, Eli Lilly announced that it would test an additional USD 500 million to expand its biologics manufacturing facility in Limerick.

- In January 2023, Johnson & Johnson announced the acquisition of Momenta Pharmaceuticals for USD 6.5 billion. Momenta is widely known for biosimilars, and the acquisition is expected to enhance Johnson & Johnson's biosimilars portfolio.

- In February 2023, AbbVie announced its acquisition of Allergen, a leading developer of biologics. The major aim of the acquisition is to improve AbbVie's biologics portfolio.

MARKET SEGMENTATION

This research report on the global biologic therapeutic drugs market has been segmented and sub-segmented based on source, product, manufacturing, end users & region.

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Antisense & RNAi Therapeutics

- Others

By Manufacturing

- In-house

- Outsourced

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How are biologic drugs different from traditional drugs?

Traditional drugs are typically synthesized chemically and have a known chemical structure, whereas biologics are complex mixtures that are not easily defined or characterized due to their biological origin. Biologics are often larger molecules with more complex mechanisms of action.

What conditions are treated with biologic drugs?

Biologics are used to treat various conditions, including autoimmune diseases (e.g., rheumatoid arthritis, psoriasis), cancers, rare genetic disorders, and infectious diseases.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]