Global Biopharmaceuticals Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type (Monoclonal Antibodies (mAb), Erythropoietin, Biotech Vaccines, Recombinant Human (RH) Insulin, Granulocyte colony-stimulating factor (G-CSF), Interferon and Human Growth Hormones (HGH)), Therapeutic Type (Neurology, Infectious diseases, Diabetes, Oncology, Cardiovascular and Other Therapeutic Areas) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From 2025 to 2033

Global Biopharmaceuticals Market Size

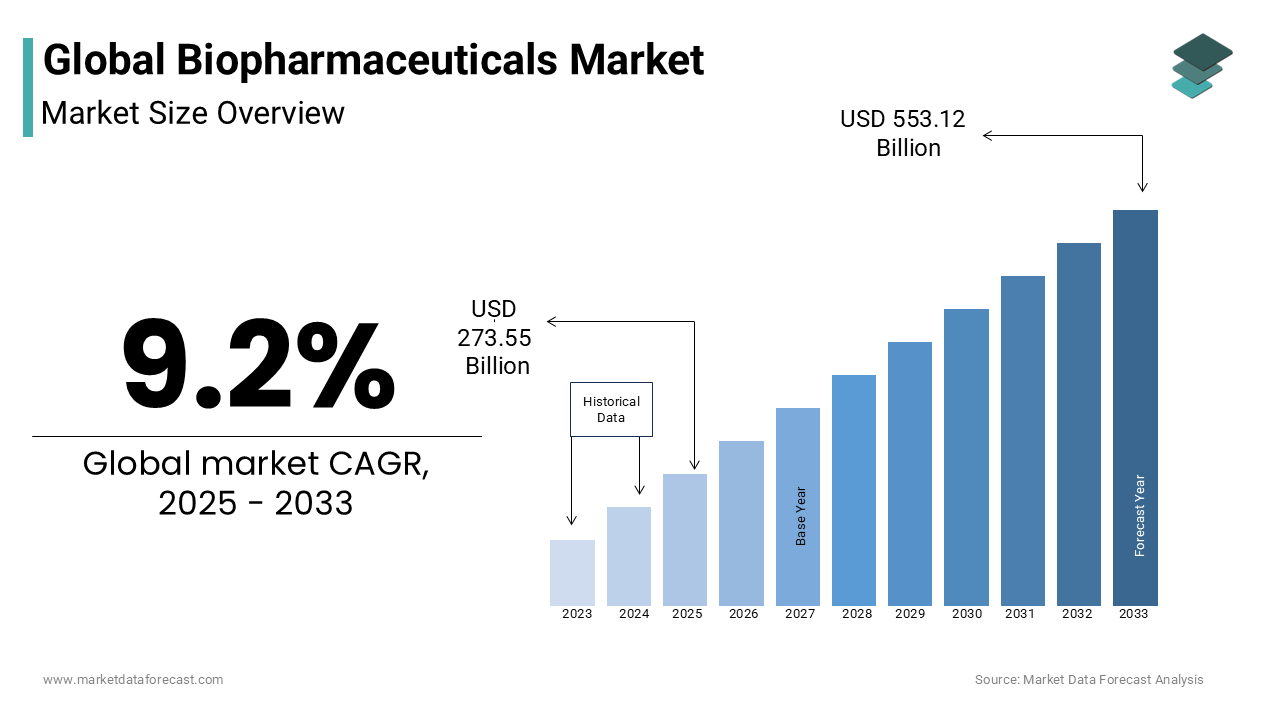

The global biopharmaceuticals market was valued at USD 250.50 billion in 2024. As per our research report, the global biopharmaceuticals market is estimated to grow at a CAGR of 9.2% during the forecast period. The market size was worth USD 273.55 billion in 2025 and is forecasted to be worth USD 553.12 billion by 2033.

Current Scenario of Global Biopharmaceuticals Market

Biopharmaceuticals are medicinal drugs developed and produced using biotechnology procedures. These medicines are produced from biological sources such as living organisms such as bacteria, white blood cells, by-products, or components of the living organisms. The biopharmaceuticals can be proteins or nucleic acids used in therapeutics or diagnostics. The global biopharmaceuticals market has accounted for significant growth in the past years and is anticipated to witness notable growth during the forecast period. Biopharmaceuticals widely use recombinant DNA technology, and they are produced in bacteria, yeast, insect, plant, or mammalian cell expressions and hybridomas, accelerating market revenue. Biopharmaceuticals are rapidly growing in the pharmaceutical industry, where about 10% of the drugs are biopharmaceuticals, contributing to the market expansion. The major classes of biopharmaceuticals include recombinant vaccines, hormones, growth factors, therapeutic enzymes, blood factors, cytokines, and monoclonal antibodies. The monoclonal antibodies have contributed to market growth over the past years owing to their average % growth rate of 35% over the past three years. The production of biopharmaceuticals requires advanced technologies in genetic engineering, bioprocessing, and advancements in biotechnology to propel the market growth rate.

MARKET DRIVERS

The growing number of patients suffering from chronic diseases and the increasing geriatric population prone to neurodegenerative and autoimmune disorders are driving the biopharmaceutical market growth.

The number of diagnoses with various chronic diseases is growing with each year passing. Every year, many people worldwide experience disability or death. Cardiovascular diseases, such as cancer, diabetes, and arthritis, are considered major chronic diseases by the Centers for Disease Prevention and Control (CDC). According to the same source, an estimated 859,000 Americans die yearly from CVDs. More than 37.3 million people in the United States have diabetes, and the number is growing consistently with each year passing. Cancer has been causing the second-highest number of deaths in the United States annually. An estimated 1.7 million people are diagnosed with cancer in the United States. As mentioned above, the growing incidence of chronic diseases among people promotes the need for biopharmaceuticals and results in global market growth. There is a massive demand for biopharmaceuticals due to the increasing incidence of chronic diseases whose treatment is possible using these drugs.

The growing patient population suffering from chronic diseases is further fuelling the growth rate of the biopharmaceuticals market.

Furthermore, an increase in the occurrence of vulnerable diseases such as cancer and diabetes, growth in obesity and sedentary lifestyle among the population, and growing acceptance of biopharmaceuticals due to their ability to treat previously untreatable diseases are further significantly driving the market growth. According to WHO, cancer is the leading cause of death globally, and diabetic patients are also increasing daily due to lifestyle changes. In addition, a sedentary lifestyle leads to several chronic diseases, thus boosting the market growth. Biopharmaceuticals hold the potential to cure the disease entirely and not just the symptoms, hence increasing its acceptance.

The presence of a strong pipeline of drug candidates, especially from emerging nations, is estimated to provide growth opportunities to the biopharmaceuticals over the forecast period, and according to the information published by Cytel in 2023, stated that around 50% of the clinical trial global activity is contributed from the Asia Pacific region which is making it a hotspot for clinical trials. The lower costs of clinical trial development, lower risk of competition, and favorable regulatory procedures, as well as the emerging economies of the Asian region, are augmenting the biopharmaceuticals market with growth opportunities. The growing focus on gene therapies in the Asian region and the growing number of clinical trials worldwide are boosting growth opportunities. For Instance, according to the data listed on ClinicalTrials.gov, there are about 443 pipeline candidates for chimeric antigen receptor T-cell therapy in 2023. The increased approvals of monoclonal antibodies by the regulatory authorities worldwide and most of the market players have robust pipeline candidates seeking approval for multiple indications.

MARKET RESTRAINTS

Side effects associated with the over-consumption of drugs and the high manufacturing cost hamper the biopharmaceuticals market growth.

High costs associated with the drug development process are significant restraints to the biopharmaceutical market. In addition, the threat of drug failure and challenging developments affects market growth. With a price of 100 million USD, it generally takes 5 to 9 years to develop a biopharmaceutical product. This regulatory framework for establishment takes a lot of work and patience, which acts as a challenge to the market players in expanding their revenue. Furthermore, the World Health Organization (WHO) also has set strict approval standards for biopharmaceuticals, which is further estimated to restrict the growth scope of the market to some extent. Biopharmaceuticals manufacturing involves high manufacturing challenges and requires expensive processing and purification, which hampers the market growth rate. The high costs of the equipment used in the manufacturing and production of biopharmaceuticals are limiting their adoption among low and middle-income organizations, negatively impacting global market revenue. The accessibility to expensive treatments and procedures, especially among the underdeveloped region population and healthcare organizations, due to restricted income levels and budgets restrains the market expansion.

The most common challenges manufacturers face in biopharmaceuticals are formulation and drug delivery issues, the availability of limited skilled labor, and a shorter time period for production. The increased cases of drug interactions between food and medications and the adverse effects associated with the biopharmaceuticals administration, such as infusion reactions, increased rates of infection, and induction or reactivation of autoimmune diseases, are widely observed with different types of biopharmaceuticals. These may limit the adoption of biopharmaceuticals among the people, which restricts market growth. The stringent regulations for the approval of medications and drug development, which involve complexity, more time consumption, and additional expenditures, will negatively influence the market growth. The presence of limited awareness and most of the underdiagnosed cases are impeding the market growth opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Therapeutic Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Merck & Co., Inc., F. Hoffmann- La Roche AG, Eli Lilly and Company, Inc., Sanofi, Amgen Inc., AbbVie Inc., Biogen Idec, Bayer AG, Johnson & Johnson Services, Pfizer, Inc. and Novartis AG. |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on the product type, the monoclonal antibodies segment had the largest worldwide market share in 2024 and is estimated to hold a significant global market share during the forecast period. Monoclonal antibodies are the most emerging technology. Monoclonal antibodies are identical to immune cells and represent a copy of the unique parent cell. Monoclonal antibodies alone contribute 40% of the global biopharmaceutical market.

The recombinant human (RH) insulin segment is estimated to hold a considerable share of the worldwide market during the forecast period owing to the regulation of the metabolism of carbohydrates, fats, and protein by promoting the absorption of glucose from the blood into the liver, fat, and skeletal muscle cells. In addition, it was the first biopharmaceutical approved for human therapeutic uses.

By Therapeutic Type Insights

In terms of therapeutic application, the oncology segment was the largest in the biopharmaceutical market in 2024. Biopharmaceuticals are mainly working on cancer-related trials compared to others. Many people who have cancer need personalized treatment and diagnostic procedures. Utilizing personalized anticancer biopharmaceuticals effectively controls and prevents cancer with fewer side effects and increases the life span of cancer patients. Biopharmaceuticals also work on macro molecules-based therapeutic drugs. Protein-based biopharmaceuticals are also used to increase the lives of millions of cancer patients.

On the other hand, segments such as diabetes and CVDs are anticipated to showcase a healthy CAGR in the coming years. Biopharmaceuticals are also responsible for the treatment and drug innovation of diabetes and cardiovascular diseases. In 2021, diabetes will be the ninth leading cause of death in the world. It is estimated that 1.7 million people have died of diabetes. Type 2 diabetes is the most common disease in many people. These biopharmaceutical companies are researching drugs, vaccines, and insulins for the fast reduction of diabetes levels in patients without any side effects.

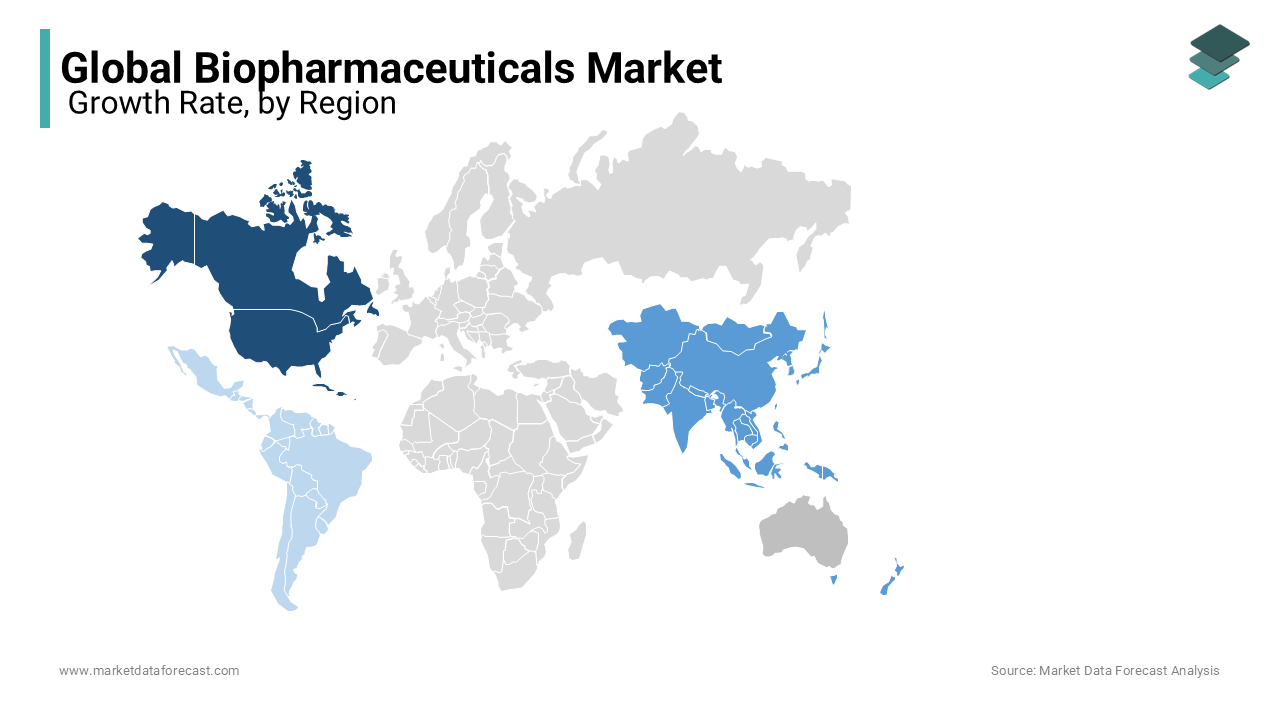

REGIONAL ANALYSIS

Geographically, North America was the largest regional segment in the worldwide market in 2024. Technological advancements in the region are propelling the dominance of the region. In North America, the United States biopharmaceuticals market holds the largest market share at 46%, followed by Canada. Because of increased R&D investment, a rise in the adoption and availability of biopharmaceuticals for disease treatment, and a surge in disease diagnosis awareness. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), U.S. firms conduct over half the world's pharmaceutical research and development(R&D) and hold the intellectual property rights on most new medicines. In addition, the U.S. government has decided to spend more money on developing advanced medicine for different diseases. Introducing advanced therapeutics, an increasing proportion of active INDs and new drug approvals, fast-growing biotech, meaningful corporate partnerships, and new technologies due to the spread of the coronavirus pandemic in this region drive the market forward.

The Asia-Pacific market is forecasted to develop as the fastest-growing region in the forecast period. Increasing awareness regarding biological drugs is driving the market in the area. Asia-Pacific is expected to grow steadily throughout the forecast period. India is rich in manufacturing vaccines for diphtheria, pertussis, tetanus, and measles. Increased R&D investments, increasing population growth, and increasing infrastructural facilities for drug manufacturing are the factors that drive the market forward. India supplies two-thirds of antiretroviral drugs worldwide to fight against AIDS. India has an increasing number of educational institutions for developing biopharmaceutical sciences and industries, which drives the market forward in this region. Due to the increase in COVID-19 cases, obesity, and sedentary lifestyles, biopharmaceutical industries have more demand due to the invention of many drugs and vaccines to prevent and reduce the virus in the body. Chinese biopharmaceutical companies supply most mRNA vaccines developed by Providence Therapeutics, a Canadian biotech company in Greater China. Japan is expected to have the largest pharmaceutical markets in the world. The Government of Japan is increasing investment in healthcare and innovative products in biopharmaceutical companies.

Europe is anticipated to hold a substantial share of the worldwide market during the forecast period. Germany is one of the main places for developing and producing biopharmaceuticals. In addition, this region has increased research on diagnostic procedures and personalized medicines.

Latin America is expected to showcase a steady CAGR during the forecast period. The MEA market is estimated to hold a moderate share of the worldwide market in the coming years. The escalation in the healthcare industry across the regions and the growing government support initiatives along with the advancements in the healthcare sector is propelling the market growth opportunities across the regions.

KEY PLAYERS IN THE GLOBAL BIOPHARMACEUTICALS MARKET

A list of crucial competitors dominating the global Biopharmaceuticals market profiled in this report is Merck & Co., Inc., F. Hoffmann- La Roche AG, Eli Lilly and Company, Inc., Sanofi, Amgen Inc., AbbVie Inc., Biogen Idec, Bayer AG, Johnson & Johnson Services, Pfizer, Inc. and Novartis AG.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Johnson & Johnson announced the acquisition of Ambrx Biopharma Inc. to enhance the advanced next-generation antibody-drug conjugates to escalate cancer treatment.

- In January 2024, AbbVie Inc. announced its collaboration with Umoja Biopharma for the development of multiple in-situ generated CAR-T cell therapy candidates for cancer treatment. This collaboration, operating from Umoja's proprietary VivoVecTM platform, holds great promise for the future of cancer treatment.

- In February 2024, F. Hoffman-La Roche expanded its digital pathology capabilities for diagnostics. To achieve these advancements, the company collaborated with the PathAI.

- In January 2023, Sanofi announced the acquisition of Inhibrx, and the primary aim is to develop the experimental drug Inhibrx, which is used to treat rare lung diseases known as alpha-1 antitrypsin deficiency.

- In October 2023, Lilly announced the receipt of US FDA approval of Omvoh infusion/injection, developed for treating moderately to severely active ulcerative colitis in adults.

- In September 2023, BieGene announced its legal agreement with Novartis AG to develop, manufacture, and commercialize the TEVIMBRA antibody.

- In December 2023, Novartis announced the approval of its first oral monotherapy, Fabhalta, developed for treating paroxysmal nocturnal hemoglobinuria.

MAEKET SEGMENTATION

This research report on the global biopharmaceuticals market segmented and sub-segmented into the following categories and analyzed market size and forecast for each segment.

By Product Type

- Monoclonal Antibodies (mAb)

- Erythropoietin

- Biotech Vaccines

- Recombinant Human (RH) Insulin

- Granulocyte colony-stimulating factor (G-CSF)

- Interferon

- Human Growth Hormones (HGH)

By Therapeutic Type

- Neurology

- Infectious diseases

- Diabetes

- Oncology

- Cardiovascular

- Other Therapeutic Areas

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which segment by product led the biopharmaceuticals market in 2024?

The monoclonal antibodies segment led the global biopharmaceuticals market in 2024.

Which region dominated the market for biopharmaceuticals worldwide in 2024?

Geographically, the North American region dominated the biopharmaceuticals market worldwide in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]