Global Big Data and Data Engineering Services Market Size, Share, Trends & Growth Forecast Report By Component (Solutions and Services), Deployment Mode, Organization Size, Business Function, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Big Data and Data Engineering Services Market Size

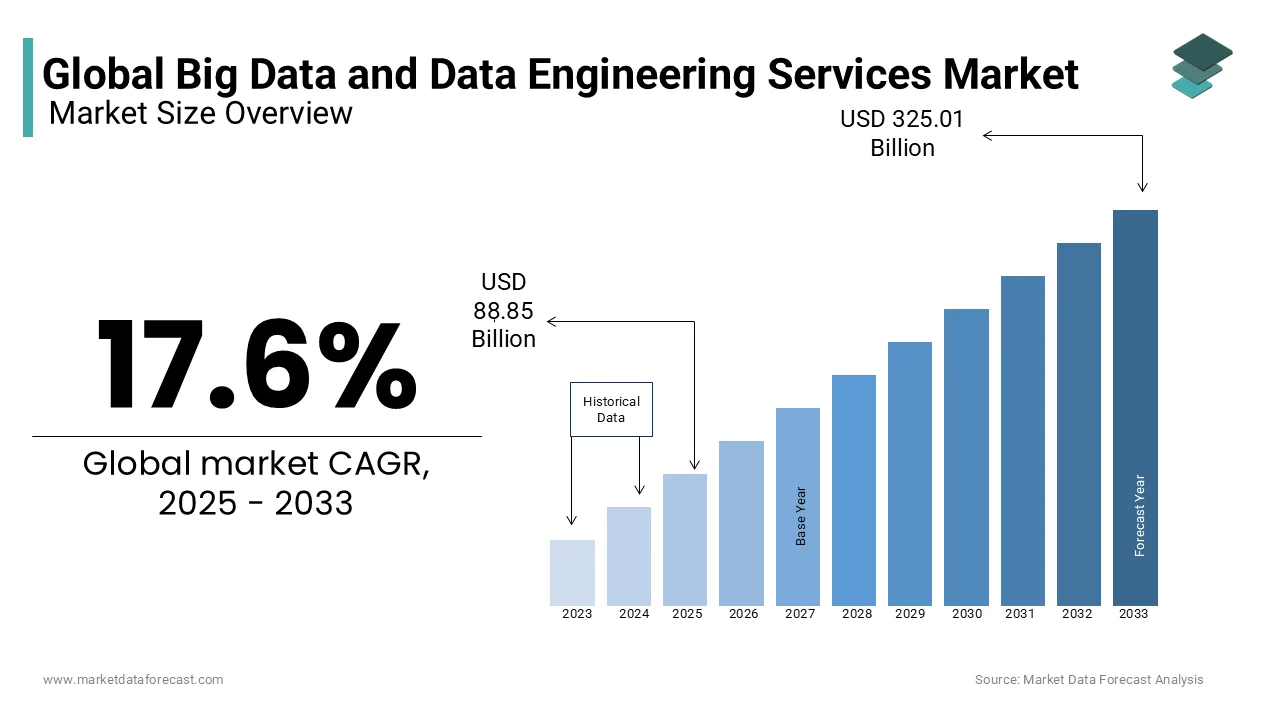

The global big data and data engineering services market was worth USD 75.55 billion in 2024. The global market size is anticipated to be worth USD 325.01 billion by 2033 from USD 88.85 billion in 2025, growing at a CAGR of 17.6% during the forecast period.

In recent years, the global big data and data engineering services market has experienced exponential growth, and the global market is likely to continue the momentum during the forecast period. Big data and data engineering services assist companies in optimizing their business processes by capturing and interpreting business data, allowing organizations to obtain information and move to fast and reliable decision-making. Most businesses are primarily driven by increased data consumption, competition, and explosion. The complexity and scalability of disparate data pose a challenge to traditional database and analytics technologies. Real-time processing of big data, using the cloud as a catalyst, has become the norm. The disruptive technologies that underpin SMAC (Social, Mobile, Analytics, and Cloud) are leading to new business scenarios that make the most of data. Countries such as the United States, China, India, the United Kingdom, and Germany stand at the forefront of the adoption of big data and data engineering services worldwide. During the forecast period, the growing recognition of the transformative potential and the abilities of big data and data engineering services in driving innovation and digital transformation are anticipated to drive demand for these services and propel global market growth.

MARKET DRIVERS

Rapid Adoption of Big Data in Banking and Fintech Sectors

The rapid adoption of big data and data engineering services in the banking and fintech sectors is majorly propelling global market growth. Big data analytics in banking is set to grow dramatically in the future. The growing number of smartphone users and increasing internet usage worldwide led to the rapid adoption of mobile banking and an increase in the number of online transactions. This gigantic volume of data requires better acquisition, organization, integration, and analysis. Given the regional analysis of government regulations, the government's focus in each region varies in intensity. European banks are taking stricter regulatory approaches than their Asian counterparts. For example, in Europe, regulations have been a major catalyst for the boom in open banking. These include the implementation in Europe of its Second Payment Services Directive (PSD2) and the Open Banking Regulations of the UK Competition and Markets Authority (CMA). According to the Open Banking Implementation Entity (OBIE), API calls expanded to about 66.7 million in the month of June 2019 (PSD2 needs banks to create APIs (vehicles to add and share discrete data sets between organizations) for digital banking transactions. Danske Bank is the largest bank in Denmark, with a customer base of more than 5 million people. It uses its advanced internal analytics to identify fraud and reduce false positives. So, after implementing a modern business analytics solution, the bank achieved a 60% reduction in false positives, increasing true positives by 50%.

Growing Volume of Data

The growing volume of data being generated by various businesses is further fuelling the global big data and data engineering services market growth. The rapid increase in the volume of unstructured data due to the phenomenal growth of interconnected devices and social networks is contributing to the increasing demand for big data and data engineering services. As the volume and variety of data increases, so does the demand for keeping and managing these records of financial transactions in banks and other financial institutions. Several companies have been investing significant amounts in data engineering services to smoothen the process of collecting, storing, and processing the data. For instance, the demand for cloud data warehouses such as Amazon Redshift and Google BigQuery has significantly grown in recent times. Companies have increasingly used these cloud data warehouses to scale their data infrastructure as needed.

Demand for Real-time Analytics and Insights

The growing demand for real-time analytics and insights to drive decision-making is also a factor contributing to the expansion of the global big data and data engineering services market. The dependency of companies on data to make informed decision making and respond to the changes in the market dynamics has tremendously increased, which is fuelling the demand for data engineering services as these services play a vital role in enabling real-time analytics by building and maintaining data pipelines which can further process and analyse data in almost real-time.

Adoption of Cloud Computing

Furthermore, factors such as the expansion of IoT devices and sensors, rapid adoption of cloud computing technologies, and Y-o-Y growth in artificial intelligence and machine learning applications are favoring the growth of the big data and data engineering services market. Regulatory requirements for data management and compliance, increasing need for data-driven decision making and the emergence of edge computing are aiding the global market growth. The rapid adoption of predictive maintenance in manufacturing, an increasing number of digital transformation initiatives, and rising demand for scalable and flexible data infrastructure are promoting global market growth.

MARKET RESTRAINTS

The Inability of Service Providers to Provide Real-time Information

However, the inability of service providers to provide real-time information is a significant restraint to the growth of the global big data and data engineering services market. Data privacy and security concerns, lack of skilled data engineering professionals, and high implementation and maintenance costs are some of the other major factors impeding the global market growth. Data silos and interoperability issues, regulatory compliance challenges, limited access to high-quality data sources, scalability limitations of existing infrastructure, and the complexity of data governance frameworks are further hindering the growth of the global big data and data engineering services market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.6% |

|

Segments Covered |

By Component, Deployment Mode, Organization Size, Business Function, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Amazon Web Services, Dell Inc., Hewlett Packard Enterprise Development LP, Microsoft, Oracle, SAP SE, SAS Institute Inc., Teradata, Datameer, Inc., Birst, Inc., Guardian Glass, LLC., Opera Solutions, LLC., Sisense Inc., MapR Technologies, Inc., Mirantis, Inc., Tele-Media Solutions, Kleiner Perkins, NORTHGATE, Wipro Limited, Red Hat, Inc, and Others. |

SEGMENTAL ANALYSIS

By Component Insights

The solutions segment accounted for 60.5% of the global market share in 2024 and was the largest segment in the global market. The solutions segment is also expected to be the fastest growing segment in the worldwide market during the forecast period. The domination of the solutions segment is primarily driven by the Y-o-Y growth in demand for advanced analytics, data-driven decision-making, and digital transformation initiatives across industries. The rapid adoption of cloud computing and hybrid IT environments is accelerating the need for scalable and flexible data processing and analytics solutions and contributing to segmental expansion.

The services segment is also a major segment and is anticipated to progress at a notable CAGR of 8.8% during the forecast period. The rising demand for outsourced data expertise and support is majorly driving the growth of the services segment in the global market. The proliferation of data-driven technologies such as artificial intelligence, machine learning, and IoT is further fuelling the demand for specialized services and aiding the segmental expansion.

By Deployment Mode Insights

The cloud segment dominated the big data and data engineering services market in 2024, holding 68.7% of the worldwide market share, and the domination of the cloud segment is expected to continue during the forecast period. The scalability, flexibility, and cost-efficiency of cloud-based deployment is majorly boosting the growth of the cloud segment in the global market. Among the sub-segments of cloud-based deployment, the public cloud segment held the major share in 2024 and is expected to hold its domination during the forecast period. Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are some of the popular public cloud services and are popular for their scalability, cost-effectiveness, and broad range of services. The private cloud and hybrid cloud segments are anticipated to account for a considerable share of the worldwide market during the forecast period.

The on-premises segment is expected to grow at a moderate CAGR during the forecast period.

By Organization Size Insights

The large enterprises segment occupied 68.7% of the global market share in 2024 and is predicted to continue its domination in the global market throughout the forecast period. Large enterprises are the major consumers of big data and data engineering services. The lead of the large enterprises segment in the worldwide market is attributed to the growing volume and complexity of data generated by large enterprises, increasing demand for real-time analytics and predictive capabilities, and the integration of big data technologies into core business processes. According to estimations, large-sized organizations usually allocate 25& of their IT budgets to big data and analytics initiatives.

The SMBs segment is gaining traction and is expected to account for a substantial share of the worldwide market during the forecast period. The growing rising demand for data-driven decision-making tools among SMBs and the scalability and flexibility offered by cloud-based data solutions are propelling the expansion of the SMBs segment in the global market.

By Business Function Insights

The marketing and sales segment had 33.8% of the global market share in 2024 and is predicted to be the fastest growing segment in the worldwide market during the forecast period. The growth of the marketing and sales segment is majorly driven by the rapid adoption of digital marketing channels and the increasing demand for personalized marketing campaigns. An estimated 70% of the marketers believes that using big data analytics assists in doing improved customer targeting and companies that use data-driven marketing strategies agreed that they had seen a considerable increase in the sales.

By Vertical Insights

The commercial applications segment led the market, accounting for 26.7% of the global market share in 2024, and is expected to grow at a healthy CAGR during the forecast period. Factors such as the growing usage of e-commerce platforms, the increasing number of digital marketing initiatives, and the rising need for businesses to remain agile and responsive to changing market dynamics are propelling the growth of the commercial applications segment in the global market.

REGIONAL ANALYSIS

North America was the largest regional segment in the global big data and data engineering services market in 2024 and accounted for 39.1% of the worldwide market share. The North American is anticipated to remain dominant in the worldwide market during the forecast period due to technological advancements and high implementation of these engineering services in the North American region. The presence of major technology hubs, extensive adoption of advanced analytics solutions, and a robust digital infrastructure are further promoting the regional market growth. The growing volume of data generated by businesses and consumers in North America is aiding the North American market growth. North America is responsible for more than 30% of the data creation worldwide. The U.S. is playing a major share in the North American market and is expected to be a major force in the worldwide market as well. The strong focus of the U.S. on innovation and technological advancements and high investments in data analytics and cloud computing are primarily contributing to the growth of the U.S. market.

Europe constituted a notable portion of the worldwide market in 2024 and is expected to witness a prominent CAGR during the forecast period. The stringent data privacy regulations such as GDPR that incentivize businesses to invest in robust data management and security solutions are propelling the European market growth. The growing demand for real-time analytics, predictive modeling, and customer insights is further boosting the growth rate of the European market.

The Asia-Pacific region is rapidly growing in the global market and is expected to be the fastest growing regional segment in the worldwide market during the forecast period. The massive influx of data from e-commerce, social media, and mobile technologies, the increasing number of initiatives that promote digital transformation and smart city development, and the rise of emerging economies such as China, India, and Southeast Asian countries as global technology hubs are driving the growth of the Asia-Pacific market.

KEY PLAYERS IN THE MARKET

Companies that play a leading role in the global big data and data engineering services market include Amazon Web Services, Dell Inc., Hewlett Packard Enterprise Development LP, Microsoft, Oracle, SAP SE, SAS Institute Inc., Teradata, Datameer, Inc., Birst, Inc., Guardian Glass, LLC., Opera Solutions, LLC., Sisense Inc., MapR Technologies, Inc., Mirantis, Inc., Tele-Media Solutions, Kleiner Perkins, NORTHGATE, Wipro Limited and Red Hat, Inc..

RECENT HAPPENINGS IN THE MARKET

-

In April 2020, Capgemini SE announces the acquisition of Advectas AB, a data science and business intelligence company that is based in Sweden. Advectas is integrated into the company's Insights and Data business unit as the company aims to capitalize on growing customer demand for data analytics services. Furthermore, in the future, the company expects continued growth of 4% by 2020 and aims to focus on its expansion in the intelligence industry market.

-

In March 2020, Infosys Limited announced a USD 4.5 million investment in the US company Waterline Data Science through its innovation funds. The startup offers data discovery and governance software and also provides business analysts and data scientists with a self-service data catalog to help them understand the information.

MARKET SEGMENTATION

This research report on the global big data and data engineering services market has been segmented and sub-segmented based on component, deployment mode, organization size, business function, vertical, and region.

By Component

-

Solutions

-

Big Data Analysis

-

Data Discovery

-

Data Visualization

-

Data Management

-

-

Services

-

Managed Services

-

Professional Services

-

Consulting

-

Support And Maintenance

-

Implementation

-

Integration

-

-

By Deployment Mode

-

On-Premises

-

Cloud

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

By Organization Size

-

SMBs

-

Large Enterprises

By Business Function

-

Marketing and Sales

-

Operations

-

Finance

-

Human Resources

By Vertical

-

Commercial Applications

-

BFSI

-

Government And Defense

-

Healthcare And Life Sciences

-

Entertainment

-

Telecommunications and IT

-

Transport

-

Logistics

By Region

-

North America

-

South America

-

Europe

-

Asia-Pacific (APAC)

-

Middle East and Africa (MEA).

Frequently Asked Questions

What are the key factors driving the growth of the Big Data and Data Engineering Services market globally?

Key factors driving the growth include the increasing volume and complexity of data, the need for advanced data analytics to gain business insights, advancements in AI and machine learning technologies, and the growing adoption of cloud-based solutions for data storage and processing.

What are the major challenges faced by organizations in implementing Big Data and Data Engineering Services?

Major challenges include data privacy and security concerns, the high cost of implementation, the complexity of integrating big data solutions with existing systems, a shortage of skilled professionals, and difficulties in managing and analyzing large volumes of data.

How are advancements in AI and machine learning influencing the Big Data and Data Engineering Services market?

Advancements in AI and machine learning are significantly influencing the market by enabling more sophisticated data analytics, predictive modeling, and automation of data processing tasks. These technologies help organizations extract deeper insights and improve decision-making processes.

What future trends are expected to shape the Big Data and Data Engineering Services market?

Future trends include the increasing integration of big data with IoT (Internet of Things), the rise of edge computing, greater emphasis on data privacy and governance, the growth of real-time data analytics, and the continued development of AI and machine learning capabilities to enhance data processing and analysis.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]