Global Berries Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Strawberries, Blueberries, Raspberries and Others), Application, And Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Berries Market Size

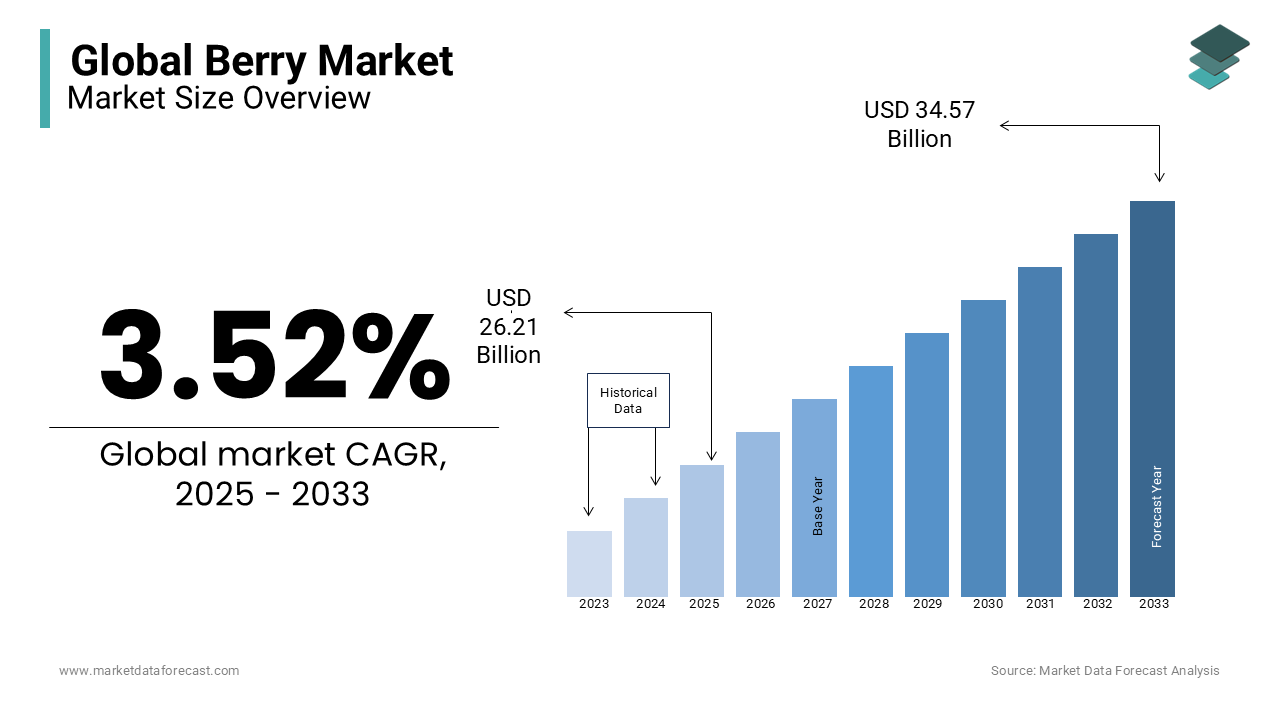

The global berries market size was calculated to be USD 25.32 billion in 2024 and is anticipated to be worth USD 34.57 billion by 2033 from USD 26.21 billion In 2025, growing at a CAGR of 3.52% during the forecast period.

Berries are among the most nutrient-dense fruits, rich in vitamins, minerals, antioxidants, and fiber, making them an essential component of a healthy diet. Globally, strawberries are the most consumed berries, followed by blueberries and raspberries. Blueberries are noted for their exceptionally high antioxidant content, with one cup containing up to 9,000 ORAC (Oxygen Radical Absorbance Capacity) units. Berries are also a low-calorie option, with most varieties providing under 50 calories per 100 grams, making them ideal for weight management. According to the Food and Agriculture Organization (FAO), global blueberry production reached 1.1 million tonnes in 2021, with the U.S. adding 32%, followed by Peru (20%) and Canada (13%). These figures highlight regional production shifts and the growing influence of berrie consumption worldwide.

MARKET DRIVERS

Health and Wellness Trends

The increasing focus on health and wellness is significantly boosting the global berries market expansion. Rich in antioxidants vitamins and nutrients berries are highly valued for their health benefits. According to the U.S. Department of Agriculture (USDA), blueberries are among the top antioxidant-rich foods, which supports their popularity as a superfood. Research shows that antioxidants found in berries can help combat oxidative stress, reduce inflammation, and lower the risk of chronic diseases. The rise in demand for functional foods that offer added health benefits is propelling berry consumption, especially in health-conscious regions like North America and Europe. In fact, the USDA reports a consistent increase in berries consumption over the past decade, with U.S. blueberry sales alone surpassing $1.8 billion in 2020, reflecting the trend toward nutrient-dense diets for improved well-being.

Organic and Clean-Label Demand

The shift toward organic and clean-label products is another key driver of the berries market. As consumers become more concerned about food quality and sustainability, the demand for organic berries has grown. According to the USDA, organic blueberry production in the U.S. grew by 60% from 2015 to 2020, demonstrating a strong shift toward pesticide-free, sustainably farmed options. This trend is further propelled by consumer preferences for natural foods that are traceable and ethically sourced, pushing berry producers to expand their organic product lines.

MARKET RESTRAINTS

Seasonal Availability and Weather Dependency

One of the significant restraints in the berries market is the seasonal nature of berry production, which can lead to supply fluctuations. Berries such as strawberries, blueberries, and raspberries have a short growing season and are highly susceptible to weather conditions. According to the USDA, U.S. blueberry production dropped by 15% in 2020 due to late spring frosts in Michigan and Oregon's key growing regions. Additionally, unfavorable weather, such as drought or excessive rainfall, can impact crop quality and yield. In 2021 U.S. strawberries production was 5% lower than the previous year largely due to drought conditions in California. This weather dependency creates supply shortages during off-season,s leading to price increases and market instability.

Post-Harvest Losses and Shelf-Life Issues

Another significant challenge for the berries market is the high post-harvest loss rate and short shelf life of these products. Berries are perishable and maintaining freshness throughout the supply chain is a logistical hurdle. The U.S. Department of Agriculture (USDA) estimates that up to 20% of the total harvest of some berry varieties is lost before reaching the consumer due to spoilage. Additionally, berries require strict temperature controls and careful handling to prevent bruising mold and deterioration, making transportation and storage more expensive and complex. These factors increase the cost of production and contribute to supply chain inefficiencies. For example, strawberries have a shelf life of only a few days, making it challenging for global distribution, especially for export markets. This issue is more pronounced in markets with limited cold chain infrastructure, which affects overall market growth.

MARKET OPPORTUNITIES

Expansion of Organic Berries Production

Rising consumer interest in organic products presents a major opportunity in the berries market. The U.S. Department of Agriculture (USDA) reports that the organic sector continues to expand, with organic food sales hitting $61.9 billion in 2020, which marks a 12.4% increase from the prior year. In 2021, over 5.5 million acres of U.S. farmland were certified organic, which indicates a broader adoption of sustainable farming practices. This growth trend creates a promising avenue for berries growers to meet the rising demand for organic and pesticide-free options to align with consumer preferences for healthier food choices.

Growth in Functional and Value-Added Products

The increasing shift toward health-conscious eating offers significant potential for berries in functional and value-added products. According to the U.S. Centers for Disease Control and Prevention (CDC), nearly 80% of Americans fail to consume the recommended daily intake of fruits and vegetables, creating a market for convenient and nutrient-rich options. Berries packed with vitamins and antioxidants can fill this gap through products like juices, smoothies, and supplements, enabling consumers to improve their health. This growing demand for functional foods provides opportunities for berries producers to innovate and diversify their offerings.

MARKET CHALLENGES

Supply Chain and Logistics Challenges

The short shelf life of berries creates significant challenges in logistics and supply chain management, particularly in preserving product quality. According to the U.S. Department of Agriculture (USDA), approximately 10% of total fruit production is lost due to spoilage during transport and storage. Maintaining an efficient cold chain is crucial because berries are highly perishable. In 2020, the USDA highlighted that nearly 5% of strawberries were wasted because of temperature fluctuations and improper handling during distribution. These logistical issues lead to both supply shortages and increased costs, consequently making it difficult to ensure steady availability.

Pest and Disease Management

Berries are susceptible to a range of pests and diseases, which can diminish both yield and product quality. The USDA’s National Agricultural Statistics Service (NASS) notes that pests such as the spotted wing drosophila and diseases like powdery mildew pose growing threats to berries cultivation. Climate change further exacerbates pest invasions and disease outbreaks. The USDA reported a 10% decrease in berry yields in 2020 in regions affected by these issues and the need for advanced pest control and disease management measures to safeguard crop productivity and quality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.52% |

|

Segments Covered |

By Application, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Driscoll’s, Naturipe Farms, The berries Farms, Dole Food Company, Ocean Spray Cranberries, Unitec S.r.l., Morafruit, berries Gardens, Camposol, and Patagonia Foods. |

SEGMENTAL ANALYSIS

By Type Insights

The strawberries segment was witnessed to hold 40% of the global berries market share in 2024. This leadership is driven by their broad appeal and diverse applications in fresh products, jams, beverages, and desserts. According to the U.S. Department of Agriculture (USDA), the U.S. produced 1.3 million tons of strawberries in 2020, making it the largest producer worldwide. The popularity of strawberries is attributed to their taste, high vitamin C content, antioxidants, and fiber, which support their role in health-conscious diets. Additionally, the ability to grow strawberries year-round through greenhouse farming ensures their continued market dominance.

The blueberries segment is seeing the highest growth in the global berries market, with a forecasted CAGR of 8.2% during the forecast period. This surge is driven by increasing awareness of their health benefits, especially their rich antioxidant profile and contributions to brain health. The USDA reported U.S. blueberry production at 1.1 million tons in 2021, with demand steadily rising. Blueberries are also gaining ground in functional foods, dietary supplements, and beverages, aligning with the global shift towards healthier, nutrient-dense foods. Their importance lies in catering to the growing market of health-focused consumers worldwide.

By Application Insights

The food and beverages sector leads the market share with 43.4% in 2024. This segment's growth is fuelled by rising consumer preferences for healthy, nutrient-rich foods. Berries are prized for their high antioxidant, vitamins, and low-calorie content and are commonly used in products like smoothies, juices, jams, and snack bars. According to the U.S. Department of Agriculture (USDA), blueberry sales in the U.S. reached $1.8 billion in 2020, reflecting the segment's strength. The demand for natural, clean-label ingredients in food products continues to grow, which further solidifies the importance of berries in this sector.

The personal care segment is more likely to grow steadily, with a CAGR of 8.5% during the forecast period. The increasing preference for natural and organic skincare products is a significant driver of this growth. Berries especially blueberries and acai are incorporated into cosmetic formulations for their antioxidant and anti-aging properties. The U.S. Food and Drug Administration (FDA) notes that these antioxidants protect skin from environmental damage. Consumers prioritize clean, sustainable beauty solutions, which are gaining traction due to their natural benefits, thereby making this segment one of the fastest-growing in the berries market.

REGIONAL ANALYSIS

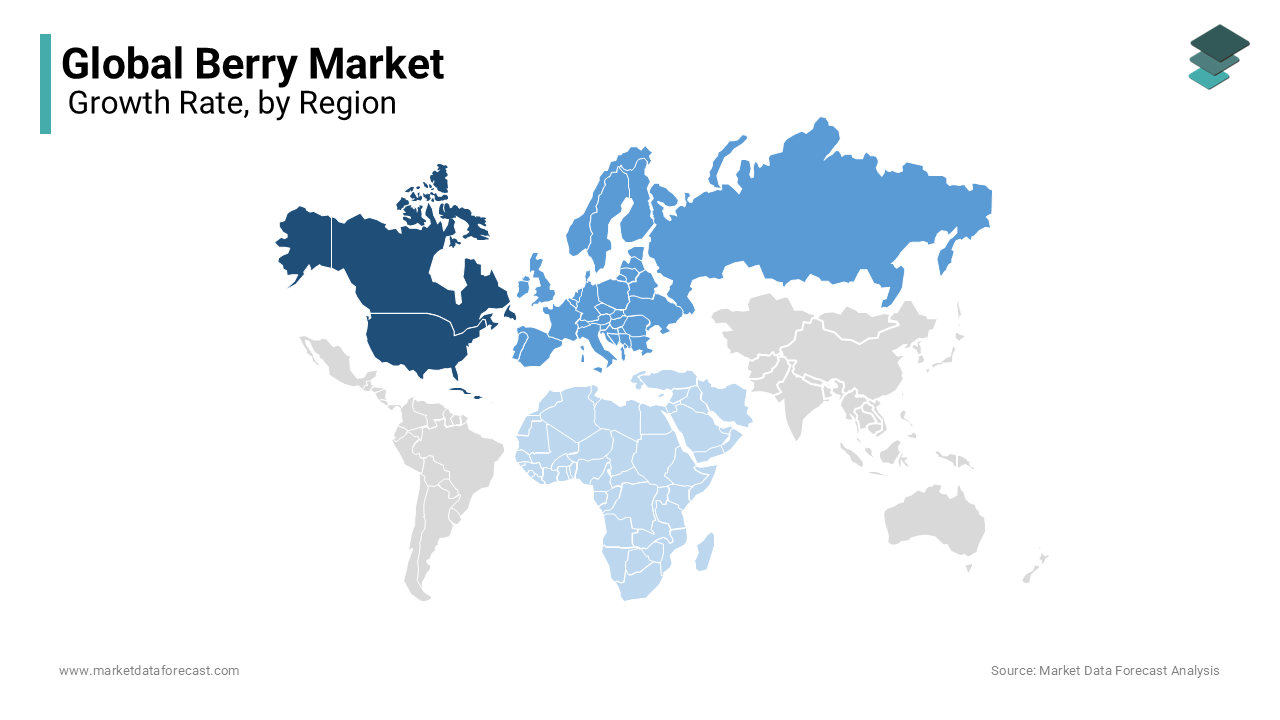

North America led the berries market worldwide and accounted for 35.3% of global market share in 2024. In 2021, U.S. blueberry production reached 1.1 million tons, reflecting the strong demand for berries, according to the U.S. Department of Agriculture (USDA). Canada also shows steady growth, particularly in blueberries and raspberries. The region’s increasing focus on functional foods, health-conscious diets, and organic products is reinforcing its position as a key market leader.

Europe is deemed to grow at a CAGR of 5.8% over the forecast period. Spain, Poland, and the Netherlands lead the market, with Spain producing over 500,000 tons of strawberries in 2020, according to the European Commission. This market growth is fueled by a rising preference for fresh organic berries and sustainable farming practices. The UK and Germany are also driving demand for premium berries products. As European consumers increasingly seek healthy options, berries continue to play an important role in the regional food industry.

The Asia-Pacific region is likely to experience the fastest CAGR of 8.5% throughout the forecast period. This rapid expansion is driven by growing health awareness and rising incomes in China, Japan and South Korea. China has seen a 25% increase in blueberry imports in 2021, as per the Food and Agriculture Organization (FAO). The growing urban population and demand for nutritious food options are propelling this region’s remarkable market growth.

Latin America is projected to have steady growth over the forecast period due to favorable climates for berry cultivation and increasing exports, especially from Mexico. In 2020, Mexico exported over 195,000 tons of berries, as reported by the U.S. Department of Agriculture (USDA). The region’s strong agricultural base and growing interest in organic farming are helping to meet the global demand for fresh, high-quality berries, further boosting growth prospects in the coming years.

The market in the Middle East and Africa is projected to grow at a moderate CAGR over the forecast period. Key markets in this region include South Africa, Morocco, and Turkey. Turkey’s blueberry production exceeded 20,000 tons in 2021, according to the Food and Agriculture Organisation (FAO). This region’s expansion is driven by rising demand for healthy food and increasing urbanization, although lower domestic production capacities somewhat constrain market growth. Import reliance remains a factor, but the growing interest in berries is expected to drive future market developments.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Driscoll’s, Naturipe Farms, The berries Farms, Dole Food Company, Ocean Spray Cranberries, Unitec S.r.l., Morafruit, berries Gardens, Camposol, and Patagonia Foods are some of the notable players in the global berries market. The berries market is highly competitive, fueled by strong consumer demand for fresh, organic, and value-added products. Major players like Driscoll's, The Fresh Market and Naturipe dominate the sector by leveraging established distribution channels and brand strength. These companies emphasize innovation and offer a range of berry varieties, including mixed selections, frozen options, and organic products, to meet the evolving preferences for healthier and more convenient food choices. In addition to industry leaders, smaller regional producers are gaining market share by focusing on local supply chains, reducing costs and appealing to eco-conscious consumers. The rise of e-commerce also fosters new competition with specialized brands offering unique berries products, such as freeze-dried or premium organic selections, directly to consumers.

Global competition is shaped by external factors such as climate change, which impacts yields and supply chains. Companies are investing in sustainable practices such as vertical farming and adopting advanced technologies to maintain product quality and availability and all this to mitigate risks. The increasing focus on functional foods has given berries an additional competitive advantage due to their rich nutritional profile, which includes antioxidants and vitamins. Consequently, the market remains dynamic i.e. constant innovation is required to stay ahead of shifting consumer trends and preferences.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Farmer Bob, which is a pioneer in sustainable agriculture, is thrilled to introduce 'Beyond Berries’. It’s a ground-breaking line of fruit products that enhance the berries experience by combining nature's finest elements.

- In November 2024, berries Global Group, Inc. announced the successful completion of the spin-off of its Health, Hygiene and Specialties Global Nonwovens and Films Business (HHNF) and its merger with Glatfelter Corporation. This strategic move aimed to position the company as a global leader in consumer-focused packaging solutions, enhancing its market presence and financial stability.

MARKET SEGMENTATION

This research report on the global berries market has been segmented and sub-segmented based on application, type, and region.

By Application

- Food and beverages

- Personal care

- Others

By Type

- Strawberries

- Blueberries

- Raspberries

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What factors are driving the growth of the berries market?

Rising health awareness, increasing demand for superfoods, growth in organic farming, and expanding food and beverage applications are key drivers.

2. How is the demand for berries changing globally?

Demand is increasing due to consumer preference for healthy, antioxidant-rich foods and the growing trend of plant-based diets.

3. Which types of berries are most popular in the global market?

Strawberries, blueberries, raspberries, blackberries, and cranberries are the most widely consumed berries worldwide.

4. Who are the key consumers of berries?

Health-conscious individuals, athletes, the food and beverage industry, and dietary supplement manufacturers are major consumers.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]