Global Beer Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Strong, Light), Production, Category, Packaging, and Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa, and Rest of the world) - Industry Analysis 2025 to 2033

Global Beer Market Size

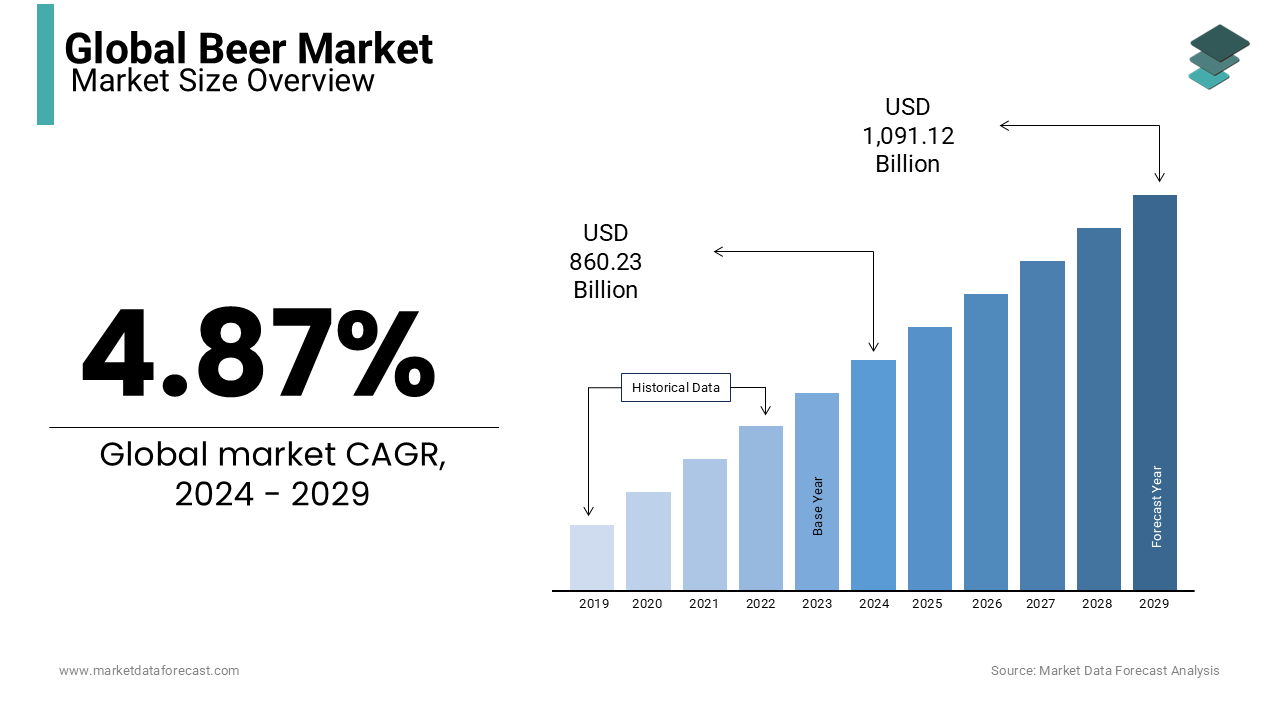

The global beer market size was valued at USD 860.23 billion in 2024, and the global market size is estimated to reach USD 1,319.70 billion by 2033 from USD 902.12 billion in 2025, with a CAGR of 4.87% during the forecast period.

The global beer market has witnessed significant growth in the past years and is anticipated to grow considerably during the forecast period.Beer is an alcoholic drink that is made from yeast-fermented malt-flavored beverages. Beer is the most consumed alcoholic beverage among people worldwide, and it ranks third position after water and tea. Different types of beer include lagers, ale, and craft, and all these types are gaining popularity among consumers, especially among younger adults and millennials, contributing to the global beer market growth. The general nutritional value of beer comprises 0.5 g protein, 4mg sodium, 27mg potassium, and approximately 45 to 50 calories per 100ml.

MARKET DRIVERS

The evolving consumer preferences and the escalating demand for alcoholic beverages among younger adults contribute to the global beer market growth. The increasing product demand due to socializing, relaxation, and celebrations promotes the market growth rate. The increasing demand for traditional brewing methods and craft beers due to unique tastes and enjoyable drinking experiences, the breweries' continuous innovations with new ingredients, and unique flavors with innovative brewing techniques drive the global market growth. The growing government support for the production, distribution, and sales of alcoholic beverages and the rising socialization and modernization around the world are influencing people to adopt alcohol consumption, leading to a market growth rate. The significant expansion in tourism and hospitality is creating opportunities for the global market owing to escalating demand for local breweries. With the growing investments by the manufacturers to enhance the taste and quality of the beer, they are focusing on providing an excellent experience to the consumers, which will augment the market expansion.

The enlarging e-commerce sector enhances consumer experiences and allows retailers to reach worldwide. E-commerce is providing growth opportunities for market expansion—the rising demand for non-alcoholic beverages due to growing awareness regarding the health effects of alcohol consumption. Most people with health concerns are opting for non-alcoholic beverages due to their advantages, such as limited calories and the presence of dietary fibers and amino acids, propelling the global market growth rate.

MARKET RESTRAINTS

High consumption of beer can cause blackouts, drowsiness, vomiting, and lower blood sugar levels, and the long-term consumption of alcoholic beer can cause severe problems such as dependence, liver problems, and cancer, which is majorly hampering the global market growth. Various medical research reports state that drinking more than two beers per day can increase the chances of developing fatty liver disease or cirrhosis. Another major factor restraining the market growth is the restricted provisional acts for marketing and advertising alcoholic beverages in most countries due to the concept of healthy living among consumers. Countries like India, the United Kingdom, China, and other governments have banned promoting alcoholic beverages; this restricted marketing will limit the global market growth rate. The presence of stringent regulations regarding alcohol consumption, the limit of consumption for different age groups in various regions, and product approvals and distribution will be significant challenges to manufacturers due to the complexity of market expansion. Most breweries face various challenges related to alcohol-related accidents, injuries, and incidents of alcohol abuse, which creates a negative impact on the market growth globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.87% |

|

Segments Covered |

By Type, Packaging, Production, Alcohol Content, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Anheuser-Busch In Bev (Leuven, Belgium), Heineken N.V. (Amsterdam, Netherlands), China Resources Breweries (Beijing, China), Carlsberg A/S (Copenhagen, Denmark), Diageo Plc (London, U.K.), Molson Coors Beverage Company (Illinois, U.S.), Boston Beer Company (Massachusetts, U.S.), Asahi Group Holdings Ltd (Tokyo, Japan), Kirin Holdings Co. Ltd (Tokyo, Japan), Beijing Yanjing Beer Group Corporation (Beijing, C |

Market Segmentation

By Type Insights

The larger segment dominated the global beer market with significant market revenue. The lager is the most popular type of beer globally due to its novel brewing process, which offers a refreshing and crisp appeal to consumers and drives the segment's growth. The lager is bottom-fermented and brewed with 5 to 11% ABV at lower temperatures, which is estimated to enhance the drinking experience of the consumers, fueling the segment revenue growth. The increasing demand for premium products is escalating the consumption of premium lagers among consumers, which boosts market growth in this segment.

The Ale segment is estimated to grow considerably during the forecast period. Ale is primarily standard among craft brewers, as ale yeast can create a beer in just seven days, which is highly convenient for small breweries and drives segment growth. The growing demand for Ales among younger adults and millennials due to their low alcohol content is expected to boost the segment revenue growth in the coming years.

By Package Insights

The glass segment dominated the global beer market revenue and is anticipated to have a prominent growth rate during the forecast period. The glass bottles preserve the integrity of the product with their impermeable nature, shielding the brew from external elements such as light and oxygen, which affect the taste and quality and boost, boosting the adoption of glass bottles, leading to segment growth. The glass bottles allow the product to remain fresh and unaltered by giving consumers an n enjoyable drinking experience, fueling the segment's growth. The glass bottles offer transparency, allowing consumers to choose the desired product visually, as the visual appeal enhances the drinking experience, and the glass bottle has a rapid cooling effect, boosting segment growth.

The PET bottles segment is expected to grow moderately in the coming years due to its affordability. PET bottles are becoming replacements for glass and go through the same cold-filling, capping, and pasteurizing processes. Most small-scale manufacturers prefer PET bottles due to their low cost compared to glass bottles, which drives the segment growth.

By Production Insights

The macro-brewery segment held the most significant share in the global beer market as it is considered the most effective method. The increasing demand for alcohol is influencing the manufacturers to focus on captivating a more extensive consumer base by introducing various new flavors in larger quantities, which drives the segment revenue growth. The growing demand for unique and innovative flavors among millennials worldwide is escalating global market growth. The lower production costs due to bulk production, which provides competitive pricing to the consumers, is a significant factor attracting consumers, leading to the expansion of the segment growth rate.

The microbrewery segment is anticipated to have a notable CAGR during the forecast period owing to its gain in consumer traction. Microbreweries do not depend on brand awareness; they build a loyal customer base due to their unique and new tastes and flavors, primarily driving the segment's revenue.

By Alcohol Content Insights

The high alcohol segment dominated the global market owing to the bold and more complex flavor profile provided by the high content, giving consumers a unique drinking experience. Craft breweries are focusing on the production of small batches of high alcohol by-volume beers by introducing various unconventional ingredients and brewing techniques for developing unique flavors, which is contributing to the segment growth and leading to market expansion. Most manufacturers focus on developing high-alcohol content products in the culture of discovery and exploration for consumers, fueling the segment growth.

The low-alcohol segment is gaining traction among younger adults, which promotes the segment growth rate during the forecast period. Rising awareness among people regarding the health effects induced by high alcohol consumption is creating opportunities for low-alcohol beers, boosting the segment size expansion.

By Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the global market revenue due to their extensive distribution network, especially in the urban areas. The ease of availability, continuous supply chain, favorable dealings with manufacturers, and competitive consumer pricing are primary factors accelerating the segment growth rate. Most consumers seek various products at a stop, making a popular choice among the people and driving the segment revenue expansion.

The online retail segment is expected to grow fastest during the forecast period due to the increasing adoption of online shopping platforms. With increased digitalization and IoT penetration, smartphone usage is making it easy for online retailers to expand their market. The growing social media influence, ease of payment, and door delivery are escalating the segment growth. The rising technological advancements are estimated to enhance online retailing during the forecast period.

REGIONAL ANALYSIS

The Asia Pacific region accounted for the most prominent share due to its dominance of high consumption in countries like China, Japan, South Korea, and India. According to the National Bureau of Statistics data, Chinese beer companies earned profits of USD 2.74 billion in 2021, a 38% increase from the previous year. With the rapid urbanization and the rising disposable incomes of the people, modernization in the merging countries is creating growth opportunities for the regional market. The growing demand for products at social gatherings and celebrations boosts market growth across the Asia Pacific region.

The European region held the second-largest market share due to the presence of major global brewers in the region. The increasing consumption of alcohol in European countries is boosting the market growth. According to Brewers of Europe, around 8,500 breweries operate in Europe, and around 20 new breweries start operations weekly. The presence of strong market players and their geographical reach are escalating the European beer market growth.

The North American region is expected to grow significantly in the coming years due to increasing demand for alcohol, especially among younger adults and millennials. According to data provided by a few reports, alcohol consumption in the United States has increased over the last 20 years and is expected to increase further. The favorable regulatory environment and vast distribution network create market growth opportunities in the North American region.

The Middle East and Africa are estimated to grow moderately in the coming years due to rising tourism in the region. The rising government favorable regulations regarding alcohol production and consumption are fueling the regional market growth. According to a few reports, the UAE government relaxed several laws and regulations regarding alcohol consumption in 2021.

The Latin America region is projected to experience sluggish growth during the forecast period due to increasing alcohol consumption among all age groups and growing urbanization.

KEY MARKET PLAYERS

Asahi Group Holdings, Ltd., Carlsberg Group, United Breweries Limited, Oettinger Brauerei GmbH, Anheuser – Busch InBev, Sierra Nevada Brewing Co., Diageo plc, Beijing Yanjing Beer Group Corporation, Dogfish Head Craft Brewery Co., Molson Coors Beverage Company are some of the notable companies in the global beer market.

RECENT DEVELOPMENTS IN THE MARKET

- In April 2023, BIRA 91 introduced two new limited-edition beers – the 022 Session Ale and 011 Gully Pilsner- and customized merchandise paid homage to the Mumbai Indians and Delhi Capital cricket teams.

- In May 2023, Camden Town Brewery announced the launch of its latest beer, Camden Stout, which has an ABV of around 4%. The Anheuser-Busch InBev-owned brand created the beer to complement its flagship Hells and Pale Ale.

- In 2023, Monster Beverage Corporation, owned by Canarchy, extended its Oscar Blues Brewery Dale's brand into American light and double IPA with two new extensions.

- In November 2022, Kenya Breweries Limited launched a new fruit-flavored beer called "Rockshire Tropical Lager." This product is infused with natural tropical African fruit flavors, such as pineapple and passion fruit, and claims to have an ABV of around 4.2%.

- In October 2022, Carlsberg Group introduced exclusive anniversary brews to celebrate 175 years of brewing, named Carlsberg brut beer with Montrachet yeast with notes of yuzu, grapefruit, and rose water.

- In May 2022, Anheuser-Busch InBev introduced Seven Rivers, a brand-new beer, in India's various states, such as Delhi, Goa, Haryana, and Uttar Pradesh.

MARKET SEGMENTATION

This research report on the global beer market has been segmented and sub-segmented based on type, packaging, production, alcohol content, distribution channel, and region.

By Type

- Lager

- Ale

- Stouts

- Others

By Package

- Glass

- PET Bottle

- Metal Cans

- Others

By Production

- Macro-Brewery

- Microbrewery

- Others

By Alcohol Content

- High

- Low

- Alcohol-free

By Distribution Channel

- Supermarkets and Hypermarkets

- Speciality Stores

- Convenience Stores

- Online Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global beer market by 2033?

The global beer market is estimated to reach USD 1,319.70 billion by 2033.

2. Which regions are expected to contribute significantly to the growth of the beer market?

Regions such as Asia-Pacific, North America, and Europe are anticipated to play a significant role due to their large consumer bases, evolving preferences, and increasing beer consumption trends.

3. What challenges does the global beer market face?

The global beer market faces challenges such as stringent government regulations, health concerns over excessive alcohol consumption, and competition from non-alcoholic beverages and other alcoholic categories like spirits and wine.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]