Global Battery Energy Storage Systems Market Research Report – Segmented By Element (Battery, Hardware and Other Elements), Battery Type (Lithium-Ion Batteries, Sodium–Sulfur Batteries, Flow Batteries, Advanced Lead-Acid Batteries and Others), Ownership (Utility Owned, Customer Owned and Third-Party Owned), Connection Type (On-Grid Connection Off-Grid Connection), Application (Residential, Non-Residential, Utilities, Other Applications) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Battery Energy Storage Systems Market Size

The size of the global battery energy storage systems market was worth USD 30.60 billion in 2024. The global market is anticipated to grow at a CAGR of 10.60% from 2025 to 2033 and be worth USD 75.77 billion by 2033 from USD 33.84 billion in 2025.

A Battery Energy Storage System (BESS) is a technology that stores electrical energy in batteries for later use. This system allows energy from sources like solar and wind to be saved and used when needed. It ensures a steady power supply even when these renewable sources are not producing electricity. Energy storage helps balance supply and demand, reduces power outages, and supports clean energy adoption.

Battery storage systems are used in homes, businesses, and power grids. They help reduce reliance on fossil fuels by storing excess solar and wind power for use at night or on cloudy days. The U.S. Department of Energy states that lithium-ion batteries are the most common type used in energy storage because they are efficient, long-lasting, and cost-effective.

According to the International Energy Agency, renewable energy provided nearly 30% of the world’s electricity in 2023. However, solar and wind power are not always available when needed. Battery storage solves this problem by keeping extra energy for later use, making renewable energy more reliable.

In transportation, battery technology is also advancing. The shift to electric vehicles has increased demand for high-performance batteries. The European Commission reports that electric car sales grew by over 50% in 2023 which is spotlighting the growing importance of battery storage across industries.

As governments push for cleaner energy, battery storage systems will continue to play a key role in creating a more stable and sustainable power supply.

MARKET DRIVERS

Growing Renewable Energy Use

More people use solar and wind power needing storage to save energy. This drives the BESS market. The International Energy Agency says renewable energy grew by 2,400 GW globally from 2022 to 2027. That’s a 75% jump. Solar power alone hit 1,300 TWh in 2023. Storage keeps power steady when the sun or wind stops. The U.S. Energy Information Administration reports 80% of U.S. homes with solar added batteries in 2023. This helps homes and grids use clean energy better pushing BESS demand up.

Government Support for Clean Energy

Governments want less pollution so they help BESS grow. They give money and rules to boost storage. The U.S. Energy Information Administration says the U.S. spent $7 billion on energy storage in 2023. This came from laws like the Inflation Reduction Act. The International Energy Agency observes Europe added 50 GW of clean energy needing storage in 2023. Countries like China aim to cut emissions by 2030 using batteries. This support makes BESS important for clean power and grids driving market growth.

MARKET RESTRAINTS

High Starting Costs

BESS costs a lot to start which slows its growth. Building big systems needs big money. The U.S. Department of Energy says installing a battery system costs $2,000 per kW on average in 2023. That’s hard for small companies or homes. The International Energy Agency reports global battery prices fell 20% in 2023 but it’s still pricey. High costs stop many from buying BESS even if it saves money later. This limits how fast the market can grow.

Hard to Recycle Batteries

Old batteries are tough to recycle holding back BESS growth. Many end up as waste. The U.S. Environmental Protection Agency says only 5% of lithium batteries were recycled in 2023. That’s 95% thrown away. The International Energy Agency emphasizes 1 million tons of battery waste piled up globally in 2023. Recycling needs special machines and costs a lot. This problem hurts the environment and makes people worry about using BESS slowing its spread.

MARKET OPPORTUNITIES

Better Battery Technology

New tech can make BESS cheaper and stronger creating growth chances. Scientists improve batteries every year. The U.S. Department of Energy says new solid-state batteries lasts 50% longer than old ones in 2023 tests. That’s 15 years of use. The International Energy Agency reports battery energy density rose 10% in 2023. Better batteries store more power in less space. This helps BESS fit more places like homes and factories opening new markets.

Power for Remote Areas

BESS can bring electricity to far-off places offering big opportunities. Many areas lack grids. The U.S. Energy Information Administration says 3 million U.S. rural homes got off-grid power in 2023. Batteries made it possible. The International Energy Agency states that 600 million people worldwide had no power in 2023 mostly in Africa. Solar with BESS can light up these spots. This grows the market by helping people and businesses in new regions.

MARKET CHALLENGES

Not Enough Skilled Workers

BESS needs smart people to build and run it but there aren’t enough. This slows progress. The U.S. Department of Labor says energy jobs grew 4% in 2023 but only 2% were trained for batteries. That’s a gap of 50,000 workers. The International Energy Agency reports Europe needs 800,000 energy workers by 2030. Without training BESS projects delay. This challenge stops the market from growing fast.

Supply Chain Problems

Getting materials for BESS is hard which limits growth. Battery parts come from few places. The U.S. Energy Information Administration says 70% of lithium came from Australia in 2023. Delays there hurt supply. According to the International Energy Agency, global cobalt demand rose 15% in 2023 but mining lagged. Shortages raise costs and slow BESS making. This challenge makes it tough to meet demand and grow the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.60% |

|

Segments Covered |

By Element, By Battery, By Ownership, By Connection, By Application, By Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

AES Corporation, BYD Company, Contemporary Amperex Technology, General Electric Hitachi, Ltd., LG Energy Solutions CO., Ltd., NEC Energy Solutions, Samsung SDI, Siemens AG, Sunverge Energy, Tesla Inc., Toshiba Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

Lithium-ion batteries are the biggest segment holding 69% market share in 2023. They lead because they store a lot of energy in a small space and cost less over time. The U.S. Energy Information Administration says lithium-ion makes up 90% of new battery storage added in 2023. This is key for renewable energy like solar and wind which need reliable storage. The International Energy Agency reports global lithium-ion production hit 1,200 GWh in 2023 proving its importance for clean energy goals.

Flow batteries are the fastest-growing segment with a CAGR of 27.5%. They grow quickly because they last longer and work well for big projects like grid storage. The U.S. Department of Energy says flow batteries can run for 20 years compared to 10 for lithium-ion. This durability cuts replacement costs. The International Energy Agency stresses that global grid storage demand rose 30% in 2023 pushing flow battery use. They are vital for stable power as renewable energy grows needing long-term solutions.

By Ownership Insights

Utility-owned systems are the largest segment with 48.4% market share in 2023. They lead because utilities need big storage to manage power grids. The U.S. Energy Information Administration states utilities added 3.2 GW of battery capacity in Texas alone by 2023. This helps balance electricity during peak times. The International Energy Agency says global utility investments in storage reached $10 billion in 2023 showing their key role in reliable power supply.

Customer-owned systems are the fastest-growing segment with a CAGR of 25.8%. They grow fast because people want control over their energy and backup power. The U.S. Energy Information Administration reports residential storage installs jumped 40% in 2023. This is due to more solar homes needing storage. The International Energy Agency says solar-plus-storage systems saved users $500 yearly on bills in 2023. They are important for energy independence and cutting costs as electricity prices rise.

By Connection Type Insights

On-grid connection is the biggest segment with 70.9% market share in 2023. It leads because most power systems connect to the main grid needing storage to stay stable. The U.S. Energy Information Administration says on-grid batteries in California hit 7.3 GW in 2023. This supports solar and wind energy use. The International Energy Agency reports 60% of global renewable energy in 2023 relied on grid storage making it essential for clean power.

Off-grid connection is the fastest-growing segment with a CAGR of 23.6%. It grows fast because remote areas need power without grid access. The U.S. Department of Energy says off-grid systems powered 2 million rural homes in 2023. This is vital for places with no electricity lines. The International Energy Agency notes off-grid solar-plus-storage projects grew 35% in 2023. They are key for bringing power to isolated communities and supporting growth.

By Application Insights

Utilities are the largest segment with 48.4% market share in 2023. They lead because grids need big storage to handle renewable energy and peak demand. The U.S. Energy Information Administration says utility-scale batteries reached 16 GW in the U.S. by 2023. This keeps power steady when solar or wind drops. The International Energy Agency reports utilities stored 200 GWh globally in 2023 showing their role in energy reliability.

Residential is the fastest-growing segment with a CAGR of 30.2%. It grows fast because more homes use solar and want cheaper bills. The U.S. Energy Information Administration says residential battery installs rose 50% in 2023. This is tied to 1.5 million new solar homes. The International Energy Agency states residential storage cut energy costs by 25% in 2023. It’s important for homeowners to save money and use clean energy independently.

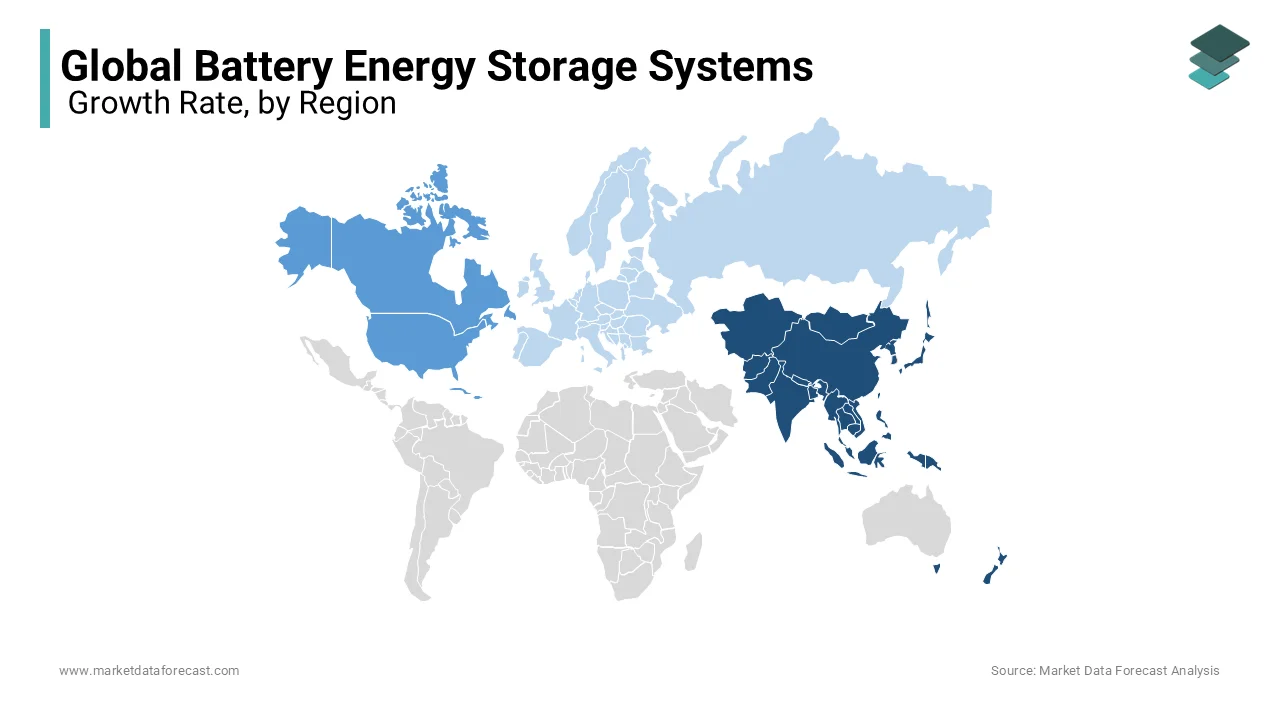

REGIONAL ANALYSIS

Asia-Pacific is the biggest region holding 32% market share in 2023. It leads because of fast growth in renewable energy and big energy needs. The International Energy Agency says China added 305 GW of solar and wind power in 2023 driving storage demand. This region is key for global clean energy goals. The U.S. Energy Information Administration reports Asia-Pacific used 54% of world battery storage capacity in 2023. Countries like China and Japan push for smart grids making it the top market.

North America is the fastest-growing region with a CAGR of 14.8%. It grows quickly because of big investments in renewable energy and grid upgrades. The U.S. Energy Information Administration says U.S. battery storage hit 16 GW in 2023 up 80% from 2022. This speed helps meet clean energy targets. The International Energy Agency reports that North America spent $12 billion on storage in 2023. It’s vital for grid stability as solar and wind use grows needing reliable power solutions.

Europe will grow steadily in coming years focusing on green energy. It uses battery storage to cut carbon emissions and boost renewables. The International Energy Agency says Europe added 50 GW of wind power in 2023 needing storage support. Germany and the UK lead with big projects. The U.S. Energy Information Administration reports Europe stored 40 GWh in 2023. Growth will come from laws pushing clean energy and fixing old grids making it a strong market ahead.

Latin America will see moderate growth in the next years as energy needs rise. It focuses on solar and storage for remote areas. The International Energy Agency says Brazil added 10 GW of solar power in 2023 needing batteries. The U.S. Energy Information Administration reports 2 GW of storage was installed by 2023. Countries like Chile and Argentina will push renewable projects. This growth helps bring power to far-off places and supports energy security.

Middle East and Africa will grow slowly but surely in future years. They use storage for solar energy and grid help. The International Energy Agency says Saudi Arabia aims for 58 GW of renewables by 2030 needing batteries. The U.S. Energy Information Administration reports 1.5 GW of storage existed in 2023. Growth will rise as countries like UAE and South Africa invest in clean power. It’s key for energy access in remote spots.

Top 3 Players in the market

Contemporary Amperex Technology Co. Limited (CATL)

CATL, based in China, has established itself as a dominant force in the global battery energy storage system (BESS) market. In the first half of 2024, CATL accounted for two-thirds of the global market for electric car batteries, underscoring its leadership in battery manufacturing. The company's rapid growth and expansive production capabilities have positioned it as a key supplier in the energy storage sector, contributing significantly to the integration of renewable energy sources worldwide.

BYD Company Limited

Founded in 1995 as a battery manufacturer, China's BYD has evolved into a major player in the electric vehicle (EV) and battery storage markets. It has surpassed Tesla in EV sales at times, reflecting its robust market position. BYD's expertise extends beyond vehicles; it is the second-largest global battery producer and offers products like the Blade battery, known for its safety and durability. The company also provides energy storage solutions, including solar panels and battery-box systems for both commercial and residential use, thereby enhancing global energy storage infrastructure.

LG Energy Solution Ltd.

South Korea's LG Energy Solution is a leading battery manufacturer, ranking first in the 2024 global BESS market. As a spin-off from LG Chem, the company is renowned for its advanced battery technologies and extensive production capacity. LG Energy Solution's contributions to the BESS market are pivotal, supporting the integration of renewable energy into power grids and facilitating the transition to more sustainable energy systems.

Top strategies used by the key market participants

Strategic Partnerships and Collaborations

Key players in the Battery Energy Storage System (BESS) market are increasingly forming strategic partnerships and collaborations to enhance their technological capabilities and market reach. For instance, Volklec, a UK-based battery start-up, has partnered with Chinese supplier Far East Battery to construct a £1 billion gigafactory. This collaboration aims to leverage Far East Battery's manufacturing expertise and secure a stable supply of raw materials, thereby strengthening Volklec's position in the market. Such alliances enable companies to pool resources, share risks, and accelerate innovation, ultimately leading to more efficient and cost-effective energy storage solutions.

Investment in Research and Development

To maintain a competitive edge, leading BESS companies are heavily investing in research and development (R&D). These investments focus on enhancing battery performance, extending lifespan, and reducing costs. For example, companies are exploring advanced battery chemistries and innovative manufacturing processes to improve energy density and safety. By prioritizing R&D, these firms aim to meet the evolving demands of the renewable energy sector and provide reliable storage solutions that facilitate the integration of intermittent energy sources into the grid.

Expansion of Production Capacities

Recognizing the growing global demand for energy storage, major BESS manufacturers are expanding their production capacities. This includes building new manufacturing facilities and upgrading existing ones to increase output. To capitalize on this growth, companies are scaling up operations to ensure they can meet the increasing demand for energy storage systems, thereby solidifying their market positions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a major role in the global battery energy storage systems market include AES Corporation, BYD Company, Contemporary Amperex Technology, General Electric Hitachi, Ltd., LG Energy Solutions CO., Ltd., NEC Energy Solutions, Samsung SDI, Siemens AG, Sunverge Energy, Tesla Inc. and Toshiba Corporation.

The Battery Energy Storage System (BESS) market is very competitive. Many companies are working to make better and cheaper energy storage solutions. Big companies like CATL, BYD, and LG Energy Solution lead the market. They focus on making powerful and safe batteries for homes, businesses, and power grids. Many new companies are also entering the market with new ideas and technologies.

Companies compete by making batteries that last longer, charge faster, and store more energy. They also try to reduce costs so more people can afford energy storage. Some companies work together with others to share knowledge and resources. This helps them grow faster and develop better products.

Governments around the world support energy storage with new rules and incentives. This creates more opportunities for companies but also makes the market more crowded. Some companies struggle to keep up because they do not have enough money or technology.

The market is growing fast because more people and businesses want to use clean energy. Solar and wind power need good storage solutions to work better. Companies that create the best batteries will become leaders. The competition will continue as technology improves and demand increases.

RECENT HAPPENINGS IN THE MARKET

In August 2024, the Victorian government approved the Joel Joel Battery Energy Storage System, a 350-megawatt project in Northern Grampians. This $250 million initiative is set to become Australia's largest battery storage system, advancing the state’s renewable energy goals.

In February 2025, Texas lawmakers introduced new regulations for battery storage facilities, requiring them to be located at least 500 yards from neighboring properties unless an agreement is made. The proposed legislation aims to address safety, noise, and environmental concerns.

In January 2025, Illinois state officials announced plans to boost renewable energy and energy storage incentives, citing concerns over grid reliability. Proposed measures aim to integrate energy storage into the state’s clean energy strategy and enhance electricity supply stability.

In February 2025, residents of Bouldercombe, Queensland, and the Rockhampton council launched a legal challenge against a proposed 500MW battery energy storage system by ACEnergy. Concerns include fire hazards, noise pollution, and its impact on local communities.

In February 2025, officials in Texas' Hill Country implemented stricter fire code regulations for battery energy storage projects. These new rules require additional permits and safety plans, reflecting growing concerns over fire risks and community safety.

MARKET SEGMENTATION

This research report on the global battery energy storage systems market has been segmented and sub-segmented based on element, battery, ownership, connection, application, and region.

By Type

- Lithium-Ion Batteries

- Sodium–Sulfur Batteries

- Flow Batteries

- Advanced Lead-Acid Batteries

- Others

By Ownership

- Utility Owned

- Customer Owned

- Third-Party Owned

By Connection Type

- On-Grid Connection

- Off-Grid Connection

By Application

- Residential

- Non-Residential

- Utilities

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the projected growth rate of the Battery Energy Storage Systems Market?

The Battery Energy Storage Systems Market is projected to grow at a CAGR of 10.60% from 2024 to 2033, with the market size expected to reach USD 75.77 billion by 2033 from USD 30.60 billion in 2024.

What are the primary drivers of the Battery Energy Storage Systems Market?

Primary drivers of the Battery Energy Storage Systems Market include technological advancements, flexibility in renewable energy integration, grid modernization initiatives, rising demand for grid energy storage, and the launch of new products by key players.

What are the major challenges facing the Battery Energy Storage Systems Market?

Major challenges in the Battery Energy Storage Systems Market include high upfront costs, technical challenges in development, lack of standardization, and the impact of stringent regulations on market demand.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]