Global Bamboos Market Size, Share, Trends, & Growth Forecast Report Segmented By End-Use (Wood and Furniture (Flooring, Ceiling, Outdoor Decking, Furniture, Mat Board), Construction (Scaffolding, Housing (building material)), Food & beverage, Paper & Pulp, Textile, Charcoal, Other), and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Bamboos Market Size

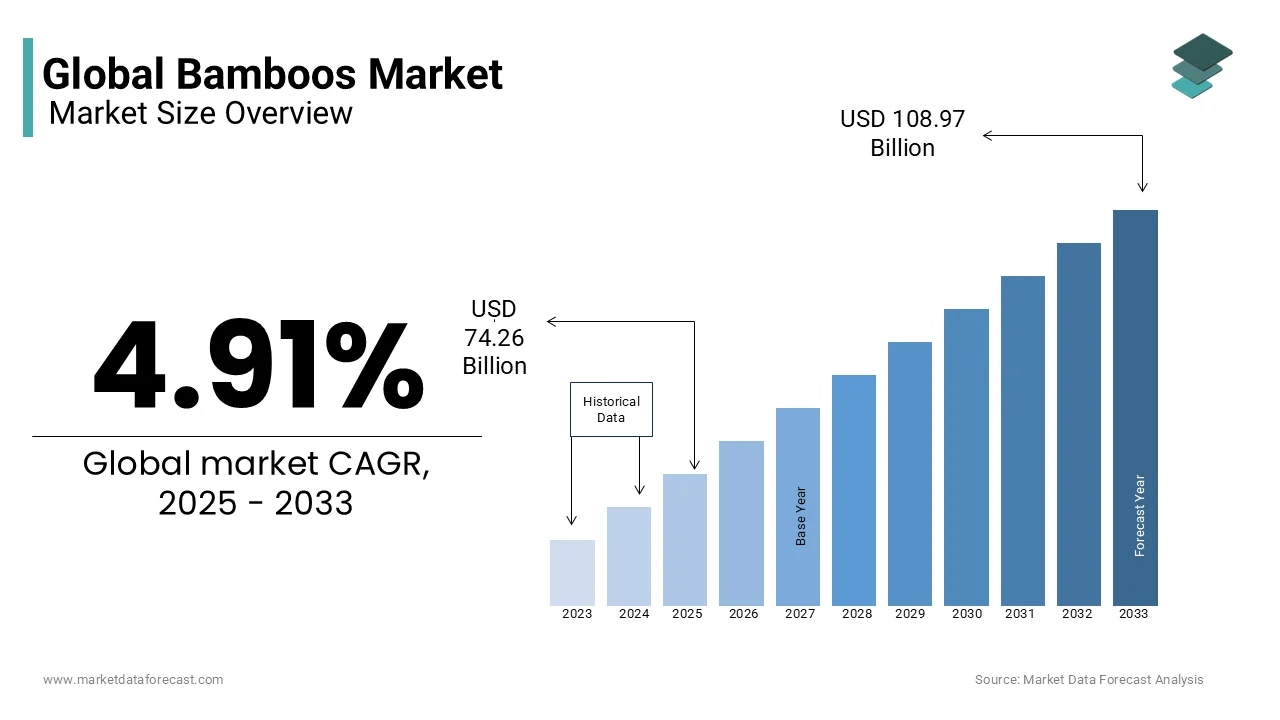

The global bamboos market size was valued at USD 70.78 billion in 2024 and is projected to grow from USD 74.26 billion in 2025 to USD 108.97 billion by 2033, the market is expected to grow at a CAGR of 4.91% during the forecast period.

MARKET OVERVIEW

Bamboos are increasingly recognized for its ecological benefits and sustainable properties and playing a pivotal role in the global transition to greener alternatives. Bamboos are known for its rapid growth and ability to regenerate without replanting and contribute significantly to environmental conservation. It can grow up to 3 feet per day in optimal conditions, making it one of the fastest-growing plants on Earth. In addition to its environmental benefits, bamboo has the potential to provide livelihoods to millions of people, particularly in rural areas across Asia, Africa, and Latin America. According to the United Nations, bamboo cultivation supports the economic welfare of over 2 billion people globally, especially in countries like China, India, and Indonesia, where it is grown extensively. Furthermore, bamboo plays a crucial role in soil conservation, as its extensive root system helps prevent erosion and maintains soil health. These ecological advantages are drawing attention from environmental groups and governments aiming to tackle climate change and promote sustainable development practices.

MARKET DRIVERS

One major driver of the bamboo market is the growing emphasis on sustainability and environmental conservation. Bamboo, often called the "green gold," is gaining recognition for its ability to absorb carbon dioxide and release oxygen at higher rates compared to other plants. Research by the Food and Agriculture Organization (FAO) indicates that bamboo can absorb up to 12 tons of CO2 per hectare annually, which is significantly higher than traditional hardwood forests. This makes bamboo a critical resource in combating climate change. Additionally, bamboo's rapid growth and minimal need for fertilizers or pesticides make it an eco-friendly alternative to timber, further boosting its demand in sectors such as construction and textiles. The adoption of bamboo as a sustainable material aligns with global initiatives to reduce carbon footprints and environmental degradation.

Another key driver is the rising demand for eco-friendly products in construction and design. Bamboo is becoming increasingly popular as a building material due to its strength, durability, and low environmental impact. According to the U.S. Department of Agriculture (USDA), bamboo can be as strong as steel and is a viable alternative to traditional timber in construction. It is used in flooring, scaffolding, and even furniture, offering a sustainable option for architects and builders. With governments and organizations pushing for sustainable construction practices, bamboo’s popularity continues to rise. In fact, the USDA estimates that global bamboo production has grown by 7% annually, driven by its widespread adoption in green building initiatives.

MARKET RESTRAINTS

A major restraint for the bamboo market is the lack of standardization in the global trade and processing of bamboo. Variations in quality, grading systems, and regulations across different regions create challenges for manufacturers and exporters. The International Trade Centre (ITC) reports that inconsistent processing techniques and quality standards across countries like India and China lead to difficulties in ensuring uniformity in bamboo-based products. This lack of standardization hinders the global scalability of bamboo industries, as many international buyers are hesitant to invest in products without a guaranteed quality assurance system. For example, BambooCo, a major supplier based in China, reported that up to 15% of its international shipments face delays or returns due to varying quality assessments across different markets. Additionally, GreenBamboo Industries in India experienced a 20% decline in orders from European markets in 2024 due to inconsistent product grading. The absence of a universal certification also restricts the market’s expansion into high-demand industries such as construction and consumer goods, where quality assurance is essential.

Another significant restraint is the limited availability of high-quality bamboo resources in certain regions. While bamboo grows abundantly in countries like China and India, it is less prevalent in others, limiting access to this sustainable resource. The Food and Agriculture Organization (FAO) states that bamboo cultivation is concentrated in just a few countries, with China contributing around 70% of global production. In regions like Africa and Europe, where bamboo is not native, large-scale cultivation remains underdeveloped. This imbalance in bamboo distribution restricts its use in industries like construction and textiles, particularly in areas where sustainable sourcing is essential, preventing widespread adoption of bamboo-based products.

MARKET OPPORTUNITIES

One significant opportunity in the bamboo market lies in the growing demand for eco-friendly packaging materials. With stricter regulations on plastic usage, industries are seeking sustainable alternatives. Bamboo, being biodegradable, is gaining traction in food containers and wrapping materials. The European Union's ban on single-use plastics has led to a 20% rise in demand for bamboo packaging. BambooPack, a leading company in the space, reported a 35% increase in production capacity in the last year, driven by partnerships with global food retailers. In addition, the World Economic Forum projects that by 2027, the global bamboo packaging market will expand by 15%, signaling a major opportunity for growth in the eco-friendly packaging sector.

Another opportunity for the bamboo market is the potential for expansion in the textile and fashion industry. Bamboo fibers, known for their softness, breathability, and natural antibacterial properties, are gaining traction in the production of eco-friendly clothing and accessories. The Textile Exchange, a global non-profit organization, reports a steady increase in the use of sustainable fibers like bamboo in the fashion industry, driven by consumer demand for environmentally conscious products. The market for bamboo textiles has grown by 8% annually, with an increasing number of brands adopting bamboo-based fabrics. As consumer preferences shift toward sustainable fashion, the bamboo textile market holds significant potential for growth in the coming years.

MARKET CHALLENGES

One major challenge in the bamboo market is the insufficient infrastructure for large-scale processing and manufacturing. In many bamboo-growing regions, especially in developing countries, there is a lack of advanced processing facilities that can handle large quantities of bamboo efficiently. According to the International Trade Centre (ITC), the global bamboo trade is often hindered by limited access to modern machinery and technology. For example, BambooCraft, a major supplier in India, reported that 30% of its bamboo exports were delayed due to the absence of processing plants equipped for large-scale production. Additionally, Bamboo Industries Ltd. in Indonesia faced a 25% reduction in production efficiency due to outdated machinery, limiting its ability to meet global demand.

Another significant challenge facing the bamboo market is the vulnerability to climate change and environmental factors. Bamboo is sensitive to shifts in climate, such as altered rainfall patterns or extreme temperatures, which can negatively impact its growth. The Food and Agriculture Organization (FAO) highlights that climate change is affecting the cultivation of bamboo in certain regions, with increased droughts and floods damaging bamboo forests in areas like Southeast Asia. For example, BambooGrow Ltd., a major supplier in Thailand, reported a 20% reduction in bamboo yield in 2024 due to unseasonal floods. Additionally, GreenBamboo Inc. in Vietnam faced a 15% increase in production costs due to drought-induced shortages, limiting high-quality bamboo availability and affecting global supply.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.91% |

|

Segments Covered |

End-Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

MOSO International B.V., Bamboo Australia, Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd, Simply Bamboo PTY LTD, Xiamen HBD Industry & Trade Co., Ltd, Dassogroup, Smith & Fong, ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Fujian HeQiChang Bamboo Product Co., Ltd., and others |

SEGMENT ANALYSIS

By End-Use Insights

The wood and furniture segment was the largest segment in the bamboos and captured a substantial share of the global market in 2024. The growth of the wood and furniture segment in the global market is primarily attributed to the widespread use of bamboo in various applications such as flooring, furniture, and outdoor decking. This segment accounts for 45.4% of the global bamboo market share. The demand for bamboo in furniture and flooring is driven by its sustainability, strength, and aesthetic appeal, particularly in eco-conscious markets. The increasing global awareness of sustainability and the push for green building practices further contribute to the rise in bamboo's popularity in the wood and furniture segment. In fact, the bamboo industry is seeing a significant uptick in investments and revenue. For example, companies like Bamboo Village reported revenue growth of 40% in 2024 as demand for bamboo-based materials surged in the construction and furniture sectors. Additionally, the Bamboo Furniture Association indicated a 25% increase in global sales in 2024, with bamboo furniture products making up 15% of the sustainable furniture market share. These trends underscore the growing recognition of bamboo as a sustainable, durable, and eco-friendly alternative to traditional wood products.

The food & beverage segment is the most rapidly expanding segment and is predicted to grow at a CAGR of 8.2% from 2025 to 2033. This growth is primarily driven by the increasing demand for bamboo-based products such as bamboo straws, cutlery, and food packaging which are seen as sustainable alternatives to plastic. The rising consumer demand for eco-friendly, biodegradable packaging options is propelling the adoption of bamboo in food and beverage industries. According to the International Trade Centre (ITC), many foodservice companies are shifting toward bamboo-based items to reduce plastic waste, contributing to the rapid growth of this segment in global markets. In 2024, EcoPack, a leading sustainable packaging company, reported a 30% increase in sales of its bamboo-based packaging line. Additionally, BambooLife saw a 40% growth in its bamboo straw sales over the last year, with major fast-food chains like McDonald's and Starbucks expanding their use of bamboo alternatives as part of their sustainability initiatives.

REGIONAL ANALYSIS

Asia-Pacific dominated the bamboos market by accounting for 63.6% of global market share in 2024. This region leads due to its favorable climatic conditions for bamboo cultivation, with China alone contributing around 70% of the world's bamboo production. According to the Food and Agriculture Organization (FAO), Asia-Pacific’s dominance is driven by large-scale bamboo farming, particularly in China and India, where bamboo is integral to local economies and industries. The region’s strong infrastructure, coupled with a growing demand for bamboo in construction, textiles, and packaging, makes it a critical hub for the global bamboo market.

Latin America is growing at a brisk pace and is anticipated to register a CAGR of 8.5% over the forecast period. The demand for sustainable products is rising in Latin America, especially in the construction and packaging sectors. According to the International Trade Centre (ITC), countries like Brazil and Colombia are increasingly adopting bamboo-based materials, driven by growing awareness of the environmental benefits of bamboo. For example, BambooTech Brazil reported a 25% increase in bamboo product sales in 2024, primarily in construction and furniture. Additionally, BambooColombia Ltd. expanded its bamboo cultivation area by 30% in 2024, following government incentives aimed at promoting sustainable agricultural practices. These factors position Latin America as a high-growth region for the bamboo market.

North America is witnessing steady growth in the bamboo market, driven by an increasing shift toward sustainable materials, especially in the construction, packaging, and textile industries. According to the U.S. Department of Agriculture (USDA), the demand for eco-friendly products is rising as consumers and businesses adopt more sustainable practices. BambooFloors USA, a leading bamboo flooring company, reported a 15% increase in sales in 2024, driven by green building certifications and sustainable construction projects. Additionally, EcoFurniture Co. saw a 20% rise in bamboo-based furniture sales, as major retailers like Home Depot and IKEA expand their sustainable product lines. The region's emphasis on reducing carbon footprints and promoting green building initiatives is likely to enhance bamboo adoption further.

Europe is expected to see moderate growth in the bamboo market, particularly in Germany, the UK, and France, driven by sustainability trends and government regulations. BambooInnovate Ltd. in the UK reported an 18% increase in bamboo flooring sales in 2024, fueled by demand for eco-friendly construction materials. In Germany, GreenBamboo GmbH saw a 25% rise in bamboo textile sales, as sustainable fashion trends gain momentum. The region’s focus on eco-friendly building materials and circular economy practices is boosting bamboo adoption, though it faces competition from materials like hemp and recycled plastics.

Middle East & Africa is likely to experience slower growth in the bamboo market compared to other regions. While there is increasing interest in sustainable products, the adoption of bamboo-based materials in sectors like construction and furniture is still in its early stages. BambooAfrica, a South African company, reported a 10% increase in bamboo-based building materials in 2024, driven by local demand for sustainable alternatives. The World Bank highlights that regions in Africa are beginning to explore bamboo cultivation, though BambooTech South Africa faced a 15% delay in product delivery due to limited local processing infrastructure and low awareness of bamboo's potential.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

MOSO International B.V., Bamboo Australia, Bamboo Village Company Limited, Shanghai Tenbro Bamboo Textile Co., Ltd, Simply Bamboo PTY LTD, Xiamen HBD Industry & Trade Co., Ltd, Dassogroup, Smith & Fong, ANJI TIANZHEN BAMBOO FLOORING CO. LTD, Fujian HeQiChang Bamboo Product Co., Ltd. are playing a dominating role in the global bamboos market.

The competition in the global bamboo market is intensifying as demand for sustainable, eco-friendly materials continues to rise across various industries such as construction, textiles, furniture, and packaging. The market is highly fragmented, with both large-scale producers and smaller regional players vying for market share. The dominant players, such as China Bamboo and Rattan, Bamboo India, and TBI (The Bamboo Industries), have established a stronghold due to their extensive production capabilities, large-scale processing facilities, and global supply chains. These companies benefit from economies of scale, enabling them to offer competitive pricing and meet the increasing demand for bamboo products worldwide.

However, the market also sees the entry of smaller, innovative players focusing on niche applications of bamboo, such as sustainable packaging and bamboo-based textiles. The competition among these players is driven by factors such as product quality, innovation, cost efficiency, and sustainability practices. Companies that invest in advanced processing technology and diversification of product offerings are gaining a competitive edge. Additionally, partnerships with government bodies and environmental organizations are becoming crucial in positioning brands as sustainable and eco-conscious leaders in the market.

The increasing adoption of bamboo as a green alternative to traditional materials ensures that competition in the bamboo market will continue to grow, with more players entering the space to meet the rising global demand.

STRATEGIES USED BY THE MARKET PLAYERS

Expanding Production Capacity

Leading players like China Bamboo and Rattan have significantly invested in expanding their bamboo cultivation and processing facilities. By increasing production capacity, they can meet growing global demand, particularly in high-demand sectors such as construction, textiles, and packaging. China Bamboo and Rattan’s strategy of establishing large-scale, automated production plants ensures the consistent supply of bamboo products, while also reducing operational costs. This expansion allows companies to cater to international markets and diversify their product offerings, from furniture and flooring to biodegradable packaging.

Innovation and Product Diversification

Companies like Bamboo India focus on continuous product innovation to stay competitive in the market. Bamboo India has developed a wide range of products beyond traditional bamboo items, such as eco-friendly building materials, bamboo-based textiles, and advanced bamboo composites. Innovation in processing technology, like improving the durability and strength of bamboo for use in construction, is a key differentiator. By diversifying product offerings, Bamboo India not only strengthens its position in the local market but also appeals to international markets with its varied and sustainable solutions.

Strategic Partnerships and Collaborations

Partnerships with both governmental and private sector entities play a vital role in the growth of companies like TBI (The Bamboo Industries). TBI has collaborated with environmental organizations and green building firms to advocate for sustainable building materials. Their partnerships help to promote bamboo as a viable alternative to timber, and through these collaborations, TBI has increased its reach within eco-conscious markets in North America and Europe. By aligning with environmentally focused organizations, TBI enhances its brand visibility and strengthens its position as a leader in the bamboo industry.

TOP 3 PLAYERS IN THE MARKET

China Bamboo and Rattan

China Bamboo and Rattan is the leading player in the bamboo market, being one of the largest producers and exporters globally. As per the China National Forestry and Grassland Administration, China accounts for approximately 70% of the global bamboo production. The company has significant influence in both the domestic and international markets, supplying bamboo to various industries such as construction, furniture, paper, and textiles. Their expertise in large-scale bamboo farming and processing facilities has allowed them to maintain a dominant position, with strong export activities to North America, Europe, and Asia-Pacific. The company’s continued expansion of its bamboo processing facilities is helping increase the adoption of bamboo-based products globally.

Bamboo India

Bamboo India is another major player, known for its innovations in bamboo cultivation and processing. As a pioneer in sustainable bamboo products, Bamboo India focuses on manufacturing high-quality bamboo products for a variety of sectors, particularly in construction and textiles. According to the Ministry of Commerce and Industry of India, Bamboo India has made significant contributions to the country’s bamboo export industry, particularly in products like bamboo flooring, furniture, and paper. The company also plays a crucial role in driving awareness about bamboo as a sustainable alternative to timber, significantly increasing its market share in Asia and other developing regions.

TBI (The Bamboo Industries)

TBI (The Bamboo Industries) is a leading player based in the United States, specializing in bamboo-based products ranging from building materials to consumer goods. The company has expanded its market presence significantly in North America, particularly in the bamboo flooring and eco-friendly packaging sectors. According to the U.S. Department of Agriculture (USDA), TBI is actively involved in pushing the adoption of bamboo in sustainable building practices. Its strong distribution network and collaborations with green architecture firms have made bamboo a prominent choice in the eco-conscious American market. TBI’s contributions to innovations in bamboo processing technology have helped boost product quality and market reach.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, Cozy Earth, known for its bamboo-based products, expanded into footwear with the launch of the Puffy Sheep Slipper. Priced at $150, these slippers feature a non-marring outsole suitable for outdoor wear and are part of the brand's commitment to comfort and sustainability.

- In May 2023, Nagaland Bamboo Industry (NBI) introduced "Tir Mijang," an organic bamboo charcoal. This product aims to provide a sustainable alternative to the defunct Tuli Paper Mill, offering new opportunities for local bamboo farmers. The charcoal has various applications, including household fuel, water purification, and cosmetic products.

MARKET SEGMENTATION

This research report on the global bamboos market has been segmented and sub-segmented based on end-use, and region.

By End-Use

- Wood and Furniture

- Flooring

- Ceiling

- Outdoor Decking

- Furniture

- Mat Board

- Construction

- Scaffolding

- Housing (building material)

- Food & beverage

- Paper & Pulp

- Textile

- Charcoal

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key factors driving the growth of the global bamboo market?

The growth of the bamboo market is driven by increasing demand for sustainable materials, rapid urbanization, government initiatives promoting bamboo cultivation, and its diverse applications in construction, furniture, paper, and textiles.

2. Which region dominates the bamboo market, and what are the growth prospects?

Asia-Pacific, particularly China and India, dominates the bamboo market due to favorable climatic conditions, abundant natural resources, and government support. The region is expected to maintain strong growth due to rising exports and increasing adoption in eco-friendly industries.

3. What are the major challenges faced by the bamboo industry?

Challenges include limited large-scale cultivation, vulnerability to pests and diseases, lack of awareness about bamboo’s commercial potential, and fluctuating market prices affecting farmers and manufacturers.

4. How is bamboo being utilized in the construction and furniture industries?

Bamboo is widely used in construction as an alternative to timber for flooring, paneling, scaffolding, and roofing due to its high strength and sustainability. In furniture, it is favored for its durability, aesthetic appeal, and lightweight nature.

5. What are the latest innovations and trends shaping the bamboo market?

Key trends include the development of engineered bamboo products, biodegradable bamboo-based packaging, increased use in bioenergy production, and technological advancements in bamboo processing for textile and paper industries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]