Global Ballast Water Treatment Market Size, Share, Trends, & Growth Forecast Report Segmented By Technology Type (Electrochlorination, Ultraviolet (UV), Oxidation, Ultrasound, Disinfectant, others), Ballast water capacity (More than 5,000, 1,500-5,000, Less than 1,500), By Vessel Type (Bulk carriers, Oil tankers, General cargo, Container ships, others), Installation (Portable, Stationary), and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2024 to 2032

Global Ballast Water Treatment Market Size

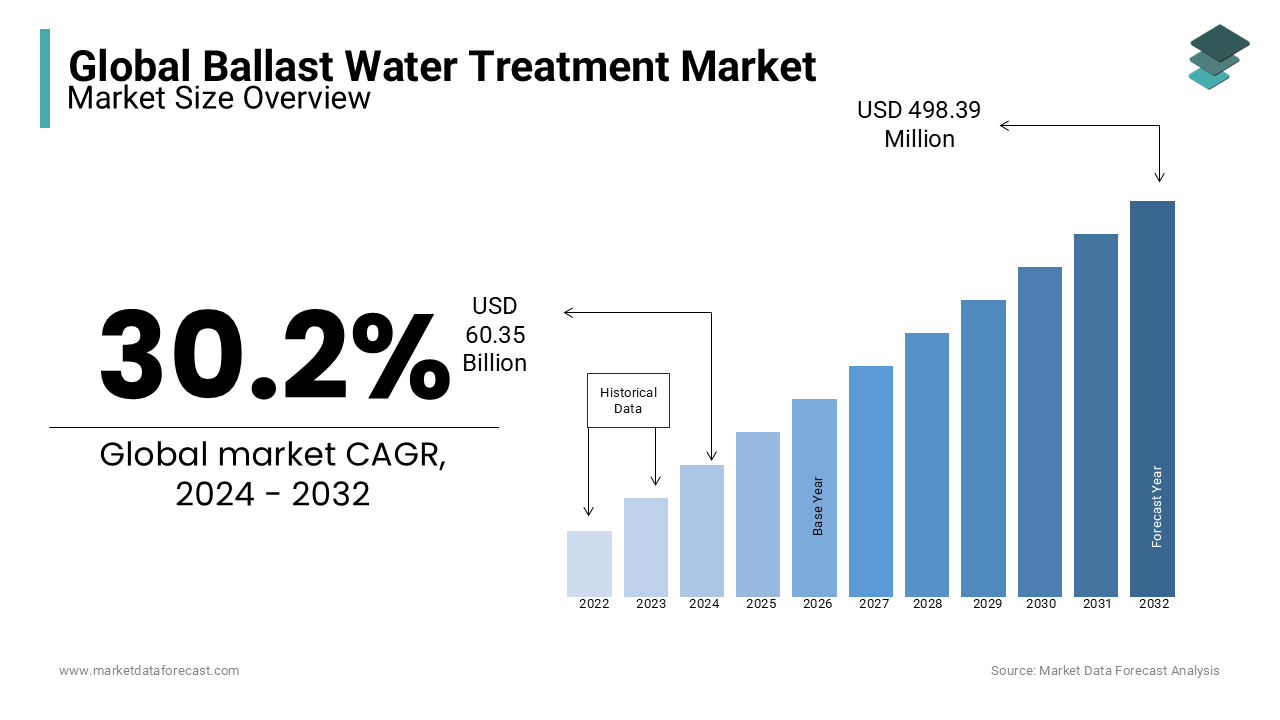

The global ballast water treatment market size was valued at USD 46.35 billion in 2023 and is expected to reach USD 498.39 billion by 2032, growing from USD 60.35 billion in 2024. The market is projected to grow at a CAGR of 30.2%.

Ballast water treatment is critical to ensure environmental compliance and protect marine ecosystems from invasive species transported via ship ballast water. International regulations such as the International Maritime Organization’s (IMO) Ballast Water Management Convention mandate ships to install approved treatment systems to prevent ecological damage. These types of initiatives are primarily driving the ballast water treatment market. According to the IMO, over 4,000 invasive aquatic species are spread annually through ballast water, which threatens biodiversity and fisheries. Shipowners face pressure to upgrade or retrofit existing vessels, with many opting for advanced systems that meet both IMO and U.S. Coast Guard standards. Eco-friendly ballast water treatment solutions continue to grow to foster innovation and stricter compliance measures as global trade increases and environmental scrutiny intensifies the demand for efficiency.

MARKET DRIVERS

Stringent Environmental Regulations

The implementation of stringent global environmental regulations is a key driver for the ballast water treatment market. The International Maritime Organization’s (IMO) Ballast Water Management Convention requires ships to treat ballast water to prevent the spread of invasive species. Additionally, the U.S. Coast Guard enforces its own standards that mandate compliance for vessels operating in U.S. waters. These regulations have created a significant demand for treatment systems. Non-compliance can lead to heavy fines; for instance, a single violation in the U.S. can result in penalties exceeding $35,000 per day by prompting shipowners to prioritize the installation of approved systems.

Growth in Global Shipping Activity

Increasing global trade and shipping activity are fueling the demand for ballast water treatment solutions. The United Nations Conference on Trade and Development (UNCTAD) reports that maritime trade handles over 80% of global merchandise and requires efficient systems to manage ballast water. Larger and more frequent vessel movements raise the risk of introducing invasive species, necessitating advanced treatment technologies. Ports worldwide are enhancing monitoring capabilities to ensure compliance alongside driving system adoption. There is a need for innovative and scalable ballast water management solutions as shipping volumes continue to rise.

MARKET RESTRAINTS

High Installation and Retrofit Costs

The significant cost of installing and retrofitting ballast water treatment systems acts as a major restraint in the market. For many shipowners, the expense of compliance with IMO and U.S. Coast Guard standards is burdensome, with retrofits for older vessels costing between $500,000 and $5 million per system depending on the vessel size and technology. Additionally, downtime during installation affects operational efficiency and profitability. Smaller shipping companies, in particular, struggle with these financial demands by delaying compliance or seeking waivers, thereby limiting the widespread adoption of advanced treatment technologies.

Operational and Maintenance Challenges

Operational and maintenance issues with ballast water treatment systems hinder market growth. Many systems require regular upkeep to function effectively, particularly under varying water salinities, temperatures, and turbidity. A 2022 industry report highlighted that 20-30% of systems faced performance issues due to poor maintenance or incompatibility with vessel operating conditions. Crew training for proper system operation is another challenge, as insufficient knowledge can lead to malfunctions or non-compliance. These challenges not only increase costs but also deter shipowners from adopting advanced systems, which affects the market’s growth potential.

MARKET CHALLENGES

Lack of Standardized Global Enforcement

One of the significant challenges in the ballast water treatment market is the inconsistent enforcement of regulations across regions. While the IMO’s Ballast Water Management Convention is widely recognized, some countries adopt varying compliance timelines and enforcement levels by creating uncertainty for shipowners. For example, ships operating in U.S. and international waters must meet differing standards and complicate system selection. A 2023 industry survey found that over 40% of ship operators faced difficulties aligning with multiple regulatory frameworks, leading to delays in system adoption and compliance gaps that ultimately hinder market growth.

Limited Awareness and Training

A lack of awareness and insufficient crew training on ballast water treatment systems pose operational challenges. Many systems require precise handling and maintenance, whereas a 2022 maritime study revealed that nearly 25% of system failures were attributed to operator errors. Additionally, shipowners often underestimate the importance of selecting technology suited to specific operating conditions, such as salinity and water temperature. Operational inefficiencies and compliance risks increase without adequate training programs and knowledge dissemination, which discourages shipowners from fully adopting advanced systems that are attributed to challenging global market expansion.

MARKET OPPORTUNITIES

Technological Advancements in Compact Systems

The development of compact and energy-efficient ballast water treatment systems presents a significant opportunity in the market. These systems cater to smaller vessels and those with limited onboard space, addressing a key challenge for older fleets. Innovations such as modular UV and electrochlorination technologies reduce energy consumption while maintaining high efficacy. A 2023 study highlighted that compact systems reduce installation time by 30%, making them cost-effective and easier to retrofit. Manufacturers focusing on compact technologies can capture a growing segment of the market as shipowners look for flexible and compliant solutions.

Emerging Markets in Asia-Pacific

Asia-Pacific represents a lucrative opportunity due to the region’s expanding shipbuilding industry and growing trade activities. Countries like China, South Korea, and Japan dominate global ship production by collectively accounting for over 90% of new vessel deliveries, according to UNCTAD. These new builds increasingly integrate ballast water treatment systems to comply with international regulations. Additionally, regional ports are adopting stricter environmental monitoring, further driving demand for advanced solutions. Manufacturers investing in localized production and distribution networks in Asia-Pacific can capitalize on the region’s growing focus on maritime sustainability and regulatory compliance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

30.2% |

|

Segments Covered |

By Technology Type, Ballast Water Capacity, Vessel Type, Installation and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alfa Laval AB, Veolia Water Technologies, Wärtsilä Corporation, Xylem Inc., Ecochlor, Inc., Hyde Marine (a Calgon Carbon Company), Panasonic Environmental Systems & Engineering Co., Ltd., Mitsubishi Heavy Industries, Ltd., Optimarin AS, Headway Technology Group (Qingdao) Co., Ltd and others. |

SEGMENTAL ANALYSIS

By Technology Type Insights

The electrochlorination segment dominated the market and accounted for 45.4% of the global market share in 2023. This dominance is attributed to its effectiveness in treating large volumes of ballast water, making it suitable for sizable vessels such as tankers and bulk carriers. Electrochlorination systems generate chlorine on-site by providing a reliable method to eliminate invasive aquatic species. Their capability to handle varying water salinities and temperatures enhances their appeal across diverse maritime environments. Additionally, compliance with stringent international regulations in the International Maritime Organization's Ballast Water Management Convention has propelled the adoption of electrochlorination systems as they meet the required discharge standards.

Conversely, the Ultraviolet (UV) segment is expected to experience the fastest CAGR of 10.4% over the forecast period. The surge in demand for UV systems is driven by their chemical-free operation, which mitigates environmental concerns associated with chemical discharges. UV treatment is particularly effective for smaller vessels and those operating in freshwater environments where electro-chlorination may be less efficient. The ease of installation and lower maintenance requirements further contribute to the rapid adoption of UV systems. UV ballast water treatment systems are gaining traction as a preferred choice for ensuring compliance and protecting marine ecosystems as environmental regulations tighten and the maritime industry seeks sustainable solutions.

By Ballast Water Capacity Insights

The more than 5,000 cubic meters segment stood as the largest segment in the global market and captured 50.4% of the global market share in 2023. This dominance is due to the prevalence of large commercial ships, such as tankers and bulk carriers, which require substantial ballast water management systems to comply with international regulations. The significant volume of ballast water these vessels handle necessitates advanced treatment solutions to prevent the spread of invasive aquatic species, thereby driving demand in this segment.

The 1,500 to 5,000 segment is likely to be the fastest-growing segment and register a CAGR of 8.8% over the forecast period. This growth is attributed to the increasing number of medium-sized vessels, container ships, and general cargo ships entering the global fleet. These vessels are adopting ballast water treatment systems to meet stringent environmental standards set by organizations like the International Maritime Organization (IMO). The scalability and cost-effectiveness of treatment solutions for this capacity range make them attractive to shipowners aiming to ensure compliance while managing operational costs.

By Vessel Type Insights

The bulk carriers segment accounted for 35.5% of the global market share in 2023. This prominence is due to their substantial ballast water requirements, which are essential for maintaining stability during cargo operations. Bulk carriers often transport heavy commodities like coal, iron ore, and grain with significant ballast water management to ensure safe navigation. The International Maritime Organization (IMO) mandates that vessels manage ballast water to prevent the spread of invasive species using bulk carrier operators to adopt advanced treatment systems. The demand for effective ballast water treatment solutions in this segment remains robust, with a high volume of global bulk trade.

The container ships segment is anticipated to be the fastest-growing segment and grow at a CAGR of 9.3% over the forecast period in the ballast water treatment market. This rapid expansion is driven by the surge in global containerized trade, which has increased the number of container vessels in operation. These ships frequently traverse international waters, making compliance with ballast water management regulations crucial to prevent ecological disturbances. The adoption of treatment systems in container ships is further accelerated by technological advancements that offer efficient and space-saving solutions with the operational needs of these vessels. The container ship segment's demand for ballast water treatment systems is expected to rise correspondingly as global trade continues to grow.

By Installation Insights

The stationary systems segment accounted for 75.7% of the global market share in 2023. These systems are permanently installed onboard vessels with continuous and automated treatment of ballast water. Their integration into the ship's infrastructure ensures compliance with international regulations, such as the International Maritime Organization's Ballast Water Management Convention, which mandates effective management of ballast water to prevent the spread of invasive species. The reliability and efficiency of stationary systems make them the preferred choice for large commercial vessels, including bulk carriers and oil tankers, which require robust solutions to handle substantial ballast water volumes.

The portable systems segment is predicted to showcase a CAGR of 10.4% over the forecast period. This surge is driven by the flexibility and cost-effectiveness that portable systems offer, which is particularly appealing to smaller vessels and older ships, where retrofitting stationary systems may be challenging or economically unfeasible. Portable systems can be transferred between vessels or used as temporary solutions, providing versatility in operations. Additionally, advancements in technology have enhanced the efficiency and user-friendliness of portable units, making them a viable alternative for shipowners seeking compliance without extensive modifications to their vessels. The adoption of portable ballast water treatment systems is expected to rise with growing awareness of environmental regulations that are deemed to contribute to the segmental expansion.

REGIONAL ANALYSIS

North America held the largest share of 35.9% of the global market share in 2023 due to strict U.S. Coast Guard regulations and robust enforcement policies. The United States leads the region by its extensive maritime trade and strong compliance culture. The region is projected to grow at a CAGR of 7% by sustaining investments in advanced treatment technologies and the need for retrofitting older vessels.

Europe is another major market for ballast water treatment worldwide. The early adoption of ballast water management systems and stringent EU environmental directives majorly propels the growth of the European market. Germany, Norway, and the Netherlands dominate due to their established shipbuilding sectors and proactive environmental policies. The region is expected to grow at a CAGR of 6.5%, supported by advancements in eco-friendly technologies and increasing retrofitting activities.

Asia-Pacific is the fastest-growing region in the worldwide market. The significant shipbuilding activities in China, South Korea, and Japan collectively produce over 90% of global vessels, which is driving the market growth in Asia-Pacific. The region’s growth is further fueled by rising awareness of environmental compliance and increasing integration of ballast water treatment systems in new builds.

The market in Latin America is driven by expanding port facilities in Brazil and Panama. Efforts to align with international standards and improve maritime infrastructure indicate a positive outlook.

The Middle East and Africa hold a moderate share of the worldwide market but the region is gradually advancing due to strategic shipping routes and investments in modern port infrastructure. Countries like the UAE and South Africa lead the adoption of ballast water treatment systems with a predicted CAGR of 5% as regulatory frameworks strengthen and awareness grows.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Alfa Laval AB, Veolia Water Technologies, Wärtsilä Corporation, Xylem Inc., Ecochlor, Inc., Hyde Marine (a Calgon Carbon Company), Panasonic Environmental Systems & Engineering Co., Ltd., Mitsubishi Heavy Industries, Ltd., Optimarin AS, Headway Technology Group (Qingdao) Co., Ltd. are playing a dominating role in the global ballast water treatment market.

The ballast water treatment market is highly competitive, driven by stringent international regulations such as the International Maritime Organization’s (IMO) Ballast Water Management Convention and U.S. Coast Guard standards. Key players like Alfa Laval AB, Veolia Water Technologies, and Wärtsilä Corporation dominate the market by offering comprehensive solutions tailored to different vessel types and sizes. These companies leverage strong global distribution networks, advanced technologies such as electrochlorination and UV systems, and robust research and development to maintain their market positions.

Emerging players like Ecochlor and Optimarin focus on niche segments, providing compact and portable solutions for smaller vessels or retrofits. These companies are gaining traction due to their ability to meet evolving regulatory requirements cost-effectively. The competition is further intensified by the adoption of smart ballast water management systems, which use IoT and AI for real-time monitoring and compliance reporting.

Regional competition is prominent, with Asia-Pacific manufacturers capitalizing on the region’s dominant shipbuilding activities, while North American and European companies emphasize innovation and compliance. As environmental standards become stricter and global maritime trade expands, the market is witnessing increased collaborations, acquisitions, and product advancements, underscoring the dynamic and evolving nature of the competition.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, ERMA FIRST Group, a provider of ballast water treatment systems, acquired Ecochlor, a U.S.-based company specializing in chlorine dioxide-based treatment solutions. This acquisition aims to broaden ERMA FIRST's product portfolio and enhance its global market presence.

- In May 2023, Xylem Inc., a water technology provider, completed the acquisition of Evoqua Water Technologies, a company specializing in water and wastewater treatment solutions. This acquisition aimed to create a leading platform of advanced water solutions and services.

MARKET SEGMENTATION

This research report on the global ballast water treatment market has been segmented and sub-segmented based on technology type, ballast water capacity, vessel type, installation, and region.

By Technology type

- Electrochlorination

- Ultraviolet (UV)

- Oxidation

- Ultrasound

- Disinfectant

- Others

By Ballast water capacity

- More than 5,000

- 1,500-5,000

- Less than 1,500

By Vessel Type

- Bulk carriers

- Oil tankers

- General cargo

- Container ships

- Others

By Installation

- Portable

- Stationary

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the current size of the Global Ballast Water Treatment Market?

As of 2023, the Global Ballast Water Treatment Market is valued at USD 84.12 billion and is projected to grow significantly, reaching USD 989.10 billion by 2032. Reflecting a robust growth trajectory with a compound annual growth rate (CAGR) of 31.5%.

2. What factors are driving the growth of the Ballast Water Treatment Market?

Key drivers include stringent environmental regulations, such as the IMO's Ballast Water Management Convention, increasing global shipping activity, and the need for advanced treatment technologies to prevent the spread of invasive species.

3. What are the main technologies used in ballast water treatment?

The primary technologies include UV-based disinfection, filtration, and chemical treatment, which are tailored to meet the operational needs of various vessel sizes.

4. What challenges does the Ballast Water Treatment Market face?

Major challenges include high installation and retrofit costs for treatment systems, operational and maintenance difficulties, lack of standardized global enforcement of regulations, and limited awareness and training among crew members.

5. What opportunities exist in the Ballast Water Treatment Market?

Opportunities include advancements in compact and energy-efficient ballast water treatment systems, particularly for smaller vessels, and emerging markets in Asia-Pacific due to the region's expanding shipbuilding industry and stricter environmental monitoring practices.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]