Global Baby Thermometers Market Size, Share, Trends & Growth Forecast Report Segmented By Type (Infrared thermometers and Digital thermometers), Distribution Channel (E-commerce and Retail), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 To 2032

Global Baby Thermometers Market Size

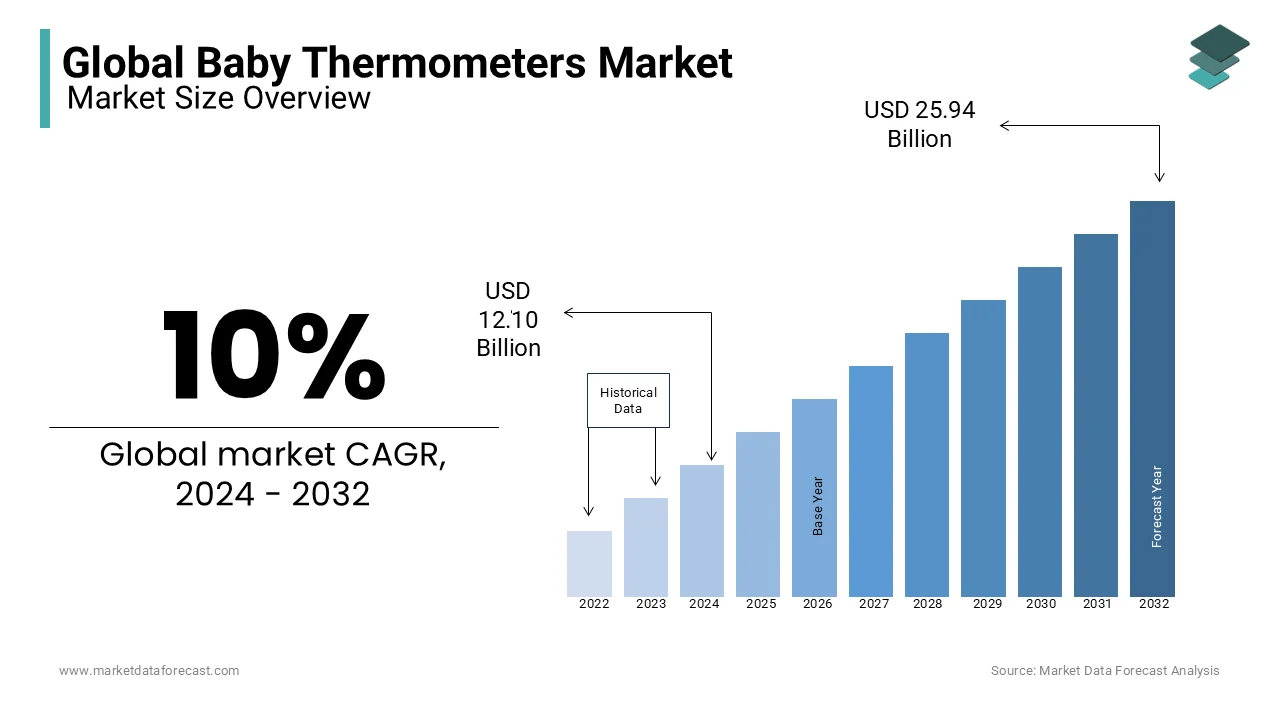

The size of the global baby thermometers market was worth USD 11 billion in 2023. The global market is anticipated to grow at a CAGR of 10% from 2024 to 2032 and be worth USD 25.94 billion by 2032 from USD 12.10 billion in 2024.

Advancements in technology have enabled features like Bluetooth connectivity, integration with mobile health apps, and multi-use functionality, which appeal to tech-savvy parents. A notable trend is the rise of contactless thermometers, especially post-COVID-19, for their hygienic benefits. Pediatric safety and ease of use remain critical drivers influencing product design and consumer choice. Devices with certifications from medical regulatory authorities, such as the FDA or CE marking, are preferred. According to studies, the accuracy of digital and infrared thermometers is generally within ±0.2°C, providing reliable readings essential for early illness detection in infants. Moreover, affordability and durability are significant considerations among buyers.

MARKET TRENDS

Rise of Contactless Infrared Thermometers

The adoption of contactless infrared thermometers has surged with hygiene concerns and the need for non-invasive temperature measurement. These devices provide results within seconds, which makes them ideal for restless infants. Studies suggest infrared thermometers offer an accuracy of ±0.2°C, aligning with pediatric care standards. The demand has increased significantly due to post-COVID-19 with their ability to reduce cross-contamination risks. According to recent consumer surveys, over 60% of parents prefer contactless options for their convenience and safety. Additionally, their dual-mode feature for measuring ambient and body temperature makes them versatile by adding value for families seeking multi-functional health monitoring tools.

Integration of Smart Technology

Wearable and smart baby thermometers are gaining popularity due to their continuous monitoring capabilities and integration with health apps. These devices allow parents to track temperature trends remotely via Bluetooth-enabled smartphones via receiving alerts for fever spikes. Approximately 35% of new parents prioritize smart thermometers for real-time monitoring during illnesses. Some models even include AI-driven analytics to predict fever patterns to improve parental confidence in managing infant health. This trend aligns with the broader digital health movement by offering convenience and peace of mind. Wearable thermometers, particularly those with adhesive patches, are highly valued for their ability to monitor without disrupting the baby.

MARKET DRIVERS

Increasing Awareness of Infant Health

The rising parental focus on infant health has significantly driven demand for accurate and reliable baby thermometers. Health organizations emphasize regular temperature monitoring as critical for early illness detection, especially in newborns. A survey by pediatric associations found that 72% of parents consider thermometers essential in baby care kits. This awareness extends to seeking FDA or CE-certified devices to ensure safety and accuracy. Rising incidences of infant febrile illnesses globally further bolster the market expansion. Thermometers play a pivotal role in home-based health management, further reducing the dependency on frequent clinical visits.

Technological Advancements in Thermometer Design

Technological innovations, such as infrared sensors, Bluetooth integration, and mobile app compatibility, have enhanced thermometer usability and functionality. Features like multi-mode temperature measurement and real-time alerts cater to modern parental needs. For example, infrared thermometers now provide readings in under two seconds with a ±0.2°C accuracy. Reports indicate that smart thermometers' adoption has grown by 40% in recent years, demonstrating how technology-driven designs significantly influence consumer preferences by combining accuracy with convenience.

Rising Demand for Hygienic and Non-Invasive Solutions

Post-pandemic hygiene consciousness has led to increased demand for contactless thermometers, as they minimize cross-contamination risks. Parents prefer non-invasive devices for their ability to provide reliable readings without disturbing a sleeping child. According to market studies, contactless thermometers now account for over 50% of total sales in the category. Their dual-use capability, such as measuring ambient temperatures, adds further appeal to parents seeking versatile and hygienic healthcare solutions for their infants.

MARKET RESTRAINTS

High Cost of Advanced Thermometers

The premium pricing of advanced thermometers, such as contactless and smart devices, acts as a restraint for budget-conscious consumers. Smart models with Bluetooth and app integration often cost 3–5 times more, while basic digital thermometers are affordable. According to surveys, nearly 40% of parents cite cost as a barrier to purchasing high-tech thermometers. This limits adoption in low- and middle-income regions where affordability is a primary concern. The higher price point reduces market penetration in countries with limited healthcare expenditure per household.

Concerns Over Accuracy in Low-Cost Models

Inexpensive thermometers often suffer from inconsistencies in temperature readings that lead to distrust among parents. Studies show that non-certified digital thermometers can have accuracy deviations of ±0.5°C, which can mislead caregivers. Approximately 25% of parents report skepticism about the reliability of low-cost options, impacting overall market perception. This concern is particularly significant in markets flooded with unregulated, non-branded products that fail to meet safety and accuracy standards and further restrict market growth.

Lack of Awareness in Developing Markets

Limited awareness about the importance of regular infant temperature monitoring in developing regions hampers market growth. Many households rely on traditional methods or general-purpose thermometers, which lack the precision required for infant care. A global study revealed that only 30% of parents in low-income regions consider baby-specific thermometers necessary. This gap in understanding, coupled with inadequate healthcare infrastructure and low market penetration by branded products, restrains the adoption of specialized baby thermometers in these areas.

MARKET OPPORTUNITIES

Expansion in Emerging Markets

Emerging markets present significant growth potential due to increasing urbanization and rising disposable incomes. A study shows that healthcare expenditure in developing regions is projected to grow by over 5% annually, offering the opportunity for baby thermometer manufacturers to penetrate these markets. Educating parents about the importance of accurate infant health monitoring can drive demand. Affordable and portable thermometers tailored for low-income families could capture untapped segments. Partnerships with local healthcare providers to distribute devices can also boost adoption in regions where awareness of baby-specific thermometers remains low.

Focus on Eco-Friendly and Sustainable Designs

The rising consumer preference for eco-friendly products offers opportunities for thermometer manufacturers to innovate with sustainable materials and packaging. Thermometers made from BPA-free plastics and recyclable components could appeal to environmentally conscious parents. For example, eco-friendly product sales have increased by 20% annually across various baby care categories. Offering products aligned with sustainability goals can create differentiation in competitive markets to build brand loyalty while addressing the environmental impact of healthcare devices.

Integration with Broader Digital Health Platforms

Integrating baby thermometers with comprehensive digital health ecosystems offers significant growth potential. For instance, thermometers linked to platforms tracking vaccination schedules, growth milestones, and illness history can provide holistic infant care solutions. Research shows that 65% of tech-savvy parents prefer devices that integrate seamlessly with health apps. Manufacturers can enhance their value proposition by leveraging AI-driven insights and offering data-sharing capabilities to pediatricians. Collaborations with telemedicine providers to deliver connected care solutions could further boost market appeal.

MARKET CHALLENGES

Regulatory Compliance and Certification

Navigating stringent regulatory frameworks poses a challenge for manufacturers. Devices must meet standards like FDA approval or CE marking, which requires rigorous testing for accuracy, safety, and reliability. Non-compliance can lead to product recalls or market bans that damage brand reputation. Approximately 20% of new baby thermometer models face delays in reaching the market due to prolonged certification processes. Smaller companies, in particular, struggle with the financial and operational burden of meeting regulatory requirements due to their ability to compete with established players.

Market Saturation in Developed Regions

In developed markets, growth opportunities are limited where baby thermometer ownership is high. Saturation has intensified competition by pressuring manufacturers to differentiate through innovation or pricing, which can erode profit margins. Research shows that over 80% of parents in developed regions already own at least one thermometer. This limits room for expansion for basic models and compels companies to focus on niche segments or premium innovations that require significant R&D investment.

Counterfeit and Low-Quality Products

The proliferation of counterfeit and substandard baby thermometers undermines consumer trust and disrupts market dynamics. Reports estimate that counterfeit products account for 10-15% of thermometers sold in some regions. These devices often fail to meet safety and accuracy standards, which leads to dissatisfied customers and potential health risks for infants. Combatting this challenge requires manufacturers to invest in anti-counterfeiting technologies and public awareness campaigns, which can strain resources and detract from core business objectives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10% |

|

Segments Covered |

By Type, distribution channel, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Braun GmbH, Kinsa Inc., Exergen Corporation, Fridababy LLC, Vicks (Kaz USA, Inc.), iProven, Safety 1st (Dorel Industries Inc.), Beurer GmbH, Omron Healthcare, Inc., Philips Avent, and Others. |

SEGMENT ANALYSIS

By Type Insights

The infrared thermometers segment led the market by capturing 55.7% of the global market share in 2023. Infrared thermometers enable non-invasive temperature measurement by ensuring hygiene and minimizing discomfort for infants. They deliver rapid results within seconds, which is crucial for handling restless or sleeping babies. Additionally, technological advancements such as digital displays and Bluetooth connectivity enhance their appeal among tech-savvy parents. These features make them highly convenient and efficient, which drives their widespread adoption in both home and clinical settings.

The digital thermometers segment is growing rapidly and is estimated to grow at a CAGR of 10.33% over the forecast period. This growth is primarily driven by their affordability, making them accessible to a larger audience, especially in developing regions. Their user-friendly design with clear digital displays and versatility for oral, rectal, or underarm use further boosts their appeal. As parents seek reliable and cost-effective solutions for infant care, digital thermometers continue to gain traction by contributing to their accelerated growth in the global market.

By Distribution Channel Insights

The e-commerce segment held the major share of the global market in 2023. E-commerce has emerged as the dominant distribution channel. This prominence is attributed to the convenience of online shopping, where parents can compare products, read reviews, and make purchases from home. E-commerce platforms also offer a wider variety of brands and models compared to traditional stores, with competitive pricing and frequent discounts. The COVID-19 pandemic further bolstered this trend, as consumers increasingly relied on online channels for essential items, including baby care products.

Meanwhile, retail stores remain an important channel, especially for consumers who prefer in-person shopping experiences. Retail outlets provide immediate product availability and the advantage of consulting knowledgeable staff before purchasing. However, the growth rate of retail sales has been slower compared to e-commerce as more consumers shift toward the convenience of online shopping. Retail remains particularly relevant in regions with less developed e-commerce infrastructure or among tactile shoppers.

REGIONAL ANALYSIS

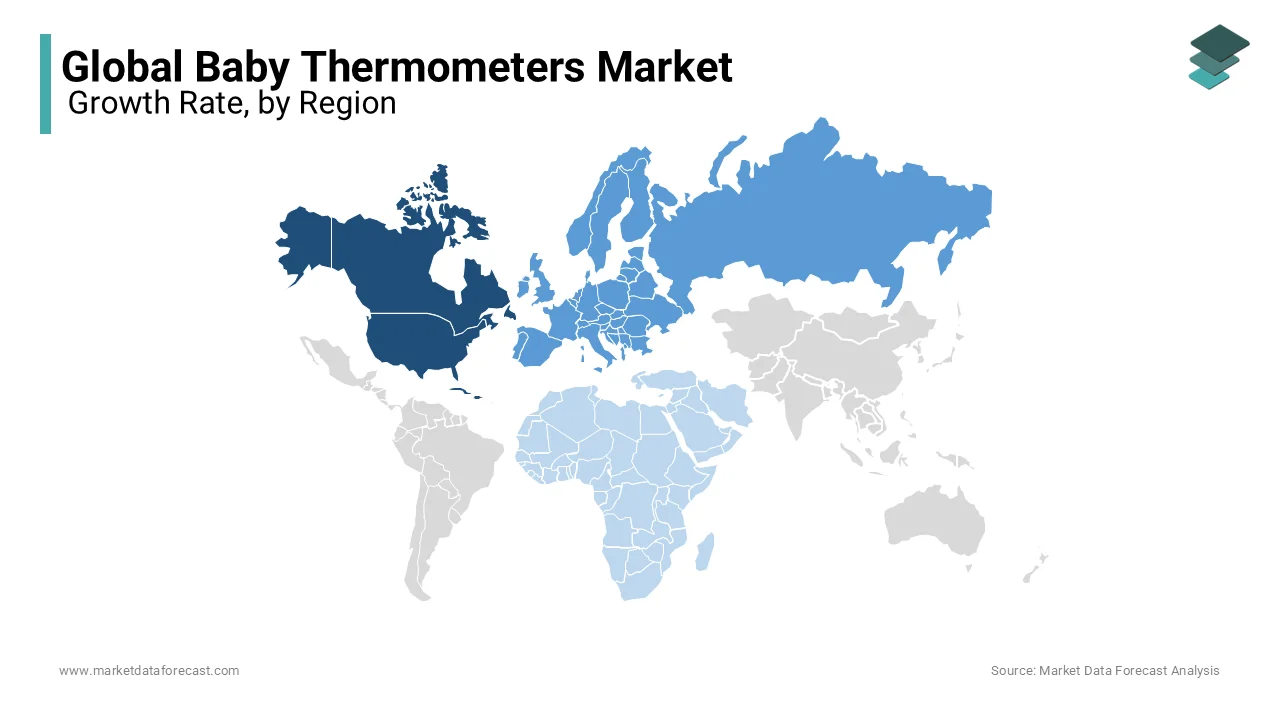

North America held 55.6% of the global market share in 2023. The domination of North America in the global market is driven by high healthcare expenditure, widespread adoption of advanced medical devices, and a strong emphasis on infant health monitoring. The United States and Canada are the primary contributors to this region. The market in North America is projected to grow steadily due to continuous technological advancements and increasing parental awareness.

Europe follows, with significant contributions from countries like Germany, France, and the United Kingdom. Robust healthcare systems and a growing focus on pediatric care bolster the region's market share. The European market is expected to experience a moderate CAGR during the forecast period, which will drive the adoption of innovative thermometer technologies and rising health consciousness among parents.

The Asia-Pacific region is anticipated to exhibit the fastest growth. This rapid expansion is attributed to increasing birth rates, improving healthcare infrastructure, and rising disposable incomes in countries such as China, India, and Japan. The growing awareness of infant health and the adoption of digital healthcare solutions further propel market growth in this region.

In Latin America, countries like Brazil and Mexico lead the market, driven by improving healthcare facilities and a growing middle-class population. The region is expected to witness a healthy CAGR during the forecast period by increasing healthcare investments and a gradual shift towards modern medical devices.

The Middle East and Africa region holds a smaller market share but is poised for gradual growth, with a steady CAGR over the forecast period. Leading countries include South Africa, Saudi Arabia, and the United Arab Emirates. Factors such as improving healthcare infrastructure, rising awareness of infant health, and government initiatives to enhance healthcare services contribute to the market's development in this region.

KEY MARKET PLAYERS

Companies playing a prominent role in the global Baby thermometers market include Braun GmbH, Kinsa Inc., Exergen Corporation, Fridababy LLC, Vicks (Kaz USA, Inc.), iProven, Safety 1st (Dorel Industries Inc.), Beurer GmbH, Omron Healthcare, Inc., Philips Avent, and Others.

RECENT MARKET DEVELOPMENTS

- In March 2024, Healthy Together, a healthcare technology company, acquired Kinsa Inc., a leader in smart thermometers. This acquisition is expected to enhance Healthy Together’s AI illness prediction capabilities and strengthen their presence in digital health platforms.

- In January 2023, Braun GmbH launched a new line of smart infrared thermometers with app connectivity. This innovation aims to cater to the rising demand for IoT-enabled healthcare devices and improve consumer convenience.

- In July 2023, Philips Avent introduced a global marketing campaign promoting their non-contact thermometers. This initiative is designed to address hygiene concerns and boost the adoption of advanced thermometer models.

- In August 2023, Fridababy LLC unveiled a subscription-based service for its thermometer range. This strategy is intended to drive customer retention and provide consistent access to replacements and accessories.

- In February 2024, iProven invested in upgrading dual-mode thermometers that provide both ear and forehead readings. This move is aimed at meeting consumer demands for versatile, multi-use devices in home and clinical settings.

- In May 2024, Vicks (Kaz USA, Inc.) partnered with healthcare organizations to promote its thermometers for at-home pediatric care. This partnership is expected to enhance trust in their products and increase adoption.

- In April 2024, Safety 1st (Dorel Industries Inc.) expanded its distribution network in Southeast Asia and Africa. This expansion is anticipated to capitalize on the growing birth rates and healthcare advancements in these regions.

- In June 2023, Beurer GmbH introduced a line of eco-friendly baby thermometers made with sustainable materials. This launch is intended to appeal to environmentally conscious consumers and differentiate their brand.

- In September 2023, Exergen Corporation upgraded its temporal artery thermometers with new patented technology for faster and more accurate readings. This update aims to maintain their leadership in non-invasive thermometer solutions.

- In December 2023, Kinsa Health launched a community health monitoring initiative using its smart thermometers in collaboration with local governments. This program is expected to enhance product utility and support public health initiatives.

MARKET SEGMENTATION

This research report on the global baby thermometers market has been segmented and sub-segmented based on type, distribution channel, and region.

By Type

- Infrared thermometers

- Digital thermometers

By Distribution Channel

- E-commerce

- Retail

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]