Global Autonomous Mobile Robots Market Size, Share, Trends, & Growth Forecast Report Segmented By Component (Hardware, Software, and Services), Type, Battery Type, Application, Payload Capacity, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Autonomous Mobile Robots Market Size

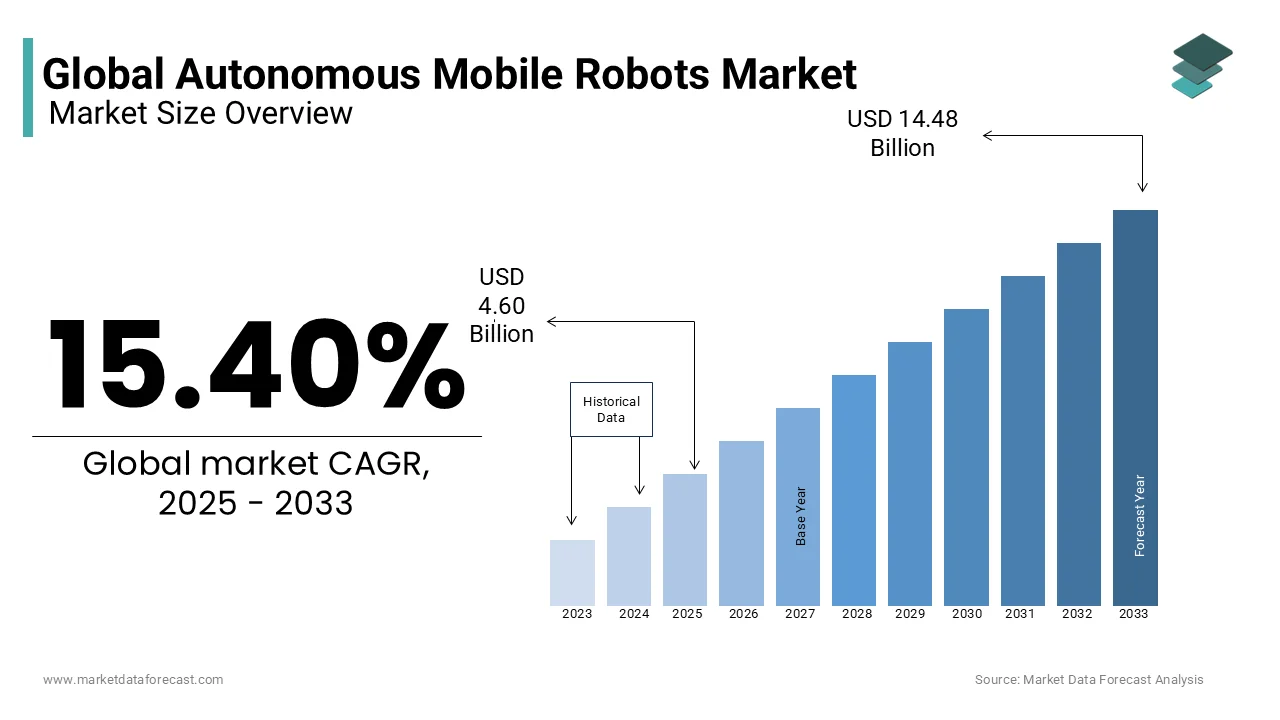

The global autonomous mobile robots market was worth USD 3.99 billion in 2024. The global market is projected to reach USD 14.48 billion by 2033 from USD 4.60 billion in 2025, growing at a CAGR of 15.40% from 2025 to 2033.

Autonomous Mobile Robots (AMRs) are advanced robotic systems engineered to navigate and execute tasks within dynamic environments without direct human intervention. Leveraging a suite of sophisticated sensors including cameras, LiDAR, and ultrasonic devices alongside artificial intelligence algorithms, AMRs possess the capability to interpret their surroundings, make real-time decisions, and perform functions such as material transport, inventory management, and assembly operations. Their versatility has rendered them indispensable across sectors like manufacturing, logistics, healthcare, and retail.

The integration of AMRs has led to notable operational enhancements across various industries. For instance, Amazon has deployed over 750,000 robots within its fulfilment centers, performing tasks that include transporting packages, sorting items, and creating customized packaging. This extensive automation has not only accelerated delivery times but also contributed to significant cost reductions. Analysts from Morgan Stanley project that Amazon's robotic innovations could yield annual savings of up to $10 billion by 2030.

Energy efficiency remains a critical focus in AMR development. Research indicates that locomotion accounts for over 50% of a mobile robot's total energy consumption, underscoring the importance of optimized control methods and energy-efficient hardware design. Advancements in battery management systems and the exploration of sustainable energy sources, such as solar power and hydrogen fuel cells, are ongoing to enhance the energy efficiency of AMRs.

MARKET DRIVERS

Addressing Labor Shortages

The global logistics sector is confronting a significant shortfall in truck drivers, a situation poised to intensify. The International Road Transport Union (IRU) reports that, without intervention, over 7 million truck driver positions could remain unfilled by 2028. This includes 4.9 million vacancies in China, accounting for 20% of total positions, and 745,000 in Europe, representing 17% of total positions. This escalating deficit is primarily attributed to an aging workforce, with less than 12% of truck drivers under the age of 25, and in Europe, this figure drops to a mere 5%. To mitigate these challenges, industries are increasingly integrating Autonomous Mobile Robots (AMRs) to automate tasks traditionally performed by human workers, thereby enhancing operational efficiency and reducing dependency on manual labour.

Enhancing Workplace Safety

Workplace safety remains a critical concern across various industries, particularly regarding the operation of forklifts. According to the Occupational Safety and Health Administration (OSHA), forklifts are involved in numerous workplace incidents annually. The Wall Street Journal highlights that each year, approximately 7,500 workers sustain injuries, and nearly 100 fatalities result from forklift-related accidents. In response, companies are increasingly adopting Autonomous Mobile Robots (AMRs) to undertake material handling tasks, thereby reducing the reliance on traditional forklifts. This strategic shift not only enhances safety by minimizing human exposure to hazardous operations but also contributes to improved operational efficiency.

MARKET RESTRAINTS

High Implementation Costs

The adoption of Autonomous Mobile Robots (AMRs) necessitates considerable initial financial outlays, which can be a significant deterrent for many organizations. The UK Government's "Robotics and Autonomous Systems: The Economic Impact Across UK Sectors" report underscores that the substantial upfront expenses associated with integrating robotics and autonomous systems can be prohibitive, particularly for small and medium-sized enterprises. These costs encompass the procurement of advanced robotic units, integration with existing operational frameworks, and necessary infrastructure modifications. Moreover, ongoing expenditures for maintenance, software updates, and personnel training further compound the financial challenges, potentially impeding the widespread adoption of AMRs.

Technical Integration Challenges

Incorporating AMRs into pre-existing operational workflows presents notable technical complexities. The UK's "Connected and Automated Mobility 2025" report emphasizes the critical need for high-quality location data and advanced technologies to ensure the safe deployment of automated vehicles. This requirement extends to AMRs, which depend on precise navigation and real-time environmental data to function effectively. The intricacies involved in retrofitting current systems to accommodate AMRs, along with the necessity for seamless communication between robots and existing infrastructure, can lead to operational disruptions. These technical hurdles demand meticulous planning and resource allocation, potentially hindering the swift and efficient integration of AMRs into established processes.

MARKET OPPORTUNITIES

Advancements in Healthcare Automation

The integration of Autonomous Mobile Robots (AMRs) in healthcare settings offers significant potential to enhance patient care and operational efficiency. While specific numerical data from government agencies is limited, the Medicines and Healthcare products Regulatory Agency (MHRA) in the UK has outlined a strategic approach to artificial intelligence (AI) in medical devices, aiming to balance patient safety with innovation. This framework facilitates the development and deployment of AI-driven AMRs in healthcare environments. For instance, Changi General Hospital has implemented autonomous mobile robots to assist in medication delivery and patient support, demonstrating the practical benefits of AMR integration in medical facilities. These advancements not only improve service delivery but also address challenges such as staff shortages and the need for enhanced infection control measures.

Enhancing Agricultural Productivity

The agricultural sector faces challenges including labor shortages and the necessity for sustainable practices. Robotics and Autonomous Systems (RAS) offer solutions by automating tasks such as planting, monitoring, and harvesting. The UK's Department for Environment, Food & Rural Affairs (Defra) has published a review exploring how the horticulture sector can utilize innovative technologies, including autonomous guided vehicles and AI-enabled robotics, to improve efficiency and reduce reliance on manual labor. This initiative aims to enhance productivity and sustainability in agriculture, ensuring food security and environmental conservation. The adoption of AMRs in agriculture not only addresses workforce challenges but also promotes precision farming techniques, leading to optimized resource use and increased crop yields.

MARKET CHALLENGES

Cybersecurity Vulnerabilities

The deployment of Autonomous Mobile Robots (AMRs) introduces significant cybersecurity challenges. The UK's Department for Science, Innovation and Technology (DSIT) has identified vulnerabilities across all stages of the AI lifecycle, including design, development, deployment, and maintenance. These vulnerabilities can be exploited through adversarial attacks, data poisoning, and model inversion, potentially compromising the functionality and safety of AMRs. The National Cyber Security Centre (NCSC) emphasizes that many cyber attackers exploit known vulnerabilities, with more than half of the top vulnerabilities in 2022 being previously disclosed flaws. This underscores the necessity for robust security measures and continuous monitoring to protect AMRs from evolving cyber threats.

Regulatory and Legislative Hurdles

Integrating AMRs into existing infrastructures is often impeded by complex regulatory and legislative frameworks. The UK's "Connected & Automated Mobility 2025" report outlines the government's roadmap for self-driving vehicle deployment, emphasizing the need for cohesive legislation to build public trust while enabling innovation. This includes developing new laws and regulations that address safety standards, liability issues, and operational guidelines for autonomous systems. Navigating these regulatory landscapes requires coordinated efforts between policymakers, industry stakeholders, and the public to facilitate the seamless adoption of AMRs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.40% |

|

Segments Covered |

By Component, Type, Battery Type, Application, Payload Capacity, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB, BALYO, Bastian Solutions, LLC., Bleum, Boston Dynamics, Clearpath Robotics, Inc., Crown Equipment Corporation, Daifuku Co., Ltd., GreyOrange, and Harvest Automation. |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the autonomous mobile robots (AMR) market by holding a 65.6% of the global market share in 2024. The growth of the hardware segment is majorly due to the critical role of components like sensors, batteries, and processors, which are indispensable for robot operation. The global industrial robotics is heavily reliant on hardware advancements, as reported by the U.S. Department of Labor. For instance, advanced LiDAR sensors which cost between $4,000 and $75,000 per unit are pivotal for navigation. Hardware’s importance lies in its foundational role; without reliable hardware, AMRs cannot function efficiently and is leading to significant productivity losses.

The software segment is anticipated to be the fastest growing segment in the global market and is anticipated to progress at an exponential CAGR of 27.8% over the forecast period. Advancements in AI, machine learning, and cloud computing that enable smarter decision-making and real-time data processing is boosting the expansion of the software segment in the global market. According to the National Science Foundation, AI-powered software has improved robotic efficiency by up to 40% in warehouse operations. Additionally, a report by the World Economic Forum highlights that software-driven automation could generate $15 trillion in global GDP by 2030 . As industries increasingly adopt AMRs, software’s ability to enhance adaptability and scalability ensures its pivotal role in optimizing workflows and reducing operational costs.

By Type Insights

The goods-to-person picking robots segment had the leading share of 40.2% in the global market in 2024. The ability of goods-to-person picking robots to enhance warehouse efficiency and reduce order processing times is primarily boosting the growth of the goods-to-person segment in the global market. With global e-commerce sales reaching $5.7 trillion in 2022, as per the United Nations Conference on Trade and Development (UNCTAD), demand for automated picking systems has surged. These robots improve picking accuracy, reducing errors by up to 25%, and are critical in addressing labor shortages. Their importance lies in enabling scalable operations in high-growth sectors like retail and logistics.

The unmanned aerial vehicles (UAVs) segment is estimated to at a promising CAGR of 28.6% over the forecast period due to the advancements in drone technology and their expanding applications in inventory management, surveillance, and delivery. The Federal Aviation Administration (FAA) reports that commercial UAV registrations grew by over 50% annually between 2020 and 2022. Additionally, a study by Deloitte highlights that UAVs reduce inventory cycle times by up to 60% , significantly improving operational efficiency. As industries adopt UAVs for tasks like stock monitoring and last-mile delivery, their scalability and cost-effectiveness make them indispensable. By 2030, UAVs could contribute $92 billion annually to the global economy, as estimated by Goldman Sachs.

By Battery Type Insights

The lithium-ion batteries segment held the major share of 55.3% in the global market in 2024. The growth of the lithium-ion batteries segment is majorly driven by their high energy density, which is 2-3 times greater than lead-acid batteries, enabling longer operational hours for AMRs. The International Energy Agency (IEA) reports that lithium-ion battery costs have dropped by 87% since 2010 , making them more affordable. These batteries are critical for industries requiring continuous operation, such as logistics and manufacturing. With global demand for lithium-ion batteries projected to reach 4,000 GWh by 2030 , as per BloombergNEF, their importance lies in powering efficient, sustainable, and scalable robotic systems.

By Application Insights

The transportation segment dominated the autonomous mobile robots (AMR) market by holding a 30.7% of the global market share in 2024. This growth stems from its critical role in logistics and manufacturing, where AMRs streamline material movement across facilities. The U.S. Department of Labor reports that transportation automation reduces operational costs by up to 25%, while improving delivery accuracy by 20%. With global warehouse automation spending projected to reach $27 billion by 2026, transportation robots are pivotal in addressing labour shortages and enhancing efficiency. Their importance lies in enabling scalable, cost-effective intra-facility logistics.

The inventory management segment is estimated to progress at a CAGR of 28.4% over the forecast period owing to the rise of e-commerce and the need for real-time inventory tracking. A study by Deloitte reported that AMRs reduce inventory cycle times by up to 50%, significantly improving accuracy. The National Retail Federation reports that retailers lose $1.1 trillion annually due to overstocking and stockouts, underscoring the need for precise inventory systems. As industries adopt AMRs for tasks like stock monitoring, their ability to integrate with AI and IoT ensures scalability. By 2030, inventory management solutions could save businesses $400 billion annually, as estimated by Goldman Sachs.

By Payload Capacity Insights

The 100 kg to 500 kg segment had the largest share of 40.7% in the global market in 2024. The versatility of 100 to 500 kg payload capacity that caters to industries like e-commerce, manufacturing, and healthcare is propelling the growth of the segment in the global market. The U.S. Department of Labor reports that robots in this range reduce material handling costs by up to 30%, while improving operational efficiency by 20% . With global warehouse automation spending projected to reach $25 billion by 2026, as per Statista, these AMRs are pivotal for medium-weight tasks such as transporting goods and components. Their importance lies in balancing payload capacity with agility, making them ideal for diverse applications.

The below 100 kg payload capacity segment is likely to register the fastest CAGR of 29.8% over the forecast period due to the rise of lightweight AMRs in e-commerce, retail, and healthcare for tasks like parcel delivery and inventory management. A study by PwC showed that lightweight AMRs reduce order fulfilment times by up to 35%, significantly enhancing productivity. The National Retail Federation reports that labour shortages cost the U.S. economy $75 billion annually, underscoring the need for automation. As industries adopt smaller, more agile robots, their ability to integrate with AI ensures scalability. By 2030, lightweight AMRs could save businesses $150 billion annually, as estimated by Goldman Sachs.

By End Use Insights

The automotive segment dominated the market by holding 23.2% of the global market share in 2024. The lead of the automotive segment is majorly attributed to the reliance of automotive industry on automation for assembly line efficiency. The U.S. Department of Labor reports that AMRs reduce production cycle times by up to 35% , while improving precision and reducing errors by 25% . With global automotive production projected to reach 95 million units annually by 2025, AMRs are critical for streamlining material handling and assembly processes. Their importance lies in enabling scalable as well as cost-effective operations in high-volume manufacturing environments.

The e-commerce segment is projected to grow at the highest CAGR of 30.4% over the forecast period owing to the rapid expansion of online shopping, with global e-commerce sales projected to reach $5.4 trillion by 2026, as per the United Nations Conference on Trade and Development (UNCTAD). A study by Deloitte stated that AMRs reduce order fulfillment costs by up to 45% , while cutting delivery times by 20% . As retailers adopt AMRs for warehouse automation, their ability to handle high-order volumes ensures scalability. By 2030, e-commerce-driven AMR adoption could contribute $700 billion annually to global GDP, as estimated by Goldman Sachs.

REGIONAL ANALYSIS

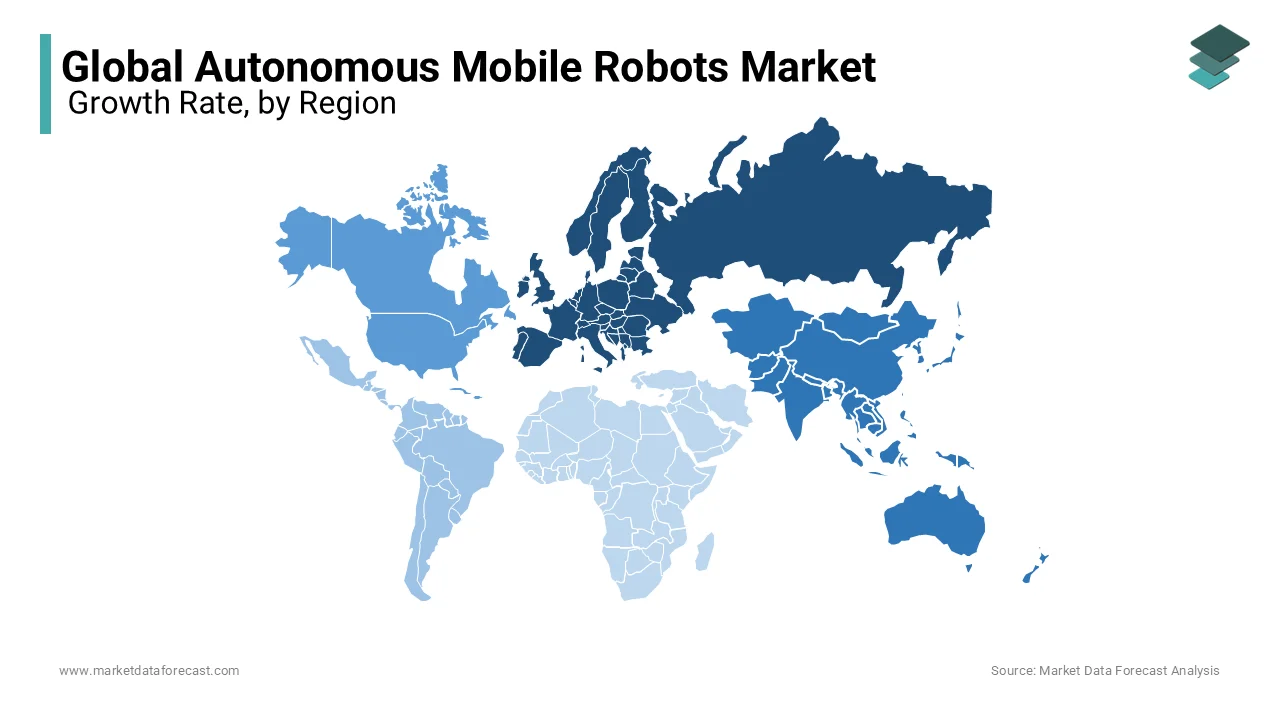

Europe dominated the autonomous mobile robots (AMRs) market by accounting for 35.32% of the global market share in 2024. The dominating position of Europe in the global market is majorly attributed to the region's robust manufacturing sector and significant investments in automation technologies. The European Union's emphasis on Industry 4.0 initiatives has accelerated the adoption of AMRs to enhance operational efficiency and productivity. Additionally, Europe's strong focus on research and development in robotics has fostered innovation, leading to advanced AMR solutions tailored for various industries, including automotive, electronics, and logistics. The region's commitment to technological advancement and automation continues to solidify its dominant position in the global AMR market.

The Asia-Pacific region is expected to experience the fastest CAGR of 22.52% during the forecast period due to factors such as the increasing adoption of automation in manufacturing and logistics sectors across countries like China, Japan, and South Korea. For example, Japan produced 282,934 robots valued at JPY 1,050.87 billion in 2022, reflecting a robust manufacturing ecosystem that supports AMR development. Government initiatives promoting smart factories and the integration of advanced technologies, such as 5G networks and artificial intelligence, further propel the demand for AMRs in the region. These factors collectively contribute to the significant growth trajectory of the AMR market in Asia-Pacific.

In North America, the Autonomous Mobile Robots (AMRs) market is experiencing significant growth, driven by the increasing adoption of automation in e-commerce and manufacturing sectors. This expansion is largely attributed to the surge in e-commerce activities, necessitating efficient warehouse operations and logistics solutions. Additionally, advancements in robotics technology and supportive government initiatives promoting automation are further propelling the market. The United States, in particular, plays a pivotal role, with its robust manufacturing base and early adoption of innovative technologies contributing to regional market dominance.

Latin America is gradually embracing AMR technology, with growth supported by infrastructure development and the integration of advanced technologies in industries such as e-commerce, automotive, food and beverage, and pharmaceuticals. The region's market is projected to witness substantial growth, driven by the increasing demand for automation to enhance operational efficiency and reduce labor costs. Countries like Brazil and Mexico are at the forefront, investing in modernizing their industrial sectors and adopting AMRs to remain competitive in the global market. Government initiatives aimed at promoting technological innovation further bolster this trend, positioning Latin America as a burgeoning market for autonomous mobile robots.

The Middle East and Africa (MEA) region is witnessing a gradual adoption of AMR technology, primarily driven by significant infrastructure development and the need for automation in industries such as oil and gas, mining, and logistics. The market is expected to grow as businesses seek to improve efficiency and safety in operations. Government investments in smart city projects and diversification of economies beyond oil dependence are also contributing factors. However, challenges such as high initial investment costs and a shortage of skilled labor may impede rapid adoption. Despite these hurdles, the MEA region holds potential for AMR market expansion as technological awareness and economic diversification efforts continue to progress.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global autonomous mobile robots market include ABB, BALYO, Bastian Solutions, LLC., Bleum, Boston Dynamics, Clearpath Robotics, Inc., Crown Equipment Corporation, Daifuku Co., Ltd., GreyOrange, and Harvest Automation.

The Autonomous Mobile Robots (AMR) market is experiencing intense competition, driven by rapid technological advancements, increased automation adoption, and growing demand for flexible, cost-effective robotic solutions. Key players, including Universal Robots, Mobile Industrial Robots (MiR), Fetch Robotics, and Boston Dynamics, are competing to capture market share by offering innovative, AI-powered, and highly adaptable robots.

Competition in this market is fueled by technological differentiation, with companies integrating AI, machine learning, and computer vision to enhance robot navigation, obstacle avoidance, and efficiency. Firms are also investing heavily in cloud-based fleet management solutions, enabling seamless remote operations.

Strategic partnerships and acquisitions are major competitive strategies, as seen with Teradyne's ownership of both Universal Robots and MiR, fostering collaboration and resource sharing. Similarly, companies are expanding their ecosystem-driven business models, such as Universal Robots' UR+ platform, which allows third-party developers to create compatible robotic applications.

Startups and regional players are entering the market with cost-effective solutions targeting specific industries, intensifying competition. Meanwhile, major automotive, e-commerce, and logistics firms are increasingly adopting AMRs, influencing market dynamics.

Overall, the AMR market remains highly competitive, with a strong focus on technological advancements, strategic alliances, and industry-specific innovations to gain an edge over rivals.

Top 3 Players in the Market

Universal Robots

Founded in 2005 in Odense, Denmark, Universal Robots specializes in manufacturing collaborative robots, or cobots, designed to work alongside humans without extensive safety measures. Their user-friendly and flexible robotic arms have been widely adopted across various industries, including automotive, electronics, and pharmaceuticals. As of 2022, Universal Robots held approximately 40-50% of the global cobot market share, underscoring their pivotal role in advancing automation and enhancing productivity worldwide.

Fetch Robotics

Based in San Jose, California, Fetch Robotics provides a range of AMRs designed for material handling and data collection in sectors such as e-commerce, manufacturing, and logistics. Their robots, including the Fetch and Freight models, are known for their versatility in automating repetitive tasks, thereby improving operational efficiency. Fetch Robotics also offers cloud-based software, FetchCore, enabling users to monitor and control their robotic fleet remotely, facilitating seamless integration into existing workflows.

Mobile Industrial Robots (MiR)

Headquartered in Odense, Denmark, MiR specializes in developing user-friendly, flexible, and safe AMRs that assist companies in automating internal transportation and logistics. Their robots are utilized across diverse industries, including manufacturing, healthcare, and logistics, to streamline workflows and reduce operational costs. MiR's commitment to innovation is evident in their continuous development of advanced robots equipped with the latest navigation technologies, enhancing efficiency and safety in dynamic environments.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Integration of Advanced Technologies

Companies like Universal Robots and Mobile Industrial Robots (MiR) are enhancing their product offerings by incorporating cutting-edge technologies. For instance, MiR's MC600 mobile collaborative robot combines the MiR600 autonomous mobile robot base with Universal Robots' UR20/UR30 collaborative robot arms. This integration enables the handling of heavier payloads and automates complex workflows in industrial environments, thereby expanding their market reach.

Expansion of Collaborative Ecosystems

Universal Robots has developed the UR+ ecosystem, a global network of over 1,200 companies. This platform fosters collaboration and innovation by allowing partners to develop and integrate compatible products and applications, thereby enhancing the versatility and appeal of their robotic solutions.

Strategic Partnerships and Joint Ventures

Key players are forming alliances to leverage shared expertise and resources. Universal Robots and MiR, both part of Teradyne Robotics, have established a joint headquarters in Odense, Denmark. This collaboration aims to create a dynamic environment for innovation, enabling both companies to benefit from increased cooperation and synergy.

RECENT HAPPENINGS IN THE MARKET

- In February 2025, Meta Platforms announced the establishment of a new division within its Reality Labs unit dedicated to developing AI-powered humanoid robots for physical tasks. This initiative signifies Meta's entry into the robotics arena, leveraging its AI models, known as Llama, to create consumer humanoid robots. The new robotics group will be led by Marc Whitten, former CEO of Cruise.

- In February 2025, Lyft revealed a partnership with Mobileye and Marubeni to introduce self-driving robo-taxis by 2026. The rollout will commence in Dallas, with plans to expand to additional cities. Mobileye will supply the autonomous driving system, while Marubeni will provide the fleet of taxis. This collaboration reflects the growing trend in autonomous vehicle services.

- In January 2025, Australian company Applied EV announced a partnership with Japan's Suzuki to develop autonomous electric vehicles designed for tasks considered dull or dangerous, such as retail delivery, mining, and warehouse transit. This collaboration aims to address labor shortages and enhance efficiency in various industries by automating monotonous tasks.

MARKET SEGMENTATION

This research report on the global autonomous mobile robots market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

By Battery Type

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

By Application

- Sorting

- Transportation

- Assembly

- Inventory Management

- Others

By Payload Capacity

- Below 100 kg

- 100 kg - 500 kg

- More than 500 kg

By End Use

- Manufacturing

- Automotive

- Aerospace

- Electronics

- Chemical

- Pharmaceuticals

- Plastics

- Defense

- FMCG

- Others

- Wholesale & Distribution

- E-commerce

- Retail Chains/Conveyance Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the Autonomous Mobile Robots (AMR) market globally?

The growth is driven by rising automation in industries, advancements in AI and sensor technologies, and increasing demand for efficient logistics solutions in e-commerce and manufacturing.

Which industries are the biggest adopters of Autonomous Mobile Robots?

E-commerce, manufacturing, healthcare, retail, and warehousing are the leading industries adopting AMRs for material handling, inventory management, and transportation.

What are the latest technological advancements in Autonomous Mobile Robots?

AI-powered navigation, real-time data analytics, 5G connectivity, edge computing, and enhanced safety sensors are some of the latest advancements in AMRs.

What is the future outlook for the Autonomous Mobile Robots market?

The market is expected to grow steadily, driven by advancements in AI, rising demand for automation, and expanding applications across industries.

4o

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]