Global Automotive Sunroof Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report, Segmented By Material (Glass and Fabric), Product (Inbuilt, Panoramic, Tilt & Slide, Top Mount, and Pop-up Sunroof), Vehicle (Passenger Cars, Light Commercial, and Electric) And Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Automotive Sunroof Market Size

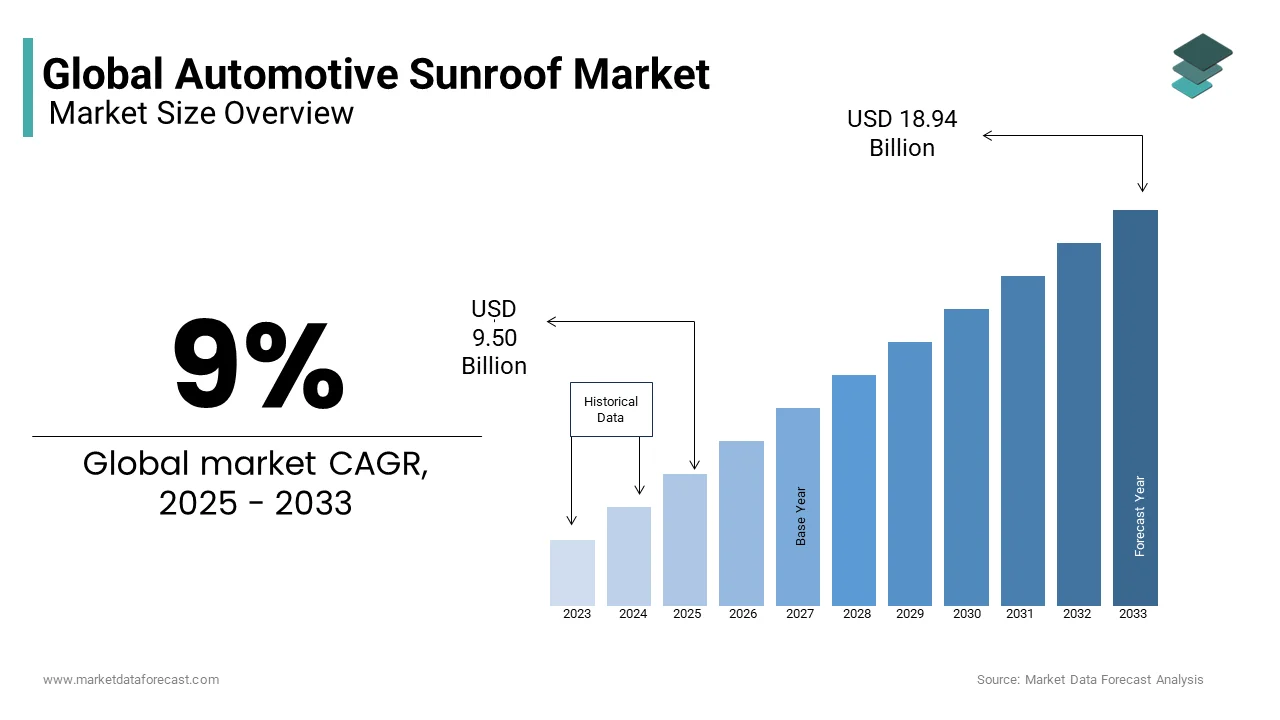

The global automotive sunroof market was valued at USD 8.72 billion in 2024 and is anticipated to reach USD 9.50 billion in 2025 from USD 18.94 billion by 2033, growing at a CAGR of 9.00% during the forecast period from 2025 to 2033.

Current Scenario of the Global Automotive Sunroof Market

An automotive sunroof is a window in the roof of a car that allows fresh air and light to enter the vehicle's interior. Sunroofs can be operated manually or electrically, and come in a variety of sizes, forms, and styles, depending on the vehicle. They improve passenger comfort by improving air circulation and delivering enhanced brightness and illumination during the day. OEMs have begun to offer panoramic, low-cost pop-up sunroofs or optional sunroof systems, as well as various spoiler-type miniature sunroofs, to mid-segment automobiles, in addition to luxury and premium vehicles.

MARKET DRIVERS

The increased popularity of mid-segment automobiles can be attributed to a growing consumer preference for vehicles that provide both aesthetic safety and comfort characteristics. The sunroof is a suitable alternative since it reduces noise while keeping the car well-ventilated and providing fresh airflow, which improves occupant comfort levels.

Automatic opening and shutting systems are quickly becoming standard in a wide range of vehicles due to their convenience. Various governments, particularly those in developing countries, are actively encouraging ecologically friendly automobiles to comply with increasingly stringent emission regulations. The electricity generated by the solar roof can be used to power the car's electrical equipment, such as seat heaters and air conditioning systems. As a result, efficiency improves, which has a positive impact on the operational range of an electric car.

MARKET RESTRAINTS

Vehicle weight reduction is a priority for manufacturers since it improves braking, acceleration, and fuel efficiency. Heavy equipment like the fuel tank, engine, and others are normally positioned as low as possible to optimize handling and vehicle stability. Regular assemblies, on the other hand, weigh between 20 and 30 kg depending on the size, and the panoramic sunroof can weigh up to 90 kg.

In addition to the required electric motor, drainage channel, and reinforcing bars, panoramic glass roofs weigh more since glass is significantly heavier and thicker than aluminum or steel roof panels. As a result, the added weight might have a substantial impact on the vehicle's fuel efficiency. In addition, glass or clear synthetic resin is utilized, and its ability to insulate from outside temperature is inferior to that of a regular vehicle roof. It's also possible that rain will seep through the rubber sealant between the window panel and the roof. They are both expensive to install and expensive to repair.

Impact Of COVID-19 On The Automotive Sunroof Market

During the COVID-19 pandemic, the global automotive sunroof market was hindered due to the shutting down of manufacturing units which halted the supply chain. The drop in demand amidst the pandemic, resulting from lockdowns and a fall in per capita income worldwide, also threatened the automotive market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.00% |

|

Segments Covered |

By Material, Product, Vehicle, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Yachiyo Industry Co Ltd (Japan), Aisin Seiki Co Ltd (Japan), CIE Automotive SA (Spain), Automotive Sunroof-Customcraft Inc (Canada), Magna International (Canada), Inteva Products LLC (US), Johnan America Inc (US), Inalfa Roof Systems Inc (Netherlands), Valmet Automotive (Finland), BOS GMBH & Co KG (Germany), and Others. |

SEGMENTAL ANALYSIS

By Material Insights

In 2020, the glass sector had the biggest market share, and it is predicted to increase at an exponential rate throughout the forecast period. This segment's increased popularity can be due to technology breakthroughs and material innovations such as improved sunroof glazing that has reduced overhead safety concerns and glass that can reflect UV rays. Because they allow a direct flow of natural light and promote natural air circulation within the vehicle, glass sunroofs can lessen dependency on the vehicle's air conditioning system. As a result of falling convertible car sales, the market for fabric sunroofs is likely to shrink over the forecast period.

By Product Insights

The inbuilt segment is expected to have the largest market share due to OEMs preferring to provide inbuilt in their cars as well as additional functions such as vents, sunshades, auto-close, and others that improve vehicle comfort levels. Because of the high demand for vehicles with short roof sizes and the ease of operation provided by their simple sliding process, the tilt and slide segment is expected to grow strongly in this market.

In this segment, the panoramic category is expected to increase significantly. Panoramic roofs cover a greater area, allowing both front and rear-seat passengers to benefit from increased natural freshness, and they are typically included as standard equipment in high-end vehicles. This segment's positive growth can be attributed to several causes.

The pop-up segment is expected to rise steadily in this market, owing to its lower cost compared to other varieties and the fact that certain vehicles have a completely removable function. The top mount section of the market is also predicted to increase steadily, as they offer more headroom and are often equipped with wind deflectors, which reduce unwanted noise at high speeds.

By Vehicle Insights

The passenger automobile segment of the business is expected to grow significantly in the next years. The introduction of cost-effective alternatives that provide natural ventilation and greater comfort without the large expenses associated with sunroof installation and maintenance has resulted in considerable growth in this area.

The light commercial vehicle category is predicted to grow fast in the market over the projection period, owing to the growing popularity of sports utility vehicles, particularly in emerging markets.

The electric vehicle (EV) segment of the market is also expected to rise significantly. The good growth of the electric car segment can be attributed to the introduction of sunroofs as a standard feature, improved all-around vision, and early adoption of novel materials.

REGIONAL ANALYSIS

In the Asia Pacific, the market for automobile sunroofs is characterized by rising population disposable income combined with a surge in demand for premium vehicles in growing economies such as China and India. To meet the increased demand, automakers have been aggressively expanding this region's domestic production capacity. Furthermore, government measures to stimulate the adoption of electrified vehicles, as well as the surge in mass-market cars that provide sunroofs as an optional feature, have boosted demand for in-vehicle sunroofs.

Europe is predicted to have the second-largest market share for automobile sunroofs. Factors driving market growth in this region include rising passenger car sales despite strict emission regulations in place, as well as the presence of manufacturers such as Audi, BMW, and Mercedes-Benz, which are leaders in technological innovation and are also established players in the premium vehicle segment.

This market is expected to grow steadily in North America, with the United States accounting for the largest share. This region has established itself as a steady contributor to the industry due to the early adoption of comfort-oriented features and the high adoption rate of sports utility vehicles.

KEY MARKET PLAYERS

Yachiyo Industry Co Ltd (Japan), Aisin Seiki Co Ltd (Japan), CIE Automotive SA (Spain), Automotive Sunroof-Customcraft Inc (Canada), Magna International (Canada), Inteva Products LLC (US), Johnan America Inc (US), Inalfa Roof Systems Inc (Netherlands), Valmet Automotive (Finland), BOS GMBH & Co KG (Germany). Some of the market players dominate the global automotive sunroof market.

RECENT HAPPENINGS IN THE GLOBAL AUTOMOTIVE SUNROOF MARKET

- A sunroof is a car that is a window in the roof that enables fresh air and light into the vehicle's interior. Sunroofs are available in a range of sizes, shapes, and styles, depending on the vehicle. They can be operated manually or electronically. During the day, they boost passenger comfort by enhancing air circulation and providing increased brightness and illumination. In addition to luxury and premium vehicles, OEMs have begun to offer panoramic, low-cost pop-up sunroofs or optional sunroof systems, as well as numerous spoiler-type micro sunroofs, to mid-segment vehicles.

- Magna's FreeFormTM seating technology is the perfect solution for automakers looking to differentiate themselves through aesthetics. The innovative seat trim technology, which will debut on four new cars, one later this year and three in 2022, delivers a clean, contoured, and smooth aesthetic surface and allows for a variety of design alternatives.

- Lightyear One, an electric car powered in part by integrated solar cells built by Lightyear from the Netherlands, has signed a letter of intent with VALMET AUTOMOTIVE. The electric vehicles will be manufactured at the Finnish automaker's assembly plant in Uusikaupunki, Southern Finland, in the first half of 2022.

MARKET SEGMENTATION

This research report on the global automotive sunroof market is segmented and sub-segmented into the following categories.

By Material

- Glass

- Fabric

By Product

- Inbuilt

- Panoramic

- Tilt & Slide

- Top Mount

- Pop-up Sunroof

By Vehicle

- Passenger Cars

- Light Commercial

- Electric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global automotive sunroof market?

The market is growing due to rising consumer demand for premium features, increasing vehicle production, and advancements in sunroof technology such as panoramic and solar roofs.

Which types of sunroofs are most popular?

Panoramic and tilt-and-slide sunroofs are in high demand, especially in SUVs and luxury vehicles, due to their aesthetic appeal and enhanced passenger experience.

What regions dominate the automotive sunroof market?

Europe and Asia-Pacific lead the market, with China and Germany being major contributors due to strong automotive industries and rising disposable incomes.

Who are the key players in the market?

Major players include Webasto, Inalfa Roof Systems, Yachiyo Industry, Inteva Products, and Aisin Seiki, known for innovation and wide OEM partnerships.

What challenges does the market face?

High installation costs, potential for water leakage, and complexity in maintenance are key challenges limiting sunroof adoption in lower-end vehicle segments.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]