Global Automotive Refinish Coatings Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Primer, Basecoat, Clearcoat, Activator, Filler & Putty, and Others), Technology (Solvent-borne Coatings, Water-borne Coatings, and UV-cured Coatings), Resin Type (Polyurethane, Alkyd, Acrylic, and Others), Distribution Channels (Automotive OEMs and Aftermarket), Vehicle Type (Passenger Cars, Commercial Vehicles, and Two Wheelers), and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

Global Automotive Refinish Coatings Market Size (2024 to 2032)

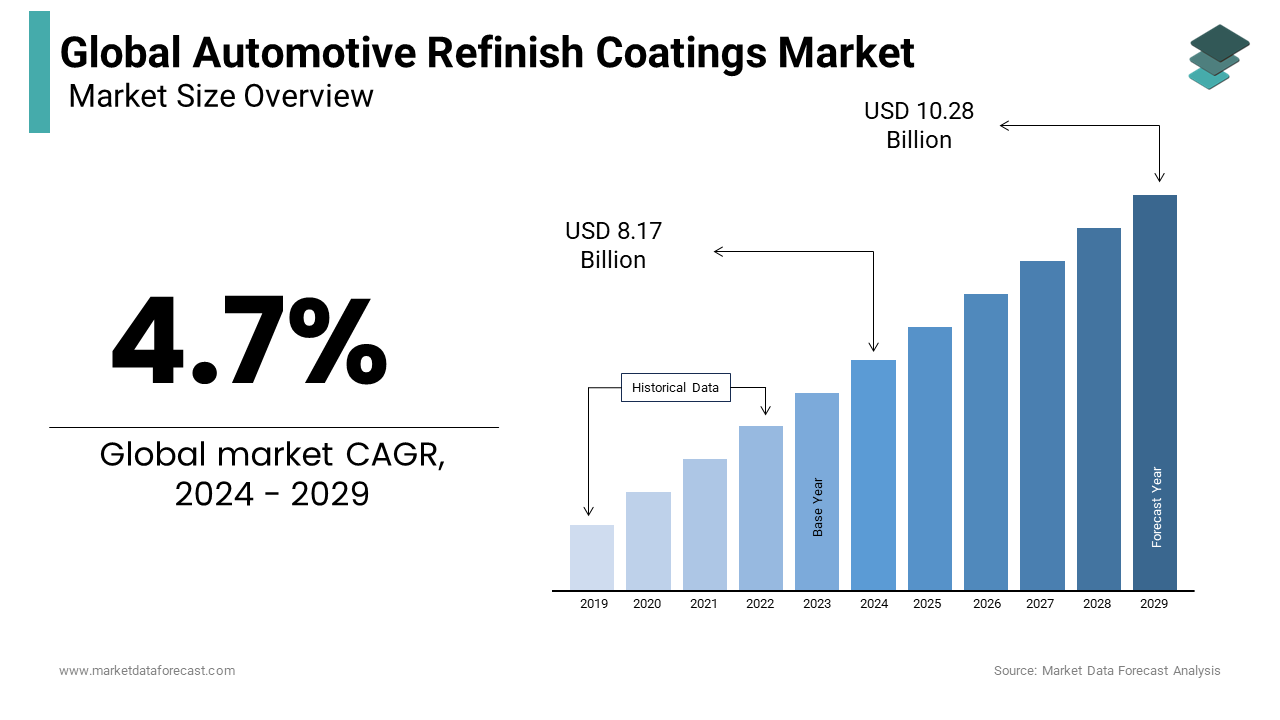

The global automotive refinish coatings market size was valued at USD 7.80 billion in 2023, and the market size is expected to reach USD 11.80 billion by 2032 from USD 8.17 billion in 2024. The market's promising CAGR for the predicted period is 4.7%.

MARKET OVERVIEW

Automotive refinish coatings in favor of more lucrative options. The loss of market share is more related to the clear coatings segment in the automotive refinish coatings market. The colorless varnishes segment in North America is predicted to be worth more than $ 625 million by the end of 2026.

Europe is far behind in the finish coatings segment of the automotive refinish coatings market. The escalating need for timely maintenance and repair of motor vehicles to improve the appearance and durability of vehicles by protecting them from external factors such as temperature and UV radiation is an innate requirement. To achieve this goal, auto refinish coatings are invented and are frequently employed by end-users in the auto aftermarket. A growing call for aesthetic finishes for vehicles around the world has led to major innovations in the operation of automotive refinish coatings. There are many developments in this context, including the invention of high-tech coating materials that are environmentally friendly and, at the same time, low insolvent.

MARKET TRENDS

The combined primers and basecoats segment has the majority share of the automotive refinish coatings market by coating structure segment. An absolute dollar opportunity of approximately US $ 1.2 billion can be seized in the primer segment of the auto refinish coatings market from 2017 to 2022. After North America, Europe is the second biggest regional contributor to the primer industry coating for car repainting. However, the APEJ is predicted to grow with the highest CAGR during the foreseen period.

MARKET DRIVERS

The escalating use of topcoats for automotive service, aftermarket repair, and painting due to visual appearance, surface protection and corrosion resistance, extreme weather conditions, temperature, heat, and water should promote the expansion of the industry. In addition, the growing need for custom designs and paints on vehicles is likely to support expansion. The growing awareness of protecting vehicle paints by repairing scratches and damage to vehicle surfaces has fueled market expansion in the United States. Foreseen period. Escalated consumption of water-based, high solids UV-cured coatings due to zero VOC emissions is predicted to drive the expansion of the automotive to refinish coatings market over the foreseen period. With the expansion in the gross domestic product (GDP) and rising revenues, car sales are on the rise, driving up the consumption of refinish coatings in emerging economies such as India and China. Escalating people's worldwide disposable income is predicted to drive expansion in passenger cars, which in turn is predicted to drive expansion in auto repair OEMs and the aftermarket. Low-cost, high-performance overcoats and people's changing mindset to keep their vehicles in good condition in terms of appearance and performance are leading to the expansion of the overcoat industry. Additionally, falling fuel prices and rising vehicle registrations and miles driven are predicted to drive expansion in the automotive refinish coatings market. Escalating disposable income has made it possible for many people to buy luxury cars and maintain their appearance and performance on the road, a determining factor in the call for auto refinish coatings.

MARKET RESTRAINTS

The volatility of raw material prices, as well as escalated spending on road infrastructure, will hamper the expansion of the industry.

MARKET OPPORTUNITIES

Advances in technology, along with continued product development to improve topcoat performance, will drive market expansion for years to come. Additionally, the government's efforts to reduce VOC emissions by deploying environmentally friendly technology will create new market opportunities during the foreseen period. Escalated investment in R&D and the introduction of new technologies have improved the quality of products that provide superior protection to automobiles. Escalating production of light commercial vehicles and passenger cars is predicted to drive the call for refinishing coatings in the coming years, thus supporting market expansion. The establishment of manufacturing facilities in economic expansion regions, the increase in traffic accidents, and vehicle customization are factors that are predicted to drive the expansion of the Coatings market.

MARKET CHALLENGES

The call for solvent-based coatings is gradually decreasing because they contain volatile organic compounds (VOCs). Solvent-based coatings consist of liquefying agents intended to evaporate by chemical reaction with oxygen.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.7% |

|

Segments Covered |

By Product Type, Technology, Resin, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Market Leaders Profiled |

KCC Corporation (South Korea), BASF SE (Germany), Mitsui Chemicals, Inc. (Japan), PPG Industries, Inc. (US), Nippon Paint (Japan), KAPCI Coatings (Egypt), The Valspar Corporation. (US), The Sherwin-Williams Company (US), 3M (US), Akzo Nobel N.V (The Netherlands), Kansai Paint Co., Ltd (Japan), Covestro AG (Germany), Esdee Paints Limited (India), Axalta Coating Systems, LLC (US), The Lubrizol Corporation (US), Berger Paints India Limited (India) |

DETAILED SEGMENTATION OF THE GLOBAL AUTOMOTIVE REFINISH COATINGS MARKET INCLUDED IN THIS REPORT

This research report on the global automotive refinish coatings market has been segmented and sub-segmented based on product type, technology, resin, and region.

Global Automotive Refinish Coatings Market By Product Type

- Primer

- Basecoat

- Clearcoat

- Activator

- Filler & putty

- Topcoat

- Others

Topcoats became the leading product segment in 2019, accounting for 35.5% of total volume. It is widely employed in car refinishing as a top coat on car surfaces.

Global Automotive Refinish Coatings Market By Technology

- Solvent-borne coatings

- Water-borne coatings

- UV-cured coatings

Solvent-based technologies accounted for 49.6% of worldwide volume in 2019. The segment is predicted to experience slow expansion due to strict regulations on VOC emission levels.

Global Automotive Refinish Coatings Market By Resin

- Polyurethane

- Alkyd

- Acrylic

- Others

Polyurethane was the most employed resin in 2019 and represented 44.2% of the worldwide volume.

REGIONAL ANALYSIS

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Asia-Pacific accounted for 42.5% of worldwide revenue in 2023 and is predicted to maintain its lead over the foreseen period.

The strong automobile manufacturing base in China, Japan and India, along with escalated passenger car sales, is predicted to boost market expansion in the coming years. Underdeveloped road networks, lack of adequate safety laws, and escalatingcall for vehicle maintenance, repair, and modification are predicted to have a positive impact on the expansion of the industry. The escalating use of old reconditioned vehicles due to lifestyle trends is predicted to support product calls during the foreseen period.

China is predicted to see strong expansion due to the escalating number of traffic accidents and the increase in the number of vehicle owners during the foreseen period. Rapid development and modernization will likely lead to an increase in the number of vehicle sales. The Middle East and Africa are predicted to grow at a CAGR of 5.5% in volume terms over the foreseen period due to the escalating call for maintenance of luxury vehicles and high-performance vehicles in the UAE, United States, and Saudi Arabia. The increase in disposable income in the region due to the maturity of the oil and gas industry has escalated the sale of luxury vehicles in the region, thus supporting the expansion of the refinish applications market.

KEY PLAYERS IN THE GLOBAL AUTOMOTIVE REFINISH COATINGS MARKET

KCC Corporation (South Korea), BASF SE (Germany), Mitsui Chemicals, Inc. (Japan), PPG Industries, Inc. (US), Nippon Paint (Japan), KAPCI Coatings (Egypt), The Valspar Corporation. (US), The Sherwin-Williams Company (US), 3M (US), Akzo Nobel N.V (The Netherlands), Kansai Paint Co., Ltd (Japan), Covestro AG (Germany), Esdee Paints Limited (India), Axalta Coating Systems, LLC (US), The Lubrizol Corporation (US), Berger Paints India Limited (India) are some of the notable companies in the global automotive refinish coatings market.

RECENT HAPPENINGS IN THE MARKET

-

For the auto body shops of the future: BASF launches a new line of water-based undercoats. As a pioneer in aqueous coating solutions for the automotive industry, BASF's Coatings division now introduces its new, most advanced line of finishing products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]