Global Automotive RADAR Market Size, Share, Growth, Trends, And Growth Forecast Report, Segmented By Range Type (Long Range RADAR and Short and Medium Range RADAR), Application (ACC, AEB, FCWS, BSD, and Intelligent Parking Assistance), Frequency (2X-GHz and 7X-GHz), Vehicle Type (Commercial Vehicle, Economic Passenger Vehicle and Luxury Passenger Vehicle, Mid-Price Passenger Vehicle), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East and Africa), Industry Analysis From (2025 to 2033)

Global Automotive RADAR Market Size

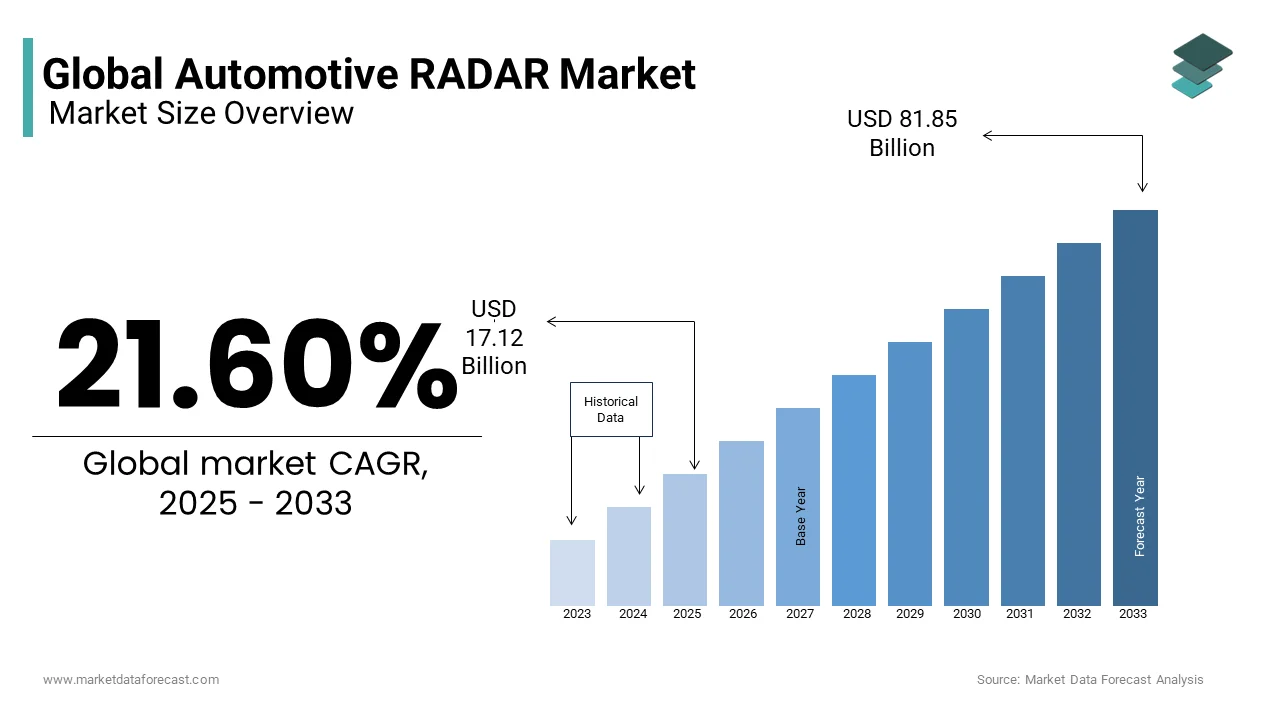

The global automotive radar market was valued at USD 14.08 billion in 2024 and is anticipated to reach USD 17.12 billion in 2025 from USD 81.85 billion by 2033, growing at a CAGR of 21.60% during thew forecast period from 2025 to 2033.

Automotive radar includes a transmitter that sends the radio waves that connect an object to the receiver and therefore, the receiver operates the movement or the direction of the vehicle. The global automotive radar market is predicted to grow during the foreseen phase because the growing concern regarding security issues while driving the car will help to raise the market. Automakers are also shifting their focus from manual cars to autonomous cars, which will successively increase the automotive radar market.

Stringent government-favorable initiatives within the field of radar systems have adversities in the event of auto safety systems and are predicted to drive the widespread adaption of radar-based security systems over the foreseen phase. Moreover, the decline in the prices of vehicle electronics and developments in automotive engineering is determined to fuel the use of automotive radars. Its installation enables the exact detection of objects and secures better vehicle safety.

The main restraint for this market is the use of the RADAR detector, which is taken into account as illegal in certain countries. A RADAR sensor is often installed in an automobile during its production period, and these automobiles are often offered for a purchase that is acceptable in most countries, but if a RADAR detector is purchased separately by an individual, it is often misused and should result into accidents and loss of life. However, it's illegal in certain countries, and violation of an equivalent ends in fines, seizure of the device, or both.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

21.60% |

|

Segments Covered |

By Application, Frequency Type, Vehicle Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Robert Bosch GmbH (Germany), HELLA KGaA (Germany), Continental AG (Germany), Denso Corporation (Japan), Delphi Automotive PLC (U.K.), Autoliv Inc. (Sweden), and Valeo S.A. (France), Infineon Technologies AG (Germany), NXP Semiconductors N.V, and Others. |

SEGMENT ANALYSIS

By Application Insights

The market share for ACC was the highest in 2024 due to the widespread adoption in prominent automotive markets, like the U.S., Germany, and China, among others. Additionally, the AEB segment is predicted to grow as one with the fastest CAGRs over the foreseen phase. Government initiatives, like the delicensing of radar frequencies and raised investment by automakers for the event of low-cost radar-based safety systems, are projected to boost growth over the foreseen phase.

By Frequency Type Insights

The RADAR of 7 X-GHz sensors is projected to steer the worldwide automotive radar market during the foreseen phase. The interest in the 7X-GHz segment is often attributed to the advantages offered by these sensors in various ADAS applications. 7X-GHz RADAR sensors are utilized in adaptive control, emergency braking systems, and collision avoidance systems, among others. The marketplace for these technologies is on the rise due to their better resolution and range capability.

2X-GHz frequency bands are mostly used for small-range software. It is available at a lower cost without any settlement in the high-end features.

By Vehicle Type Insights

The passenger Vehicle segment is predicted to grow at a faster rate than the commercial vehicles segment. The foremost factor driving the growth of this segment is the rising awareness regarding vehicle safety among mid-priced vehicle owners. Consistent with OICA, globally, the passenger vehicles segment witnessed a rise of 4.5% in 2016 compared to 2015. As passenger vehicles are steadily adopting the radar-based safety system, the global automotive radar market is projected to gain traction over the forecast period.

However, the increasing logistics industry and hiking e-commerce have targeted sales for commercial vehicles. The increasing consumer expectations for vehicle autonomy among commercial vehicles are additionally supposed to trigger the expansion of the segment.

REGIONAL ANALYSIS

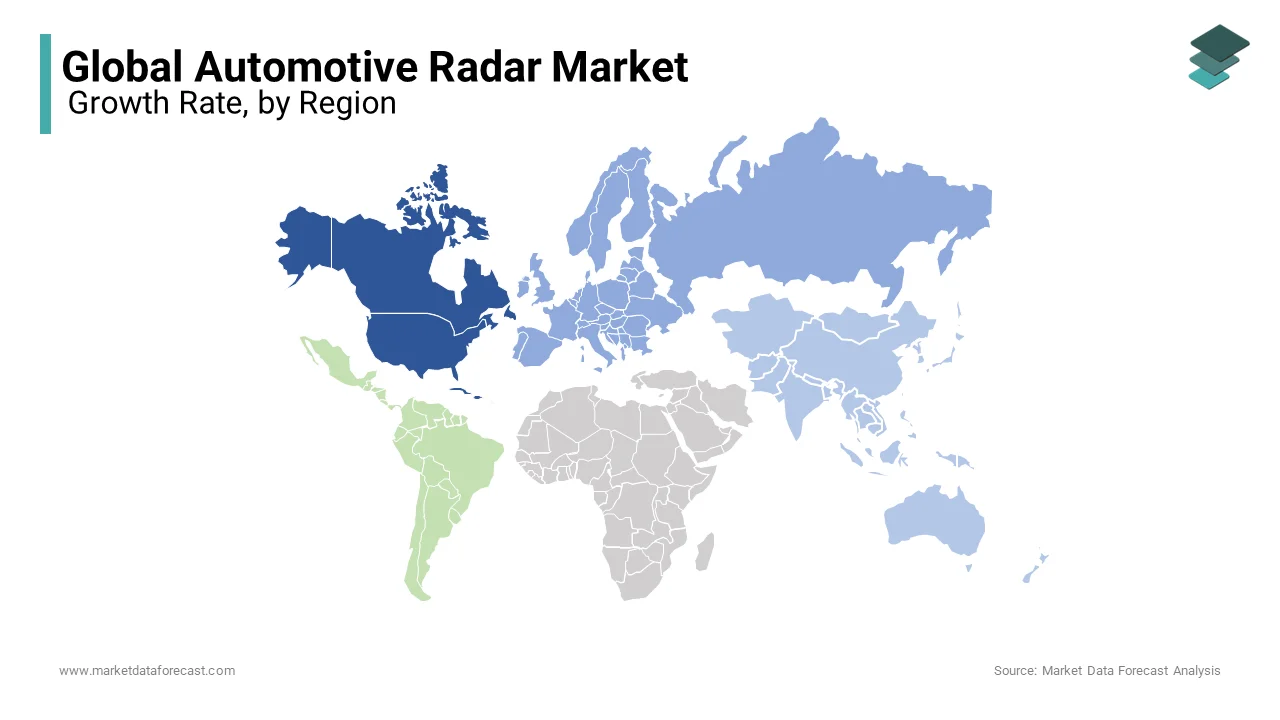

North America is showing substantial growth and is likely to continue this trend over the foreseen phase. Europe accounted for a notable part of the worldwide market in terms of value and is predicted to grow at a CAGR of 17.8% over the foreseen phase. This will be attributed to the EU Commission's rising stringency of auto safety norms. German automakers hold up to 70% of the premium vehicle production. However, the nation's automotive industry spends approximately 33% of its revenue on R&D development. Thus, the German automotive radar market is foreseen to record the most crucial share by 2025.

Compared to other regions, Asia-Pacific (APAC) is predicted to witness the fastest growth within the global automotive radar market over the foreseen phase. It's mainly because of the rising income in the developing countries of the APAC region, like India and China, which results in an increasing demand for premium vehicles.

KEY MARKET PLAYERS

Major players in the global market are Robert Bosch GmbH (Germany), HELLA KGaA (Germany), Continental AG (Germany), Denso Corporation (Japan), Delphi Automotive PLC (U.K.), Autoliv Inc. (Sweden), Valeo S.A. (France), Infineon Technologies AG (Germany), NXP Semiconductors N.V.

RECENT HAPPENINGS IN THIS MARKET

- Bosch has introduced a replacement long-range radar sensor. Like its predecessors, it uses the 77-gigahertz frequency bandwidth. It's also additionally even more powerful, compact, and more cost-effective than its direct predecessor.

- This new (third-generation Long Range Radar) automotive radar sensor system from Robert Bosch GmbH will apply a chip from Infineon Technologies’ (Radar System IC) product family. Bosch introduced the LRR3 for adaptive controllers at ranges up to 250 m.

- Oculii and HELLA introduced a tactical Partnership to showcase the Radar Perception Platform That Scales from ADAS to Autonomous Driving – HELLA Ventures Becomes Investor. Oculii’s particular Virtual Space Imaging Application Technology fundamentally expands the angular resolution of a radar-phased array, significantly improving the security, reliability, and efficiency of autonomous vehicles.

MARKET SEGMENTATION

This market research report on the global automotive RADAR market is segmented and sub-segmented into the following categories.

By Application

- Adaptive Cruise Control (ACC)

- Autonomous Emergency Braking (AEB)

- Blind Spot Detection (BSD)

- Forward Collision Warning System

- Intelligent Park Assist

- ADAS Applications

By Frequency Type

- 2X-GHZ Systems

- 7X-GHZ Systems

By Vehicle Type

- Commercial Vehicles

- Economic Passenger Vehicle

- Luxury Passenger Vehicle

- Mid-Price Passenger Vehicle

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the Global Automotive RADAR market?

As of the latest data, the Global Automotive RADAR market is estimated to be USD 17.12 billion in 2025.

Which factors are driving the growth of Automotive RADAR in Europe?

The growth of Automotive RADAR in Europe will be attributed to the rising stringency of auto safety norms by the EU Commission.

What are the emerging trends in Automotive RADAR market in North America?

Emerging trends include the integration of RADAR with other sensor technologies, the development of 4D imaging RADAR, and the increased use of RADAR in North America.

what are the key market players involved in Automotive RADAR market

Major players in the global market are Robert Bosch GmbH (Germany), HELLA KGaA (Germany), Continental AG (Germany), Denso Corporation (Japan), Delphi Automotive PLC (U.K.), Autoliv Inc. (Sweden), Valeo S.A. (France), Infineon Technologies AG (Germany), NXP Semiconductors N.V.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com