Global Automated Trucks Market Size, Share, Trends, And Growth Forecasts Report Segmented By Level of Automation (Level-3, Level-4, Level-5), Truck Type (Cab Integrated, And Cabless Trucks), End-Use Industry (Mining, Logistics, And Construction and Ports), And Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From (2025 to 2033)

Global Automated Trucks Market Size

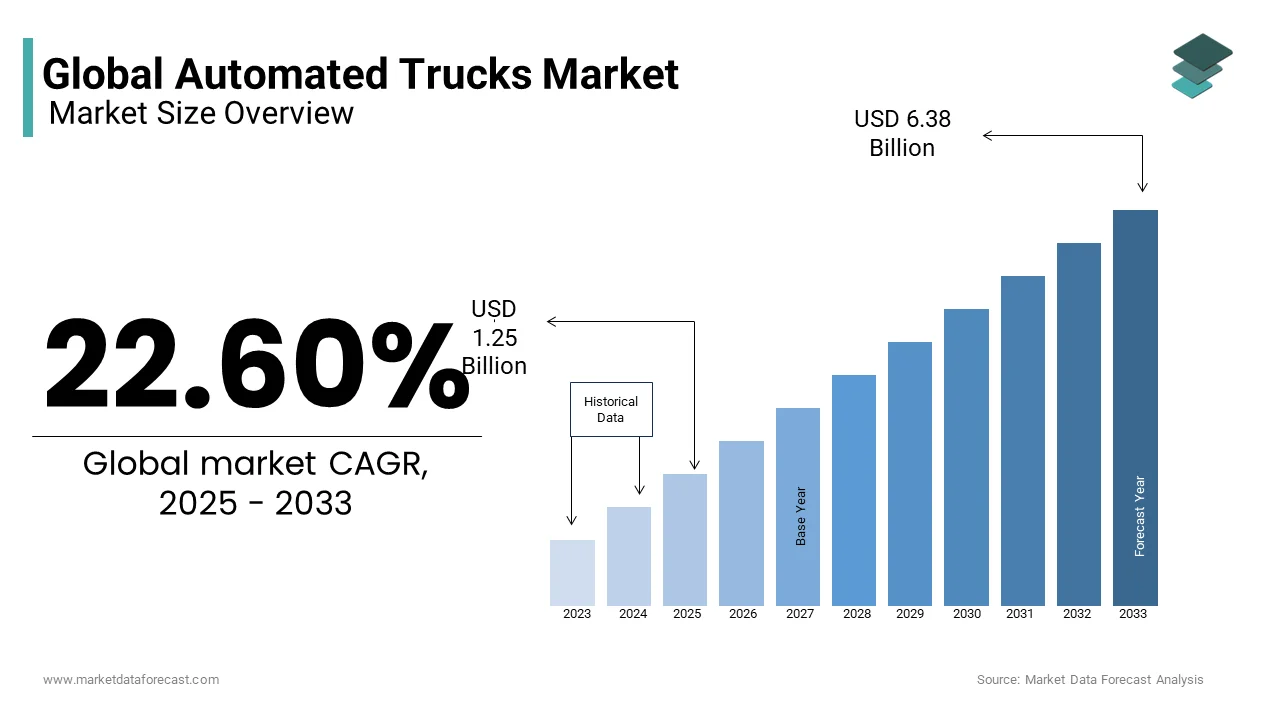

The global automated trucks market was valued at USD 1.02 billion in 2024 and is anticipated to reach at USD 1.25 billion in 2025 from USD 6.38 billion by 2033, growing at a CAGR of 22.60% during the forecast period from 2025 to 2033.

Automated trucks, also known as self-driving trucks, are one of AI's miracles. These trucks use artificial intelligence (AI) software, Light Detection & Scope (LiDAR), and RADAR sensing technology, which is used to monitor the scope of 60 meters of the vehicle and to create a precise 3D map of the current environment. The car was designed to work between destinations without a human operator. We use sensors and software to track, control, and run the vehicle. Amid a sea full of innovations driving top-of-the-line technology in the automotive industry, automated trucks are overtaking and speeding up to rapid adoption in end-use industries. The trend of electrically driven vehicles has turned the automated truck arena green, making it easier for manufacturers to move past the environmental barriers.

MARKET DRIVERS

The lack of drivers in developed countries has provided a significant boost to the scramble of various industries towards automated trucks, which are likely to remain key drivers of the automated trucks market. The sharp increase in sales of these trucks needs a thorough assessment to gauge the growth prospects of the overall landscape. The investments of top companies into automation drives are another significant driver of the automated truck market. The environmental concerns are making people move cleaner and methods such as electric vehicles, and many of these vehicles also come with the extension of automation.

MARKET RESTRAINTS

Government concerns and restrictions about the loss of jobs in a few places and people's safety concerns are what are hindering the automated truck market. The automated trucks market is a competitive one with many regional players and many other large MCNs. Few of these companies are continually investing in R&D for better and smarter technologies. It is a bit difficult for new companies to join the game for market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.60% |

|

Segments Covered |

By End-Use Industry, Level Of Automation, Truck Type, And Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BMW AG, Otto Motors, Isuzu Motors Limited, General Motors, Daimler AG, AB Volvo, Tesla, Toyota, Waymo, Volkswagen, and Others. |

SEGMENTAL ANALYSIS

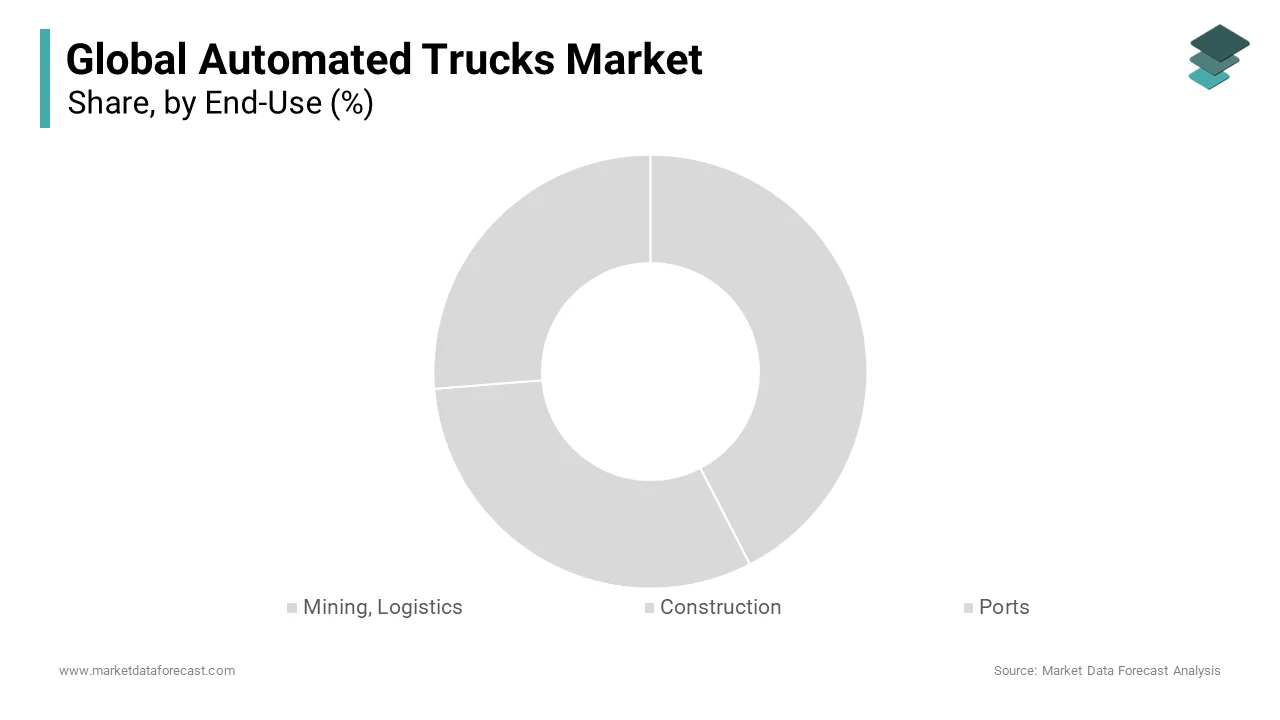

By End-Use Industry Insights

The growing digital shopping behavior of consumers has increased the appetite for streamlined logistics among fleet management companies seeking reduced operating costs. As such, the logistics industry is at the forefront of the automated truck take-up curve. The mining industry is likely to remain an attractive end-use industry by 2019, as mining companies are deliberating on efforts to improve their production capacity to meet the growing demand for minerals from manufacturing sectors. After 2019, e-commerce platforms are rising rapidly, and their need for logistics is likely to reduce the market share of the mining industry in terms of volume.

By The Level of Automation Insights

Level 3: A driver is still required, but if specific criteria are met, it is not necessary to navigate or monitor the area. Nevertheless, the driver must remain ready to resume control of the vehicle once the conditions for the ADS have ceased to be met.

Level-4: The vehicle can perform all driving functions and does not allow the driver to remain ready for navigation. Moreover, under certain conditions, such as off-road driving or other forms of abnormal or dangerous situations, the accuracy of ADS navigation may be compromised. The driver may be able to control the vehicle.

Level-5: The ADS system is sophisticated enough to allow the vehicle to perform all driving functions, regardless of the conditions.

Level 5 automated trucks remain highly favored in the mining industry as they operate without any driver assistance and operate with the aid of cloud data and artificial intelligence. However, automated Level 3 trucks will exceed the Level 5 acceptance rate of automated vehicles and account for ~40% of the total market share at the end of the forecast period, as they form an integral part of automated trucks. In contrast, the high cost of Level 5 automated trucks would redirect sales to Level 3 trucks.

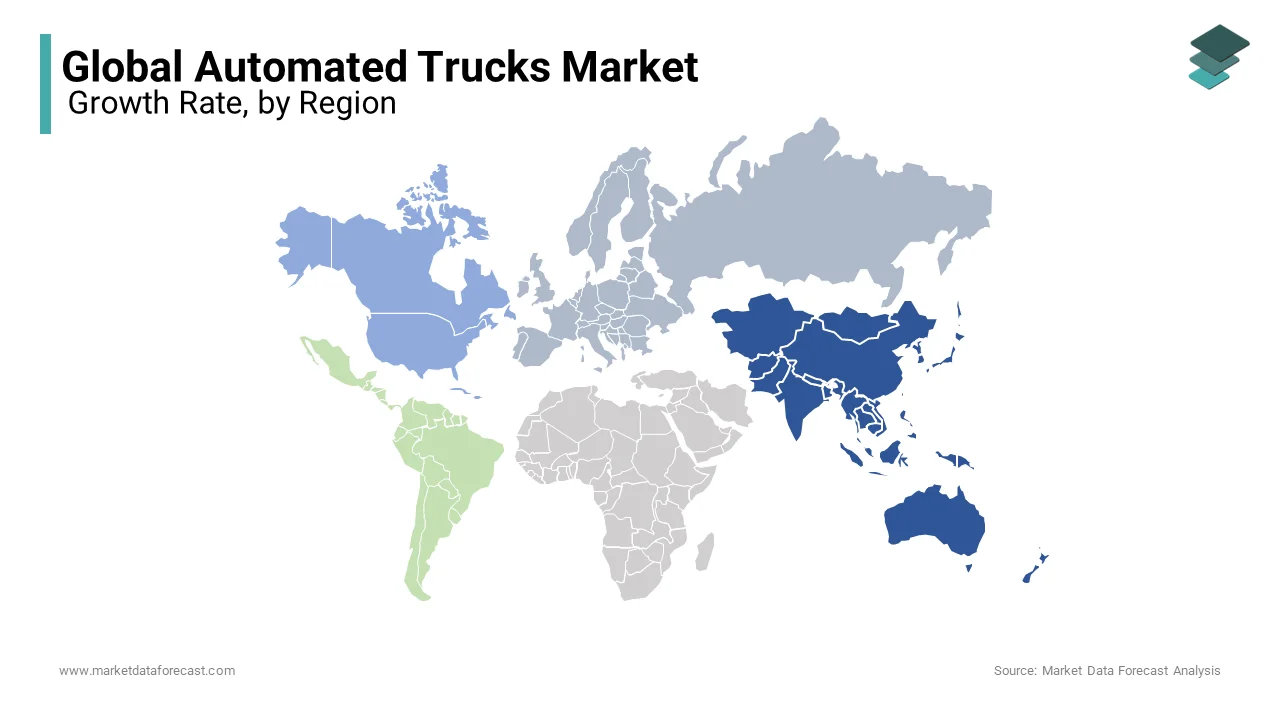

REGIONAL ANALYSIS

Geographically, Asia Pacific is likely to remain a key automated truck market, as demand for automated trucks for mining activities has increased in Australia, and improved road infrastructure is likely to bump up their sales to the logistics industry as well. In addition, the lack of drivers in developed regions, such as the United States and Japan, would remain a major opportunity for automated trucks to enter these regions.

KEY MARKET PLAYERS

Some of the key players dominating the global automated trucks market are BMW AG, Otto Motors, Isuzu Motors Limited, General Motors, Daimler AG, AB Volvo, Tesla, Toyota, Waymo, and Volkswagen.

RECENT HAPPENINGS IN THE MARKET

- Recently, Daimler, a multinational automaker, acquired Torc Robotics, an American independent vehicle company to integrate autonomous vehicle technology. Torc Robotics has a collaboration with Caterpillar, an American manufacturer and supplier of engines, machinery, and other equipment for the production of self-driving technology for mining and agricultural applications.

- In April 2019, the California government announced a regulation introduced by the State Department of Motor Vehicles that would require the testing of self-driving trucks on public roads.

MARKET SEGMENTATION

This research report on the global automated trucks market has been segmented and sub-segmented into the following categories.

By End-Use Industry

- Mining, Logistics

- Construction

- Ports

By The Level of Automation

- Level-3

- Level-4

- Level-5

By Truck Type

- Cab Integrated

- Cabless Trucks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global automated trucks market?

As of the latest data, the global automated trucks market is valued at USD 1.25 billion in 2025.

Which regions contribute significantly to the growth of the automated trucks market in North America?

Key contributors to market growth in North America include the United States and Canada, with increased adoption driven by the need for efficient logistics and the automation of freight operations.

What technological advancements are driving the automated trucks market in Japan?

Technological advancements in Japan focus on AI-driven navigation systems, advanced sensor technologies, and vehicle-to-everything (V2X) communication, enhancing the capabilities of automated trucks.

How is the Automated Trucks Market in China adapting to urban mobility challenges?

In China, the market is adapting to urban mobility challenges by developing automated trucks tailored for last-mile delivery, reducing congestion, and improving delivery speed in urban areas.

who are the key market players dominating the global automated trucks market?

Some of the key players dominating the global automated trucks market are, BMW AG, Otto Motors, Isuzu Motors Limited, General Motors, Daimler AG, AB Volvo, Tesla, Toyota, Waymo, Volkswagen.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]