Global Auto parts Market Size, Share, Trends & Growth Forecast Report – Segmented By End-User (OEM, Aftermarket), Distribution Channel (Offline, Online) And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) - Industry Analysis Forecast (2025 to 2033)

Global Auto Parts Market Size

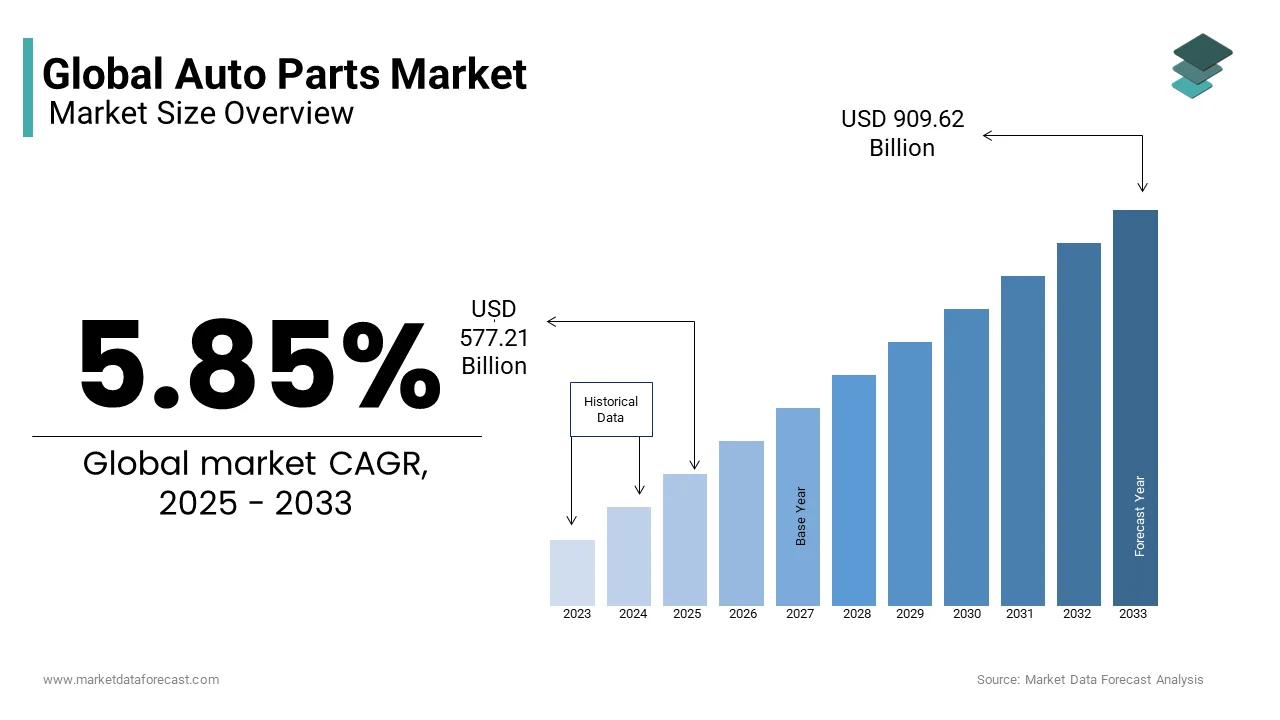

The global auto parts market size was valued at USD 545.31 billion in 2024 and is anticipated to reach USD 577.21 billion in 2025 from USD 909.62 billion by 2033, growing at a CAGR of 5.85% during the forecast period from 2025 to 2033.

The auto parts market includes everything involved in making, selling, and distributing parts needed for vehicle production, maintenance, and repairs. The rising complexity of vehicle technology, the growing popularity of electric vehicles (EVs), and advancements in automation and connectivity are promoting the demand for auto parts worldwide. According to the International Organization of Motor Vehicle Manufacturers (OICA), over 80 million vehicles were produced globally in 2021, showing a recovery from the pandemic. Additionally, the total number of cars worldwide crossed 1.57 billion in 2023. As EVs gain popularity, the demand for parts like batteries, powertrains, and charging systems is increasing, making them a major focus for auto parts manufacturers.

Market Drivers

More Vehicles Being Produced

One of the biggest reasons the auto parts market is growing is the rising number of vehicles being manufactured worldwide. In 2021, global vehicle production increased by 3%, signaling recovery after the pandemic. The International Organization of Motor Vehicle Manufacturers (OICA) expects this trend to continue, especially in fast-growing economies. More vehicle production means a higher demand for parts like engines, transmissions, and safety systems. Additionally, with more cars on the road, there is an increasing need for auto parts in both the OEM and aftermarket segments, ensuring long-term market growth.

Advancements in Vehicle Technology

New vehicle technologies, especially in electric and self-driving cars, are driving demand for innovative auto parts. According to the International Energy Agency (IEA), the number of electric vehicles (EVs) worldwide surpassed 16.5 million by the end of 2021, and EVs are expected to make up 35% of global car sales by 2030. This shift is increasing the need for specialized auto parts such as advanced batteries, electric motors, and charging systems. Additionally, the rise of autonomous vehicles is fueling demand for high-tech components like sensors, radars, and artificial intelligence (AI) systems, pushing auto parts suppliers to innovate and keep up with industry changes.

Market Restraints

Supply Chain Problems

One of the biggest challenges in the auto parts market is supply chain disruptions. The COVID-19 pandemic caused major delays in manufacturing due to shortages of important materials like semiconductors. According to the U.S. Department of Commerce, a lack of these chips caused a global loss of 7.7 million vehicles in 2021. These chips are essential for modern vehicle systems, and without them, production slows down for both new vehicles and replacement parts. On top of this, delays in transporting raw materials and increased production costs make it harder for auto parts manufacturers to meet demand.

Rising Costs of Raw Materials

The increasing cost of raw materials is another big challenge for the auto parts market. According to the World Bank, global prices for essential materials like steel and aluminum rose sharply in 2021. Steel prices alone increased by 23% from 2020 to 2021, as reported by the U.S. Bureau of Labor Statistics. Since these metals are used in many vehicle components, higher costs lead to increased production expenses for auto parts manufacturers. As a result, auto parts become more expensive, which may slow down sales and reduce overall market growth.

Market Opportunities

Rising Demand for Electric Vehicles (EVs)

The growing popularity of electric vehicles (EVs) presents a major opportunity for the auto parts industry. According to the International Energy Agency (IEA), the total number of EVs worldwide crossed 16.5 million in 2021, and global EV sales are expected to rise significantly by 2030. As more EVs hit the road, there is a greater demand for specialized parts such as electric drivetrains, battery management systems, and charging infrastructure. Governments and automakers worldwide are pushing for cleaner transportation, which is encouraging auto parts suppliers to focus on EV-related components, making this a key area for growth.

Advancements in Self-Driving Technology

The development of self-driving technology is creating new opportunities for auto parts manufacturers. According to the U.S. Department of Transportation (DOT), the market for autonomous vehicles is expected to be worth $60 billion by 2030. This growth is fueled by advancements in artificial intelligence (AI), machine learning, and vehicle connectivity. Self-driving cars rely on complex systems such as LIDAR, radar sensors, cameras, and high-precision GPS, which increases the demand for these advanced components. As automakers continue to work toward fully autonomous vehicles, auto parts suppliers have a chance to lead innovation in this growing sector.

Market Challenges

Lack of Skilled Workers

The auto parts industry is facing a labor shortage, with not enough skilled workers to meet demand. According to the U.S. Bureau of Labor Statistics (BLS), the manufacturing sector could have up to 2.1 million unfilled jobs by 2030 due to a lack of qualified workers. This problem is made worse by the rapid advancement of technology in the auto industry, which requires workers to have specialized knowledge of electric drivetrains, robotics, and automation. Without enough skilled labor, companies struggle to keep up with demand, slowing production and innovation in the auto parts market.

Strict Government Regulations

Auto parts manufacturers must comply with increasingly strict environmental regulations, which can be costly and complex. According to the U.S. Environmental Protection Agency (EPA), the Clean Air Act aims to reduce vehicle emissions by 2035, requiring significant changes in how auto parts are made. Similarly, the European Union’s Green Deal sets a goal for Europe to be climate-neutral by 2050, which means automakers must shift to cleaner vehicle technologies. These regulations require auto parts companies to invest in new manufacturing processes and cleaner technologies. While necessary for sustainability, compliance with these laws can increase production costs and pose challenges for smaller manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.85% |

|

Segments Covered |

By End-user, Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Co, AISIN CORP., Akebono Brake Industry Co. Ltd., Autoliv Inc., BorgWarner Inc., Brembo Spa, General Motors Co., HELLA GmbH and Co. KGaA, Hyundai Motor Co., Lear Corp. |

SEGMENT ANALYSIS

Auto Parts Market Analysis By End-User

The OEM (Original Equipment Manufacturer) segment dominated the market by accounting for 56.1% of the global market share in 2024. The dominating position of OEM segment in the global market is primarily due to the strong demand for components in the production of new vehicles. In 2021, global vehicle production was over 80 million units which further boosts the demand for OEM parts. OEM parts are integral to maintaining vehicle quality, performance, and warranty compliance which is making this segment essential for automakers and consumers who prioritize reliability and performance in new vehicles.

The aftermarket segment is projected to grow at the fastest CAGR of 6.5% from 2025 to 2033 owing to factors such as the increasing size of the global vehicle fleet and longer vehicle lifespans. According to a study, the average age of vehicles in the U.S. reached 12.1 years in 2021, up from 9.6 years in 2002. As vehicles age, the need for replacement parts, maintenance and upgrades rises significantly and thus propelling the demand for aftermarket parts. The segment benefits from consumers’ preference to extend the life of their existing vehicles instead of purchasing new ones.

Auto Parts Market Analysis By Distribution Channel

The offline segment ruled the market by holding 71.4% of the global market share in 2024. The domination of offline segment in the global market is majorly attributed to the widespread presence of physical retail stores, auto repair shops, and service centers where customers can directly interact with professionals. According to the U.S. Bureau of Labor Statistics, the automotive repair and maintenance industry generated over $70 billion in revenue in 2020 which is showcasing the importance of offline sales. The hands-on experience, immediate product availability, and professional installation services offered by offline retailers continue to drive consumer preference and is making it the leading channel for auto parts sales.

The online segment is projected to witness the highest CAGR of 10.2% over the forecast period. The shift towards e-commerce in the auto parts sector is driven by factors such as convenience, competitive pricing, and the ability to compare products easily. According to the U.S. Census Bureau, e-commerce sales in the U.S. reached over $870 billion in 2021, with a growing share attributed to automotive parts. Additionally, the pandemic has accelerated the trend of consumers turning to online platforms for purchasing auto parts, enhancing the segment's growth and transforming consumer buying behaviours.

REGIONAL ANALYSIS

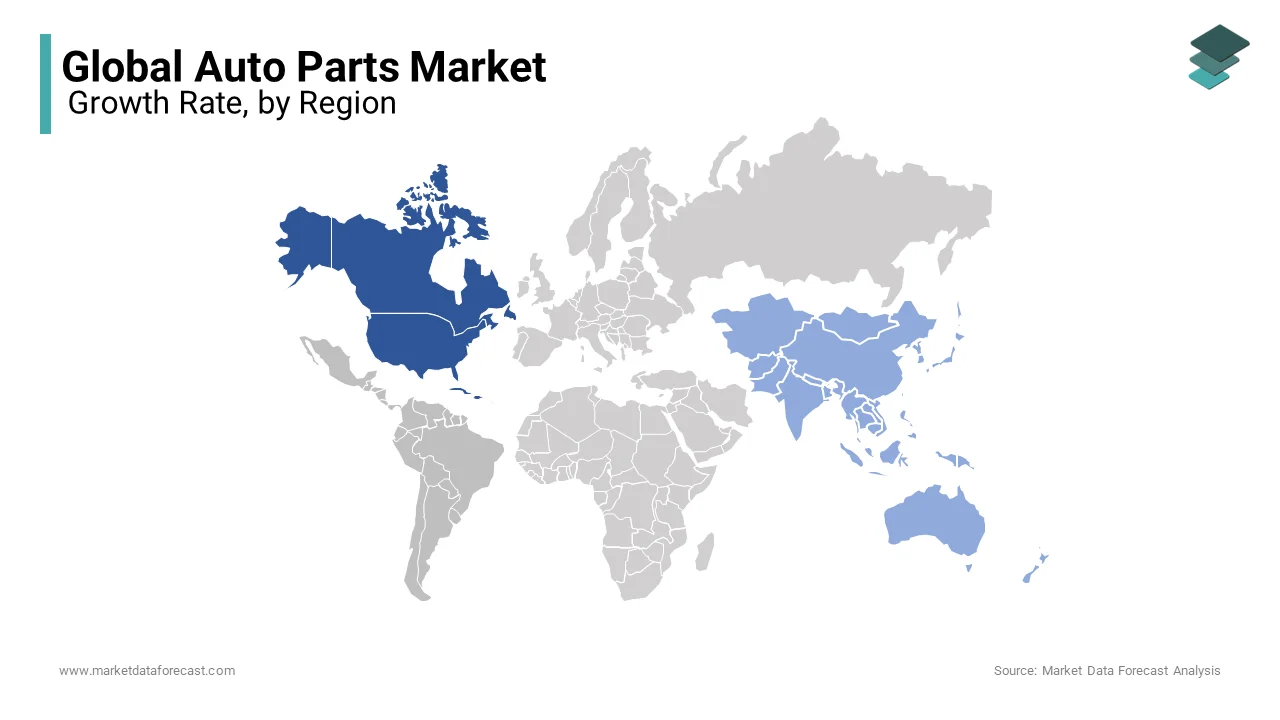

North America held the commanding share of the global auto parts market in 2024. The leading position of North America is largely due to the well-established automotive industry in the U.S. and Canada. According to the U.S. Bureau of Economic Analysis, the automotive sector contributed $450 billion to the U.S. GDP in 2020. Additionally, the U.S. Bureau of Transportation Statistics reports that the average age of vehicles on U.S. roads reached 12.1 years in 2021 that is indicating a high demand for replacement and aftermarket parts. The large vehicle fleet and high vehicle production, combined with the region’s preference for high-quality parts, make North America a dominant force in the auto parts market.

The Asia-Pacific region is predicted to grow at highest CAGR of 7.2% over the forecast period owing to the booming automotive markets in China, India, and Japan. According to the International Organization of Motor Vehicle Manufacturers (OICA), China produced 26 million vehicles in 2021, marking it as the world’s largest vehicle producer. Additionally, the rising incomes and expansion of the middle class in countries like India are fueling the demand for vehicles and auto parts. With electric vehicle adoption accelerating in the region, the Asia-Pacific market is poised for continued expansion in both OEM and aftermarket segments.

Europe remains a significant player in the global auto parts market, with consistent growth driven by high production and demand for advanced vehicle technologies. According to the European Automobile Manufacturers' Association (ACEA), the European Union produced 10 million vehicles in 2021. As the region transitions to electric vehicles, supported by the EU's Green Deal aiming for climate neutrality by 2050, the demand for parts related to electric drivetrains and EV infrastructure will continue to rise. Europe's focus on sustainability and innovation, coupled with its strong automotive industry, supports a steady demand for both OEM and aftermarket parts.

Latin America's auto parts market is expected to experience moderate growth, supported by increasing vehicle sales and rising urbanization. In 2021, Brazil produced 2.2 million vehicles, according to the International Organization of Motor Vehicle Manufacturers (OICA). While economic challenges persist in the region, vehicle ownership is steadily increasing, particularly in countries like Brazil and Mexico. As more consumers purchase vehicles, the demand for replacement parts, maintenance services, and upgrades will grow. The aftermarket segment and in particular will benefit from this trend, driving further market expansion.

The Middle East and Africa are showing strong potential for growth in the auto parts market. According to the International Trade Administration, vehicle sales in the UAE and Saudi Arabia are on the rise. The Middle East, particularly in cities like Dubai, is also seeing an increase in electric vehicle adoption, which is expected to boost demand for specialized parts. Economic diversification efforts in several countries are helping to increase disposable income, further supporting vehicle ownership. Although the region is still influenced by oil price fluctuations, the growing automotive market and infrastructure development will lead to increased demand for both OEM and aftermarket auto parts.

Top 3 Players in the market

Robert Bosch GmbH

Robert Bosch GmbH is one of the largest and most influential players in the global auto parts market, headquartered in Stuttgart, Germany. Bosch has an extensive portfolio of products that span across nearly every automotive system, from powertrains to safety systems, making it a critical supplier for automakers worldwide. The company is known for its technological innovation, particularly in the fields of electrification, automation, and connected mobility. Bosch is a major provider of electric vehicle (EV) components, including powertrains, electric motors, and charging infrastructure, driving the global transition towards sustainable automotive solutions. Additionally, its advanced driver-assistance systems (ADAS), including radar sensors and camera systems, are key enablers of autonomous driving. Bosch's commitment to sustainability and reducing emissions is also evident in its focus on developing cleaner technologies and eco-friendly vehicle systems, positioning itself as a leader in the future of mobility.

Denso Corporation

Denso Corporation, based in Kariya, Japan, is a global leader in automotive components and systems, with a broad range of products designed to improve vehicle performance, safety, and comfort. As one of the world’s largest auto parts suppliers, Denso has made significant contributions to both traditional internal combustion engines (ICE) and emerging electric vehicle (EV) technologies. The company is well-regarded for its expertise in powertrain solutions, including fuel injectors, starters, and air conditioning systems, all of which help improve fuel efficiency and reduce emissions. Denso is also heavily involved in the development of advanced electronics such as sensors, ADAS, and infotainment systems, which are critical for the advancement of autonomous driving and connected vehicles. As the automotive industry increasingly embraces electrification, Denso has adapted by producing EV-specific components like battery management systems, power inverters, and electric motors, establishing itself as a key player in the EV market.

Magna International

Magna International, headquartered in Aurora, Canada, is one of the largest automotive suppliers in the world, providing a diverse range of products across vehicle systems, including powertrains, chassis, electronics, and seating. Magna’s ability to innovate and integrate complex vehicle systems has made it a crucial partner for automakers around the globe. The company has been at the forefront of the electric vehicle revolution, developing key EV components such as electric drivetrains, battery enclosures, and power electronics. Magna is also heavily invested in autonomous driving technologies and connected vehicle solutions, offering advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication systems. Its extensive manufacturing footprint, spanning North America, Europe, and Asia, enables Magna to provide efficient, high-quality solutions for automakers worldwide. As the automotive industry continues to shift toward electric, autonomous, and connected vehicles, Magna’s contributions position it as a vital player in shaping the future of the automotive sector.

Top strategies used by the key market participants

Bosch - Investment in Electric Mobility and Sustainability

Bosch has made significant investments in electric mobility and sustainable automotive solutions to strengthen its market position. Recognizing the global shift toward electrification, the company has expanded its portfolio to include key components for electric vehicles (EVs) such as electric motors, power electronics, battery management systems, and charging infrastructure. Bosch is also focused on sustainability by developing technologies that reduce emissions and improve fuel efficiency. Its efforts include offering eco-friendly solutions like regenerative braking systems, advanced fuel injection systems, and emission control technologies. By aligning itself with the automotive industry's transition to cleaner and more sustainable mobility, Bosch ensures its position as a leader in both traditional and electric vehicle systems. This forward-looking approach allows Bosch to not only maintain relevance but also drive innovation in a rapidly changing market.

Denso - Focus on Advanced Technologies and Autonomous Driving

Denso’s strategy revolves around integrating cutting-edge technologies into its product offerings, particularly in the areas of autonomous driving and connected vehicles. The company is heavily invested in developing advanced driver-assistance systems (ADAS), including sensors, cameras, radar, and software platforms, which are crucial for the development of self-driving cars. Denso also focuses on enhancing vehicle connectivity through infotainment and telematics systems, keeping pace with the growing demand for smart, connected vehicles. Additionally, Denso is positioning itself as a key supplier for the electrification of vehicles by producing EV-specific components such as electric motors, inverters, and battery systems. By prioritizing technological advancement, Denso is not only securing its role in the future of mobility but also establishing itself as an innovation leader in the highly competitive automotive market.

Magna International - Strategic Partnerships and Acquisitions

Magna International leverages strategic partnerships and acquisitions as a key part of its strategy to maintain a competitive edge in the auto parts market. The company has formed numerous alliances with automakers and technology firms to co-develop next-generation vehicle technologies, particularly in the fields of electric and autonomous vehicles. For example, Magna has partnered with leading EV manufacturers to supply critical components like electric drivetrains, battery enclosures, and power electronics. Additionally, Magna has acquired several companies to expand its capabilities in areas such as advanced driver-assistance systems (ADAS) and autonomous driving technologies. These acquisitions not only strengthen Magna’s product offerings but also enhance its ability to innovate and respond quickly to changing market demands. By strategically positioning itself through partnerships and acquisitions, Magna ensures it stays at the forefront of automotive advancements and secures a leading role in the future of mobility.

Robert Bosch GmbH - Diversification and Product Integration

Bosch's strategy of diversification and product integration has played a pivotal role in strengthening its market position. The company has diversified its product offerings across multiple automotive sectors, including powertrains, safety systems, infotainment, and connected vehicle technologies. Bosch’s approach to integrating these products—such as combining its advanced sensors and software for ADAS with its electric powertrains and fuel-efficient technologies—allows it to offer comprehensive solutions to automakers. This integration not only strengthens Bosch’s relationships with customers but also enables the company to be a one-stop supplier for various automotive systems. By offering a wide range of products that are compatible across different vehicle types and embracing new technologies such as autonomous driving and electrification, Bosch has maintained a dominant presence in both traditional and next-generation vehicle markets.

Denso - Global Expansion and Localized Manufacturing

Denso employs a strategy of global expansion combined with localized manufacturing to strengthen its position in the global automotive parts market. The company operates manufacturing facilities in key automotive hubs across Asia, North America, Europe, and beyond, ensuring it can cater to regional demands efficiently. By localizing production, Denso is able to better serve its customers with faster delivery times, lower logistics costs, and products tailored to regional regulatory requirements and market preferences. This global footprint enables Denso to stay competitive in the fast-changing automotive landscape while mitigating risks related to supply chain disruptions. The company’s ability to leverage local expertise and global scale has positioned it as a trusted supplier for automakers worldwide.

Magna International - Focus on Product Innovation and R&D

Magna International has placed a strong emphasis on product innovation and research and development (R&D) to maintain its leadership in the auto parts market. The company allocates significant resources to R&D to develop innovative solutions that address the evolving needs of automakers, particularly in the areas of electric vehicles (EVs), autonomous driving, and advanced manufacturing processes. Magna’s R&D investments have led to the creation of state-of-the-art systems such as advanced safety technologies, lightweight materials for fuel efficiency, and cutting-edge powertrains for EVs. This commitment to innovation not only enhances Magna’s product offerings but also ensures that it remains at the forefront of market trends, particularly as the automotive market moves toward electric and autonomous vehicles.

KEY MARKET PLAYERS

3M Co, AISIN CORP., Akebono Brake Industry Co. Ltd., Autoliv Inc., BorgWarner Inc., Brembo Spa, General Motors Co., HELLA GmbH and Co. KGaA, Hyundai Motor Co., Lear Corp. these are the market players that are dominating the global auto parts market.

COMPETITIVE LANDSCAPE

The global auto parts market is highly competitive, characterized by a diverse array of players vying for dominance across various segments, including powertrains, electronics, safety systems, and advanced technologies for electric and autonomous vehicles. Competition is driven by several factors, including technological innovation, cost efficiency, product diversification, and the growing shift toward electric mobility. Major suppliers like Robert Bosch, Denso, Magna International, and Continental AG dominate the market, leveraging their extensive R&D capabilities, global manufacturing footprints, and deep partnerships with automakers to maintain a competitive edge.

As the automotive industry increasingly embraces electrification, autonomous driving, and connected vehicle technologies, auto parts suppliers must adapt to these transformative trends. The rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has led to increased competition in areas like battery management systems, electric drivetrains, and autonomous technologies. This shift has spurred significant investment from leading suppliers to stay ahead of market demands, with companies ramping up their efforts in EV components, safety systems, and digital cockpit solutions.

At the same time, suppliers are under pressure to deliver cost-effective solutions while meeting strict environmental regulations. Smaller suppliers and new entrants are also intensifying competition, particularly in niche markets like electric vehicle components and lightweight materials, pushing market giants to continually innovate and streamline operations to retain market share.

RECENT HAPPENINGS IN THIS MARKET

- In January 2025, Bain Capital reported that it invested in Dhoot Transmission, a prominent Aurangabad-based automotive component manufacturer, acquiring a minority stake for an undisclosed amount. This investment aims to leverage Bain's global experience to broaden Dhoot Transmission's international presence through strategic acquisitions and partnerships, foster innovation, and strengthen its position in rapidly growing sectors like electric vehicles.

MARKET SEGMENTATION

This research report on the global auto parts market is segmented and sub-segmented into the following categories.

By End-User

- OEM

- Aftermarket

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global auto parts market?

The current market size of the global auto parts market size was valued at USD 577.21 billion in 2025.

What are the market drivers that are driving the global auto parts market?

More vehicles are being produced and Advancements in vehicle technology are the market drivers that are driving the global auto parts market.

What segments are added in the global auto parts market?

Segments that are added in this market are the end-user, distribution channel, and region.

Who are the market players that are dominating the global auto parts market?

3M Co, AISIN CORP., Akebono Brake Industry Co. Ltd., Autoliv Inc., BorgWarner Inc., Brembo Spa, General Motors Co., HELLA GmbH and Co. KGaA, Hyundai Motor Co., Lear Corp. these are the market players that are dominating the global auto parts market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]