Australia Nuclear Magnetic Resonance (NMR) Market Research Report – Segmentation By Type (Low-field NMR Spectroscopy, High-field NMR Spectroscopy), End-use (Academic, Pharmaceutical & Biotech Companies, Agriculture & Food, Chemical Industry, Others), and Country – Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast (2024 to 2032).

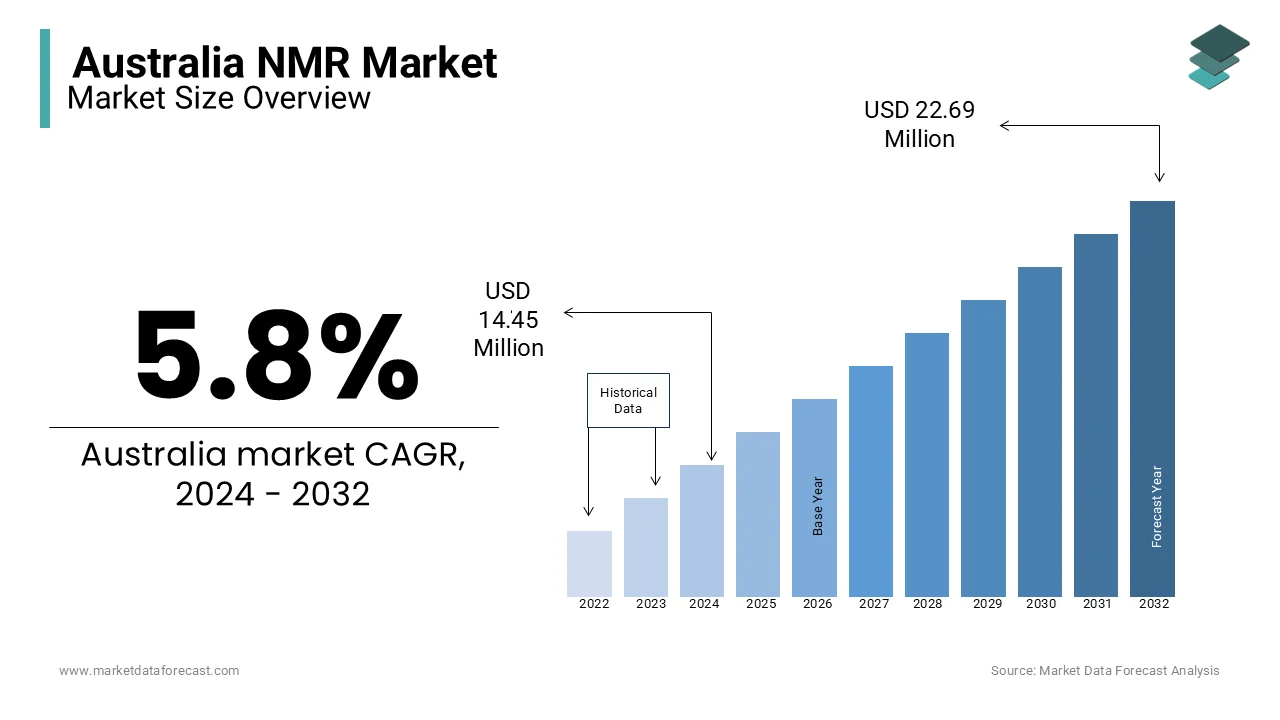

Australia Nuclear Magnetic Resonance (NMR) Market Size (2024-2032)

The Australia NMR market was valued at US$ 13.66 million in 2023 and is anticipated to reach US$ 22.69 million by 2032 from US$ 14.45 million in 2024 and registering a CAGR of 5.8% during the foreseen period from 2024 to 2032.

The nuclear magnetic resonance (NMR) thrives on its pivotal role in advancing research in pharmaceuticals, healthcare, and material sciences. NMR spectroscopy is instrumental in determining molecular structures and supporting drug discovery, metabolomics, and environmental studies. Australian universities and research institutions, such as CSIRO and the Australian Nuclear Science and Technology Organisation (ANSTO) are actively leveraging NMR for groundbreaking research. In healthcare, NMR is extensively used for metabolic profiling, aiding in the identification of biomarkers for conditions like cancer and neurodegenerative diseases. According to the University of Sydney,2023, the contribution to precision medicine with metabolomics shall improve diagnostic accuracy by over 25%. Additionally, Australia’s growing focus on renewable energy research has positioned NMR as a critical tool in developing advanced battery materials and hydrogen storage technologies. Backed by government funding and robust R&D frameworks, the NMR market in Australia fosters scientific innovation across diverse sectors.

MARKET DRIVERS

Expansion of Metabolomics in Healthcare

The increasing adoption of metabolomics in healthcare drives the Australian NMR market. NMR spectroscopy enables precise metabolic profiling, aiding in biomarker identification for diseases like cancer and cardiovascular disorders. Garvan Institute studies in 2023 have shown that metabolomics can improve early detection rates by up to 30% for certain cancers. Australian hospitals and research institutions are increasingly integrating NMR-based metabolomics into diagnostic and therapeutic processes in personalized medicine. This driver is further strengthened by government initiatives, such as the National Health and Medical Research Council's funding for advanced diagnostic technologies which ensures sustained growth in healthcare applications.

Rising Focus on Renewable Energy Research

Australia’s emphasis on renewable energy research significantly boosts NMR adoption. NMR plays a key role in analyzing advanced battery materials and hydrogen storage systems, critical for the country’s clean energy transition. NMR technology has become indispensable in material characterization with the Australian Renewable Energy Agency (ARENA) allocating over AUD 1 billion for innovative energy projects in 2023. Researchers report a 20% improvement in understanding battery performance using NMR according to University of Queensland, 2023 that further drives its application in energy-related studies.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

The Australia NMR market faces significant challenges due to the high cost of NMR spectrometers, which can range from AUD 500,000 to over AUD 3 million, depending on specifications. Maintenance and operational expenses, including cryogens like liquid helium, add to the financial burden, limiting adoption among smaller research facilities and private organizations. According to a 2023 study by the Australian Research Council, nearly 40% of academic institutions reported difficulty in acquiring advanced NMR systems due to budget constraints. These high costs hinder market expansion, especially for smaller organizations with limited funding opportunities.

Shortage of Skilled Operators

A limited workforce skilled in operating and interpreting data from NMR systems presents another restraint. Advanced NMR analysis requires specialized training in spectroscopy and data processing, and Australia faces a shortfall in experienced professionals. A report by the Australian Academy of Science (2023) highlighted a 20% gap in the required number of experts for complex research projects involving NMR. This shortage impacts the efficiency and scalability of research programs, delaying progress in fields such as healthcare and material science.

MARKET OPPORTUNITIES

Integration of NMR with Artificial Intelligence (AI)

The integration of NMR spectroscopy with AI presents a significant opportunity in Australia’s research landscape. AI-driven algorithms can process NMR data faster and with greater accuracy, reducing analysis time by up to 50% according to Australian National University, 2023. This is particularly beneficial in complex fields like metabolomics and drug discovery, where data sets are extensive. Australian startups and research institutions are increasingly collaborating to develop AI-powered NMR platforms, enhancing accessibility and efficiency. AI integration is poised to revolutionize how NMR technology supports diverse scientific endeavors, by addressing skill shortages and improving productivity.

Government Support for Research Infrastructure

Australia’s government is investing heavily in research infrastructure, creating opportunities for expanding NMR capabilities. Initiatives like the National Collaborative Research Infrastructure Strategy (NCRIS) provide funding for acquiring advanced NMR systems and upgrading existing facilities. In 2023, NCRIS allocated AUD 100 million to scientific infrastructure projects by enabling institutions to enhance their analytical tools. This support accelerates innovation in sectors like renewable energy and advanced materials, where NMR plays a crucial role. Organizations can drive advancements and strengthen Australia’s position as a leader in scientific research and development by leveraging this government backing.

MARKET CHALLENGES

Limited Access in Remote and Regional Areas

The Australia NMR market faces challenges in extending its reach to remote and regional areas. Most NMR facilities are concentrated in metropolitan hubs like Sydney and Melbourne by leaving regional research institutions and industries with limited access. A 2023 report by the Regional Australia Institute indicated that less than 15% of regional labs have access to advanced NMR systems, slowing scientific progress outside major cities. Transporting samples over long distances to centralized facilities adds to time and cost burdens that further constrains the adoption in these regions.

Helium Supply Constraints

Australia’s reliance on imported helium for cryogenically cooling NMR systems poses a significant challenge. Global helium shortages in 2023 caused price spikes of over 30% (CSIRO), increasing operational costs for NMR facilities. This volatility not only disrupts budgets but also forces researchers to seek alternative cooling methods which may not match helium’s effectiveness. Developing a stable domestic helium supply chain or investing in cryogen-free technologies could address this issue, but current constraints hinder market growth and operational efficiency.

SEGMENTAL ANALYSIS

Australia NMR Market Analysis By Product

- Instruments

- Consumables

The Instruments segment dominates the Nuclear Magnetic Resonance (NMR) spectroscopy market, accounting for approximately 81% of the total market share in 2023. This leadership is attributed to the critical role of NMR instruments in high-precision molecular analysis for applications in pharmaceuticals, structural biology, and material science. The introduction of cryogen-free systems has further enhanced instrument adoption by addressing operational cost challenges. Advanced NMR instruments have contributed to breakthroughs in drug discovery that improves success rates by up to 25% in preclinical studies according to Pharmaceutical Journal in 2023.

The Consumables segment is growing at the fastest rate, with a compound annual growth rate (CAGR) of 5.3% from 2024 to 2029). This growth is driven by the recurring demand for consumables like deuterated solvents, NMR tubes, and sample preparation kits, which are essential for daily NMR operations. Industries such as biotechnology and food safety rely heavily on these materials to maintain consistent experimental output. The consumables market's expansion is further fueled by increasing NMR adoption in quality control with consumable demand rising 15% annually in the pharmaceutical sector.

Australia NMR Market Analysis By Type

- Low-field NMR Spectroscopy

- High-field NMR Spectroscopy

The High-field NMR Spectroscopy segment accounts for approximately 89% of the global market in 2023. This dominance stems from its ability to achieve higher sensitivity and resolution, essential for detailed molecular structure analysis. High-field NMR systems operate at magnetic field strengths of 600 MHz and above which are widely used in drug discovery, metabolomics, and structural biology. For instance, research has shown that high-field NMR improves accuracy in identifying biomarkers by over 30% compared to low-field systems according to Nature Chemistry in 2023. Major pharmaceutical companies and academic institutions rely on these advanced systems for cutting-edge R&D, further driving market demand.

The Low-field NMR Spectroscopy segment is growing rapidly, with a projected CAGR of 14.65% from 2024 to 2030. This growth is fueled by the rising demand for portable, affordable systems suitable for routine applications in industries such as food safety and petrochemicals. For example, benchtop NMR systems have reduced analysis time in quality control by up to 40% that makes them a practical choice for small laboratories and manufacturers. Additionally, low-field systems have enabled greater adoption in educational settings where cost-effective instruments support hands-on learning for students.

Australia NMR MarketAnalysis By End-use

- Academic

- Pharmaceutical & Biotech Companies

- Agriculture & Food

- Chemical Industry

- Others

The Academic Institutions segment dominates the NMR spectroscopy market, holding approximately 47% of the total market share in 2023. NMR systems are integral to university research programs for applications such as structural biology, organic synthesis, and metabolomics. For example, according to Nature survey in 2023, the use of NMR in academic drug research has increased efficiency in identifying drug targets by up to 30%. Institutions like CSIRO and leading universities in Australia heavily invest in NMR technology for cutting-edge research. Government grants, such as Australia’s $1.6 billion National Health and Medical Research Council fund, support the acquisition and maintenance of these systems by solidifying academia’s role as a primary end-user.

The Agriculture & Food segment is experiencing rapid growth, with a projected compound annual growth rate (CAGR) of 7.2% from 2024 to 2029. NMR is increasingly utilized for compositional analysis and authenticity testing, detecting contaminants and verifying food integrity. For instance, studies show that NMR can identify adulterants in olive oil with 95% accuracy, ensuring compliance with quality standards according to Food Chemistry Journal, 2023. Rising consumer demand for safe & high-quality food and stringent regulatory requirements are driving the sector’s adoption of NMR technology.

COUNTRY LEVEL ANALYSIS

Australia's Nuclear Magnetic Resonance (NMR) spectroscopy market plays a vital role in advancing the country’s scientific research and industrial applications. Australia represents a modest portion of the global NMR market that valued at approximately USD 760.71 million in 2023. Its potential is underpinned by a strong focus on research and development (R&D) across pharmaceuticals, biotechnology, agriculture, and renewable energy. The global NMR market is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030, and Australia’s NMR market is expected to align with this trajectory by increasing adoption in academia and industry.

Australia hosts some of the most advanced NMR facilities globally by leading research institutions like the Commonwealth Scientific and Industrial Research Organisation (CSIRO), the University of Sydney, and Monash University. These institutions utilize NMR for groundbreaking studies in drug discovery, metabolomics, structural biology, and materials science. For instance, NMR spectroscopy has been pivotal in the identification of biomarkers for cancer and neurodegenerative diseases by contributing to a 30% improvement in diagnostic accuracy according to Garvan Institute of Medical Research in 2023.

In the renewable energy sector, NMR technology is being employed to enhance the efficiency of hydrogen storage and battery materials. Research conducted at the University of Queensland in 2023 demonstrated that using high-field NMR improved the analysis of battery components that optimizes performance by 20%. This positions Australia as a significant player in the global transition to clean energy.

The Australian government’s commitment to fostering scientific innovation is a critical driver for the NMR market. Through initiatives like the National Collaborative Research Infrastructure Strategy (NCRIS), over AUD 100 million has been allocated for upgrading research infrastructure by including NMR systems. This funding ensures access to high-end instruments for universities and research centers that enhances their ability to conduct cutting-edge studies.

Australia’s strategic focus on innovation ensures steady growth in its NMR market despite challenges like the high costs of NMR instruments and helium supply constraints. The country’s investments in integrating artificial intelligence (AI) with NMR are set to further enhance data analysis efficiency by paving the way for greater adoption across industries.

As Australia continues to emphasize R&D, its NMR market is poised to strengthen its position within the global landscape, driving advancements in science, healthcare, and energy sustainability.

KEY MARKET PLAYERS

Companies playing a prominent role in the australia NMR market include Bruker Corporation, JEOL Ltd., Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Oxford Instruments plc, Anasazi Instruments, Inc., Nanalysis Corp., Shenzhen Niumag Corporation, Magritek Ltd., Aspect Imaging, and Others.

COMPETITIVE LANDSCAPE

The NMR spectroscopy market is highly competitive, driven by a mix of established global players and emerging innovators. Companies such as Bruker Corporation, JEOL Ltd., and Agilent Technologies dominate the market with extensive product portfolios, cutting-edge technology, and strong global distribution networks. These companies cater to a wide range of applications, including pharmaceuticals, biotechnology, and material sciences, maintaining their competitive edge through consistent innovation and R&D investments.

Emerging players like Nanalysis Corp. and Magritek Ltd. are reshaping the market by offering portable and cost-effective NMR solutions, such as benchtop systems, which are gaining traction among small research labs and educational institutions. These compact devices provide sufficient resolution for routine applications while being more accessible than traditional high-field systems.

Competition is further fueled by advancements in technology, such as AI-integrated NMR systems, which improve data processing and analysis. Strategic collaborations with academic institutions and industry players also play a key role in market positioning. For instance, partnerships for drug discovery or renewable energy research enhance product relevance and market reach.

Price sensitivity, particularly in emerging markets, intensifies competition, pushing companies to innovate while maintaining affordability. Overall, the NMR market remains dynamic, with players focusing on technological advancements and tailored solutions to sustain growth.

RECENT MARKET DEVELOPMENTS

- In July 2024, Bruker Corporation installed a 1.2 GHz NMR system at the Leibniz Forschungsinstitut für Molekulare Pharmakologie in Berlin. This initiative is anticipated to enhance molecular pharmacological research and establish Bruker’s leadership in advanced NMR technology.

- In 2023, Oxford Instruments plc acquired WITec, a leader in Raman microscopy. This acquisition aims to expand Oxford Instruments’ spectroscopy portfolio and strengthen its market position in advanced analytical solutions.

- In 2023, JEOL Ltd. launched the ECZ Luminous NMR spectrometer. This product introduction is expected to deliver enhanced performance and user experience, reinforcing JEOL’s innovation-driven growth.

- In 2023, Thermo Fisher Scientific Inc. acquired PPD, a clinical research organization. This acquisition is expected to integrate analytical technologies with clinical research services, broadening Thermo Fisher’s market reach.

- In 2023, Agilent Technologies, Inc. launched the 990 Micro GC System. This innovation aims to provide rapid gas analysis solutions, complementing Agilent’s spectroscopy offerings for broader market coverage.

- In 2023, Magritek Ltd. introduced the Spinsolve ULTRA, an enhanced benchtop NMR spectrometer. This product is anticipated to improve sensitivity for complex sample analysis, strengthening Magritek’s portfolio.

- In 2023, Anasazi Instruments, Inc. launched the Eft-90 NMR spectrometer. This launch is aimed at providing cost-effective NMR solutions for academic and industrial laboratories, boosting accessibility.

- In 2023, Shenzhen Niumag Corporation introduced the PQ001 NMR analyzer. This product caters to the growing demand for low-field NMR applications in food and agriculture, expanding Niumag’s market footprint.

- In 2023, Aspect Imaging developed the M3 compact MRI system. This product is expected to enhance preclinical imaging capabilities, expanding Aspect Imaging’s presence in the research sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]