Australia Food Safety Testing Market Research Report - Segmented By Food tested, Target Tested, Technology, and By Region – Analysis on Size, Share, Trends, Growth Forecast Analysis Report 2024 to 2032

Australia Food Safety Testing Market Size

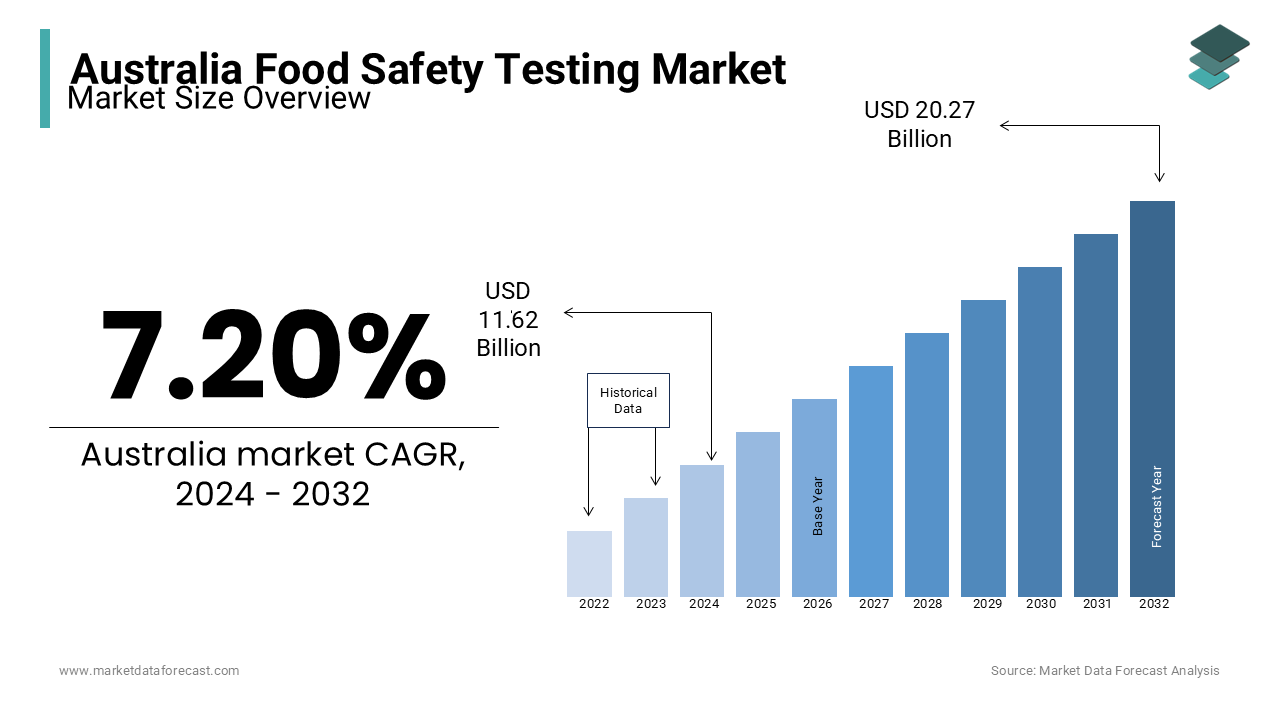

The Australia Food Safety Testing Market Size was calculated to be USD 10.84 billion in 2023 and is anticipated to be worth USD 20.27 billion by 2032 from USD 11.62 billion In 2024, growing at a CAGR of 7.20% during the forecast period.

Ensuring food safety has become a top priority for the food industry, driven by rising incidences of contamination from pathogens, allergens, and chemical residues. According to the Australian Institute of Health and Welfare, 4.1 million cases of foodborne illnesses occur annually in Australia, leading to approximately 31,920 hospitalizations and 86 deaths. High-profile cases of food recalls and outbreaks, such as the 2018 listeria outbreak linked to rockmelons, which caused 7 deaths and a significant drop in produce sales, have heightened the focus on robust testing protocols. Advanced testing technologies, including polymerase chain reaction (PCR) and immunoassays, are gaining traction for their accuracy and efficiency. For instance, PCR-based testing can detect pathogens like salmonella and E. coli in as little as 24 hours which significantly reducing response times compared to traditional methods. Australia's strict compliance standards, including adherence to Food Standards Australia New Zealand (FSANZ) regulations and require all food producers and processors to meet stringent safety benchmarks which ensures the integrity of the supply chain.

Additionally, the demand for imported food products, which constitutes 15% of Australia’s food supply, and the growth of organic and minimally processed foods require enhanced testing measures to ensure quality and safety. Laboratories and food producers are increasingly adopting rapid testing kits and automated systems, which can process up to 500 samples per hour, to meet regulatory standards and maintain consumer trust.

MARKET DRIVERS

Stringent Food Safety Regulations

Australia's stringent food safety regulations, overseen by Food Standards Australia New Zealand (FSANZ), are a major driver of the food safety testing market. FSANZ enforces strict standards for detecting pathogens, allergens, and chemical contaminants in food. High-profile food contamination incidents, such as the 2018 listeria outbreak linked to rockmelons, have intensified regulatory scrutiny. In 2022, 78% of food manufacturers in Australia reported increased testing to meet compliance standards. These regulations compel food producers and processors to invest in advanced testing technologies to ensure the safety and quality of their products, reducing the risk of recalls and penalties.

Rising Incidence of Foodborne Illnesses

The growing prevalence of foodborne illnesses in Australia is driving the demand for robust food safety testing solutions. The Australian Institute of Health and Welfare reported that 4.1 million Australians suffer from foodborne diseases annually, with pathogens like salmonella and E. coli being the primary culprits. This rising incidence has heightened consumer awareness, prompting food producers to adopt more comprehensive testing measures. Additionally, the increasing consumption of ready-to-eat and imported foods requires stringent testing protocols to prevent contamination and ensure public health. This focus on proactive food safety measures boosts market growth.

MARKET RESTRAINTS

High Costs of Advanced Testing Technologies

The high cost of implementing advanced food safety testing technologies, such as Polymerase Chain Reaction (PCR) and mass spectrometry, poses a significant restraint in the Australian market. Many small and medium-sized enterprises (SMEs) in the food industry struggle to afford the necessary equipment, which can cost upwards of $50,000 per unit, alongside recurring expenses for maintenance and reagents. A 2022 survey revealed that 35% of SMEs cited financial constraints as a barrier to adopting advanced testing methods. These costs limit widespread adoption, particularly among smaller producers which potentially compromising food safety in less-regulated segments of the market.

Complex Regulatory Compliance

Navigating Australia's stringent regulatory framework for food safety testing, overseen by Food Standards Australia New Zealand (FSANZ), is a challenge for many businesses. Regulations require meticulous documentation, adherence to specific testing protocols, and regular audits, which can be time-consuming and costly. A 2023 report indicated that 25% of food manufacturers faced delays in market entry or product recalls due to non-compliance with testing standards. This complexity disproportionately affects smaller producers who may lack the resources or expertise to meet regulatory requirements is potentially stalling their operations and market growth.

MARKET OPPORTUNITIES

Emerging Demand for Allergen Testing

The increasing prevalence of food allergies in Australia presents a significant opportunity for the food safety testing market. Approximately 10% of infants and 2% of adults in Australia are affected by food allergies that drives the need for rigorous allergen testing. The introduction of stricter labeling regulations by Food Standards Australia New Zealand (FSANZ) has amplified this demand. Testing for common allergens such as nuts, gluten, and dairy is becoming a standard practice, with innovative rapid testing kits enabling efficient compliance. This trend provides a lucrative avenue for laboratories and testing equipment manufacturers to expand their offerings and capture new market segments.

Adoption of Blockchain for Food Traceability

The integration of blockchain technology for food traceability offers immense growth potential. Blockchain ensures transparency and accountability across the food supply chain, enabling real-time tracking of safety testing results and contamination incidents. A 2023 industry report revealed that 30% of Australian food producers are exploring blockchain for improved traceability and compliance. The technology aligns with consumer demand for ethically sourced and safe food products. Partnering with technology firms to offer blockchain-enabled safety solutions can help testing companies expand their market share while meeting the evolving needs of regulators and consumers.

MARKET CHALLENGES

Limited Testing Infrastructure in Remote Areas

Australia’s vast geography poses a significant challenge in establishing adequate food safety testing infrastructure in remote and rural regions. Food producers in these areas often face logistical difficulties in accessing advanced laboratories or transporting samples to urban centers. A 2022 government report highlighted that 20% of rural food manufacturers experienced delays in testing due to infrastructure limitations, increasing the risk of undetected contamination. Addressing this challenge requires investment in mobile testing units and localized facilities to ensure consistent food safety compliance across all regions.

Shortage of Skilled Professionals

The lack of skilled personnel trained in advanced food safety testing technologies is a persistent challenge in Australia. Operating sophisticated equipment such as PCR systems or mass spectrometry devices requires specialized expertise, which is not always readily available. A 2023 survey revealed that 40% of food testing laboratories in Australia struggled to fill positions for qualified technicians. This skills gap not only delays testing processes but also limits the adoption of innovative technologies. Expanding training programs and fostering partnerships between academia and the industry are essential to mitigate this challenge.

SEGMENTAL ANALYSIS

By Food tested Insights

The Meat, Poultry, and Seafood segment holds the largest share of the global food safety testing market, accounting for approximately 35% of the market in 2023. These food categories are highly perishable and prone to contamination by pathogens like Salmonella, Listeria, and E. coli. The high risk of spoilage and foodborne illnesses drives stringent safety protocols and extensive testing. According to a 2022 report, 40% of global foodborne illness outbreaks were linked to meat and seafood products, emphasizing the critical need for robust testing solutions. Advanced detection methods such as PCR and immunoassays are widely used to ensure compliance with international safety standards, reinforcing the dominance of this segment.

The Fruits & Vegetables segment is the fastest-growing, with a projected compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. The increasing demand for fresh, minimally processed produce and organic foods is driving the need for rigorous testing to identify pesticide residues, microbial contamination, and heavy metals. The World Health Organization (WHO) reports that 20% of foodborne illnesses globally are linked to contaminated fresh produce. This segment's growth is further accelerated by stricter regulatory requirements and advancements in rapid testing technologies that enable efficient analysis of these high-risk food categories.

By Target tested Insights

The Pathogens segment is the largest in the global food safety testing market, accounting for approximately 40% of the market share in 2023. Pathogen testing is critical due to the widespread prevalence of foodborne illnesses caused by microorganisms such as E. coli, Salmonella, Campylobacter, and Listeria. For instance, the Centers for Disease Control and Prevention (CDC) estimates that Salmonella alone causes 1.35 million infections annually worldwide. Advanced methods like PCR and immunoassays are extensively employed to detect pathogens quickly and accurately. This segment's dominance is reinforced by the high rate of food recalls and stringent regulatory frameworks aimed at reducing microbial contamination in food products.

The Allergens segment is the fastest-growing, with a projected compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. Rising awareness of food allergies, which affect approximately 10% of children and 2% of adults globally, is driving the demand for allergen testing. Gluten, nuts, dairy, and seafood are among the most common allergens that require stringent testing. A 2023 industry report revealed a 25% year-over-year increase in allergen testing adoption, particularly in processed and packaged foods. The development of advanced, rapid allergen detection kits and stricter labeling requirements further fuel this segment's rapid growth.

By Technology Insights

The Rapid Technology segment was accounted approximately 55% of the global food safety testing market share in 2023. Within this segment, Polymerase Chain Reaction (PCR) and Immunoassay methods dominate due to their accuracy, speed, and ability to detect contaminants at trace levels. PCR can identify pathogens such as Salmonella and E. coli in under 24 hours, significantly reducing the response time for contamination control. According to a 2022 industry report, 70% of global food testing facilities have adopted rapid methods to enhance safety and comply with stringent regulatory standards by making this segment the market leader.

The Chromatography & Spectrometry segment is the fastest-growing, with a projected compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. These advanced technologies are critical for detecting chemical contaminants such as pesticides, mycotoxins, and heavy metals with high precision. Gas Chromatography-Mass Spectrometry (GC-MS) and Liquid Chromatography-Mass Spectrometry (LC-MS) are widely used for analyzing complex food matrices. A 2023 study noted that 40% of food testing laboratories globally are investing in chromatography systems to address rising consumer demand for safer, chemical-free food products which drives the growth rate of the market.

REGIONAL ANALYSIS

The Australia food safety testing market contributes significantly to the global market, accounting for approximately 4% of the global share in 2023. Australia’s position is bolstered by stringent regulations enforced by Food Standards Australia New Zealand (FSANZ), high consumer awareness, and a strong focus on food export quality. The market in Australia is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030, driven by advancements in rapid testing technologies and an expanding range of tested food products, including organic and minimally processed foods.

Within the country, New South Wales and Victoria lead in food safety testing activities due to their high concentration of food processing facilities and export hubs. These states account for a combined 60% of the national market which is fueled by robust infrastructure and government support for regulatory compliance.

The northern regions, while smaller in market size, are experiencing a CAGR of 7.8%, reflecting increased investment in food safety measures to support local producers and exporters. Alongside, the growing popularity of ready-to-eat and allergen-free products is expected to play a pivotal role in maintaining global quality standards that further promotes the growth rate of the Australia food safety testing market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major key players of the Australia Food Safety Testing Market include Eurofins Scientific, SGS S.A., Bureau Veritas, Intertek Group plc, ALS Limited, Thermo Fisher Scientific Inc., Merck KGaA, 3M Company, Agilent Technologies, Inc., and Neogen Corporation

The Australia food safety testing market is highly competitive, driven by stringent regulatory requirements, increasing consumer awareness, and advancements in testing technologies. Leading global players such as Eurofins Scientific, SGS S.A., and Bureau Veritas dominate the market by offering comprehensive testing services, including pathogen detection, allergen testing, and chemical analysis. These companies leverage their global expertise and advanced infrastructure to cater to Australia’s robust food export industry and stringent domestic safety standards.

Local players like ALS Limited and specialized laboratories compete by providing region-specific services, such as tailored testing for Australian produce like dairy, meat, and seafood. Companies like Thermo Fisher Scientific and Agilent Technologies contribute by supplying state-of-the-art testing equipment, enabling laboratories to meet the increasing demand for rapid and accurate results.

E-commerce platforms for testing kits and the growing use of blockchain technology for traceability add a new dimension to the competitive landscape. Smaller firms focus on niche markets, such as organic food testing and allergen-free certification, to differentiate themselves.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Eurofins Scientific expanded its service portfolio by introducing advanced allergen testing solutions in Australia. This initiative aims to address the increasing prevalence of food allergies and meet the rising demand for accurate allergen detection.

- In March 2024, SGS S.A. launched a blockchain-based food traceability platform in Australia. This initiative is designed to provide transparent and tamper-proof tracking of food products, ensuring safety and quality from farm to fork.

- In February 2024, Bureau Veritas acquired a local Australian laboratory specializing in microbiological testing. This acquisition is expected to expand its regional footprint and offer comprehensive food safety testing services to a broader client base.

- In April 2024, Intertek Group plc partnered with a leading Australian university to develop innovative rapid testing methods for detecting foodborne pathogens. This collaboration aims to accelerate testing processes and improve the accuracy of pathogen detection.

- In May 2024, ALS Limited invested in state-of-the-art mass spectrometry equipment for its Australian laboratories. This investment enhances the detection of chemical contaminants, including pesticides and heavy metals, in food products.

- In June 2024, Thermo Fisher Scientific Inc. launched a new range of PCR-based testing kits tailored for the Australian market. This product line provides rapid and reliable detection of foodborne pathogens, aligning with local regulatory standards.

- In July 2024, Merck KGaA opened a research and development center in Australia focused on food safety testing technologies. This center is intended to develop cutting-edge solutions for emerging food safety challenges.

- In August 2024, 3M Company introduced an advanced immunoassay-based testing platform in Australia. This platform offers efficient tools for detecting allergens and ensuring product safety.

- In September 2024, Agilent Technologies, Inc. collaborated with Australian regulatory bodies to standardize testing protocols for genetically modified organisms (GMOs) in food. This collaboration ensures consistency and reliability in GMO testing across the industry.

- In October 2024, Neogen Corporation launched a comprehensive suite of food safety testing solutions, including rapid test kits and digital platforms, in the Australian market. This launch provides end-to-end solutions to help food producers maintain safety and compliance.

MARKET SEGMENTATION

This research report on the Australia Food Safety Testing market is segmented and sub-segmented into the following categories.

By Food tested

- Meat, poultry, and seafood

- Dairy products

- Processed food

- Fruits & vegetables

- Cereals & grains

- Other food products tested

By Target tested

- Pathogens

- E. coli

- Salmonella

- Campylobacter

- Listeria

- Others

- Pesticides

- GMOs

- Mycotoxin

- Allergens

- Heavy metals

- Other targets tested

By Technology

- Traditional

- Rapid

- Convenience-based

- Polymerase chain reaction (PCR)

- Immunoassay

- Chromatography & spectrometry

Frequently Asked Questions

1. Who benefits from food safety testing in Australia?

Food manufacturers, processors, distributors, and consumers benefit from improved safety standards and reduced risks of contamination.

2. Which industries drive the demand for food safety testing in Australia?

The food and beverage industry, including dairy, meat, seafood, and packaged food sectors, drives the demand.

3. How is the food safety testing process carried out?

Food samples are collected and analyzed in laboratories using advanced techniques like PCR, chromatography, and ELISA to detect contaminants or harmful substances.

4. What are the key drivers for the growth of the food safety testing market in Australia?

Factors such as stringent government regulations, rising consumer awareness, and the increasing demand for safe and high-quality food products drive market growth

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]