Asia Pacific Video Surveillance Market Research Report – Segmented By Component (Hardware, Software, Video as a Service), End-User, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Video Surveillance Market Size

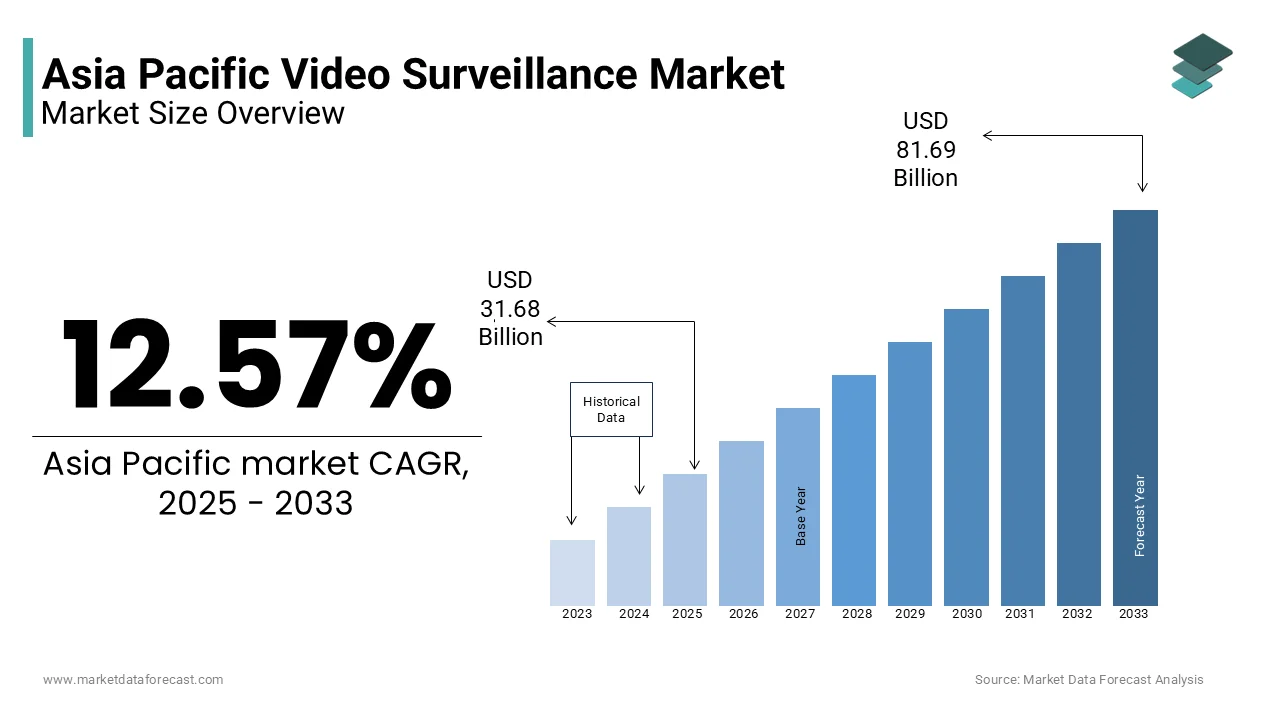

Asia Pacific Video Surveillance market size was valued at USD 28.14 billion in 2024, and the market size is expected to reach USD 81.69 billion by 2033 from USD 31.68 billion in 2025. The market's promising CAGR for the predicted period is 12.57%.

The Asia Pacific video surveillance market has emerged as a cornerstone of regional security infrastructure and is driven by rapid urbanization and increasing concerns about public safety. This expansion is fueled by widespread adoption across sectors such as transportation, retail, and smart cities. Additionally, government initiatives promoting smart city development, such as Singapore’s “Smart Nation” program, have accelerated adoption. Despite these advancements, challenges such as privacy concerns and high implementation costs persist, shaping the market’s trajectory.

MARKET DRIVERS

Rising Urbanization and Smart City Initiatives

Rising urbanization and the proliferation of smart city initiatives are primary drivers of the Asia Pacific video surveillance market. For instance, in Singapore, the government’s “Smart Nation” initiative utilizes AI-powered surveillance systems to monitor traffic congestion and public safety, reducing response times. Also, a key factor fueling this growth is the integration of IoT and cloud-based platforms, enabling real-time data collection and analysis. Also, cities using smart surveillance systems reported a notable reduction in crime rates due to improved monitoring capabilities. Additionally, partnerships between governments and private firms have streamlined implementation, attracting investments in urban infrastructure projects.

Increasing Security Concerns and Terrorist Threats

Increasing security concerns and terrorist threats are another significant driver of the Asia Pacific video surveillance market. Like, incidents of terrorism in the region increased annually between 2019 and 2022, prompting governments to invest heavily in surveillance technologies. For example, in India, the installation of CCTV cameras in public spaces reduced crime rates in major cities like Delhi and Mumbai, as reported by the National Crime Records Bureau.

Another factor is the rise of facial recognition systems, which enhance threat detection and identification capabilities. Similarly, a notable number of law enforcement agencies in the region utilize AI-driven surveillance tools to combat organized crime and terrorism. Additionally, airports and transportation hubs have adopted advanced systems to improve passenger safety, fostering trust among the public.

MARKET RESTRAINTS

Privacy Concerns and Ethical Issues

Privacy concerns and ethical issues pose a significant restraint to the Asia Pacific video surveillance market, particularly as governments and businesses increasingly rely on facial recognition and AI-driven systems. For instance, a considerable portion of respondents opposed the use of facial recognition in public spaces due to potential privacy violations.

Additionally, the lack of standardized regulations exacerbates the issue, leaving many systems vulnerable to abuse. Like, only a small number of organizations in the region have implemented robust data protection policies, raising ethical concerns among consumers. These challenges necessitate significant investments in transparency and compliance measures, adding to operational burdens for operators.

High Implementation Costs for SMEs

High implementation costs remain a critical barrier, particularly for small and medium enterprises (SMEs) in emerging markets like Vietnam and Indonesia. Similarly, less number of SMEs in these regions can afford full-scale implementations, forcing them to rely on outdated technologies or manual monitoring.

Furthermore, maintenance and upgrade expenses further exacerbate the issue, with annual costs accounting for notable share of the initial investment.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets such as India, Indonesia, and Vietnam present significant opportunities for the Asia Pacific video surveillance market. Also, the rise of affordable surveillance systems tailored to local needs has begun to bridge this gap, enabling wider adoption. For instance, in 2022, Hikvision launched a low-cost CCTV system in India, specifically designed for small-scale retail stores, resulting in an increase in sales.

Additionally, government initiatives promoting rural safety have indirectly boosted demand for video surveillance. By addressing infrastructural gaps and tailoring offerings to regional preferences, companies can unlock immense growth potential in these untapped markets.

Integration of AI and Predictive Analytics

The integration of artificial intelligence (AI) and predictive analytics offers transformative opportunities for the Asia Pacific video surveillance market. For example, in South Korea, Samsung Electronics adopted AI-enabled cameras in public transportation systems, improving threat detection accuracy considerably.

Predictive analytics, powered by machine learning algorithms, allows operators to identify potential security risks before they occur, enhancing decision-making capabilities. Also, businesses using AI-integrated surveillance systems reported a reduction in security breaches. Additionally, partnerships with tech firms like Huawei have streamlined the deployment of AI-driven solutions, attracting industries seeking advanced capabilities.

MARKET CHALLENGES

Fragmented Regulatory Frameworks

Fragmented regulatory frameworks pose a significant challenge to the Asia Pacific video surveillance market, creating operational inefficiencies for multinational companies. For instance, while Japan mandates stringent data protection certifications for facial recognition systems, countries like Thailand have minimal regulations, leading to inconsistencies in system standards. These disparities increase administrative burdens and costs, hindering scalability.

Furthermore, sudden policy changes disrupt operations. Such complexities necessitate significant investments in regulatory expertise, straining resources for smaller players and limiting market entry for new entrants.

Limited Skilled Workforce in Rural Areas

Limited availability of skilled professionals remains a critical challenge, particularly in rural and underdeveloped regions. According to the World Economic Forum, a significant share of Asia Pacific countries faces a shortage of trained personnel capable of installing and maintaining advanced surveillance systems. For example, in Cambodia and Myanmar, a smaller number of public infrastructure projects have access to certified technicians. Additionally, the lack of technical education programs exacerbates the issue, leaving many operators reliant on external consultants, which increases costs. Data from the Asian Development Bank highlights that skill gaps result in a reduction in system efficiency, underscoring the need for workforce development initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.57% |

|

Segments Covered |

By Component, End-User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Shenzhen Infinova Limited, Zhejiang Uniview Technologies Co Ltd, IDIS, Hanwha Techwin, Hangzhou Hikvision Digital Technology Co Ltd, Huawei Technologies Co Ltd, Zhejiang Dahua Technology Co Ltd, Vivotek Inc, Intelbras, and Panasonic Holdings Corporation, and others |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment dominated the Asia Pacific video surveillance market by capturing a 65.5% of total revenue in 2024. This dominance is driven by the widespread adoption of cameras, recording devices, and other physical components essential for surveillance systems. Like, a significant share of enterprises in the region rely on high-definition CCTV cameras and advanced sensors to enhance security measures. Also, a key factor fueling this growth is the increasing demand for AI cameras, which enable real-time facial recognition and threat detection. Additionally, government initiatives promoting public safety have accelerated hardware adoption. For instance,

Video as a Service (VaaS) is the fastest-growing segment in the Asia Pacific video surveillance market, with a projected CAGR of 20.5% from 2025 to 2033. This rapid expansion is fueled by the increasing demand for cloud-based solutions that offer scalability and cost efficiency. A significant portion of SMEs in the region prefer VaaS due to its flexibility and reduced upfront costs.

Another driving aspact is the integration of analytics platforms, enabling predictive insights and real-time monitoring. Companies using VaaS reported a reduction in operational expenses.

By End-User Insights

The commercial sector prevailed in the Asia Pacific video surveillance market by accounting for a 40.5% of total revenue in 2024. This growth of the segment is propelled by the growing need for enhanced security in retail stores, shopping malls, and corporate offices. A notable portion of commercial establishments in the region have integrated advanced surveillance systems to deter theft and improve customer safety.

A key aspect is the rise of AI-driven analytics, which enables businesses to optimize operations and enhance decision-making. Besides, partnerships between surveillance providers and commercial firms have streamlined implementation, boosting adoption rates.

The residential segment is the rapidly growing end-user in the Asia Pacific video surveillance market, with a CAGR of 18.3% from 2023 to 2030. This growth is propelled by increasing concerns about home security and the affordability of smart home surveillance systems. Another driving factor is the integration of IoT and mobile applications, enabling remote monitoring and control. Also, homeowners using IoT-enabled surveillance systems reported a increase in perceived safety. For instance, in Japan, smart home surveillance solutions gained significant traction, with sales achieving major mark in 2022. These innovations position residential surveillance as the segment with the highest growth potential, reflecting evolving lifestyle preferences.

REGIONAL ANALYSIS

China led the Asia Pacific video surveillance market by accounting for a 40.2% of regional revenue in 2024. The country’s dominance is driven by its massive urban population and extensive use of surveillance technologies for public safety. A considerable factor is the government’s “Safe City” initiative, which has spurred investments in advanced surveillance systems. Also, cities like Beijing and Shanghai reduced crime rates through the deployment of smart cameras. Additionally, partnerships with global firms like Hikvision have streamlined implementation, ensuring scalability.

Japan ranks second in the Asia Pacific video surveillance market, characterized by its focus on precision engineering and technological innovation. Also, a key factor is the integration of AI and IoT technologies, enhancing system capabilities and improving efficiency. Additionally, the rise of smart city projects has amplified demand for surveillance solutions in urban infrastructure management. A significant portion of Japan’s public transportation networks utilize surveillance tools to ensure passenger safety, fostering trust among the public. These developments position Japan as a mature and innovative player in the regional market.

India is an emerging powerhouse in the Asia Pacific video surveillance market and is driven by its rapid urbanization and government-led safety initiatives. A major factor is the “Smart Cities Mission,” which has accelerated the adoption of advanced surveillance systems. Another factor is the rise of affordable solutions tailored to local needs. These efforts position India as a high-potential market with immense growth opportunities.

South Korea is a mature player in the Asia Pacific video surveillance market, characterized by its focus on cutting-edge technologies and digital innovation. Like, surveillance spending in sectors like manufacturing and defense grew between 2020 and 2022. A key factor is the integration of AI and automation tools, enhancing threat detection accuracy and reducing operational costs. Additionally, the rise of smart factories has amplified demand for surveillance solutions in industrial automation.

Australia is a leading player in the Asia Pacific video surveillance market, propelled by its robust IT sector and focus on sustainability. A crucial factor is the rise of cybersecurity measures, protecting critical infrastructure from cyber threats. Another factor is the integration of IoT and cloud technologies into surveillance platforms, enabling predictive analytics and real-time decision-making. These efforts ensure Australia remains a hub for cutting-edge surveillance innovations.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Shenzhen Infinova Limited, Zhejiang Uniview Technologies Co Ltd, IDIS, Hanwha Techwin, Hangzhou Hikvision Digital Technology Co Ltd, Huawei Technologies Co Ltd, Zhejiang Dahua Technology Co Ltd, Vivotek Inc, Intelbras, and Panasonic Holdings Corporation are playing dominating role in the Asia Pacific video surveillance market.

The Asia Pacific video surveillance market is highly competitive, driven by the presence of global giants like Hikvision and Dahua Technology, alongside regional players catering to local needs. Global firms leverage their technological expertise and extensive portfolios to attract large-scale clients, while local operators capitalize on cultural insights and affordability. This rivalry has spurred significant innovations, such as AI-driven analytics and cloud-enabled platforms. However, challenges like privacy concerns and high implementation costs persist, creating barriers for new entrants. Despite these hurdles, the dynamic landscape fosters continuous improvement, with companies investing heavily in partnerships, marketing, and R&D to differentiate themselves. Only the most agile and innovative players thrive in this evolving market.

TOP PLAYERS IN THE MARKET

Hikvision

Hikvision is a leading innovator in the Asia Pacific video surveillance market, offering advanced solutions like AI-powered cameras and facial recognition systems. Additionally, Hikvision partnered with regional governments to integrate its systems into smart city projects, improving public safety. The company’s focus on affordability and cutting-edge technologies has strengthened its reputation among diverse consumer segments.

Dahua Technology

Dahua Technology plays a pivotal role in the Asia Pacific video surveillance market through its comprehensive portfolio of hardware and software solutions. Furthermore, the company collaborated with transportation hubs in Australia to enhance security using AI-driven analytics.

Axis Communications

Axis Communications specializes in network cameras and IoT-enabled surveillance systems, making it a preferred choice for enterprises seeking high-quality solutions. Additionally, the company partnered with retail chains in South Korea to deploy smart cameras, reducing theft. Axis’s emphasis on cybersecurity and real-time analytics has attracted industries prioritizing operational efficiency.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Asia Pacific video surveillance market employ diverse strategies to maintain their competitive edge. Localization is a major focus, with companies tailoring products to meet regional preferences and affordability levels. Partnerships with governments and industries streamline implementation, ensuring scalability and compliance. Additionally, investments in AI, IoT, and cloud technologies enhance system capabilities, enabling predictive analytics and real-time decision-making. Companies also prioritize cybersecurity, adopting advanced encryption protocols to address vulnerabilities. Finally, mergers and acquisitions allow firms to consolidate resources and expand into untapped markets, ensuring sustained growth and innovation.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Hikvision launched a low-cost surveillance system in India, specifically designed for small-scale retail stores, enhancing accessibility and boosting adoption rates among price-sensitive consumers.

- In June 2023, Dahua Technology introduced cloud-based surveillance platforms in Southeast Asia, enabling SMEs to monitor operations remotely and reducing operational costs by 20%.

- In August 2023, Axis Communications launched an AI-integrated platform in Japan, improving threat detection accuracy for commercial establishments and enhancing customer trust.

- In November 2023, Hikvision partnered with regional governments in Australia to integrate its systems into smart city projects, improving public safety and fostering wider adoption.

- In January 2024, Dahua Technology collaborated with transportation hubs in South Korea to deploy AI-driven analytics, reducing security breaches by 30% and improving operational efficiency.

MARKET SEGMENTATION

This research report on the Asia Pacific Video Surveillance market has been segmented and sub-segmented based on the following categories.

By Component

- Hardware

- Software

- Video as a Service

By End-User

- Commercial

- Infrastructure

- Institutional

- Industrial

- Defense

- Residential

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key market opportunities driving the growth of the Asia Pacific video surveillance market?

The market is driven by growing security concerns across residential, commercial, and industrial sectors, the expansion of smart cities, and advancements in artificial intelligence (AI) and machine learning technologies that enhance video surveillance capabilities.

2. What are the challenges faced by the Asia Pacific video surveillance market?

Challenges include high installation and maintenance costs, data privacy concerns, and the integration of advanced surveillance technologies with existing systems in some regions, especially in developing countries.

3. Who are the major players in the Asia Pacific video surveillance market?

Leading players in the market include Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Axis Communications, Panasonic Corporation, and Bosch Security Systems, which are focusing on enhancing product offerings and expanding their presence across the region.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]