Asia Pacific UPS Market Size, Share, Trends & Growth Forecast Report By Capacity (Less than 10 kVA, 10-100 kVA, Above 100 kVA), Type (Standby UPS System, Online UPS System, Line-interactive UPS System), Application (Data Centers, Telecommunications, Healthcare, Industrial, Other Applications), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific UPS Market Size

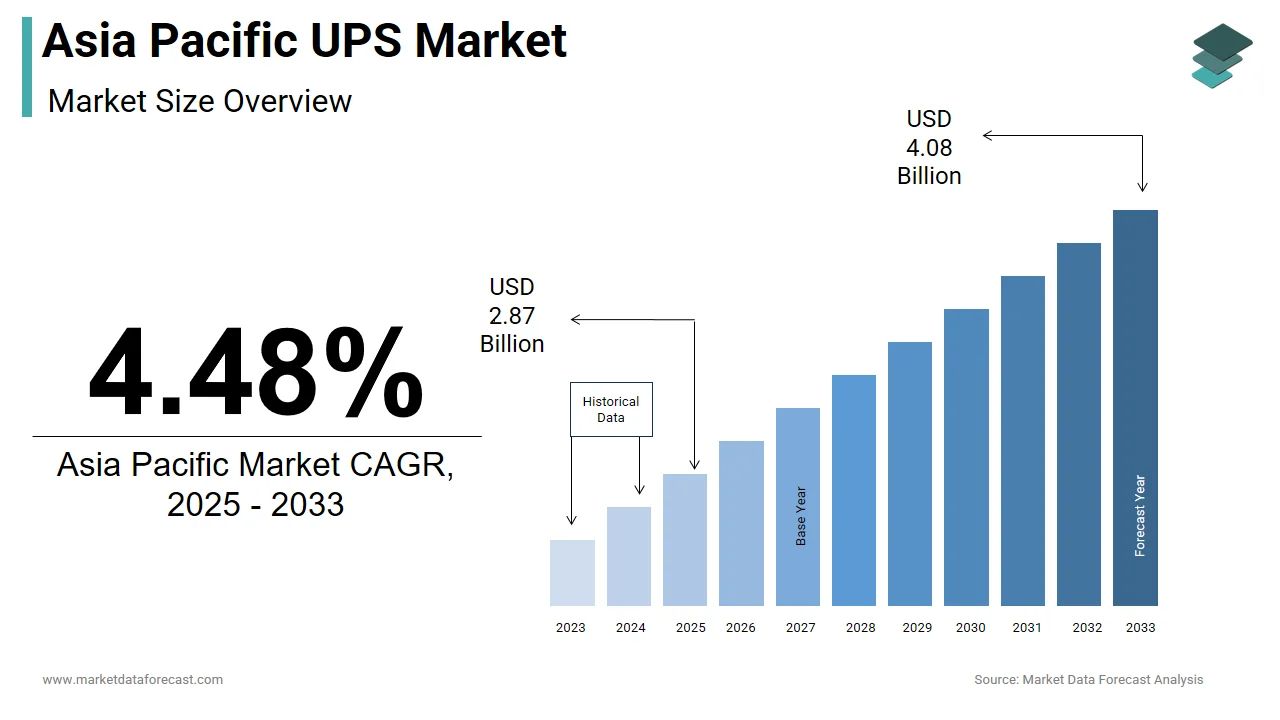

The size of the Asia Pacific UPS market was worth USD 2.75 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 4.48% from 2025 to 2033 and be worth USD 4.08 billion by 2033 from USD 2.87 billion in 2025.

The Asia Pacific uninterruptible power supply (UPS) market is a cornerstone of regional energy infrastructure. It is driven by increasing industrialization, urbanization, and reliance on digital systems. Additionally, frequent power outages in developing economies like Indonesia and Vietnam exacerbate the need for UPS systems. Furthermore, government initiatives promoting smart grids and renewable energy integration are propelling adoption

MARKET DRIVERS

Expansion of Data Centers

The proliferation of data centers is a primary driver of the Asia Pacific UPS market, fueled by the growing demand for cloud computing and digital services. These facilities require uninterrupted power to maintain server operations, making UPS systems indispensable. For instance, Alibaba Cloud’s expansion in Malaysia includes deploying advanced UPS solutions to ensure 99.99% uptime. Additionally, the rise of hyperscale data centers in China, which consume a notable share of the country’s total electricity, has intensified demand for high-capacity UPS systems.

Rising Industrial Automation

Industrial automation is another key driver, with manufacturers increasingly adopting UPS systems to safeguard critical processes. For example, automotive plants in Thailand and Vietnam rely on UPS systems to prevent production losses during power fluctuations. Furthermore, the push for Industry 4.0 technologies, such as IoT and AI, is driving demand for smart UPS systems capable of predictive maintenance. These advancements show the pivotal role of industrial automation in propelling the UPS market forward.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

One of the primary restraints hindering the Asia Pacific UPS market is the high upfront cost of advanced systems. According to PricewaterhouseCoopers, premium UPS models equipped with lithium-ion batteries can be significantly more expensive than traditional lead-acid alternatives, deterring price-sensitive buyers. This financial barrier is particularly pronounced in developing economies like Bangladesh and Myanmar, where small and medium enterprises (SMEs) dominate the industrial landscape.

A considerable number of SMEs in Southeast Asia prioritize short-term affordability over long-term reliability, opting for cheaper, less efficient UPS systems. Additionally, public sector projects, which constitute a significant portion of demand, often face budgetary limitations. The Asian Development Bank notes that municipal budgets for infrastructure upgrades are constrained, delaying the adoption of modern UPS solutions in public facilities. These challenges create bottlenecks in market expansion, despite the growing awareness of uninterrupted power needs.

Limited Awareness and Technical Expertise

Another significant restraint is the lack of awareness and technical expertise among end-users, particularly in rural areas. A notable portion of businesses in Tier-III cities lack knowledge about the benefits of UPS systems, resulting in underutilization or improper installation. This issue is compounded by a shortage of skilled technicians capable of maintaining advanced systems. According to the International Electrotechnical Commission, the absence of standardized training programs in emerging markets further exacerbates the problem.

MARKET OPPORTUNITIES

Growing Adoption of Renewable Energy Systems

The Asia Pacific UPS market faces a transformative opportunity with the integration of renewable energy systems. As these energy sources are intermittent, they require dependable backup solutions to ensure a stable power supply, thereby increasing the demand for UPS systems.

For example, Australia’s rooftop solar installations have surged by 40% since 2020, necessitating advanced UPS systems for households and businesses. Similarly, India’s Solar Energy Corporation has mandated UPS integration in off-grid solar projects, boosting adoption in rural areas.

Expansion into Emerging Economies

Emerging economies like Vietnam, Indonesia, and the Philippines offer untapped opportunities for UPS manufacturers. For instance, Vietnam’s manufacturing sector relies heavily on UPS systems to mitigate frequent power outages. Additionally, government initiatives to improve rural electrification are driving demand for affordable UPS solutions. A significant percentage of rural households in these regions lack stable power access, presenting a fertile market for distributed UPS systems. By targeting these underserved areas, manufacturers can unlock significant growth potential.

MARKET CHALLENGES

Intense Price Competition and Margin Pressure

Intense price competition poses a significant challenge to the Asia Pacific UPS market, eroding profit margins and stifling innovation. This dynamic forces companies to compete on pricing rather than technological differentiation, undermining investments in R&D. For instance, a report by the Federation of Indian Chambers of Commerce and Industry reveals that domestic UPS manufacturers in India have seen their profit margins shrink over the past five years due to import pressures. Additionally, buyers in the region often prioritize upfront costs over lifecycle savings, discouraging the adoption of premium products.

Supply Chain Disruptions and Raw Material Volatility

Supply chain disruptions and volatility in raw material prices represent another critical challenge for the Asia Pacific UPS market. Also, the ongoing semiconductor shortage has impacted the production of advanced UPS systems, delaying deliveries and increasing costs. Similarly, fluctuations in lithium prices, essential for lithium-ion batteries, have created uncertaintyThese challenges are compounded by geopolitical tensions and trade restrictions, which disrupt supply chains further. For instance, the U.S.-China trade war has led to tariff impositions on critical components, forcing manufacturers to seek alternative suppliers at higher costs. Such disruptions not only inflate production expenses but also hinder timely project execution, straining customer relationships and eroding trust in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Capacity, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

Emerson Electric Co., ABB Ltd, Schneider Electric SE, Riello Elettronica SpA, EATON Corporation PLC, and others. |

|

Market Leaders Profiled |

Siemens AG, ABB Ltd, General Electric Company, Mitsubishi Electric Corporation, Schneider Electric, and others. |

SEGMENTAL ANALYSIS

By Capacity Insights

The less than 10 KVA segment dominated the Asia Pacific UPS market by commanding a 50.3% share in 2024. This dominance is driven by its widespread use in small businesses, residential spaces, and Tier-II cities, where cost-effectiveness and compact designs are prioritized. For instance, in India, a considerable percentage of SMEs rely on these systems to mitigate frequent power outages, as per the Confederation of Indian Industry. Government initiatives promoting rural electrification further amplify demand. Additionally, the rise of home offices and remote work has increased residential adoption.

The above 100 KVA segment is the fastest-growing, with a projected CAGR of 12% from 2025 to 2033. This development is fueled by the expansion of data centers and industrial automation across the region. For example, China’s hyperscale data centers, which require high-capacity UPS systems, are expected to grow significantly in recent years. Similarly, industries like oil and gas in Malaysia and Indonesia are adopting large-scale UPS systems to ensure uninterrupted operations. These advancements position the above 100 KVA segment as the fastest-growing category, supported by rising industrial and commercial demands.

By Type Insights

Online UPS systems led the market by holding a 45.1% share in 2024. Their leading position is caused by their ability to provide continuous power conditioning, making them ideal for critical applications like healthcare and telecommunications. The proliferation of smart cities is also driving adoption. A significant number of new commercial buildings in Singapore are equipped with online UPS systems to ensure seamless operations. Additionally, the rise of cloud computing has amplified demand in data centers.

Line-interactive UPS systems segment is quickly advacning with a CAGR of 10.8%. This development is driven by their affordability and suitability for small-to-medium enterprises (SMEs) and residential users. Additionally, advancements in battery technology, such as lithium-ion integration, are enhancing their appeal. Also, modern line-interactive systems now offer energy savings, narrowing the gap with online models. These innovations position line-interactive UPS systems as the segment with the highest growth potential.

By Application Insights

The data centers segment spearheaded the Asia Pacific UPS marketby accounting for 35.4% of the market share in 2024. The rapid expansion of cloud computing and digital services is the primary driver. Government support for digital infrastructure further amplifies demand. Additionally, the rise of edge computing is driving demand for compact, high-efficiency UPS systems. Also, data centers account for a significant portion of UPS sales in Tier-I cities, exhibiting their dominance in the market.

The healthcare segment is swiftly advancing, with a CAGR of 15% from 2025 to 2033. This progress is propelled by the increasing reliance on medical equipment requiring uninterrupted power. For example, in Thailand, a major percentage of hospitals have upgraded their UPS systems to safeguard MRI and CT scanners. Besides, the rise of telemedicine and remote patient monitoring is amplifying demand for reliable power solutions.

COUNTRY LEVEL ANALYSIS

China prevailed in the Asia Pacific UPS market by capturing a 40.4% share in 2024. This dominance is fueled by massive industrial output and the proliferation of data centers. Additionally, government mandates for renewable energy integration have increased adoption in solar and wind projects.

India is a key marke, propelled by initiatives like Digital India and Smart Cities Mission. A significant number of SMEs have adopted UPS systems to mitigate power outages. Moreover, the expansion of rural electrification programs is boosting demand for affordable UPS solutions.

Japan holds a notable market share and that is driven by its focus on reliability and sustainability. Plus, a major portion of hospitals and data centers use advanced UPS systems. Additionally, the aging population has increased demand for uninterrupted power in healthcare facilities.

This region contributes significantly to the market. It is propelled by green building initiatives. Additionally, the push for net-zero emissions is accelerating adoption in both residential and commercial sectors.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC UPS market profiled in this report are Emerson Electric Co., ABB Ltd, Schneider Electric SE, Riello Elettronica SpA, EATON Corporation PLC, and others.

TOP LEADING PLAYERS IN THE MARKET

Schneider Electric

Schneider Electric is a key innovator in the Asia Pacific UPS market, renowned for its EcoStruxure platform, which integrates IoT and predictive analytics to enhance system reliability. The company has strengthened its presence through strategic partnerships with regional governments. Additionally, the company launched its new Galaxy VL series, offering compact and energy-efficient designs tailored for data centers. These initiatives underscore Schneider’s commitment to addressing diverse customer needs while promoting sustainability.

Vertiv Co.

Vertiv Co. is a prominent player in the region, specializing in high-capacity UPS systems for data centers and industrial applications. By partnering with local cloud service providers, Vertiv has expanded its footprint in Tier-I cities, where demand for reliable backup power is surging. Furthermore, the company invested $50 million in upgrading its manufacturing facilities in Thailand to meet rising regional demand. Vertiv’s focus on innovation and localization has solidified its reputation as a leader in critical infrastructure solutions.

Eaton Corporation

Eaton Corporation has established itself as a pioneer in modular UPS systems, catering to both commercial and industrial sectors. The company also partnered with renewable energy firms in Australia to integrate UPS systems with solar power setups, enhancing energy efficiency. Through investments in R&D, Eaton has developed advanced lithium-ion battery technologies, positioning itself at the forefront of sustainable power solutions.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Key players in the Asia Pacific UPS market employ strategies such as product innovation, strategic collaborations, and sustainability initiatives. Product innovation is central, with companies launching IoT-enabled and energy-efficient UPS systems to meet evolving consumer needs.

COMPETITION OVERVIEW

The Asia Pacific UPS market is highly competitive, driven by technological advancements and increasing demand for reliable power solutions. Established players like Schneider Electric, Vertiv, and Eaton dominate through continuous innovation, while regional manufacturers offer cost-effective alternatives. The market is witnessing a surge in IoT-enabled UPS systems, creating opportunities for differentiation. Regulatory mandates promoting energy efficiency further intensify rivalry, pushing companies to invest in R&D. Additionally, emerging markets like India and Vietnam are attracting investments, fostering a dynamic competitive landscape.

RECENT MARKET DEVELOPMENTS

- In April 2023, Schneider Electric partnered with India’s Ministry of Power to deploy advanced UPS systems in rural healthcare facilities, ensuring uninterrupted power for critical equipment.

- In January 2024, Eaton unveiled its 93PR series, offering scalable and eco-friendly solutions for SMEs in Southeast Asia.

- In March 2024, ABB introduced its DPA 250 S modular UPS system, designed for industrial automation projects in Vietnam and Indonesia.

- In May 2024, Huawei expanded its FusionPower series, integrating AI-driven predictive maintenance for data centers in Singapore and Malaysia.

MARKET SEGMENTATION

This Asia Pacific UPS market research report is segmented and sub-segmented into the following categories.

By Capacity

- Less than 10 kVA

- 10-100 kVA

- Above 100 kVA

By Type

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

By Application

- Data Centers

- Telecommunications

- Healthcare (Hospitals, Clinics, etc.)

- Industrial Other Applications

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives demand in the Asia Pacific UPS market?

The Asia Pacific UPS market is driven by rapid data center expansion, industrial automation, digitalization, and frequent power outages in developing economies

2. What challenges does the Asia Pacific UPS market face?

High upfront costs, price competition, supply chain disruptions, and lack of technical expertise hinder Asia Pacific UPS market growth

3. What opportunities exist in the Asia Pacific UPS market?

Integration with renewables, rural electrification, and rising demand in emerging economies offer major opportunities for the Asia Pacific UPS market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]