Asia Pacific Transformer Market Size, Share, Trends & Growth Forecast Report By Power Rating (Large, Medium, Small), Cooling Type (Air-cooled, Oil-cooled), Transformer Type (Power Transformer, Distribution Transformer), and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC) – Industry Analysis From 2025 to 2033.

Asia Pacific Transformer Market Size

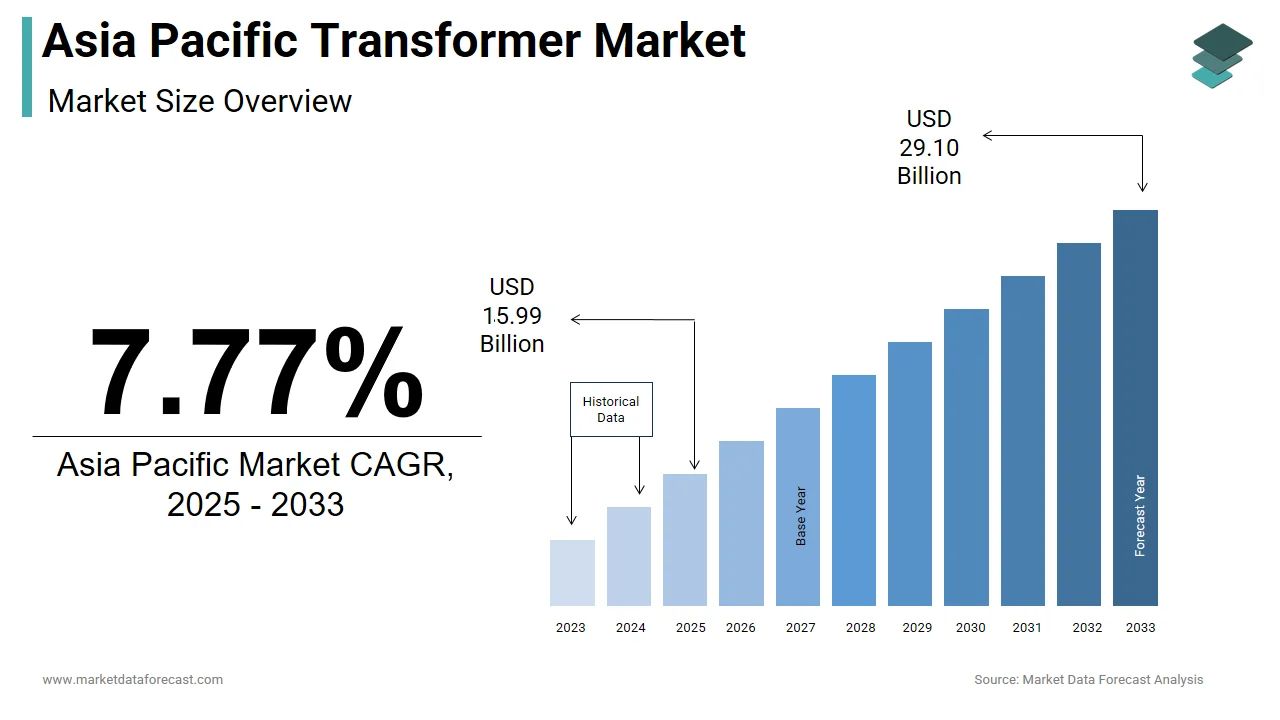

The size of the Asia Pacific transformer market was worth USD 14.84 billion in 2024. The Asia Pacific market is anticipated to grow at a CAGR of 7.77% from 2025 to 2033 and be worth USD 29.10 billion by 2033 from USD 15.99 billion in 2025.

MARKET DRIVERS

Growing Electricity Demand and Grid Expansion

Rising electricity demand is a key driver of the Asia Pacific transformer market, fueled by urbanization and industrial growth. Like, electricity consumption in the region is projected to increas by 2030, creating a surge in demand for efficient transformers. For example, India’s Ministry of Power plans to expand its transmission network by 25% by 2025, requiring a significant number of new transformers. Additionally, the rise of decentralized power systems has increased reliance on compact transformers, ensuring their indispensability in modern energy networks. These trends collectively fuel the market’s expansion.

Government Initiatives for Renewable Energy Integration

Government initiatives promoting renewable energy integration are another major driver, particularly in countries like Japan and South Korea.

South Korea’s Green New Deal allocates $65 billion for clean energy projects, including upgrades to grid infrastructure, as reported by Reuters. Transformers play a pivotal role in stabilizing renewable energy grids, reducing intermittency issues. Additionally, advancements in smart transformers with IoT-enabled monitoring capabilities have improved grid reliability, positioning them as critical enablers of sustainable energy solutions.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

One of the primary restraints of the Asia Pacific transformer market is the high initial investment required for installation and maintenance. This financial barrier limits adoption, particularly in developing economies like Bangladesh and Myanmar, where budget constraints are prevalent. Additionally, maintenance costs account for a notable share of the total lifecycle expenses. Smaller players often find these costs prohibitive, hindering widespread adoption. While leasing models and financing options exist, they remain inaccessible to many stakeholders, particularly in rural or semi-urban areas.

Supply Chain Disruptions and Raw Material Shortages

Another restraint is supply chain disruptions exacerbated by geopolitical tensions and logistical bottlenecks. Natural disasters, such as floods in Thailand and typhoons in the Philippines, further disrupt supply chains, delaying project timelines and increasing operational risks. These challenges not only hinder timely deliveries but also strain relationships with clients, impacting brand reputation and customer loyalty.

MARKET OPPORTUNITIES

Integration with Smart Grid Technologies

The integration of transformers with smart grid technologies presents a significant opportunity for the Asia Pacific market. Like, IoT-enabled transformers with real-time monitoring capabilities are expected to grow notably, driven by industries like power transmission and renewable energy. This trend is supported by government incentives promoting automation. Additionally, advancements in predictive maintenance have reduced downtime, making transformers more efficient for prolonged use. These innovations position smart transformers as a critical enabler of sustainable energy solutions, fostering synergies across sectors.

Expansion into Emerging Markets

Emerging markets, such as Vietnam, Indonesia, and the Philippines, offer another promising opportunity. For example, the rise of e-commerce platforms further accelerates adoption. Additionally, innovations in lightweight designs have made transformers more accessible for decentralized applications, ensuring long-term market growth.

MARKET CHALLENGES

Competition from Low-Cost Alternatives

One of the primary challenges facing the Asia Pacific transformer market is competition from low-cost alternatives, particularly in price-sensitive regions. For instance, a significant portion of transformers sold in rural markets fail safety standards, posing risks to grid stability. This trend is exacerbated by the lack of stringent regulations, allowing substandard products to flood the market. Additionally, public awareness about product quality remains low, deterring investments in premium transformers.

Environmental Concerns and Material Limitations

Another challenge is environmental concerns associated with transformer materials and energy losses. According to the Environmental Defense Fund, improper disposal of transformer oils contributes significantly to environmental pollution, raising scrutiny from regulatory bodies. For example, China’s Ministry of Ecology and Environment has introduced stricter recycling mandates, increasing compliance costs for manufacturers, as reported by Reuters. Material limitations, such as core efficiency and thermal degradation, further complicate adoption. These challenges not only increase operational risks but also deter investments, complicating the market’s growth trajectory.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Power Rating, Cooling Type, Transformer Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

Siemens AG, ABB Ltd, General Electric Company, Mitsubishi Electric Corporation, Schneider Electric, and others. |

SEGMENTAL ANALYSIS

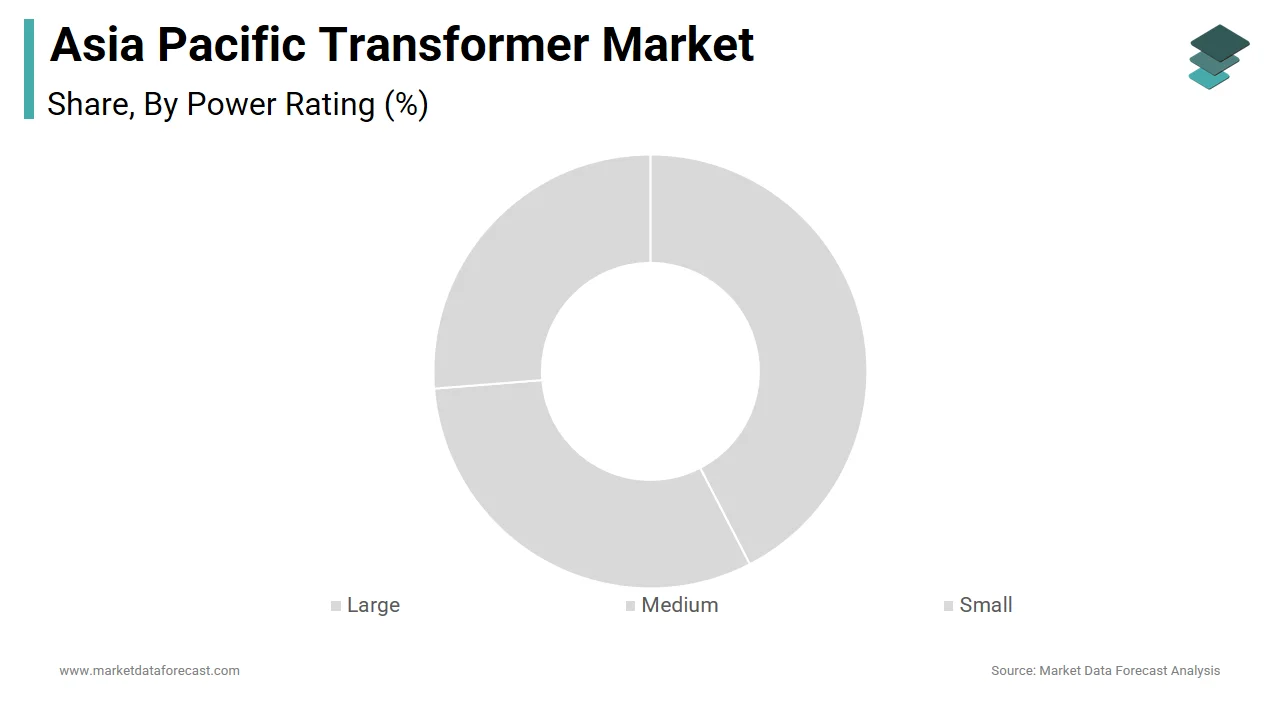

By Power Rating

The large transformer segment dominated the Asia Pacific market by capturing a 50.5% of the total share. This is driven by its critical role in high-voltage power transmission projects, particularly in countries with extensive grid networks like China and India. Government initiatives promoting grid modernization further reinforce this trend. Additionally, advancements in core materials have improved efficiency, reducing energy losses and making them indispensable for long-distance power transmission. These factors collectively ensure the segment’s dominance in the market.

The small transformer segment is the fastest-growing, with a projected CAGR of 8.5%. This is fueled by its increasing use in decentralized power systems and rural electrification projects. For example, Vietnam’s Ministry of Industry and Trade plans to deploy over 10,000 small transformers in rural areas by 2025, as reported by the Vietnam News Agency. The rise of renewable energy integration also drives adoption. Additionally, innovations in compact designs have made these transformers more accessible for emerging markets, positioning them as the fastest-growing segment in the market.

By Cooling Type

The oil-cooled transformer segment commanded the Asia Pacific market by holding a 70.6% of the total share in 2024. This dominance is attributed to their superior cooling efficiency and ability to handle high-power applications, making them indispensable for industrial and utility-scale projects. Government policies promoting grid stability further bolster this trend. Besides, advancements in biodegradable oils have reduced environmental risks, making them more sustainable for prolonged use.

The air-cooled transformer segment is the quickest expanding, with a CAGR of 9.2%. This growth is propelled by its increasing use in urbanized areas and industries requiring eco-friendly solutions. For example, South Korea’s Green New Deal allocates $65 billion for clean energy projects, including investments in air-cooled transformers for residential and commercial applications, as stated by Reuters. The rise of smart cities further accelerates adoption. Additionally, innovations in thermal management have improved efficiency, positioning air-cooled transformers as the fastest-growing segment in the market.

By Transformer Type

The distribution transformer segment prevailed the Asia Pacific market by capturing a 60.6% of the total share in 2024. This leading position is driven by its widespread application in low-voltage networks, particularly in urbanized and rural electrification projects. Government initiatives promoting universal electrification further reinforce this trend. Also, advancements in dry-type transformers have improved safety and efficiency, making them indispensable for localized applications.

The power transformer segment is the fastest-growing, with a projected CAGR of 8.1%. This progress is caused by its increasing use in high-voltage transmission projects and renewable energy integration. The rise of cross-border energy trading also drives adoption. According to the IEA, a notable share of regional energy trade requires high-capacity transformers, reducing transmission losses. Moreover, innovations in IoT-enabled monitoring have improved reliability, positioning power transformers as the fastest-growing segment in the market.

COUNTRY LEVEL ANALYSIS

China led the Asia Pacific transformer market by holding a 40.8% of the regional share in 2024. The country’s dominance is driven by its massive industrial base and government-led grid modernization projects. Government initiatives promoting smart grids further reinforce this trend. For instance, China’s Belt and Road Initiative has allocated substantial amount for infrastructure projects across Asia, driving demand for advanced transformers. In addition, innovations in biodegradable oils have improved sustainability, making transformers more eco-friendly for prolonged use.

India is witnessing an impressive development in the market share, driven by its growing urbanization and universal electrification goals. The rise of renewable energy integration further accelerates adoption. For example, India’s Solar Energy Corporation of India (SECI) has launched pilot projects integrating transformers with solar farms, enhancing grid stability. Also, advancements in dry-type transformers have improved safety, ensuring sustained market growth.

Japan holds key share of the market, with a strong emphasis on energy efficiency and sustainability. The focus on carbon neutrality further drives adoption. For instance, Japan’s Society 5.0 program promotes smart factories, mandating the use of oil-cooled transformers. Also, innovations in thermal management have improved efficiency, positioning Japan as a leader in sustainable energy solutions.

South Korea is seeing notable growth rate in the market which is driven by its Green New Deal. Transformers are integral to this initiative, particularly in sectors like renewable energy and smart cities. The rise of EVs and renewable energy further boosts demand. These trends ensure sustained market growth.

Australia & New Zealand contributes majorly of the market, with a focus on renewable energy integration and industrial modernization. Also, New Zealand’s commitment to sustainability has spurred demand for eco-friendly designs, such as dry-type transformers powered by renewable energy. Additionally, Australia’s booming mining sector has increased demand for robust transformers in mineral processing. These dynamics position the region as a key player in the market.

KEY MARKET PLAYERS

Some of the noteworthy companies in the APAC transformer market profiled in this report are Siemens AG, ABB Ltd, General Electric Company, Mitsubishi Electric Corporation, Schneider Electric, and others.

TOP LEADING PLAYERS IN THE MARKET

ABB Ltd.

ABB is a global leader in the transformer market, renowned for its innovative and energy-efficient products tailored to utility and industrial applications. The company has strengthened its presence in Asia Pacific by investing in localized manufacturing hubs and R&D facilities. Additionally, it partnered with renewable energy firms in Australia to integrate transformers into solar and wind farms, reinforcing its commitment to sustainability and technological advancement.

Siemens Energy

Siemens Energy plays a pivotal role in the Asia Pacific market, offering advanced transformers designed for high-voltage transmission and smart grid applications. The company focuses on innovation, introducing IoT-enabled transformers with real-time monitoring capabilities. Its emphasis on digitalization and energy efficiency positions it as a preferred choice for large-scale projects across the region.

Mitsubishi Electric Corporation

Mitsubishi Electric is a key player in the Asia Pacific market, leveraging its expertise in compact and high-efficiency transformers. The company focuses on sustainability, launching eco-friendly designs in Japan to align with carbon neutrality goals. Its focus on affordability and reliability ensures long-term market presence while addressing evolving energy needs.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific transformer market employ diverse strategies to maintain their competitive edge. Innovation is central, with companies investing heavily in R&D to develop advanced technologies like IoT-enabled transformers and biodegradable cooling oils. Partnerships and collaborations are another critical strategy; Siemens partners with renewable energy firms to integrate transformers into solar and wind farms, while Mitsubishi collaborates with governments to address rural electrification needs.

Expansion into emerging markets is also a priority. Companies are establishing manufacturing units and service centers in countries like Vietnam and Thailand to cater to growing demand. Additionally, mergers and acquisitions play a pivotal role. Sustainability initiatives are gaining traction, with firms adopting eco-friendly materials and energy-efficient designs to align with government regulations. These strategies collectively ensure that key players remain at the forefront of technological advancements while addressing the unique demands of the Asia Pacific market.

COMPETITION OVERVIEW

The Asia Pacific transformer market is highly competitive, driven by the presence of both global giants and regional players. Global leaders like ABB, Siemens, and Mitsubishi dominate through technological superiority and extensive distribution networks, while regional players focus on affordability and localized solutions. Price wars are common, particularly in price-sensitive markets like India and Indonesia, where smaller firms struggle to compete with established brands.

Government policies promoting renewable energy integration have intensified rivalry, as companies race to capture contracts for large-scale projects. For instance, budget constraints in Southeast Asia have created a battleground for cost-effective solutions. Additionally, the rise of counterfeit transformers poses a significant challenge, forcing manufacturers to innovate or risk obsolescence. Despite these challenges, the market remains dynamic, with innovation and strategic collaborations serving as key differentiators.

RECENT MARKET DEVELOPMENTS

- In March 2023, ABB launched its next-generation eco-friendly transformers in India, featuring biodegradable oils to reduce environmental risks. This move aimed to strengthen its presence in sustainable energy solutions.

- In July 2023, Mitsubishi Electric collaborated with Vietnam’s Ministry of Industry and Trade to supply transformers for rural electrification projects, addressing emerging market needs.

- In September 2023, ABB partnered with renewable energy firms in Australia to integrate transformers into solar and wind farms, enhancing grid stability and reliability.

- In November 2023, Siemens introduced IoT-enabled transformers with real-time monitoring capabilities in South Korea, improving grid efficiency by 20%.

MARKET SEGMENTATION

This Asia Pacific transformer market research report is segmented and sub-segmented into the following categories.

By Power Rating

- Large

- Medium

- Small

By Cooling Type

- Air-cooled

- Oil-cooled

By Transformer Type

- Power Transformer

- Distribution Transformer

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

1. What drives the Asia Pacific transformer market?

The Asia Pacific transformer market is driven by surging electricity demand from rapid urbanization, industrial growth, and government initiatives for grid modernization and renewable energy integration

2. What are the main challenges for the Asia Pacific transformer market?

Key challenges include high installation and maintenance costs, supply chain disruptions, competition from low-cost alternatives, and environmental concerns over transformer materials and energy losses

3. What opportunities are emerging in the Asia Pacific transformer market?

Major opportunities include adoption of smart transformers with IoT monitoring, expansion in rural and decentralized grids, and rising demand for energy-efficient and eco-friendly transformer technologies

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]