Asia Pacific Titanium Dioxide Market Research Report – Segmentation By Grade (Ilmenite, Rutile), Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Titanium Dioxide Market Size

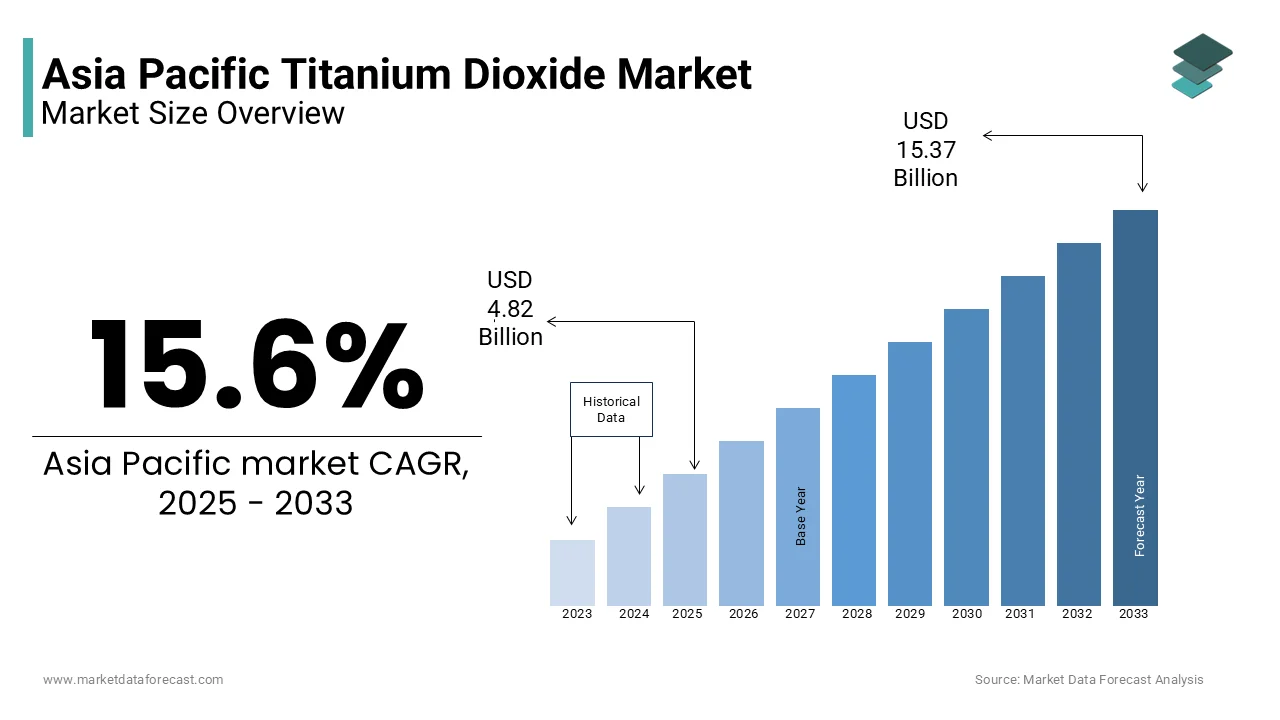

The Asia Pacific titanium dioxide market size was valued at USD 4.17 billion in 2024 and the market size is expected to reach USD 15.37 billion by 2033 from USD 4.82 billion in 2025. The market is predicted to register a CAGR of 15.6% during the forecast period.

Asia Pacific titanium dioxide is a vital chemical compound widely found and used across the region. Derived from titanium minerals, it serves as a white pigment extensively applied in paints, coatings, plastics, and cosmetics. Renowned for its opacity, brightness, and UV resistance, it's a key component in architectural and industrial coatings, plastic production for whitening and UV protection, and cosmetics for opacity and sun defense. Its versatile properties make it a significant contributor to various industries in the Asia Pacific region.

MARKET DRIVERS

The region's burgeoning population and rapid urbanization are significant drivers for the market’s peak. Titanium dioxide, a crucial component in paints, coatings, and plastics, is witnessing increased use in the construction, automotive, and consumer goods industries. The construction boom, driven by urban development, necessitates titanium dioxide for paints and coatings in new structures. Similarly, the growing demand for consumer goods, including packaging materials, textiles, and household products, further boosts the market. As urban lifestyles become more prevalent, the Asia Pacific Titanium Dioxide Market is poised to experience sustained growth, underpinned by the region's dynamic demographic and urbanization trends.

Technological advancements act as a transformative phase which hype up the demand of the Asia Pacific Titanium Dioxide Market growth. Innovations in titanium dioxide manufacturing are revolutionizing the industry by enhancing efficiency and elevating product quality. These advancements not only contribute to cost efficiencies but also make titanium dioxide increasingly appealing to manufacturers across diverse sectors. Improved production methods, including novel synthesis techniques and sustainable practices, are shaping the market landscape. As manufacturers embrace these innovations, the Asia Pacific Titanium Dioxide Market stands poised for expansion, meeting the rising demand from industries such as paints, coatings, plastics, and textiles.

MARKET RESTRAINTS

The Asia Pacific Titanium Dioxide Market, while experiencing robust growth, confronts the persistent challenge of overcapacity. Fluctuating production levels occasionally result in excess supply, fostering intense competition and exerting downward pressure on prices. This scenario poses a considerable challenge for producers, impacting profit margins and overall market stability. The struggle to maintain competitiveness amid overcapacity necessitates strategic adaptations, including cost-cutting measures and enhanced operational efficiencies. Producers must navigate this dynamic landscape by seeking avenues for innovation and differentiation to mitigate the adverse effects of pricing pressures. Market players in the Asia Pacific region are compelled to carefully manage production capacities, fostering resilience in the face of overcapacity-induced challenges and ensuring sustainable growth in a market characterized by periodic imbalances.

However, there is another notable challenge arises from the inherent volatility in raw material prices, specifically ilmenite and rutile. These essential inputs in titanium dioxide production are susceptible to price fluctuations, thereby influencing the overall production costs for manufacturers in the region. The unpredictable nature of raw material prices poses a significant challenge, compelling industry players to grapple with cost uncertainties that can impact profit margins. Producers in the Asia Pacific region must strategically navigate this challenge by adopting risk mitigation measures, including supply chain diversification and forging stable supplier relationships. Adapting to the ebb and flow of raw material prices becomes imperative for sustained competitiveness, emphasizing the need for agile strategies to ensure market resilience and stable operations amid the unpredictable dynamics of the titanium dioxide industry.

SEGMENTAL ANALYSIS

By Grade Insights

Rutile tends to be more dominating in the market growth as it is often favoured due to its higher titanium dioxide content compared to ilmenite, making it a more efficient and desirable feedstock for titanium dioxide production. Rutile's superior quality contributes to the production of higher-grade titanium dioxide products, which are often preferred in various applications, including paints, coatings, and plastics.

On the other hand, while ilmenite is a commonly used raw material, its titanium dioxide content is generally lower than that of rutile. Despite being less dominant, ilmenite still plays a significant role in the market, particularly when cost considerations come into play. Ilmenite is often more abundant and economically feasible, making it a viable option in situations where cost competitiveness is a primary concern.

By Application Insights

Among the applications, paints hold the largest market share in the Asia Pacific region. Titanium dioxide is a key pigment in the paint industry, providing opacity, brightness, and durability to coatings. While dominating, the demand for titanium dioxide in paints is closely followed by other sectors, contributing significantly to the overall market.

Varnishes utilize titanium dioxide for its whitening and protective properties. However, its dominance is typically lesser compared to the paint industry. Varnishes represent a substantial but secondary application compared to paints.

REGIONAL ANALYSIS

China is a powerhouse in the Asia Pacific Titanium Dioxide Market growth, often dominating due to its significant manufacturing capabilities and vast industrial infrastructure. The country has a robust demand for titanium dioxide across various industries such as construction, automotive, and consumer goods. While dominating, China faces competition from other countries, particularly in terms of technological advancements and environmental sustainability practices.

India represents a growing market for titanium dioxide, driven by expanding construction activities, a burgeoning automotive sector, and increasing consumer goods consumption. India's market is characterized by a mix of domestic production and imports, with competition from other regional players.

Japan has a mature and technologically advanced market for titanium dioxide. The country is a significant consumer, particularly in industries emphasizing high-quality products such as automotive coatings and electronics.

South Korea plays a substantial role in the Asia Pacific Titanium Dioxide Market, driven by its well-developed industrial sector. The country is a major consumer, especially in applications such as paints, coatings, and electronics.

KEY MARKET PLAYERS

Chemours Company, Tronox Holdings plc, Venator Materials PLC, Tayca Corporation, Ishihara Sangyo Kaisha, Ltd., Lomon Billions Group, Kronos Worldwide, Inc., The National Titanium Dioxide Company Ltd. (Cristal), Jilin GPRO Titanium Industry Co., Ltd., CNNC Hua Yuan Titanium Dioxide Co., Ltd., Grupa Azoty SA, Kerala Minerals and Metals Ltd. (KMML), Billions Chemicals Group are playing dominating role in the Asia Pacific titanium dioxide market.

MARKET SEGMENTATION

This research report on the Asia Pacific titanium dioxide market has been segmented and sub-segmented based on the following categories.

By Grade

- Ilmenite

- Rutile

By Application

- Paints

- Varnishes

- Cosmetic products

- Paper and plastics

- Healthcare

- Food industry

- Thin films

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is the Asia Pacific Titanium Dioxide Market growth rate during the projection period?

The Asia Pacific Titanium Dioxide Market is expected to grow with a CAGR of 15.6% between 2025 and 2033.

2. What can be the total Asia Pacific Titanium Dioxide Market value?

The Asia Pacific Titanium Dioxide Market size is expected to reach a revised size of USD 15.37 billion by 2033.

3. Name any three Asia Pacific Titanium Dioxide Market key players?

Tronox Holdings plc, Venator Materials PLC, and Tayca Corporation are the three Asia Pacific Titanium Dioxide Market key players.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]