Asia Pacific Smart Vending Machine Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Fast Food Restaurants, Shopping Malls, Retail Stores, Public Transportation Hubs, Airports, Hospitals, Hotels, Train Stations, Schools, And Business Centers), Type, Technology, Region (Japan, India, Singapore, Australia, China, Korea) - Industry Analysis from 2025 to 2033

Asia Pacific Smart Vending Machine Market Size

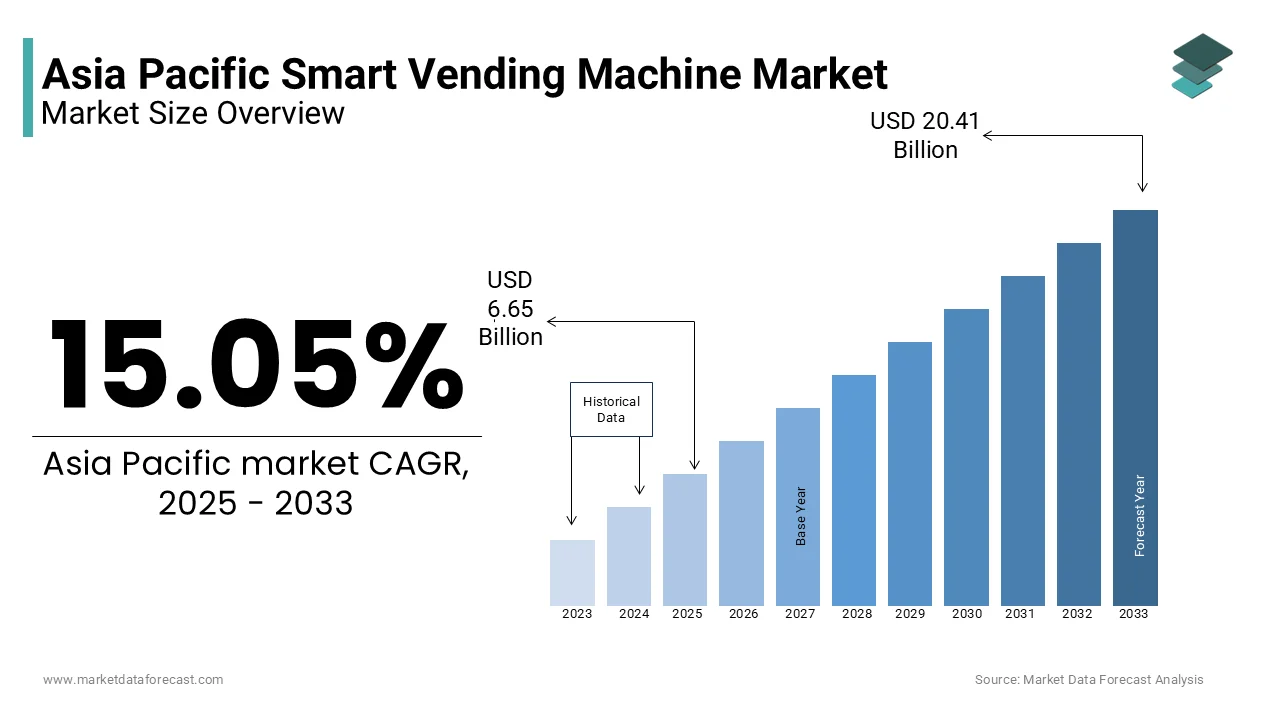

Asia Pacific Smart Vending Machine Market size was valued at USD 5.78 billion in 2024. The Asia Pacific market size is estimated to reach USD 20.41 billion by 2033 from USD 6.65 billion in 2025, with a CAGR of 15.05% from 2025 to 2033.

Several manufacturers are launching online vending machines that allow customers to purchase items over the Internet. These machines provide customers with Internet connectivity and enable the online purchase of products through smartphone applications. These interactive solutions will attract more customers to the stores that buy with these machines in the coming years. Several manufacturers in the smart vending industry are integrating these machines with cashless payment technologies.

The increasing penetration of the Internet of Things (IoT) and connected device technologies is expected to drive the growth of smart vending machines. The growing consumer inclination towards cashless payments is further helping accelerate the growth of the industry. Cashless communication, near field communication (NFC), and mobile payment protocols are believed to have a favourable impact on the industry. Technological proliferation is leading to the adoption of innovative techniques, such as facial and voice recognition, in distribution systems. Built-in machines with voice and facial recognition sensors make it easy for users to recommend products based on their age and gender. Vendors focus on implementing interactive distribution systems to generate more revenue through advertising and displaying other information and news. In addition, the systems help reduce operating costs as they can be managed across remote sites, eliminating the need for a machine administrator to intervene. However, increased regulations on the sale of junk food on avenues such as schools and a ban on potentially dangerous confectionery products, such as cigarettes and tobacco, are believed to discourage market growth. Furthermore, the manufacture and deployment of these machines is an expensive affair, which subsequently affects the interests of the seller.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.05% |

|

Segments Covered |

By Application, Type, Technology, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

IBM Corporation, Azkoyen Group, Fuji Electric Co. Ltd., Glory, Ltd., Fujitsu Limited, Hitachi, Ltd., Honeywell International, Inc., Bianchi Vending Group S.p.A., Aramark Corporation, and Compass Group., and others. |

SEGMENTAL ANALYSIS

By Type Insights

Beverages are believed to emerge as the fastest-growing type segment in the smart vending market due to the growing emphasis on healthy distribution. The segment mainly includes packaged beverages such as juices, water, milk, flavoured water, and energy drinks, among others.

Consumers are constantly looking for new packaged beverages that are low in calories and fit healthy lifestyles and needs. The availability of beverages packaged in tetra paks and aseptic multilayer cartons is increasing the adoption of packaged beverages. The adoption of these systems in office buildings offers several advantages, such as space conservation, cost-effectiveness, and cleanliness. Shopping malls and retail stores are expected to dominate the application segment during the forecast period.

REGIONAL ANALYSIS

The market for Asia Pacific Smart Vending Machine has been categorized on the basis of geography to offer a clear understanding of the market. The Market for Asia Pacific Smart Vending Machine has been divided into China, Taiwan, South Korea, India, Japan, Australia, and New Zealand, and the rest of the Asia-Pacific. The Asia-Pacific smart vending market is expected to register significant growth in terms of revenue due to increasing digitization in the region. Furthermore, the shift in the attention of the tech-savvy population towards hassle-free shopping, coupled with increasing disposable income, are key factors that are expected to drive the demand for smart vending machines in India, especially for installation in metropolitan cities. Additionally, manufacturers are focusing on adopting high-end technologies and launching innovative vending machines to make it easier for consumers to purchase products.

RECENT HAPPENINGS IN THE MARKET

- In June 2018, in an effort to establish and expand its offline presence, grocery platform BigBasket was in talks to acquire a controlling stake in the Kwik24 smart vending machine startup, according to two people familiar with the matter. The development comes after the Alibaba-backed company launched a pilot project with Kwik24 to implement smart vending machines in five apartment buildings in Bengaluru.

- Almost seven months after raising $ 300 million from Alibaba Group Holding Ltd., online grocery store Bigbasket said it had acquired three startups, which will help it offer subscription-based services and allow customers to buy commodities through vending machines. Bigbasket has acquired two startups: Bengaluru-based Morning Cart and RainCan, a Pune-based milk subscription platform, it said today in a statement. According to the statement, it also bought a controlling stake in the Kwik 24 cloud-connected smart vending machine platform.

- 365 Retail Markets has acquired 'smart store' technology company Stockwell for an undisclosed figure as the company aims to improve its underserved retail offering. Based in Oakland, California, Stockwell pioneered an unattended retail solution that uses artificial intelligence, machine learning, and computer vision to create fully-managed and customizable "smart stores" for apartments, offices, hotels, and similar venues.

- Fastenal Co., Winona, MN, purchased certain assets of Apex Industrial Technologies on March 30, according to an 8-K filed by the company. Over the past 12 years, Apex has supplied Fastenal with thousands of industrial vending machines, and the dealer is widely regarded as the leader in the use of this on-site sales tool at industrial and commercial sites.

- Cleveland-based Vendors Exchange International acquired American Vending Machine, according to a Vending Times report. The combination of the companies and the additional operational site will allow Vendors Exchange to better serve its customers by generating shorter lead times and more profitable solutions. AVM's St. Louis plant will provide additional manufacturing space and a highly skilled workforce.

- Luckin Coffee has grown at a rapid pace as it aims to steal market share from Starbucks, its main competitor. Unmanned coffee vending machines are another way to further saturate the market, including key places where busy people need a caffeine boost, such as airports and office buildings. As customers seek convenience, the chance to grab a cup of coffee while traveling in an unexpected location may also boost brand loyalty for some coffee drinkers or entice Starbucks drinkers to try Luckin's coffee, placing them in an area where Starbucks is not available.

KEY MARKET PLAYERS

Key players in the Asia Pacific Smart Vending Machine Market are IBM Corporation, Azkoyen Group, Fuji Electric Co. Ltd., Glory, Ltd., Fujitsu Limited, Hitachi, Ltd., Honeywell International, Inc., Bianchi Vending Group S.p.A., Aramark Corporation, and Compass Group.

MARKET SEGMENTATION

This Research Report on Asia Pacific Smart Vending Machine Market is segmented and sub segmented into following categories

By Application

- Fast Food Restaurants

- Shopping Malls

- Retail Store

- Public Transportation

- Airports

- Hospitals

- Hotels

- Train Stations

- Schools

- Business Centres

By Type

- Beverages

- Snacks

- Commodities

- others

By Technology

- Cashless Systems

- Telemetry Systems

- Voice Recognition

By Country

- China

- Taiwan

- South Korea

- India

- Japan

- Australia

- New Zealand

- rest of the Asia-Pacific

Frequently Asked Questions

1. What is the projected growth rate for the Asia Pacific smart vending machine market?

The market is expected to grow at a compound annual growth rate (CAGR) of 15.05% from 2025 to 2033.

2. What factors are driving the growth of the Asia Pacific smart vending machine market?

Key drivers include increasing urbanization, rising disposable incomes, demand for convenience, and technological advancements such as cashless payment options and IoT integration.

3. What trends are influencing the Asia Pacific smart vending machine market?

Current trends include the integration of advanced technologies like AI and machine learning for inventory management, increased consumer preference for contactless transactions, and a growing focus on health-conscious product offerings.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]