Asia Pacific Recycled Plastics Market Research Report - Segmented Based on Type, Recycling process, Application and Country (India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) - Analysis on Size, Share, Trends, & Growth Forecast from 2025 to 2033

Asia Pacific Recycled Plastics Market Size

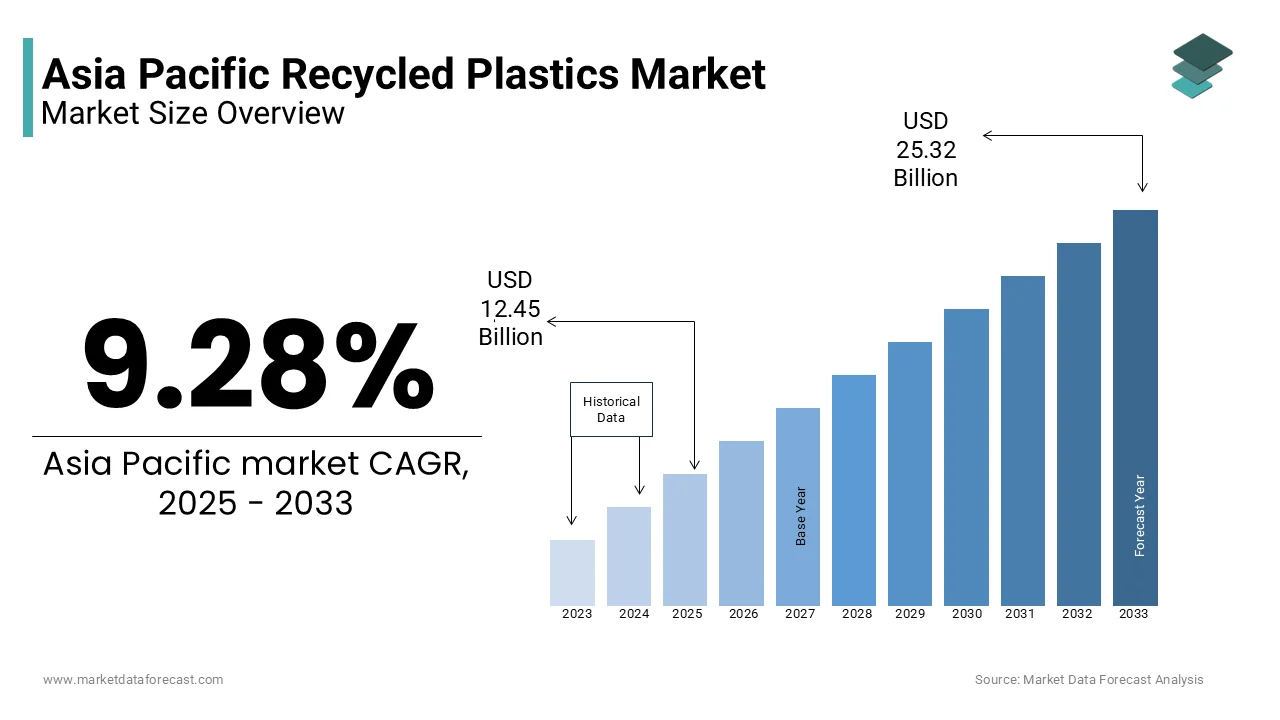

The Asia Pacific Recycled Plastics Market size was valued at USD 11.39 billion in 2024 and is anticipated to reach a valuation of USD 25.32 billion by 2033 from USD 12.45 billion in 2025, with a CAGR of 9.28% during the forecast period 2025 to 2033.

MARKET OVERVIEW

Asia Pacific Recycled Plastic undergo eco-friendly processes, diverting waste from landfills. They include PET, HDPE, PVC, sourced from used or industrial origins. After recycling, they find new life in packaging, construction, and more, supporting sustainable practices across Asia-Pacific. By transforming discarded plastics into valuable resources, these recycled materials play a vital role in environmental conservation and fostering a circular economy in the region. They're the second chance for plastics, offering a sustainable solution to reduce waste and environmental impact throughout the Asia-Pacific area.

MARKET DRIVERS

Environmental awareness acts as an important driver for market growth. Governments, businesses, and consumers across the Asia-Pacific region are increasingly recognizing the imperative to decrease plastic waste and fostering recycling initiatives. This heightened consciousness has manifested in stringent regulations, with governments implementing policies to curb single-use plastics and encourage the integration of recycled materials. Corporations are aligning with sustainability objectives, incorporating recycled plastics into their production processes as part of broader environmental stewardship. As technology advances, the market witnesses improved recycling methods, enhancing the quality and availability of recycled plastics. The circular economy paradigm is gaining traction, further stimulating the adoption of recycled plastics.

MARKET RESTRAINTS

The growth of the Asia Pacific recycled plastics market encounters restraints notably in cost dynamics. While the region witnesses a surge in environmental consciousness, the initial expenses associated with establishing recycling infrastructure pose a hurdle for market expansion. Investments in advanced recycling technologies demand substantial capital, impacting the adoption rate. Moreover, the price competitiveness of recycled plastics in comparison to their virgin counterparts remains a critical consideration, particularly in industries sensitive to production costs.

MARKET OPPORTUNITIES

Technologies stand as a transformative force, reshaping the market. Ongoing innovations in sorting and cleaning processes represent a pivotal leap forward, rectifying historical challenges associated with the consistency and performance of recycled plastics. These technological strides not only bolster the environmental credentials of recycled materials but also render them increasingly appealing to industries. Improved quality ensures that recycled plastics meet stringent standards, expanding their applicability across diverse sectors. plastics.

MARKET CHALLENGES

The Asia Pacific recycled plastics market faces a substantial challenge in the form of quality variability. The inconsistent quality of recycled plastics poses a hurdle, impacting their performance across diverse applications. This variability is attributed to differences in feedstock composition and varying processing methods employed in recycling facilities. Such disadvantage can lead to recycled plastics with distinct characteristics, raising concerns about reliability and uniformity in end-product applications.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.28% |

|

Segments Covered |

By Type, Recycling Process, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

eolia, SUEZ Group, Indorama Ventures Public Company Limited, Reliance Industries Limited, KW Plastics Recycling Division, Biffa plc, Cleanaway Waste Management Limited, PLASgran Ltd., China National Sword Program, and others. |

SEGMENTAL ANALYSIS

By Type Insights

Among these, PET holds a dominant position in the market growth. Its prevalence is attributed to its widespread use in packaging, particularly in the beverage industry, and its favourable recycling properties. The demand for recycled PET is high due to its versatility, clarity, and strength, making it suitable for applications like bottles and containers. HDPE also maintains a significant presence, driven by its applications in packaging, containers, and pipes.

By Recycling Process Insights

Mechanical recycling is leading in the Asia Pacific region. This process involves collecting, sorting, cleaning, and reprocessing plastics without significantly altering their chemical structure. It is particularly effective for plastics with similar properties, such as PET and HDPE.

By Application Insights

Packaging holds the largest market share as it has driven the use of recycled plastics, particularly in the production of bottles, containers, and other packaging materials. Packaging industries prioritize environmental sustainability, and recycled plastics, especially PET and HDPE, are commonly used to create eco-friendly packaging solutions. The established collection and recycling infrastructure also contributes to the dominance of recycled plastics in the packaging sector.

REGIONAL ANALYSIS

China has been a dominant player in the Asia Pacific recycled plastics market. The country has a well-established recycling industry and has been a major global importer of plastic waste for recycling. However, China has implemented stricter regulations on waste imports, impacting the dynamics of the market.

Japan has a significant presence in the Asia Pacific recycled plastics market. The country has advanced recycling technologies and a strong commitment to environmental sustainability. Japan's sophisticated recycling infrastructure and stringent environmental regulations contribute to the utilization of recycled plastics.

KEY MARKET PLAYERS

Companies playing a prominent role in the Asia Pacific recycled plastics market include Veolia, SUEZ Group, Indorama Ventures Public Company Limited, Reliance Industries Limited, KW Plastics Recycling Division, Biffa plc, Cleanaway Waste Management Limited, PLASgran Ltd., China National Sword Program, Jayplas, Seraphim Plastics LLC, Green Ant Plastic Recycling, Kuusakoski Group, MBA Polymers, Inc., Enviroplast Inc., Delta Plastics of the South, Revive, Alpek SAB de CV, LyondellBasell Industries Holdings B.V., and Others.

RECENT HAPPENINGS IN THE MARKET

- In 2022, Veolia, expanded its presence in the Asia Pacific recycled plastics market through strategic partnerships or investments in advanced recycling technologies. They may have focused on increasing recycling cAsia Pacificities and enhancing plastic waste recovery systems.

- In 2023, SUEZ have implemented innovative recycling solutions in the Asia Pacific region, emphasizing circular economy principles. This might involve collaborations with local governments or industries to improve plastic recycling rates and quality.

MARKET SEGMENTATION

This research report on the Asia Pacific recycled plastics market has been segmented and sub-segmented based on the following categories.

By Type

- PET

- HDPE

- LDPE

- PP

- Others

By Recycling Process

- mechanical

- chemical

By Application

- packaging

- construction

- textile

- automotive

- others

By Country

- China

- Japan

- India

- South Korea

Frequently Asked Questions

1. What is the APAC Recycled Plastics Market growth rate during the projection period?

The APAC Recycled Plastics Market is expected to grow with a CAGR of 9.28% between 2025 to 2033.

2. What can be the total APAC Recycled Plastics Market value?

The APAC Recycled Plastics Market size is expected to reach a revised size of USD 25.32 billion by 2033.

3. Name any three APAC Recycled Plastics Market key players?

Jayplas, Seraphim Plastics LLC, and Green Ant Plastic Recycling are the three APAC Recycled Plastics Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]