Asia-Pacific Preclinical CRO Market Size, Share, Trends & Growth Forecast Report By Service Type, End User & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific Preclinical CRO Market Size

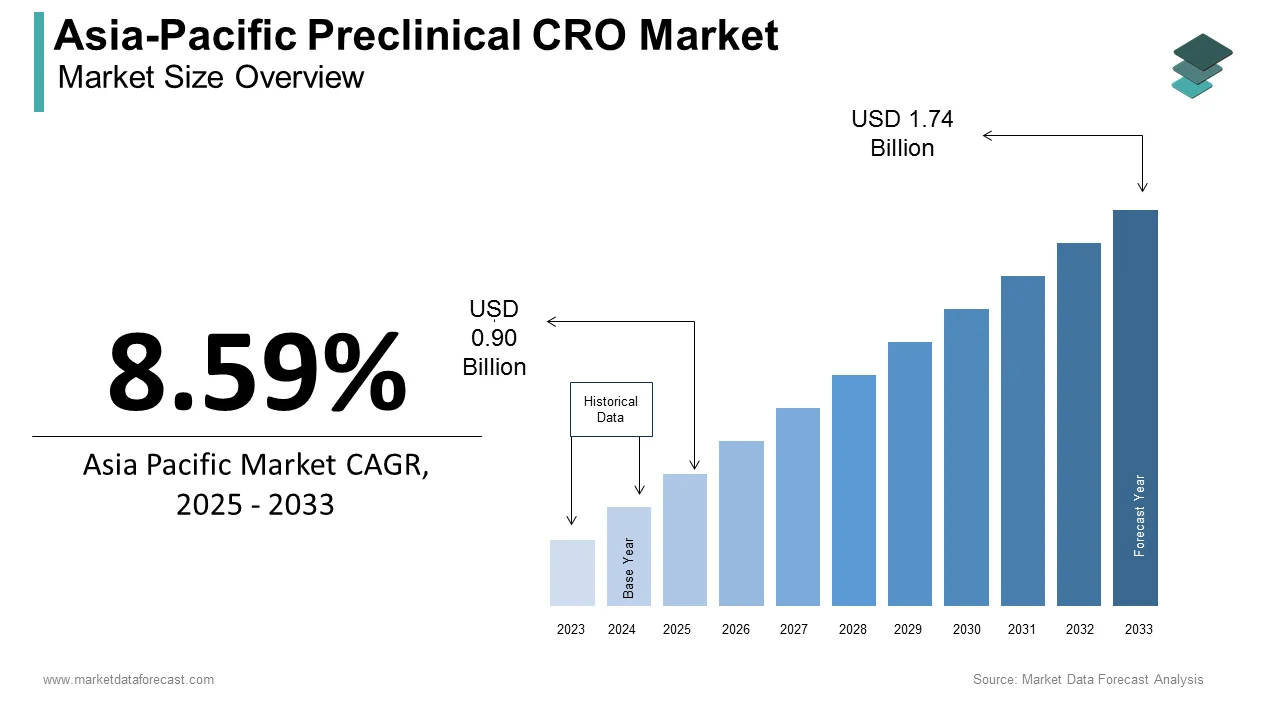

The preclinical CRO market size in Asia-Pacific was valued at USD 0.83 billion in 2024. The regional market is estimated to be growing at a CAGR of 8.59% from 2025 to 2033 and be worth USD 1.74 billion by 2033 from USD 0.90 billion in 2025.

Preclinical CRO encompasses organizations that provide outsourced research services for the preclinical stages of drug development. These services include toxicology studies, pharmacokinetics and pharmacodynamics (PK/PD) assessments, bioanalysis, and preclinical safety evaluations that are essential for regulatory approval and advancing drugs to clinical trials. The rapid growth of the Asia-pacific preclinical CRO market is driven by increased R&D investments, expanding biopharmaceutical industries, and the availability of skilled researchers. According to the World Health Organization, Asia Pacific accounts for a significant share of the global clinical trials landscape due to the preclinical research support. China, India, and South Korea are at the forefront of the Asia-Pacific preclinical CRO market.

MARKET DRIVERS

Growing Biopharmaceutical and Pharmaceutical R&D Investments

The Asia Pacific preclinical CRO market is driven by increasing investments in pharmaceutical and biopharmaceutical research and development. According to the National Bureau of Statistics of China, China allocated over $441 billion to R&D in 2022, with a significant portion directed toward drug development. Similarly, India’s Department of Biotechnology highlights that the country’s biotechnology industry is growing at a 14% annual rate, fueled by supportive government policies like the Biotechnology Industry Research Assistance Council (BIRAC) initiatives. This surge in R&D expenditure underscores the growing reliance on preclinical CROs to optimize timelines and costs for drug discovery and regulatory approval, bolstering market growth across the region.

Favorable Regulatory Environment and Streamlined Approval Processes

Favorable regulatory frameworks in the Asia Pacific region are significantly driving the preclinical CRO market. Countries such as South Korea and Singapore have implemented streamlined approval processes to attract global pharmaceutical companies. The Korean Ministry of Food and Drug Safety has established fast-track pathways for preclinical studies, reducing time-to-market for new therapies. Additionally, Singapore’s Economic Development Board offers grants and tax incentives to CROs and pharmaceutical companies, fostering a conducive environment for research activities. These regulatory advantages, combined with skilled workforces and state-of-the-art infrastructure, are drawing increased demand for preclinical services in the region, solidifying its status as a global hub for drug development.

MARKET RESTRAINTS

High Costs of Advanced Preclinical Technologies

The high costs associated with adopting advanced preclinical technologies are a significant restraint for the Asia Pacific preclinical CRO market. Technologies such as AI-driven drug discovery, high-throughput screening, and next-generation sequencing require substantial capital investment, limiting their accessibility to smaller CROs. According to the Asian Development Bank, approximately 40% of small and medium enterprises (SMEs) in Asia Pacific struggle with funding challenges, which restricts their ability to incorporate cutting-edge technologies. This financial burden impacts the scalability and competitiveness of smaller players, slowing market expansion and innovation in the region’s preclinical CRO sector.

Insufficient Skilled Workforce in Emerging Economies

The lack of adequately trained professionals in emerging economies is a critical challenge for the Asia Pacific preclinical CRO market. Although countries like India and China have robust scientific talent pools, the specialized expertise required for advanced preclinical studies, such as toxicology and bioanalysis, remains limited. According to UNESCO, only 15% of researchers in the region specialize in biomedical sciences, leading to skill gaps in essential areas. This shortage often results in increased training costs and delays in project execution, particularly in developing nations. Addressing this issue is vital to enhancing the overall efficiency and reliability of preclinical research services in the region.

MARKET OPPORTUNITIES

Increasing Demand for Outsourcing Preclinical Services

The rising demand for outsourcing preclinical services presents a significant growth opportunity for the Asia Pacific preclinical CRO market. Pharmaceutical and biotechnology companies are increasingly outsourcing preclinical studies to reduce costs and expedite drug development timelines. According to the Asian Development Bank, outsourcing preclinical services can reduce R&D expenses by up to 30%, making it an attractive option for global firms. Countries like India and China, with their cost-efficient labor and advanced facilities, are becoming preferred destinations for outsourcing. The Indian government’s Make in India initiative further supports this trend, fostering a favorable ecosystem for CROs and encouraging partnerships with global companies to enhance their service portfolios.

Adoption of AI and Digital Technologies in Drug Discovery

The adoption of AI and digital technologies in drug discovery offers a transformative opportunity for the Asia Pacific preclinical CRO market. AI-driven platforms enable faster and more accurate analysis of preclinical data, improving decision-making and reducing time-to-market for new drugs. According to UNESCO, the Asia Pacific region has experienced a 20% annual increase in AI-related research, with countries like South Korea and Singapore leading advancements. Government-backed initiatives, such as South Korea’s AI National Strategy, promote the integration of AI in healthcare R&D. This trend allows CROs to offer innovative, technology-driven services, positioning the region as a global leader in advanced drug discovery and preclinical research solutions.

MARKET CHALLENGES

Regulatory Variability Across Countries

The lack of harmonized regulatory frameworks across Asia Pacific countries poses a significant challenge for the preclinical CRO market. Each country has distinct guidelines for preclinical studies, leading to complexities and delays in regulatory approval. For example, while China’s National Medical Products Administration enforces stringent preclinical testing protocols, India’s Central Drugs Standard Control Organization has relatively flexible standards. This variability creates inefficiencies for global pharmaceutical companies, as studies must be tailored to meet individual country requirements. The Asian Development Bank notes that these disparities increase compliance costs by up to 20%, hindering the seamless execution of multinational research projects and limiting the region’s attractiveness for international collaborations.

Limited Infrastructure in Emerging Markets

Insufficient infrastructure in several emerging Asia Pacific economies significantly hampers the growth of the preclinical CRO market. While countries like Japan and South Korea boast advanced research facilities, others, such as Vietnam and Indonesia, face challenges due to limited access to state-of-the-art laboratories and equipment. According to UNESCO, less than 1% of GDP in many Southeast Asian nations is allocated to R&D, leading to a lack of resources for conducting sophisticated preclinical studies. This infrastructure gap forces companies to rely on a few well-developed markets, reducing overall efficiency and limiting opportunities for market expansion across the region.

SEGMENT ANALYSIS

By Service Type Insights

REGIONAL ANALYSIS

China dominated the preclinical CRO market in the Asia-Pacific in 2024 and the domination of China is anticipated to continue throughout the forecast period owing to its substantial R&D investments and well-established pharmaceutical industry. As per the reports of the National Bureau of Statistics of China, the R&D expenditure of China reached $441 billion in 2022, marking a continuous upward trend. China’s pharmaceutical exports exceeded $25 billion in 2021, reflecting its strong global presence. The regulatory reforms by the National Medical Products Administration, including faster drug approval processes, have attracted significant international collaborations. With advanced infrastructure and cost-efficient services, China has become a preferred destination for outsourcing preclinical studies, reinforcing its leadership in the regional market.

India is another key regional market for preclinical CRO in Asia-Pacific. The cost-effective services and the availability of skilled workforce are boosting the market growth in India. According to the Department of Biotechnology in India, the Indian biotechnology sector is growing at an annual rate of 14% owing to the initiatives such as Make in India. India’s R&D expenditure, though modest at 0.7% of GDP, is effectively utilized due to lower operational costs compared to developed nations. The country is a hub for preclinical research, with numerous CROs offering comprehensive toxicology and pharmacology services. Its regulatory body, the Central Drugs Standard Control Organization, continues to streamline processes, enhancing its appeal for global pharmaceutical companies.

Japan stands out as a leader in the Asia Pacific preclinical CRO market due to its cutting-edge technology and robust focus on innovation. According to Japan’s Ministry of Health, Labour, and Welfare, the country allocated $160 billion to healthcare R&D in 2022, emphasizing drug development. Japan’s highly advanced infrastructure and regulatory expertise make it a global hub for preclinical research, particularly in toxicology and pharmacokinetics. With strong domestic pharmaceutical players and significant collaborations with international firms, Japan ensures high-quality outputs, reinforcing its position as a key player in the Asia Pacific preclinical CRO market.

KEY MARKET PLAYERS

Charles River Laboratories International, Inc.; Laboratory Corporation of America; Envigo, Eurofins Scientific; PRA Health Science, Inc.; Wuxi AppTec; Medpace, Inc.; Pharmaceutical Product Development, LLC.; and Paraxel International Corporation are some of the prominent players in the Asia-Pacific preclinical CRO market.

MARKET SEGMENTATION

This research report on the Asia-Pacific preclinical CRO market is segmented and sub-segmented into the following categories.

By Service Type

- Bioanalysis And DMPK Studies

- Toxicology Testing

- Other Preclinical Services

By End User

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]