Asia Pacific Medical Second Opinion Market Size, Share, Trends & Growth Forecast Report By Type, Supply Providers & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) – Industry Analysis From (2025 to 2033)

Asia Pacific Medical Second Opinion Market Size

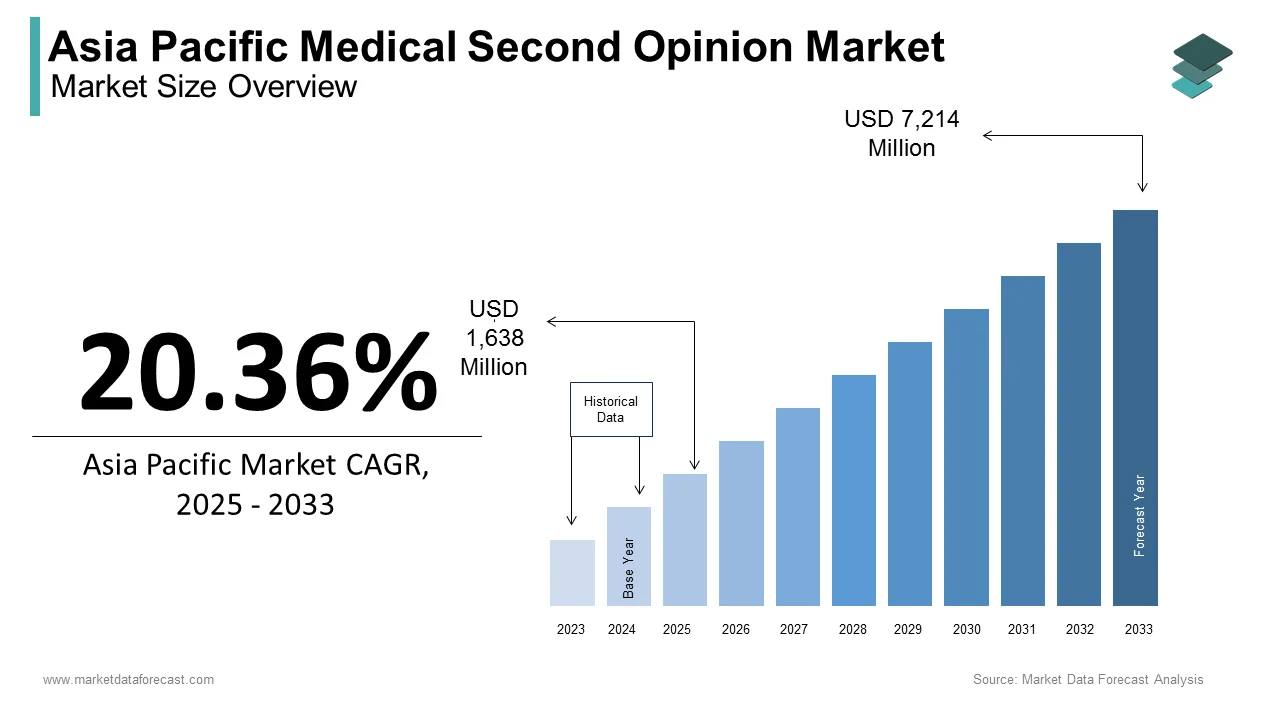

The size of the medical second opinion market in Asia Pacific was valued at USD 1,361 million in 2024. The Asia Pacific market is expected to be valued at USD 1,638 million in 2025 and USD 7,214 million by 2033, exhibiting a CAGR of 20.36% from 2025 to 2033.

The Asia-Pacific medical second opinion market is experiencing substantial growth, driven by increasing healthcare awareness and the rising burden of chronic diseases. Countries like China, Japan, and India are seeing a surge in demand for second opinions, particularly for complex conditions such as cancer and cardiovascular diseases. This demand is fueled by the growing middle class in these regions, where patients seek to ensure accurate diagnoses before committing to invasive treatments. Telemedicine has played a significant role in boosting the market, allowing patients to access expert opinions from specialists across the globe. For example, the adoption of telemedicine in India grew by 25% in 2022, according to the Ministry of Health and Family Welfare, offering an alternative to in-person consultations for second opinions. However, challenges remain. Regulatory inconsistencies across the region and concerns over patient data privacy present obstacles to seamless cross-border consultations. Despite these barriers, the market's growth trajectory is expected to continue, particularly as healthcare infrastructure improves and telemedicine becomes more widely accepted. With the demand for patient-centric, accurate healthcare solutions rising, the Asia-Pacific medical second opinion market is poised for sustained expansion in the coming years.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, particularly cancer and cardiovascular conditions, is a major factor driving the medical second opinion market in the Asia-Pacific region. According to the World Health Organization (WHO), cancer cases in China and India contributed to over 40% of the global cancer burden in 2020, with approximately 4.57 million new cancer cases in China and 1.39 million in India. These rising numbers create an urgent need for accurate and reliable diagnoses, as treatment options for such conditions are often complex and invasive.

Patients are increasingly seeking second opinions to confirm or challenge their initial diagnoses, ensuring that they are opting for the best possible treatment plans. For diseases like cancer, where early and precise treatment is critical to survival, getting a second opinion can significantly impact patient outcomes. According to a study published in the Journal of Clinical Oncology, obtaining a second opinion in oncology cases led to a change in diagnosis or treatment plans in up to 20% of cases, highlighting the importance of second opinions in improving care. As the incidence of chronic diseases continues to rise, so too will the demand for second opinion services, making this one of the most influential drivers of market growth in the region.

Expansion of Telemedicine Services

The rapid expansion of telemedicine services is transforming healthcare delivery in the Asia-Pacific region and is a key driver of the medical second opinion market. In 2022, the adoption of telemedicine increased by 18% in Asia-Pacific, according to Frost & Sullivan, with countries like India, Australia, and China leading the way. Telemedicine platforms enable patients to seek expert consultations from specialists located across the world, providing access to a wider pool of medical expertise than was previously possible. This is particularly important in rural areas, where access to specialized medical care is often limited.

For example, India, where the doctor-to-patient ratio is still below the WHO recommendation of 1:1000, has seen a rapid surge in telemedicine adoption. The Ministry of Health and Family Welfare reported a 25% increase in telemedicine usage in 2022, reflecting the growing reliance on digital platforms for healthcare services. By enabling patients to obtain second opinions without the need to travel long distances, telemedicine has significantly reduced barriers to expert consultations, making high-quality medical advice more accessible. This shift is expected to further drive the second opinion market as more patients turn to digital platforms for reliable, remote consultations with specialists.

Growth of Medical Tourism

The growth of medical tourism in Asia-Pacific is another significant driver of the second opinion market. Countries like Thailand, Singapore, and Malaysia have become popular destinations for patients seeking advanced medical treatments at competitive prices. According to the International Medical Travel Journal, Thailand alone received over 2.4 million medical tourists in 2022, while Singapore’s world-class healthcare infrastructure continues to attract thousands of international patients annually. Many of these patients seek second opinions before committing to complex surgeries or expensive treatments, often relying on top-tier specialists in these countries for reassurance.

Medical tourists frequently come from neighboring countries where healthcare options may be more limited or costly, such as Indonesia, Bangladesh, and the Philippines. They travel to Thailand or Singapore for their renowned medical services, which include advanced diagnostics and treatment technologies. The second opinion process is often a crucial part of the decision-making journey for these patients, ensuring that they are choosing the most effective and least invasive treatment options available. With the medical tourism industry expected to grow at a steady pace, the demand for second opinion services is also set to increase, contributing to the overall growth of the market in the Asia-Pacific region.

MARKET RESTRAINTS

Regulatory and Legal Challenges

One of the most significant restraining factors in the Asia-Pacific medical second opinion market is the variation in healthcare regulations across the region. Each country has different legal frameworks governing telemedicine and cross-border healthcare services, creating a fragmented environment for second opinion providers. For example, Japan has stricter telemedicine laws that limit online consultations to follow-up care, while India has embraced telemedicine more openly, as highlighted by the Indian Ministry of Health and Family Welfare's guidelines released in 2020.

This regulatory inconsistency makes it difficult for telemedicine providers to standardize their services across borders, complicating the second opinion process. Additionally, in many countries, the lack of clear legal provisions regarding telemedicine raises concerns about malpractice liabilities and the enforceability of healthcare standards. A 2021 report by the Asian Development Bank emphasized the need for harmonized regulations to support the growth of digital health services, including second opinions. Until these legal hurdles are addressed, cross-border second opinion services will continue to face obstacles, limiting their potential growth.

Data Privacy and Security Concerns

Data privacy and security are major challenges in the Asia-Pacific medical second opinion market, especially as digital platforms become the primary method for obtaining consultations. The region's diverse legal landscape regarding data protection poses a significant barrier. For instance, while countries like Singapore have stringent data privacy laws, such as the Personal Data Protection Act (PDPA), others like Vietnam and Indonesia have less comprehensive regulations in place. The absence of a unified data protection standard complicates the safe handling of sensitive medical information across borders.

According to a report by KPMG, healthcare data breaches increased by 19% in 2021 across the Asia-Pacific region, raising concerns about the vulnerability of patient data in telemedicine services. Patients are often hesitant to share their medical records digitally, fearing that their personal health data might be exposed or misused. This lack of trust in digital health platforms can deter patients from seeking second opinions online, slowing the adoption of these services. The need for secure, encrypted platforms is critical, and companies that fail to address these concerns may struggle to build patient confidence.

High Costs of Second Opinion Services

Despite the benefits, the high cost of obtaining a second opinion, particularly from renowned specialists, remains a restraining factor in the market. While telemedicine has made it easier to access international medical experts, the associated costs can still be prohibitive for many patients. For instance, a second opinion from a top-tier specialist in Singapore can range from $500 to $1,500, depending on the complexity of the case, as reported by the Singapore Medical Council. This price range is often beyond the reach of middle-income and low-income patients, especially in countries like India or the Philippines, where the average healthcare expenditure per capita is relatively low.

Moreover, many health insurance plans in the region do not cover the costs of second opinions, particularly if they are obtained internationally or through telemedicine. According to a study published by PwC, only 18% of healthcare plans in Asia-Pacific provide reimbursement for second opinion services. This lack of financial support further discourages patients from seeking out additional consultations, even when they are faced with complex or life-threatening conditions. Without better insurance coverage or affordable pricing models, the second-opinion market may struggle to reach its full potential.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Disease, Supply Provider, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Amradnet, London Pain Clinic, Johns Hopkins USA, Cynergy Care, Bright Grey Royal London Group, Helsana Group, Mendocino County Mental Health, Hyjiya Digital Wellness FZCO, Penn Medicine., and Others. |

SEGMENTAL ANALYSIS

By Disease Insights

The cancer segment is the leading segment in the Asia-Pacific medical second opinion market and accounted for 35.8% of the regional market share in 2023. The rising incidence of cancer in countries like China, Japan, and India, coupled with the complexity of treatment options, has fueled the demand for second opinions. According to the World Health Organization (WHO), China and India together contributed to over 40% of global cancer cases in 2020. This growth is driven by advancements in precision medicine, targeted therapies, and the availability of advanced oncology care. A study in the Journal of Clinical Oncology found that around 25% of cancer second opinions result in a change in diagnosis or treatment plan, underscoring the segment's significance in improving patient outcomes.

The cardiac disorders segment represents the second-largest segment and held 25.4% of the regional market share in 2023. Cardiovascular diseases (CVDs) are a major health concern in the region, with over 50% of global CVD deaths occurring in Asia-Pacific, according to the WHO. Patients with conditions such as coronary artery disease or heart failure often seek second opinions to evaluate treatment options like angioplasty or bypass surgery. While not as large as the cancer segment, the cardiac disorder segment benefits from increasing patient awareness, especially as new, less invasive treatments emerge. Patients are more likely to seek second opinions for these complex treatments, particularly in countries like Japan and Australia, which have well-established cardiac care centers.

By Supply Provider Insights

The hospitals segment holds the largest share of the supply provider segment and captured 40.1% of the regional market share in 2023. Hospitals in countries like Singapore, Thailand, and India are recognized for their advanced medical infrastructure and specialized care, making them the top choice for second opinions, particularly in oncology and cardiology. For instance, Singapore’s hospitals are internationally renowned for their oncology departments, which receive a significant portion of the second opinion requests in the region. The growth of the hospitals segment is majorly driven by investments in telemedicine infrastructure and collaborations with international medical institutions. Hospitals are increasingly adopting digital platforms to offer remote second opinions, further enhancing their reach and market dominance.

The online and offline medical second opinion providers segment is the fastest-growing segment and is likely to witness a CAGR of 18.4% during the forecast period due to the rise of telemedicine. Platforms such as Second Opinion Asia and Grand Rounds Health have seen increased demand, especially post-COVID-19, which accelerated the adoption of remote healthcare solutions. Online providers are particularly appealing to patients in rural areas or those seeking consultations from international specialists without the need to travel. However, data privacy and regulatory challenges could slow growth unless adequately addressed.

REGIONAL ANALYSIS

India holds the largest share in the Asia-Pacific medical second opinion market. This dominance is driven by the country's rapidly growing healthcare infrastructure, coupled with the increasing prevalence of chronic diseases such as cancer and cardiovascular conditions. India had over 1.39 million new cancer cases in 2020, according to the World Health Organization (WHO), which has led to a surge in patients seeking second opinions. Additionally, the adoption of telemedicine in India grew significantly, with a 25% rise in telemedicine consultations in 2022, as reported by the Ministry of Health and Family Welfare. Telemedicine platforms have expanded access to second opinions, particularly for rural populations.

China is the second-largest market for medical second opinions in the region. The country’s rapidly aging population and increasing incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders are significant drivers. China accounted for over 4.57 million new cancer cases in 2020, according to the WHO, making it a critical driver of second opinion services. The Chinese government’s push towards modernizing healthcare infrastructure and expanding telemedicine platforms is further fueling market growth. China’s telemedicine market is expected to reach $18.5 billion by 2027, according to Frost & Sullivan, providing a robust platform for second opinion services. The market is expected to grow at a CAGR of 17%, driven by increased healthcare spending and the growing middle class seeking access to high-quality healthcare services.

Japan is another key player in the Asia-Pacific medical second opinion market. Japan’s highly developed healthcare system and aging population contribute significantly to the demand for second opinion services. The country has one of the highest life expectancies globally, and its healthcare system is renowned for its excellence in fields like oncology and cardiology. Second opinions are commonly sought for complex cases such as cancer, which had over 1 million new cases in Japan in 2020 (WHO). The market in Japan is expected to grow at a notable CAGR, as patients increasingly look for second opinions to confirm diagnoses and treatment options, particularly for cancer and cardiac disorders. However, Japan’s stricter regulations on telemedicine, which limit initial consultations to in-person visits, could moderate growth have compared to more telemedicine-friendly countries.

South Korea is emerging as a strong player in the medical second opinion market. South Korea's advanced healthcare infrastructure, coupled with its prominence as a medical tourism destination, drives demand for second opinion services, particularly in oncology and cardiology. South Korea’s government has been promoting telemedicine to expand access to healthcare, particularly during the COVID-19 pandemic. The country’s well-established hospitals, such as Samsung Medical Center and Seoul National University Hospital, have created dedicated second opinion platforms for both domestic and international patients.

Australia is experiencing rising demand for second opinions, particularly in cancer treatment, as the country had more than 150,000 new cancer cases in 2020, according to the Australian Institute of Health and Welfare (AIHW). The adoption of telemedicine has significantly grown in Australia, with the government providing strong support for digital health initiatives. Telemedicine consultations have made it easier for patients to obtain second opinions, especially in remote and underserved areas.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the Asia Pacific medical second opinion market profiled in the report are Amradnet, London Pain Clinic, Johns Hopkins USA, Cynergy Care, Bright Grey Royal London Group, Helsana Group, Mendocino County Mental Health, Hyjiya Digital Wellness FZCO, Penn Medicine., and Others.

MARKET SEGMENTATION

This research report on the Asia-Pacific medical second opinion market has been segmented and sub-segmented into the following categories.

By Disease

- Cancer

- Cardiac Disorders

- Diabetes

- Injuries

By Supply Provider

- Hospitals

- Health Insurance Players

- Online and Offline Medical Second Opinion Providers

- Private clinics

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]