Asia-Pacific Medical Cannabis Market Size, Share, Trends & Growth Forecast Report By Species, Derivatives, Application, Route of Administration & Country (India, China, Japan, South Korea, Australia & New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of APAC) – Industry Analysis From (2025 to 2033)

Asia-Pacific Medical Cannabis Market Size

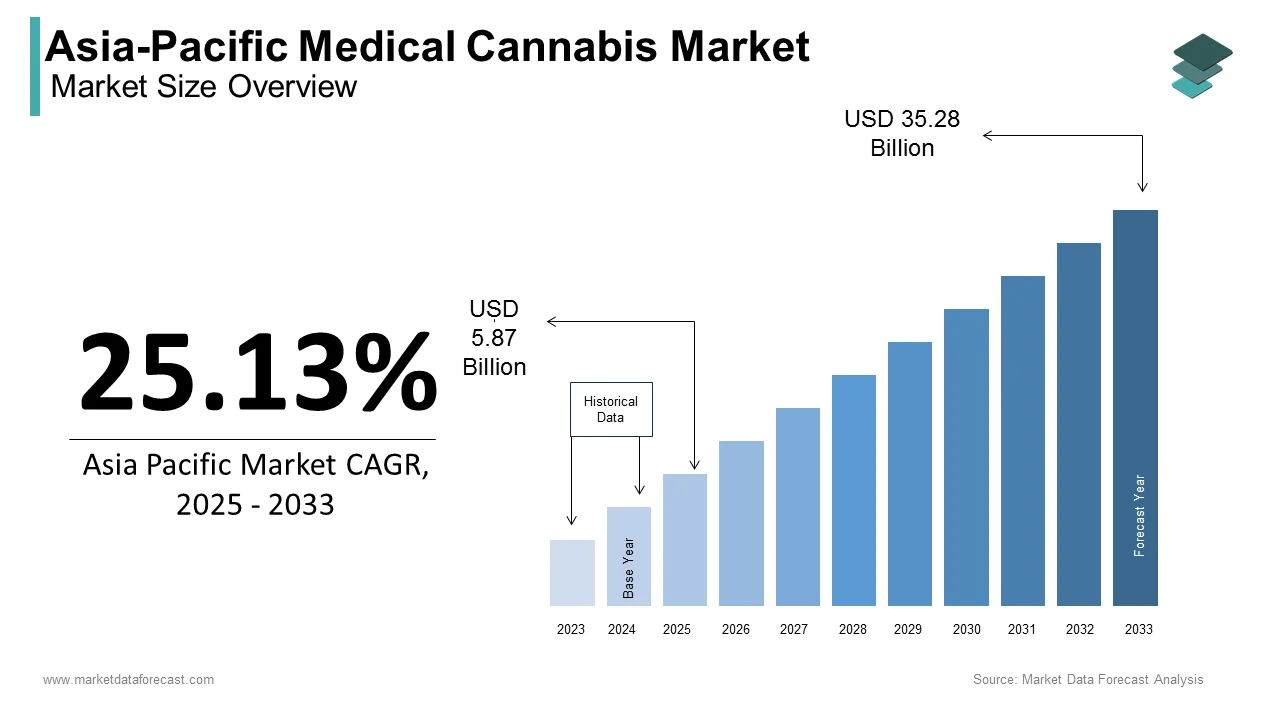

The size of the medical cannabis market in Asia Pacific was valued at USD 4.69 billion in 2024. The Asia Pacific market is expected to be valued at USD 5.87 billion in 2025 and USD 35.28 billion by 2033, exhibiting a CAGR of 25.13% from 2025 to 2033.

MARKET DRIVERS

Increasing prevalence of chronic diseases

The increasing prevalence of chronic pain, epilepsy, multiple Sclerosis, and other chronic diseases in the Asia Pacific is one of the prime factors elevating the market share of the APAC cannabis market. Also, rising emphasis on the study of the incorporation and usage of cannabis for medical purposes is gaining traction in the region. As ASEAN countries are popular for their traditional health practices and medicines for treating and healing diseases or medical conditions, the demand for medical cannabis is showing an upward trend. The demand for cannabis-derived from hemp is rising as more people become aware of its benefits. Legalisation has increased tax revenues. This is one of the reasons that is ultimately shooting up the market share of the APAC medical cannabis market.

MARKET OPPORTUNITIES

Collaboration with established cannabis markets and research institutions

Collaborating with well-established cannabis markets and research institutions globally can promote the exchange of knowledge and technology, expediting the development of the APAC medical cannabis market during the forecast period. Investing in research and development to create standardized cannabis-based products ensures adherence to regulatory requirements while also guaranteeing quality, accurate dosage, and safety. This approach enhances acceptance within the medical community.

MARKET CHALLENGES

Stringent cannabis regulations and outright prohibitions

The stringent cannabis regulations in the Asia Pacific region, including outright prohibitions, present substantial hurdles to establishing a robust APAC medical cannabis market. Businesses in the cannabis industry might encounter difficulties arising from regulations that overlap, lack clarity, and occasionally contradict each other across different government levels. In a recent survey among cannabis cultivators, 37% of participants highlighted discrepancies between county, regional, and state regulations as a major challenge to conducting legal operations.

Regulatory costs surpass potential profits, affecting market growth.

The legalized cannabis industry's economic potential may be fully realized if new regulations don't exceed the costs operators would incur in the illegal market. Furthermore, the cannabis business often faces short-term, high-interest loans from private equity firms and small investor groups, high lease premiums, and high taxes, making profitability difficult for growers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Species, Derivatives, Application, End User, Route of Administration, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of APAC. |

|

Market Leader Profiled |

Report are BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc., and Others. |

SEGMENTAL ANALYSIS

By Species Insights

The Indica segment is holding the maximum market share under this segment of the APAC medical cannabis market. The demand for Cannabis Indica strains has expanded dramatically due to the growing interest in CBD-based products and their therapeutic applications.

By Derivatives Insights

The cannabidiol segment has a significantly higher market share. However, the growth rate of tetrahydrocannabinol will propel further during the forecast period due to its characteristic of being a reliever of mental health like stress, anxiety, etc.

By Application Insights

The epilepsy segment is gaining traction over the market share. According to a poll conducted on 5k people, more than sixty percent of cannabis consumers use it to relieve anxiety symptoms.

By End User Insights

The research and development centers segment is currently dominating the region due to a rise in research, collaboration, and new discoveries regarding epilepsy and cancer diseases.

By Route of Administration Insights

The oral solutions and capsules segment is leading with the largest share of the market. PureTech Health created Epidiolex, an oral CBD capsule formulation released in December 2023, enabling users to dispense up to 5 mL of CBD solution from a bottle.

REGIONAL ANALYSIS

Japan's medical cannabis market is likely to evolve and is in the process of making cannabis legal. A shift in perception towards the medical use of cannabis is taking place.

As a result, in October 2023, the Japanese government revised the old cannabis control act and renamed it Law Concerning Regulation of the Cultivation of Cannabis Plants. Furthermore, it plans to make it applicable within one year. Hence, the demand for cannabis in the APAC medical cannabis market will increase.

China's medical cannabis market is anticipated to witness a rise in market share in the coming years. Currently, China produces about half of the legal hemp grown worldwide. Cannabis is present in Chinese culture and produces hemp for industrial usage, but it is not legalized. It also exports it to Germany, the UK, the United States, Japan, and the Netherlands.

India's medical cannabis market is anticipated to grow at a steady pace during the forecast period. Cannabis is banned under the Narcotic Drugs and Psychotropic Substances Act, but State governments have the authority to grant licenses for medical and scientific purposes. Cannabis was first legalized in the state of Uttarakhand, and then in a few other states like Gujarat, Madhya Pradesh, Rajasthan, Orissa, and Uttar Pradesh have legalized cannabis and practice restricted farming. The market share is anticipated to grow in the future. Also, the demand for cannabidiol-based products has increased in recent times in the country.

South Korea's medical cannabis market is expected to register an upward trend in growth rate during the forecast period. Gyeongbuk, a hemp regulation-free zone in southeast South Korea, is the hub of the cannabis industry. And has recently accepted its use for medical and pharmaceutical purposes. However, just 19 percent of people are happy with the introduction of over-the-counter medical marijuana, which is now only available with a doctor's prescription.

Singapore's medical cannabis market is estimated to grow at a slower rate during the forecast period. The laws against cannabis have been eased for medical and recreational purposes. However, it has some of the most stringent cannabis usage laws and rules. One of the major issues in Singapore is the surge in cannabis addiction, which delays the large-scale use of medical cannabis.

KEY MARKET PLAYERS

Some of the notable companies playing a significant role in the Asia Pacific medical cannabis market Profiled in the Report are BOL Pharma, Tilray, Medreleaf Corporation, Aurora Cannabis, Inc., Canopy Growth Corporation, Insys Therapeutics, Inc., Aphria, Inc., MGC Pharmaceuticals Limited, GW Pharmaceuticals, plc., and Others.

MARKET SEGMENTATION

This research report on the Asia Pacific medical cannabis market has been segmented and sub-segmented based on species, derivatives, application, end user, route of administration, and country.

By Species

- Indica

- Satiiva

- Hybrid

By Derivatives

- Cannabidiol (CBD)

- Tetrahydrocannabinol (THC)

- Others

By Application

- Cancer

- Arthritis

- Epilepsy

- Migraine

By End User

- Pharmaceutical Industry

- Research and Development Centres

- Others

By Route of Administration

- Oral Solutions and Capsules

- Smoking

- Vaporizers

- Topicals

- Others

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of APAC

Frequently Asked Questions

What factors are driving the growth of the medical cannabis market in the APAC region?

The rising acceptance of medical cannabis, changing regulatory landscape, and growing awareness of its therapeutic benefits are majorly accelerating the growth of the medical cannabis market in APAC.

What are the major challenges faced by the medical cannabis industry in the APAC region?

Varying regulatory frameworks, cultural stigmas, and the need for more clinical evidence supporting the efficacy and safety of medical cannabis are some of the major challenges to the APAC medical cannabis market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]