Asia Pacific Mattress Market Size, Share, Trends & Growth Forecast Report By Type (Innerspring mattresses, Memory foam mattresses), Application, Distribution Channel, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Mattress Market Size

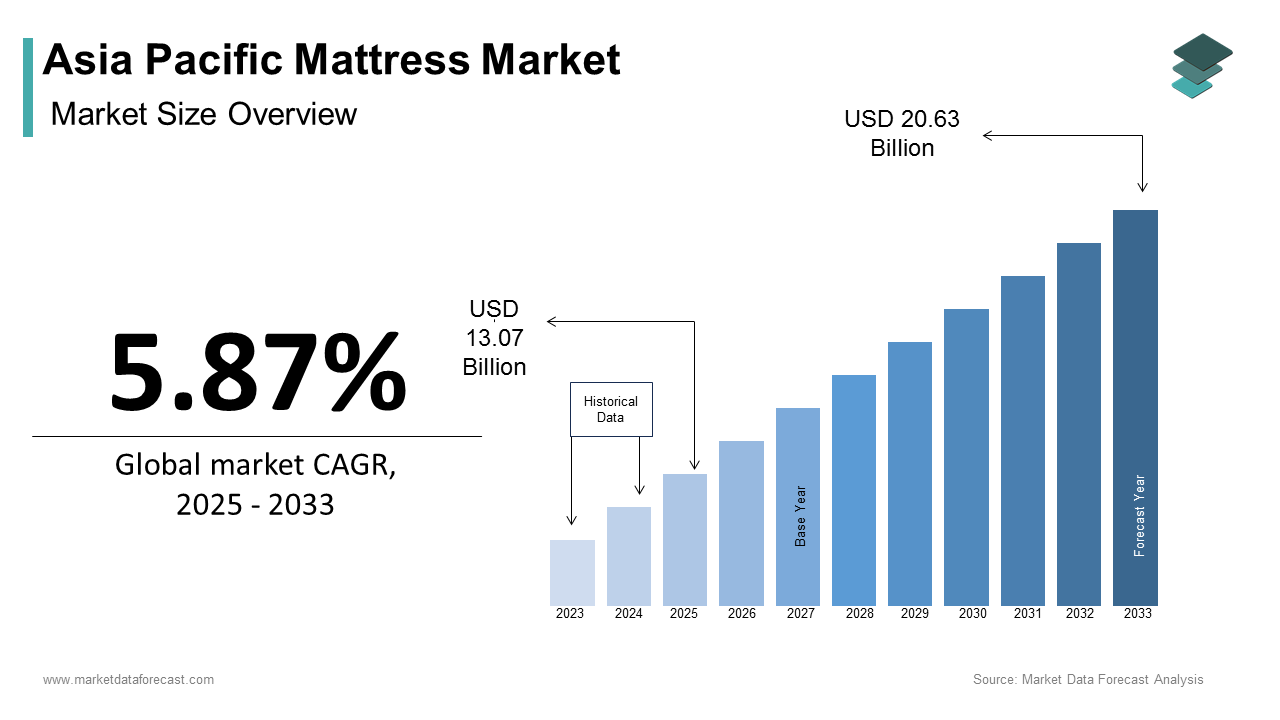

The Asia Pacific mattress market size was calculated to be USD 12.35 billion in 2024 and is anticipated to be worth USD 20.63 billion by 2033, from USD 13.07 billion in 2025, growing at a CAGR of 5.87% during the forecast period.

The Asia Pacific mattress market has emerged as a pivotal segment in the global sleep products industry, driven by rising urbanization, changing consumer lifestyles, and an increasing focus on health and wellness. Countries like China, India, and Japan are at the forefront, with China alone contributing to nearly 60% of the regional demand. A significant factor shaping the market is the growing middle-class population, which now exceeds 2 billion people in the region, according to the World Bank. This demographic shift has led to increased disposable incomes by enabling more households to invest in premium sleep solutions. Furthermore, the rising prevalence of sleep disorders, as per the Asia Pacific Sleep Society, has propelled demand for ergonomic and therapeutic mattresses.

MARKET DRIVERS

Rising Urbanization and Changing Lifestyles

Urbanization is a key driver reshaping the Asia Pacific mattress market, with over 50% of the region’s population expected to reside in urban areas by 2030, as per the United Nations. The growth of the market is due to the consumers priority towards comfort and functionality in their furnishings. Additionally, the rise of nuclear families and dual-income households has fueled demand for premium, space-saving sleep solutions. Moreover, modern lifestyles have heightened awareness about sleep quality, driving consumers toward advanced mattress technologies. In South Korea, sales of memory foam and hybrid mattresses surged by 25% in 2022, as reported by the Korea Furniture Industry Association. This trend reflects a broader regional preference for innovative products that enhance sleep hygiene. Manufacturers are capitalizing on this shift by introducing customizable options, thereby catering to diverse consumer needs. Urbanization, coupled with lifestyle changes that continues to unlock new avenues for growth in the mattress market.

Growing Health Awareness and Ergonomic Trends

Health consciousness is another major driver propelling the Asia Pacific mattress market forward. According to the World Health Organization, chronic conditions like back pain and insomnia affect over 30% of adults in the region by creating a surge in demand for ergonomic sleep solutions. For example, in Australia, the market for orthopedic mattresses grew by 18% in 2021, as per the Australian Sleep Association. Consumers are increasingly prioritizing mattresses that offer spinal support and pressure relief, especially amid sedentary work cultures exacerbated by remote working trends.

Additionally, governments across the region are promoting public health initiatives. In Japan, the Ministry of Health launched campaigns emphasizing the importance of quality sleep is leading to a 15% increase in mattress sales within a year. Similarly, in China, the popularity of smart mattresses equipped with sensors to monitor sleep patterns is rising from past few years, which is substantially to elevate the growth of the market.

MARKET RESTRAINTS

Fluctuating Raw Material Costs

One significant restraint impacting the Asia Pacific mattress market is the volatility in raw material prices, particularly for foam, latex, and steel springs. For instance, the price of polyurethane foam, a critical component in mattress production, increased by 20% in 2022 due to supply chain disruptions caused by geopolitical tensions, according to the Asia Pacific Chemical Industry Council. This price instability forces manufacturers to either absorb the additional costs or pass them on to consumers, potentially reducing affordability. The fluctuations disproportionately affect small and medium-sized enterprises that lack the financial resilience to navigate these challenges. Moreover, the reliance on imported raw materials in countries like Vietnam and Thailand, exacerbates the issue due to currency fluctuations and import tariffs.

Stringent Environmental Regulations

Another key restraint is the implementation of stringent environmental regulations governing the production and disposal of mattresses. According to the Environmental Protection Authority of Australia, improper disposal of mattresses contributes significantly to landfill waste by prompting stricter recycling mandates. Compliance with these regulations often requires substantial investments in eco-friendly manufacturing processes and waste management systems. While such measures aim to reduce environmental impact, they increase operational costs for businesses. In China, the introduction of carbon neutrality goals has further intensified scrutiny on emissions from foam production by leading to a 12% rise in compliance-related expenses, as per the China National Environmental Monitoring Center.

MARKET OPPORTUNITIES

Expansion into Tier-II and Tier-III Cities

A promising opportunity for the Asia Pacific mattress market lies in expanding reach to tier-II and tier-III cities, where rapid urbanization and rising disposable incomes are creating untapped potential. According to the Confederation of Indian Industry, tier-II cities in India witnessed a 22% annual increase in household spending on home furnishings between 2020 and 2022. This trend reflects a growing appetite for branded and mid-range mattresses among aspirational consumers seeking better living standards. Companies can capitalize on this by adopting localized marketing strategies and offering affordable yet durable products tailored to regional preferences. For instance, spring mattresses remain popular in rural areas due to their durability, while urban centers favor foam-based options for their comfort.

Adoption of Smart and Connected Mattresses

The growing integration of technology into everyday life presents another lucrative opportunity for the mattress market in the form of smart and connected mattresses. According to the Korea Electronics Association, the market for IoT-enabled sleep products in South Korea grew by 35% in 2022, driven by consumer interest in health monitoring features. These mattresses, equipped with sensors to track sleep patterns, heart rate, and posture, appeal to tech-savvy millennials and Gen Z consumers. In China, Alibaba’s Tmall platform reported a 50% increase in online sales of smart mattresses during the 2022 Singles’ Day shopping festival. Furthermore, advancements in AI and machine learning enable personalized sleep recommendations by enhancing user experience. By investing in R&D and forming partnerships with tech firms, manufacturers can position themselves at the forefront of this innovation-driven segment.

MARKET CHALLENGES

Intense Competition and Price Wars

One of the foremost challenges facing the Asia Pacific mattress market is the intense competition among domestic and international players that often resulting in price wars that erode profit margins. This trend is particularly pronounced in price-sensitive markets such as India and Indonesia, where consumers prioritize affordability over brand loyalty. In addition, the proliferation of unorganized sector players further complicates the competitive landscape. These products, though inferior in quality, undercut branded alternatives by offering steep discounts. Such dynamics make it challenging for established brands to differentiate themselves and sustain profitability.

Counterfeit Products and Brand Dilution

Another pressing challenge is the prevalence of counterfeit products, which undermines brand equity and consumer confidence. According to the Intellectual Property Office of Singapore, counterfeit mattresses accounted for an estimated 10% of the market in Southeast Asia in 2022. These imitation products, often sold through informal channels, not only compromise safety standards but also dilute the reputation of genuine brands. In China, the State Administration for Market Regulation identified over 200 cases of counterfeit mattress sales in 2021, with many containing hazardous materials like formaldehyde. Such incidents deter consumers from investing in premium products, fearing substandard quality. Furthermore, the ease of e-commerce platforms facilitates the sale of counterfeit goods, exacerbating the issue. Brands must adopt robust anti-counterfeiting measures, such as hologram labels and blockchain traceability, to combat this menace.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.87% |

|

Segments Covered |

By Type, Application, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Sleepwell, Tempur Sealy International Inc., King Koil, Serta Simmons Bedding LLC, Spring Air International, Kurlon Enterprises Limited, Sheela Foam Limited, Peps Industries Pvt. Ltd., Duroflex Pvt. Ltd., Paramount Bed Co. Ltd., Airland, Therapedic International |

SEGMENTAL ANALYSIS

By Type Insights

The innerspring mattresses segment was the largest and held 45.3% of the Asia Pacific mattress market share in 2024. This segment’s dominance is driven primarily by its affordability and widespread availability by making it a preferred choice for price-sensitive consumers across the region. One key factor contributing to its dominance is the robust manufacturing infrastructure for innerspring mattresses in China and India. As per the China National Furniture Association, over 60% of all mattresses produced in China are innerspring-based, benefiting from economies of scale that keep production costs low. Additionally, the durability of innerspring mattresses appeals to rural populations, where longevity is a critical purchasing criterion. Another driving factor is the adaptability of innerspring mattresses to diverse climatic conditions. In tropical regions like Thailand and Indonesia, these mattresses are favored for their breathability, which helps mitigate heat retention. Furthermore, advancements in coil technology, such as pocketed coils, have enhanced comfort levels by attracting urban consumers seeking a balance between cost and quality.

The memory foam mattresses segment is likely to register a CAGR of 12.5% from 2025 to 2033. This rapid growth is fueled by increasing consumer awareness of sleep health and the rising adoption of ergonomic sleep solutions. A primary driver is the growing prevalence of lifestyle-related ailments, such as back pain and insomnia. According to the Japan Orthopedic Association, over 30% of Japanese adults suffer from chronic back pain, which is prompting a surge in demand for memory foam mattresses that offer superior spinal support. Technological advancements also play a pivotal role. Innovations like gel-infused memory foam, which addresses heat retention issues, have broadened the product’s appeal.

By Application Insights

The residential segment was the largest and held dominant share of the Asia Pacific mattress market in 2024 due to growing population and the proliferation of nuclear families, which drive demand for home furnishings. A significant factor propelling this segment is urbanization in countries like India and Vietnam. The United Nations projects that urban areas in these nations will house an additional 200 million people by 2030 by creating substantial demand for residential mattresses. Another driving force is the cultural emphasis on home ownership in the region. This trend fosters investment in durable goods like mattresses, with consumers increasingly prioritizing comfort and quality. Moreover, the rise of remote working has heightened awareness of sleep hygiene that is boosting demand for premium residential mattresses tailored to home office environments.

The commercial segment is likely to witness a CAGR of 9.2% from 2025 to 2033. This growth is fueled by the expansion of the hospitality sector, particularly luxury hotels and serviced apartments, which prioritize high-quality sleep experiences for guests. A key driver is the booming tourism industry in the region. According to the World Tourism Organization, international tourist arrivals in Southeast Asia increased by 25% in 2022, with countries like Thailand and Malaysia witnessing record occupancy rates. Hotels are investing heavily in premium mattresses to enhance guest satisfaction, with brands like Hilton and Marriott sourcing custom-designed products from regional manufacturers. Additionally, the rise of co-living spaces and short-term rentals is amplifying demand.

By Distribution Channel Insights

The offline segment held a significant share of the Asia Pacific mattress market in 2024 due to the region’s strong retail infrastructure and consumer preference for tactile shopping experiences. A major factor driving offline dominance is the presence of established brick-and-mortar stores in tier-I cities. In Japan, department stores like Takashimaya and Matsuya account for nearly 40% of all mattress sales. These outlets provide personalized consultations and trial options, which are crucial for high-involvement purchases like mattresses. Rural markets also favor offline channels due to limited internet penetration.

The online segment is lucratively growing with a CAGR of 15.8% from 2025 to 2033. This growth is driven by the increasing penetration of digital platforms and shifting consumer behavior toward convenience-driven shopping. A key driver is the rise of e-commerce giants like Alibaba and Flipkart, which offer competitive pricing and doorstep delivery. These platforms also enable direct-to-consumer models by allowing brands to bypass intermediaries and offer premium products at lower prices. Additionally, innovations in packaging and logistics have facilitated online growth. In South Korea, companies like IKEA have introduced vacuum-sealed mattresses, reducing shipping costs and enhancing portability. These advancements, combined with personalized online marketing strategies, are transforming the way consumers purchase mattresses by ensuring robust growth for the online segment.

REGIONAL ANALYSIS

China led the Asia Pacific mattress market with 40.3% share in 2024 owing to its massive manufacturing base and rising consumer demand for premium sleep products. Urbanization is a key driver, with over 60% of the population residing in cities by fostering demand for modern, space-saving mattresses. Additionally, the government’s focus on improving sleep health has spurred innovation, with smart mattresses gaining traction among affluent consumers.

India positioned second by holding 15.4% of the Asia Pacific mattress market share in 2024. The market is propelled by a growing middle class and increasing awareness of sleep disorders. Rural electrification programs have expanded access to cooling systems, which is boosting demand for foam-based mattresses. Furthermore, government initiatives like ‘Make in India’ have encouraged local production by reducing reliance on imports and enhancing affordability.

Japan mattress market growth is likely to grow in the next coming years. The country’s aging population drives demand for orthopedic mattresses, with over 28% of citizens aged 65 or older. Technological advancements, such as AI-powered sleep trackers integrated into mattresses, cater to health-conscious consumers. Additionally, compact living spaces favor thin-profile designs, which is aligning with traditional Japanese aesthetics.

South Korea is likely to grow with prominent growth opportunities in the next coming years. The segment is driven by the popularity of smart homes, with IoT-enabled mattresses witnessing a 35% sales increase in 2022. Young professionals prioritize ergonomic designs, while urbanization fuels the demand for multifunctional sleep solutions. Government incentives for sustainable manufacturing further bolster market growth.

Australia's mattress market growth is due to the high disposable incomes and a strong focus on wellness. Rising cases of sleep apnea have led to increased adoption of therapeutic mattresses.

LEADING PLAYERS IN THE ASIA PACIFIC MATTRESS MARKET

Tempur Sealy International

Tempur Sealy is a global leader in the sleep products industry, renowned for its innovative mattress designs and premium offerings. In the Asia Pacific region, the company has expanded its footprint by introducing localized product lines, such as hybrid mattresses tailored to tropical climates. Recently, Tempur Sealy partnered with regional e-commerce platforms to enhance online sales, ensuring accessibility for urban consumers. Their focus on sustainability is evident in their adoption of eco-friendly materials, aligning with growing environmental consciousness.

Sleep Number Corporation

Sleep Number has carved a niche in the Asia Pacific market with its smart mattresses featuring adjustable firmness and sleep tracking capabilities. The company’s commitment to personalization appeals to tech-savvy consumers, particularly in urban centers like Tokyo and Sydney. To strengthen its position, Sleep Number launched a regional marketing campaign emphasizing health benefits, targeting aging populations prone to sleep disorders. Additionally, the company collaborated with local distributors to expand its offline presence in tier-II cities by ensuring wider accessibility.

Simmons Bedding Company

Simmons Bedding Company is a trusted name in the Asia Pacific mattress market, known for its durable innerspring mattresses. The company has adapted to regional preferences by introducing cost-effective yet high-quality products for price-sensitive markets like India and Indonesia. Recently, Simmons invested in ergonomic designs catering to urban professionals working from home. Furthermore, the brand partnered with hospitality chains across the region to supply premium mattresses with its presence in the commercial segment. Through strategic collaborations and product diversification, Simmons continues to bolster its regional influence.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC MATTRESS MARKET

Key players in the Asia Pacific mattress market employ strategies like product innovation, strategic partnerships, and digital transformation to maintain competitiveness. Product innovation focuses on developing eco-friendly and smart mattresses, addressing consumer demand for sustainability and health-centric solutions. Strategic partnerships with e-commerce platforms and local distributors enhance market penetration in underserved regions. Digital transformation involves adopting AI-driven technologies for personalized marketing and improving online customer experiences. Additionally, companies invest in R&D to introduce advanced features like temperature regulation and posture correction. These strategies collectively enable brands to adapt to evolving consumer preferences and regulatory landscapes by ensuring sustained growth.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Mattress market include Sleepwell, Tempur Sealy International Inc., King Koil, Serta Simmons Bedding LLC, Spring Air International, Kurlon Enterprises Limited, Sheela Foam Limited, Peps Industries Pvt. Ltd., Duroflex Pvt. Ltd., Paramount Bed Co. Ltd., Airland, Therapedic International

The Asia Pacific mattress market is characterized by intense competition, driven by the presence of both global giants and regional players. Global brands like Tempur Sealy and Simmons leverage their expertise in innovation and branding to capture urban markets, while local manufacturers compete on affordability and customization. The rise of e-commerce has intensified rivalry, with companies vying for online visibility through aggressive marketing campaigns. Additionally, the market faces challenges from counterfeit products by prompting brands to adopt anti-counterfeiting measures. Regulatory pressures around sustainability further push companies to innovate responsibly.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Tempur Sealy launched a new line of gel-infused memory foam mattresses in India, which is targeting heat-sensitive consumers and expanding its product portfolio.

- In May 2023, Sleep Number partnered with JD.com, a leading Chinese e-commerce platform, to enhance its online distribution network and reach tech-savvy urban buyers.

- In July 2023, Simmons introduced a recycling program in Australia, allowing customers to return old mattresses for sustainable disposal by aligning with eco-conscious trends.

- In September 2023, King Koil collaborated with Marriott International to supply premium mattresses for luxury hotels in Southeast Asia, which is strengthening its presence in the commercial segment.

- In December 2023, Therapedic unveiled a smart mattress integrated with IoT sensors in Japan by offering real-time sleep monitoring and appealing to health-focused consumers.

MARKET SEGMENTATION

This research report on the Asia Pacific mattress market has been segmented and sub-segmented based on type, application, distribution channel, and region.

By Type

- Innerspring mattresses

- Memory foam mattresses

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key factors driving the Asia Pacific Mattress Market growth?

Key factors include rising disposable incomes, growing urbanization, increasing awareness about sleep health, and demand for premium and orthopedic mattresses.

2. Who are the major players operating in the Asia Pacific Mattress Market?

Major players include Sleepwell, Tempur Sealy International Inc., King Koil, Serta Simmons Bedding LLC, and Kurlon Enterprises Limited.

3. Which mattress types are most popular in the Asia Pacific region?

Memory foam mattresses, innerspring mattresses, hybrid mattresses, and latex mattresses are among the most popular types.

4. How are changing consumer preferences impacting the mattress market in Asia Pacific?

Consumers are increasingly preferring premium, orthopedic, and eco-friendly mattresses, influencing manufacturers to innovate accordingly.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]