Asia-Pacific In-Vitro Diagnostics (IVD) Market Size, Share, Trends & Growth Forecast Report By Product(Reagents, Instruments, Software & Services), Technology, Application & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of Asia-Pacific), Industry Analysis From 2025 to 2033

Asia-Pacific In-Vitro Diagnostics (IVD) Market Size

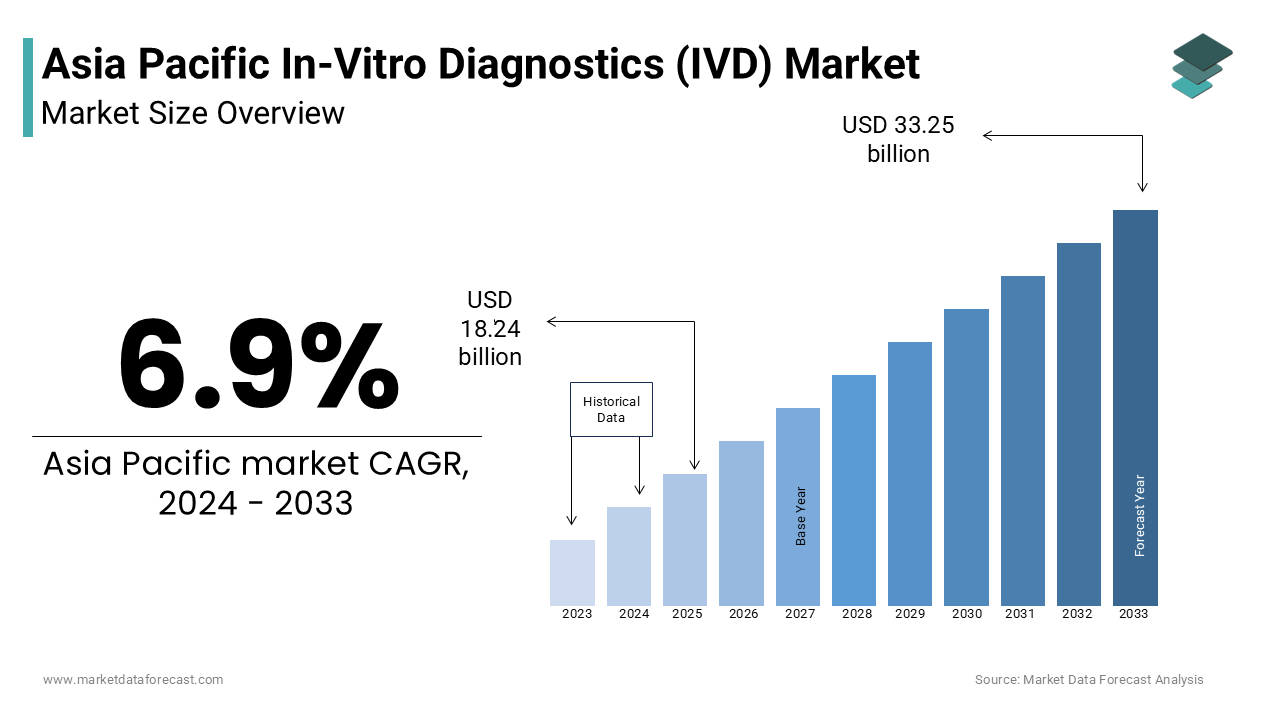

The Asia-Pacific in-vitro diagnostics (IVD) market size was valued at USD 18.24 billion in 2024. The Asia-Pacific market is estimated to grow at a CAGR of 6.9% from 2025 to 2033 and be worth USD 33.25 billion by 2033 from USD 19.50 billion in 2025.

MARKET DRIVERS

In-vitro diagnostics involves testing of blood and tissues to identify any diseases, infections, and chronic ailments in the body. The increase in the elderly population, coupled with the rising awareness related to health, is the primary factor driving the Asia Pacific in-vitro diagnostics market. Also, the spike in lifestyle diseases that augment the requirement for early diagnosis among people is another factor driving this business growth. There has been a huge rise in the cases of diabetes, obesity, and anemia in Asia Pacific countries like India, China, and other Southeast Asian nations. In addition, advances in medical technology like point-of-care testing, molecular diagnostics, clinical sequencing, and quick turnaround time have also created a positive outlook for the Asia Pacific in-vitro diagnostics market. The surge in investments from both private and public enterprises in healthcare solutions is predicted to increase demand in the Asia Pacific in-vitro diagnostics market in the coming years.

MARKET RESTRAINTS

The major challenge to the Asia Pacific in-vitro diagnostics market is the high cost associated with some of the testing methods, limiting certain sections of the population. Although governments are promoting the early detection of diseases, strict regulations related to testing parameters are limiting this business. In addition, the lack of proper insurance coverage and availability of diagnostic centers in villages and remote areas is also leading to a negative impact on the Asia Pacific in-vitro diagnostics market. Besides, the lack of awareness about the benefits of early identification of diseases is slowing down the developments in the local market.

SEGMENTAL ANALYSIS

By Product Type Insights

The reagents segment accounted for a significant share of the regional market in 2023, owing to the use of chemicals in different diagnostic processes. The instruments segment is likely to increase in the forecast period due to the expanding applications of new equipment, machines, and automated solutions like readers, analyzers, and testing platforms in diagnostic procedures.

By Technique Insights

The clinical chemistry segment had the major share of the regional market in 2023. Clinical chemistry that involves the identification of diseases using blood samples, tissues, and body fluids recorded a prominent portion of the Asia Pacific in-vitro diagnostics market. However, the molecular diagnostics segment is supposed to expand at a considerable rate because of the spread of several infectious diseases and the need to detect changes in DNA or RNA.

By Application Insights

The infectious disease segment is anticipated to grow at the highest CAGR over the forecast period, followed by diagnostics related to oncology and diabetes.

By End-User Insights

The hospital segment dominated the Asia Pacific in-vitro diagnostics market in 2023 and is likely to register a tremendous growth rate in the future with the increasing investments and advancements in the hospital infrastructure to offer efficient medical solutions to patients.

REGIONAL ANALYSIS

China dominated the regional in-vitro diagnostics (IVD) market owing to the rising adoption of the in-vitro diagnostics (IVD) process in hospitals, growth in the older population, and increased awareness among patients. The favorable government initiatives, investments in the medical sector research and development activities, and collaborations in pharmaceutical, healthcare, and biotechnology industries are promoting the Chinese IVD market. India is an emerging nation in terms of in-vitro diagnostics supported by the rapid.

KEY MARKET PLAYERS

Noteworthy companies operating in the APAC IVD Market are Abbott Laboratories, Johnson and Johnson, Siemens Healthcare, Becton Dickinson, Roche Diagnostic, Beckman Coulter Inc., Biomérieux, Ortho Clinical Diagnostics, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, and Thermo Fisher Scientific, Inc.

MARKET SEGMENTATION

This research report on the Asia-Pacific in-vitro diagnostics (IVD) market is segmented and sub-segmented into the following categories.

By Product Type

- Reagents

- Instruments

- Software & Services

By Technique

- Immunochemistry

- Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Others

By Application

- Infectious Diseases

- Oncology

- Cardiology

- Diabetes

- Autoimmune Diseases

- Nephrology

- Gastroenterology

- Others

By End User

- Clinical Laboratories

- Hospitals

- Physician’s Offices

- Others

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

What is the current size of the APAC IVD market?

The APAC IVD Market is expected to be valued at USD 18.24 billion in 2024.

Which countries contribute the most to the APAC IVD market share?

Japan, China, and India are the leading contributors to the APAC IVD market share

What are the key trends driving growth in the APAC IVD market?

Increasing adoption of advanced diagnostic technologies, rising healthcare awareness, and a growing aging population are among the key trends fueling APAC IVD market growth.

How has the COVID-19 pandemic impacted the APAC IVD market?

The pandemic has accelerated the demand for diagnostic solutions, leading to a surge in the adoption of in vitro diagnostics (IVD) in the APAC region.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]