Asia Pacific Hydrogen Generation Market Research Report – Segmented By Technology (Steam Methane Reforming (SMR), Electrolysis), Application, Source, Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis From 2025 to 2033

Asia Pacific Hydrogen Generation Market Size

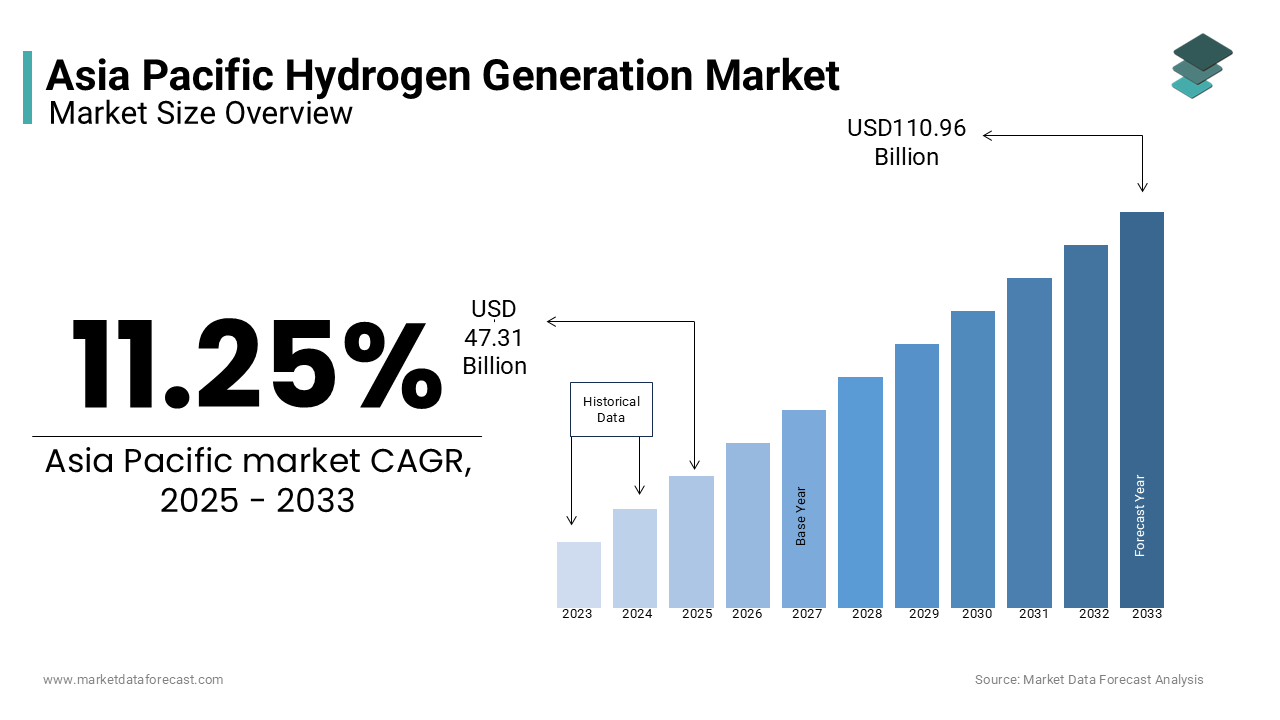

The Asia Pacific hydrogen generation market was worth USD 42.51 billion in 2024. The Asia Pacific market is expected to reach USD 110.96 billion by 2033 from USD 47.31 billion in 2025, rising at a CAGR of 11.25% from 2025 to 2033.

The Asia Pacific hydrogen generation market is at the forefront of global energy transformation, with countries like Japan, South Korea, China, and Australia leading innovation and adoption. Japan’s commitment to becoming a hydrogen society is evident through initiatives like the Fukushima Hydrogen Energy Research Field, which produces green hydrogen using renewable energy. Similarly, South Korea’s Hydrogen Economy Roadmap outlines plans to produce 6.2 million tons of hydrogen annually by 2040, supported by $38 billion in investments.

China is rapidly scaling its hydrogen infrastructure, focusing on green hydrogen to achieve carbon neutrality by 2060. Meanwhile, Australia aims to position itself as a global hydrogen exporter, leveraging its abundant solar and wind resources. The Australian Renewable Energy Agency estimates that the country could produce up to 11 terawatt-hours of green hydrogen annually by 2030. These developments underscore the region’s dynamic market conditions, shaped by technological advancements, policy support, and cross-border collaborations.

MARKET DRIVERS

Government Policies and Strategic Initiatives

Government policies and strategic initiatives are pivotal drivers propelling the Asia Pacific hydrogen generation market forward. China’s Five-Year Plan emphasizes hydrogen as a cornerstone of its energy strategy, offering tax incentives and subsidies to manufacturers and operators. Furthermore, India’s National Hydrogen Mission seeks to produce at least 5 million tonnes of green hydrogen by 2030, aligning with global sustainability goals. Such proactive government interventions create a conducive environment for hydrogen generation technologies, driving demand across industries like transportation, power, and manufacturing.

Industrial Decarbonization Needs

The hydrogen generation market. Industries such as steel, chemicals, and refineries are increasingly adopting hydrogen to reduce their carbon footprints. For instance, South Korea’s POSCO Steel aims to replace coal with hydrogen in its direct reduction iron-making process, targeting a 10% reduction in emissions by 2030.

In China, Baowu Steel Group is piloting hydrogen-based steelmaking processes, supported by government grants aimed at achieving net-zero emissions. The Federation of Indian Chambers of Commerce and Industry highlights that ammonia production, a major consumer of hydrogen, could transition to green hydrogen, reducing lifecycle emissions. These industrial shifts demonstrate how hydrogen generation aligns with sustainability objectives, driving demand in high-emission sectors.

MARKET RESTRAINTS

High Production Costs of Green Hydrogen

One of the primary restraints hindering the Asia Pacific hydrogen generation market is the high cost associated with producing green hydrogen. Electrolysis, the process used to generate green hydrogen, requires significant electricity input, often sourced from renewable energy. While economies of scale and technological advancements are gradually lowering these costs, progress remains slow. For example, the Asian Development Bank reports that small-scale green hydrogen projects in Southeast Asia face financial bottlenecks, with only a small portion securing full funding due to perceived risks. High production costs also deter smaller enterprises from adopting green hydrogen, particularly in emerging markets like Vietnam and Indonesia. This cost barrier is further compounded by the need for complementary infrastructure, such as pipelines and storage facilities, which require additional capital outlays, slowing the pace of adoption.

Limited Infrastructure for Storage and Distribution

Another critical restraint is the inadequate infrastructure for hydrogen storage and distribution, which limits its scalability. For instance, South Korea’s Ministry of Trade, Industry and Energy acknowledges that only a small percentage of planned hydrogen pipelines are operational, hindering supply chain efficiency. In rural areas of Southeast Asia, where energy access is already limited, building hydrogen infrastructure poses even greater challenges. A study notes that fragmented regulatory frameworks exacerbate these issues, delaying cross-border hydrogen trade agreements. Without substantial progress in infrastructure development, the scalability of hydrogen generation technologies will remain constrained, impeding their broader commercialization and integration into existing energy systems.

Major Opportunities

Integration of Green Hydrogen in Renewable Energy Systems

The integration of green hydrogen into renewable energy systems presents a transformative opportunity for the Asia Pacific hydrogen generation market. With solar and wind capacities surging across the region, green hydrogen offers a sustainable pathway to store excess energy and address intermittency issues. This aligns seamlessly with Japan and South Korea’s import needs, creating a lucrative export-import dynamic. Also, integrating green hydrogen into renewable grids can enhance energy reliability while reducing lifecycle emissions. Such developments position green hydrogen as a catalyst for scaling renewable energy applications across mobility, power generation, and industrial sectors, unlocking new avenues for economic growth and sustainability.

Urban Mobility and Public Transportation

Urban mobility and public transportation offer immense potential for hydrogen integration in the Asia Pacific region. By 2050, the United Nations projects that a significant portion of Asia’s population will reside in urban areas, driving demand for clean energy solutions. Singapore’s Smart Nation initiative, for example, includes deploying hydrogen fuel cells for grid stabilization and powering public transport hubs. Meanwhile, India’s Smart Cities Mission identifies hydrogen-powered buses as a priority, with pilot projects underway in cities like Pune and Ahmedabad. These initiatives underscore how urban development strategies can unlock new opportunities for hydrogen generation, fostering sustainable and resilient cities.

MARKET CHALLENGES

Scalability of Green Hydrogen Production

A significant challenge facing the Asia Pacific hydrogen generation market is the scalability of green hydrogen production. While pilot projects demonstrate feasibility, scaling up to meet industrial and commercial demands remains complex. According to the Hydrogen Council, building a comprehensive hydrogen ecosystem in Japan alone would require an estimated $10 billion in investments over the next decade. Similarly, China’s National Development and Reform Commission acknowledges that only 20% of planned hydrogen pipelines are operational, limiting supply chain efficiency. In rural areas of Southeast Asia, where energy access is already limited, establishing scalable hydrogen production facilities poses even greater challenges.

Public Perception and Safety Concerns

Another pressing challenge is the lack of public awareness and trust in hydrogen technologies. Misconceptions about hydrogen safety persist, deterring consumer acceptance despite evidence of its safe use in industrial applications. This perception gap is particularly pronounced in countries like India and Indonesia, where educational campaigns are minimal. Additionally, misinformation about the environmental benefits of hydrogen undermines its appeal among eco-conscious consumers. Addressing these misconceptions requires targeted outreach programs, yet governments and private entities have been slow to act. Bridging this awareness gap is essential to fostering confidence and driving consumer adoption of hydrogen generation technologies.

SEGMENTAL ANALYSIS

By Technology Insights

The segment of steam methane reforming (SMR) dominated the Asia Pacific hydrogen generation market by capturing a 60.7% of the total share in 2024. This dominance is driven by its cost-effectiveness and established infrastructure, particularly in industrial applications. SMR’s efficiency in producing gray hydrogen, hydrogen derived from natural gas, is a key factor. A major driver is its alignment with existing energy systems. In India, reliance on SMR for hydrogen production is equally pronounced, with Reliance Industries operating large-scale facilities to meet domestic demand. Another factor is scalability; SMR plants can be easily expanded to accommodate growing industrial needs.

The electrolysis segment is projected to grow at a CAGR of 45.6% from 2025 to 2033. This swift progress is fueled by increasing investments in green hydrogen and renewable energy integration. Japan’s Ministry of Economy, Trade and Industry reports that electrolyzer capacity is expected to reach 5 GW by 2030, supported by government subsidies worth $378 million annually. Urban mobility also plays a significant role. Additionally, Australia’s Commonwealth Scientific and Industrial Research Organisation emphasizes electrolysis as a solution for off-grid mining operations, where reliability is paramount. These dynamics position electrolysis as the fastest-growing segment, driven by sustainability goals and technological advancements.

By Application Insights

The hydrogen generation for refinery applications held the largest market share at 40.5%. Hydrogen is critical in refining processes like hydrocracking and desulfurization, ensuring compliance with stringent environmental regulations. For example, China’s refining sector consumes approximately 9 million tons of hydrogen annually, with PetroChina investing heavily in SMR facilities to meet this demand. Government mandates further amplify its importance. According to McKinsey & Company, refineries in South Korea and Japan are transitioning to low-carbon hydrogen sources, aligning with national decarbonization targets. Additionally, India’s oil refineries are adopting hydrogen to produce cleaner fuels, supported by policies under the National Hydrogen Mission.

The transportation segment is poised to move forward at a CAGR of 40.5%. This surge is driven by governments promoting hydrogen-powered vehicles to achieve carbon neutrality. South Korea’s Hyundai Motor Group aims to deploy 80,000 hydrogen vehicles by 2025, supported by $38 billion in investments under the Hydrogen Economy Roadmap. Public transit systems are also embracing hydrogen. These initiatives position transportation as the fastest-growing application segment.

By Source Insights

The segment of gray hydrogen accounted for 55.5% of the Asia Pacific hydrogen generation market in 2024. This influence is attributed to its cost efficiency. China’s heavy reliance on gray hydrogen is evident, with a significant portion of its hydrogen supply derived from steam methane reforming. Industrial demand drives its prevalence. The Federation of Indian Chambers of Commerce and Industry notes that gray hydrogen supports ammonia and methanol production, ensuring steady demand across sectors. However, growing concerns about carbon emissions are prompting transitions to cleaner alternatives, though gray hydrogen remains integral to current operations.

The green hydrogen segment is likely to grow at a CAGR of 25.8%. This rapid growth is fueled by declining renewable energy costs and government incentives. Technological advancements also play a role. Like, integrating electrolyzers with renewable grids reduces lifecycle emissions. South Korea’s SK Group invests in green hydrogen to meet its 2040 target of producing 6.2 million tons annually. These developments position green hydrogen as the fastest-growing source.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific hydrogen generation market by holding a 30.5% share in 2024. This leading position is supported by heavy industrial demand, particularly in refining and chemical manufacturing. Public transportation also thrives. Industrial applications further bolster growth, with Baowu Steel piloting hydrogen-based steelmaking processes.

Japan is another significant player in the market. It is driven by its commitment to becoming a hydrogen society. Residential fuel cells, or ENE-FARM units, have seen widespread adoption, with Panasonic reporting sales exceeding 400,000 units since inception. Government backing plays a pivotal role. Tokyo’s hosting of a carbon-neutral Olympics in 2021 showcased hydrogen-powered buses and buildings.

South Korea captured a notable market share which is propelled by its Hydrogen Economy Roadmap. Also, stationary applications gain traction. SK Group’s investments in SOFCs aim to deliver 1 GW of capacity by 2025, while POSCO’s hydrogen production goals align with decarbonization targets.

Australia remains a key player in the market by leveraging its renewable energy resources for green hydrogen production. The Australian Renewable Energy Agency outlines plans to produce 11 TWh of green hydrogen annually by 2030. Export opportunities abound, with Japan and South Korea identified as key markets. Mining companies like Fortescue Metals Group invest heavily in hydrogen-powered equipment, reducing emissions.

India is an attractive market with growing attention to its R&D. It is driven by its National Hydrogen Mission. Urban centers like Delhi and Mumbai pilot hydrogen refueling stations, fostering infrastructure growth.

Top Players in the Asia Pacific Hydrogen Generation Market

Reliance Industries Limited

Reliance Industries Limited has emerged as a key player in the hydrogen generation space, leveraging its vast industrial expertise and resources. The company’s focus on green hydrogen aligns with India’s National Hydrogen Mission, positioning it as a leader in sustainable energy solutions. Reliance is investing heavily in developing electrolyzer technologies and renewable energy infrastructure to produce low-cost green hydrogen. Its partnerships with global technology providers ensure access to cutting-edge innovations, enabling it to cater to both domestic and international markets. By integrating hydrogen into its refining and petrochemical operations, Reliance strengthens its contribution to decarbonizing high-emission industries globally.

Hyundai Motor Group

Hyundai Motor Group is a trailblazer in the hydrogen economy, particularly through its advancements in fuel cell technologies and hydrogen production. The company’s HTWO brand focuses on scaling hydrogen solutions for mobility, power generation, and industrial applications. Hyundai actively collaborates with governments and private entities across Asia Pacific to establish hydrogen ecosystems, including refueling stations and production facilities. Its commitment to sustainability drives investments in green hydrogen projects, reinforcing its role as a global leader in clean energy transitions. Hyundai’s holistic approach ensures it remains at the forefront of hydrogen innovation.

Panasonic Corporation

Panasonic Corporation has established itself as a pioneer in residential hydrogen solutions, particularly through its ENE-FARM systems. These compact fuel cells provide combined heat and power for households, promoting energy efficiency and sustainability. Panasonic’s focus extends beyond Japan, as it explores opportunities to deploy similar systems in urban centers across Asia Pacific. Its emphasis on reliability and user-friendly designs enhances its reputation as a trusted contributor to the global hydrogen market.

Top Strategies Used by Key Players

Strategic Partnerships and Collaborations

Key players in the Asia Pacific hydrogen generation market leverage strategic partnerships to enhance their technological capabilities and expand their reach. Collaborations with governments, research institutions, and private entities enable companies to co-develop innovative solutions and address regional challenges. For instance, partnerships facilitate the integration of hydrogen into public transportation networks, accelerating adoption rates. These alliances also help align with national hydrogen strategies, ensuring compliance with regulatory frameworks while fostering mutual growth.

Investment in R&D and Innovation

Research and development form the backbone of competitive strategies in the hydrogen generation market. Leading companies allocate significant resources to innovate materials, improve system efficiencies, and reduce costs. By focusing on next-generation technologies, firms aim to differentiate themselves and capture emerging opportunities. Innovation hubs established in collaboration with universities drive breakthroughs in hydrogen production and storage, enhancing the overall feasibility of hydrogen applications across various sectors.

Expansion of Production Facilities

To meet rising demand, key players are expanding their manufacturing capacities within the Asia Pacific region. Establishing localized production facilities not only reduces logistical costs but also strengthens supply chain resilience. Companies invest in state-of-the-art plants capable of producing high-quality hydrogen components at scale. This strategy ensures the timely delivery of products while catering to specific regional requirements, thereby solidifying their market presence and customer loyalty.

RECENT MARKET DEVELOPMENTS

- In January 2023, Reliance Industries announced the establishment of a new green hydrogen production facility in Gujarat, India, aimed at supporting the country’s transition to renewable energy and strengthening its position as a leader in sustainable hydrogen solutions.

- In March 2023, Hyundai Motor Group partnered with seven South Korean energy companies to launch the Korea Hydrogen Alliance, focusing on developing hydrogen infrastructure and promoting widespread adoption of fuel cell technologies in the Asia Pacific markets.

- In June 2023, Panasonic unveiled plans to expand its ENE-FARM residential hydrogen fuel cell business into Southeast Asia, targeting urban households seeking reliable and sustainable energy solutions amid increasing electricity costs.

- In September 2023, Fortescue Metals Group completed the acquisition of a renewable energy startup in Australia, enabling the company to accelerate its green hydrogen production initiatives and reduce emissions in the mining sector.

- In December 2023, SK Group announced the construction of a large-scale electrolyzer manufacturing plant in South Korea, aiming to support the production of green hydrogen and meet the growing demand for clean energy solutions in the region.

MARKET SEGMENTATION

This research report on the Asia Pacific hydrogen generation market is segmented and sub-segmented into the following categories.

By Technology

- Steam Methane Reforming (SMR)

- Electrolysis

By Application

- Refinery

- Transportation

By Source

- Gray Hydrogen

- Green Hydrogen

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the challenges faced by the Asia Pacific Hydrogen Generation Market?

Key challenges include high production costs of green hydrogen, lack of infrastructure, storage and transportation issues, and limited public-private partnerships.

What is the market outlook for hydrogen generation in Asia Pacific?

The market is expected to grow significantly, driven by carbon neutrality goals, increased industrial adoption, and technological advancements in hydrogen production and storage.

What are the emerging trends in the Asia Pacific Hydrogen Generation Market?

Emerging trends include the rapid adoption of green hydrogen, integration of renewable energy with electrolysis, establishment of hydrogen hubs, and increasing investments in fuel cell electric vehicles (FCEVs) and hydrogen infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]