Asia-Pacific Home Healthcare Market Size, Share, Trends & Growth Report By Product Type, Services Type, Software & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC), Industry Analysis From 2025 to 2033

Asia-Pacific Home Healthcare Market Size

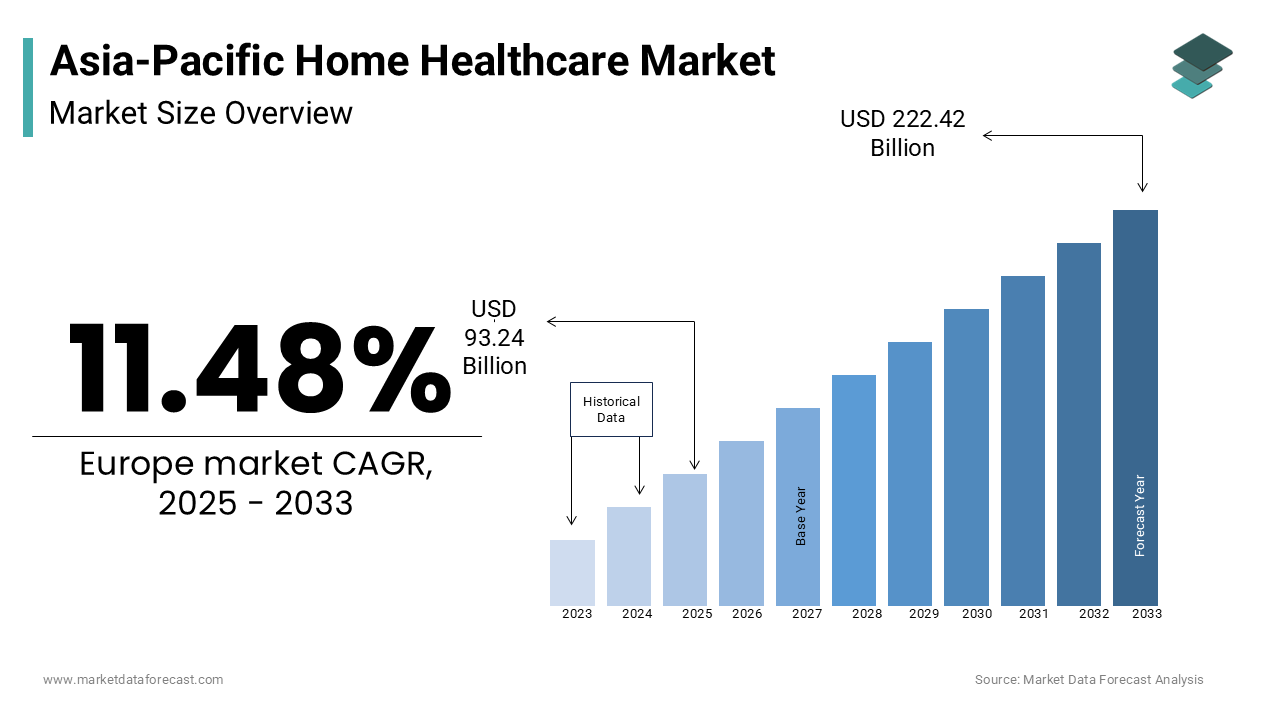

The size of the home healthcare market in the Asia Pacific was valued at USD 83.64 billion in 2024. The Asia-Pacific market is predicted to be growing at a CAGR of 11.48% from 2025 to 2033 and worth 222.42 billion by 2033 from USD 93.24 billion in 2025.

Home healthcare is a vital component of the healthcare continuum, offering cost-effective and convenient solutions for patients seeking care within the comfort of their homes. As per the World Health Organization, the Asia-Pacific region faces a rising burden of chronic diseases, with cardiovascular conditions, diabetes, and cancer among the leading causes of morbidity. Countries such as Japan and South Korea have aging populations, with more than 28% of Japan’s population aged 65 or older, according to the Japanese Ministry of Internal Affairs and Communications. This demographic shift is fueling the demand for home healthcare services tailored to elderly care.

MARKET DRIVERS

Aging Population and Rising Demand for Elderly Care

The rapidly aging population in Asia-Pacific is a key driver of the home healthcare market. According to the United Nations Department of Economic and Social Affairs, by 2050, one in four people in Asia will be aged 60 or older, with countries like Japan and South Korea leading this demographic trend. The elderly population often requires long-term care for chronic conditions and mobility issues, which are best managed at home for cost-effectiveness and convenience. This shift toward aging-in-place has increased the demand for home healthcare services, including skilled nursing, rehabilitation, and remote monitoring, making it a pivotal factor in the market’s growth.

Growing Prevalence of Chronic Diseases

The increasing burden of chronic diseases in Asia-Pacific is significantly driving the demand for home healthcare solutions. The World Health Organization reports that non-communicable diseases, including cardiovascular conditions, diabetes, and respiratory illnesses, account for over 80% of all deaths in the region. These conditions often require ongoing monitoring and management, which home healthcare services effectively provide. For example, India’s National Health Mission emphasizes expanding community-based healthcare services to support chronic disease management. The growing awareness of personalized care, combined with advancements in remote patient monitoring technologies, is further accelerating the adoption of home healthcare solutions across the region.

MARKET RESTRAINTS

Lack of Skilled Workforce for Home Healthcare Services

The shortage of qualified healthcare professionals is a significant restraint in the Asia-Pacific home healthcare market. The World Health Organization states that the region faces a healthcare workforce deficit of over 6 million professionals, particularly in rural and underserved areas. This shortage is exacerbated by limited training programs tailored for home-based care services. Countries like India and Indonesia struggle to provide adequate training and certification for home healthcare workers, leading to inconsistent care quality. This gap in skilled personnel affects the reliability and accessibility of home healthcare services, limiting market growth despite rising demand for personalized care.

High Cost of Advanced Equipment and Technologies

The financial burden of adopting advanced medical technologies and devices for home healthcare is a major challenge in the Asia-Pacific region. The World Bank reports that out-of-pocket healthcare expenditures remain high in countries like India, where they account for over 60% of total health expenditures. Remote monitoring systems, mobility aids, and other advanced equipment often require significant investment, which is inaccessible to low- and middle-income populations. Additionally, the high costs of importing such technologies further escalate expenses, particularly in emerging economies. This financial barrier restricts the widespread adoption of home healthcare solutions, affecting the overall growth potential of the market.

MARKET OPPORTUNITIES

Integration of Telemedicine and Remote Monitoring Technologies

The growing adoption of telemedicine and remote monitoring technologies presents a significant opportunity for the Asia-Pacific home healthcare market. The World Health Organization highlights that telemedicine has become a crucial tool for delivering healthcare services in remote and underserved regions. Countries like China and India have implemented large-scale digital health initiatives to improve accessibility. For instance, India’s Ayushman Bharat Digital Mission aims to enhance telehealth services across rural areas. Remote monitoring devices for chronic conditions, such as wearable glucose monitors and cardiac health trackers, have gained traction. These innovations reduce hospital visits and enable personalized care, driving the expansion of home healthcare services.

Government Support and Healthcare Policy Reforms

Government-backed healthcare initiatives and reforms are creating significant opportunities for the home healthcare market in Asia-Pacific. The Australian Department of Health has introduced community-based care models to reduce hospital admissions and promote home-based healthcare. Similarly, Japan’s Long-Term Care Insurance System supports elderly care at home, which has increased the demand for skilled nursing and therapeutic services. According to the World Bank, healthcare expenditure in the Asia-Pacific region is rising, reflecting a focus on improving access and affordability. Such policies incentivize the adoption of home healthcare solutions, addressing both the aging population and the growing burden of chronic diseases, thereby driving market growth.

MARKET CHALLENGES

Fragmented Healthcare Infrastructure

The fragmented healthcare infrastructure across Asia-Pacific poses a significant challenge to the home healthcare market. The World Health Organization notes that many countries in the region, particularly low- and middle-income nations like Indonesia and the Philippines, lack a cohesive system to deliver seamless healthcare services. This fragmentation results in inconsistent availability of home healthcare services, particularly in rural and remote areas. Limited integration between healthcare providers and insufficient investment in community healthcare further exacerbates the issue. These disparities hinder the efficient delivery of home healthcare services, affecting patient outcomes and slowing market growth.

Cultural Barriers and Resistance to Non-Traditional Care

Cultural attitudes toward home healthcare remain a significant challenge in Asia-Pacific, where family caregiving is deeply ingrained in societal norms. The United Nations Population Fund highlights that in countries like India and Vietnam, families traditionally assume the responsibility of caring for elderly or chronically ill members, which reduces the acceptance of professional home healthcare services. Additionally, the lack of awareness about the benefits of home healthcare, coupled with concerns about privacy and the quality of care, further limits its adoption. Overcoming these cultural barriers requires targeted awareness campaigns and education to promote the value of professional home-based healthcare services in improving patient well-being.

REGIONAL ANALYSIS

India is a dominant player in the Asia-Pacific home healthcare market due to its vast population and growing burden of chronic diseases. According to the World Health Organization, India has over 77 million people living with diabetes and a high prevalence of hypertension and cardiovascular diseases. The government’s Ayushman Bharat initiative has been pivotal in expanding healthcare access, including home-based care services, to underserved areas. Additionally, the rising adoption of telemedicine and remote monitoring technologies is addressing gaps in rural healthcare. The increasing awareness of cost-effective and personalized care options makes India a key contributor to the Indian home healthcare market.

China’s leadership in the home healthcare market is driven by its rapidly aging population and advancements in digital healthcare. The National Bureau of Statistics of China states that over 14% of the population is aged 65 or older, necessitating home-based elderly care services. Government policies like Healthy China 2030 emphasize improving healthcare access and integrating home healthcare into the broader system. The adoption of remote patient monitoring and telehealth solutions has further bolstered the market. China’s focus on reducing hospital congestion through home-based care and its significant investments in healthcare infrastructure make it a crucial market in the region.

Japan stands out in the Asia-Pacific home healthcare market due to its aging population and advanced healthcare policies. The Ministry of Internal Affairs and Communications reports that over 28% of Japan’s population is aged 65 or older, creating a high demand for elderly care. Japan’s Long-Term Care Insurance System supports home healthcare services, offering subsidies and ensuring affordability for families. Additionally, the country’s emphasis on innovation has led to the adoption of robotic assistants and smart monitoring devices for home use. These initiatives, combined with a cultural shift towards aging in place, position Japan as a leader in the regional home healthcare market.

Australia plays a significant role in the Asia-Pacific home healthcare market, supported by its robust healthcare infrastructure and government policies. According to the Australian Institute of Health and Welfare, over 300,000 people access home-based care annually, benefiting from programs like Medicare and the National Disability Insurance Scheme. Australia’s aging population and rising prevalence of chronic conditions, such as arthritis and diabetes, have driven demand for home healthcare services. The government’s focus on community-based care models and investments in telehealth have further enhanced the sector. Australia’s high healthcare spending and emphasis on patient-centric solutions solidify its position in the market.

South Korea is a prominent market for home healthcare, driven by its technological advancements and significant healthcare expenditure. The Korean Statistical Information Service indicates that the country has one of the highest healthcare expenditures per capita in Asia-Pacific. This supports the adoption of advanced home healthcare technologies, such as wearable health monitors and remote patient care systems. South Korea’s aging population and focus on digital health solutions have accelerated the demand for home-based services. Additionally, government initiatives promoting telemedicine and community healthcare models ensure comprehensive care delivery, making South Korea a leading contributor to the regional home healthcare market.

TOP COMPANIES IN THE MARKET

Companies that play a key role in the Asia-Pacific home healthcare market profiled in the report are Almost Family Inc., Amedisys Inc., General Electric Company (GE), Kinnser Software Inc., Linde Group, Omron Corporation, Roche Holding AG, Philips Healthcare, Mckesson Corporation, LHC Group Inc., Kindred Healthcare, Fresenius Se & Co Kgaa, Abbott Laboratories, and Apria Healthcare Group.

MARKET SEGMENTATION

This research report on the Asia-Pacific home healthcare market has been segmented and sub-segmented into the following categories.

By Product Type

- Testing, Screening, & Monitoring Products

- Therapeutic Products

- Mobility Care Products

By Type

- Home Telehealth Monitoring Devices

- Home Telehealth Services

- Home Telehealth Software

By Services Type

- Rehabilitation Therapy Services

- Infusion Therapy Services

- Unskilled Care Services

- Respiratory Therapy Services

- Pregnancy Care Services

- Skilled Nursing Care Services

- Hospice

- Palliative Care Services

By Software

- Agency Software

- Clinical Management Systems

- Hospice Solutions

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of APAC

Frequently Asked Questions

What are the major trends in the APAC Home Healthcare Market?

The growing adoption of telehealth services, the rise of mobile health apps, and the development of IoT-based healthcare devices are some of the major trends in the APAC home healthcare market.

What are the opportunities for investors in the APAC Home Healthcare Market?

Investors can explore opportunities in telehealth startups, medical device manufacturing, and home healthcare service providers in the APAC region.

How is the COVID-19 pandemic impacting the APAC Home Healthcare Market?

The COVID-19 pandemic has accelerated the adoption of telehealth and home healthcare services in APAC, making it a growing sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]