Asia Pacific Handicrafts Market Size, Share, Trends & Growth Forecast Report By Product (Woodworks, Metal Artworks, Hand-printed Textiles & Embroidered Goods, Imitation Jewellery, Others), End User, Distribution Channel, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Handicrafts Market Size

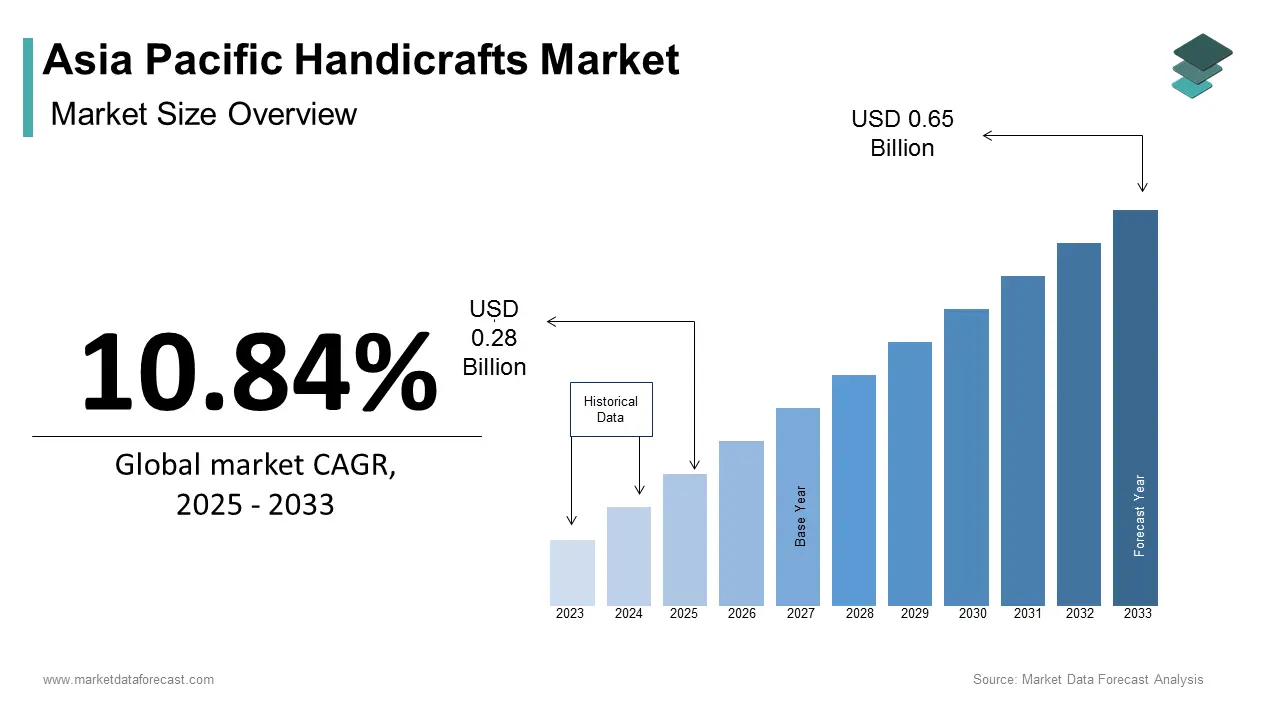

The Asia pacific handicrafts market size was calculated to be USD 0.26 billion in 2024 and is anticipated to be worth USD 0.65 billion by 2033, from USD 0.28 billion in 2025, growing at a CAGR of 10.84% during the forecast period.

The Asia Pacific handicrafts market is a vibrant and culturally rich sector, deeply rooted in the region's heritage. The market thrives on traditional craftsmanship, which has been passed down through generations by creating unique products that appeal to both domestic and international consumers. According to the World Crafts Council, the export value of handicrafts from the region exceeded USD

Market conditions are shaped by the increasing preference for sustainable and eco-friendly products. Consumers in affluent economies, such as Japan and Australia, are willing to pay premium prices for authentic, handmade items. Additionally, the rise of e-commerce platforms has expanded market access by enabling artisans to reach a broader audience.

MARKET DRIVERS

Cultural Tourism and Heritage Preservation

One of the primary drivers of the Asia Pacific handicrafts market is the surge in cultural tourism. Tourists increasingly seek authentic experiences, including purchasing locally made handicrafts as souvenirs. Countries like Thailand and Vietnam have capitalized on this trend, with handicraft markets becoming integral to their tourism offerings. For instance, the Chiang Mai Night Bazaar in Thailand attracts over 10 million visitors annually by generating significant revenue for local artisans. The emphasis on preserving cultural heritage further fuels this demand, as governments promote traditional crafts as part of national identity. UNESCO estimates that over 500,000 artisans across the region benefit directly from heritage preservation initiatives with the symbiotic relationship between tourism and handicraft sales.

Rising Demand for Sustainable Products

Another key driver is the global shift toward sustainability. Consumers are increasingly favoring eco-friendly and ethically produced goods, which aligns perfectly with the ethos of handmade handicrafts. Handicrafts, being biodegradable and crafted using natural materials, cater to this demand effectively. For example, bamboo products from Indonesia and handwoven textiles from India have gained popularity in Europe and North America. This trend is further amplified by collaborations between artisans and international designers, who incorporate traditional techniques into modern designs by enhancing their appeal to environmentally conscious buyers.

MARKET RESTRAINTS

Limited Access to Modern Technology

A major restraint in the Asia Pacific handicrafts market is the limited adoption of modern technology among artisans. Many craftsmen operate in rural areas with minimal infrastructure by hindering their ability to leverage digital tools for marketing or production efficiency. According to the International Labour Organization, only 30% of artisans in the region have access to online platforms for selling their products. This technological gap restricts their reach to international markets, where demand for authentic handicrafts is high. Furthermore, the lack of technical training prevents artisans from adopting advanced techniques that could enhance productivity and product quality. For instance, traditional weavers in Bangladesh often rely on manual looms, which limits their output compared to mechanized competitors.

High Production Costs and Raw Material Scarcity

Another significant restraint is the rising cost of raw materials and labor. Artisans face volatility in the availability and pricing of essential inputs like wood, silk, and natural dyes. The Food and Agriculture Organization states that deforestation and climate change have reduced the availability of certain raw materials by up to 25% in the past decade. For example, sandalwood, a key material for carved artifacts in India, has become scarce due to overharvesting and strict export regulations. Additionally, wage inflation in countries like China and Vietnam has increased labor costs by making it difficult for small-scale producers to compete with mass manufacturers. These escalating expenses compress profit margins by forcing some artisans to abandon their craft altogether.

MARKET OPPORTUNITIES

Digital Transformation and E-Commerce Expansion

The rapid expansion of e-commerce presents a transformative opportunity for the Asia Pacific handicrafts market. Platforms like Etsy, Amazon Handmade, and regional players such as Tokopedia in Indonesia have created a global marketplace for artisans. Digital tools enable artisans to bypass intermediaries by allowing them to retain a larger share of profits while reaching diverse customer bases. For instance, Indian artisans leveraging platforms like Flipkart and Meesho reported a 35% increase in sales in 2022. Moreover, social media channels like Instagram and TikTok provide cost-effective avenues for showcasing craftsmanship, attractive younger demographics. The government and NGOs can empower artisans to harness these opportunities with sustainable income generation that further amplifies the growth of the market.

Collaborations with Global Designers and Brands

Another promising opportunity lies in partnerships between artisans and international designers or luxury brands. Collaborations introduce traditional crafts to contemporary audiences by blending cultural authenticity with modern aesthetics. For example, Japanese washi paper and Indian block-printed fabrics have been incorporated into collections by brands like Hermès and Gucci by elevating their visibility worldwide. Such alliances not only boost sales but also preserve endangered crafts by providing steady demand. Additionally, these collaborations often include fair trade practices by ensuring artisans receive equitable compensation.

MARKET CHALLENGES

Competition from Mass-Produced Alternatives

A pressing challenge for the Asia Pacific handicrafts market is the intense competition posed by mass-produced goods. Industrial manufacturing offers lower prices and higher production volumes, making it difficult for handmade products to compete on price alone. For example, machine-woven textiles from China often mimic traditional patterns at a fraction of the cost by luring budget-conscious consumers. This trend undermines the perceived value of authentic handicrafts, especially among younger generations who prioritize affordability over uniqueness. Additionally, counterfeit products flooding international markets dilute brand trust by making it harder for genuine artisans to differentiate their offerings.

Lack of Standardization and Quality Assurance

Another significant hurdle is the absence of standardized quality control measures across the region. Unlike industrial goods, handicrafts are inherently variable, depending on the skill level of individual artisans. The Asian Productivity Organization notes that inconsistent product quality leads to customer dissatisfaction in export markets where buyers expect uniformity. For instance, hand-painted ceramics from Vietnam often face rejection due to variations in design or finish by resulting in financial losses for producers. Furthermore, inadequate certification systems make it challenging to authenticate products as genuinely handmade by impacting credibility. This lack of standardization also hampers efforts to secure premium pricing, as buyers hesitate to invest in products without guarantees of durability or authenticity. Addressing these issues requires investment in training programs and the establishment of quality benchmarks, which remain underdeveloped in many parts of the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.84% |

|

Segments Covered |

By Product, End User, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Handicraft Collections (India) Pvt. Ltd., Asian Handicraft Private Limited, Naraiphand Co. Ltd., Thai International Handicraft Ltd., Shandong Laizhou Arts and Crafts Imp & Exp Co. Ltd., Ten Thousand Villages, Novica, Cottage Industries Exposition Limited, Fabindia. |

SEGMENTAL ANALYSIS

By Product Insights

The Hand-printed textiles and embroidered goods segment was accounted in holding 35.4% of the Asia Pacific handicrafts market share in 2024. This segment's prominence is driven by the universal appeal of textiles in both fashion and home décor, coupled with the region's rich heritage of weaving and embroidery techniques. The demand for sustainable fashion has further fueled growth, with rising consumers in Asia Pacific prefer eco-friendly clothing options. A key factor driving this dominance is cultural tourism. Tourists visiting countries like Indonesia and Thailand often purchase hand-printed sarongs or embroidered fabrics as souvenirs, boosting local sales. Additionally, collaborations between traditional weavers and international designers have elevated these products' global visibility.

The online stores segment is deemed to witness a fastest CAGR of 18.5% throughout the forecast period with the increasing penetration of e-commerce platforms and shifting consumer preferences toward digital shopping. For instance, during the pandemic, online handicraft sales in India surged by 45%, as reported by the Confederation of Indian Industry. Platforms like Etsy and regional players such as Tokopedia have democratized access to global markets, enabling artisans to bypass intermediaries.

Another driving factor is the rise of social commerce. Instagram and TikTok have become vital tools for artisans to showcase their work, with influencers amplifying reach. As per a study by Bain & Company, 60% of millennials in Asia Pacific discover handicrafts through social media. Furthermore, government initiatives like India’s “One District, One Product” program promote digital literacy among artisans, empowering them to leverage online channels effectively.

By End-User Insights

The residential segment was the largest by capturing the largest share of the Asia Pacific handicrafts market in 2024 with the growing trend of home personalization, where consumers seek unique, handmade items to enhance their living spaces. In affluent economies like Japan and Australia, homeowners are willing to invest in premium handicrafts. For example, Japanese washi paper lamps and Australian Aboriginal art pieces are highly sought after for interior décor.

Another critical factor is the rise of urbanization, which fosters a desire for culturally significant items in modern homes. The United Nations estimates that urban populations in Asia Pacific will grow by 50% by 2050 by creating a vast customer base. Additionally, sustainability plays a pivotal role; consumers increasingly prefer biodegradable and ethically sourced products. A survey by Deloitte reveals that 80% of urban households in the region prioritize eco-friendly home furnishings.

The commercial segment is poised to grow at a CAGR of 12.3% in the next coming years with the burgeoning hospitality and retail industries. Hotels and restaurants across the region are incorporating handicrafts into their interiors to create authentic cultural experiences. For instance, luxury resorts in Bali and Thailand extensively use locally crafted furniture and textiles are boosting artisanal sales. Moreover, corporate gifting has emerged as a lucrative avenue for growth. Companies are increasingly opting for unique and handmade items to strengthen client relationships.

By Distribution Channel Insights

The specialty stores accounted for 40.6% of the Asia Pacific handicrafts market share in 2024 due to their ability to offer curated collections that escalate the authenticity and uniqueness of handmade products. For instance, specialty stores in India and China often collaborate with local artisans, ensuring high-quality, exclusive offerings. According to Euromonitor, these stores attract discerning customers who value craftsmanship and are willing to pay premium prices. Another contributing factor is the experiential aspect of shopping. Consumers visiting specialty stores often engage directly with artisans, which is gaining insights into the creative process. Furthermore, these outlets serve as cultural hubs by preserving traditional crafts while educating buyers about their heritage.

The online stores segment is likely to exhibit a CAGR of 18.5% in the next coming years. This surge is propelled by the widespread adoption of e-commerce platforms and changing consumer behavior. During the pandemic, online handicraft sales in Southeast Asia grew by 50%, as reported by the ASEAN Business Advisory Council. Platforms like Lazada and Shopee have enabled artisans to reach global audiences, reducing dependency on local markets.

Social media also plays a transformative role. Artisans leveraging Instagram and TikTok witness a 30% increase in inquiries, according to a study by Accenture. Additionally, governments are promoting digital inclusion through initiatives like Malaysia’s “Craft Forward” program, which trains artisans in digital marketing.

REGIONAL ANALYSIS

India was the top performer in the Asia Pacific handicrafts market with 25.4% of share in 2024 owing to its unparalleled diversity of crafts, ranging from Jaipur’s block prints to Kashmir’s papier-mâché. With over 7 million artisans, India boasts the largest artisan population globally. The government’s initiatives, such as the Geographical Indication (GI) tag, have boosted exports, with handicrafts generating USD 3.6 billion in foreign exchange in 2022. Another driver is the rise of cultural tourism. States like Rajasthan and Gujarat attract millions of tourists annually, with handicrafts being a primary attraction. According to the Ministry of Tourism, cultural tourism contributes 20% to India’s GDP, benefiting local artisans.

China held 14.9% of the Asia Pacific handcrafts market share in 2024 owing to the expertise in porcelain, silk, and jade crafts. The Belt and Road Initiative has expanded export opportunities, with porcelain exports reaching USD 1.2 billion in 2022. Additionally, the integration of traditional crafts into modern designs has attracted younger consumers. Urbanization is another catalyst, with cities like Hangzhou becoming hubs for contemporary handicrafts. As per a report by the Chinese Academy of Social Sciences, 60% of urban households own artisanal decor by reflecting growing domestic demand.

Indonesia is likely to pose significant growth opportunities in the next coming years. The UNESCO recognition of batik as an intangible cultural heritage has spurred global interest, with exports exceeding USD 500 million in 2023. Tourism in Bali and Yogyakarta further propels sales, as per the Ministry of Tourism and Creative Economy.

Sustainability also drives growth, with eco-friendly bamboo products gaining traction. A study by the Indonesian Chamber of Commerce reveals a 25% increase in demand for sustainable handicrafts, positioning Indonesia as a leader in green craftsmanship.

Japan and Thailand are attributed to have prominent growth opportunities in the next coming years with the increasing support from the government initiatives. The aging population’s preference for traditional aesthetics sustains domestic demand, as per the Japan External Trade Organization. Government support through grants and exhibitions has preserved these crafts, ensuring their relevance in modern markets.

LEADING PLAYERS IN THE ASIA PACIFIC HANDICRAFTS MARKET

Fabindia Overseas Pvt. Ltd.

Fabindia, an Indian retail giant, has significantly contributed to the Asia Pacific handicrafts market by promoting sustainable and handcrafted products. The company collaborates with over 55,000 artisans across India, empowering them through fair trade practices. Fabindia’s expansion into North America includes partnerships with luxury retailers like Neiman Marcus, showcasing Indian textiles and home décor. In 2023, Fabindia launched a digital platform to connect artisans directly with global buyers, enhancing accessibility and fostering cross-cultural exchanges.

Ten Thousand Villages

Ten Thousand Villages is a pioneer in fair trade handicrafts by sourcing products from artisans in Asia Pacific countries like Indonesia and Nepal. The company emphasizes ethical sourcing and storytelling by prompting the cultural significance of each product. Recently, Ten Thousand Villages expanded its online presence, introducing virtual artisan workshops to engage consumers. These efforts have strengthened its reputation as a socially responsible brand while boosting demand for authentic crafts in North America.

The Silk Road Collection

The Silk Road Collection specializes in premium handicrafts from China, including silk and porcelain. The company has established itself as a bridge between traditional Asian artisans and global markets. To enhance its position, it partnered with luxury hotels in North America to feature its products in guest rooms and lobbies. In 2023, the company launched a sustainability initiative, ensuring all materials are ethically sourced by aligning with growing consumer preferences for eco-friendly products.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC HANDICRAFTS MARKET

Key players in the Asia Pacific handicrafts market employ diverse strategies to maintain their competitive edge. A primary focus is on digital transformation, with companies investing in e-commerce platforms to reach global audiences. Collaborations with international designers and luxury brands have also become a popular strategy by enabling artisans to blend traditional techniques with modern aesthetics. Additionally, many firms emphasize sustainability, adopting eco-friendly practices to appeal to environmentally conscious consumers. Fairtrade certifications and ethical sourcing initiatives further enhance brand credibility. The cultural tourism partnerships and participation in global trade fairs help expand market reach by ensuring consistent growth in both domestic and international markets.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific handicrafts market include Handicraft Collections (India) Pvt. Ltd., Asian Handicraft Private Limited, Naraiphand Co. Ltd., Thai International Handicraft Ltd., Shandong Laizhou Arts and Crafts Imp & Exp Co. Ltd., Ten Thousand Villages, Novica, Cottage Industries Exposition Limited, Fabindia.

The Asia Pacific handicrafts market is characterized by intense competition, driven by a mix of traditional artisans, retail giants, and e-commerce platforms. Large-scale players like Fabindia and Ten Thousand Villages dominate through extensive artisan networks and ethical sourcing practices, while smaller enterprises focus on niche markets such as luxury or sustainable products. E-commerce has intensified rivalry, with platforms like Etsy and regional players offering artisans direct access to global consumers. Governments also play a role, in supporting local craftsmen through subsidies and export promotion schemes. Innovation in design and collaboration with international brands further differentiate competitors.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Fabindia launched a digital marketplace connecting artisans directly with global buyers by enhancing accessibility and transparency.

- In June 2023, Ten Thousand Villages introduced virtual artisan workshops by engaging North American consumers and promoting cultural storytelling.

- In September 2023, The Silk Road Collection partnered with luxury hotels in the U.S., which is featuring its silk and porcelain products in guest rooms and lobbies.

- In January 2024, Dariya Handicrafts, an Indian exporter, obtained a Geographical Indication tag for its block-printed textiles, which is boosting exports to Europe and North America.

In March 2023, Artisans of Australia initiated a sustainability program, ensuring all products are made from biodegradable materials by aligning with eco-conscious consumer trends.

MARKET SEGMENTATION

This research report on the Asia Pacific handicrafts market has been segmented and sub-segmented based on product, end-user, distribution channel, and region.

By Product

- Woodworks

- Metal Artworks

- Hand-printed Textiles & Embroidered Goods

- Imitation Jewellery

- Others

By End User

- Residential

- Commercial

By Distribution Channel

- Specialty Stores

- Independent Retailers

- Online Stores

- Others

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the Asia Pacific handicrafts market?

The market is growing due to increasing demand for handmade and sustainable products, rising tourism, and growing global interest in ethnic and traditional art.

2. Which countries are the largest producers of handicrafts in Asia Pacific?

India, China, Vietnam, Thailand, Indonesia, and the Philippines are among the top producers in the region.

3. How does e-commerce impact the handicrafts industry in Asia Pacific?

E-commerce platforms have expanded global reach for artisans, boosted exports, and enabled small businesses to connect directly with customers.

4. Who are the key Players of the Asia Pacific handicrafts market?

Handicraft Collections (India) Pvt. Ltd., Asian Handicraft Private Limited, Naraiphand Co. Ltd., Thai International Handicraft Ltd., Shandong Laizhou Arts and Crafts Imp & Exp Co. Ltd., Ten Thousand Villages, Novica, Cottage Industries Exposition Limited, Fabindia.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]