Asia Pacific Elevator Market Size, Share, Trends & Growth Forecast Report By Type (Hydraulic, Traction), Business, Application, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Elevator Market Size

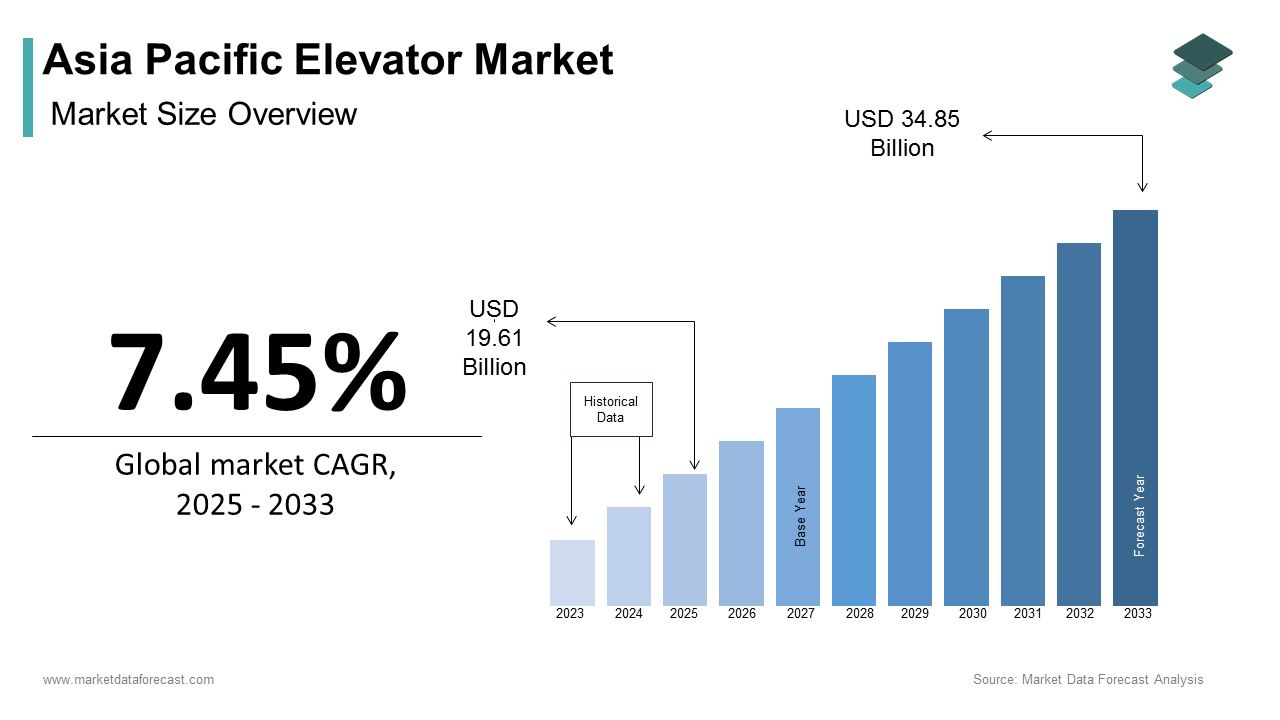

The Asia Pacific elevator market size was calculated to be USD 18.25 billion in 2024 and is anticipated to be worth USD 34.85 billion by 2033, from USD 19.61 billion in 2025, growing at a CAGR of 7.45% during the forecast period.

The Asia Pacific elevator market is a dynamic and rapidly evolving sector, driven by urbanization and infrastructural development. The market conditions reflect a strong demand for energy-efficient and smart elevators, spurred by stringent environmental regulations. Additionally, the rise of high-rise buildings, particularly in metropolitan cities, has further propelled growth. These trends underline the region's robust market presence, supported by technological advancements and infrastructure investments. The elevator market is also witnessing consolidation, with key players focusing on mergers and acquisitions to strengthen their foothold in this competitive landscape.

MARKET DRIVERS

Urbanization and Population Growth

Urbanization is a pivotal driver of the Asia Pacific elevator market. This demographic shift necessitates the construction of high-density residential and commercial spaces, where elevators play a critical role. For example, in India, the government’s Smart Cities Mission aims to develop 100 smart cities, which will require advanced vertical transportation systems. A report by McKinsey states that urban households in Asia Pacific are likely to spend more on housing by 2030, further accelerating elevator installations. These statistics underscore how urbanization directly correlates with the rising demand for elevators, making it a key growth driver.

Technological Advancements in Elevator Systems

Technological innovation is another major driver, with smart and IoT-enabled elevators gaining traction. South Korea, for instance, is investing heavily in AI-driven predictive maintenance systems, reducing downtime. Japan, a leader in robotics, is integrating autonomous elevator systems into public infrastructure, enhancing efficiency and safety. Furthermore, energy-efficient elevators are becoming a priority, with Singapore mandating green building codes under the Building and Construction Authority. These advancements not only meet consumer expectations but also align with sustainability goals, driving the market forward.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

One of the primary restraints of the Asia Pacific elevator market is the high initial investment required for installation, coupled with ongoing maintenance costs. In developing nations like India and Indonesia, where budget constraints are prevalent, this poses a significant barrier. Additionally, maintenance costs account for a notable portion of the total lifecycle expenses. Small and medium enterprises (SMEs) often find these costs prohibitive, limiting their ability to adopt modern elevator systems. The lack of affordable financing options further exacerbates the issue, particularly in rural or semi-urban areas where economic disparities are pronounced.

Regulatory Challenges and Compliance Issues

Another restraint is the complexity of regulatory frameworks governing elevator safety and performance. According to the International Organization for Standardization, compliance with safety standards such as ISO 8100 requires rigorous testing and certification processes, which can delay project timelines. In countries like Malaysia and Thailand, inconsistent enforcement of regulations creates uncertainty for manufacturers and installers. Moreover, retrofitting older buildings with modern elevators often involves navigating outdated building codes, as highlighted by the Asian Development Bank. The fragmented nature of regulations across the region adds another layer of difficulty, hindering seamless market expansion.

MARKET OPPORTUNITIES

Rising Demand for Green Buildings

The increasing emphasis on sustainability presents a significant opportunity for the Asia Pacific elevator market. This trend is driving demand for energy-efficient elevators, which consume less electricity than traditional models. Similarly, China’s Green Building Evaluation Standard mandates energy-saving measures, encouraging developers to opt for regenerative drive elevators. These factors create a fertile ground for innovation and market penetration, positioning the elevator industry as a key contributor to sustainable urban development.

Expansion of Smart City Projects

Smart city initiatives across the Asia Pacific offer another lucrative opportunity for the elevator market. For example, India’s Smart Cities Mission includes plans for 100 smart cities, each requiring advanced elevator systems to manage urban density. Japan’s Society 5.0 initiative integrates IoT-enabled elevators to enhance connectivity and user experience. Furthermore, the adoption of predictive maintenance technologies in smart cities reduces operational downtime.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The Asia Pacific elevator market faces stiff competition, with both global giants and local players vying for market share. Intense rivalry often leads to price wars, eroding profit margins and straining resources. For instance, in China, aggressive pricing strategies have resulted in a reduction in average elevator prices over the past three years. Smaller manufacturers, particularly in emerging economies like Vietnam and the Philippines, find it challenging to match the scale and technological prowess of established brands.

Supply Chain Disruptions and Raw Material Shortages

Another significant challenge is supply chain disruptions exacerbated by geopolitical tensions and natural disasters. According to the International Chamber of Commerce, the global semiconductor shortage has affected the production of IoT-enabled elevators, with Asia Pacific being particularly vulnerable due to its reliance on imported components. Additionally, fluctuations in steel and aluminum prices have increased manufacturing costs notably. Natural calamities such as typhoons in Southeast Asia further disrupt logistics, delaying project completions and increasing operational risks. These challenges not only hinder timely deliveries but also strain relationships with clients, impacting brand reputation and customer loyalty.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.45% |

|

Segments Covered |

By Type, Business, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Otis Elevator Company, Schindler Group, KONE Corporation, Hitachi Ltd., Mitsubishi Electric Corporation, TK Elevator, Fujitec Co. Ltd., Hyundai Elevator Co. Ltd., Johnson Lifts Pvt. Ltd., Wittur Group |

SEGMENTAL ANALYSIS

By Type Insights

The Traction elevators segment dominated the Asia Pacific elevator market by holding a 65.5% of the total market share in 2024. This is primarily attributed to their superior energy efficiency and suitability for high-rise buildings, which are increasingly prevalent in urbanized regions. For instance, China alone accounts for a considerable share of global skyscraper construction driving demand for traction elevators that can handle heavy loads and long vertical distances.

One key factor propelling this segment is the rapid urbanization rate in the region. Traction elevators, with their regenerative drive systems, consume less energy compared to hydraulic systems, making them a preferred choice in green building projects. Another driver is government initiatives promoting sustainable infrastructure. For example, Singapore mandates eco-friendly technologies under its Green Mark Scheme, encouraging developers to adopt traction elevators.

Hydraulic elevators are the fastest-growing segment in the Asia Pacific elevator market, with a projected CAGR of 8.5% during the forecast period. This is fueled by their cost-effectiveness and ease of installation, particularly in low-rise residential and commercial buildings. In countries like India and Indonesia, where budget constraints are significant, hydraulic elevators offer an affordable solution for mid-tier developments. The affordability factor is bolstered by the growing middle-class population in the region. Like, the middle class in the Asia Pacific is expected to reach significant mark by 2030, increasing demand for affordable housing equipped with basic vertical mobility solutions. Additionally, advancements in hydraulic technology, such as variable frequency drives, have improved energy efficiency, making them more competitive against traction systems.

By Business Insights

The new equipment segment held the largest share of the Asia Pacific elevator market by accounting for a 55.8% of the total revenue in 2024. This influence is credited to the region’s aggressive infrastructure development plans, including smart city initiatives and high-rise construction projects. Another critical factor is the increasing demand for energy-efficient elevators. Like, energy consumption in buildings accounts for notable share of total energy use globally is prompting governments to enforce stricter energy standards. For example, Japan has mandated the use of energy-saving elevators in all new constructions under its Top Runner Program. This regulatory push, combined with technological advancements such as IoT-enabled systems, is driving the adoption of new equipment. Furthermore, the rise of mega-cities like Tokyo and Shanghai, which require advanced vertical transportation solutions, further cements the segment’s leading position.

The modernization segment is advancing quickly, with a CAGR of 10.2%. This progress is caused by the aging elevator stock in developed economies like Japan and Australia, where a considerable portion of elevators are more than 20 years old, as per the Elevator World Trade Association. Retrofitting these systems with modern technologies not only enhances safety but also improves energy efficiency. Government regulations are also a key driver. Additionally, the growing emphasis on sustainability is pushing building owners to adopt eco-friendly solutions. Also, retrofitting existing elevators with energy-efficient components can reduce operational costs, making it an attractive option for businesses.

By Application Insights

The residential segment commanded the Asia Pacific elevator market by capturing a 60% of the total share in 2024. This leading position is supported by the region’s booming real estate sector, particularly in emerging economies like India and Indonesia, where urbanization is accelerating at an unprecedented rate. Affordable housing projects are another critical factor. For instance, India’s Pradhan Mantri Awas Yojana aims to construct 20 million affordable homes by 2025, as reported by the Ministry of Housing and Urban Affairs. These projects often incorporate cost-effective hydraulic elevators, boosting the residential segment’s growth. Moreover, the rise of gated communities and high-rise apartments in metropolitan cities like Bangkok and Manila is further driving demand.

The commercial segment is accelerating in this market, with a CAGR of 9.8%. This is propelled by the proliferation of office spaces, shopping malls, and hospitality facilities in urban centers. Technological advancements are also a major driver. Smart elevators equipped with AI and IoT capabilities are being adopted in commercial buildings to enhance user experience and operational efficiency. Additionally, the rise of co-working spaces and business hubs in cities like Singapore and Sydney is further accelerating demand.

REGIONAL ANALYSIS

China led the Asia Pacific elevator market by commanding a 50% share in 2024. This dominance is rooted in the country’s massive urbanization drive, with a significant portion of its population residing in cities by 2030. The proliferation of skyscrapers in cities like Shanghai and Shenzhen, which account for notable portion of global high-rise buildings, is a key factor driving demand. Government policies such as the 14th Five-Year Plan prioritize green infrastructure, encouraging the adoption of energy-efficient elevators.

India held a notable share of the market. The country’s rapid urbanization and infrastructure development are the primary drivers. The Smart Cities Mission, which targets 100 cities, is expected to generate a demand for significant portion elevators by 2030. Affordable housing projects under Pradhan Mantri Awas Yojana are also contributing significantly. Furthermore, the rise of Tier-II and Tier-III cities is expanding the market beyond metropolitan areas, ensuring sustained growth.

The Japanese market is driven by its focus on modernization and technological innovation. The Ministry of Land, Infrastructure, and Transport enforces mandatory safety checks, creating a robust pipeline for modernization projects. Additionally, Japan’s leadership in robotics and AI is fostering the development of autonomous elevators, positioning it as a pioneer in next-generation solutions.

South Korea accounts for a considerable of the market which is fueled by its smart city initiatives and emphasis on sustainability. The government’s Green Growth Strategy mandates the use of energy-efficient elevators in public infrastructure, driving adoption. Seoul, one of the most densely populated cities globally, is investing heavily in vertical transportation solutions to manage urban density.

Australia holds smaller portion of the market, with growth driven by urbanization and green building certifications. The country’s NABERS rating system incentivizes the adoption of eco-friendly elevators, with substantial share of new constructions incorporating sustainable technologies. Melbourne and Sydney, known for their high-rise developments, are key contributors to the market.

LEADING PLAYERS IN THE ASIA PACIFIC ELEVATOR MARKET

KONE Corporation

KONE Corporation is a global leader in the elevator industry, with a strong presence in the Asia Pacific region. The company focuses on innovation, offering energy-efficient and IoT-enabled elevators tailored to urbanization needs. KONE’s UltraRope technology has revolutionized high-rise mobility, reducing energy consumption. Their collaboration with local governments on smart city projects underscores their commitment to sustainability and technological advancement.

Schindler Group

Schindler Group is renowned for its advanced vertical transportation solutions, catering to both residential and commercial applications. The company emphasizes digital transformation, integrating AI-driven predictive maintenance systems to enhance operational efficiency. Schindler has invested heavily in expanding its R&D facilities in Southeast Asia, particularly in Vietnam and Thailand, to develop cost-effective solutions for emerging markets. Additionally, Schindler’s partnership with regional developers on green building projects highlights its focus on eco-friendly innovations.

Otis Worldwide Corporation

Otis Worldwide Corporation is a pioneer in elevator technology, known for its cutting-edge Gen360 escalators and IoT-enabled systems. The company has strengthened its footprint in Asia Pacific through strategic collaborations with construction firms in Australia and Japan. Furthermore, their investments in training programs for technicians in India demonstrate their dedication to improving service quality and customer satisfaction.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific elevator market employ diverse strategies to maintain their competitive edge. Innovation is a cornerstone, with companies like KONE and Schindler investing heavily in R&D to develop energy-efficient and IoT-enabled systems. Partnerships and collaborations are another critical strategy, as seen in Otis’ alliances with construction firms to integrate smart elevators into green buildings.

Expansion into emerging markets is also a priority. Companies are establishing new manufacturing units and service centers in countries like India, Vietnam, and Indonesia to cater to growing urbanization. Additionally, mergers and acquisitions play a pivotal role. Sustainability initiatives are gaining traction, with firms adopting eco-friendly practices to comply with government regulations.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific Elevator Market include Otis Elevator Company, Schindler Group, KONE Corporation, Hitachi Ltd., Mitsubishi Electric Corporation, TK Elevator, Fujitec Co. Ltd., Hyundai Elevator Co. Ltd., Johnson Lifts Pvt. Ltd., Wittur Group

The Asia Pacific elevator market is characterized by intense competition, driven by the presence of both global giants and regional players. Global leaders like KONE, Schindler, and Otis dominate through technological superiority and extensive service networks. These companies leverage innovations such as IoT, AI, and energy-efficient systems to differentiate themselves. Meanwhile, regional players focus on affordability and localized solutions, targeting budget-conscious markets in Southeast Asia.

Government policies promoting green infrastructure have intensified rivalry, as companies race to develop sustainable products. For instance, mandatory energy-saving standards in Japan and Singapore push firms to adopt eco-friendly technologies. Price wars are common, particularly in price-sensitive markets like India and Indonesia, where smaller firms struggle to compete with established brands. Additionally, partnerships with local governments and real estate developers are crucial for securing large-scale projects. The rise of smart city initiatives further amplifies competition, as companies vie for contracts in urban centers.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, KONE Corporation launched its DX Class elevators in China, featuring IoT-enabled predictive maintenance systems. This move aimed to enhance operational efficiency and strengthen its position in the high-rise building segment.

- In June 2023, Schindler Group partnered with Vietnam’s Ministry of Construction to provide energy-efficient elevators for urban housing projects. This collaboration helped Schindler expand its footprint in Southeast Asia.

- In August 2023, Otis Worldwide Corporation opened a new R&D facility in India, focusing on affordable solutions for residential buildings. This initiative supported its growth in emerging markets.

- In October 2023, Mitsubishi Electric introduced regenerative drive elevators in Japan, aligning with the country’s carbon neutrality goals. This reinforced its reputation as a sustainability leader.

- In December 2023, Thyssenkrupp acquired a regional player in Thailand to enhance its service network. This acquisition bolstered its presence in Southeast Asia’s rapidly growing market.

MARKET SEGMENTATION

This research report on the Asia Pacific elevator market has been segmented and sub-segmented based on type, business, application, and region.

By Type

- Hydraulic

- Traction

By Business

- New Equipment

- Maintenance

- Modernization

By Application

- Residential

- Commercial

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What factors are driving the growth of the elevator market in Asia Pacific?

Key growth drivers include rapid urbanization, infrastructure development, rising high-rise construction, and increasing demand for modernization and smart elevators.

2. Which countries in Asia Pacific contribute most to elevator market demand?

China, India, Japan, South Korea, and Australia are major contributors, with China being the largest market due to its high urban population and massive construction activities.

3. Who are the leading players in the Asia Pacific Elevator Market?

Top companies include Otis, Schindler, KONE, Mitsubishi Electric, Hitachi, Fujitec, TK Elevator, Hyundai Elevator, and Johnson Lifts.

4. How is the demand for elevators distributed across residential and commercial sectors?

While residential buildings hold a major share due to urban housing needs, commercial and infrastructure projects like airports, malls, and metros are seeing rising demand for high-speed and heavy-duty elevators.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]