Asia Pacific E-Learning Market Size, Share, Trends & Growth Forecast Report By Type (Custom E-Learning, Responsive E-Learning, Micro E-Learning, Translation & Localization, Game-Based Learning, Rapid E-Learning), Courses, Learning Method, Technology, End Use, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific E-Learning Market Size

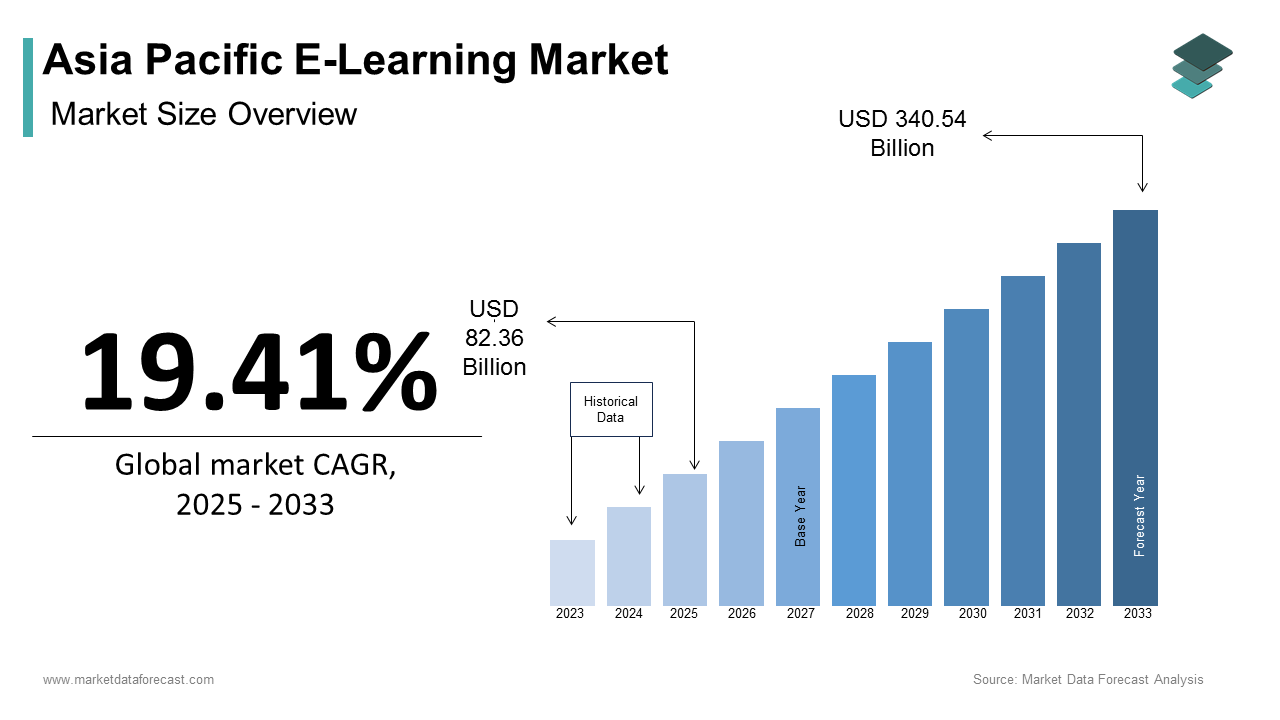

The Asia Pacific e-learning market size was calculated to be USD 68.96 billion in 2024 and is anticipated to be worth USD 340.54 billion by 2033, from USD 82.36 billion in 2025, growing at a CAGR of 19.41% during the forecast period.

The Asia Pacific e-learning market has emerged as a transformative force, driven by rapid digitalization and the growing emphasis on accessible education. According to HolonIQ, the region accounts for over 40% of global e-learning investments by creating substantial demand for innovative platforms and tools. Government initiatives promoting digital literacy further accelerate adoption. However, challenges such as high implementation costs and uneven internet penetration persist, influencing market dynamics. The region’s focus on affordability and innovation positions the e-learning market as both vibrant and resilient with steady growth anticipated in the foreseeable future.

MARKET DRIVERS

Rising Internet Penetration and Smartphone Usage

The exponential rise in internet penetration and smartphone usage serves as a primary driver for the Asia Pacific e-learning market, fueled by the region’s growing digital economy. Government support further amplifies this trend. As per the Ministry of Electronics and Information Technology in India, subsidies for digital infrastructure have increased by 25% since 2020 by ensuring widespread connectivity. Additionally, the proliferation of affordable smartphones in rural areas, creates new opportunities for e-learning providers.

Increasing Demand for Skill Development Programs

The increasing demand for skill development programs is another critical driver propelling the Asia Pacific e-learning market. For instance, South Korea’s workforce development initiatives utilize e-learning platforms to upskill employees in emerging technologies like AI and IoT by enhancing productivity. The rise of remote work models further amplifies adoption. Additionally, sectors like IT and healthcare rely on e-learning platforms for continuous education, driving demand for scalable solutions. These factors collectively reinforce the pivotal role of skill development in shaping the e-learning market’s growth trajectory.

MARKET RESTRAINTS

Uneven Internet Connectivity and Digital Divide

Uneven internet connectivity and the digital divide pose significant restraints to the Asia Pacific e-learning market, undermining accessibility and inclusivity. According to the International Telecommunication Union, over 40% of the region’s population lacks reliable internet access, particularly in rural and underserved areas. For instance, countries like Vietnam and the Philippines face challenges in delivering seamless e-learning experiences due to inadequate broadband infrastructure by deterring cost-sensitive learners. Moreover, affordability remains a key concern. While larger corporations can invest in offline learning tools, smaller players often lack the resources to address these disparities.

High Implementation Costs for Institutions

High implementation costs for institutions present another major restraint for the Asia Pacific e-learning market for budget-constrained schools and universities. According to Deloitte, the average cost of deploying an e-learning platform ranges from 50,000 to 200,000 by depending on the scale and complexity, making it inaccessible for many educational institutions. This financial barrier is particularly pronounced in emerging economies like Bangladesh and Nepal, where capital expenditure remains a key concern.

Additionally, the need for specialized hardware and software compounds the issue. While larger institutions can absorb these costs, smaller players often prioritize traditional methods over digital solutions. Consequently, high implementation costs not only hinder market inclusivity but also slow down the widespread adoption of e-learning technologies in the region.

MARKET OPPORTUNITIES

Expansion of Gamified Learning Platforms

The expansion of gamified learning platforms presents a transformative opportunity for the Asia Pacific e-learning market by enabling businesses to engage learners through interactive and immersive content. For instance, Japan’s K-12 education sector utilizes gamified platforms to enhance STEM learning outcomes. China, a leader in digital innovation, is spearheading the adoption of gamified solutions in language learning. Additionally, sectors like retail and hospitality utilize gamified platforms for employee training, which is driving demand for scalable technologies.

Growing Adoption of AI-Powered Personalized Learning

The growing adoption of AI-powered personalized learning offers significant growth avenues for the Asia Pacific e-learning market with the region’s focus on tailored education experiences. For example, India’s edtech sector utilizes AI-driven tools to create personalized learning paths for students, enhancing operational efficiency. Similarly, China’s dominance in AI research drives the need for advanced e-learning platforms. Sectors like healthcare and engineering further amplify demand, as AI-powered simulations require seamless integration with e-learning systems.

MARKET CHALLENGES

Intense Market Competition

Intense market competition poses a formidable challenge for the Asia Pacific e-learning market, characterized by the presence of numerous domestic and international players vying for dominance. This overcrowded landscape results in price wars, eroding profit margins and straining smaller players. For instance, global providers like Coursera and Udemy dominate the market with cost-effective offerings by leveraging economies of scale to undercut competitors.

India and Southeast Asia witness similar dynamics, where local players struggle to compete with established brands. Additionally, the lack of product differentiation limits growth opportunities, forcing companies to focus on aggressive marketing strategies rather than innovation. Intellectual property disputes further complicate the scenario, as per the World Intellectual Property Organization, with allegations of design infringements being common. These competitive pressures hinder profitability and stifle technological advancements by challenging manufacturers to strike a balance between affordability and innovation to remain relevant in the market.

Skilled Labor Shortages

Skilled labor shortages represent another pressing challenge for the Asia Pacific e-learning market, undermining operational efficiency and hindering growth. According to the International Labour Organization, the education technology sector faces a deficit of skilled professionals, particularly in emerging economies like India and Indonesia. For instance, a survey by the Associated Chambers of Commerce and Industry of India reveals that nearly 40% of e-learning implementations experience delays due to a lack of trained personnel. Furthermore, the complexity of modern e-learning systems requires specialized training, which is often inaccessible to workers in rural areas. This scarcity not only impacts project timelines but also increases operational risks, as untrained personnel are more prone to errors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

19.41% |

|

Segments Covered |

By Type, Courses, Learning Method, Technology, End Use, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of Asia-Pacific |

|

Market Leaders Profiled |

BYJU'S, Tencent Classroom, Vedantu, Coursera, Udemy, edX, Simplilearn, Toppr, Teachable, Skillshare, NIIT, Saba Software, Instructure, Cornerstone OnDemand, iTutorGroup |

SEGMENTAL ANALYSIS

By Type Insights

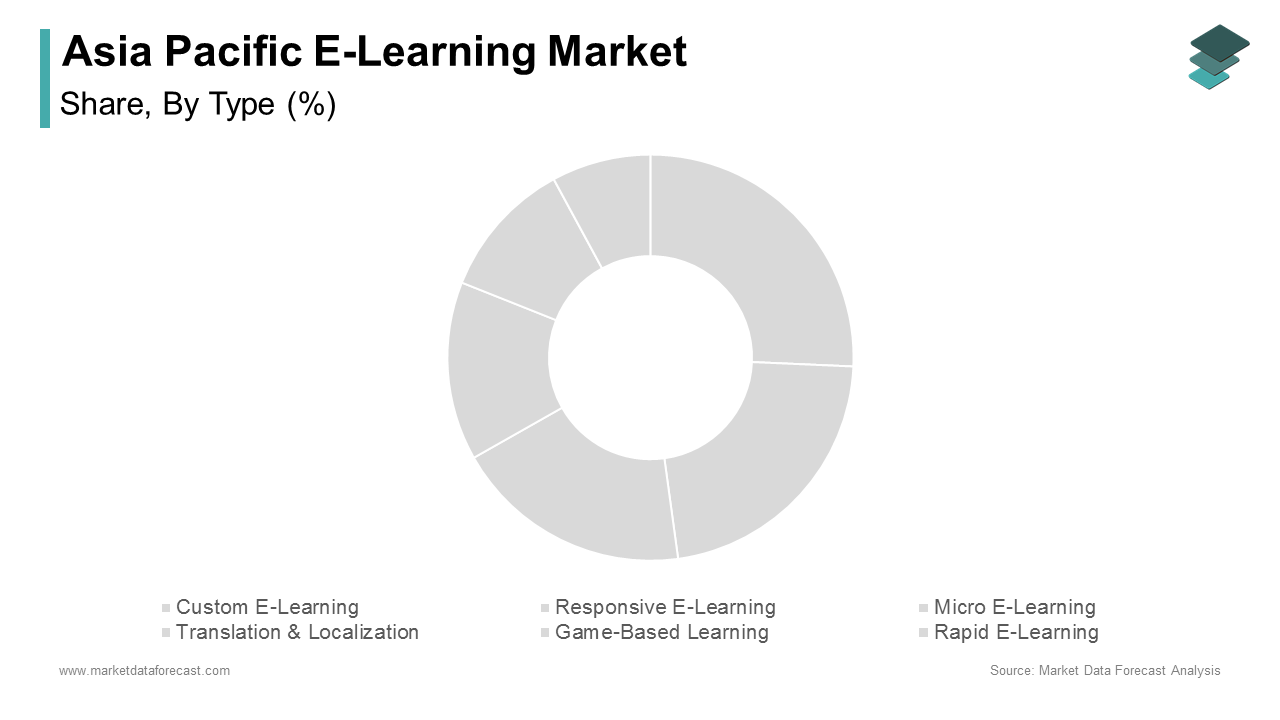

The custom e-learning dominated the Asia Pacific market with a 35.4% of share in 2024 with its ability to cater to specific organizational needs and deliver tailored learning experiences. The corporate training programs in the region now rely on custom e-learning solutions to address skill gaps and enhance workforce productivity. For instance, China’s manufacturing sector utilizes custom platforms to train employees on advanced technologies like AI and IoT. Government support further amplifies this trend. Additionally, sectors like healthcare and retail utilize custom e-learning platforms for compliance training, which is driving demand for scalable solutions.

The game-based learning is projected to grow with a CAGR of 28.5% in the coming years. The growth of the segment is fueled by its ability to engage learners through interactive and immersive content, particularly among younger demographics. For example, Japan’s K-12 education sector utilizes game-based platforms to enhance STEM learning outcomes. The rise of gamification in corporate training further amplifies adoption. As per the report by PwC, over 70% of companies in the region have implemented gamified learning tools to improve employee engagement and retention. Additionally, sectors like hospitality and retail rely on game-based platforms for soft skills training, driving demand for innovative technologies.

By Courses Insights

The self-paced courses segment was accounted in holding the prominent share of the Asia Pacific e-learning market in 2024 with their affordability and flexibility by making them ideal for learners seeking cost-effective and accessible education. For instance, India’s edtech sector relies heavily on self-paced courses to cater to diverse learner needs by enhancing scalability. Government initiatives further amplify this trend. As per the Ministry of Electronics and Information Technology in India, investments in digital infrastructure have increased by 30% since 2020 by ensuring widespread connectivity. Additionally, sectors like IT and engineering utilize self-paced platforms for continuous education, driving demand for scalable solutions.

The instructor-led virtual courses segment is swiftly emerging with a CAGR of 22.3% in the next coming years. This growth is fueled by the increasing demand for real-time interaction and personalized guidance in professional development programs. For example, South Korea’s corporate sector utilizes virtual classrooms to upskill employees in emerging technologies, which is driving regional demand. The proliferation of remote work models further amplifies adoption. Additionally, sectors like healthcare and finance rely on instructor-led platforms for compliance training, which is driving demand for innovative technologies.

By Learning Method Insights

The blended learning segment was the largest and held 40.3% of the Asia Pacific e-learning market share in 2024 due to its ability to combine traditional classroom methods with digital tools by offering a balanced approach to education. According to UNESCO, blended learning is projected to boost student engagement by up to 30%, which is driving adoption across schools and universities. For instance, China’s higher education sector utilizes blended platforms to enhance learning outcomes, driving regional demand. Government support further amplifies this trend. As per the Ministry of Education in China, subsidies for hybrid learning tools have increased by 25% since 2020 by ensuring widespread adoption. Additionally, sectors like healthcare and engineering utilize blended learning for hands-on training, which is driving demand for scalable solutions.

The mobile learning segment is likely to experience a CAGR of 25.8% in the coming years with the region’s rapid smartphone adoption and mobile-first consumer behavior. For example, Indonesia’s K-12 education sector utilizes mobile apps to engage students in remote areas. The rise of microlearning further amplifies adoption. Additionally, sectors like retail and hospitality rely on mobile platforms for employee training is driving demand for innovative technologies.

By Technology Insights

Cloud computing segment was accounted in holding 50.1 Asia Pacific e-learning market, holding a 50% market share, as per data from IDC. This dominance is driven by its affordability, scalability, and accessibility, making it ideal for businesses seeking cost-effective e-learning platforms. For instance, India’s edtech sector leverages cloud-based platforms to manage vast repositories of educational content, enhancing scalability. Government initiatives further amplify this trend. Additionally, sectors like healthcare and engineering utilize cloud platforms for secure and efficient content delivery, which is driving demand for scalable technologies.

The Artificial intelligence (AI) segment is esteemed to register CAGR of 30.5% of the Asia Pacific e-learning market in 2024 due to its ability to deliver personalized learning experiences and automate administrative tasks. For example, China’s language learning sector utilizes AI-driven platforms to create customized learning paths for students. The proliferation of adaptive learning further amplifies adoption. Additionally, sectors like IT and healthcare rely on AI-powered platforms for predictive analytics, driving demand for innovative technologies.

By End Use Insights

The academic end use segment was the largest by capturing 55.4% of the Asia Pacific e-learning market share in 2024. This dominance is driven by the region’s focus on improving educational accessibility and enhancing learning outcomes. According to UNESCO, over 70% of schools and universities in the region now rely on e-learning platforms to deliver quality education in underserved areas. For instance, India’s higher education sector utilizes e-learning tools to bridge the gap between urban and rural learners. Government support further amplifies this trend. As per the Ministry of Education in India, subsidies for digital education tools have increased by 30% since 2020 by ensuring widespread adoption. Additionally, sectors like STEM and vocational training utilize academic platforms for hands-on learning, which is driving demand for scalable solutions.

The corporate end use segment is deemed to hit a CAGR of 24.7% in the foreseen years with the increasing demand for skill development programs and workforce upskilling initiatives. For example, Japan’s corporate sector utilizes e-learning platforms to train employees in emerging technologies like AI and IoT. The rise of remote work models further amplifies adoption. A report by PwC, over 60% of companies in the region have implemented hybrid work policies with online training solutions for employee onboarding and professional development. Additionally, sectors like healthcare and finance rely on corporate platforms for compliance training, driving demand for innovative technologies.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific e-learning market with a 40.3% of share in 2024 due to its massive population and stringent localization laws. For instance, China’s "14th Five-Year Plan" allocates huge investment to digital education by emphasizing the adoption of AI-driven platforms for personalized learning. Government support further amplifies growth.

India was positioned second in holding Asia Pacific e-learning market with a 20.4% share in 2024. The country’s rapid digitalization and startup ecosystem drive demand for scalable e-learning solutions. According to the Ministry of Electronics and Information Technology, investments in digital infrastructure have increased by 25% since 2020 by encouraging businesses to adopt online platforms. The proliferation of affordable smartphones further amplifies adoption. For instance, Byju’s and Vedantu rely heavily on mobile apps to engage students by reducing operational costs. Additionally, partnerships with domestic providers like Tata Consultancy Services bolster supply chain resilience.

Japan’s market growth is driven by its expertise in advanced automation technologies in corporate training programs. For instance, Toyota and Sony utilize e-learning platforms extensively for employee upskilling by enhancing precision and energy efficiency. Government initiatives play a pivotal role. According to the Ministry of Economy, Trade, and Industry, Japan plans to invest $5 billion in sustainable education by 2025 by focusing on eco-friendly technologies. Collaborations with global players like IBM ensure access to cutting-edge systems.

South Korea e-learning market growth is driven by its dominance in the gaming and entertainment sectors. For example, Nexon and NCSoft rely heavily on gamified platforms to engage students, driving regional demand. Government support further amplifies growth. According to the Ministry of Science and ICT, investments in smart education tools have increased by 25% since 2020 by ensuring access to advanced technologies.

Australia and New Zealand e-learning market’s growth is driven by its focus on sustainability and renewable energy projects. Government initiatives further amplify growth. According to the Department of Industry, Science, and Resources, subsidies for green energy projects have increased by 20% since 2020 by encouraging the adoption of energy-efficient technologies. Collaborations with global players like Google Cloud ensure access to cutting-edge systems.

LEADING PLAYERS IN THE ASIA PACIFIC E-LEARNING MARKET

Coursera

Coursera is a dominant player in the Asia Pacific e-learning market, renowned for its extensive course offerings and partnerships with leading universities. The company leverages AI-driven tools to deliver personalized learning experiences, catering to both academic and corporate learners. Recently, Coursera expanded its localized content library in India, offering region-specific courses in multiple languages to enhance accessibility. Additionally, collaborations with government bodies like Singapore’s SkillsFuture initiative ensure widespread adoption of its platforms.

Byju’s

Byju’s plays a pivotal role in the Asia Pacific e-learning market in K-12 education, where its interactive and gamified platforms dominate. The company’s focus on mobile-first solutions aligns with regional consumer preferences among younger demographics. Recently, Byju’s introduced AI-powered adaptive learning tools in Indonesia, enhancing user engagement for rural students. Collaborations with local schools and educational institutions further solidify its position.

Tencent Education

Tencent Education is a key force in the Asia Pacific e-learning market, particularly in China, where its platforms cater to both academic and professional training needs. Its cloud-based solutions enable seamless integration of multimedia content by enhancing scalability. Recently, Tencent partnered with vocational training centers in Southeast Asia to offer AI-driven skill development programs targeting the tech-savvy workforce. The company also collaborated with government agencies to ensure compliance with data localization laws.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Asia Pacific e-learning market employ diverse strategies to maintain their competitive edge. Innovation and R&D investments rank among the most prominent approaches, with companies developing AI-driven and gamified learning solutions. Strategic partnerships and collaborations are also widely adopted, enabling firms to tap into emerging markets and secure contracts for large-scale projects. Localization efforts, such as creating region-specific content and language options, reduce barriers and improve accessibility. Sustainability-focused measures, such as low-emission data centers that further strengthen market positioning.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Asia Pacific E-learning market include BYJU'S, Tencent Classroom, Vedantu, Coursera, Udemy, edX, Simplilearn, Toppr, Teachable, Skillshare, NIIT, Saba Software, Instructure, Cornerstone OnDemand, iTutorGroup

The Asia Pacific e-learning market is characterized by intense competition, driven by the presence of global giants and regional players vying for dominance. Established companies like Coursera, Byju’s, and Tencent leverage their technological expertise and extensive distribution networks to maintain prominence. Meanwhile, local manufacturers compete aggressively on pricing, offering cost-effective solutions tailored to budget-conscious customers. The market’s competitive landscape is further shaped by rapid technological advancements and government initiatives aimed at boosting digital education. To differentiate themselves, players focus on innovation, introducing cutting-edge products for AI, gamification, and cloud integration. Sustainability initiatives, such as eco-friendly platforms, are also gaining traction amid stricter environmental regulations.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Coursera launched a localized content library in India by offering region-specific courses in multiple languages to enhance accessibility and engagement for learners across underserved areas.

- In May 2023, Byju’s introduced AI-powered adaptive learning tools in Indonesia by targeting rural students with interactive and gamified platforms to improve educational outcomes and drive regional demand.

- In July 2023, Tencent Education partnered with vocational training centers in Southeast Asia to offer AI-driven skill development programs by enhancing scalability and addressing workforce upskilling needs.

- In September 2023, Udemy expanded its instructor-led virtual courses in South Korea by targeting corporate clients with real-time training solutions to address emerging technology skill gaps.

- In November 2023, Edmentum collaborated with Australian schools to deploy blended learning platforms, which is combining traditional classroom methods with digital tools to improve student engagement and learning outcomes.

MARKET SEGMENTATION

This research report on the Asia Pacific E-Learning market has been segmented and sub-segmented based on type, courses, learning method, technology, end use and region.

By Type

- Custom E-Learning

- Responsive E-Learning

- Micro E-Learning

- Translation & Localization

- Game-Based Learning54

- Rapid E-Learning

By Courses

- Self-Paced Courses

- Instructor-Led Virtual Courses

By Learning Method

- Blended Learning

- Mobile Learning

- Virtual Classrooms

- Simulation

By Technology

- Cloud Computing

- Big Data

- Augmented Reality

- Virtual Reality

- Artificial Intelligence

By End Use

- Academic

- Corporate

- Government

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the Asia Pacific E-Learning market?

The market is primarily driven by increasing internet penetration, smartphone adoption, government initiatives in digital education, and growing demand for flexible, remote learning options.

2. How are companies in the Asia Pacific region using E-Learning solutions?

Corporations use e-learning for employee onboarding, compliance training, professional development, and upskilling through cloud-based platforms and mobile apps.

3. Which technologies are most commonly used in the Asia Pacific e-learning market?

Common technologies include Learning Management Systems (LMS), mobile learning platforms, AI-based personalized learning, virtual classrooms, and augmented/virtual reality (AR/VR).

4. Who are the major players in the Asia Pacific e-learning market?

Leading companies include BYJU'S, Tencent Classroom, Vedantu, Coursera, edX, Simplilearn, iTutorGroup, and NIIT.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]