Asia Pacific Construction Equipment Rental Market Research Report - Segmented By Equipment Type (Earthmoving Equipment, Material Handling Equipment, Concrete & Road Construction Equipment, and Others), Application, and Region (India, China, Japan, South Korea, Australia & New Zealand, Thailand) - Industry Analysis, Size, Share, Growth, Trends, And Forecasts 2025 to 2033

Asia Pacific Construction Equipment Rental Market Size

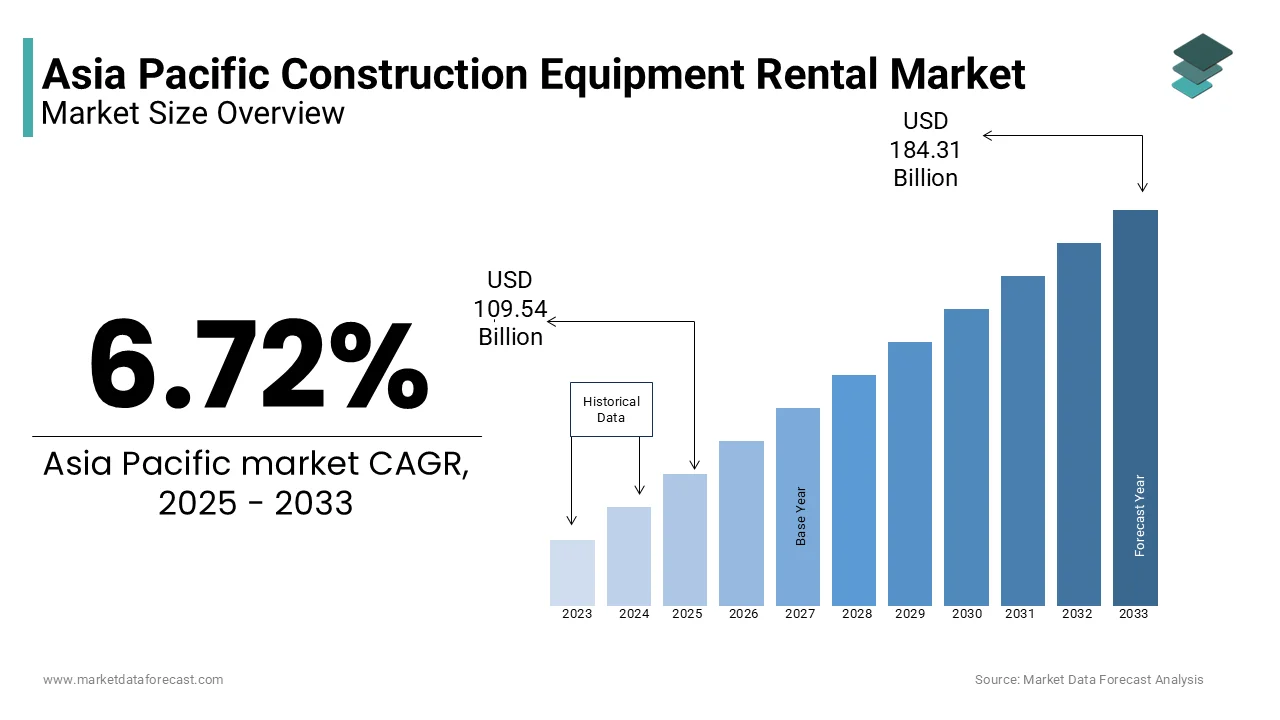

Asia Pacific Construction Equipment Rental market size was valued at USD 102.64 billion in 2024, and the market size is expected to reach USD 184.31 billion by 2033 from USD 109.54 billion in 2025. The market's promising CAGR for the predicted period is 6.72%.

MARKET DRIVERS

Rising Urbanization and Infrastructure Projects

Urbanization and large-scale infrastructure projects are key drivers of the Asia Pacific construction equipment rental market. According to the United Nations, the urban population in the region is projected to grow by 30% by 2030, which is prompting extensive construction activities. Small-scale contractors prefer rentals due to their affordability and flexibility. Additionally, governments are incentivizing public-private partnerships, which rely heavily on rented equipment.

Cost Efficiency and Flexibility

Cost efficiency and operational flexibility are transforming the Asia Pacific construction equipment rental market by making it an attractive option for small and medium enterprises (SMEs). The flexibility of short-term contracts allows businesses to adapt to fluctuating project demands without long-term commitments. Additionally, advancements in digital platforms have streamlined the rental process. For instance, Vietnam’s Ministry of Construction reported a 30% increase in app-based equipment rentals during 2023.

MARKET RESTRAINTS

High Initial Investment for Rental Companies

One of the most significant restraints for the Asia Pacific construction equipment rental market is the high initial investment required by rental companies to procure advanced machinery. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), the cost of acquiring energy-efficient excavators can be up to 40% higher than traditional models by posing financial barriers for smaller rental firms. This challenge is particularly acute in developing economies like Vietnam and the Philippines, where limited access to financing hinders fleet expansion. Additionally, maintaining and upgrading rental equipment involves substantial expenses by deterring investments in modern technology.

Supply Chain Disruptions

Supply chain vulnerabilities have emerged as a critical restraint for the Asia Pacific construction equipment rental market due to geopolitical tensions and natural disasters. According to the United Nations Conference on Trade and Development, disruptions caused by events like the 2022 floods in Thailand delayed shipments of critical components by affecting equipment availability. These disruptions not only escalate costs but also hinder project completions by causing reputational damage and financial losses. The reliance on imported parts from China and Europe further compounds risks for countries like Thailand and Malaysia. Additionally, the lack of localized supply chains forces companies to depend on global networks by amplifying exposure to external shocks. Addressing these challenges requires strategic investments in supply chain resilience by adding to operational complexities.

MARKET OPPORTUNITIES

Growing Adoption of Digital Platforms

The integration of digital platforms is reshaping the Asia Pacific construction equipment rental market by creating immense growth opportunities. According to the Australian Construction Equipment Rental Association, online rental platforms experienced a 30% surge in usage during 2023, driven by the convenience of real-time equipment tracking and booking. Additionally, digital platforms enable rental companies to expand their reach in urban areas with high demand for compact machinery. In Vietnam, the Ministry of Construction reported a 25% increase in equipment rentals facilitated through mobile apps by reflecting the growing acceptance of digital solutions.

Focus on Sustainability and Green Machinery

The growing emphasis on sustainability presents a transformative opportunity for the Asia Pacific construction equipment rental market. Australia’s Renewable Energy Integration Plan facilitated a 25% rise in solar-powered loaders used in urban projects. China’s Ministry of Science and Technology provided financial incentives for rental companies using green machinery in urban redevelopment.

MARKET CHALLENGES

Stringent Environmental Regulations

While environmental regulations aim to promote sustainability, they pose significant challenges for the Asia Pacific construction equipment rental market by imposing compliance burdens on rental companies. According to the Chinese Ministry of Ecology and Environment, China’s recent emission standards mandate a 30% reduction in nitrogen oxide (NOx) emissions from construction machinery by 2025, requiring costly upgrades for existing fleets. Similarly, as per the Indian Central Pollution Control Board, industries must adhere to stricter particulate matter limits with investments in advanced filtration systems for rental equipment. Non-compliance risks penalties or operational shutdowns, while compliance increases capital expenditures. Smaller players struggle to meet these standards without substantial financial and technical support. Furthermore, the complexity of navigating diverse regulatory frameworks across the region adds to operational challenges. These stringent regulations, while beneficial for the environment, create barriers to entry and limit flexibility for market participants ,that is hindering the growth of the market.

Economic Uncertainty and Project Delays

Economic uncertainty represents another critical challenge for the Asia Pacific construction equipment rental market amid fluctuating interest rates and inflationary pressures. According to the International Monetary Fund, economic growth in the region slowed to 4.5% in 2023 by impacting private sector investments in infrastructure projects. These uncertainties not only affect immediate sales but also discourage long-term investments in advanced equipment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.72% |

|

Segments Covered |

By Equipment Type, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, and the Rest of Asia-Pacific |

|

Market Leaders Profiled |

Caterpillar Inc., Finning InternationalInc.c, Liebherr Group, KanamotCo.Co Ltd, United Rentals Inc, and others |

SEGMENTAL ANALYSIS

By Equipment Type Insights

The earthmoving equipment segmets accounted in holding 45.3% of the Asia Pacific construction equipment rental market share in 2024, owing to its extensive use in large-scale infrastructure projects, mining operations, and urban redevelopment. Additionally, governments across the region are prioritizing public-private partnerships (PPPs), which rely heavily on rented machinery. The affordability and flexibility of renting earthmoving equipment make it an attractive option for small-scale contractors handling complex projects.

The concrete and road building equipment segment is anticipated to register a CAGR of 9.5% during 2025-2033. This growth is fueled by the rapid expansion of road networks and urbanization across the region. Governments are also incentivizing sustainable practices; for instance, South Korea’s Ministry of Land, Infrastructure and Transport mandates eco-friendly concrete technologies by resulting in a 10% surge in specialized machinery rentals. The integration of automation and digital solutions further enhances productivity,y which also fuels the growth of the market.

By Application Insights

The residential segment held the largest share of the Asia Pacific construction equipment rental market by accounting for 40.6% of the total share in 2024. The growth of the segment is attributedtoh the rapid urbanization and government-led housing initiatives aimed at addressing population growth. For instance, as per the Indian Ministry of Housing and Urban Affairs, the Pradhan Mantri Awas Yojana (PMAY) led to an increase in residential construction projects, which is driving demand for rented equipment like compact excavators and loaders. Additionally, the affordability of rental services makes them an ideal choice for small-scale developers.

The industrial segment is poised to register a CAGR of 10.2% during 2025-2033. The growth of the market is likely to be driven by the expansion of industrial hubs and manufacturing facilities across the region. According to Vietnam’s Ministry of Industry and Trade, foreign direct investments (FDI) in manufacturing boosted demand for rented equipment by 20%. Advancements in technology, such as telematics-enabled machinery, have enhanced operational efficiency by making rentals more appealing to industrial clients.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific construction equipment rental market with 40.4% of the share in 2024, owing to its status as the world’s largest infrastructure hub, with significant investments in urban development and transportation networks. The rising demand for constructional activities by directly boost demand for rented machinery. Additionally, the Belt and Road Initiative has spurred demand for heavy machinery in international projects. For instance, over 50% of China’s construction equipment rentals were directed to Southeast Asia during 2023.

India's construction equipment rental market is next in holding 15.3% of the share in 2024, with the rapid urbanization and government-led infrastructure projects driving equipment demand. For example, the Ministry of Finance allocated $1.4 trillion for the National Infrastructure Pipeline (NIP) by increasing the procurement of rented machinery like excavators and loaders. Additionally, rental services have gained traction, with the Confederation of Indian Industry reporting a 25% rise in equipment rentals during 2023.

Japan is likely to have steady growth in the coming years. The country’s focus on sustainability and innovation drives demand for advanced machinery. For instance, Tokyo’s “Zero Emission Tokyo” initiative led to a 20% rise in hybrid excavator rentals in urban areas during 2023. Additionally, aging infrastructure necessitates upgrades by creating opportunities for high-efficiency systems.

South Korea's construction equipment rental market is likely to gain huge opportunities in the coming years. The country’s emphasis on green technologies and urban development drives equipment adoption. Additionally, South Korea’s robust manufacturing sector ensures steady demand for industrial machinery.

Australia focuses on renewable energy sources, boosts demand for electric machinery. Additionally, Australia’s mining sector requires robust machinery for mineral extraction to ensure consistent demand.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Caterpillar Inc, Finning International Inc, Liebherr Group, Kanamoto Co Ltd, United Rentals Inc are playing a dominant role in the Asia Pacific construction equipment rental market.

The Asia Pacific construction equipment rental market is characterized by intense competition, driven by both global giants and regional players striving to capture market share. Global leaders like United Rentals, Sumitomo Corporation, and Coates Hire dominate through innovation, offering cutting-edge technologies like autonomous machinery and hybrid systems. Meanwhile, regional players such as Mahindra Construction Equipment and Komatsu Rental focus on affordability and localized strategies to appeal to price-sensitive consumers. The shift toward electric and smart equipment has intensified rivalry, prompting companies to develop sustainable solutions. Stringent environmental regulations and rising demand for rental services have further shaped market dynamics. Price wars and aggressive marketing tactics escalate competition in mature markets like China and India. Despite these challenges, opportunities abound in emerging segments like compact equipment and digital platforms by encouraging players to diversify their portfolios.

TOP PLAYERS IN THE MARKET

United Rentals Asia-Pacific

United Rentals Asia-Pacific has established itself as a key player in the region by offering a diverse fleet of construction equipment tailored to meet the needs of urban and industrial projects. In 2023, the company expanded its digital rental platform across Australia and India, enabling customers to book equipment seamlessly. Additionally, United Rentals partnered with local governments under urban redevelopment initiatives, supplying energy-efficient machinery like hybrid excavators. The company also invested in training programs for operators by ensuring better adoption rates and customer satisfaction.

Sumitomo Corporation

Sumitomo Corporation is a prominent contributor to the Asia Pacific construction equipment rental market by leveraging its expertise in heavy machinery and localized strategies. In 2023, the company introduced AI-driven telematics systems in Japan by enhancing real-time monitoring and predictive maintenance for rented equipment. Sumitomo also collaborated with mining firms in Indonesia to supply high-capacity haulers by addressing the growing demand in the mineral extraction sector. Furthermore, the company expanded its rental hubs in Thailand, targeting urban infrastructure projects.

Coates Hire

Coates Hire is a leading name in the Asia Pacific rental market with its extensive fleet and customer-centric services. In 2023, Coates launched its electric machinery range in Australia by targeting low-emission urban projects. The company also partnered with renewable energy developers by aligning its offerings with sustainability goals. Additionally, Coates expanded its service network in Southeast Asia, ensuring better accessibility for maintenance and parts.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Asia Pacific construction equipment rental market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop advanced machinery, such as autonomous and electric equipment. Partnerships with governments and industries are another critical strategy by enabling customized solutions for specific applications. For instance, collaborations with renewable energy providers have become pivotal as the region shifts toward cleaner energy sources. Additionally, market leaders are expanding their production capacities in emerging economies like Vietnam and Indonesia to leverage cost advantages and meet regional demand. Digitalization is also gaining traction, with firms integrating IoT-enabled monitoring systems to enhance operational efficiency.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, United Rentals Asia-Pacific launched its digital rental platform in India by enabling seamless equipment booking and enhancing customer accessibility.

- In June 2023, Sumitomo Corporation partnered with Indonesian mining firms to supply high-capacity haulers by addressing the growing demand in the mineral extraction sector.

- In August 2023, Coates Hire expanded its electric machinery range in Australia by targeting urban development projects requiring low-emission solutions.

- In October 2023, Mahindra Construction Equipment inaugurated new rental hubs in Thailand by focusing on urban infrastructure projects and boosting regional presence.

- In December 2023, Komatsu Rental announced a joint venture with a Chinese EV manufacturer to develop specialized electric loaders by aligning with sustainability goals.

MARKET SEGMENTATION

This research report on the Asia Pacific construction equipment rental market has been segmented and sub-segmented based on the following categories.

By Equipment Type

- Earthmoving Equipment

- Material Handling Equipment

- Concrete & Road Construction Equipment

- Others

By Application

- Residential

- Commercial

- Industrial

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

1. What are the key opportunities in the Asia Pacific Construction Equipment Rental Market?

Opportunities lie in the rapid urbanization, large-scale infrastructure development, and rising demand for cost-effective and flexible construction equipment solutions across emerging economies like India and Southeast Asia.

2. What are the major challenges facing the Asia Pacific Construction Equipment Rental Market?

Challenges include high maintenance costs, lack of skilled operators, and logistical complexities in transporting heavy equipment across diverse terrains and regions.

3. Who are the major players in the Asia Pacific Construction Equipment Rental Market?

Key players include United Rentals Inc., Nishio Rent All Co., Kanamoto Co., Ltd., Aktio Corporation, and Hitachi Construction Machinery, all offering diverse fleets and rental solutions across the region.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]