Asia Pacific Concrete Admixtures Market Research Report – Segmented By Type ( Water Reducing admixtures, air entraining admixtures ) Application and Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore and Rest of APAC) - Industry Analysis on Size, Share, Trends& Growth Forecast from 2025 to 2033

Asia Pacific Concrete Admixtures Market Size

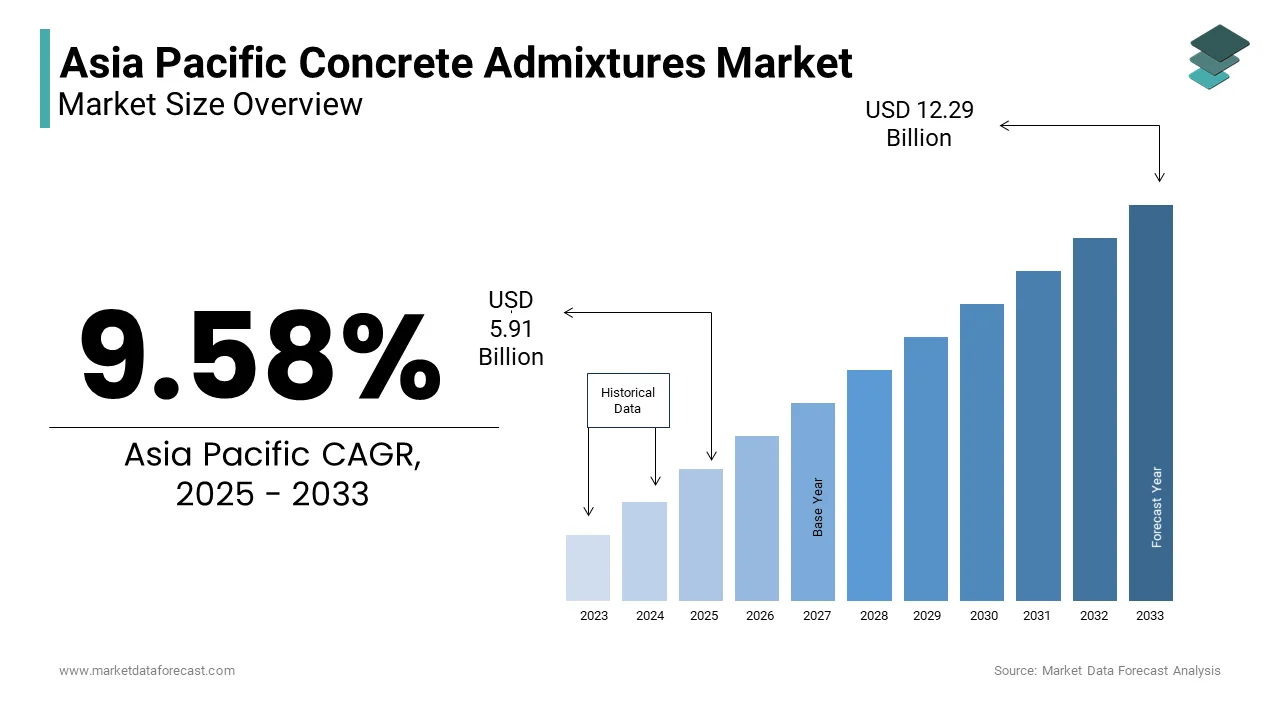

The Asia Pacific Concrete Admixtures Market Size was valued at USD 5.39 billion in 2024. The Asia Pacific Concrete Admixtures Market size is expected to have 9.58 % CAGR from 2025 to 2033 and be worth USD 12.29 billion by 2033 from USD 5.91 billion in 2025.

Concrete admixtures play a pivotal role in enhancing the performance and durability of concrete. Concrete admixtures are chemical additives or materials incorporated during the mixing process to modify the properties of fresh or hardened concrete, such as workability, strength, durability, and resistance to environmental factors. The Asia-Pacific region accounts for the significant share of global construction activity, with countries like China, India, and Japan leading large-scale infrastructure projects. The rise of energy-efficient building practices has fuelled the demand for high-performance concrete admixtures that reduce water consumption, improve thermal insulation, and enhance structural longevity. Additionally, rapid urbanization in the Asia Pacific region has led to an unprecedented surge in residential, commercial, and industrial construction, creating immense demand for innovative admixture solutions. With advancements in material science enabling the development of eco-friendly formulations, the Asia Pacific Concrete Admixtures Market continues to expand, serving as a vital enabler of progress across multiple industries.

MARKET DRIVERS

Rising Demand in Infrastructure Development

The escalating demand for robust and durable infrastructure is primarily driving the growth of the Asia Pacific Concrete Admixtures Market. The infrastructure investments of Asia-Pacific are projected to grow at a CAGR of 8% over the next decade, which is expected to create significant opportunities for concrete admixtures. Countries like China and India are undertaking massive projects, including highways, bridges, airports, and metro systems, which require high-performance concrete to withstand heavy loads and harsh environmental conditions. The growing focus on sustainable and resilient construction practices in this region are further boosting the regional market expansion. As per the United Nations Environment Programme (UNEP), adopting concrete admixtures can reduce water usage by up to 30%, directly impacting resource efficiency and operational costs. Additionally, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of admixtures that enhance durability and reduce carbon footprints. These factors not only cater to economic considerations but also align with global sustainability goals, thereby fueling the expansion of the concrete admixtures market.

Expansion of High-Rise Residential Construction

The rapid expansion of high-rise residential construction in urban areas has significantly bolstered the demand for concrete admixtures designed to improve workability, setting time, and compressive strength. According to the World Bank, over 50% of the Asia Pacific population is expected to reside in urban areas by 2030, creating immense demand for affordable and durable housing solutions. Concrete admixtures, such as superplasticizers and air-entraining agents, are extensively used to ensure the quality and longevity of vertical structures. The rising adoption of ready-mix concrete that relies heavily on admixtures to maintain consistency and performance is further aiding the regional market expansion. The growing adoption of advanced admixture technologies has fuelled the demand for high-strength concrete formulations that minimize cracking and shrinkage. Moreover, the shift toward modular construction practices has increased investments in admixtures that improve early strength development, further boosting their demand. These innovations position concrete admixtures as a transformative solution for modern construction, ensuring both performance and sustainability.

MARKET RESTRAINTS

Stringent Environmental Regulations

The stringent environmental regulations governing the use of certain chemical additives is one of the significant restraints of the Asia-Pacific concrete admixtures market. The United Nations Environment Programme (UNEP) and regional authorities impose strict guidelines on permissible levels of volatile organic compounds (VOCs) and toxic substances, which are often mirrored by national policies. However, as per the Biotechnology Innovation Organization, the average time required to secure regulatory approval for new admixture formulations can exceed three years, accompanied by substantial R&D expenditures. This prolonged timeline poses significant challenges for manufacturers aiming to introduce innovative solutions tailored to emerging industry needs. Moreover, discrepancies between national and international regulations often lead to fragmented compliance requirements, complicating distribution efforts. For example, Japan’s Ministry of the Environment imposes additional restrictions on VOC emissions, creating hurdles for companies operating across multiple markets. Such inconsistencies deter investment in research and development, stifling innovation and delaying the availability of next-generation products capable of addressing pressing issues like toxicity and sustainability.

Volatility in Raw Material Prices

The volatility in raw material prices, particularly for key inputs like polymers, surfactants, and synthetic resins that impacts production costs and profitability is further hindering the growth of the Asia-Pacific concrete admixtures market. For instance, fluctuations in crude oil prices have surged by 40% in recent years due to geopolitical tensions and supply chain disruptions. This instability creates challenges for concrete admixture manufacturers, who must navigate rising input costs while maintaining competitive pricing for their products. Such price volatility disproportionately affects small-scale producers who operate on tight margins and lack the resources to absorb sudden cost increases. Larger enterprises, though more resilient, also face pressure to balance input expenses against market dynamics. Additionally, the complexity of reformulating admixtures to accommodate changing ingredient availability often requires additional R&D investments, further inflating operational costs. These combined factors limit accessibility to high-quality concrete admixtures, impeding their overall market penetration across diverse industrial sectors.

MARKET OPPORTUNITIES

Adoption of Bio-Based and Eco-Friendly Admixtures

The rising adoption of bio-based and eco-friendly concrete admixtures due to the growing consumer demand for environmentally friendly products is one of the significant opportunities of the Asia-Pacific concrete admixtures market. As per the United Nations Environment Programme (UNEP), the Asia Pacific region is projected to account for over 50% of global green product consumption by 2030, creating significant demand for admixtures derived from renewable sources like plant extracts and recycled materials. These bio-based alternatives not only reduce reliance on petrochemicals but also align with regulatory frameworks aimed at promoting circular economies. Simultaneously, the rise of regenerative practices presents a novel avenue for innovation. For instance, admixtures derived from algae-based polymers are effective in reducing greenhouse gas emissions during production, as reported by the University of Queensland. By diversifying into these emerging sectors, manufacturers can tap into rapidly expanding markets driven by sustainability goals and shifting consumer preferences, positioning themselves at the forefront of future-oriented industrial practices.

Growth in Smart and Self-Healing Concrete Technologies

The advent of smart and self-healing concrete technologies is another notable opportunity for the Asia Pacific Concrete Admixtures Market. For instance, smart concrete applications, such as those incorporating sensors and self-repairing capabilities, are projected to grow at a compound annual growth rate (CAGR) of 15% over the next decade, creating immense demand for specialized admixtures. These technologies enable real-time monitoring of structural health and extend the lifespan of infrastructure by autonomously repairing cracks. For example, advancements in nano-admixture formulations enable manufacturers to achieve superior durability and resilience, directly impacting structural performance. Additionally, the growing adoption of sustainable construction practices has increased the demand for admixtures that minimize maintenance costs and enhance service life. These benefits not only cater to economic considerations but also align with consumer preferences for responsibly produced goods, thereby fueling the expansion of the concrete admixtures market.

MARKET CHALLENGES

Resistance to Adoption of New Technologies

The resistance to adoption of new technologies exhibited by traditional contractors entrenched in conventional practices is one of the major challenges to the growth of the Asia-Pacific concrete admixtures market. As per surveys conducted by the Federation of Indian Chambers of Commerce and Industry (FICCI), nearly 40% of small-scale construction firms remain hesitant to adopt advanced admixture formulations or bio-based alternatives due to skepticism about their effectiveness or unfamiliarity with implementation processes. This reluctance is particularly pronounced among older generations who prioritize tried-and-tested methods over experimental approaches. Furthermore, cultural and regional disparities exacerbate this issue. For example, rural areas in Southeast Asia tend to have lower adoption rates compared to technologically progressive regions like Japan and South Korea, where large-scale operations dominate. For instance, addressing these gaps necessitates tailored communication strategies that resonate with local contexts and priorities. Without overcoming this barrier, the full potential of advanced concrete admixtures cannot be realized, limiting their contribution to enhanced productivity and sustainability across the industrial value chain.

Concerns Over Environmental Impact and Regulation

Environmental concerns are further impeding the expansion of the Asia Pacific Concrete Admixtures Market, especially regarding pollution and resource depletion. As per findings from the World Resources Institute, over 70% of industrial emissions in the region are attributed to chemical manufacturing, including concrete admixture production, prompting stricter regulations on chemical discharges. Traditional admixtures, despite their efficiency, are often scrutinized for their potential contribution to these issues if not managed responsibly. Such sentiments place immense pressure on manufacturers to develop low-impact alternatives while adhering to complex regulatory frameworks. For example, China’s Ministry of Ecology and Environment imposes strict limits on wastewater and air emissions, creating additional hurdles for companies operating nationwide. Additionally, misinformation spread via social media platforms amplifies public distrust, creating reputational risks for brands associated with controversial admixture practices. To navigate these challenges effectively, industry players must invest in transparent marketing campaigns and engage directly with stakeholders to build trust and dispel misconceptions surrounding concrete admixture safety and functionality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.58 % |

|

Segments Covered |

By Type, Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

China, India, Japan, South Korea, Australia, New Zealand, Thailand, Indonesia, Philippines, Vietnam, Singapore, Rest of APAC. |

|

Market Leader Profiled |

Sika, RPM International, Pidilite Industries, Tremco, Schneider Electric |

SEGMENTAL ANALYSIS

By Type Insights

The water reducing admixtures segment had the leading share of 35.5% of the Asia Pacific concrete admixtures market in 2024. The leading position of water reducing admixtures segment in the Asia-Pacific market is driven by their widespread use in high-performance and ready-mix concrete applications, which are critical for large-scale infrastructure projects. For instance, over 60% of construction projects in the region utilize water-reducing admixtures to enhance workability, reduce water content, and improve compressive strength. The rising focus on sustainable construction practices in this region is also fuelling the expansion of the water reducing admixtures segment in the Asia-Pacific market. As per the United Nations Environment Programme (UNEP), adopting water-reducing admixtures can reduce water consumption by up to 30%, directly impacting resource efficiency and operational costs. Additionally, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of admixtures that enhance durability and reduce carbon footprints. These factors ensure that water-reducing admixtures remain the largest segment in the market.

The air entraining admixtures segment is a promising segment and is anticipated to exhibit a CAGR of 10.4% over the forecast period owing to the increasing demand for durable and weather-resistant concrete in regions prone to harsh environmental conditions, such as freezing temperatures or heavy rainfall. The rising adoption of air-entraining admixtures in infrastructure projects like highways, bridges, and dams is also boosting the growth of the air enhancing admixtures segment in the Asia-Pacific market. For instance, over 40% of road networks in the Asia Pacific region require freeze-thaw resistant concrete, creating significant opportunities for manufacturers. Moreover, as per the Asian Development Bank, adopting resilient construction practices has amplified the demand for admixtures that minimize cracking and spalling, further boosting their demand. These innovations position air-entraining admixtures as a transformative solution for modern construction, ensuring both performance and sustainability.

By Application Insights

The infrastructure segment had the largest share of 41.4% of the Asia Pacific concrete admixtures market in 2024. The booming construction sector of the Asia-Pacific region that supports large-scale projects like highways, airports, metro systems, and energy facilities is majorly driving the domination of the infrastructure segment in the Asia-pacific market. According to the United Nations Industrial Development Organization (UNIDO), over 50% of global infrastructure investments occur in the Asia Pacific region, creating immense demand for high-performance concrete admixtures. The leading position of infrastructure segment is also attributed to the increasing focus on sustainable and resilient construction practices. As per the United Nations Environment Programme (UNEP), adopting concrete admixtures can reduce water usage by up to 30%, directly impacting resource efficiency and operational costs. Additionally, stringent building codes enforced by governments, such as China’s Green Building Evaluation Standard, have accelerated the adoption of admixtures that enhance durability and reduce carbon footprints. These factors ensure that infrastructure remains the largest application segment in the market.

The residential segment is anticipated to register a prominent CAGR of 11.3% over the forecast period owing to the increasing demand for affordable and durable housing solutions in urban areas. According to the World Bank, over 50% of the Asia Pacific population is expected to reside in urban areas by 2030, creating immense demand for high-rise and modular residential structures that rely heavily on concrete admixtures. The rising adoption of ready-mix concrete that relies on admixtures to maintain consistency and performance is further boosting the expansion of residential segment in the Asia-Pacific market. For instance, the rising adoption of advanced admixture technologies has fuelled the demand for high-strength concrete formulations that minimize cracking and shrinkage. Moreover, the shift toward modular construction practices has increased investments in admixtures that improve early strength development, further boosting their demand. These innovations position the residential segment as a transformative force in the concrete admixtures market.

COUNTRY LEVEL ANALYSIS

China dominated the Asia Pacific concrete admixtures market by holding 37.4% of the regional market share in 2024. The vast infrastructure development sector of China that supports large-scale projects like high-speed railways, airports, and urban housing is primarily driving the growth of the concrete admixtures market in China. For instance, China accounts for over 50% of global infrastructure investments, underscoring its critical role in the concrete admixtures market. The presence of advanced manufacturing technologies in China is also contributing to the domination of China in the Asia-Pacific concrete admixtures market. For instance, more than 70% of Chinese admixture producers utilize automated systems, enabling seamless integration of innovative formulations. Additionally, stringent environmental regulations enforced by the Ministry of Ecology and Environment have accelerated the adoption of eco-friendly admixtures, ensuring compliance with global standards.

India is predicted to play a key role in the Asia Pacific concrete admixtures market over the forecast period owing to the strong emphasis of India on sustainable practices and increasing recognition of India as a hub for eco-friendly admixture solutions. For instance, more than 60% of admixture manufacturers in India have adopted green technologies to reduce carbon emissions and water pollution. The prominence of India in the Asia-Pacific is further driven by its thriving infrastructure and residential construction sectors. According to reports, the Indian urban housing projects exceed $1 trillion annually, which is expected to generate significant demand for high-performance admixtures. Additionally, government incentives for adopting renewable energy sources have spurred the use of bio-based admixtures, further bolstering the market's growth.

Japan is a notable market for concrete admixtures in the Asia-Pacific market. The growing emphasis of Japan on innovation and precision engineering has developed a fertile ground for high-performance admixtures used in advanced applications like earthquake-resistant structures and smart infrastructure. According to the Japan External Trade Organization (JETRO), Japan's construction industry exports exceed $150 billion annually, necessitating advanced admixtures to meet global quality standards. The rising adoption of specialized admixtures facilitated by investments in R&D in Japan is further boosting the market expansion in Japan. According to the National Institute of Advanced Industrial Science and Technology, nano-admixtures have gained traction due to their ability to enhance durability and resilience. Additionally, efforts to modernize construction processes through government-funded programs have encouraged small-scale producers to invest in premium admixture solutions, contributing to Japan's steady market expansion.

South Korea is projected to register a healthy CAGR in the Asia-Pacific concrete admixtures market over the forecast period. As per the Korea International Trade Association (KITA), the country is witnessing gradual adoption of admixtures due to its growing focus on export-oriented industries. For instance, South Korea's high-rise residential projects have surged by 15% annually, driven by investments in advanced admixture formulations. The influx of foreign expertise and technology in South Korea is further aiding the market expansion in South Korea. The Korea Institute of Industrial Technology reports that partnerships with international organizations have introduced cost-effective admixture solutions tailored to local conditions.

Australia and New Zealand are anticipated to account for a considerable share of the Asia Pacific concrete admixtures market over the forecast period. As per the Australian Department of Industry, Science, Energy and Resources, the region's construction sector is undergoing transformation, with a focus on self-sufficiency and resilience against external shocks. Recent bushfires have underscored the need for fortified admixtures to mitigate production losses. A key driver of this progress is the adoption of bio-based admixtures, which safeguard environmental health during adverse weather conditions. The University of Queensland highlights that these products have increased structural resilience by up to 20% in local buildings. Additionally, government subsidies aimed at revitalizing rural economies have incentivized builders to invest in advanced admixture solutions, fostering incremental growth in the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Asia Pacific Concrete Admixtures Market are Sika, RPM International, Pidilite Industries, Tremco, Schneider Electric, ACI Materials, GRT, Cemex, Wolfgang Group, Fosroc, BASF, DOW Chemical, Global Building Solutions, Mapei.

The Asia Pacific Concrete Admixtures Market is characterized by intense competition, driven by the presence of established multinational corporations and emerging niche players. Companies strive to differentiate themselves through innovation, sustainability, and customer-centric strategies, creating a dynamic and rapidly evolving landscape. Leaders like BASF SE, Sika AG, and Fosroc International Limited dominate the market by leveraging their extensive R&D capabilities and global reach to deliver high-performance solutions. At the same time, smaller firms focus on specialized products that cater to specific industrial segments or address unique challenges such as toxicity and environmental impact. Regulatory pressures and shifting consumer preferences further intensify competition, compelling companies to adopt sustainable practices and transparent labeling. Collaborations, mergers, and acquisitions are common strategies used to consolidate market share and expand product portfolios. This competitive environment fosters continuous innovation, ensuring that the market remains responsive to the needs of both producers and consumers.

Top Players in the Market

BASF SE

BASF SE is a global leader in the Asia Pacific Concrete Admixtures Market, renowned for its innovative and sustainable admixture solutions tailored to meet the diverse needs of industries such as infrastructure, residential, and commercial construction. The company specializes in producing high-performance admixtures that enhance workability, durability, and resistance to environmental factors. BASF’s commitment to research and development has positioned it as a pioneer in creating eco-friendly formulations that align with stringent environmental regulations. By fostering partnerships with manufacturers and leveraging advanced technologies, BASF continues to drive advancements in sustainable industrial practices, reinforcing its leadership in the regional market.

Sika AG

Sika AG plays a pivotal role in the Asia Pacific Concrete Admixtures Market by offering specialized admixtures designed for niche applications like earthquake-resistant structures, modular construction, and water-proofing systems. The company focuses on developing sustainable and high-performance admixtures that cater to evolving consumer preferences for green solutions. Sika’s emphasis on reducing carbon footprints aligns with its efforts to promote circular economies, making its products a preferred choice for eco-conscious industries. By leveraging cutting-edge R&D capabilities, Sika ensures its admixtures deliver consistent quality and performance, solidifying its reputation as an industry innovator.

Fosroc International Limited

Fosroc International Limited is a prominent player in the Asia Pacific Concrete Admixtures Market, specializing in the production of advanced admixtures for infrastructure, industrial, and residential applications. The company emphasizes sustainable sourcing practices and invests heavily in developing specialty formulations that enhance product durability and functionality. Fosroc’s vertically integrated business model allows it to maintain control over the entire supply chain, ensuring traceability and compliance with international standards. By prioritizing customer-centric solutions and investing in next-generation admixture technologies, Fosroc continues to strengthen its position as a trusted partner for industrial manufacturers.

Top Strategies Used by Key Market Participants

Strategic Acquisitions and Partnerships

Key players in the Asia Pacific Concrete Admixtures Market have prioritized strategic acquisitions and partnerships to expand their product portfolios and strengthen their market presence. By acquiring smaller firms specializing in niche admixture formulations or forming alliances with research institutions, these companies gain access to cutting-edge technologies and innovative solutions. Such collaborations enable them to address unmet needs in the industrial sector while enhancing their competitive edge. This strategy also facilitates entry into underserved markets, allowing companies to capitalize on untapped opportunities and diversify their revenue streams.

Investment in Sustainable Solutions

Sustainability has emerged as a cornerstone of competitive strategy in the concrete admixtures market. Leading companies are investing heavily in the development of eco-friendly admixtures that reduce environmental impact, improve resource efficiency, and align with regulatory standards. By focusing on reducing carbon emissions and promoting circular economies, these players position themselves as champions of sustainable industrial practices. Their commitment to environmental stewardship not only enhances brand loyalty but also ensures compliance with evolving global standards, reinforcing their leadership in the market.

Emphasis on Research and Development

R&D is a critical driver of innovation in the Asia Pacific Concrete Admixtures Market. Key players are channeling significant resources into exploring novel formulations and advanced manufacturing processes that improve admixture performance and application versatility. By staying at the forefront of technological advancements, these companies can introduce groundbreaking solutions tailored to specific industrial needs. This focus on innovation enables them to differentiate their offerings, meet the demands of modern construction practices, and maintain a strong foothold in an increasingly competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, BASF SE launched a new line of bio-based concrete admixtures designed to enhance sustainability and reduce environmental impact. This move aims to address growing concerns about pollution in the Asia Pacific region.

- In June 2023, Sika AG partnered with a leading infrastructure developer to develop high-performance admixtures for earthquake-resistant structures. This collaboration underscores Sika’s commitment to advancing resilient construction practices through innovation.

- In January 2023, Fosroc International Limited acquired a startup specializing in nano-admixture technology. This acquisition strengthens Fosroc’s ability to offer high-performance solutions for industrial and infrastructure applications.

- In September 2022, GCP Applied Technologies introduced a range of low-VOC admixtures aimed at supporting the residential and commercial construction sectors. This initiative aligns with consumer preferences for durable and environmentally friendly products.

- In November 2022, Mapei expanded its production facilities in India to increase the supply of specialized admixtures. This expansion supports the company’s goal of meeting rising demand in the Asia Pacific Concrete Admixtures Market.

MARKET SEGMENTATION

This research report on the asia pacific concrete admixtures market has been segmented and sub-segmented into the following.

By Type

- Water Reducing admixtures

- air entraining admixtures

By Application

- Infrastructure

- Residential

By Country

- China

- India

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Indonesia

- Philippines

- Vietnam

- Singapore

- Rest of APAC

Frequently Asked Questions

What is driving the growth of the Asia Pacific Concrete Admixtures Market?

Key drivers include rapid urbanization, increasing construction activities, infrastructure development, and the growing demand for high-performance and sustainable building materials in countries like China and India.

Which countries in Asia Pacific are leading the concrete admixtures market?

China, India, Japan, and South Korea are the key contributors to the Asia Pacific concrete admixtures market due to their booming construction industries and large-scale infrastructure projects.

What are the key challenges in the Asia Pacific Concrete Admixtures Market?

Challenges include the fluctuating prices of raw materials, environmental concerns, and the high cost of advanced admixtures. Regulatory barriers and the need for research and development also pose obstacles.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]