Asia Pacific Boiler Market Size, Share, Trends & Growth Forecast Report By Fuel (Natural Gas, Oil, Coal, Electric, Others), Capacity, Application, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Boiler Market Size

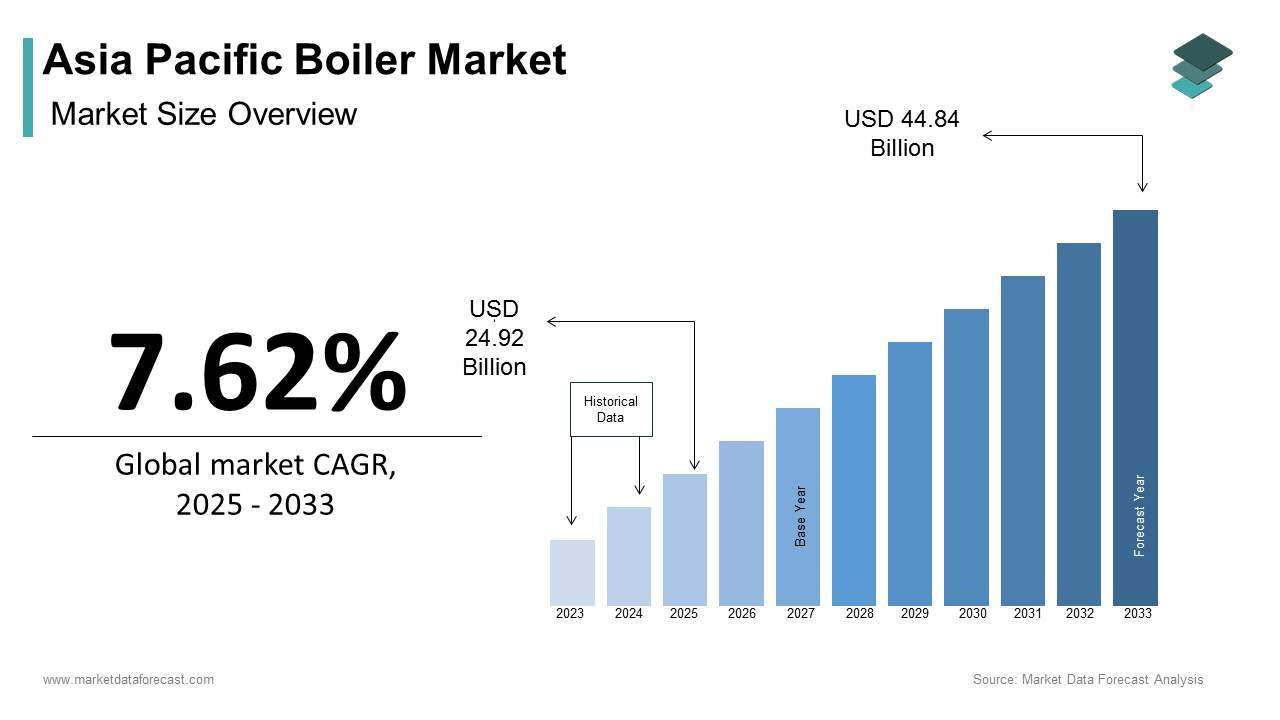

The Asia Pacific boiler market size was calculated to be USD 23.15 billion in 2024 and is anticipated to be worth USD 44.84 billion by 2033, from USD 24.92 billion in 2025, growing at a CAGR of 7.62% during the forecast period.

The Asia Pacific boiler market growth is driven by the region's rapid industrialization and urbanization. Countries like China, India, and Japan are leading adopters, supported by government initiatives promoting energy efficiency. For instance, as per the Chinese Ministry of Industry and Information Technology, China’s industrial boiler installations grew by 8% in 2022, which was led by investments in renewable energy integration and retrofitting outdated systems. Meanwhile, India’s push toward sustainable practices has led to a surge in demand for high-efficiency boilers in sectors like textiles and pharmaceuticals. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), natural gas-based boiler installations increased by 15% in 2023 due to lower emissions.

MARKET DRIVERS

Industrial Expansion and Urbanization

The rapid pace of industrial expansion and urbanization across the Asia Pacific region serves as a primary driver for the boiler market. Industries such as chemicals, food processing, and pharmaceuticals rely heavily on boilers for steam generation are driving consistent demand. For example, as per the Confederation of Indian Industry (CII), India’s chemical industry expanded by 12% in 2022 by directly correlating with increased boiler installations. Similarly, China’s Belt and Road Initiative has spurred industrial projects across Southeast Asia, boosting boiler adoption in manufacturing hubs like Vietnam and Thailand. Urbanization also drives demand for district heating systems in colder regions like Northern China and Japan. These systems rely on advanced boilers to provide centralized heating solutions, further amplifying market growth.

Government Policies Promoting Energy Efficiency

Stringent government regulations aimed at reducing carbon emissions have significantly propelled the adoption of energy-efficient boilers in the Asia Pacific region. According to the Japanese Ministry of Economy, Trade and Industry, Japan mandates the use of high-efficiency boilers in industries to meet its 2030 emission reduction targets. Similarly, India’s Perform, Achieve, and Trade (PAT) scheme incentivizes industries to upgrade to energy-efficient equipment, including boilers by resulting in a 20% increase in efficient boiler installations in 2023, as per the Bureau of Energy Efficiency. These policies not only reduce environmental impact but also offer cost savings through lower fuel consumption. Furthermore, subsidies for renewable energy integration, such as biomass and solar-assisted boilers, have encouraged businesses to adopt greener alternatives. For instance, South Korea’s Green New Deal has facilitated the installation of over 10,000 renewable-energy-based boilers since 2021.

MARKET RESTRAINTS

High Initial Investment Costs

One of the most significant restraints for the Asia Pacific boiler market is the high initial investment required for advanced and energy-efficient boilers. According to the Federation of Indian Chambers of Commerce & Industry (FICCI), the cost of installing a high-efficiency condensing boiler can be up to 40% higher than traditional models by posing financial barriers for small and medium enterprises (SMEs). This challenge is particularly acute in developing economies like Indonesia and the Philippines, where limited access to capital hinders widespread adoption. Additionally, retrofitting existing systems with modern boilers often involves additional expenses, such as infrastructure upgrades and compliance with safety standards. As per the Malaysian Industrial Development Authority, nearly 60% of SMEs in Malaysia cite financial constraints as a barrier to upgrading their boiler systems. While long-term operational savings offset initial costs, the upfront expenditure remains a deterrent, especially in price-sensitive markets. These financial hurdles slow down market penetration despite growing awareness of the benefits of energy-efficient systems.

Fluctuating Fuel Prices

Fluctuating fuel prices represent another critical restraint for the Asia Pacific boiler market, particularly for industries reliant on fossil fuels like coal and oil. According to the International Energy Agency (IEA), crude oil prices surged by 25% in early 2023 due to geopolitical tensions, directly impacting operating costs for oil-fired boilers. Similarly, as per the Australian Energy Market Operator, natural gas prices in Australia increased by 18% during the same period by creating uncertainty for industries transitioning to gas-based systems. These price volatilities make it challenging for businesses to forecast operational expenses by deterring investments in new boiler technologies. Moreover, the reliance on imported fuels exacerbates risks, particularly for countries like Japan and South Korea, which depend heavily on energy imports. While the shift toward renewable fuels offers a potential solution, the transition requires significant investment and time, leaving many industries exposed to ongoing price fluctuations

MARKET OPPORTUNITIES

Integration of Renewable Energy Sources

The integration of renewable energy sources into boiler systems presents a transformative opportunity for the Asia Pacific boiler market. This trend aligns with the increasing adoption of hybrid boilers that combine conventional fuels with renewable energy sources like biogas and solar thermal energy. For instance, as per the Thai Ministry of Energy, Thailand’s bioenergy sector contributed to a 20% rise in biomass boiler installations during 2023 in agro-based industries. Similarly, India’s National Solar Mission has incentivized solar-assisted steam generation systems, reducing dependency on fossil fuels. These innovations not only enhance energy efficiency but also align with global sustainability goals by attracting investments from environmentally conscious stakeholders. The boiler manufacturers can tap into emerging markets while addressing regulatory and consumer demands for greener solutions by leveraging renewable energy integration.

Digitalization and Smart Boiler Technologies

The advent of digitalization and smart boiler technologies offers immense growth potential for the Asia Pacific boiler market. These systems enable real-time monitoring of boiler performance, optimizing fuel consumption and reducing downtime. Additionally, cloud-based platforms allow remote diagnostics by enabling operators to address issues proactively and minimize operational disruptions. The integration of artificial intelligence (AI) further enhances system reliability by predicting failures before they occur. These advancements not only improve operational efficiency but also position boiler manufacturers as innovators in the era of Industry 4.0 by opening new revenue streams and strengthening market competitiveness.

MARKET CHALLENGES

Stringent Environmental Regulations

While environmental regulations aim to promote sustainability, they pose significant challenges for the Asia Pacific boiler market by imposing compliance burdens on manufacturers and end-users. According to the Chinese Ministry of Ecology and Environment, China’s recent emission standards mandate a 30% reduction in nitrogen oxide (NOx) emissions from industrial boilers by 2025 by requiring costly upgrades for existing systems. Similarly, as per the Indian Central Pollution Control Board, industries must adhere to stricter particulate matter limits by necessitating investments in advanced filtration technologies. Non-compliance risks penalties or operational shutdowns, while compliance increases capital expenditures. Smaller players, in particular, struggle to meet these standards without substantial financial and technical support. Furthermore, the complexity of navigating diverse regulatory frameworks across the region adds to operational challenges. These stringent regulations, while beneficial for the environment, create barriers to entry and limit flexibility for market participants by slowing down overall growth.

Supply Chain Disruptions

Supply chain vulnerabilities have emerged as a critical challenge for the Asia Pacific boiler market, exacerbated by geopolitical tensions and natural disasters. According to the United Nations Conference on Trade and Development, disruptions caused by events like the 2022 floods in Malaysia delayed raw material shipments by affecting boiler production timelines. Similarly, as per the Indonesian Chamber of Commerce, supply chain bottlenecks led to a 12% increase in lead times for boiler components in Indonesia during 2023. These disruptions not only escalate costs but also hinder project completions by causing reputational damage and financial losses. The reliance on imported materials, such as specialized steel alloys, further compounds risks for countries like Japan and South Korea. Additionally, the lack of localized supply chains forces companies to depend on global networks by amplifying exposure to external shocks. Addressing these challenges requires strategic investments in supply chain resilience by including digitalization and regional sourcing strategies by adding to operational complexities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.62% |

|

Segments Covered |

By Fuel, Capacity, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

Mitsubishi Heavy Industries, Thermax Limited, Babcock & Wilcox Enterprises, IHI Corporation, Doosan Heavy Industries, Forbes Marshall, Siemens AG, Cleaver-Brooks, Bosch Thermotechnology, and Fulton Boiler Works |

SEGMENTAL ANALYSIS

By Fuel Insights

The natural gas segment was the largest and held 40.2% of the Asia Pacific boiler market share in 2024 due to its clean-burning properties and increasing availability due to investments in liquefied natural gas (LNG) infrastructure. According to the Chinese National Development and Reform Commission, China’s natural gas consumption grew by 15% in 2022 due to the growing demand for gas-fired boilers. Additionally, government policies promoting cleaner energy sources have accelerated adoption. The cost-effectiveness of natural gas compared to oil and coal further strengthens its position. As per the Federation of Indian Chambers of Commerce & Industry (FICCI), industries using natural gas boilers reported a 10% reduction in operational costs due to lower fuel prices and improved efficiency.

The electric boilers segment is likely to grow with an anticipated CAGR of 8.5% during 2025-2033. This growth is fueled by the rising adoption of renewable energy sources like wind and solar, which integrate seamlessly with electric boilers. For example, as per the Australian Energy Market Operator, Australia’s renewable energy capacity increased by 20% in 2022 by driving demand for electric steam generation systems. Additionally, urbanization and stricter emission regulations have encouraged the use of electric boilers in residential and commercial applications. South Korea’s Green New Deal has incentivized the installation of over 5,000 electric boilers in urban districts since 2021, reducing reliance on fossil fuels. Moreover, advancements in battery storage technologies have addressed intermittency issues, making electric boilers more reliable.

By Capacity Insights

The >10 - 50 MMBTU/hr capacity range segment in the Asia Pacific boiler market by capturing 35.6% of the total share in 2024. This segment’s prominence is driven by its versatility across small to medium-scale industries, including food processing, textiles, and pharmaceuticals. Additionally, governments across the region are promoting energy-efficient solutions for SMEs, further boosting demand. For instance, Thailand’s Ministry of Industry provided subsidies for upgrading to high-efficiency boilers in this capacity range, leading to a 20% rise in installations during 2023. The affordability and ease of maintenance associated with these boilers make them attractive to price-sensitive markets.

The ≤ 10 MMBTU/hr capacity segment is projected to register a CAGR of 9.2% during 2025-2033. This growth is attributed to the rising demand for compact and energy-efficient boilers in residential and small-scale commercial applications. For example, according to the Singapore Economic Development Board, Singapore’s push toward sustainable urban living has led to a 30% increase in small-capacity boiler installations in residential complexes during 2023. Similarly, Vietnam’s Ministry of Construction reported a surge in demand for low-capacity boilers in hotels and restaurants, driven by urbanization and tourism growth. Additionally, advancements in modular designs have made these boilers easier to install and operate by appealing to budget-conscious consumers. The integration of IoT-based monitoring systems has further enhanced their appeal by enabling remote diagnostics and predictive maintenance.

By Application Insights

The industrial segment was accounted in holding a prominent share of the Asia Pacific boiler market in 2024 owing to the region’s robust industrial base, particularly in sectors like chemicals, power generation, and manufacturing. Similarly, India’s focus on self-reliance through initiatives like “Make in India” has spurred industrial activity by boosting boiler demand. The shift toward cleaner fuels and energy-efficient systems has further amplified this trend. According to the Australian Manufacturing Technology Institute, industries adopting high-efficiency boilers that is to reduce energy cost, which will encourage widespread adoption.

The commercial segment is likely to grow with a CAGR of 7.8% in the next coming years. This growth is fueled by rapid urbanization and the expansion of commercial spaces, including malls, hospitals, and office complexes. For example, according to the Thai Ministry of Commerce, Thailand’s commercial real estate sector grew by 18% in 2023 is impacting boiler demand for centralized heating and cooling systems. Additionally, stricter environmental regulations have encouraged the adoption of energy-efficient boilers in commercial buildings. South Korea’s Ministry of Land, Infrastructure and Transport mandates green building certifications, which include the use of advanced boiler systems by resulting in a 25% increase in installations during 2022-2023. The integration of smart technologies has also enhanced operational efficiency by making commercial boilers more appealing.

REGIONAL ANALYSIS

China was the top performer in the Asia Pacific boiler market with 45.3% of the share in 2024. The country’s growth is due its status as the world’s largest industrial hub, with significant investments in energy infrastructure. Additionally, the government’s push for cleaner energy sources has accelerated the adoption of natural gas and electric boilers. For instance, Beijing’s “Blue Sky Protection Campaign” incentivized industries to replace coal-fired boilers with cleaner alternatives, resulting in a 30% increase in gas-fired installations during 2023. These initiatives ensure China remains a pivotal player in shaping regional market dynamics.

India ranks second in the Asia Pacific boiler market by holding 15.7% of the regional share in 2024 with the growing industrial base and urbanization drive boiler demand. For example, the Confederation of Indian Industry (CII) reported a 12% increase in boiler installations in India’s pharmaceutical sector during 2023, driven by export opportunities. Additionally, government schemes like “Perform, Achieve, and Trade” have promoted energy-efficient boilers by reducing carbon emissions and operational costs. Investments in renewable energy integration further bolster growth by positioning India as a key contributor to the regional market.

Japan’s emphasis on sustainability and innovation drives demand for advanced boiler technologies will propel the growth of the market. For instance, Tokyo’s “Zero Emission Tokyo” initiative has led to a 20% rise in electric boiler installations in urban areas during 2023. Additionally, Japan’s aging industrial infrastructure necessitates upgrades by creating opportunities for high-efficiency systems.

South Korea holds a significant position in the Asia Pacific boiler market. The country’s focus on green technologies and urban development drives boiler adoption. For example, Seoul’s Green New Deal has incentivized the installation of over 5,000 renewable-energy-based boilers since 2021. Additionally, South Korea’s robust manufacturing sector ensures steady demand for industrial boilers.

Australia’s transition to renewable energy sources boosts demand for electric boilers. For instance, Victoria’s Renewable Energy Action Plan facilitated a 25% increase in solar-assisted boiler installations during 2023. Additionally, Australia’s mining sector requires robust boiler systems for process heating, ensuring consistent demand.

LEADING PLAYERS IN THE ASIA PACIFIC BOILER MARKET

Thermax Limited

Thermax Limited is a prominent player in the Asia Pacific boiler market, renowned for its innovative and energy-efficient solutions. The company has strengthened its presence by focusing on sustainable technologies, such as biomass and waste heat recovery boilers. In 2023, Thermax launched its AI-driven predictive maintenance platform, enhancing operational efficiency for industrial clients. Additionally, the company expanded its manufacturing facilities in India to cater to rising regional demand. Thermax’s strategic partnerships with global OEMs have enabled it to offer tailored solutions for diverse applications to fuel their position in the market.

Babcock & Wilcox Enterprises

Babcock & Wilcox Enterprises has established itself as a key innovator in the Asia Pacific boiler market through its advanced steam generation technologies. In 2023, the company introduced its eco-friendly Circulating Fluidized Bed (CFB) boilers by targeting coal-to-biomass conversion projects in Southeast Asia. Babcock & Wilcox also partnered with renewable energy firms in Australia to integrate solar-assisted boiler systems by aligning with sustainability goals. Furthermore, the company invested in R&D to develop compact boilers for urban applications by enhancing its market reach.

Mitsubishi Heavy Industries

Mitsubishi Heavy Industries (MHI) is a leading contributor to the Asia Pacific boiler market, leveraging its expertise in high-capacity industrial boilers. In 2023, MHI unveiled its ultra-supercritical boiler technology, designed to achieve higher thermal efficiency and lower emissions. The company collaborated with Japanese municipalities to implement district heating systems powered by advanced boilers. Additionally, MHI expanded its service network across Southeast Asia, ensuring better accessibility for maintenance and upgrades.

TOP STRATEGIES USED BY KEY PLAYERS IN THE ASIA PACIFIC BOILER MARKET

Key players in the Asia Pacific boiler market employ diverse strategies to maintain their competitive edge. Innovation remains central, with companies investing heavily in R&D to develop energy-efficient and eco-friendly products. Partnerships with governments and industries are another critical strategy, enabling customized solutions for specific applications. For instance, collaborations with renewable energy providers have become pivotal as the region shifts toward cleaner energy sources. Additionally, market leaders are expanding their production capacities in emerging economies like India and Vietnam to leverage cost advantages and meet regional demand. Digitalization is also gaining traction, with firms integrating IoT-enabled monitoring systems to enhance operational efficiency. The companies emphasize sustainability by adopting circular economy practices, such as recycling materials and using bio-based fuels.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major players of the Asia Pacific boiler market include Mitsubishi Heavy Industries, Thermax Limited, Babcock & Wilcox Enterprises, IHI Corporation, Doosan Heavy Industries, Forbes Marshall, Siemens AG, Cleaver-Brooks, Bosch Thermotechnology, and Fulton Boiler Works

The Asia Pacific boiler market is marked by intense competition, driven by both global giants and regional players striving to capture market share. Global leaders like Thermax, Babcock & Wilcox, and Mitsubishi Heavy Industries dominate through innovation, offering cutting-edge technologies like biomass boilers and AI-driven systems. Meanwhile, regional players such as Sugimat and Taikisha focus on affordability and localized strategies to appeal to price-sensitive consumers. The shift toward renewable energy integration has intensified rivalry by prompting companies to develop hybrid systems combining conventional fuels with solar or biogas. Sustainability initiatives, including emission reduction and energy efficiency, have become key differentiators. Price wars and aggressive marketing tactics further escalate competition in mature markets like China and India. Despite these challenges, opportunities abound in emerging segments like electric boilers and modular designs, encouraging players to diversify portfolios.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Thermax Limited launched its AI-driven predictive maintenance platform in India by enhancing operational efficiency for industrial boiler users.

- In June 2023, Babcock & Wilcox Enterprises partnered with an Australian renewable energy firm to integrate solar-assisted boiler systems by targeting urban applications.

- In August 2023, Mitsubishi Heavy Industries expanded its service network in Southeast Asia by improving accessibility for maintenance and upgrades of industrial boilers.

- In October 2023, Sugimat inaugurated a new production facility in Vietnam by boosting capacity for small-to-medium capacity boilers catering to local demand.

- In December 2023, Taikisha announced a joint venture with a Chinese EV manufacturer to develop specialized boilers for lithium battery production by addressing unique industrial needs.

MARKET SEGMENTATION

This research report on the Asia Pacific boiler market has been segmented and sub-segmented based on fuel, capacity, application, and region.

By Fuel

- Natural Gas

- Oil

- Coal

- Electric

- Others

By Capacity

- ≤ 10 MMBTU/hr

- 10 - 50 MMBTU/hr

- 50 - 100 MMBTU/hr

- 100 - 250 MMBTU/hr

- 250 MMBTU/hr

By Application

- Residential

- Commercial

- Industrial

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the boiler market in Asia Pacific?

Growth is driven by rapid industrialization, increasing demand for energy, expansion of manufacturing sectors, and rising infrastructure development across countries like China, India, and Southeast Asia.

2. Which types of boilers are commonly used in the Asia Pacific region?

Common types include fire-tube boilers, water-tube boilers, and electric boilers, used in industries such as power generation, chemicals, food processing, and oil & gas.

3. Who are the key players in the Asia Pacific boiler market?

Key players include Mitsubishi Heavy Industries, Thermax Limited, Babcock & Wilcox Enterprises, IHI Corporation, and Doosan Heavy Industries.

4. How is the boiler market growing in the Asia Pacific region?

The market is experiencing steady growth due to rapid industrialization, urbanization, and increasing demand for energy-efficient heating solutions across sectors like power generation, manufacturing, and food processing.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]