Asia Pacific Battery Market Size, Share, Trends & Growth Forecast Report By Material (Lead Acid, Lithium Ion, Nickel-based, Sodium-ion, Flow Battery), End Use, And Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore And Rest Of Asia-Pacific), Industry Analysis From 2025 To 2033

Asia Pacific Battery Market Size

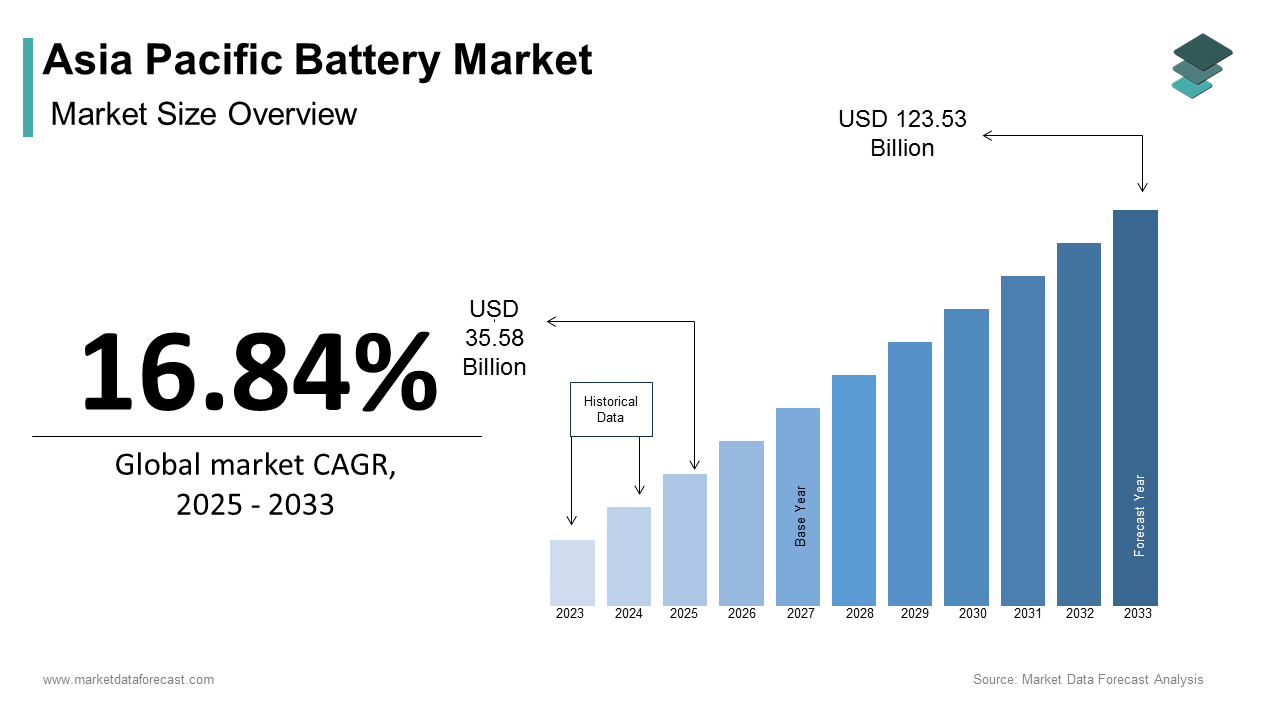

The Asia Pacific battery market size was calculated to be USD 30.44 billion in 2024 and is anticipated to be worth USD 123.53 billion by 2033, from USD 35.58 billion in 2025, growing at a CAGR of 16.84% during the forecast period.

The Asia Pacific battery market is a dynamic and rapidly expanding sector with its pivotal role in powering everything from consumer electronics to electric vehicles (EVs) and renewable energy storage systems. The robust manufacturing capabilities and favorable government policies aimed at fostering clean energy adoption is likely to fuel the growth of the market. For instance, South Korea’s Ministry of Trade, Industry, and Energy has allocated huge investments toward developing advanced battery technologies by 2030. Additionally, the rise of solar and wind energy projects necessitates reliable energy storage solutions, driving investments in grid-scale batteries. Japan, for example, has implemented policies mandating energy storage integration into renewable projects, creating a surge in demand.

MARKET DRIVERS

Electrification of Transportation

The electrification of transportation is a primary driver propelling the Asia Pacific battery market forward. Government incentives, such as subsidies and tax breaks, have accelerated EV adoption, particularly in urban areas grappling with air pollution. For example, India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme has spurred EV sales, with annual growth rates exceeding 120%. This surge has created unprecedented demand for high-performance batteries. Lithium-ion batteries dominate due to their superior energy density and efficiency, with production capacities expected to double by 2025. Furthermore, collaborations between automakers and battery manufacturers, like Toyota’s partnership with Panasonic, are enhancing innovation and scalability.

Renewable Energy Integration

Another significant driver is the integration of renewable energy sources with battery storage systems. The intermittent nature of these sources necessitates reliable storage solutions to ensure grid stability. Australia, for instance, has invested heavily in large-scale battery installations, with the Hornsdale Power Reserve being one of the world’s largest lithium-ion battery systems. Similarly, China’s State Grid Corporation has deployed over 1 GW of grid-scale storage to support its renewable energy initiatives. These developments promote the role of batteries in enabling the transition to a low-carbon energy future.

MARKET RESTRAINTS

Supply Chain Vulnerabilities

Supply chain vulnerabilities pose a significant challenge to the Asia Pacific battery market by concerning raw material sourcing. According to a study by the World Economic Forum, over 80% of the world’s cobalt, a key battery component, originates from the Democratic Republic of Congo by creating dependency risks. Geopolitical tensions and trade disputes further exacerbate supply disruptions. For instance, China’s dominance in refining rare earth metals has raised concerns among neighbouring countries about potential export restrictions. Additionally, the mining of materials like lithium and nickel often involves environmental degradation is leading to stricter regulations. The Australian Conservation Foundation reports that lithium mining in Western Australia has caused water scarcity issues by prompting calls for sustainable practices.

Environmental Concerns

Environmental concerns represent another major restraint impacting the market. Battery production involves energy-intensive processes that contribute to carbon emissions with the sustainability goals they aim to achieve. According to Greenpeace East Asia, the manufacturing of a single EV battery generates approximately 74 kg of CO2 is equivalent to driving a gasoline-powered car for 1,500 km. Moreover, improper disposal of used batteries poses significant ecological risks, as toxic chemicals can leach into soil and water systems. In response, governments are tightening regulations, with Japan introducing mandatory recycling laws for lithium-ion batteries by 2024. However, compliance costs strain manufacturers, particularly smaller firms. Addressing these concerns requires investment in cleaner production methods and circular economy models to minimize environmental footprints.

MARKET OPPORTUNITIES

Advancements in Solid-State Batteries

Advancements in solid-state battery technology present a transformative opportunity for the Asia Pacific battery market. Unlike traditional lithium-ion batteries, solid-state batteries offer higher energy density, faster charging times, and enhanced safety due to their non-flammable electrolytes. Companies like Toyota and Samsung SDI are investing heavily in research and development by aiming to commercialize these batteries by 2025. For instance, Toyota plans to launch its first solid−state EV prototype within the next two years by targeting a 500km range on a single charge. Governments are also supporting these efforts, with South Korea allocating 1.3 billion for solid-state R&D initiatives. These innovations position the region at the forefront of next-generation energy storage solutions by unlocking new revenue streams and applications.

Expansion of Microgrid Solutions

The expansion of microgrid solutions represents another promising opportunity, particularly in rural and remote areas. According to the International Renewable Energy Agency (IRENA), over 400 million people in Asia Pacific lack access to reliable electricity by creating a strong case for decentralized energy systems. Microgrids powered by advanced batteries enable communities to harness renewable energy while ensuring uninterrupted power supply. Similarly, India’s Smart Power Initiative aims to install 10,000 microgrids by 2025, supported by companies like Tata Power.

MARKET CHALLENGES

High Initial Costs

High initial costs remain a significant barrier to widespread battery adoption, particularly for small-scale users and emerging economies. For instance, Vietnam’s renewable energy projects face delays due to insufficient funding for storage infrastructure, despite abundant solar and wind resources. Residential consumers also hesitate to invest in home battery systems, with prices averaging $10,000 per unit. As per a study by the Energy Research Institute, 60% of households in Southeast Asia prioritize affordability over sustainability when adopting energy solutions. Although economies of scale and technological advancements are gradually reducing costs by bridging the affordability gap requires targeted subsidies and financing mechanisms to accelerate adoption.

Recycling Infrastructure Gaps

Recycling infrastructure gaps hinder the sustainable growth of the Asia Pacific battery market, as end-of-life battery management becomes increasingly critical. For example, Thailand’s e-waste management facilities lack the capacity to handle the growing volume of discarded batteries, resulting in illegal dumping. China, despite being a leader in battery production, faces similar challenges, with Greenpeace reporting that only 2% of lithium is recovered during recycling. To address this issue, governments are exploring extended producer responsibility (EPR) policies, mandating manufacturers to manage battery disposal. However, establishing efficient recycling ecosystems requires substantial investment and collaboration across industries by posing a complex challenge to long-term sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.84% |

|

Segments Covered |

By Material, End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest Of Asia-Pacific |

|

Market Leaders Profiled |

CATL, BYD, Panasonic, LG Energy Solution, Samsung SDI, Toshiba, Hitachi Chemical, Amperex Technology Limited (ATL), GS Yuasa, Contemporary Amperex Technology USA |

SEGMENTAL ANALYSIS

By Material Insights

Lithium-ion batteries dominated the Asia Pacific battery market with an estimated share of 61.1% in 2024 due to their superior energy density, long cycle life, and versatility across multiple applications. One of the primary factors fueling this segment’s growth is the booming electric vehicle (EV) industry. The IEA estimates that EV sales in the region will surpass 15 million units annually by 2030, with lithium-ion batteries being the preferred choice due to their efficiency and performance. For instance, China’s CATL, the world’s largest battery manufacturer, supplies over 30% of global EV batteries. Another driving factor is the declining cost of lithium-ion batteries. Additionally, government incentives are propelling adoption. This factor ensures lithium-ion batteries remain at the forefront of the region’s energy transition.

The sodium-ion batteries segment is swiftly emerging with a projected CAGR of 35% from 2025 to 2033. This rapid expansion is fueled by their lower material costs and environmental benefits compared to lithium-ion counterparts. A key driver is the increasing scarcity of lithium and cobalt, which has prompted manufacturers to explore alternative chemistries. For example, BYD, a Chinese EV giant, launched its first sodium-ion battery-powered bus in 2023 by demonstrating its potential in commercial applications. Government support also plays a pivotal role. Japan’s New Energy and Industrial Technology Development Organization (NEDO) invested $200 million in sodium-ion R&D initiatives, aiming to reduce reliance on imported materials.

By End-Use Insights

The automobile sector held a prominent share of the Asia Pacific battery market in 2024. The growth of the segment is attributed to be driven by the rapid electrification of transportation, particularly in countries like China and India. Government policies, such as China’s dual-credit system mandating EV production quotas, have accelerated adoption. For instance, Tesla’s Gigafactory in Shanghai produces over 500,000 EVs annually, all powered by advanced battery systems.

Consumer demand is another critical factor. According to McKinsey & Company, over 80% of urban consumers in Asia Pacific prioritize eco-friendly vehicles are driving automakers to invest in high-performance batteries. Hyundai, for example, partnered with LG Energy Solution to develop next-generation batteries for its EV lineup.

The telecom sector is poised to grow at a CAGR of 28.5% during the forecast period with the rollout of 5G networks and the need for reliable backup power solutions. A key driver is the exponential rise in data consumption, with Cisco estimating that mobile data traffic in the region will triple by 2025. To meet this demand, telecom operators are deploying advanced batteries to ensure uninterrupted service. For example, Reliance Jio installed lithium-ion-based energy storage systems across its towers in India by reducing operational costs by 30%. Government initiatives also play a crucial role. Australia’s National Broadband Network allocated $1 billion to upgrade telecom infrastructure, including battery backups.

REGIONAL ANALYSIS

China led the Asia Pacific battery market by accounting for 70.7% of share in 2024 as its dominance is underpinned by robust manufacturing capabilities and favorable government policies. The country’s Belt and Road Initiative has facilitated partnerships with neighboring nations to export battery technologies.

Japan was accounted in holding 20.1% of the market share in 2024 by leveraging its expertise in advanced battery technologies. Companies like Panasonic collaborate with global automakers, including Tesla, to produce high-performance batteries. Sustainability is another focus area.

South Korea holds a significant share, driven by its strong presence in the EV and consumer electronics sectors. LG Energy Solution and Samsung SDI are among the top five global battery manufacturers, supplying products to major brands like Apple and BMW. According to the Korea Battery Industry Association, exports surged by 40% in 2022, reaching $25 billion.

India is an emerging market, driven by its push toward clean energy and EV adoption. According to NITI Aayog, the country aims to achieve 30% EV penetration by 2030 by creating massive demand for batteries. Tata Chemicals recently announced plans to build a $2 billion lithium-ion manufacturing facility, supported by government incentives under the PLI scheme.

Australia & New Zealand contribute significantly through their focus on renewable energy storage. Tesla’s Hornsdale Power Reserve remains a flagship project, showcasing the viability of large-scale storage solutions. Government funding supports these initiatives, with New Zealand allocating $500 million to develop sustainable energy infrastructure. These efforts position the region as a leader in green energy adoption, driving battery demand.

LEADING PLAYERS IN THE ASIA PACIFIC BATTERY MARKET

CATL (Contemporary Amperex Technology Co. Limited)

CATL is a global leader in battery manufacturing, contributing significantly to the Asia Pacific market through its cutting-edge lithium-ion technologies. The company has pioneered advancements in energy density and safety, making its products ideal for EVs and renewable energy storage. Additionally, the company launched its sodium-ion battery line by targeting cost-sensitive markets.

LG Energy Solution

LG Energy Solution plays a pivotal role in the Asia Pacific battery market in the EV and consumer electronics sectors. The company’s collaboration with Tesla resulted in the development of 4680 cylindrical cells, enhancing performance and scalability. Furthermore, LG introduced AI-driven quality control systems to improve production efficiency. These strategic moves elevates LG’s commitment to innovation and sustainability by ensuring its position as a key player.

Panasonic Holdings Corporation

Panasonic remains a cornerstone of the Asia Pacific battery market by leveraging its expertise in high-performance lithium-ion systems. The company supplies batteries to Tesla’s Gigafactory in Shanghai, supporting the growing EV market in China. In 2023, Panasonic launched a pilot project for cobalt-free batteries, aiming to reduce costs and environmental impact. Additionally, the company invested $1 billion in expanding its production capacity in Japan.

MAJOR STRATEGIES USED BY KEY PLAYERS

Key players in the Asia Pacific battery market employ strategies such as partnerships, R&D investments, and geographic expansion to strengthen their positions. Collaborations with automakers and governments enable companies to align with regional demands. For instance, CATL partnered with Hyundai to co-develop next-generation EV batteries. R&D investments are another critical strategy, with Panasonic launching cobalt-free battery initiatives to enhance sustainability. Geographic expansion is also prevalent, as seen in LG Energy Solution’s joint venture with Honda to establish a production facility in North America. These strategies ensure sustained growth and competitiveness in an increasingly dynamic market.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players in the Asia Pacific battery market include CATL, BYD, Panasonic, LG Energy Solution, Samsung SDI, Toshiba, Hitachi Chemical, Amperex Technology Limited (ATL), GS Yuasa, Contemporary Amperex Technology USA

The Asia Pacific battery market is highly competitive, characterized by rapid technological advancements and aggressive expansion strategies. Leading players like CATL, LG Energy Solution, and Panasonic dominate through innovation by offering solutions ranging from EV batteries to grid-scale storage systems. The market thrives on digital transformation, with AI-driven quality control and cobalt-free chemistries gaining prominence. Government incentives, such as subsidies for EV adoption and renewable energy projects, fuel competition by incentivizing modernization efforts. Smaller firms focus on niche segments, leveraging specialized expertise to carve out market space. This dynamic landscape fosters innovation but also intensifies rivalry, as companies strive to differentiate themselves through unique value propositions. Sustainability and cost efficiency are emerging as key battlegrounds by shaping the future trajectory of competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, CATL partnered with Hyundai to co-develop next-generation EV batteries, enhancing performance and range capabilities.

- In May 2023, LG Energy Solution announced a $4.4 billion joint venture with Honda to build a battery production plant in North America.

- In July 2023, Panasonic launched a pilot project for cobalt-free batteries, aiming to reduce costs and environmental impact.

- In September 2023, BYD unveiled its first sodium-ion battery-powered bus, targeting commercial applications in cost-sensitive markets.

- In November 2023, Samsung SDI introduced AI-driven quality control systems to improve production efficiency and product reliability.

MARKET SEGMENTATION

This research report on the Asia Pacific battery market has been segmented and sub-segmented based on material, end-use, and region.

By Material

- Lead Acid

- Lithium Ion

- Nickel-based

- Sodium-ion

- Flow Battery

By End Use

- Aerospace

- Automobile

- Consumer Electronics

- Telecom

By Region

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest Of Asia-Pacific

Frequently Asked Questions

1. What is driving the growth of the Asia Pacific battery market?

The market is growing due to increasing demand for electric vehicles (EVs), expansion of renewable energy storage systems, and the rising use of consumer electronics.

2. Which types of batteries are most commonly used in the Asia Pacific region?

Lithium-ion batteries are the most widely used due to their high energy density, long life cycle, and efficiency. Other types include lead-acid, nickel-metal hydride, and solid-state batteries.

3. How is the battery market supporting the electric vehicle (EV) industry?

Batteries are a core component of EVs, and advancements in battery technology are directly improving EV range, charging time, and affordability.

4. Who are the major players in the Asia Pacific battery market?

Key players include CATL, BYD, Panasonic, LG Energy Solution, Samsung SDI, Toshiba, Hitachi Chemical, and GS Yuasa.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]