Asia-Pacific Antibodies Market Size, Share, Trends, COVID-19 Impact & Growth Forecast Report By Product Type, Indication, End User, Application & Country (India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore & Rest of Asia-Pacific) - Industry Analysis From 2025 to 2033

Asia-Pacific Antibodies Market Size

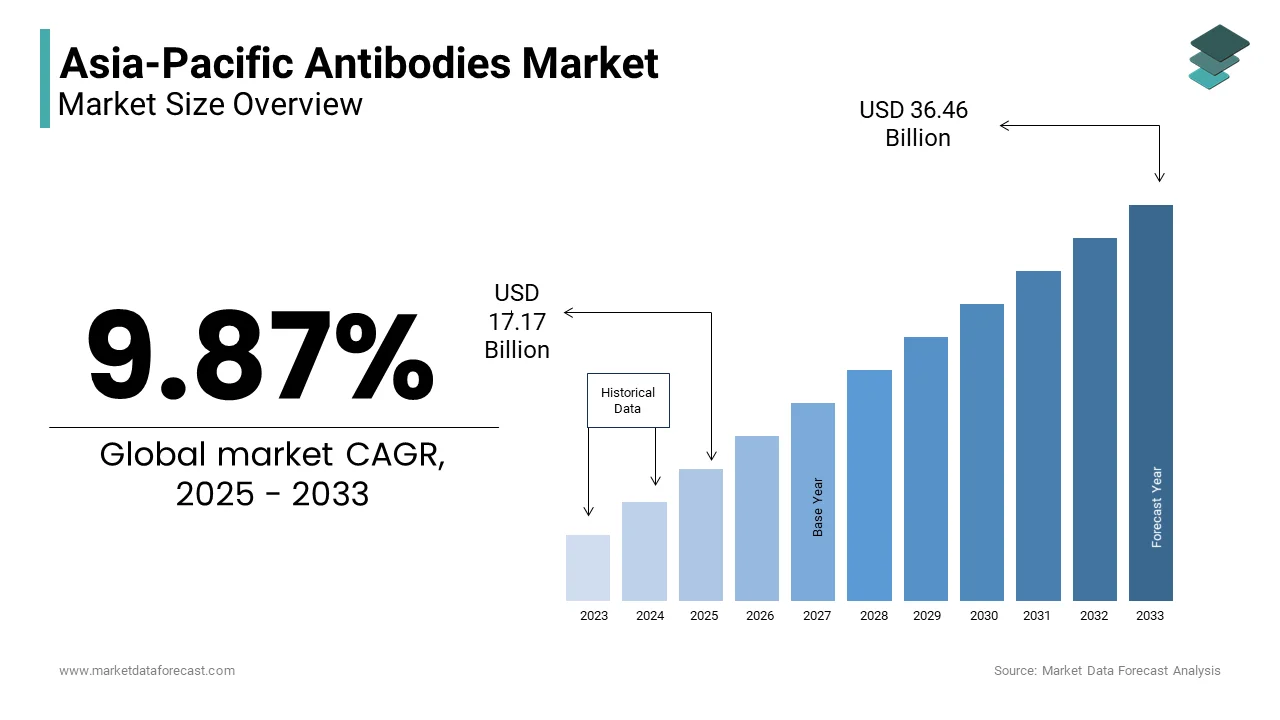

The antibodies market size in the Asia Pacific was valued at USD 15.63 Billion in 2024. This value is estimated to reach USD 36.46 Billion by 2033 from USD 17.17 Billion in 2025, showcasing a growing potential of 9.87% CAGR during the forecast period.

MARKET DRIVERS

Growing Patient Population of Chronic Diseases in Asia-Pacific

The Asia-Pacific region has the fastest growth rate of the antibodies market in the world. The chronic disease burden of the region is increasing; thus, there is a rise in the research on monoclonal antibodies. The technological advancements and progressive R&D in antibodies in Asia Pacific countries like India, China, Japan, and Australia are expected to propel market growth. Antibodies are used in research to develop new diagnoses and treatments for rare diseases and to study different biomarkers of different conditions. There is significant adoption of therapeutic antibodies in this region, and the regulatory bodies in the area also have approved the treatment at a fast track without affecting safety. There are many antibody products in the clinical trials in the region, and research has been going on in this region to create a vaccine for COVID-19 by using the antibody resistance to coronavirus.

MARKET RESTRAINTS

High Costs

The cost of antibody treatment is high, and the process is complex, restraining the Asia Pacific market growth to some extent. In addition, some side effects of the antibody’s treatment include an allergic reaction, flu-like symptoms, vomiting, diarrhea, and low blood pressure, which are predicted to impact the market to a limited extent negatively. In addition, less awareness in undeveloped countries further degrades market growth.

SEGMENTAL ANALYSIS

Based on product type, the monoclonal antibodies held the major share of the APAC antibodies market in 2024.

Based on indication, the cancer segment is anticipated to lead the market during the forecast period.

REGIONAL ANALYSIS

Asia-Pacific occupied a considerable share of the worldwide market in 2024 and is forecasted to grow at the highest CAGR among all the regions during the forecast period. The Indian antibody market is one of the potential markets for antibodies in the Asia-Pacific region. It is anticipated to grow at the highest CAGR during the forecast period. The National Institute of Immunology (NII) has generated monoclonal antibodies to detect typhoid fever and the hepatitis B virus. In addition, NII also develops monoclonal antibodies against rotavirus and virulent strains of E. coli.

The Chinese antibodies market held the major share of the Asia-Pacific market in 2024, and the domination of the Chinese market in the Asia-Pacific region is expected to continue in the coming years. China has many institutes that are researching antibodies. In addition, China is trying to develop a vaccine for COVID-19. During the forecast period, the Japanese market is expected to capture a substantial share of the APAC market and witness a healthy CAGR. The Japanese government is promoting the production of biosimilars using antibodies. Japan has also developed antibodies for anti-glycosaminoglycan.

KEY MARKET PLAYERS

Companies that play a promising role in the Asia-Pacific antibodies market profiled in the report are Abbott Diagnostics, Novartis AG, Pfizer Inc, Thermo Fisher Scientific Inc, Eli Lilly and Company, A.G. Scientific, Bristol-Myers Squibb, F. Hoffmann-La Roche Ltd, and AbbVie Inc.

MARKET SEGMENTATION

This research report on the Asia-Pacific antibodies market has been segmented and sub-segmented into the following categories.

By Product Type

- Monoclonal Antibodies

- Murine

- Chimeric

- Humanized

- Human

- Polyclonal Antibodies

- Type I

- Type II

- Type III

- Type IV

- Type V

- Type VI

- Type VII

- Type VIII

- Anti-body drug complexes

- Immunogen Technology

- Seattle Genetics Technology

- Immunomedics Technology

By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Cardiovascular Diseases

- CNS Disorders

- Others (Inflammatory, Microbial Diseases, & Others)

By End User

- Hospitals/Clinics

- Research institutes

- Diagnostics Laboratories

By Application

- Medical

- Experimental

- Western blot

- ELISA

- Radioimmune Assays

- Immunofluorescence

- Others (Immunohistochemistry, Immunoprecipitation, & Immunocytochemistry)

By Country

- India

- China

- Japan

- South Korea

- Australia

- New Zealand

- Thailand

- Malaysia

- Vietnam

- Philippines

- Indonesia

- Singapore

- Rest of Asia-Pacific

Frequently Asked Questions

What is the growth rate of the APAC antibodies market?

The antibodies market in APAC is estimated to grow at a CAGR of 9.87% from 2025 to 2033.

What factors are driving the growth of the APAC antibodies market?

Factors such as the increasing prevalence of chronic diseases, rising demand for personalized medicine, growing investments in research and development, and technological advancements in the development of monoclonal antibodies are propelling the antibodies market growth in the Asia-Pacific region.

Which country led the antibodies market in APAC in 2024?

China held the major share of the APAC antibodies market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]