Global Artificial Sweetener Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Aspartame, Acesulfame-K, Monosodium Glutamate, Saccharin, And Sodium Benzoate), Application (Bakery Items, Dairy Products, Confectionery, Beverages, And Other), Distribution Channel (Supermarkets & Hypermarkets, Departmental Stores, Convenience Stores, And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Artificial Sweetener Market Size

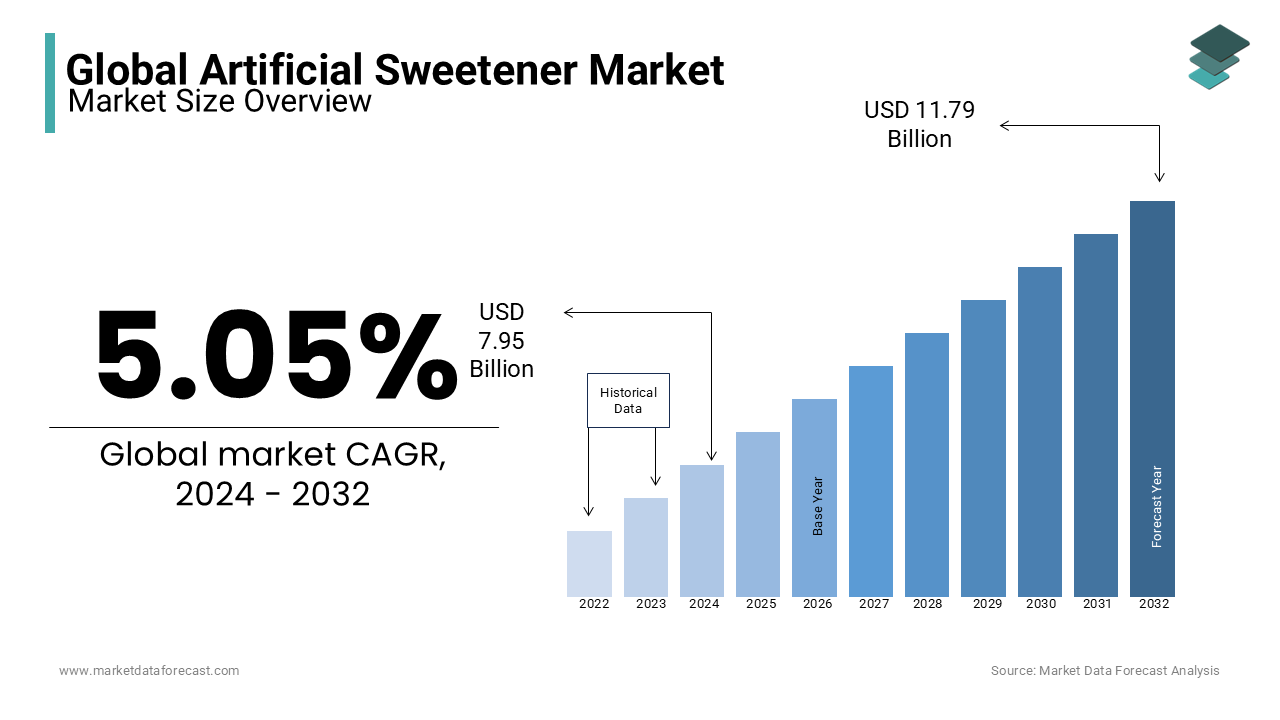

The global artificial sweetener market size was worth USD 7.95 billion in 2024 and is predicted to be worth USD 8.35 billion in 2025 to USD 12.38 billion by 2033, growing at a CAGR of 5.05% during the forecast period. As concerns about obesity increase, consumer acceptance of a healthy diet plan is growing rapidly across the globe.

Artificial sweeteners are produced synthetically as sugar substitutes and have a sweet taste. Not all artificial sweeteners are the same. The Food and Drug Administration and the European Food Safety Administration (EFSA) have approved only five artificial sweeteners, and they are saccharin, acesulfame, aspartame, neo-time, and sucralose. Sugar-free foods are very popular due to their low-calorie content and properties. As a result, the food sector uses various low-calorie artificial sweeteners instead of high-calorie sugar. It is currently used as an alternative to sugar, as it keeps blood sugar levels low, and is widely used in processed foods like sugary drinks, jams and jellies, and other similar products. The main artificial sweeteners include aspartame, saccharin, and sodium benzoate. Aspartame is extensively used as a tabletop sweetener in the developed nations. It is approximately 200 times sweeter than regular sugar and is used in low-calorie desserts, sugarless chewing gum, cereal, tea, coffee, yogurt, milk formulations, etc.

MARKET DRIVERS

The rising demand for low-calorie sugar substitutes and sugar-free products is driving the growth of the global artificial sweetener market.

Artificial Sweetener recognize the health of society and prefer sugar substitutes over real sugar and, as a result, are expected to stimulate market growth. Furthermore, health problems, the harmful effects of sugar, and the spread of lifestyle diseases like heart disease and diabetes have led people to choose healthy alternatives like artificial sweeteners. Therefore, food processing companies promote low-calorie and sugar-free substitutes as their main products, promoting market growth. Of the five sweeteners, aspartame and sucralose are common additives used to sweeten various products in the food and beverage industry. Artificial sweeteners find greater application in the food and beverage industry, including soft drinks, sauces, chewing gum, jellies, dressings, baked goods, candy, fruit juices, ice cream, and more. The soft drink industry has been found to have the highest consumption of artificial sweeteners as the demand for low-sugar and diet drinks increases. Toxicological evidence and concerns about the safety of artificial sweeteners are the main limitations on the market. Aspartame has been a high-intensity sweetener in recent years and is supposed to grow during the outlook period. These products are calorie-free, which helps control weight by increasing diet drinks, and are assumed to increase market demand.

The growing number of people turning health-conscious worldwide is contributing to the expansion of the global artificial sweetener market.

There is a significant demand for the production of healthy drinks like natural fruit juices. Realizing that diet has a profound effect on health, consumers were encouraged to change consumption patterns. More and more people are looking for a healthy alternative to 'less sugar'. The adoption of artificial sweeteners is also increasing significantly as we move into a health-savvy demographic of low-calorie foods and beverages. Food producers use high-strength artificial sweeteners to provide lighter products with fewer calories and attractive flavor properties based on consumer preference. Other products that contain artificial sweeteners as an integral part of the ingredient base include diet drinks, tabletop sweeteners, yogurt, and frozen dairy products. The power and investment of many existing and emerging players in the market are increasing. Consumers, despite the high obesity rate, the constant desire for delicious and sweet foods leads to an increase in demand for artificial sweeteners, which is anticipated to create numerous opportunities for market growth.

MARKET RESTRAINTS

Recent studies show that the long-term use of artificial sweeteners may lead to health-related issues like cardiovascular diseases and type II diabetes. The rising incidences of these diseases across the world are likely to hinder the growth rate of the artificial sweetener market. According to the National Library of Medicine, many diabetes patients completely rely on these sweeteners as substitutes for sugars, which may be deleterious in the long run use. Also, the lack of proper knowledge about the use of artificial sweeteners in limited dosages may also negatively affect the growth rate of the artificial sweeteners market.

MARKET OPPORTUNITIES

The US Food and Drug Administration has approved the use of artificial sweeteners within a specific limit, which is attributed to elevating the growth opportunities for the market growth rate in the coming years. The use of artificial sweeteners will be more effective if the nutritionist advises them according to age, sex, and nutritional status. The US Food and Drug Administration has already stated the consumption of artificial sweeteners that are manufactured with specific agents is safe for obesity and diabetic patients. The growing popularity over the use of artificial sweeteners, especially in developed and emerging countries, is attributed to leveraging the growth rate of the market in the coming years. Social media influencers are playing a major role in spreading information about the benefits involved in using artificial sweeteners. This factor is additionally to propel the growth rate of the market.

MARKET CHALLENGES

Food and Drug Administration has given approvals only for the specific agents that are safe for consumption, but a few companies are still producing products that are completely unsafe and show adverse effects on the consumption of those agents used to manufacture the products, which is majorly challenging the market key players. Also, the unavailability of raw materials will substantially degrade the growth rate of the artificial sweeteners market in the coming years. Stringent rules for exports and imports between the countries by respective government authorities for the safety of the people are straightly declining the availability of raw materials.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.05% |

|

Segments Covered |

By Type, Application, Distribution Channel, & Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Zydus Wellness Ltd., Sunwin Stevia International, Inc., PureCircle, MORITA KAGAKU KOGYO CO., LTD, Hermes Sweeteners Ltd., NutraSweet Property Holdings, Inc., McNeil Nutritionals, JK Sucralose, Ajinomoto Co., Inc., and Roquette |

SEGMENTAL ANALYSIS

By Type Insights

The aspartame segment is leading with the largest share of the artificial sweeteners market. World Health Organization (WHO) has approved the limited use of aspartame as an artificial sweetener that can be used in limited dosages for effective results for those who are facing obesity-related issues. Rising awareness of the need to consult a nutritionist for weight loss or weight gain is notably leveraging the aspartame segment’s growth rate. The acesulfame-K segment is gaining huge traction over the growth rate of the market.

By Application Insights

The bakery items segment is ruling with the highest share of the artificial sweeteners market. The use of artificial sweeteners in bakery items is increasing continuously, with the growing focus on consuming bakery items with low-calorie diet options escalating the growth rate of the artificial sweeteners market growth rate. The dairy products segment is likely to have prominent growth opportunities in the coming years. The launch of innovative dairy products that are best suitable for diabetic patients who are able to eat a low-sugar diet is accompanied by leveraging the market’s growth rate.

By Distribution Channel Insights

The supermarkets and hypermarkets segment is likely to hold the prominent growth rate of the artificial sweeteners market. The rising number of consumers and increasing prominence in buying the products at the nearest stores are enhancing the growth rate of this segment. The growing population and their demand for processed products with healthy substitutes are ascribed to bolster the growth rate of the market.

REGIONAL ANALYSIS

North America had the major share of the global artificial sweetener market in 2023, and the domination of the North American region in the worldwide market is estimated to continue during the forecast period. The US and Canada are the major contributors to the growth rate of the artificial sweeteners market. Americans give a high preference for bakery products that are made with sugar substitutes, which is likely to enhance the demand for artificial sweeteners. FDA has already approved more than six specific agents that can be used as artificial sweeteners, which are safe for use in various food products. Top companies are planning to launch innovative food products for those people who prefer to eat a low-calorie diet with no compromise in taste, which is likely to create huge growth opportunities for the market in the coming years, particularly in the US.

The artificial sweeteners market size in Europe has been growing astonishingly in the past few years. Growing per capita income is one of the common factors that will help the market grow in this region. The rising number of people suffering from diabetes and their preference to replace sugar with artificial sweeteners in food and beverages is emphasizing the growth rate of the market. UK, Germany, Spain, Italy, and France are focusing on the launch of various cookies, jams, and jellies with specific calories to attract various consumers who check for nutritional value solely to promote the growth rate of the market. In addition, the rising support from government authorities for the launch of high-quality food products is likely to escalate the growth rate of the market. According to the WHO, more than 60% of European people are suffering from obesity and overweight-related issues, and the demand to take care of health is increasing prominently by substituting artificial sweeteners with sugar in accordance with the nutritionist's advice.

Asia Pacific artificial sweetener market is deemed to have the highest CAGR by the end of 2029, with the population eventually increasing in India and China. The most populous countries, India and China, are emerging with the latest technologies in the food and beverages industry, which is one of the major factors for the market to grow. The demand for processed and convenient food or beverages is promoting the scale of the artificial sweeteners market. Driven by the size of the artificial sweetener market in Australia, Korea, Japan, India, and China, the Asia Pacific market may be driven by the growth of the dairy manufacturing industries, including milk, yogurt, tofu, and cream. These products are used in the manufacture of dairy products, giving them a sweet taste without compromising the texture and appearance that can promote the growth of the market in the evaluated period.

Latin America and Middle East & Africa are likely to grow steadily throughout the forecast period.

KEY PLAYERS IN THE GLOBAL ARTIFICIAL SWEETENER MARKET

Major Key Players in the Global Artificial Sweetener Market are Zydus Wellness Ltd., Sunwin Stevia International, Inc., PureCircle, MORITA KAGAKU KOGYO CO., LTD, Hermes Sweeteners Ltd., NutraSweet Property Holdings, Inc., McNeil Nutritionals, JK Sucralose, Ajinomoto Co., Inc., and Roquette

RECENT HAPPENINGS IN THE MARKET

In 2024, PureCircle and Ingredion together launch plant-based clean label stevia options for manufacturers. The Purecircle clean taste solubility solution is emerging as the latest trend in today’s world. This solution is best suitable for use in various applications like beverages, fruit juices, syrups, and liquid concentrates.

DETAILED SEGMENTATION OF GLOBAL ARTIFICIAL SWEETENER MARKET INCLUDED IN THIS REPORT

This research report on the global Artificial Sweetener Market has been segmented and sub-segmented based on type, application, distribution channel & region.

By Type

- Aspartame

- Acesulfame-K

- Monosodium Glutamate

- Saccharin

- Sodium Benzoate

By Application

- Bakery Items

- Dairy Products

- Confectionery

- Beverages

By Distribution Channel

- Supermarkets & Hypermarkets

- Departmental Stores

- Convenience Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is driving the growth of the artificial sweetener market?

The market for artificial sweeteners is driven by several factors, including the increasing demand for low-calorie and sugar-free food and beverages due to health concerns related to sugar consumption, the rising diabetic population, and the growing preference for healthier alternatives.

2. What are the major challenges faced by the artificial sweetener market?

One of the challenges the artificial sweetener market faces is the growing consumer preference for natural sweeteners over artificial ones due to health and safety concerns associated with some artificial sweeteners. Additionally, regulatory issues and fluctuations in raw material prices can impact the market.

3. Are there any emerging trends in the artificial sweetener market?

Yes, there are several emerging trends in the artificial sweetener market, including the development of blends combining artificial and natural sweeteners to improve taste profiles, the use of advanced technologies in sweetener production, and the introduction of innovative products targeting specific consumer segments, such as athletes or individuals with specific dietary needs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com