Global Artificial Insemination Market Size, Share, Trends & Growth Analysis Report – Segmented By Type (Intrauterine, Intracervical, Intravaginal, Intratubal), Source Type, End-User, & and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Industry Analysis From 2025 to 2033

Global Artificial Insemination Market Size

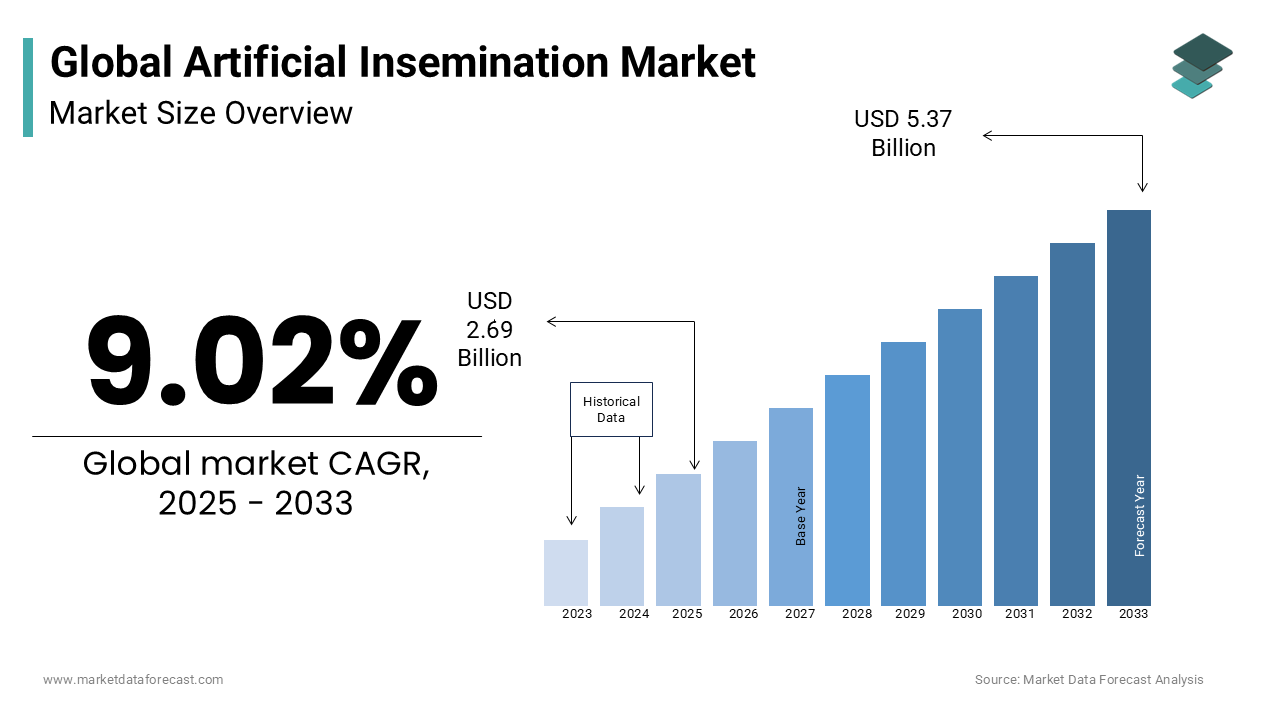

The global artificial insemination market size was worth USD 2.47 billion in 2024. This value is further estimated to grow at a CAGR of 9.02% from 2025 to 2033 and reach USD 5.37 billion by 2033 from USD 2.69 billion in 2025.

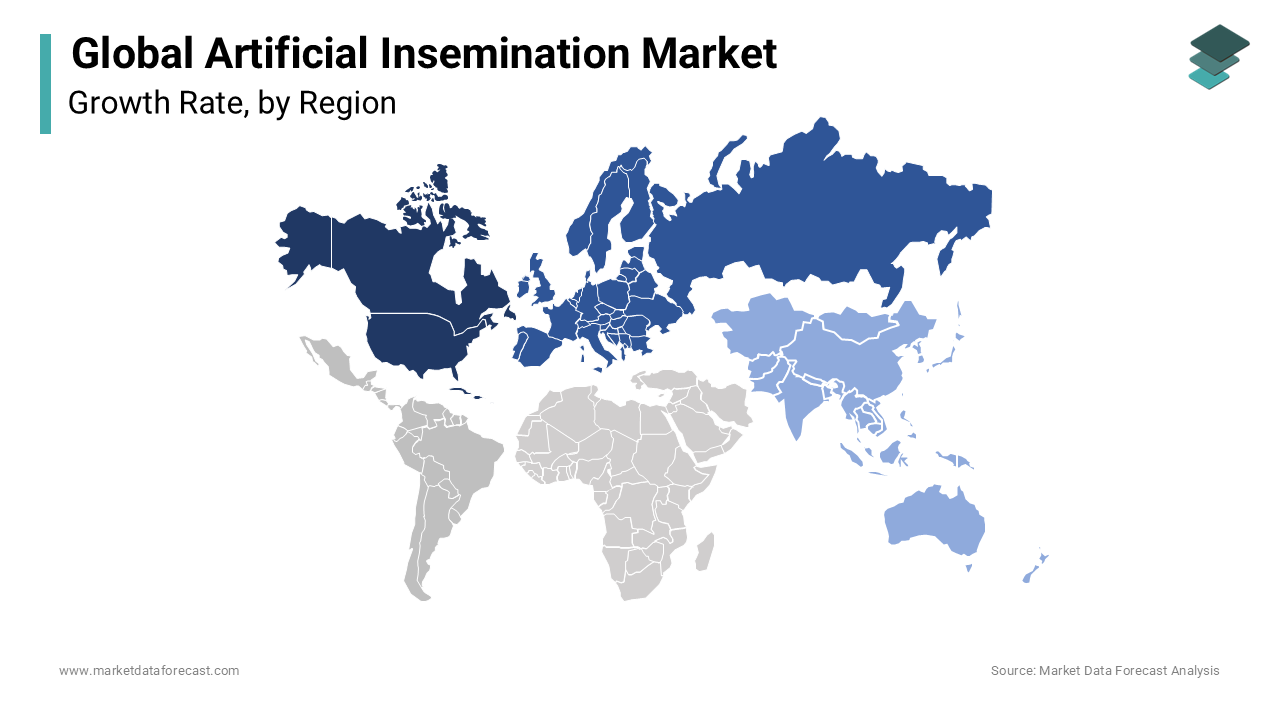

The artificial insemination (AI) market exhibits a strong global presence, with North America, Europe, and Asia-Pacific leading adoption. North America dominates the market, accounting for the largest share of the global market due to the advanced livestock management practices and high demand for genetically superior animals. Europe follows closely, supported by stringent regulations favoring sustainable farming and animal welfare. Countries like the Netherlands and Denmark have adoption rates exceeding 70% in dairy cattle, underscoring their leadership in precision breeding. Meanwhile, Asia-Pacific is witnessing rapid growth due to increasing investments in livestock farming and rising protein consumption. For instance, India’s National Dairy Development Board reports that AI usage in cattle has grown by 15% annually since 2018, boosting milk production significantly.

MARKET DRIVERS

Rising Demand for High-Quality Livestock

The rising demand for genetically superior livestock to enhance productivity is one of the major factors driving the growth of the artificial insemination market. According to the Food and Agriculture Organization (FAO), livestock contributes approximately 40% of global agricultural GDP, making genetic improvement critical for maximizing yields. AI enables farmers to selectively breed animals with desirable traits such as higher milk yield, disease resistance, and faster growth rates. For instance, in the U.S., the Holstein Association reports that AI-derived cattle produce 20-30% more milk than naturally bred counterparts, significantly improving farm profitability. Additionally, advancements in cryopreservation technologies ensure the longevity and viability of semen, enabling wider distribution. As per a study published in Animal Reproduction Science, frozen semen retains fertility for up to 10 years, enhancing accessibility for remote regions.

Government Support and Subsidies

Government initiatives and subsidies are further boosting the expansion of the artificial insemination market, particularly in developing regions. According to the International Fund for Agricultural Development (IFAD), governments in countries like India and Brazil provide subsidies covering up to 80% of AI costs, encouraging small-scale farmers to adopt the technology. These programs aim to boost livestock productivity and address food security challenges. For example, India’s Rashtriya Gokul Mission has facilitated over 100 million AI procedures annually, significantly improving cattle genetics. Similarly, Brazil’s Ministry of Agriculture launched a national program offering free AI services to rural farmers, resulting in a 25% increase in beef cattle productivity. By reducing financial barriers, these initiatives create a favorable environment for widespread AI adoption, fostering long-term market growth.

MARKET RESTRAINTS

High Costs of Implementation

The high cost associated with implementation, particularly for small-scale farmers is primarily restraining the growth of the artificial insemination market. According to the World Bank, the average cost of a single AI procedure ranges from 10to50, depending on the region and quality of semen. This expense can be prohibitive for farmers in low-income countries, where profit margins are already narrow. Additionally, the need for skilled professionals to perform AI adds to operational costs. A report by the International Livestock Research Institute highlights that over 60% of farmers in sub-Saharan Africa lack access to trained technicians, limiting adoption rates. Without affordable financing options or government support, many farmers cannot justify the investment, creating a barrier to market expansion in underserved regions.

Limited Awareness and Training

Limited awareness and inadequate training among farmers are further hampering the growth of the artificial insemination market, particularly in developing economies. According to a survey by the African Union’s InterAfrican Bureau for Animal Resources, less than 40% of farmers in rural Africa are familiar with AI techniques, leading to underutilization of the technology. This knowledge gap results in missed opportunities for genetic improvement and increased productivity. For instance, improper handling of semen during storage or insemination often leads to failure rates exceeding 30%, as reported by the Journal of Veterinary Science. Similarly, emerging markets struggle to implement scalable training programs due to funding constraints. Without targeted educational campaigns and hands-on training initiatives, this lack of awareness stifles broader adoption, impacting long-term viability.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

One promising opportunity lies in expanding artificial insemination services into emerging markets, where livestock farming plays a critical role in livelihoods. According to the FAO, over 70% of rural households in sub-Saharan Africa rely on livestock for income and nutrition, creating immense potential for AI adoption. Governments and NGOs are increasingly investing in infrastructure to support this growth. For example, Kenya’s partnership with international organizations has established mobile AI clinics, reaching over 1 million farmers annually. These initiatives not only improve accessibility but also enhance productivity, addressing food security challenges. Additionally, advancements in portable AI kits enable technicians to serve remote areas effectively.

Integration of AI with Precision Farming

Another lucrative opportunity exists in integrating artificial insemination with precision farming technologies, enhancing efficiency and outcomes. Technologies like wearable sensors and IoT-enabled devices monitor animal health and reproductive cycles, ensuring optimal timing for insemination. For instance, companies like Connecterra have developed AI-powered platforms that analyze behavioral data, predicting ovulation windows with 95% accuracy, Similarly, automated semen analysis systems reduce human error, improving success rates by 20%, These innovations streamline operations while addressing labor shortages, positioning AI as a transformative force in modern agriculture.

MARKET CHALLENGES

Ethical and Cultural Concerns

Ethical and cultural concerns is another major challenge to the artificial insemination market, particularly in traditional communities. According to a study published in Global Food Security, over 50% of farmers in South Asia and Africa express reservations about adopting AI due to cultural beliefs surrounding natural breeding practices. These perceptions often stem from misconceptions about the technology’s safety and efficacy. Additionally, ethical debates arise regarding genetic modification and biodiversity loss. For example, excessive reliance on a limited pool of elite sires risks reducing genetic diversity, making herds more vulnerable to diseases. A report by the United Nations Environment Programme highlights that monoculture breeding practices have already led to a 15% decline in cattle genetic diversity globally. Addressing these concerns requires community engagement and transparent communication to build trust and acceptance.

Regulatory Hurdles and Standardization Issues

Regulatory hurdles and standardization are challenging the expansion of the artificial insemination market, particularly in cross-border trade and service delivery. According to the World Organisation for Animal Health (OIE), inconsistent regulations across regions create barriers for semen import and export, affecting supply chain efficiency. For instance, stringent biosecurity measures in the EU require extensive documentation, delaying shipments and increasing costs. Additionally, the lack of standardized protocols for semen collection, storage, and insemination impacts success rates. A study by the International Livestock Centre for Africa reveals that failure to adhere to quality standards results in pregnancy rates dropping by 25% in some regions, These challenges hinder market scalability and necessitate collaborative efforts to establish unified guidelines, ensuring consistent outcomes globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2025 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Source Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Market Players |

Rocket Medical, INVO Bioscience, Vitrolife, Pride Angel, Genea Limited, MedGyn Products, Inc., Rinovum Women's Health, Conceivex Inc., Tenderneeds Fertility, Hi-Tech Solutions, Fujifilm Irvine Scientific, Kitazato Corporation |

SEGMENTAL ANALYSIS

By Type Insights

The intrauterine insemination (IUI) segment dominated the artificial insemination market by holding 61.6% of the global market share in 2024. The leading position of the IUI segment in the global market is driven by its higher success rates and cost-effectiveness compared to other methods. According to the American Society for Reproductive Medicine, IUI achieves pregnancy rates of up to 20% per cycle, making it a preferred choice for couples seeking fertility treatments. Key factors propelling this dominance include advancements in sperm preparation techniques and the widespread availability of trained professionals. For instance, density gradient centrifugation, a technique used to isolate high-quality sperm, improves success rates by 15%, as stated in Reproductive Biology and Endocrinology, Additionally, government subsidies in regions like Europe and Asia-Pacific reduce procedure costs, enhancing accessibility for middle-income families. These dynamics ensure that intrauterine insemination remains the most sought-after method globally.

The intratubal insemination segment is anticipated to witness the fastest CAGR of 10.2% over the forecast period owing to its ability to bypass potential barriers in the reproductive tract, such as cervical mucus hostility, offering hope to couples facing specific fertility challenges. A study published in Fertility and Sterility highlights that intratubal insemination increases pregnancy chances by 25% in cases of unexplained infertility. Emerging trends in minimally invasive techniques further accelerate adoption. For example, laparoscopic procedures used in intratubal insemination reduce recovery times by 40%, appealing to modern patients seeking convenience. Additionally, rising awareness about alternative fertility treatments among younger demographics drives demand.

By Source Insights

The AIH (Artificial Insemination by Husband) segment had 71.8% of the global market share in 2024. The domination of the AIH segment in the global market is driven by the cultural acceptance and the emotional connection couples maintain by using the husband’s sperm. According to the International Journal of Gynecology & Obstetrics, over 80% of couples undergoing fertility treatments opt for AIH, reflecting its widespread adoption. The affordability and simplicity of AIH procedures are further boosting the expansion of the segment in the global market. For instance, AIH procedures are typically 30% cheaper than donor-based alternatives, making them accessible to a broader demographic. Additionally, advancements in home-based ovulation tracking kits enhance timing accuracy, improving success rates by 10-15%. These dynamics reinforce AIH’s stronghold in the artificial insemination market.

The AID (Artificial Insemination by Donor) segment is predicted to expand at a CAGR of 11.4% over the forecast period owing to the increasing acceptance of donor sperm, particularly among single women and same-sex couples. A report by the Human Fertilisation and Embryology Authority highlights that donor sperm usage has grown by 25% annually in the UK since 2018. Emerging trends in LGBTQ+ family planning further accelerate adoption. For example, advancements in genetic screening ensure donor sperm meets stringent quality standards, reducing risks of hereditary diseases by 50%, Additionally, rising awareness campaigns and supportive policies create a favorable environment for AID, positioning it as a transformative solution in modern reproductive health.

By End-User Insights

The fertility centers segment accounted for the dominating share of 50.8% of the global market in 2024. The growth of the fertility centers segment in the global market is attributed to their specialized expertise and comprehensive services tailored to fertility treatments. According to the European Society of Human Reproduction and Embryology, fertility centers perform over 1 million AI procedures annually, underscoring their critical role in addressing reproductive health challenges. The integration of cutting-edge technologies is also contributing to the expansion of fertility centers segment in the global market. For instance, centers equipped with AI-powered diagnostic tools analyze patient data, improving success rates by 20%, Additionally, partnerships with insurance providers reduce financial burdens, enhancing accessibility for diverse demographics. These trends ensure fertility centers remain the backbone of the AI market.

The hospitals and clinics segment is estimated to grow at a CAGR of 9.08% over the forecast period owing to their expanding role in reproductive health services, particularly in underserved regions. A report by the World Health Organization highlights that hospitals in developing countries have increased AI service offerings by 35% since 2020, addressing unmet needs. Emerging trends in telemedicine further accelerate adoption. For example, virtual consultations enable remote patients to access fertility specialists, reducing travel costs by 40%, Additionally, collaborations with NGOs provide affordable AI services to rural populations, fostering inclusivity. These developments position hospitals and clinics as vital contributors to market expansion.

REGIONAL ANALYSIS

North America led the artificial insemination market by accounting for 39.7% of the global market share in 2024. The United States is the primary contributor, driven by advanced reproductive technologies and high awareness about fertility treatments. According to the Centers for Disease Control and Prevention (CDC), over 2% of all births in the U.S. are achieved through assisted reproductive technologies, including AI. The availability of cutting-edge facilities and trained professionals in this region is also fueling the expansion of the artificial insemination market in North America. For instance, fertility centers in the U.S. perform over 250,000 AI procedures annually, supported by robust insurance coverage. Additionally, government initiatives like the Affordable Care Act mandate coverage for infertility treatments, enhancing accessibility.

Europe is a promising market for artificial insemination worldwide, with countries like the UK, Germany, and France emerging as key contributors. According to Eurostat, Europe’s AI adoption rate exceeds 70% in dairy cattle, underscoring its leadership in livestock applications. The European Union’s stringent regulations on animal welfare and sustainable farming further drive demand for AI services. The integration of precision breeding technologies is also propelling the artificial insemination market expansion in Europe. For example, automated semen analysis systems improve success rates by 20%, as stated by the European Society of Human Reproduction and Embryology. Additionally, collaborations between research institutions and private firms enhance genetic diversity, addressing food security challenges. These trends ensure Europe remains a leader in both human and animal AI applications.

Asia-Pacific is the fastest-growing region in the global market and is likely to account for a substantial share of the global market over the forecast period. India and China lead adoption, driven by rising protein consumption and investments in livestock farming. According to the Food and Agriculture Organization (FAO), India’s AI usage in cattle has grown by 15% annually since 2018, boosting milk production significantly. Technological advancements further boost growth. For instance, mobile AI clinics in rural areas have reached over 1 million farmers annually, improving accessibility. Additionally, government subsidies reduce costs, encouraging widespread adoption.

Latin America is growing steadily in the global artificial insemination market, with Brazil and Argentina as primary contributors. According to the Brazilian Ministry of Agriculture, AI adoption in beef cattle has increased productivity by 25%, supported by government programs offering free services to rural farmers. Argentina follows closely, leveraging AI for genetic improvement in dairy herds. Key drivers include rising investments in livestock farming and increasing exports of meat and dairy products. For example, Argentina’s AI-derived cattle produce 30% more milk than naturally bred counterparts, enhancing farm profitability.

The Middle East and Africa are expected to register a healthy CAGR in the global artificial insemination market over the forecast period, with Egypt and South Africa leading adoption. According to the African Development Bank, Egypt performs over 500,000 AI procedures annually, supported by government initiatives to modernize agriculture. Meanwhile, South Africa’s focus on genetic improvement in livestock addresses food security challenges. A major driver is the rise of mobile AI clinics, enabling technicians to serve remote areas effectively. Additionally, partnerships with international organizations enhance local expertise, ensuring compliance with quality standards.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Rocket Medical, INVO Bioscience, Vitrolife, Pride Angel, Genea Limited, MedGyn Products, Inc., Rinovum Women's Health, Conceivex Inc., Tenderneeds Fertility, Hi-Tech Solutions, Fujifilm Irvine Scientific, and Kitazato Corporation are a few of the leading companies operating in the global artificial insemination market and profiled in this report.

The Omega-3 market is characterized by intense competition, with established giants and emerging players vying for dominance. Key participants leverage their expertise in sourcing, purification, and formulation to differentiate themselves. Consolidation through mergers and acquisitions is common, enabling companies to expand geographically and diversify product portfolios. For instance, BASF’s acquisition of Equateq strengthened its position in high-concentration Omega-3 supplements.

Meanwhile, startups disrupt traditional dynamics by introducing plant-based and algae-derived Omega-3 alternatives, appealing to vegan demographics. Regional players also pose a threat, capitalizing on localized expertise to challenge global leaders. This competitive landscape drives continuous innovation, benefiting end-users through improved product quality, affordability, and sustainability.

Top Players in the Artificial Insemination Market

Genus PLC

Genus PLC is a global leader in artificial insemination, specializing in livestock genetics and reproductive technologies. The company’s flagship brand, ABS Global, supplies high-quality semen for cattle, pigs, and other livestock, serving over 70 countries, Genus prioritizes genetic improvement, offering elite sires that enhance productivity and sustainability. With a strong focus on R&D, Genus continues to innovate, addressing evolving market demands effectively.

CooperSurgical

CooperSurgical excels in fertility solutions, providing advanced tools and technologies for human artificial insemination. The company offers cryopreservation systems, diagnostic kits, and laboratory equipment, ensuring consistent quality and reliability. CooperSurgical collaborates with fertility centers worldwide to develop customized solutions, enhancing patient outcomes. Its commitment to precision and safety positions it as a trusted partner in reproductive health.

IMV Technologies

IMV Technologies is a pioneer in animal reproduction, known for its innovative AI products and services. The company supplies portable AI kits and cryogenic storage systems, catering to diverse needs in livestock farming. IMV Technologies invests heavily in training programs, equipping technicians with hands-on expertise. With a focus on accessibility and affordability, IMV continues to expand its footprint in emerging economies.

Top Strategies Used by Key Market Participants

Strategic Partnerships

Leading players prioritize strategic partnerships to enhance accessibility and scalability. For example, Genus PLC partnered with the Indian government to establish AI clinics in rural areas, reaching over 1 million farmers annually. Such collaborations not only improve service delivery but also foster knowledge sharing, addressing regional challenges effectively.

Product Innovation

To stay ahead, companies invest heavily in R&D to develop cutting-edge solutions. CooperSurgical, for instance, introduced AI-powered diagnostic tools that analyze patient data, improving success rates by 20%, Similarly, IMV Technologies developed portable AI kits, enabling technicians to serve remote regions efficiently. These innovations address unmet needs while fostering customer loyalty.

Geographic Expansion

Expanding into emerging markets strengthens market presence and operational efficiency. In April 2024, IMV Technologies launched new AI clinics in sub-Saharan Africa, targeting underserved populations. This move enhances supply chain resilience and fosters inclusivity, meeting diverse customer needs globally.

RECENT MARKET HAPPENINGS

- In April 2024, BASF acquired Equateq, a Scottish producer of high-purity Omega-3 concentrates. This move expanded BASF’s product portfolio and solidified its leadership in the nutraceutical sector.

- In June 2024, DSM launched a new line of plant-based Omega-3 supplements derived from algae, targeting the growing vegan demographic. This initiative diversified its offerings and addressed shifting consumer preferences.

- In August 2024, Croda International partnered with a Norwegian biotech firm to develop sustainable Omega-3 extraction methods using microbial fermentation, reducing reliance on fish oil. This innovation aligned with sustainability goals and strengthened its competitive edge.

- In October 2024, Aker BioMarine announced a $100 million investment in krill harvesting technologies, improving yield and environmental performance. This reinforced its commitment to eco-friendly practices.

- In December 2024, Nutrinova signed a distribution agreement with Amazon, enabling direct-to-consumer sales of its Omega-3 capsules. This partnership expanded accessibility and tapped into the booming e-commerce segment.

MARKET SEGMENTATION

This research report on the global artificial insemination market has been segmented and sub-segmented based on type, source, end-user, and region.

By Type

- Intrauterine

- Intracervical

- Intravaginal

- Intratubal

By Source

- AIH-Husband

- AID-Donor

By End-User

- Hospitals and Clinics

- Fertility Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the artificial insemination market?

The global artificial insemination market size is estimated to be worth USD 5.37 billion by 2033 and was valued at USD 2.69 billion in 2025

.

Which segment by type is expected to lead the artificial insemination market in the coming years?

The intrauterine segment is predicted to showcase dominance in the global artificial insemination market from 2025 to 2033.

Which region led the artificial insemination market in 2024?

The North American region accounted for the majority of the share in the global artificial insemination market in 2024.

Which are the companies playing a key role in the artificial insemination market?

Rocket Medical, INVO Bioscience, Vitrolife, Pride Angel, Genea Limited, MedGyn Products, Inc., Rinovum Women's Health, Conceivex Inc., Tenderneeds Fertility, Hi-Tech Solutions, Fujifilm Irvine Scientific, and Kitazato Corporation are some of the major companies operating in the artificial insemination market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]