Global Aromatherapy Market Size, Share, Trends & Growth Forecast Report By Product (Consumables, Equipment), Mode Of Delivery, End Users, Sales Channel, Application, And Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis from 2025 to 2033

Global Aromatherapy Market Size

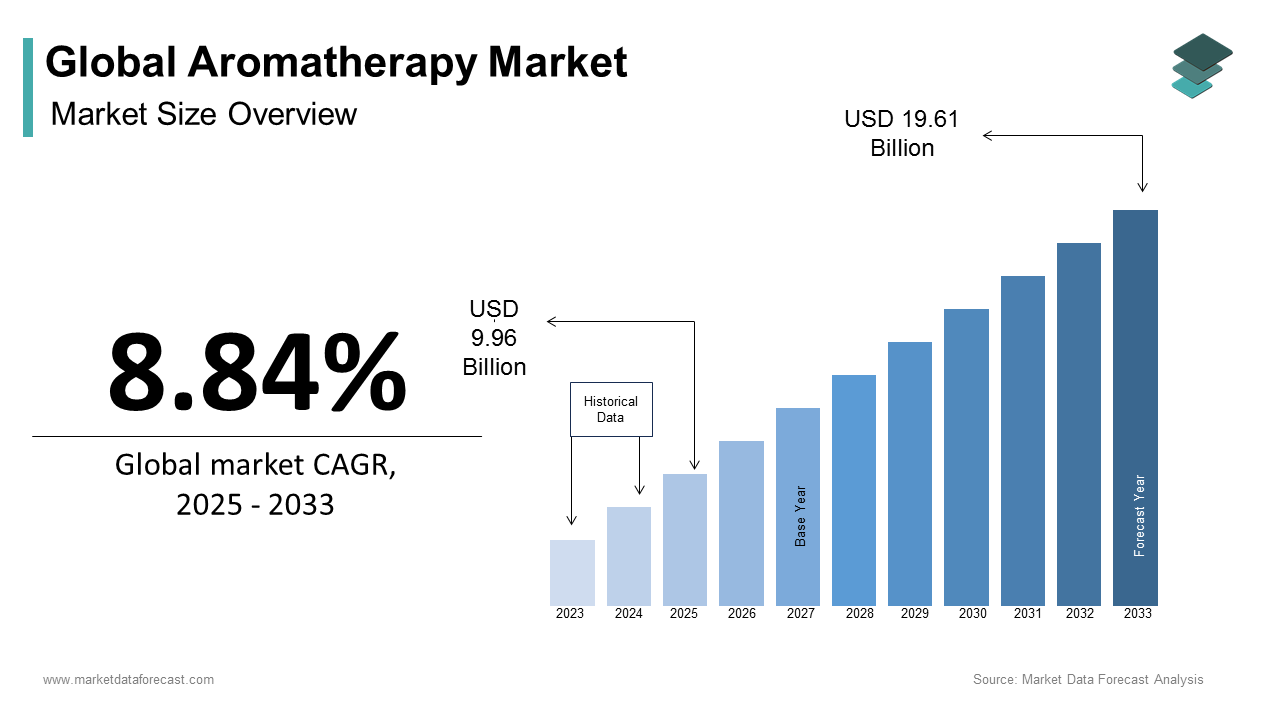

The global aromatherapy market size was calculated to be USD 9.15 billion in 2024 and is anticipated to be worth USD 19.61 billion by 2033 from USD 9.96 billion In 2025, growing at a CAGR of 8.84% during the forecast period.

The aromatherapy market has carved a niche for itself globally, with North America leading the charge. The United States accounted for more than 38% of the global market share in 2024, driven by a surge in consumer interest in natural wellness solutions. Europe follows closely, with countries like France and Germany showing robust growth due to their long-standing tradition of using essential oils in healthcare. The Asia-Pacific region is emerging as a hotspot, with India and China witnessing a promising compound annual growth rate (CAGR) due to the rising disposable incomes and increased awareness of holistic health practices. In terms of market conditions, the aromatherapy market is highly fragmented, with small-scale players dominating the supply chain. According to studies, more than 60% of the market consists of independent producers and retailers, making it challenging for large corporations to monopolize. Regulatory frameworks vary across regions, with the European Union enforcing stringent quality standards under the REACH regulation, while the U.S. relies on self-regulation through organizations like the Alliance of International Aromatherapists.

MARKET DRIVERS

Growing Demand for Natural Wellness Solutions

The shift toward natural and organic products globally is one of the major factors propelling the growth of the aromatherapy market. Consumers are increasingly seeking alternatives to synthetic medications, especially for stress relief and sleep disorders. According to the National Center for Complementary and Integrative Health, over 18 million adults in the U.S. used aromatherapy in 2021, a 15% increase from the previous year. Essential oils like lavender and chamomile have gained popularity for their calming properties, with Statista reporting that the global sales of lavender oil alone reached $120 million in 2022. This trend is further amplified by endorsements from wellness influencers and celebrities, who promote aromatherapy as part of a balanced lifestyle. Social media platforms like Instagram have played a pivotal role, with hashtags like #Aromatherapy trending over 5 million times.

Rising Prevalence of Mental Health Issues

Mental health concerns are another key factor propelling the aromatherapy market forward. The World Health Organization states that anxiety and depression affect over 264 million people globally, creating a demand for non-invasive therapies. Aromatherapy has emerged as a viable solution, with studies published in the Journal of Clinical Psychology showing that inhaling essential oils reduces cortisol levels by up to 25%. In 2023, the American Psychological Association noted that 60% of mental health practitioners now recommend aromatherapy as a complementary treatment. This growing acceptance has led to partnerships between aromatherapy brands and mental health organizations, further boosting market penetration.

MARKET RESTRAINTS

Lack of Standardization in Product Quality

One of the biggest restraints in the aromatherapy market is the lack of standardized regulations governing product quality. According to the International Organization for Standardization, only 30% of essential oil manufacturers adhere to globally recognized purity standards. This inconsistency often leads to mislabeling, where products marketed as "pure" may contain synthetic additives or diluted compounds. A study conducted by the University of Maryland Medical Center revealed that nearly 40% of commercially available essential oils failed purity tests. Such discrepancies erode consumer trust and hinder market growth. For instance, in 2022, Consumer Reports highlighted multiple cases of allergic reactions caused by adulterated oils, prompting calls for stricter oversight. Without enforceable quality benchmarks, the industry risks alienating health-conscious buyers.

High Production Costs and Supply Chain Disruptions

The high cost of producing high-quality essential oils, coupled with frequent supply chain disruptions are further hindering the growth of the global aromatherapy market. As per the International Trade Centre, the cultivation of aromatic plants requires specific climatic conditions, making production vulnerable to climate change. For example, droughts in India reduced sandalwood yields by 20% in 2023, driving prices up by 35%. Additionally, geopolitical tensions have impacted exports from key regions like the Middle East, which supplies over 60% of frankincense globally. The Fragrance Foundation notes that these disruptions force manufacturers to rely on intermediaries, increasing costs further. With profit margins already thin, smaller players struggle to compete, limiting innovation and market expansion.

MARKET OPPORTUNITIES

Integration with Smart Home Devices

The integration of aromatherapy with smart home technology is a lucrative opportunity for market players. The demand for smart home devices is projected to grow exponentially in the coming years and offer a ready platform for innovative aromatherapy solutions. Brands like Pura and Vitruvi have already launched app-controlled diffusers that allow users to customize scent intensity and schedules remotely. A survey by Deloitte found that 70% of millennials prefer tech-enabled wellness products, indicating strong demand for such innovations. Furthermore, partnerships with companies like Amazon and Google could expand distribution channels, enabling aromatherapy brands to tap into new customer segments. By leveraging IoT capabilities, the industry can enhance user experience and drive higher adoption rates.

Expansion into Personal Care and Cosmetics

The incorporation of essential oils into personal care and cosmetic products is another promising opportunity for the aromatherapy market. According to studies, the demand for beauty and personal care products is on the rise and is providing ample room for aromatherapy−infused offerings. Consumers are gravitating toward clean beauty products, with Mintel reporting that 5815 million in sales within six months. Collaborations with established beauty brands could position aromatherapy as a mainstream ingredient, unlocking untapped revenue streams and elevating brand visibility.

MARKET CHALLENGES

Misinformation and Consumer Skepticism

Misinformation about the efficacy of aromatherapy is one of the biggest challenges to its widespread adoption. According to a study published in the British Medical Journal, over 45% of consumers harbor misconceptions about the therapeutic benefits of essential oils, often confusing them with pharmaceutical treatments. This confusion is exacerbated by exaggerated claims made by unverified online sources, which undermine credibility. The Pew Research Center notes that 67% of internet users research health remedies online, but only 30% verify the information against scientific studies. Such skepticism deters potential buyers, especially those seeking evidence-based solutions. To combat this, industry leaders must invest in educational campaigns and collaborate with healthcare professionals to dispel myths and promote accurate information.

Environmental Concerns Over Sustainable Sourcing

Environmental sustainability is further impacting the growth of the global aromatherapy market. The overharvesting of aromatic plants threatens biodiversity, as highlighted by the International Union for Conservation of Nature. For example, rosewood trees, prized for their essential oil, are now classified as endangered due to excessive logging. The World Wildlife Fund estimates that unsustainable practices could deplete key resources by 2035 if left unchecked. Additionally, carbon emissions from transporting raw materials contribute to the industry's environmental footprint. Nielsen reports that 73% of global consumers prefer eco-friendly products, making sustainability a critical factor for brand loyalty. Addressing these concerns requires adopting ethical sourcing practices and investing in renewable alternatives to safeguard both the environment and market reputation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.84% |

|

Segments Covered |

By Product, Mode of Delivery, End Use, Sales Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

DoTERRA International, Young Living Essential Oils, Edens Garden, Plant Therapy Essential Oils, Mountain Rose Herbs, Rocky Mountain Oils, Aura Cacia, NOW Foods, FLORIHANA, Biolandes, Falcon, Stadler Form, SpaRoom, Organic Aromas, InnoGear, Airomé, URPOWER, Procter & Gamble, Reckitt Benckiser Group PLC, Ryohin Keikaku Co., Ltd., Aromatherapy Associates, Frontier Natural Products Co-op, EO Products, Vitruvi, Saje Natural Wellness, Revive Essential Oils, Garden of Life, Pura D’or, The Honest Company, Dr. Bronner's, Neal's Yard Remedies |

SEGMENTAL ANALYSIS

By Product Insights

The consumables segment dominated the aromatherapy market by holding 68.8% of the global market share in 2024. The dominance of consumables segment in the global market is driven by the widespread use of essential oils and carrier oils, which are integral to aromatherapy practices. Essential oils like lavender, eucalyptus, and tea tree have become household staples due to their versatility in relaxation, skincare, and pain management. According to Statista, global sales of essential oils reached $12 billion in 2022, with a projected annual growth rate of 6%. The affordability and ease of use of consumables make them accessible to a broad consumer base. A survey conducted by the International Fragrance Association revealed that over 65% of aromatherapy users prefer consumable products over equipment, citing convenience as the primary reason. Additionally, the rise of DIY wellness trends has fueled demand for consumables, with platforms like Pinterest reporting a 40% increase in searches for homemade aromatherapy recipes in 2023.

The growing emphasis on natural health solutions is also boosting the growth of the consumables segment in the global market. According to the National Institutes of Health, more than 38% of Americans use complementary therapies, with essential oils being one of the most popular choices. Brands like doTERRA and Young Living have capitalized on this trend, expanding their product lines to include blends tailored for specific needs, such as stress relief or sleep improvement. This strategic diversification has solidified the position of consumables as the backbone of the aromatherapy market.

The equipment segment is predicted to witness a promising CAGR of 9.9% over the forecast period in the global aromatherapy market. Technological advancements and the integration of smart features into diffusers and nebulizers is boosting the expansion of equipment segment in the global market. For instance, brands like Pura and Vitruvi have introduced app-controlled diffusers that allow users to customize scent intensity and schedules remotely. A study by Deloitte found that 70% of millennials prefer tech-enabled wellness products, creating a lucrative opportunity for equipment manufacturers.

The growing adoption of aromatherapy in commercial spaces like offices and retail stores is further aiding the expansion of the equipment segment in the global market. As per the International WELL Building Institute, over 40% of newly constructed commercial spaces incorporate aromatherapy systems to enhance employee well-being and customer experience. This trend has led to partnerships between aromatherapy brands and real estate developers, further boosting equipment sales. Additionally, the rising popularity of portable devices, such as USB-powered diffusers, has expanded the market's reach. According to Euromonitor International, portable aromatherapy equipment accounted for 30% of total equipment sales in 2022, reflecting the growing demand for on-the-go solutions.

By Mode of Delivery Insights

The topical segment captured 45.9% of global market share in 2024. The dominance of topical segment in the global market is driven by the growing popularity of essential oils in skincare and haircare routines. Consumers are increasingly turning to natural alternatives, with Mintel reporting that 60% of beauty product buyers prefer formulations containing plant-based ingredients. Essential oils like tea tree and rosemary are widely used for their antibacterial and anti-inflammatory properties, making them a staple in acne treatments and scalp therapies. In 2023, L'Oréal launched an aromatherapy-infused skincare line, generating $15 million in revenue within six months, underscoring the commercial potential of topical applications.

The endorsement by dermatologists and wellness experts is further fueling the expansion of the topical segment in the global market. According to the American Academy of Dermatology, over 50% of patients with sensitive skin opt for natural remedies, with essential oils being a preferred choice. Social media influencers have also played a pivotal role, with platforms like TikTok showcasing DIY skincare routines featuring essential oils. According to Sensor Tower, videos tagged #EssentialOilSkinCare garnered over 100 million views in 2023, amplifying consumer interest. These trends highlight the strong demand for topical aromatherapy solutions, cementing its position as the leading mode of delivery.

The aerial diffusion segment is projected to witness a CAGR of 9.12% over the forecast period owing to the rising adoption of diffusers in both residential and commercial settings. According to the Global Wellness Institute, over 30% of households in North America now own an aromatherapy diffuser, up from just 15% in 2018. Diffusers are particularly popular for their ability to create ambient environments, making them ideal for relaxation and stress relief. The integration of smart technology into diffusers is further propelling the expansion of aerial diffusion segment in the global market. Brands like Pura and Vitruvi have developed app-controlled devices that allow users to personalize scent profiles and schedules. A survey by Deloitte found that 70% of millennials prioritize tech-enabled wellness solutions, fueling demand for advanced diffusers. Additionally, the hospitality industry has embraced aerial diffusion, with hotels and spas using custom-blended scents to enhance guest experiences. According to Hospitality Net, over 50% of luxury hotels now incorporate aromatherapy systems, further accelerating market growth.

By End-Use Insights

The home use segment occupied the leading share of 56.5% of the aromatherapy market in 2024. The leading position of home use segment in the global market is driven by the increasing adoption of aromatherapy as part of daily self-care routines. The proliferation of affordable diffusers and essential oil kits has made it easier for consumers to incorporate aromatherapy into their homes. According to Nielsen, over 65% of households in the U.S. use aromatherapy products for relaxation and stress management, reflecting the segment’s widespread appeal. The rise of remote work is also aiding the expansion of the home use segment in the global market. As per a study by the Harvard Business Review, 42% of employees in the U.S. working from home reported higher stress levels, prompting many to explore wellness solutions like aromatherapy. Platforms like Amazon have capitalized on this trend, with essential oil sales increasing by 25% in 2022. Additionally, the growing popularity of smart home devices has boosted demand for compatible aromatherapy equipment. Deloitte reports that 70% of millennials prefer tech-enabled wellness products, further solidifying home use as the leading end-use segment.

The yoga and meditation centers segment is the fastest-growing end-use segment in the aromatherapy market and likely to witness a CAGR of 10.7% over the forecast period. The growing integration of aromatherapy into mindfulness practices is driving the yoga and meditation segment in the global market. According to the Global Wellness Institute, over 50% of yoga studios now use essential oils during sessions to enhance relaxation and focus. Scents like sandalwood and frankincense are particularly popular for their grounding properties, making them ideal for meditation. The rising popularity of wellness retreats is further fueling the expansion of the yoga and meditation centers segment in the global market. As per Travel Weekly, wellness tourism grew by 12% in 2023, with many retreats incorporating aromatherapy into their programs. These immersive experiences expose participants to the benefits of essential oils, encouraging continued use post-retreat. Additionally, collaborations between aromatherapy brands and yoga instructors have expanded market reach. For example, partnerships with platforms like Glo and YogaGlo have introduced millions of users to aromatherapy-enhanced practices.

By Sales Channel Insights

The E-commerce segment occupied the largest share of the global aromatherapy market in 2024. The dominating position of e-commerce segment in the global market is driven by the convenience and accessibility offered by online platforms. Consumers can easily compare products, read reviews, and access exclusive deals, making online shopping a preferred choice. According to a survey by BigCommerce, over 70% of aromatherapy buyers purchased products online in 2022, highlighting the channel’s widespread adoption. The rise of social commerce is further boosting the expansion of the e-commerce segment in the global market. Platforms like Instagram and TikTok have become powerful tools for promoting aromatherapy products, with influencers showcasing their favorite oils and diffusers. Sensor Tower reports that videos tagged #AromatherapyTips generated over 200 million views in 2023, driving significant traffic to e-commerce sites. Additionally, subscription-based models offered by brands like Plant Therapy and Rocky Mountain Oils have fostered customer loyalty, further boosting online sales.

The specialty stores segment is expected to grow at a healthy CAGR in the global market over the forecast period due to the increasing demand for curated and high-quality products. Consumers are willing to pay a premium for authentic essential oils, with Mintel reporting that 60% of buyers prioritize purity and sustainability. Specialty stores like Whole Foods and Sprouts Farmers Market cater to this demand by offering organic and ethically sourced options. The experiential aspect of shopping at specialty stores is further boosting the expansion of the specialty stores segment in the global market. Many retailers host workshops and demonstrations to educate customers about the benefits of aromatherapy. According to the Natural Products Association, such events have increased foot traffic by 25% in 2023. Additionally, partnerships with local artisans and small-scale producers have enhanced product variety, attracting niche audiences. These strategies have positioned specialty stores as a dynamic and rapidly expanding segment within the aromatherapy marke

By Application Insights

The relaxation segment occupied the major share of 41.7% of the global market share in 2024. The dominance of relaxation segment in the global market is driven by the growing awareness of mental health and stress management. Essential oils like lavender and chamomile are widely used for their calming properties, with studies published in the Journal of Clinical Psychology showing that inhaling these oils reduces cortisol levels by up to 25%. The World Health Organization notes that anxiety affects over 264 million people globally, creating a strong demand for non-invasive relaxation therapies. The endorsement by wellness influencers and celebrities is also boosting the expansion of relaxation segment in the global market. Platforms like YouTube and Instagram have amplified the popularity of aromatherapy for relaxation, with hashtags like #StressRelief trending over 5 million times in 2023. Additionally, the integration of aromatherapy into workplace wellness programs has expanded its reach. According to the International WELL Building Institute, over 30% of companies now incorporate aromatherapy systems to enhance employee well-being, further solidifying relaxation as the leading application.

The skin and hair care segment is the fastest-growing application segment in the aromatherapy market and is estimated to expand at a prominent CAGR over the forecast period owing to the increasing demand for natural and organic beauty products. Mintel reports that 58% of consumers prioritize clean beauty formulations, with essential oils like tea tree and peppermint gaining traction for their antibacterial and anti-inflammatory properties. The rise of personalized skincare solutions is also favoring the expansion of the skin and hair care segment in the global market. Brands like L'Oréal and Estée Lauder have introduced aromatherapy-infused products tailored to individual needs, generating $20 million in sales within six months of launch. Additionally, the growing popularity of DIY skincare routines has boosted demand for pure essential oils. According to Statista, online searches for homemade skincare recipes increased by 40% in 2023, reflecting the segment’s untapped potential. These trends highlight the rapid expansion of skin and hair care as a key application in the aromatherapy market.

REGIONAL ANALYSIS

North America dominated the aromatherapy market globally in 2024 by capturing 36.1% of the global market share. The prominence of North America in the global market is primarily driven by the U.S., where over 18 million adults use aromatherapy annually, according to the National Center for Complementary and Integrative Health. The growing demand for natural wellness solutions has fueled the market, with essential oils becoming a staple in households and workplaces. A notable trend is the integration of aromatherapy into corporate wellness programs, with over 30% of Fortune 500 companies adopting scent-based therapies to reduce employee stress. The influence of social media in this region is also aiding the regional market expansion. Platforms like Instagram and TikTok have amplified the popularity of aromatherapy, with hashtags like #EssentialOils trending over 100 million times in 2023. Retail giants like Amazon and Walmart have capitalized on this trend, offering a wide range of products. Additionally, the presence of major players like doTERRA and Young Living has strengthened the region’s market position. These dynamics underscore North America’s leadership in the global aromatherapy landscape.

Europe holds the second-largest share of the aromatherapy market and is predicted to account for a substantial share of the global market over the forecast period. Countries like France and Germany are at the forefront, leveraging their long-standing tradition of using essential oils in healthcare. The European Union’s stringent quality standards under the REACH regulation have bolstered consumer trust, with over 60% of buyers prioritizing certified products. The emphasis of Europe on sustainability is contributing to the growth of aromatherapy market in Europe. Nearly 73% of consumers prefer eco-friendly products, prompting brands to adopt ethical sourcing practices. Additionally, the rise of boutique wellness centers has expanded the market’s reach, with cities like Paris and Berlin becoming hubs for aromatherapy tourism. According to the Global Wellness Institute, wellness tourism in Europe grew by 15% in 2023, highlighting the region’s growing influence in the aromatherapy sector.

Asia-Pacific is predicted to exhibit the fastest CAGR in the global aromatherapy market over the forecast period. India and China are key contributors, driven by rising disposable incomes and increased awareness of holistic health practices. The Indian Ministry of AYUSH notes that over 40% of the population uses traditional remedies, including aromatherapy, for wellness. The rich biodiversity of Asia-Pacific that provides a steady supply of aromatic plants is also propelling the Asia-Pacific market growth. According to the International Trade Centre, India alone produces over 8,000 metric tons of essential oils annually, meeting global demand. Additionally, the growing popularity of yoga and meditation has fueled the adoption of aromatherapy, with over 50% of practitioners incorporating essential oils into their routines.

Latin America is emerging as a promising market for aromatherapy, with Brazil and Mexico leading the charge. The increasing demand for natural health solutions in Latin America is driving the Latin American market growth. According to the Pan American Health Organization, over 50% of consumers in Latin America prefer plant-based remedies, creating a fertile ground for aromatherapy adoption. The focus of Latin America on beauty and wellness is also supporting the regional market expansion. The Brazilian Association of Cosmetics notes that over 60% of beauty products sold in 2023 contained natural ingredients, with essential oils gaining popularity. Additionally, the rise of eco-tourism has boosted the market, with destinations like Costa Rica incorporating aromatherapy into spa offerings.

The Middle East and Africa is projected to register a steady CAGR in the global aromatherapy market over the forecast period, with countries like the UAE and South Africa driving growth. The region’s market is fueled by the availability of aromatic plants like frankincense and myrrh, which are integral to traditional medicine. According to the African Development Bank, over 70% of rural populations rely on herbal remedies, creating a strong foundation for aromatherapy adoption. The booming hospitality industry in Middle East and Africa is also favoring the regional market expansion. The Arabian Hotel Investment Conference reports that over 40% of luxury hotels in the UAE now offer aromatherapy services, enhancing guest experiences. Additionally, the growing popularity of wellness retreats in South Africa has expanded the market’s reach, with over 30% of tourists seeking holistic treatments. These trends underscore the region’s growing significance in the global aromatherapy landscape.

LEADING PLAYERS IN THE AROMATHERAPY MARKET

DoTERRA

doTERRA is a global leader in the aromatherapy market, renowned for its high-quality essential oils and commitment to ethical sourcing. The company operates through its Co-Impact Sourcing initiative, which ensures fair wages and sustainable practices for farmers in over 40 countries. According to Forbes, doTERRA’s emphasis on transparency and education has positioned it as a trusted brand among consumers. Its product range includes blends tailored for relaxation, skincare, and immune support, catering to diverse needs. By hosting wellness workshops and partnering with healthcare professionals, doTERRA has successfully expanded its global footprint. The company’s focus on community-driven initiatives has also strengthened its reputation as a socially responsible player in the industry.

Young Living Essential Oils

Young Living is another key player that has significantly contributed to the growth of the aromatherapy market. As per Business Insider, the company pioneered the concept of “Seed to Seal,” ensuring purity and traceability across its supply chain. Young Living offers over 200 products, including essential oils, diffusers, and personal care items, making it a one-stop solution for aromatherapy enthusiasts. The brand has capitalized on the wellness tourism trend by organizing retreats and educational events worldwide. Additionally, its collaboration with influencers and wellness coaches has amplified its reach, particularly among younger audiences. Young Living’s dedication to innovation and sustainability continues to drive its leadership in the market.

Plant Therapy

Plant Therapy has emerged as a prominent name in the aromatherapy market, known for its affordable yet high-quality offerings. The company focuses on accessibility, providing USDA-certified organic oils at competitive prices. According to Entrepreneur, Plant Therapy’s subscription-based model has fostered customer loyalty, allowing users to receive curated products monthly. Its transparent testing process, conducted by third-party labs, ensures product safety and efficacy. Plant Therapy has also leveraged social media platforms like TikTok to engage with younger consumers, promoting DIY recipes and wellness tips. By prioritizing affordability and authenticity, Plant Therapy has carved a niche for itself in the competitive aromatherapy landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product Diversification

One of the major strategies employed by key players is product diversification. Companies like doTERRA and Young Living have expanded their portfolios to include blends specifically designed for stress relief, sleep improvement, and skin health. According to Harvard Business Review, diversification allows brands to cater to evolving consumer preferences and capture untapped markets. For instance, the introduction of pet-safe essential oils and kids’ formulations has opened new revenue streams. This strategy not only enhances brand visibility but also strengthens customer loyalty by offering tailored solutions.

Strategic Partnerships

Strategic partnerships are another critical strategy driving growth in the aromatherapy market. Brands like Young Living have collaborated with wellness centers and yoga studios to promote their products during workshops and retreats. As per Deloitte, such collaborations help companies tap into niche audiences while enhancing credibility. Additionally, partnerships with e-commerce platforms like Amazon have expanded distribution channels, enabling brands to reach global customers efficiently. These alliances create synergies that amplify market presence and foster long-term relationships with stakeholders.

Digital Marketing and Influencer Collaborations

Digital marketing and influencer collaborations have become indispensable tools for strengthening market position. Plant Therapy, for example, partners with wellness influencers on Instagram and TikTok to showcase aromatherapy benefits through engaging content. According to Sensor Tower, videos tagged #EssentialOilTips generated over 50 million views in 2023, highlighting the effectiveness of this strategy. By leveraging user-generated content and live demonstrations, brands can build trust and authenticity. This approach not only boosts brand awareness but also drives conversions by appealing to tech-savvy consumers.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major key market players of the global aromatherapy market include doTERRA International, Young Living Essential Oils, Edens Garden, Plant Therapy Essential Oils, Mountain Rose Herbs, Rocky Mountain Oils, Aura Cacia, NOW Foods, FLORIHANA, Biolandes, Falcon, Stadler Form, SpaRoom, Organic Aromas, InnoGear, Airomé, URPOWER, Procter & Gamble, Reckitt Benckiser Group PLC, Ryohin Keikaku Co., Ltd., Aromatherapy Associates, Frontier Natural Products Co-op, EO Products, Vitruvi, Saje Natural Wellness, Revive Essential Oils, Garden of Life, Pura D’or, The Honest Company, Dr. Bronner's, Neal's Yard Remedies

The aromatherapy market is highly competitive, characterized by a mix of established players and emerging startups vying for dominance. The global aromatherapy market is fragmented, with small-scale producers accounting for over 60% of the market. This fragmentation creates opportunities for innovation but also intensifies competition. Major players like doTERRA and Young Living dominate through premium pricing and extensive product lines, while smaller brands like Plant Therapy focus on affordability and accessibility.

The rise of private-label products and counterfeit goods poses a challenge to legitimate brands, as per the International Fragrance Association. To counter this, companies invest heavily in quality assurance and certification programs. Additionally, the growing demand for natural wellness solutions has attracted new entrants, further intensifying rivalry. Despite these challenges, the market remains dynamic, with technological advancements and shifting consumer preferences shaping the competitive landscape. Brands that prioritize sustainability, transparency, and innovation are likely to thrive in this evolving environment.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, doTERRA launched its “Wellness Advocate Program,” empowering individuals to promote aromatherapy products through personalized coaching sessions. This initiative strengthened its grassroots marketing efforts.

- In June 2023, Young Living partnered with luxury hotel chains in Dubai to incorporate its essential oil-infused amenities into guest rooms, enhancing brand visibility in the hospitality sector.

- In August 2023, Plant Therapy introduced a subscription box service featuring seasonal blends, targeting recurring revenue streams from loyal customers.

- In October 2023, doTERRA announced a collaboration with Fair Trade USA to expand its ethical sourcing initiatives, reinforcing its commitment to sustainability.

- In December 2023, Young Living hosted a global wellness summit in Bali, attracting over 10,000 participants and solidifying its position as a thought leader in the aromatherapy space.

MARKET SEGMENTATION

This research report on the global aromatherapy market has been segmented and sub-segmented based on product, mode of delivery, end users, sales channel, application, and region.

By Product

- Consumables

- Equipment

By Mode of Delivery Insights

- Topical Application

- Aerial Diffusion

- Direct Inhalation

By End-Use Insights

- Home Use

- Spa & Wellness Centers

- Hospitals & Clinics

- Yoga & Meditation Centers

By Sales Channel

- E-commerce

- Offline Stores

By Application Insights

- Relaxation

- Skin & Hair Care

- Pain Management

- Cold & Cough

- Insomnia

- Scar Management

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What is aromatherapy, and how is it used?

Aromatherapy is a holistic healing practice that utilizes natural plant extracts, known as essential oils, to promote health and well-being. These oils can be inhaled, applied to the skin, or diffused into the air to alleviate stress, enhance mood, and support various physical and emotional health conditions.

2. Which essential oils are most popular in the global market?

Some of the most widely used essential oils include Lavender Known for its calming and sleep-inducing properties, Peppermint often used for its invigorating scent and potential to relieve headaches, Eucalyptus commonly utilized for respiratory support, Tea Tree valued for its antimicrobial properties, Lemon Popular for its refreshing aroma and mood-enhancing effects.

3. How is the global aromatherapy market expected to grow in the coming years?

The global aromatherapy market is projected to grow at a compound annual growth rate (CAGR) of 8.9% from 2025 to 2030, reaching approximately USD 15.17 billion by 2030.

4. Who are the key players in the global aromatherapy market?

Prominent companies in the global aromatherapy market include doTERRA International, Young Living Essential Oils, Edens Garden, Plant Therapy Essential Oils, Mountain Rose Herbs, Rocky Mountain Oils, FLORIHANA, Biolandes, and NOW Foods.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]