Global Armoured Personnel Carrier Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Military Operations, Civilian Protection, Peacekeeping Missions, and Counter-Terrorism Operations), Armour Type, Vehicle Capacity, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Armoured Personnel Carrier Market Size

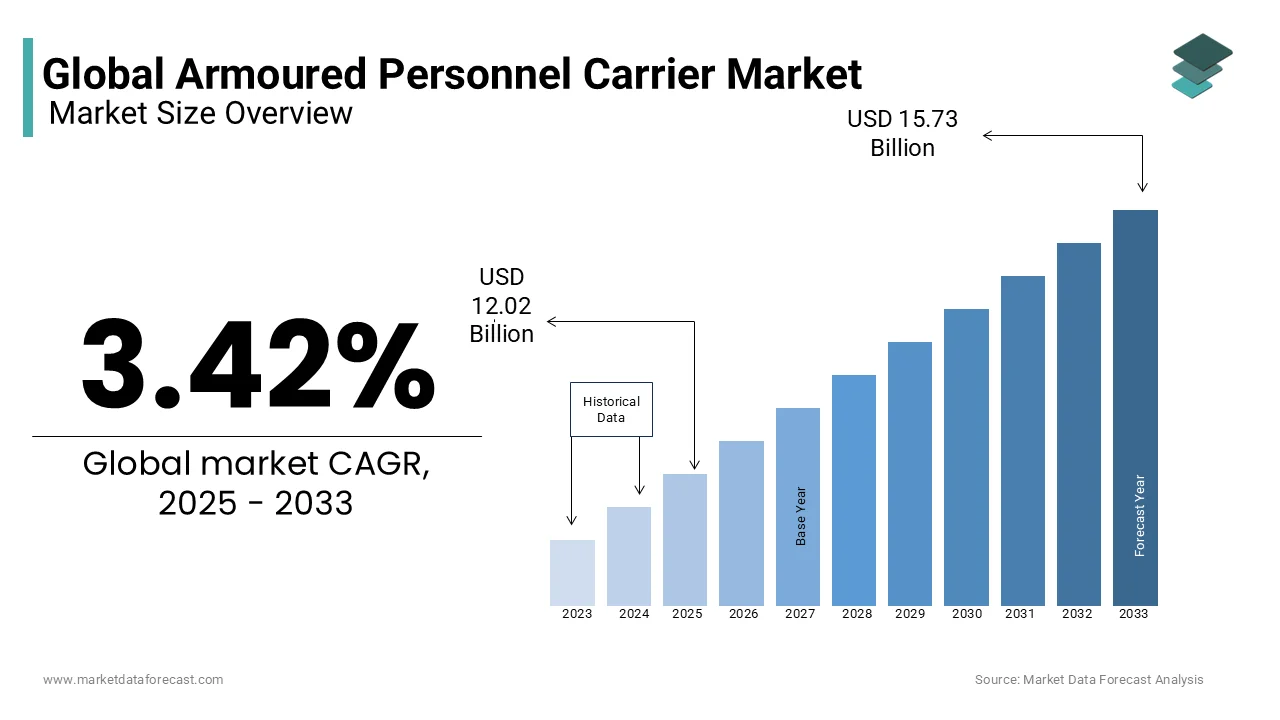

The global armoured personnel carrier market was worth USD 11.62 billion in 2024. The global market is projected to reach USD 15.73 billion by 2033 from USD 12.02 billion in 2025, growing at a CAGR of 3.42% from 2025 to 2033.

Armoured personnel carriers (APCs) are important military vehicles that help move soldiers and equipment safely through battle zones. They are built to protect troops from bullets, explosions, and shrapnel. APCs have been used worldwide for decades. A well-known model, the M113, has been in service since the 1960s. More than 80,000 of these vehicles have been produced and are used by over 50 countries. The widespread use of APCs shows how reliable they are and how vital they have become in military operations. Recently, rising conflicts and tensions between countries have led to increased spending on military upgrades. The Stockholm International Peace Research Institute (SIPRI) reported that in 2023, global military spending reached $2.443 trillion, an increase of 6.8% from the previous year. This rise shows that governments are focusing more on improving their defense systems, including buying better APCs to keep soldiers safe and mobile.

New technology has also made APCs more advanced. Modern versions now have stronger armor, better communication systems, and improved engines, helping them perform well in modern warfare. These upgrades make APCs even more effective at protecting troops and supporting military missions. In conclusion, APCs are a crucial part of military forces worldwide. As security threats change, countries continue to develop and upgrade these vehicles to ensure their soldiers remain protected and ready for any situation.

MARKET DRIVERS

Increasing Global Conflicts

As tensions rise between nations, the demand for Armoured Personnel Carriers (APCs) has grown significantly. In 2023, global military spending hit a record $2.443 trillion, a 6.8% increase from the previous year, as reported by the Stockholm International Peace Research Institute (SIPRI). This rise is mainly due to conflicts like the Ukraine war and increasing tensions in Asia and the Middle East. Military budgets in Europe also saw their largest jump in 30 years as countries focused on strengthening their defense systems. The United States spent $916 billion on defense, while China spent $296 billion and Russia allocated $109 billion. These rising investments highlight the urgency for stronger APC fleets to tackle growing security threats.

Rising Armed Conflicts

More conflicts worldwide mean a greater need for APCs to keep soldiers safe and improve battlefield operations. According to the Uppsala Conflict Data Program (UCDP) at Uppsala University, there were 59 state-based conflicts in 2023, the highest since 1946. The Ukraine war alone caused 71,000 deaths, while the Israel-Hamas conflict led to over 22,000 deaths. These high numbers of casualties emphasize why stronger, more advanced APCs are crucial. With such conflicts on the rise, military forces worldwide are investing in vehicles that offer greater mobility, safety, and adaptability in unpredictable and dangerous war zones.

MARKET RESTRAINTS

High Costs of Buying and Maintaining APCs

Buying and maintaining APCs is very expensive for governments. The Congressional Budget Office (CBO) estimates that the U.S. Army will spend about $5 billion every year on ground combat vehicles until 2050. This includes $4.5 billion for buying new vehicles and $0.5 billion for research and upgrades. The Government Accountability Office (GAO) states that the maintenance costs of APCs over their lifespan often exceed their initial purchase price. These high costs put pressure on governments, especially those with smaller defense budgets. Some nations struggle to keep their APCs updated due to financial constraints, which may slow down their ability to modernize their military fleets.

Environmental Regulations and Challenges

The environmental impact of APCs is a growing concern. The Environmental Protection Agency (EPA) enforces strict rules on emissions from non-road diesel engines, including military vehicles. Meeting these regulations means manufacturers must use advanced, cleaner technology, which increases production costs. Additionally, the Department of Defense (DoD) found that APC training exercises damage natural environments, leading to soil erosion and habitat destruction. As global focus shifts toward sustainability, the defense industry faces pressure to develop eco-friendly armored vehicles. These environmental and regulatory issues could slow down the manufacturing and deployment of new APC models.

MARKET OPPORTUNITIES

Advancing Technology in APCs

The U.S. Army is working on new, more advanced APCs, including the Armored Multi-Purpose Vehicle (AMPV), which will replace the old M113 model. According to the Congressional Budget Office (CBO), the U.S. Army plans to spend around $5 billion per year on upgrading its combat vehicle fleet until 2050. This includes $4.5 billion for purchasing new APCs and $0.5 billion for research and development. These investments offer opportunities for companies developing lighter, stronger materials, better protection systems, and improved communication technology in APCs. With global defense forces seeking smarter, more efficient vehicles, the APC market is expected to grow rapidly through innovation.

Faster Prototyping and APC Production

As military threats change, defense agencies want faster and more adaptable APC development. The Army Rapid Capabilities and Critical Technologies Office (RCCTO) is focusing on quickly researching, testing, and delivering new APCs. The goal is to reduce production time and increase efficiency, so forces can get updated APCs much faster. This faster process also gives businesses a chance to work with the military by providing quickly developed solutions. This shift toward rapid production and flexible vehicle designs opens major opportunities for manufacturers, making it easier to supply APCs to modern military forces.

MARKET CHALLENGES

Technology Becoming Outdated Quickly

With defense technology advancing rapidly, APCs can become outdated much faster. The U.S. Army has struggled with this issue in the past, as seen with the Ground Combat Vehicle program, which was meant to replace older models but was canceled due to constantly changing requirements. To stay effective, APCs need regular updates in armor, mobility, and electronics. However, keeping up with these changes is costly and time-consuming. If APCs do not keep pace with modern warfare needs, they may no longer be useful, creating a big challenge for defense agencies and manufacturers.

Difficulties in Moving and Deploying APCs

APCs are large and heavy, making them hard to transport. Special equipment is often needed to move them across different terrains, especially in places with rough landscapes or urban environments. The U.S. Marine Corps found that adding stronger armor and weapons to amphibious combat vehicles made them heavier, reducing their ability to move efficiently in water. These logistical problems make it harder for armies to quickly deploy APCs where they are needed most. Governments and manufacturers must find ways to make APCs more mobile and easier to transport without sacrificing their protective capabilities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.42% |

|

Segments Covered |

By Application, Armour Type, Vehicle Capacity, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Navistar International, General Dynamics, Krauss-Maffei Wegmann, FNSS Defense Systems, Iveco, BAE Systems, Northrop Grumman, Textron, Hanwha Defense, COMPOSITE NA, Oshkosh Corporation, Lockheed Martin, Rheinmetall, Elbit Systems, andThales. |

SEGMENTAL ANALYSIS

By Application Insights

The military operations segment led the market and held 55.7% of the global market share in 2024 owing to the essential role APCs play in enhancing troop mobility and protection during combat scenarios. The increasing defense budgets worldwide further bolster this segment's prominence. For instance, the Stockholm International Peace Research Institute (SIPRI) reported that global military expenditure reached a record high of $2.24 trillion in 2022, reflecting a 3.7% increase from the previous year. Such substantial investments underscore the critical need for advanced APCs to ensure the safety and operational effectiveness of military personnel.

However, the counter-terrorism operations segment is anticipated to register the highest CAGR of 7.9% over the forecast period. Factors such as the escalating global threat of terrorism that necessitate specialized vehicles capable of operating in diverse and challenging environments are boosting the expansion of the counter-terrorism segment in the global market. Governments are increasingly allocating resources to equip their security forces with APCs designed for rapid response and enhanced survivability. The United Nations Office of Counterterrorism (UNOCT) emphasizes the importance of such investments, noting a significant rise in counter-terrorism funding to address the evolving nature of global threats. The agility, protection, and versatility of APCs make them indispensable assets in counter-terrorism missions, enabling forces to effectively neutralize threats while minimizing risks to personnel.

By Armour Type Insights

The composite armour segment held the dominating position in the global market by accounting for 55.7% of the global market share in 2024. The growth of the composite armour segment is attributed to its superior protection-to-weight ratio, enhancing vehicle mobility without compromising defense capabilities. Composite materials, such as ceramics combined with metals, offer enhanced resistance against ballistic threats and improvised explosive devices (IEDs). The U.S. Army Research Laboratory has been actively developing advanced composite armours to improve soldier survivability, reflecting the strategic importance of this armour type in modern military applications.

The ceramic armour segment is projected to expand at a CAGR of 7.9% over the forecast period owing to the exceptional hardness and lightweight properties of ceramics that significantly enhance vehicle protection while maintaining maneuverability. The U.S. Department of Defense has invested in research focusing on ceramic materials for armor applications, aiming to develop solutions that offer robust defense against high-velocity projectiles. The increasing adoption of ceramic armour in APCs underscores its critical role in advancing military vehicle technology to address evolving battlefield threats.

By Vehicle Capacity Insights

The 11-20 personnel segment dominated the market by holding 40.8% of the global market share in 2024. The domination of the 11-20 personnel segment is majorly credited to its optimal balance between troop capacity and operational mobility, making it ideal for both urban and rural combat scenarios. According to the U.S. Army’s Modernization Strategy (2022), medium-capacity APCs are deployed in over 70% of joint military exercises worldwide, underscoring their versatility. Additionally, advancements in hybrid propulsion systems have improved fuel efficiency by up to 25%, further boosting demand. Its importance lies in enabling rapid deployment while maintaining logistical flexibility, ensuring mission success in diverse environments.

The 21+ personnel segment is anticipated to witness a CAGR of 7.8% over the forecast period due to the increasing demand for large-scale troop transport in peacekeeping and humanitarian missions. The United Nations Department of Peace Operations reports that such missions have expanded by 20% since 2018, requiring high-capacity vehicles. Furthermore, technological advancements like integrated AI-based navigation systems have enhanced operational efficiency, as noted by the Defense Advanced Research Projects Agency (DARPA). Global spending on heavy APCs reached $9.5 billion in 2022, reflecting rising investments in national security infrastructure. This segment's importance lies in its ability to support large-scale operations while ensuring troop safety.

By End Use Insights

The defense forces segment had the largest share of 70.1% of the global market share in 2024. The growth of the defense forces segment is majorly attributed to the increasing demand for modernized APCs to counter evolving security threats. According to NATO's 2022 defense expenditure report, member countries allocated over $1.2 trillion to defense spending, with 25% dedicated to ground vehicle procurement. The importance of this segment lies in its role in enhancing military mobility and survivability, with the U.S. Army reporting that APCs are utilized in 90% of mechanized infantry operations. Advancements in lightweight composite armor have further increased adoption, ensuring adaptability across diverse combat environments.

The private security segment is another major segment and is estimated to showcase a CAGR of 8.3% over the forecast period owing to the rising geopolitical instability and the need for secure transportation in high-risk areas. The United Nations Office on Drugs and Crime (UNODC) reports that private security spending has increased by 30% in conflict-prone regions since 2018, driven by threats to corporate assets and personnel. Additionally, the International Code of Conduct for Private Security Providers highlights that over 70% of private security firms now require armored vehicles for executive protection. Technological advancements, such as AI-based threat detection systems, are also driving adoption. This segment's importance lies in safeguarding critical infrastructure and ensuring operational continuity in volatile environments.

REGIONAL ANALYSIS

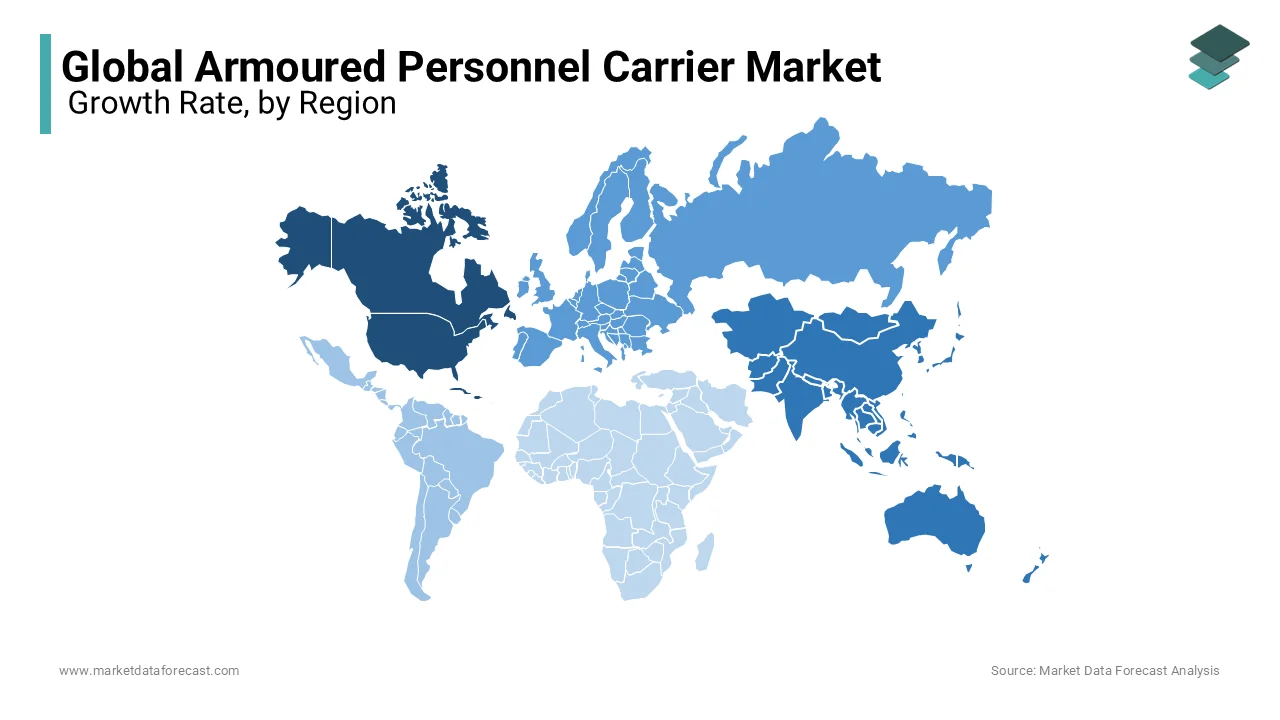

North America played the leading role in the global armoured personnel carrier (APC) market by holding 43.2% of the global market share in 2024. This is mainly because the region, especially the United States, spends a large amount of money on defense and constantly upgrades its military vehicles. The U.S. Department of Defense is focused on keeping its military equipment modern and efficient. According to the Congressional Budget Office (CBO), in 2021, the U.S. Army planned to spend $5 billion annually on ground combat vehicles until 2050. This money covers both buying new vehicles and improving technology through research. Such heavy investment in APCs shows how serious North America is about maintaining strong defense capabilities and ensuring its armed forces have the best possible protection.

Asia-Pacific is the fastest-growing region in the global APC market and is expected to grow at a CAGR of 7.9% over the forecast period owing to the increased defense spending and military modernization in China and India. According to the Stockholm International Peace Research Institute (SIPRI), China spent $293 billion on defense in 2021, marking its 27th consecutive year of rising military budgets. India also increased its spending, reaching $76.6 billion in 2021, making it the third-highest military spender worldwide. These rising investments show that governments in the region are working hard to improve their military strength, leading to more demand for advanced APCs.

Europe remains an important market for APCs, mainly due to concerns about security and commitments to defense cooperation among countries. Countries like Germany, France, and the United Kingdom are focused on upgrading their military vehicles to meet NATO standards. A good example is Germany, which had a defense budget of approximately €53 billion in 2021, showing its strong commitment to improving military readiness. Due to ongoing conflicts in Eastern Europe, nations are putting even more effort into getting advanced APCs. This helps them be prepared for any security threats by ensuring their troops can move quickly and stay well-protected in crisis situations.

The APC market in Latin America is gradually growing as countries begin to improve their military equipment. Governments are focusing on increasing their defense strength to tackle local security challenges, such as drug trafficking and organized crime. Brazil is the leading country in the region when it comes to military spending. In 2021, it spent $19 billion on defense, as per SIPRI reports. A part of this budget went into buying modern armored vehicles to boost military effectiveness. Colombia and Mexico are also investing in APCs to strengthen their forces for counter-insurgency operations and anti-narcotics missions, helping to maintain peace and internal stability.

The Middle East and Africa are seeing a rising demand for APCs, mainly because of ongoing conflicts, the need for better border security, and efforts to combat terrorism. Countries like Saudi Arabia and the United Arab Emirates (UAE) are putting significant amounts of money into defense. According to SIPRI, Saudi Arabia spent around $57.5 billion on military expenses in 2021, showing its strong focus on improving defense power. In Africa, nations like Nigeria and South Africa are actively investing in APCs. These countries are using APCs to improve their internal security and also support United Nations peacekeeping missions, ensuring that their armed forces can operate effectively in challenging environments.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global armoured personal carrier market include Navistar International, General Dynamics, Krauss-Maffei Wegmann, FNSS Defense Systems, Iveco, BAE Systems, Northrop Grumman, Textron, Hanwha Defense, COMPOSITE NA, Oshkosh Corporation, Lockheed Martin, Rheinmetall, Elbit Systems, andThales.

The APC market is highly competitive because many companies are constantly developing new technologies and improving their vehicles. The main companies in the market are BAE Systems, General Dynamics Corporation, Patria, Rheinmetall, and Lockheed Martin. Each company uses different strategies to stay ahead of the competition and increase its market share.

Companies compete by offering better technology, cost-effective solutions, and more adaptable designs. Many firms focus on research and development (R&D) to create next-generation APCs. For example, BAE Systems and Patria invest in new armor and protection systems, while General Dynamics and Rheinmetall secure large government contracts to ensure stable revenue. Lockheed Martin, though known for aerospace, competes by offering flexible, modular APCs that can be modified based on military needs.

Apart from technology and contracts, partnerships and mergers also shape the APC market. Many countries prefer local production and technology transfer, which forces companies to collaborate with foreign defense agencies. As the demand for hybrid-powered APCs, autonomous vehicles, and battlefield communication systems grows, the companies that lead in these areas will have a competitive advantage. The APC market will continue to change as companies invest in innovation and adapt to new security challenges worldwide.

Top 3 Players in the Market

BAE Systems

BAE Systems is one of the biggest defense, security, and aerospace companies in the world. It is based in the United Kingdom and is known for producing advanced military vehicles. One of its most famous products is the M113 APC, which has been used by many countries for years. BAE Systems is always working on new technology to improve its armored vehicles. It has teamed up with Patria, a Finnish defense company, to develop the Patria 8×8 Armoured Modular Vehicle (AMV). This vehicle is designed to meet the needs of modern armies. Through such partnerships, BAE Systems continues to provide high-quality APCs for different military forces worldwide.

General Dynamics Corporation

General Dynamics is an American company that specializes in aerospace and defense. It has a major presence in the APC market through its subsidiary General Dynamics Land Systems. This company is responsible for making the Piranha series of APCs, which are used in many military operations globally. The Piranha APC is popular because it is highly versatile and can be used in different combat situations. General Dynamics is committed to staying ahead in the market by continuously upgrading its vehicles with the latest technologies. By focusing on innovation and adaptability, the company ensures that its APCs meet the changing needs of modern armies around the world.

Patria

Patria is a Finnish company that focuses on defense, security, and aviation support services. One of its most famous products is the Armoured Modular Vehicle (AMV), which is known for its flexible design and excellent performance. The AMV is used by many countries, proving that Patria is a trusted name in the global APC market. To expand its reach, Patria has partnered with companies like BAE Systems to develop modern APCs. These collaborations help the company increase its market presence. By focusing on innovation and quality, Patria continues to be a key supplier of advanced APCs to defense forces worldwide.

TOP STRATEGIES USED BY THE KEY PARTICIPANTS

Innovation and Technological Advancement – BAE Systems

BAE Systems invests heavily in research and development (R&D) to improve its armored vehicles. The company focuses on new technologies such as active protection systems, hybrid engines, and digital battlefield systems. These features make APCs more effective and safer for soldiers. BAE Systems also keeps improving its older vehicles, like the M113, while designing new ones. Through partnerships, like its collaboration with Patria on the AMV program, BAE Systems ensures that its APCs meet the highest military standards and remain useful for modern armies.

Strategic Acquisitions and Diversification – General Dynamics Corporation

General Dynamics strengthens its market position by buying other defense companies and expanding its product range. Its subsidiary, General Dynamics Land Systems, focuses on making a variety of wheeled and tracked APCs to serve different military needs. The Piranha APC series has been upgraded over time to offer better protection, mobility, and technology. The company secures big military contracts from the U.S. military and NATO allies, making it one of the top APC providers. This strategy ensures that General Dynamics remains a strong competitor in the market.

Global Expansion and Strategic Partnerships – Patria

Patria has expanded its business by forming international partnerships and signing licensing agreements. It has worked with companies like BAE Systems and Rheinmetall to promote its AMV series in different countries. Through joint ventures and technology-sharing agreements, Patria has won large defense contracts in countries such as Poland, Croatia, and Sweden. This approach helps Patria increase its market presence while allowing local production of APCs, making them more accessible to foreign buyers.

Modular and Customizable Solutions – Lockheed Martin

Lockheed Martin develops customizable APCs that meet different military needs. Its vehicles have modular designs, meaning that armies can add or remove weapons, communication systems, and armor based on their requirements. This flexibility makes it easier for countries to upgrade their vehicles over time instead of buying completely new ones. Because of this, many defense forces prefer Lockheed Martin’s APCs, as they offer long-term value and adaptability.

Government Contracts and Domestic Market Focus – Rheinmetall

Rheinmetall, a German company, focuses on securing government contracts and strengthening its presence in European defense markets. Its Boxer and Lynx APCs are widely used by NATO countries, ensuring steady demand. Rheinmetall works closely with governments to align its production with national defense policies. By setting up local manufacturing facilities, it benefits from long-term modernization programs. The company also focuses on homeland security and rapid deployment, making it a trusted supplier for many military forces.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Patria and Babcock International Group signed a Memorandum of Understanding to present the Patria 6×6 vehicle platform to the UK Armed Forces. Patria will lead the design and development, while Babcock will manage the build solution and develop a support package to ensure operational readiness.

- In January 2025, the German Armed Forces selected the Patria 6×6 as their new Armoured Personnel Carrier, requesting a binding offer for 300 vehicles. The German government is expected to approve a budget for acquiring around 1,000 vehicles in various configurations by the end of 2025.

- In December 2024, the UK Ministry of Defence highlighted progress on the Ares Armoured Personnel Carrier, a key component of the Ajax Armoured Cavalry Programme. The Ares is expected to achieve Initial Operating Capability by December 2025, supporting the modernization of the British Army.

- In August 2024, Denmark placed an order for 115 additional CV90 vehicles, specifically the CV9035 Mk IIIC model. This €1.35 billion deal aims to enhance the Danish Army's armored vehicle capabilities.

- In December 2024, the UK Ministry of Defence reinforced its commitment to modernizing its mechanized infantry by investing further in the Ares Armoured Personnel Carrier. This APC is expected to play a crucial role in the Army’s future operations.

MARKET SEGMENTATION

This research report on the global armoured personal carrier market is segmented and sub-segmented into the following categories.

By Application

- Military Operations

- Civilian Protection

- Peacekeeping Missions

- Counter-Terrorism Operations

By Armour Type

- Composite Armour

- Steel Armour

- Ceramic Armour

- Soft Armour

By Vehicle Capacity

- 2-4 Personnel

- 5-10 Personnel

- 11-20 Personnel

- 21+ Personnel

By End Use

- Defense Forces

- Law Enforcement Agencies

- Private Security

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is driving the growth of the global Armoured Personnel Carrier (APC) market?

Increasing defense budgets, rising geopolitical tensions, and the need for modernized military fleets are driving demand. Technological advancements in armor, mobility, and weaponry also contribute. Growing use in peacekeeping and law enforcement further supports market expansion.

What trends are shaping the future of APCs?

Modular designs for multi-role capabilities and increased use of unmanned APCs are key trends. Focus on lightweight, high-mobility vehicles with enhanced survivability is rising. Demand for digitalization and AI-based automation is also growing.

How are APCs used beyond military applications?

APCs support law enforcement, border security, and UN peacekeeping missions worldwide. Some are adapted for riot control, counter-terrorism, and emergency response operations. Governments also use them for VIP protection and critical infrastructure security.

What are the future growth opportunities in the APC market?

Emerging markets in Asia, the Middle East, and Africa offer significant growth potential. Increased R&D in electric and hybrid APCs presents new business opportunities. Demand for customizable, multi-role APCs will shape future market expansion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]