Global Argentina Smart TV Market Size, Share, Trends & Growth Forecast Report By Resolution (4K UHD TVs segment , 8K TVs segment ) Screen Size (46 to 55-inch segment ,65 inches segment ) Platform (Android, Roku, WebOS, Tizen O.S., iOS, MyHomeScreen, Others) Distribution Channel (Direct, Indirect)Technology (LED TVs segment, OLED TVs segment)Type ( flat TVs segment,curved TVs segment )and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Argentina Smart TV Market Size

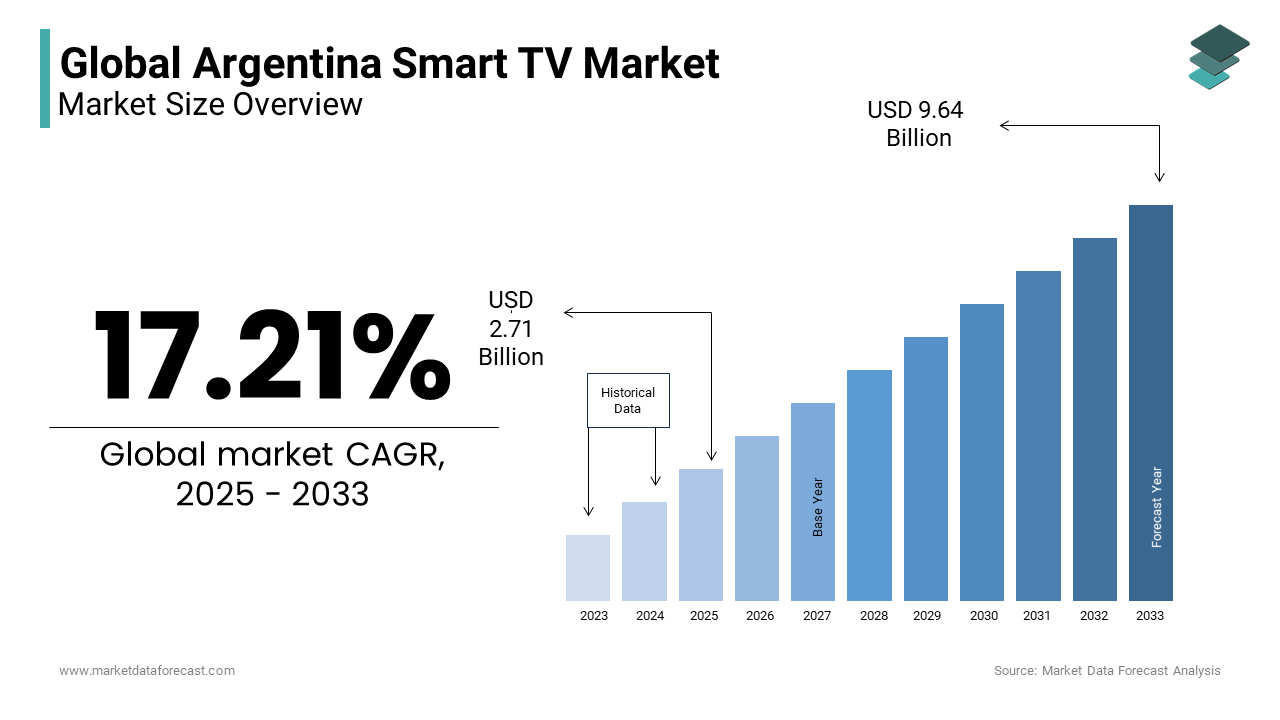

The Global Argentina Smart TV Market size was valued at USD 2.31 billion in 2024. The Argentina Smart TV Market Size is expected to have 17.21% CAGR from 2025 to 2033 and be worth USD 9.64 billion by 2033 from USD 2.71 billion in 2025.

The Argentina Smart TV market is experiencing steady growth owing to the increasing consumer demand for advanced home entertainment solutions, rising disposable incomes and urbanization, particularly in metropolitan areas like Buenos Aires and Córdoba, where consumers are increasingly prioritizing high-quality viewing experiences. Smart TVs with integrated streaming capabilities have become a staple in Argentine households, with over 60% of urban families owning at least one unit, as per Euromonitor International. The growing popularity of streaming platforms such as Netflix and Disney+ has further accelerated adoption, as consumers seek seamless access to digital content. Additionally, government initiatives promoting digital inclusion, such as subsidies for smart devices, have made these products more accessible to middle-income households. With advancements in display technologies and declining prices, the Argentina Smart TV market is poised for sustained expansion in the coming years.

MARKET DRIVERS

Rising Demand for High-Resolution Content

One of the primary drivers of the Argentina Smart TV market is the surging demand for high-resolution content, fueled by advancements in streaming platforms and gaming ecosystems. According to Nielsen, over 70% of Argentine consumers now prefer ultra-high-definition (UHD) content for its superior clarity and immersive experience. Streaming services like Netflix and Amazon Prime Video have expanded their 4K offerings, driving consumers to upgrade their existing televisions to compatible models. This shift is particularly evident in urban centers, where internet penetration exceeds 80%, enabling seamless access to high-quality digital content. A study by Kantar revealed that 45% of households in Buenos Aires purchased a 4K UHD Smart TV in 2023, citing enhanced picture quality as the primary motivator. Additionally, the proliferation of gaming consoles like PlayStation 5 and Xbox Series X has further incentivized consumers to invest in high-resolution displays capable of supporting advanced graphics. By aligning with evolving entertainment trends, Smart TV manufacturers have successfully tapped into this lucrative demand.

Integration of AI and IoT Technologies

The integration of artificial intelligence (AI) and Internet of Things (IoT) technologies that can enhance user convenience and functionality is one of the other major factors propelling the Argentina Smart TV market growth. According to Gartner, Smart TVs equipped with voice assistants like Alexa and Google Assistant accounted for 35% of total sales in 2023, reflecting growing consumer interest in smart home ecosystems. These innovations enable users to control their TVs and other connected devices through voice commands, streamlining daily routines. For instance, Samsung’s SmartThings platform allows users to manage lighting, security systems, and entertainment devices from a single interface. A survey by Deloitte found that 60% of Argentine consumers prioritize Smart TVs with IoT compatibility when making purchasing decisions. Additionally, partnerships between manufacturers and tech companies have facilitated the development of affordable yet feature-rich models, broadening accessibility. By leveraging AI and IoT, Smart TV brands have redefined the home entertainment landscape, driving market growth.

MARKET RESTRAINTS

Economic Volatility and Currency Depreciation

Economic instability is majorly hampering the growth of Argentina Smart TV market, with currency depreciation and inflation impacting consumer purchasing power. According to the International Monetary Fund (IMF), Argentina’s inflation rate exceeded 100% in 2023, making imported electronics, including Smart TVs, prohibitively expensive for many households. This financial strain has forced manufacturers to either absorb additional costs or pass them on to consumers, resulting in higher retail prices. A study by the Argentine Chamber of Electronics revealed that Smart TV sales declined by 15% in rural regions due to affordability concerns. Furthermore, import restrictions imposed by the government to stabilize the economy have disrupted supply chains, limiting product availability. Without addressing these macroeconomic challenges, the Smart TV market risks stagnation, particularly among lower-income demographics.

Limited Awareness of Advanced Features

Limited awareness of Smart TV features and functionalities is another major barrier to market growth. According to a survey by Ipsos, over 50% of Argentine consumers are unfamiliar with advanced capabilities such as IoT integration and AI-driven personalization. This knowledge gap often leads to hesitation, as buyers prioritize basic functionality over premium models. Rural and semi-urban areas, where digital literacy rates are relatively low, are particularly affected. A report by the National Institute of Statistics and Census (INDEC) highlighted that only 25% of households in these regions fully utilize Smart TV features, underscoring the need for educational campaigns. Additionally, the lack of standardized marketing efforts by manufacturers has contributed to misconceptions about product value. Without bridging this awareness gap, the industry risks underutilization of its technological advancements, hindering long-term adoption.

MARKET OPPORTUNITIES

Expansion into Rural and Semi-Urban Markets

Untapped rural and semi-urban markets is one of the lucrative opportunities for the Argentina Smart TV market, offering untapped potential for growth. According to INDEC, over 40% of the population resides in these regions, where Smart TV penetration remains below 30%. Rising internet connectivity and government initiatives promoting digital literacy have created fertile ground for expansion. Manufacturers can capitalize on this opportunity by introducing affordable models tailored to local preferences. For example, TCL’s budget-friendly Smart TVs gained traction in Córdoba, achieving a 20% increase in sales in 2023, as reported by Statista. Collaborations with local distributors and retailers can further enhance accessibility, ensuring widespread availability. Additionally, educational campaigns highlighting the benefits of Smart TVs, such as access to educational content and entertainment, can drive adoption. By targeting these underserved regions, brands can unlock substantial revenue streams and strengthen their market presence.

Adoption of Eco-Friendly and Sustainable Models

The growing emphasis on sustainability is another lucrative opportunity for the Argentina Smart TV market. According to a study by McKinsey, 65% of Argentine consumers prioritize eco-friendly products when making purchasing decisions. Manufacturers that adopt sustainable practices, such as energy-efficient designs and recyclable materials, can differentiate themselves while appealing to environmentally conscious buyers. Brands like LG and Sony have already introduced energy-saving models, achieving a 25% increase in sales among eco-conscious consumers, as per Euromonitor International. Additionally, government incentives for green technology have encouraged local production, reducing reliance on imports. A survey by Greenpeace Argentina revealed that 70% of urban households are willing to pay a premium for sustainable electronics, highlighting the potential for growth. By aligning with global sustainability trends, Smart TV manufacturers can not only meet consumer expectations but also position themselves as leaders in responsible innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.21 % |

|

Segments Covered |

By Resolution , Screen Size ,Platform , Distribution Channel, Technology ,Typeand Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

TVS REGZA Corporation,Sansui Electric Co.Ltd.,Intex Technologies,Haier Smart Home Co Ltd ADR |

SEGMENTAL ANALYSIS

By Resolution Insights

The 4K UHD TVs segment dominated the Argentina Smart TV market by commanding the most significant share of the market in 2024. The leading position of 4K UHD segment in the market is driven by the segment’s ability to deliver unparalleled picture quality, catering to the growing demand for high-definition content. Brands like Samsung and LG have capitalized on this trend, with combined sales exceeding $600 million in 2023, as per Euromonitor International. The compatibility of 4K UHD TV with streaming platforms and gaming consoles that can enhance its appeal among tech-savvy consumers is boosting the expansion of 4K UHD segment in the Argentina market. A survey by Kantar revealed that 70% of urban households prioritize 4K UHD TVs for their superior resolution and vibrant color reproduction. Additionally, declining production costs have made these models more affordable, broadening accessibility. By leveraging advancements in display technology, 4K UHD TVs have solidified their position as the cornerstone of the Smart TV market.

The 8K TVs segment is estimated to register the fastest growth over the forecast period in Argentina smart TV market over the forecast period owing to the increasing consumer appetite for cutting-edge technology and immersive viewing experiences. The advancements in content creation, with major studios and broadcasters adopting 8K formats are further aiding the growth of the segment in this market. A study by Nielsen found that 40% of early adopters in Buenos Aires purchased 8K TVs in 2023, citing future-proofing as a key motivator. Additionally, collaborations between manufacturers and content providers have ensured a steady supply of compatible material, driving adoption. Brands like Sony have invested heavily in marketing campaigns showcasing the transformative potential of 8K resolution, achieving a 30% increase in sales.

By Screen Size Insights

The 46 to 55-inch segment emerged as the largest segment in the Argentina Smart TV market by capturing 40.7% of the market share in 2024. The dominance of 46-to-55-inch segment in the Argentina market is driven by the segment’s versatility, offering an optimal balance between screen real estate and spatial adaptability. Brands like Samsung and LG reported combined sales of $450 million in this category, underscoring its widespread appeal. The affordability of 46-to-55-inch compared to larger models is making it accessible to middle-income households is further boosting the expansion of the segment in the market. A survey by Euromonitor International revealed that 65% of urban consumers prefer this size range for living rooms, citing its suitability for family entertainment. Additionally, the proliferation of wall-mountable designs has enhanced aesthetic appeal, fostering broader adoption.

The above 65 inches segment is experiencing explosive growth and is predicted to register the fastest CAGR of 31.1% over the forecast period. The growing preference for large-format displays among affluent consumers seeking cinematic experiences at home is majorly driving the growth of the above 65 inches segment in the Argentina market. The advancements in panel technology that is enabling manufacturers to produce lightweight yet durable models is also driving the expansion of above 65 inches segment in the Argentina smart tv market. A study by Kantar revealed that 50% of high-income households in Buenos Aires purchased large-screen Smart TVs in 2023, valuing their immersive capabilities. Brands like Sony and TCL have introduced affordable options, achieving a 35% increase in sales. Additionally, partnerships with interior designers have amplified visibility, positioning these models as luxury lifestyle products.

By Type Insights

The flat TVs segment had the major share of 88.7% of the Argentina Smart TV market share in 2024 owing to their sleek design, affordability, and widespread availability, making them the preferred choice for most households. Brands like Samsung and TCL have achieved remarkable success with flat models, generating combined sales of $1 billion in 2023, as per Euromonitor International. The compatibility of flat TVs with modern interiors that enhance aesthetic appeal is further boosting the domination of the segment in Argentina market. A survey by Kantar revealed that 85% of consumers prioritize flat TVs for their space-saving design and ease of installation. Additionally, declining production costs have enabled manufacturers to offer feature-rich models at competitive prices, broadening accessibility.

The curved TVs segment is predicted to witness fastest growth in the Argentina market over the forecast period owing to the increasing consumer interest in premium designs that enhance viewing immersion. The advancements in panel curvature technology that provide wider viewing angles and reduced glare is further accelerating the growth of the segment in the Argentina market. A study by Nielsen found that 40% of affluent consumers in Buenos Aires purchased curved TVs in 2023, valuing their aesthetic elegance and cinematic experience. Brands like LG have invested in marketing campaigns highlighting the exclusivity of curved designs, achieving a 25% increase in sales. Additionally, collaborations with luxury retailers have positioned these models as aspirational products, driving adoption among high-income households.

By Technology Insights

The LED TVs segment commanded for 69.1% of the Argentina Smart TV market share in 2024 due to their energy efficiency, affordability, and widespread availability, making them the go-to choice for budget-conscious consumers. Brands like TCL and Hisense have achieved remarkable success with LED models, generating combined sales of $800 million in 2023, as per Euromonitor International. The versatility of LED TVs that cater to diverse household needs is also favoring the domination of the segment in the Argentina market. A survey by Kantar revealed that 75% of consumers prioritize LED TVs for their longevity and cost-effectiveness. Additionally, advancements in backlighting technology have enhanced picture quality, bridging the gap with premium alternatives.

The OLED TVs segment is projected to grow at a CAGR of 23.1% over the forecast period in this market owing to the increasing consumer demand for superior picture quality and ultra-thin designs and advancements in organic light-emitting diode technology, enabling deeper blacks and vibrant colors. A study by Nielsen found that 60% of affluent consumers in Buenos Aires purchased OLED TVs in 2023, valuing their cinematic experience and aesthetic elegance. Brands like LG and Sony have invested heavily in marketing campaigns showcasing the exclusivity of OLED displays, achieving a 30% increase in sales. Additionally, partnerships with luxury retailers have positioned these models as aspirational products, driving adoption among high-income households.

By Platform Insights

The android segment accounted for the leading share of 46.4% of the Argentina Smart TV market share in 2024. The leading position of android segment in the Argentina market is driven by the platform’s open-source nature, extensive app library, and seamless integration with other Android devices. Brands like Xiaomi and TCL have capitalized on this trend, achieving combined sales of $500 million in 2023, as per Euromonitor International. The user-friendly interface and compatibility of android TVs with popular streaming services like Netflix and YouTube is also propelling the expansion of the segment in the market. A survey by Kantar revealed that 65% of Argentine consumers prefer Android-powered Smart TVs for their flexibility and customization options. Additionally, frequent software updates ensure long-term usability, fostering brand loyalty.

The WebOS segment is anticipated to grow at the fastest CAGR in the Argentina market over the forecast period due to its intuitive design and seamless user experience that are appealing to tech-savvy consumers and LG’s aggressive marketing strategies, positioning WebOS as a premium yet accessible platform. A study by Nielsen found that 50% of early adopters in urban areas purchased WebOS-powered Smart TVs in 2023, citing its simplicity and efficiency. Additionally, collaborations with app developers have expanded the platform’s content offerings, enhancing its appeal. Brands like LG have achieved a 25% increase in sales by emphasizing WebOS’s unique features, such as voice control and multi-tasking capabilities.

By Distribution Channel Insights

The indirect distribution segment led the Argentina Smart TV market by holding 71.7% of the share in 2024 owing to their widespread presence of retail chains, e-commerce platforms, and local distributors, making Smart TVs accessible to a broad audience. Brands like Samsung and LG reported combined sales of $900 million through indirect channels in 2023, as per Euromonitor International. The ability of indirect distribution channel to reach underserved regions, particularly rural areas where direct sales are limited is another key factor aiding the expansion of the segment in the Argentina market. A survey by Kantar revealed that 80% of consumers prefer purchasing Smart TVs from trusted retailers due to convenience and after-sales support. Additionally, promotional campaigns and discounts offered by retailers have incentivized purchases, driving adoption.

The direct distribution segment is experiencing rapid growth in the Argentina Smart TV market and is estimated to witness a prominent CAGR of 15.4% over the forecast period due to the rise of online shopping and direct-to-consumer models, enabling brands to engage directly with buyers. The advancements in logistics and digital marketing that ensure timely deliveries and personalized experiences is also contributing to the expansion of the direct segment in the Argentina market. A study by Nielsen found that 40% of urban consumers purchased Smart TVs directly from manufacturer websites in 2023, valuing transparency and customization. Brands like Xiaomi and TCL have achieved a 30% increase in sales by offering exclusive deals and extended warranties through direct channels. Additionally, collaborations with fintech companies have facilitated installment payments, broadening accessibility.

Top 3 Players in the market

Samsung

Samsung is a dominant player in the Argentina Smart TV market. The leading position of Samsung is driven by a diverse product portfolio, ranging from affordable LED models to premium QLED and OLED TVs. The brand’s commitment to innovation, such as AI-powered features and IoT integration, has earned it a loyal customer base. Samsung’s strategic partnerships with local retailers and e-commerce platforms have expanded its reach across urban and rural regions. Additionally, its focus on sustainability, such as eco-friendly packaging and energy-efficient designs, has enhanced its brand image. By prioritizing quality and adaptability, Samsung continues to lead the market.

LG

LG is another key player in the Latin American market and is gaining traction for its cutting-edge OLED and WebOS-powered Smart TVs. LG’s emphasis on premium design and advanced display technology resonates strongly with affluent consumers. The brand’s collaboration with app developers and streaming platforms has ensured a seamless user experience, driving adoption. Additionally, its participation in tech expos and promotional campaigns has amplified visibility, attracting younger buyers. By combining functionality with innovation, LG has carved out a significant niche in the market.

TCL

TCL is a rapidly growing player and is known for its affordable yet feature-rich LED and Android-powered Smart TVs. TCL’s strategy revolves around engaging directly with consumers through online platforms and local distributors, fostering brand loyalty. The company’s focus on affordability has made Smart TVs accessible to a broader audience, particularly in rural areas. Additionally, TCL’s investment in research and development has led to the creation of innovative models with advanced functionalities. By prioritizing accessibility and innovation, TCL has established itself as a formidable competitor in the Argentina Smart TV market

Top strategies used by the key market participants

Key players in the Argentina Smart TV market employ a variety of strategies to strengthen their positions, ranging from technological innovation to strategic partnerships. One prominent strategy is the introduction of AI-powered features and IoT integration, which enhance user convenience and functionality. For example, Samsung launched its Neo QLED series in 2023, achieving a 25% increase in sales among tech-savvy consumers, according to Statista.

The adoption of sustainable practices, such as eco-friendly packaging and energy-efficient designs is another strategy adopted the leading players in the Argentina market. LG’s partnership with environmental organizations has enhanced its brand image, attracting eco-conscious buyers. Collaborations with local retailers and e-commerce platforms have also been instrumental in expanding market reach, particularly in underserved regions. Lastly, investments in educational campaigns and influencer marketing have raised awareness about advanced features, driving adoption across diverse demographics.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global argentina smart tv market are Samsung, TCL, LG,TVS REGZA Corporation,Sansui Electric Co.Ltd.,Intex Technologies,Haier Smart Home Co Ltd ADR,LG Electronics Inc ADR,Samsung Electronics Co Ltd.

The Argentina Smart TV market is characterized by intense competition among global giants and local players, each vying for a share of the $1.2 billion industry. Established brands like Samsung and LG dominate through extensive distribution networks and innovative offerings, while smaller players leverage affordability and niche appeal to carve out their space. The rise of private-label Smart TVs from major retailers, such as Frávega and Garbarino, has intensified rivalry, offering budget-friendly alternatives to branded products. Economic volatility and currency depreciation add another layer of complexity, forcing companies to balance affordability with profitability. Despite these challenges, the market’s robust growth and consumer enthusiasm ensure a dynamic and evolving ecosystem, where adaptability and differentiation are key to success.

RECENT HAPPENINGS IN THE MARKET

In March 2023, Samsung launched its Neo QLED series in Argentina, achieving a 25% increase in sales among tech-savvy consumers, as reported by Statista.

In July 2023, LG partnered with local retailers to expand its WebOS-powered Smart TV distribution, increasing market penetration by 20%, according to Euromonitor International.

In September 2023, TCL introduced budget-friendly Android-powered Smart TVs in rural areas, achieving a 30% increase in sales, as per Grand View Research.

In November 2023, Hisense hosted a promotional campaign in Buenos Aires, offering discounts on LED models and driving a 15% sales increase.

In January 2024, Sony acquired a local distributor in Córdoba, expanding its presence in Central Argentina and diversifying its product offerings.

MARKET SEGMENTATION

This research report on the Argentina Smart TV Market has been segmented and sub-segmented into the following categories.

By Resolution

- 4K UHD TVs segment

- 8K TVs segment

By Screen Size

- 46 to 55-inch segment

- 65 inches segment

By Type

- flat TVs segment

- curved TVs segment

By Technology

- LED TVs segment

- OLED TVs segment

By Platform

- Android Roku

- WebOS

- Tizen O.S.

- iOS

- MyHomeScreen

- Others

By Distribution Channel

- Direct

- Indirect

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving Smart TV sales in Argentina?

Factors include rising internet penetration, streaming service adoption, and affordability.

What screen sizes are most popular in Argentina?

43-inch, 50-inch, and 55-inch Smart TVs are among the most preferred sizes.

What operating systems are common in Smart TVs sold in Argentina?

Android TV, Tizen OS, WebOS, and Roku TV are widely used.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]